- •S. Seiffulin kazakh agro technical university

- •Astana 2011

- •Introduction

- •Exercises

- •Cause damage hold invite make overtake show surround translate write

- •5. Write questions using the passive. Some are present and some are past.

- •6. Put the verb into the correct form, present simple or past simple, active or passive.

- •7. Rewrite these sentences. Instead of using somebody, they, people etc., write a passive sentence.

- •Passive Voice

- •Perfect infinitive

- •Present continuous

- •Sources of food

- •Exercises

- •1. Translate these interesting facts about food into your own language

- •6. Rewrite these sentences. Instead of using somebody or they etc., write a passive sentence.

- •7. Make sentences from the words in brackets. Sometimes the verb is active, sometimes passive.

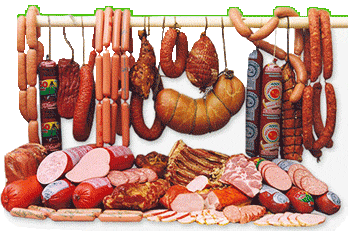

- •Food from animals

- •Exercises

- •2. Make 10 test questions with 5 answers about this text and try to use Passive Voice

- •3. Retell the text

- •4. Find the right answer Test . Passive Voice

- •Unit 2 Text: The food of the Nomad Grammar: Question tags

- •Exercises

- •I. Choose the right variant

- •II. Make five questions about this text

- •2. Put a question tag on the end of these sentences

- •3 Read the situation and write a sentence with a question tag. In each situation you are asking your friend to agree with you.

- •4 In these situations you are asking for information, asking people to do things etc.

- •Exercises

- •1. Rewrite the sentences using Reported speech

- •2. Retell the text using reported speech

- •3. Yesterday you met a friend of yours, Steve. You hadn’t seen him for a long time. Here are some of the things Steve said to you:

- •Exercises

- •The following sentences are direct speech. Rewrite the sentences using reported speech.

- •Here are some things that Sarah said to you:

- •Complete the sentences with say or tell (in the correct form). Use only one word each time

- •The following sentences are direct speech

- •Reported Speech

- •Exercises

- •1. Write 10 questions about this text

- •3. Make a new sentence from the question in brackets.

- •4 You are making a phone call. You want to speak to Sue, but she isn't there. Somebody else answers the phone. You want to know three things:

- •Grammar Reported Speech (questions)

- •Grammar Revision. Passive Voice, Question tags, Reported Speech

- •I variant

- •II variant

- •III variant

- •IV variant

- •Unit 4 Text: The food industry

- •The food industry

- •Exercises

- •Translate the text into your own language and learn by heart the new words.

- •Now answer these questions:

- •Complete each sentence with one of the following verbs (in the correct form): answer apply be forget listen live lose make read try use

- •Complete the sentences so that they mean the same as the first sentence. Use -ing.

- •Use your own ideas to complete these sentences. Use -ing.

- •Unit 5 Text: History of Chocolate

- •Short History of Chocolate

- •Exercises

- •Read and translate the text.

- •Now answer these questions

- •Look at the picture and write what you see and how it has been made. Use gerund or infinitive.

- •Food processing. Translate the text into your own language

- •Food packaging. Read and retell the text.

- •Complete each sentence with a suitable verb.

- •Put the verb into the correct form, to ... Or -ing.

- •Make a new sentence using the verb in brackets.

- •Unit 6 Text: Food transportation and food marketing

- •Food transportation

- •Grammar:

- •(I want you to ... Etc.) want ask help would like

- •Make and let

- •Exercises:

- •2. Complete each second sentence so that the meaning is similar to the first sentence.

- •Unit 7 Text: Problems with frozen foods

- •Problems with frozen foods

- •1 Put the verb into the correct form, -ing or to ... . Sometimes either form is possible.

- •2 Here is some information about Tom when he was a child.

- •3 Complete each sentence with a verb in the correct form, -ing or to ... .

- •Enjoy finish imagine admit avoid feel like (infml) (don't)mind can't stand give up deny

- •Manage refuse promise offer

- •Exercises:

- •1. Underline the correct word(s). Be careful: in two sentences, both possibilities are correct.

- •2 Complete part (c) of each sentence in a suitable way, starting with a verb.

- •3 Read the story and answer the questions below.

- •Unit 8 Text: Interesting Facts about British Food Grammar: Conditional sentence 1

- •Exercises:

- •1 Complete the sentences using the verbs in brackets. All the sentences are about the future. Use Will/won't or the present simple (I see / he plays / it is etc.).

- •2 Make one sentence from two:

- •3 Read the situations and complete the sentences.

- •4 Put in when or if.

- •Translate the text into your own language

- •Interesting Facts about British Food: English Pub Food

- •English Cream Teas

- •Unit 9 Text: 10 Poisonous Foods we like to eat Grammar: Conditional sentence 2 (If I knew ... I wish I knew ...)

- •Exercises:

- •1 Put the verb into the correct form.

- •2 Write a sentence with if ... For each situation.

- •Write sentences beginning I wish ... .

- •4 Write your own sentences beginning I wish ... .

- •Potatoes

- •Tomatoes

- •Almonds

- •Cherries

- •Mushrooms

- •Elderberry

- •Rhubarb

- •Castor Oil

- •Pufferfish

- •Unit 10 Text: Discover a few interesting facts that You May Not Know. Grammar: Conditional sentence 3 (If I had known I wish I had known)

- •Grammar: Conditional sentence (3)

- •If I had known you were in hospital, I would have gone to see you.

- •Exercises:

- •1 Put the verb into the correct form.

- •2 For each situation, write a sentence beginning with If.

- •3 Imagine that you are in these situations. For each situation, write a sentence with I wish.

- •4. Translate the sentences into your own language.

- •Interesting Food Facts

- •Unit 11 Text: History of Tomatoes Grammar: Phrasal verbs: form and meaning

- •1 Complete the phrasal verbs. Remember to put the verb into the correct form.

- •2 Complete these sentences in a logical way.

- •3 Look at the dictionary entry for 'go off, and match the meanings with the sentences below.

- •4 Correct any mistakes with word order in these sentences. Be careful: some are correct.

- •5 Make these texts more informal by changing the underlined verbs to phrasal verbs.

- •6 Fill the gaps to complete the phrasal verbs in these sentences.

- •7 Complete these sentences in a logical way.

- •History of Tomatoes

- •Revision for all materials

- •1 Variant

- •2 Variant

- •3 Variant

- •4 Variant

- •5 Variant

- •6 Variant

- •7 Variant

- •Additional texts Texts for reading and retelling popcorn

- •Popcorn Balls

- •The Healthy Eating Pyramid includes the following: Whole Grains

- •Healthy Fats and Oils

- •Vegetables and Fruits

- •Nuts, Seeds, Beans, and Tofu

- •Fish, Poultry, and Eggs

- •Dairy (1 to 2 Servings Per Day) or Vitamin d/Calcium Supplements

- •Use Sparingly: Red Meat and Butter

- •Multivitamin with Extra Vitamin d (For Most People)

- •Optional: Alcohol in Moderation (Not for Everyone)

- •Kazakhstan’s cuisine

- •Food and drink

- •Food and drink based on milk

- •Dishes from cereals

- •Cold first courses

- •Hot first courses

- •Second courses

- •Bread and pasta

- •Desserts

- •Meals in Britain (1)

- •Vocabulary:

- •Meals in Britain (2)

- •British Cuisine

- •Questions:

- •Vocabulary:

- •Spirits in Ireland

- •Questions:

- •Traditional American Food

- •The Story of “McDonald's” and “Coca-Cola”

- •World Food Kazakhstan: a Focus on the Food Industry

- •About Kazakhstan trade recovering in kazakhstan

- •A review of the food and beverage market in kazakhstan

- •Kazakhstan to Launch Its Own Infant Food Production

- •Kazakhstan to Develop Winemaking

- •Source: Kazakhstan Today

- •Kazakhstan: a 200-Hectare Food Terminal Being Built Near Astana

- •Halal-Industry Association Established in Kazakhstan

- •Second Record Bumper Harvest over Last Five Years in Kazakhstan – About 21 Million Tons in Store – Nazarbayev

- •Examination tests test-1

- •Irregular verbs

- •Bibliograhpy

- •Content

About Kazakhstan trade recovering in kazakhstan

A pprehensive

of the second crisis wave in Kazakhstan due to potential drop in

demand in the FMCG sector, I decided to review the statistics on

commercial activities in Kazakhstan. The statistics on retail

turnover from 2008 through the summer of 2010 shows that the crisis,

indeed, reduced the trade volume. The year 2009 was the most

difficult one for commercial chains. However, since 2010, turnover

volumes have been on the rise. In June 2010, trade volume in

Kazakhstan exceeded the June 2009 level by 17%. The positive trend

has been observed during all 6 months of 2010.

pprehensive

of the second crisis wave in Kazakhstan due to potential drop in

demand in the FMCG sector, I decided to review the statistics on

commercial activities in Kazakhstan. The statistics on retail

turnover from 2008 through the summer of 2010 shows that the crisis,

indeed, reduced the trade volume. The year 2009 was the most

difficult one for commercial chains. However, since 2010, turnover

volumes have been on the rise. In June 2010, trade volume in

Kazakhstan exceeded the June 2009 level by 17%. The positive trend

has been observed during all 6 months of 2010.

It should also be noted that positive dynamics are observed mostly because of sales growth in the food segment, whereas a slight drop of trade volumes is observed in the non-food segment (around 3-5%). Still, food products make up about 36% in the total structure of retail turnover in Kazakhstan.

Leaders in trade volumes in the food segment include:

Meat, including poultry meat and meat products (sales volume in 2009 = about 131 billion tenge)

Various drinks, including alcoholic drinks(162 billion tenge)

Dairy products and eggs (97 billion tenge)

Bread and confectionary made from flour (74 billion tenge)

Leaders in trade volumes in the non-food segment include:

Clothes and textile goods (about 186 billion tenge)

Building materials (76 billion tenge)

Computers and software (74 billion tenge)

electrical household appliances (about 70 billion tenge)

On the whole, the Kazakhstanis’ purchase behaviour recovers from the crisis shock. People see that economy is not going down but rather shows signs of stability. In such conditions, purchase behaviour becomes softer. If positive trends in Kazakhstan’s economy remain, trade volumes in the non-food sector will, too, recover by 2010 or early 2011.

A review of the food and beverage market in kazakhstan

T he

food industry is a critical sector in any economy because production

of food has a direct impact on the country’s economic and food

security.

he

food industry is a critical sector in any economy because production

of food has a direct impact on the country’s economic and food

security.

In this document, we will review the food and beverage market in Kazakhstan, and try to see what future this sector has, what trends exist in the market today, and what sectors are leading in Kazakhstan.

According to the Kazakhstan Agency for Statistics, in 2009, food and beverage production’s share in the processing industry was about 24% (8.9% of all industrial production). As compared with 2008, the share of food production in the processing industry in 2009 has grown by 4%.

On the whole, in monetary terms, the market slightly decreased in 2009 in comparison with the previous year, and totalled around 940 billion tenge, first of all due to import reduction. But by and large, the market is going through the economic recession quite well.

In 2009, domestic production in kind (volume index) grew although somewhat a little. The growth was about 2%. The domestic production trend in such an important market, with import volumes shrinking down, is a pleasing one.

I n

monetary terms, the following market segments in Kazakhstan are

leaders in production volumes:

n

monetary terms, the following market segments in Kazakhstan are

leaders in production volumes:

flour milling

beverage production

bread baking

dairy sector

In the number of companies which make food and beverages, the flour milling and bread making sectors lead again, as well as alcohol-free drink production and milk processing.

It is also important to understand trade activity in the market. According to statistical data, the food trade recession in 2008 (about 2%) was followed in 2009 by a 2.8% increase in food and beverage trade in Kazakhstan.

This also demonstrates that the population is gradually switching from “economic austerity” characteristic of the first crisis years, and recovers its liberal purchase behavior.