- •Chapter 6. The Labor Market

- •I. Motivating Question How Is the Unemployment Rate Determined in the Medium Run?

- •II. Why the Answer Matters

- •III. Key Tools, Concepts, and Assumptions

- •1. Tools and Concepts

- •2. Assumptions

- •IV. Summary of the Material

- •1. A Tour of the Labor Market

- •2. Movements in Unemployment

- •3. Wage Determination

- •4. Price Determination

- •5. The Natural Rate of Unemployment

- •6. Where We Go from Here

- •V. Pedagogy

- •1. Points of Clarification

- •2. Alternative Sequencing

- •VI. Extensions

- •1. The Concept of the Medium Run

- •2. Additional Examples

- •VII. Observations

5. The Natural Rate of Unemployment

If price expectations are correct (i.e., P=Pe), equations (6.1) and (6.3) yield two different expressions for the real wage:

W/P=F(u,z) (6.1')

W/P=1/(1+). (6.3')

The text refers to the first of these equations as the wage-setting relation (WS) and to the second as the price-setting relation (PS). Conditional on P=Pe, labor market equilibrium requires that the real wage implied by WS equal the real wage implied by PS, or

F(u,z)=1/(1+). (6.4)

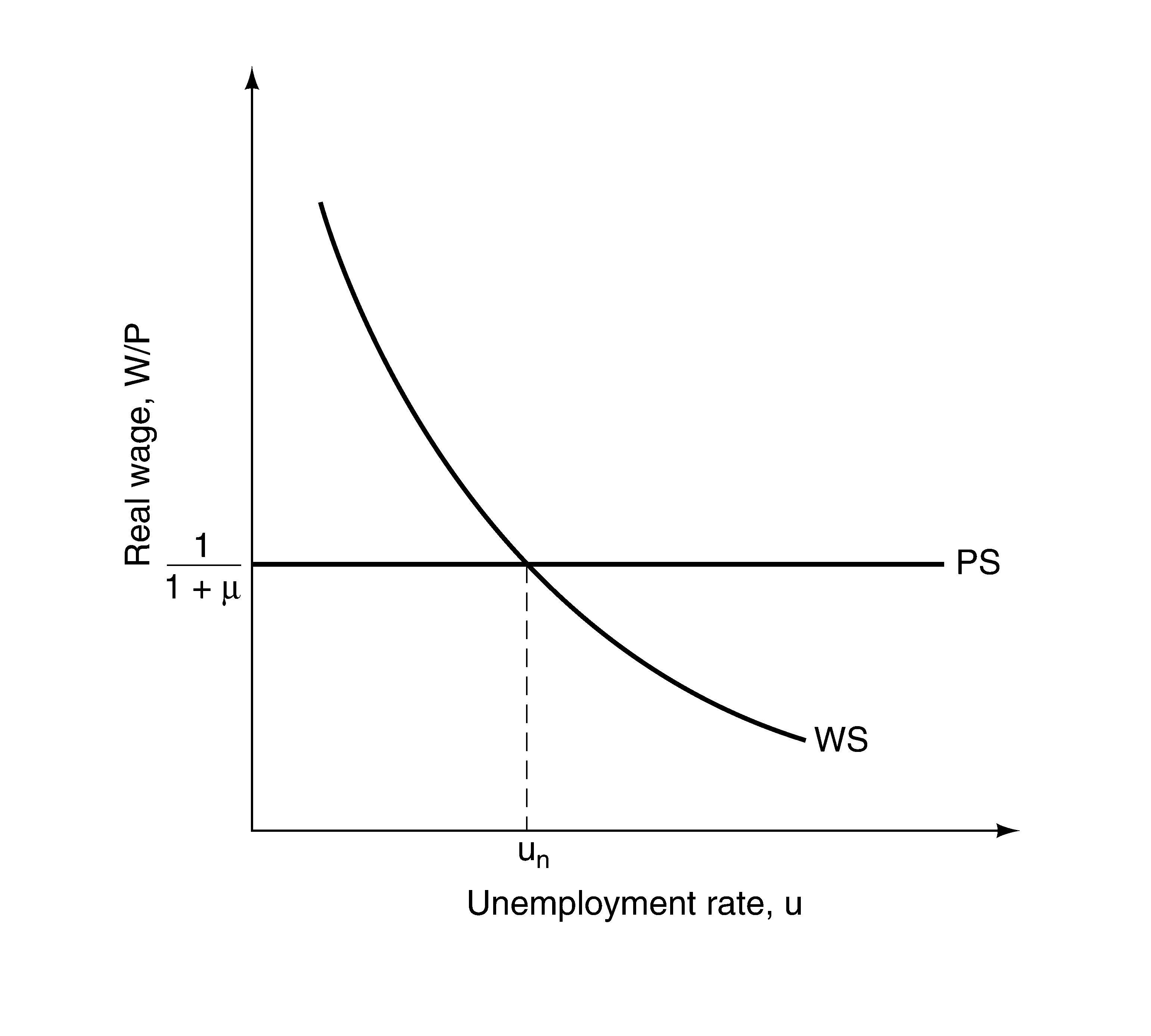

The value of u that satisfies equation (6.4) is called the natural rate of unemployment. The graphical solution is given in Figure 6.1. Note that WS slopes down, since an increase in the unemployment rate tends to reduce the relative power of workers in wage bargaining. The PS curve is flat as a result of the assumption of constant returns to scale in the production function. If the production function exhibited decreasing returns to scale, the price-setting relation would be upward sloping.

The natural rate of unemployment is the rate of unemployment that makes WS and PS consistent when P=Pe. It is a medium-run concept, for two reasons. First, prices can adjust over the medium run. Second, in the absence of economic disturbances, it is unreasonable to assume that workers and firms will continually hold incorrect price expectations. Eventually, workers and firms will learn from past experience in forming price expectations. In the short run, there is no presumption that P=Pe, so the actual unemployment rate need not equal the natural rate of unemployment.

Figure 6.1: The Natural Rate of Unemployment

Moreover, the adjective natural is misleading. The natural rate of unemployment depends on labor market institutions and market structure. For example, an increase in competition in the goods market (a decrease in ) would shift the PS line up and reduce the natural rate of unemployment. An increase in the z index—say, because of an increase in unemployment benefits—would shift the WS curve up and increase the natural rate of unemployment.

Note that employment N is given by N=(1-u)L, where L is the labor force. Assuming that L is fixed, the natural rate of unemployment (un) defines a natural level of employment Nn=(1-un)L, which implies a natural level of output Yn= Nn. The natural level of output is the level of output that would prevail if price expectations were correct. Like the natural rate of unemployment, the natural level of output is a medium-run concept. In the short run, the actual price level can differ from the expected price level, the actual unemployment rate can differ from the natural rate, and the actual level of output can differ from the natural level of output.

6. Where We Go from Here

This chapter discusses the determination of the unemployment rate and output in the medium run, when it is reasonable to assume that the price level equals the expected price level. In the short run, when the expected price level need not equal the actual price level, the demand factors discussed in the previous chapters affect the unemployment rate. The next three chapters incorporate the labor market into the model developed in the previous chapters and analyze the determination of output, the unemployment rate, and the interest rate in the short and medium run.