- •1. Financial investment portfolio: the concept, the basic types and their characteristics

- •By the purpose of forming financial results are distinguished by:

- •The required number of shares in control share package of strategic investor

- •2. Management of formation of company's financial investments Portfolio

- •The main stages of investment portfolio according to portfolio theory

- •3. Principles and parameters of the operational management of company's financial investments portfolio

- •The main factors leading to lower yield of share investment instruments:

- •The main factors leading to lower yield of debt investing instruments:

- •Topsc 11. Portfolio Management of financial investments companies

|

Investment financial portfolio of enterprises |

|

|

|

1. By the purposes of forming investment income: |

► |

Portfolio income; s Portfolio growth |

|

|

— |

2. By the level of accepted risks: |

|

|

|

|

fr |

3. By the level of liquidity: |

|

|

|

|

f* |

4. By investment period: |

Short-term (up to 1 year); - Long-term (more than 1 year) |

|

|

|

» |

5. According to the terms of investment income taxation: |

|

|

|

|

> |

6. By stability of the main investment instruments structure: |

|

|

|

|

► |

7. By specialization of the main types of financial investment instruments: |

|

|

|

|

|

8. By number of strategic objectives of: |

|

|

|

|

|

9. By the primacy of formation: |

|

' ; - Start; .. - Restructured |

1. Financial investment portfolio: the concept, the basic types and their characteristics

Financial investment portfolio - a purposefully formed set of financial instruments, managed as a unit according to the investment policy of the company.

The main goal of building an investment portfolio - to

ensure the implementation of the main policy trends of the financial investment company by choosing the most profitable financial instruments of a high level of reliability.

Casting investment portfolios is dependent on the priority objectives of investment.

According to the main goal the following local tasks of investment portfolio should be resolved:

ensure high investment income in the current period;

ensure high growth rate of invested capital in the long tern period;

minimize investment risks related to financial investment;

ensure the required level of investment portfolio liquidity.

By the purpose of forming financial results are distinguished by:

Portfolios income

Portfolio formed by the criterion of maximizing the investment income in the current period regardless of the growth rate of invested capital in the long run

Portfolios of growth

Portfolio formed by the criterion of maximizing the growth rate of capital invested in the long ran, regardless of the level of investment income in the current period

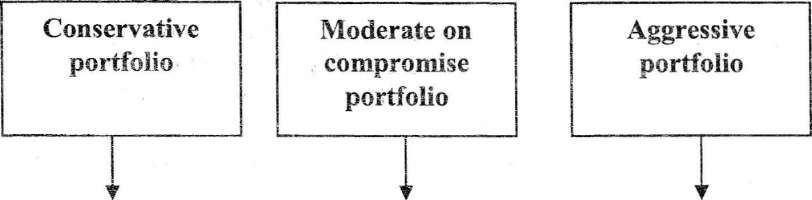

Formed

by the criterion of a minimum level of investment risk

Formed

on the basis of mid-market levels of risk and return

formed on the basis of maximization and rate of growth of invested capital, regardless of the accompanying level of risk

The required number of shares in control share package of strategic investor

Decisive share package |

Blocking share package |

Initiative share package |

A. Higher level 75% +1 share |

A. Higher level: 50% +1 share |

A. Higher level: 20% share |

E. Ordinary level: 50% +1 share |

B. Ordinary level: 25% +1 share |

E. Ordinary level: 10% share |

2. Management of formation of company's financial investments Portfolio

Portfolio theory - based on statistical methods of mechanism optimization of investment portfolio that is formed according to the given of correlation of its profitability level and risk.

The main stages of investment portfolio according to portfolio theory

Stage |

Main content of works by the stage |

result of operations by stage |

1-H stage Estimation of investment properties of certain financial investment instruments |

The review process of the advantages and disadvantages of certain types of financial instruments according to policy objectives of financial investment |

Determination of the ratio of share and debt financial instruments in the portfolio, and in each of these groups - structure with certain types of financial instruments (stocks, bonds) |

2-h stage Formation of investment decisions about inclusion of certain financial investment instruments in the portfolio |

The process of review and evaluation of specific financial investments instruments traded on the market, and their ranking |

Ranking by the levels of profitability and risk of specific financial instruments for inclusion them in the portfolio |

Stage |

Main content of works by the stage |

result of operations by stage |

3-h stage Optimization of the investment portfolio, aimed at reducing its risk in a given level of profitability |

Estimation of covariance and the corresponding diversification of specific financial instruments of portfolio |

Providing the lowest possible level of investment risk at a given level of portfolio profitability according to type which is formed |

4-ii stage The total assessment of formed investment portfolio according to the correlation of the profitability level and risk |

calculations of level profitability of portfolio and the level of its risk and its comparison |

Determination of the effect of reducing portfolio risk to the mid- market value on a given level of investment portfolio profitability |

Covariance - statistical characteristics, illustrating the degree of similarity (or difference) of two variables considered in the dynamics, amplitude and direction changes.

Covariance degree of fluctuations directions in investment income compared to each other by financial instruments is estimated on the base of the correlation coefficient and the of which value can range from -1 to +1.

Portfolio investment diversification: a method of investment portfolio formation by expanding the types of financial instruments with opposite covariance aimed at reducing non- systematic and the total levels.

The higher is the number of types of financial instruments with opposite covariance, which is included in the portfolio, the lower is the level of non-systematic and the total risk in the overall level of investment income.