International Economics and Trade March 2013

Igor N. Baranov, Ph.D

“Global savings glut” as one of the major reasons for the latest financial crisis of 2008

Victoria Eliseeva

Alexey Konovalenkov

Adam Wojciech Nowak

Nicolas Sylvestre-Boncheval

Introduction

The following paper addresses the very current issue, whose consequences the world has been forced to face till this moment, that is the financial crisis of 2008. Before the analysis of the root causes one has to understand the significance of the crisis.

Not going into much details investors and economists from all over the world in 2008 had to face a series of bank and insurance company failures that effectively halted global credit markets. The unprecedented situation required government intervention on the unprecedented scale. One of the biggest shock was the fall of Bear Stearns and Lehman Brothers, which was followed by forced takeover of Merrill Lynch by Bank of America, governmental takeover of Fannie Mae (FNM) and Freddie Mac (FRE). Besides that the insurance pillar of the financial system, i.e. American International Group (AIG) went practically bankrupt and was saved only due to $85 billion capital injection by the government.

As the result of these events the world faced the worst financial crisis in two generations and the start of the Great Recession – as it quickly turned out that financial crisis would quickly affect the real economy. For instance the erasure of $14.5 trillion, or 33%, of the value of the world’s companies was observed in less than half a year1. Above that, unprecedented growth in global level of debt combined with the GDP slowdown (recession in most of the developed countries) was observed. Last but not least, the crisis gave a start to currency wars, increased the uncertainty in the economy and triggered sovereign debt crisis in EU whose ending is yet to be revealed…

All in all, facing the significance of the crisis and austerity of its consequences one has to discover its root causes. During the oral presentation the group defended the hypothesis of global saving glut as a major reason of the crisis This remains somehow true, but in order to analyze the crisis in depth and let the research be non-biased three main causes of the crisis were pointed out and elaborated in this report: trade imbalance, money supply and banking system. Only a combination of these three give can give the answer for the causes of the financial crisis of 2008

Trade Imbalance

As soon as we start searching for the roots of the financial crisis the first idea is to determine the scale on which it happened. It is beyond doubt that the description of the crisis as “global” is the most prominent one. An incontrovertible fact is that global imbalances were at least one of the major reasons of the breakdown in the financial system of the US.

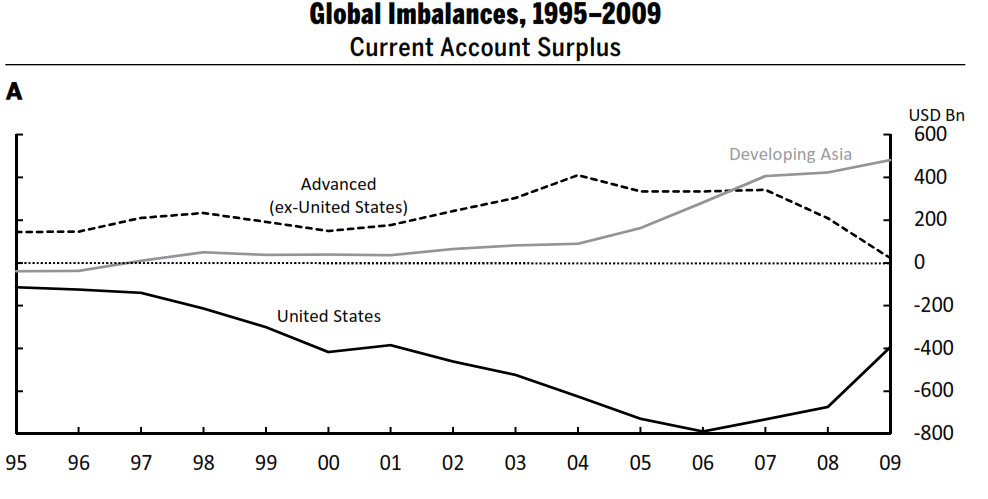

The idea of the global imbalances to be a universal explanation of the latest crisis is quite debatable, however, it is a hard fact that these imbalances have been present in the global economy and have only grown with the course of time. The most popular indicator to be employed is the Current Account balance, which incorporates the difference between the savings in the national economy and investments in the economy. The following figure illustrates that the situation in the world deteriorated significantly with the constant increase in the US CA deficit and developing countries’ growing CA surplus.

1Source: Obstfeld, Maurice and Kenneth Rogoff, Global Imbalances and the Financial Crisis: Products of Common Causes, 2009

The most common explanation of this imbalance2is that Asian countries (mostly China) pursued export-led strategies for maintaining high pace of growth after the waves of crisis (incl. Asian crisis) from the 1990s. The major tool for keeping high growth rates was exchange rate policy aimed at keeping national currency at the competitive level, thus stimulating export via making it relatively cheaper on the global market.

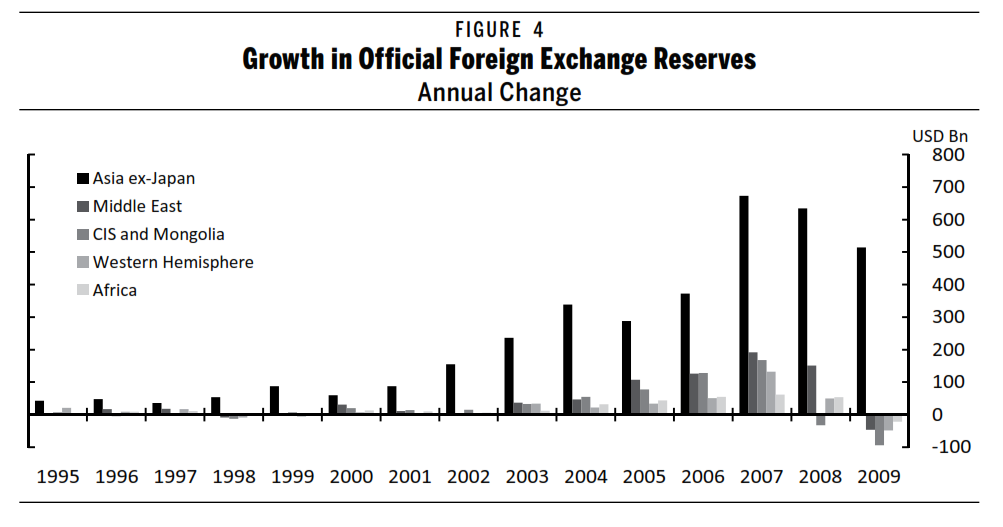

The second idea closely related to the first one is that those countries (with CA surpluses) having shortly before suffered some crises realized their need in accumulating stocks in the foreign currency to have them as buffers against the potential repetition of the defaults. The increase in Asian foreign reserves is shown in the figure below.

2Source: Obstfeld, Maurice and Kenneth Rogoff, Global Imbalances and the Financial Crisis: Products of Common Causes, 2009

As a result of these imbalances the whole idea of efficient resource allocation appeared to be not sustainable: developed countries were borrowing money (yielding low returns on investments) instead of investing it in the countries with potentially higher returns. This position can be attributed to the World Bank who favored development and which stated global imbalances led to an inefficient resource allocation (otherwise borrowers would not have had deficits).

When talking about the roots of these imbalances, one should bear in mind that the export-led strategy implies high inflow of cash to the country in the foreign currency; if the government exchanges this money into the national currency, it will expose the economy to inflation. What is more important, the number of the projects with acceptable returns/risk ratio within the economy at a given moment is quite limited, therefore the government has to find some other investment opportunities that would be, first, safe, and, second, bear at least some fruits. This opportunity was the US financial market.

Moreover,

a reliable government will set a high price on its bonds (=low

discount rate), which in turn means that banks can offer loans at an

extremely low interest rate. If

,

then one would borrow even without collateral. The issue of banks is

to be discussed later on.

,

then one would borrow even without collateral. The issue of banks is

to be discussed later on.

To draw a bottom line of the discussion on the role of trade balance in the crisis it would be beneficial to highlight the following. Since developing countries were aiming at export, they kept their currencies relatively cheap; inflow of funds into their economy from export operations made these countries find a safe place to invest which created excessive money supply in the US and enabled institutional lenders give loans almost for free; the problem known as adverse selection resulted in high number of the unsecured debts, which was a direct road to the bubble.