- •1.5.1 The Environment for Economic Decisions

- •2.3 Demand

- •2.4 Supply

- •2.5.1 Changes in Equilibrium

- •2.6.1 Price Ceiling

- •2.6.2 Price Floor

- •2.6.3 Problems of Price Ceilings and Floors

- •2.9.1 Labour Demand

- •2.9.2 Labour Supply: Individual Supply Decision

- •2.9.3 Equilibrium in the Labour Market

- •3.2.1 Consumption Goods

- •3.3.1 The Assumption of Rationality in Economics

- •3.4.1 The Law of Demand – Income and Substitution Effects

- •3.5.1 Consumer Surplus and Consumer Welfare

- •3.6.1 Price Elasticity of Demand

- •3.6.2 Applications of Elasticity Analysis

- •3.6.3 Other Elasticity Examples

- •3.7.1 The Attribute Model: Breakfast Cereals

- •4.3.1 Decisions of Firms and the Role of Time

- •4.3.2 Firm Revenue

- •4.3.3 Firm Output (Product): Marginal and Average Output

- •4.3.4 Firm Costs

- •4.3.5 Marginal and Average Costs

- •4.4.1 Profit Maximization, Normal Profit and Efficiency

- •4.4.2 Maximizing Profits Over the Short Run

- •4.8.1 Using Subsidies – An Example with International Trade

- •4.8.2 Environmental Taxes – Effects on Production

- •4.8.3 Tax Incidence

- •5.3.1 Explanations/Causes of Business Cycles

- •5.3.2 Implications for Business and Government

- •5.4.1 Other Measures of Economic Activity

- •5.4.2 Economic Activity: GNP, GDP and Income

- •5.5.1 The Price Level

- •5.5.2 Aggregate Demand

- •5.5.3 Aggregate Supply

- •5.5.4 Bringing AD and AS Together: The Short Run

- •5.7.1 Explaining Growing International Trade

- •5.7.2 Benefits and Costs of International Trade

- •5.8.1 Another Perspective on Economic Activity: The Economy as a Production Function

- •6.2.1 Competition as a Process

- •6.2.2 Entrepreneurship, Discovery and the Market Process

- •6.3.1 Perfect Competition

- •6.3.2 Monopoly

- •6.3.3 Perfect Competition vs. Monopoly

- •6.3.4 Monopolistic Competition

- •6.3.5 Oligopoly

- •6.5.1 Why Markets May Fail

- •6.5.2 Implications of Market Failure

- •6.6.1 Competition Spectrum

- •6.6.2 Structure, Conduct and Performance

- •6.6.3 Competition Policy

- •7.3.1 The Money Multiplier

- •7.5.1 Which Interest Rate?

- •7.5.2 Nominal and Real Interest Rates

- •7.7.1 Demand in the Foreign Exchange Market

- •7.7.2 Supply in the Foreign Exchange Market

- •7.7.3 Exchange Rate Determination

- •7.7.4 Causes of Changes in Exchange Rates

- •7.8.1 Investment in Bond Markets

- •7.8.2 Bonds, Inflation and Interest Rates

- •7.9.1 Difficulties in Targeting Money Supply

- •7.9.2 Alternative Targets

- •7.9.3 Taylor Rules and Economic Judgement

- •7.10.1 Considering the Euro

- •8.2.1 Labour Market Analysis: Types of Unemployment

- •8.2.2 Analysing Unemployment: Macro and Micro

- •8.2.3 Unemployment and the Recessionary Gap

- •8.2.4 The Costs of Unemployment

- •8.3.1 The Inflationary Gap

- •8.3.2 Trends in International Price Levels

- •8.3.3 Governments’ Contribution to Inflation

- •8.3.4 Anticipated and Unanticipated Inflation – the Costs

- •8.4.1 A Model Explaining the Natural Rate of Unemployment

- •8.4.2 Causes of Differences in Natural Rates of Unemployment

- •8.5.1 Employment Legislation

- •9.2.1 The Dependency Ratio

- •9.4.1 More on Savings

- •9.4.2 The Solow Model and Changes in Labour Input

- •9.4.3 The Solow Model and Changes in Technology

- •9.4.4 Explaining Growth: Labour, Capital and Technology

- •9.4.5 Conclusions from the Solow Model

- •9.4.6 Endogenous Growth

244 |

T H E E C O N O M I C S Y S T E M |

A further mechanism central to the determination of the money supply in an economy is the required reserve ratio held by banks.

The required reserve ratio is the percentage of all deposits received by banks that must be held in the bank and not used for loans or other purposes.

Through the required reserve ratio, banks manage to create money, thereby increasing the supply of money, in an economy. Central banks indicate what the desired reserve ratio is and commercial banks must retain that specified amount of reserves. Reserves are held so that any depositors requiring to withdraw their deposits are sure to be able to do so and will have confidence in their banking system. If on average, the central bank observes that banks need to hold 8% of their deposits for customers wishing to withdraw their deposits, this will be the preferred reserve ratio. For a ratio of 8%, a bank that has deposits of £50m must retain £4m in reserves but it is free to loan out the remaining £46m as it sees fit, within the guidelines set out by its central bank.

Since banks must hold a fraction of their deposits in the form of reserves, the banking system is known as a fractional reserve system.

The incentive for banks to loan out funds is generated once the interest they pay on deposits is less than the interest they can charge on loans so they can make profits. Since the banking market contains several competitors, each bank needs to ensure that its interest rates compare well to those offered by other competitors.

7.3.1THE MONEY MULTIPLIER

If loans are created, they produce money in the economy in a multiplicative manner based on the money multiplier. This is easily explained using an example. Taking the case of the hypothetical BankOne, which has reserves of £4m and deposits of £50m. We can consider what happens to the money supply if the bank receives an additional deposit of £1000 from a customer, Moneybags Inc.

BankOne’s deposits rise to £50 001 000 so it needs to increase its reserves at the central bank by £80 (8% of £1000). When the reserves have increased by £80, the remaining £920 can be loaned out by the bank. If a loan of £920 is issued to Grandon’s, Ltd, their account at the bank is credited with this amount, thus increasing deposits by £920 to £50 001 920. As deposits rise, reserves must increase

M O N E Y A N D F I N A N C I A L M A R K E T S I N T H E E C O N O M I C S Y S T E M |

245 |

T A B L E 7 . 2 M O N E Y C R E A T I O N V I A T H E

M O N E Y M U L T I P L I E R

Assuming a required reserve ratio of 8%

|

Deposit £ |

Required reserves £ |

Loan £ |

Moneybags |

1000 |

80 |

920 |

Grandon’s |

920 |

73.6 |

846.4 |

Next customer |

846.4 |

67.7 |

778.7 |

Next customer |

778.7 |

62.3 |

716.4 |

. . . |

. . . |

. . . |

. . . |

Total |

12 500 |

1000 |

11 500 |

in line and 8% of £920 is £73.60. When £73.60 is held in the bank’s reserves, again the remainder of £846.40 (£920 – £73.60) can be used for loans by the bank. Then the bank can issue a further loan to Safelock Ltd, which is credited to their account in the bank, increasing bank deposits, requiring an addition to the bank’s reserves

. . . and so on as shown in Table 7.2.

This process ensures that the initial addition to the bank’s deposits generates an increase in the money supply considerably greater than the initial change.

The money multiplier describes how a change in money supply leads to an ultimate change in money supply by a multiple of the initial change.

The size of the money multiplier depends on the required reserve ratio according to the formula:

1

Money multiplier =

required reserve ratio

Since the ratio is 8% in the example, the money multiplier is 1/0.08 = 12.5. This means that any change in deposits will lead to an increase in the money supply 12.5 times the initial increase. If the initial change is £1000 it generates £12 500 in additional money supply as shown by the process in Table 7.2. Hence, banks create money.

246 |

T H E E C O N O M I C S Y S T E M |

7 . 4 M O N E Y D E M A N D

Taken together, money supply and money demand determine the equilibrium price and quantity of money in the money market.

We hold money or demand money (in more liquid forms) for different purposes – for transactions, as a precautionary measure and for speculative purposes. These are known as the motives for holding money.

The transactions demand for money relates to the medium of exchange function of money in that it is the demand for day-to-day spending on things like groceries, bus fares, and so on. The amount of money people demand for their transactions will vary depending on their income – generally those earning more spend more – and on the general price level – if prices are high, then relatively more money is needed to pay for purchases.

The precautions demand for money relates to the money demanded for unexpected emergencies and is again associated with the money’s medium of exchange function. The amount of money demanded for precautionary purposes again depends on individuals’ incomes, and their age.

The transactions and precautionary demands for money are known as the demand for active balances because the money is actively used to buy goods and services.

The price of money – the interest rate – is not of interest in explaining the demand for active balances.

The third motive for money demand is for speculative purposes. This motive is related to money’s store of value function because individuals concerned about the value of financial investments in the future who are afraid the value of their investments will fall prefer to hold money rather than financial assets.

The speculative demand for money is also called the demand for idle balances since it relates to the desire to demand money to avoid potential losses from holding interest-bearing financial assets.

The demand for speculative purposes depends on the interest rate, which is the opportunity cost of holding money. With a relatively high rate, people will prefer the more attractive option of holding interest-bearing assets rather than more liquid forms of money.

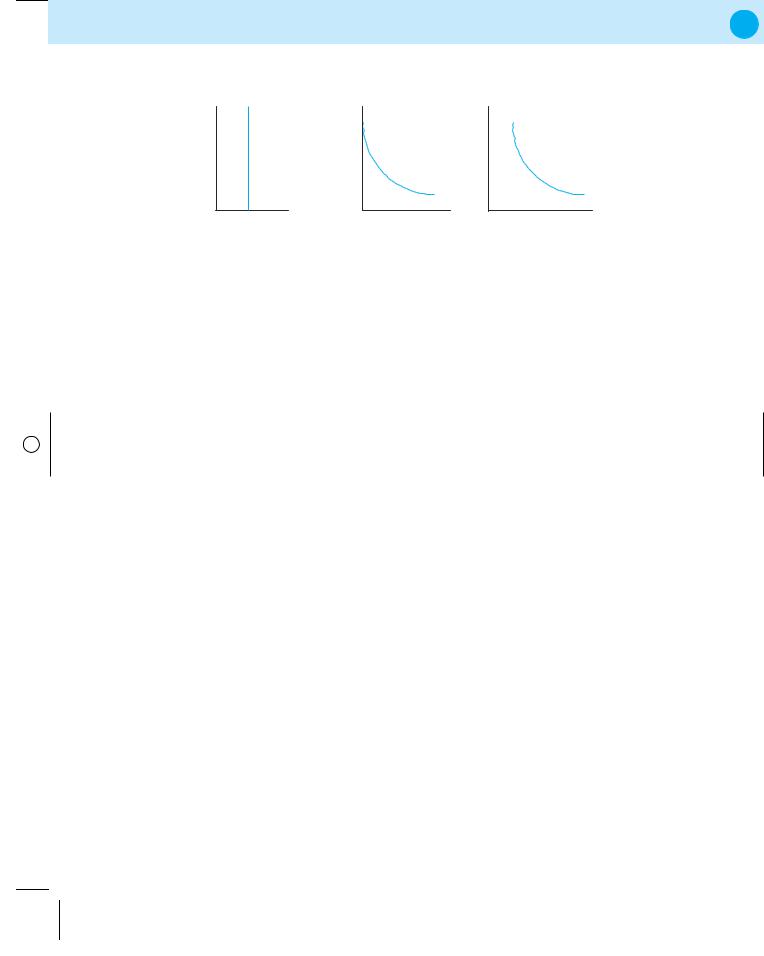

Figure 7.2 shows the demands for active, idle and total money balances. Note that the price of money P is the interest rate. This demand for money or the liquidity

M O N E Y A N D F I N A N C I A L M A R K E T S I N T H E E C O N O M I C S Y S T E M |

247 |

A |

B |

C |

P |

P |

P |

Demand for active |

Demand for |

Demand for total |

balances |

idle balances |

balances |

Q |

Q |

Q |

F I G U R E 7 . 2 M O N E Y D E M A N D : L I Q U I D I T Y |

||

P R E F E R E N C E C U R V E |

|

|

preference curve is shown in Figure 7.2 panel C, which is the sum of the demand for active and idle balances. This indicates the desire for holding assets in liquid form, i.e. cash rather than in other financial asset forms.

7 . 5 T H E M O N E Y M A R K E T : D E M A N D A N D S U P P LY

Equilibrium in the money market requires an assessment of both demand and supply together, as presented in Figure 7.3. The opportunity cost of money is determined by the intersection of demand and supply, and this is shown as r in Figure 7.3 panel A.

If there is a fixed quantity of money supply then, depending on the demand for total balances, the interest rate may vary as shown in the comparison between Figure 7.3 panels A and B. In both panels the money supply is the same and money demand is different. The intersection between demand and supply gives rise to an interest rate r in panel A, while it is higher at r in panel B. The demand for money in panel B is greater than in A (the demand curve in panel B is above and to the right of that in panel A) but because supply is fixed the price must rise to bring the market to equilibrium. If the interest rate did not rise the demand for total balances at r would exceed the available supply – there would be a shortage of money – and the market would not clear.

In Figure 7.3 panels C and D we can examine what happens when the central bank conducts open-market operations and expands the money supply (when it buys government bonds). Initially the interest rate is r but once the open market operation increases the supply of money the interest rate declines to r +.