- •Contents

- •Companies ranked by 12M return

- •Companies ranked by 12M return

- •How to trade steel companies around met coal prices

- •Cautious steel demand outlook

- •Metallurgical coal a key steel input cost

- •Coking coal price sensitivity

- •Coking coal outlook

- •Steel sector margins and capex support near-term cash generation

- •Earnings revisions

- •Commodity and currency assumptions

- •Peer comparison per calendar year

- •ArcelorMittal South Africa

- •Evraz

- •Severstal

- •Anglo American

- •Glencore

- •Vale

- •Appendix

- •Disclosures appendix

vk.com/id446425943

Vale – BUY

Renaissance Capital

3 December 2018

Steel

Figure 71: Vale, $mn (unless otherwise noted)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vale |

|

|

|

VALE.N |

|

|

|

|

|

Target price, $: |

|

|

15.5 |

|||

Market capitalisation, $mn: |

|

|

|

70,009 |

|

|

|

|

|

Last price, $: |

|

|

13.5 |

|||

Enterprise value, $mn: |

|

|

|

90,243 |

|

|

|

|

|

Potential 12-month return: |

|

22.0% |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

|

2015 |

2016 |

2017 |

2018E |

2019E |

2020E |

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

||

Income statement |

|

|

|

|

|

|

|

|

Balance sheet |

|

|

|

|

|

|

|

Revenue |

|

25,609 |

29,334 |

35,713 |

37,304 |

38,014 |

37,951 |

|

Net operating assets |

66,066 |

62,915 |

|

54,806 |

55,592 |

56,234 |

|

Adjusted EBITDA |

|

7,081 |

12,181 |

15,337 |

16,757 |

16,085 |

15,074 |

|

Investments |

18 |

18 |

|

18 |

19 |

20 |

|

Adjusted EBIT |

|

3,052 |

8,267 |

10,873 |

12,908 |

11,986 |

10,932 |

|

Equity |

39,042 |

43,458 |

|

44,291 |

47,073 |

48,381 |

|

Net interest |

|

-10,801 |

1,966 |

-3,019 |

-4,761 |

-1,898 |

-1,883 |

|

Minority interest |

1,982 |

1,314 |

|

944 |

952 |

960 |

|

Taxation |

|

5,100 |

-2,781 |

-830 |

-1,529 |

-2,612 |

-2,344 |

|

Net debt (target: $10bn) |

25,060 |

18,161 |

|

9,589 |

7,587 |

6,913 |

|

Minority interest in profit |

|

491 |

6 |

-14 |

-46 |

-40 |

-40 |

|

|

|

|

|

|

|

|

|

Net profit for the year |

|

-12,129 |

5,277 |

6,935 |

6,580 |

7,796 |

6,992 |

|

Balance sheet ratios |

|

|

|

|

|

|

|

Underlying earnings |

|

-1,698 |

4,968 |

7,188 |

8,278 |

7,796 |

6,992 |

|

Gearing * |

31.4% |

22.4% |

|

11.6% |

8.5% |

7.5% |

|

Underlying EPS, $ |

|

-0.33 |

0.96 |

1.39 |

1.59 |

1.50 |

1.35 |

|

Net debt to EBITDA |

2.1x |

1.2x |

|

0.6x |

0.5x |

0.5x |

|

|

|

RoCE |

13.1% |

16.4% |

|

20.9% |

20.8% |

18.8% |

||||||||

Thomson Reuters consensus EPS, $ |

|

|

|

1.44 |

1.70 |

1.59 |

|

RoIC (after tax) |

12.6% |

19.8% |

|

13.4% |

13.9% |

12.9% |

||

DPS declared, $ |

|

0.29 |

0.27 |

0.28 |

0.84 |

1.02 |

1.16 |

|

RoE |

13.7% |

17.4% |

|

18.9% |

17.1% |

14.7% |

|

Adjusted EBIT |

|

|

|

|

|

|

|

|

Cash flow statement |

|

|

|

|

|

|

|

Ferrous Minerals |

|

4,230 |

8,747 |

11,497 |

12,311 |

11,031 |

10,110 |

|

Operating cash flow |

10,030 |

16,819 |

|

11,969 |

12,845 |

12,084 |

|

EBIT margin |

|

26% |

43% |

46% |

43% |

39% |

36% |

|

Capex less disposals |

-5,480 |

-4,154 |

|

-2,406 |

-4,372 |

-4,281 |

|

Coal |

|

-700 |

-244 |

-25 |

165 |

433 |

176 |

|

Other cash flows |

-987 |

-1,825 |

|

3,226 |

0 |

0 |

|

EBIT margin |

|

-133% |

-29% |

-2% |

10% |

17% |

8% |

|

FCF |

3,563 |

10,840 |

|

12,790 |

8,473 |

7,803 |

|

Base metals |

|

-453 |

186 |

501 |

1,037 |

963 |

1,084 |

|

Equity shareholders' cash |

702 |

8,574 |

|

11,407 |

7,017 |

6,358 |

|

EBIT margin |

|

-7% |

3% |

7% |

15% |

13% |

14% |

|

Dividends and share buy-backs |

-500 |

-1,675 |

|

-2,836 |

-5,014 |

-5,684 |

|

Fertiliser nutrients |

|

257 |

-138 |

-885 |

-109 |

0 |

0 |

|

Excess cash |

202 |

6,899 |

|

8,572 |

2,002 |

674 |

|

EBIT margin |

|

12% |

-7% |

-51% |

-122% |

n/a |

n/a |

Cash flow ratios |

|

|

|

|

|

|

||

Others and logistics |

|

-282 |

-284 |

-215 |

-497 |

-441 |

-439 |

|

|

|

|

|

|

|

||

EBIT margin |

|

-212% |

-179% |

-54% |

-183% |

-153% |

-146% |

|

Working capital days |

0 |

7 |

|

11 |

7 |

7 |

|

Adjusted EBIT - Group production |

3,052 |

8,267 |

10,873 |

12,908 |

11,986 |

10,932 |

|

Capex/EBITDA |

45.0% |

27.1% |

|

14.4% |

27.2% |

28.4% |

||

Income statement ratios |

|

|

|

|

|

|

|

|

FCF yield |

6.6% |

15.4% |

|

15.9% |

10.8% |

10.0% |

|

|

|

|

|

|

|

|

|

Equity shareholders' yield |

2.6% |

16.9% |

|

16.3% |

10.0% |

9.1% |

||

EBITDA margin |

|

27.7% |

41.5% |

42.9% |

44.9% |

42.3% |

39.7% |

|

Cash conversion |

0.1x |

1.2x |

|

1.4x |

0.9x |

0.9x |

|

EBIT margin |

|

11.9% |

28.2% |

30.4% |

34.6% |

31.5% |

28.8% |

|

Valuation |

|

|

|

|

|

|

|

EPS growth |

|

-138% |

393% |

44% |

15% |

-6% |

-10% |

|

|

|

|

|

|

|

||

Dividend payout ratio |

|

-88% |

29% |

20% |

52% |

68% |

86% |

|

SoTP valuation and calculation of target price |

|

|

|

$mn |

$ |

||

Input assumptions |

|

|

|

|

|

|

|

|

Ferrous minerals |

|

|

|

|

92,054 |

17.7 |

|

|

|

|

|

|

|

|

|

Coal |

|

|

|

|

1,409 |

0.3 |

||

Iron ore fines (62%Fe,CIF China), $/t |

56 |

58 |

71 |

66 |

65 |

64 |

|

Base metals |

|

|

|

|

7,527 |

1.4 |

||

Brazil to China freight charge, $/t |

|

11 |

9 |

15 |

19 |

19 |

16 |

|

Fertiliser nutrients |

|

|

|

|

1,488 |

0.3 |

|

Nickel, $/t |

|

11,864 |

9,599 |

10,404 |

13,353 |

13,839 |

14,537 |

|

Others and logistics |

|

|

|

|

-1,486 |

-0.3 |

|

Copper, $/t |

|

5,512 |

4,867 |

6,170 |

6,565 |

6,500 |

6,576 |

|

Total enterprise value |

|

|

|

|

100,991 |

19.4 |

|

Thermal coal, $/t |

|

57 |

64 |

85 |

99 |

95 |

87 |

|

Net debt as at latest year end |

|

|

|

|

-18,161 |

-3.5 |

|

Hard coking coal, $/t |

|

95 |

144 |

188 |

200 |

190 |

167 |

|

Cash used in share buy-backs |

|

|

|

|

0 |

0.0 |

|

$/BRL |

|

3.33 |

3.49 |

3.19 |

3.70 |

3.77 |

3.41 |

|

Other investments |

|

|

|

|

18 |

0.0 |

|

|

|

|

|

|

|

|

|

|

|

Minority interest (DCF value) |

|

|

|

|

-2,072 |

-0.4 |

Required breakeven price |

|

|

|

|

|

|

|

|

Equity value as at 30/11/2018 |

|

|

|

|

80,776 |

15.5 |

|

Iron ore breakeven price, $/t |

|

39 |

27 |

31 |

28 |

32 |

34 |

|

Rounded to |

|

|

|

|

|

15.5 |

|

Metallurgical coal breakeven price, $/t |

198 |

192 |

152 |

|

|

|

|

|

|

|

|

|

|

|

||

162 |

148 |

148 |

|

Share price on 29/11/2018 |

|

|

|

|

|

13.5 |

||||||

Nickel breakeven price, $/t |

|

12,198 |

8,160 |

9,137 |

8,406 |

9,096 |

9,652 |

|

Expected share price return |

|

|

|

|

|

15.1% |

|

Copper breakeven price, $/t |

|

4,574 |

2,893 |

2,341 |

3,248 |

3,123 |

3,307 |

|

Plus: expected dividend yield |

|

|

|

|

|

6.9% |

|

Sales volumes |

|

|

|

|

|

|

|

|

Total implied one-year return |

|

|

|

|

|

22.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Iron ore, mnt |

|

289 |

293 |

289 |

336 |

343 |

340 |

|

Share price range, $: |

|

|

|

|

|

|

|

Iron pellets, mnt |

|

46 |

48 |

52 |

54 |

58 |

60 |

|

12-month high on 3/10/2018 |

16.13 12-month low on 7/12/2017 |

10.55 |

|||||

Nickel, kt |

|

291 |

311 |

294 |

251 |

260 |

268 |

|

Price move since high |

-16.5% Price move since low |

|

27.7% |

||||

Copper, kt |

|

397 |

430 |

424 |

386 |

404 |

404 |

|

|

|

|

|

|

|

|

|

Attributable Cu eq volumes, kt |

|

5,238 |

5,403 |

5,382 |

5,374 |

5,674 |

5,719 |

|

Calculation of WACC |

|

|

|

|

|

|

|

Volume growth |

|

|

3.2% |

-0.4% |

-0.1% |

5.6% |

0.8% |

|

WACC |

10.9% |

Cost of debt |

|

|

7.0% |

||

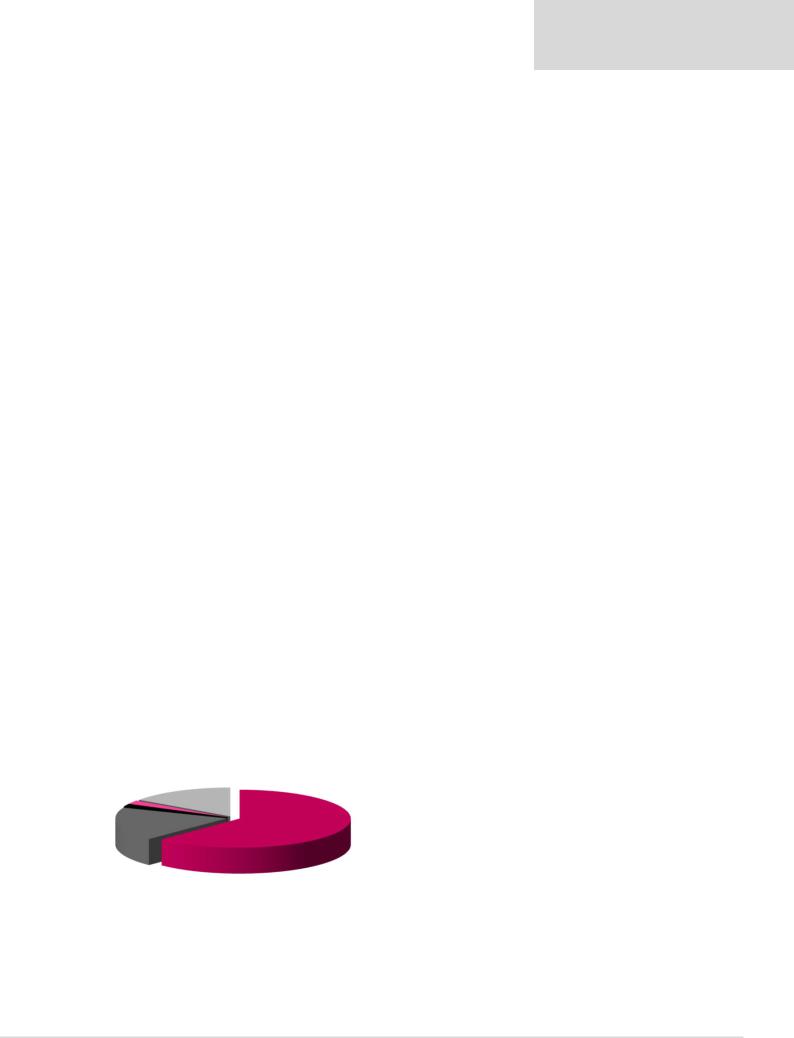

Contribution to FY18E Adjusted EBITDA |

|

|

|

|

|

|

|

Risk-free rate |

4.0% |

Tax rate |

|

|

30% |

|||

|

|

|

|

|

|

|

Equity risk premium |

6.2% |

After-tax cost of debt |

|

4.9% |

|||||

|

Base metals |

|

|

|

|

|

|

|

Beta |

1.30 |

Debt weighting |

|

15% |

|||

|

|

|

|

|

|

|

|

Cost of equity |

12.0% |

Terminal growth rate |

|

2.0% |

||||

|

Coal |

15% |

|

|

|

|

|

|

|

|

||||||

|

2% |

|

|

|

|

|

|

|

|

Valuation ratios |

|

|

|

|

|

|

|

Manganese |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-YE |

2016 |

2017 |

|

2018E |

2019E |

2020E |

|

|

2% |

|

|

|

|

|

|

|

|

P/E multiple |

5.3x |

7.1x |

|

8.4x |

9.0x |

10.0x |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

Dividend yield |

5.3% |

2.9% |

|

6.2% |

7.6% |

8.6% |

|

|

|

|

|

|

|

|

|

|

EV/EBITDA |

4.4x |

4.6x |

|

4.8x |

4.9x |

5.2x |

|

|

|

|

|

|

|

|

|

|

P/B |

0.7x |

1.2x |

|

1.6x |

1.5x |

1.4x |

|

Pellets |

|

|

|

|

|

|

|

|

NAV per share, $ |

7.6 |

8.4 |

|

8.5 |

9.1 |

9.3 |

|

19% |

|

|

|

|

Iron ore |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

62% |

|

|

Dividend policy: Minimum payment of 30% of EBITDA less sustaining capex. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Gearing defined as net debt/(net debt +equity)

Source: Bloomberg, Thomson Reuters, Company data, Renaissance Capital estimates

45