- •Acknowledgement

- •Abstract

- •International Market Entry Strategies

- •Regulatory Environment

- •Challenges of International Expansion

- •Purpose of the Study

- •Research Objectives

- •Research Questions

- •Justification for the Study

- •Scope of the Study

- •Delimitations

- •Chapter 2: Literature Review

- •Introduction

- •International Expansion

- •Internationalization/Transaction-Cost Theory

- •Eclectic Theory

- •Resource-Based Theory

- •Uppsala Model

- •International Market Entry Strategies

- •Exporting

- •Licensing

- •Franchising

- •Joint-Ventures/Strategic Alliances

- •Acquisitions

- •Wholly-Owned Subsidiaries/Greenfield Operations

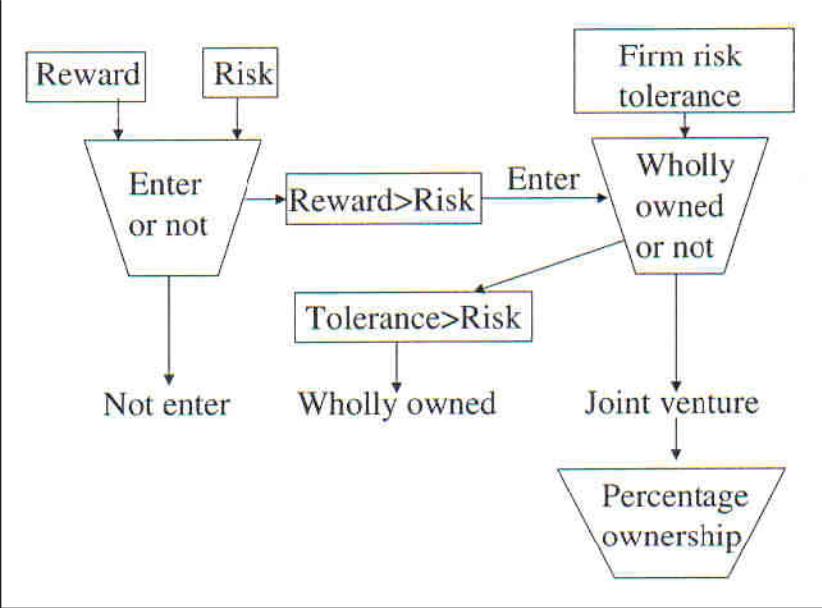

- •Figure 2‑1: Selecting Market Entry Mode: Risk Profiling

- •Regulatory Environment

- •Challenges of International Expansion

- •Research Gaps

- •Chapter 3: Research Methodology

- •Introduction

- •Research Methodology

- •Research Methods

- •Research Approach

- •Research Design

- •Choice of Companies

- •International Expansion

- •Host Country Overview: Kenya

- •Company Overview: eabl

- •Table 4‑1: Kenyan Beer Market

- •Source: Irungu (2012)

- •Market Entry Strategy

- •Regulatory Environment

- •Market Performance

- •Market Challenges

- •Case Study: sab Miller (Colombia – Grupo Bavaria)

- •Company Background: sab Miller

- •International Expansion

- •Host Country Overview: Colombia

- •Company Overview: Grupo Bavaria

- •Market Entry Strategy

- •Regulatory Environment

- •Market Performance

- •Market Challenges

- •Chapter 5: Discussion of Findings

- •Introduction

- •Case Analysis: Diageo (Kenya)

- •Case Analysis: sab Miller (Colombia)

- •Cross-Case Analysis

- •Chapter 6: Summary, Conclusions, and Recommendations

- •Introduction

- •Summary

- •Conclusions

- •Recommendations

- •Future Research

- •Chapter 7: References

- •Chapter 8: Appendices Table 8‑2: Common Size Analysis: Diageo and sab Miller

- •Source: Diageo (2013) and sab Miller (2013a)

- •Table 8‑3: Comparison of Market Entry Modes and Performance

- •Source: Diageo (2013a), eabl (2013), and sab Miller (2013)

Wholly-Owned Subsidiaries/Greenfield Operations

An Establishment of Greenfield operation is tied with effective control that is achieved by the expanding business (Hitt, Ireland, & Hoskisson, 2011). The cost implications of establishing a wholly - owned subsidiary are quite extensive as the internationalizing business has to invest all tangible and intangible resources in the new business.

There are cultural challenges, as the organization has to learn domestic cultural alignments without the support of domestic partner. The major advantage is that the firm has effective control, which allows it to be more effective and potential returns are relatively higher than for most of the entry modes. The process of establishes a Greenfield operation is time-consuming and anticipated returns take time to achieve.

Figure 2‑1: Selecting Market Entry Mode: Risk Profiling

Kos (2010; p.323)

Regulatory Environment

Globalization of businesses has increased contact between them and countries which operate under different rule sets than their domestic markets (Lee & Carter, 2012). Transparency levels are diverse depending on the localities and legal frameworks that are established in the different countries with varied business implications.

Burger, Kostevc, & Polanec (2011) noted that companies have to consider political risks and consider the need to secure their businesses. There are insurance products that protect a business when considering the potential for expropriation risks particularly in highly regulated emerging markets where there is strong government control.

According to Rugman & Collinson (2006), there are three main economic systems that guide market access; socialism, capitalism, and mixed (pseudo capitalism). Economies can either be market-driven or centrally-determined (Rugman & Collinson, 2006). The two setups have different implications on the regulatory environment.

Market-driven economies thrive on the allocation of production based on supply and demand while centrally-determined economies rely on formulas derived by management committee (Rugman & Collinson, 2006). Majority of western nations including United States, Canada, and the European Union operate market-driven economies.

Classic examples of centrally-determined economies include; Cuba, Venezuela, and North Korea. Mixed economies have been emerging from previously controlled economies such as China and Brazil. The regulatory environment has been influenced by the ascension of some of these nations into global trade agreements.

This has had major implications on the taxation regimes that can be applied to foreign firms. Increasingly, emerging markets are attracting foreign firms by offering extensive incentives such as reduction of taxes (import, corporate, and personal income), reducing registration processes, and generally providing greater market access.

Increased competition that has been prompted by the consolidation of trading blocs such as NAFTA, WTO, ASEA, EU, COMESA, and MERCUSAL have meant that governments have focused on enhancing the competitiveness of their markets. Newman, Rickert, & Schaap (2011) assessed relevant opportunities in different markets as a result of evolving reforms.

They noted that the advanced markets such as Australia and Germany had stable tax regimes but with substantial complexity. Emerging nations such as China, Colombia, and India had divergent market regulations while riskier economies such as Nigeria and Philippines had significant regulatory challenges as far as taxation and liberalization were concerned.