GS Metals Monitor_watermark

.pdf

vk.com/id446425943

Goldman Sachs

Metals Monitor

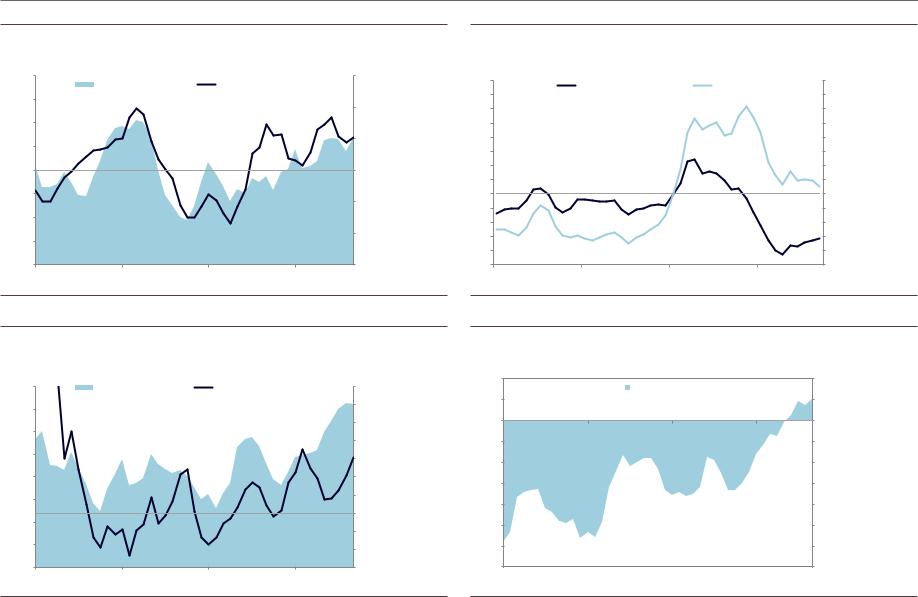

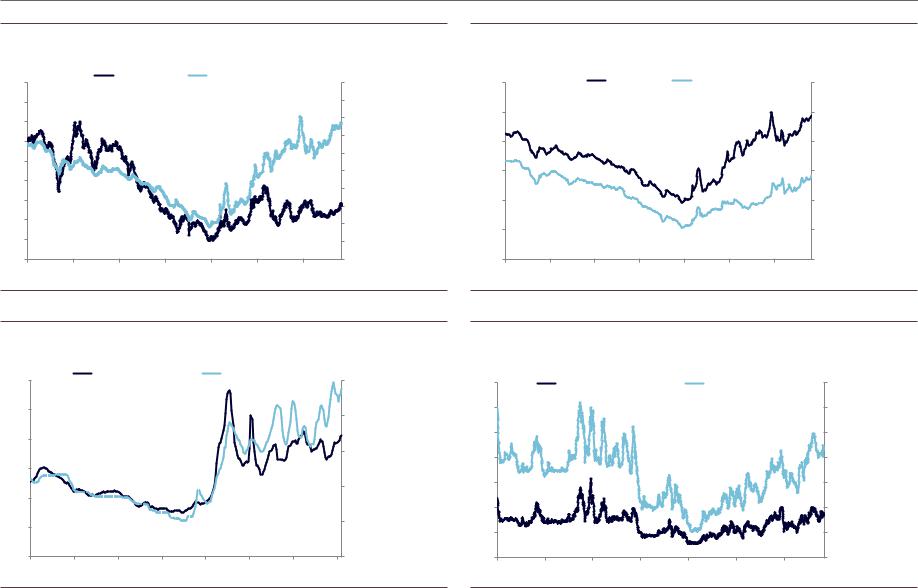

Exhibit 70: China refined copper net imports

Kt |

China Refined Copper Imports (3mma) |

% |

|

6,000 |

Annualized Level |

|

60 |

|

YoY Percent Change (right) |

||

5,500 |

|

|

40 |

|

|

|

|

5,000 |

|

|

|

4,500 |

|

|

20 |

|

|

|

|

4,000 |

|

|

0 |

3,500 |

|

|

-20 |

|

|

|

|

3,000 |

|

|

|

2,500 |

|

|

-40 |

|

|

|

|

2,000 |

|

|

-60 |

2015 |

2016 |

2017 |

2018 |

Source: Haver Analytics, Goldman Sachs Global Investment Research

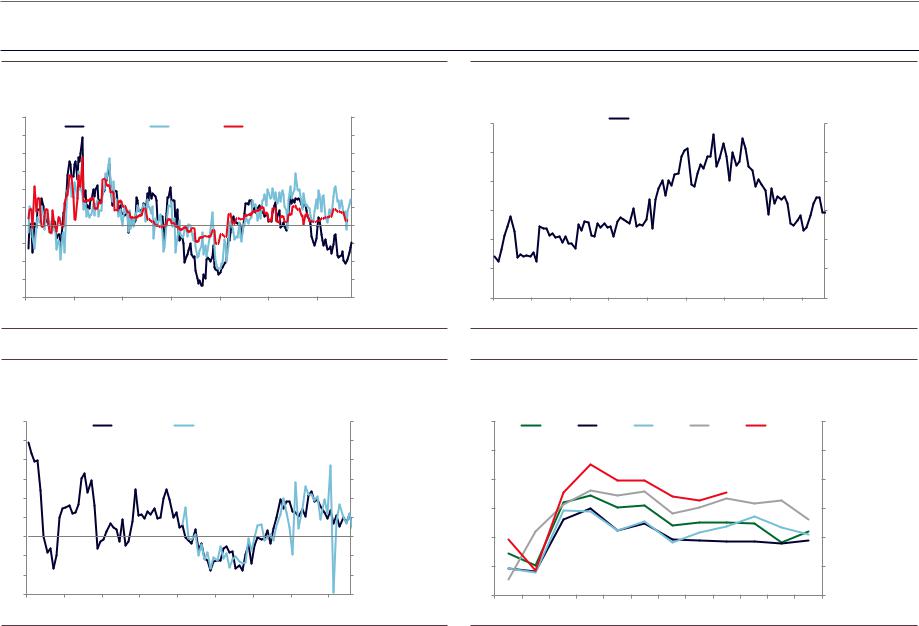

Exhibit 72: China aluminum net exports

Kt |

China Aluminum Exports (3mma) |

% |

6,000 |

Annualized Level |

YoY Percent Change (right) |

70 |

|

5,500 |

|

|

|

60 |

|

|

|

|

|

5,000 |

|

|

|

50 |

|

|

|

40 |

|

|

|

|

|

|

4,500 |

|

|

|

30 |

|

|

|

|

|

4,000 |

|

|

|

20 |

3,500 |

|

|

|

10 |

|

|

|

|

|

3,000 |

|

|

|

0 |

|

|

|

-10 |

|

|

|

|

|

|

2,500 |

|

|

|

-20 |

|

|

|

|

|

2,000 |

|

|

|

-30 |

2015 |

2016 |

2017 |

2018 |

|

Exhibit 71: China copper scrap imports

% |

YoY Percent Change in China Copper Scrap Imports (3mma) |

% |

80 |

Gross Weight |

|

Import Value |

80 |

70 |

|

70 |

||

|

|

|

||

60 |

|

|

|

60 |

50 |

|

|

|

50 |

40 |

|

|

|

40 |

30 |

|

|

|

30 |

20 |

|

|

|

20 |

10 |

|

|

|

10 |

0 |

|

|

|

0 |

-10 |

|

|

|

-10 |

-20 |

|

|

|

-20 |

-30 |

|

|

|

-30 |

-40 |

|

|

|

-40 |

-50 |

|

|

|

-50 |

2015 |

2016 |

2017 |

2018 |

|

Source: Haver Analytics, Goldman Sachs Global Investment Research

Exhibit 73: China alumina net export

Kt |

China Alumina Exports (3mma) |

Kt |

|

2,000 |

|

Annualized Level |

2,000 |

|

|

|

|

1,000 |

|

|

1,000 |

0 |

|

|

0 |

-1,000 |

|

|

-1,000 |

-2,000 |

|

|

-2,000 |

-3,000 |

|

|

-3,000 |

-4,000 |

|

|

-4,000 |

-5,000 |

|

|

-5,000 |

-6,000 |

|

|

-6,000 |

-7,000 |

|

|

-7,000 |

2015 |

2016 |

2017 |

2018 |

Source: Haver Analytics, Goldman Sachs Global Investment Research |

Source: Haver Analytics, Goldman Sachs Global Investment Research |

5 November 2018 |

2< |

vk.com/id446425943

Goldman Sachs

Iron Ore Charts

Metals Monitor

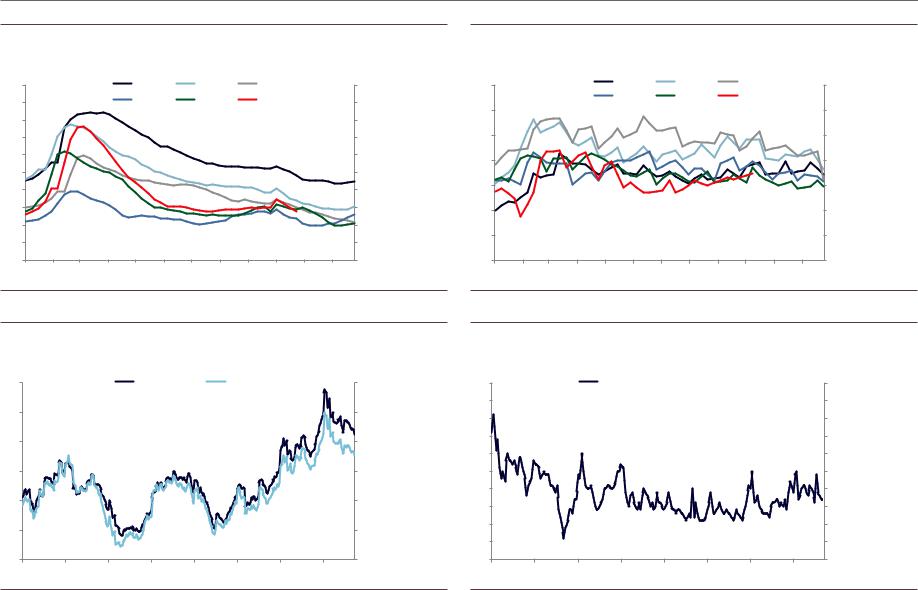

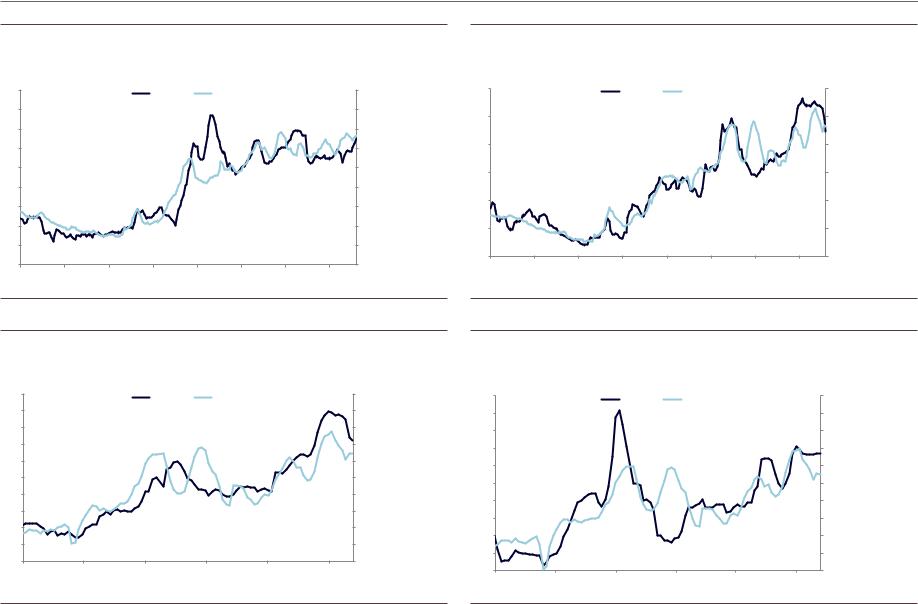

Exhibit 74: China steel production growth

% |

|

YoY growth in crude steel production |

% |

|||

30 |

|

30 |

||||

|

Mysteel |

CISA |

|

|

||

25 |

|

|

NBS (adjusted) |

|||

|

|

|

|

|

25 |

|

20 |

|

|

|

|

|

20 |

15 |

|

|

|

|

|

15 |

10 |

|

|

|

|

|

10 |

5 |

|

|

|

|

|

5 |

0 |

|

|

|

|

|

0 |

-5 |

|

|

|

|

|

-5 |

-10 |

|

|

|

|

|

-10 |

-15 |

|

|

|

|

|

-15 |

-20 |

|

|

|

|

|

-20 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Mysteel, CISA, Haver Analytics, Goldman Sachs Global Investment Research

Exhibit 76: China steel consumption growth

% |

|

|

YoY Steel Consumption Growth |

|

% |

|||

30 |

|

|

|

30 |

||||

|

Apparent |

|

Real (Inventory Adjusted) |

|||||

|

|

|

|

|||||

25 |

|

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

|

20 |

15 |

|

|

|

|

|

|

|

15 |

10 |

|

|

|

|

|

|

|

10 |

5 |

|

|

|

|

|

|

|

5 |

0 |

|

|

|

|

|

|

|

0 |

-5 |

|

|

|

|

|

|

|

-5 |

-10 |

|

|

|

|

|

|

|

-10 |

-15 |

|

|

|

|

|

|

|

-15 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Exhibit 75: China steel exports

Mt |

|

|

|

|

|

|

|

Mt |

12 |

|

|

|

China Steel Exports |

|

|

12 |

|

|

|

|

|

|

|

|

||

10 |

|

|

|

|

|

|

|

10 |

8 |

|

|

|

|

|

|

|

8 |

6 |

|

|

|

|

|

|

|

6 |

4 |

|

|

|

|

|

|

|

4 |

2 |

|

|

|

|

|

|

|

2 |

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Haver Analytics

Exhibit 77: China steel consumption seasonal pattern

Mt |

|

China crude steel daily real consumption (NBS) |

Mt |

||||||||

|

|

|

|||||||||

2.6 |

2014 |

|

2015 |

|

2016 |

|

2017 |

|

2018 |

2.6 |

|

|

|

|

|

|

|

||||||

2.4 |

|

|

|

|

|

|

|

|

|

|

2.4 |

2.2 |

|

|

|

|

|

|

|

|

|

|

2.2 |

2.0 |

|

|

|

|

|

|

|

|

|

|

2.0 |

1.8 |

|

|

|

|

|

|

|

|

|

|

1.8 |

1.6 |

|

|

|

|

|

|

|

|

|

|

1.6 |

1.4 |

|

|

|

|

|

|

|

|

|

|

1.4 |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Source: Haver Analytics, Bloomberg, Mysteel, Goldman Sachs Global Investment Research |

Source: Haver Analytics, Bloomberg, Mysteel, Goldman Sachs Global Investment Research |

5 November 2018 |

22 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

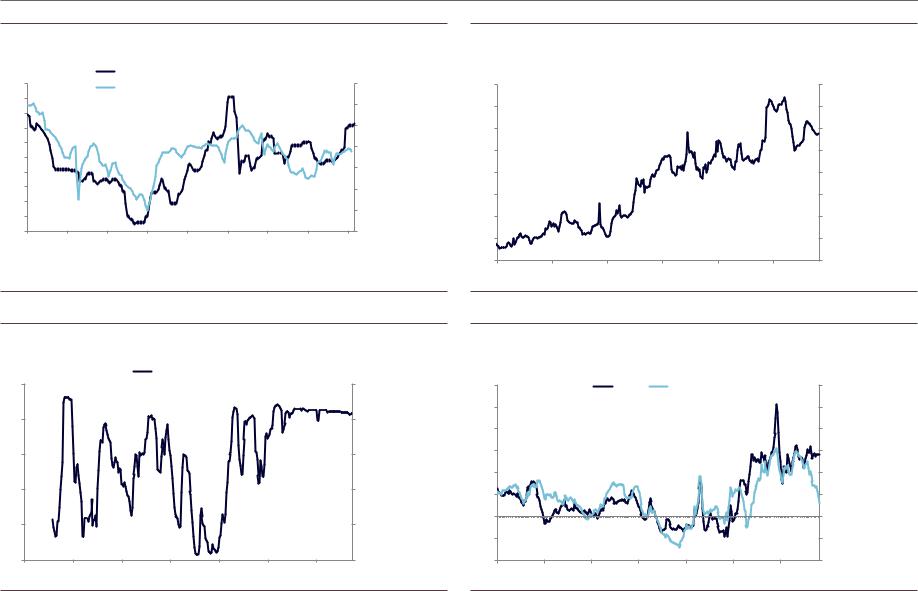

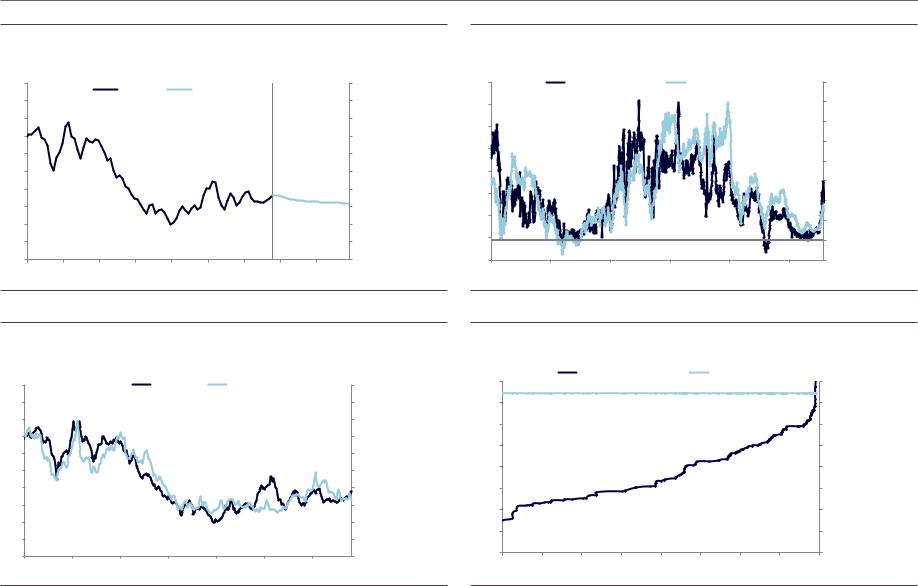

Exhibit 78: Steel trader inventory |

|

Exhibit 79: Steel inventory at mills |

|

||

Mt |

Steel trader inventories |

Mt |

Mt |

Steel mill inventories |

Mt |

24 |

|

|

|

2013 |

|

2014 |

|

2015 |

|

24 |

|

22 |

|

|

|

2016 |

|

2017 |

|

2018 |

|

22 |

|

20 |

|

|

|

|

|

|

|

|

|

|

20 |

18 |

|

|

|

|

|

|

|

|

|

|

18 |

16 |

|

|

|

|

|

|

|

|

|

|

16 |

14 |

|

|

|

|

|

|

|

|

|

|

14 |

12 |

|

|

|

|

|

|

|

|

|

|

12 |

10 |

|

|

|

|

|

|

|

|

|

|

10 |

8 |

|

|

|

|

|

|

|

|

|

|

8 |

6 |

|

|

|

|

|

|

|

|

|

|

6 |

4 |

|

|

|

|

|

|

|

|

|

|

4 |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

20 |

|

|

|

2013 |

|

2014 |

|

2015 |

|

20 |

|

|

|

|

2016 |

|

2017 |

|

2018 |

|

|||

|

|

|

|

|

|

|

|

||||

18 |

|

|

|

|

|

|

|

|

|

|

18 |

16 |

|

|

|

|

|

|

|

|

|

|

16 |

14 |

|

|

|

|

|

|

|

|

|

|

14 |

12 |

|

|

|

|

|

|

|

|

|

|

12 |

10 |

|

|

|

|

|

|

|

|

|

|

10 |

8 |

|

|

|

|

|

|

|

|

|

|

8 |

6 |

|

|

|

|

|

|

|

|

|

|

6 |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Source: Bloomberg, Goldman Sachs Global Investment Research |

Source: Mysteel, Goldman Sachs Global Investment Research |

Exhibit 80: Iron ore port inventory in days of use

Days |

|

Iron Ore Port Inventory in Days of Use |

Days |

||||

45 |

|

|

Steelhome |

|

Mysteel |

|

45 |

40 |

|

|

|

|

|

|

40 |

35 |

|

|

|

|

|

|

35 |

30 |

|

|

|

|

|

|

30 |

25 |

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

20 |

15 |

|

|

|

|

|

|

15 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Exhibit 81: Inventory of imported iron ore at Chinese steel mills

Days |

|

|

|

|

|

|

Days |

60 |

|

|

Imported Iron Ore Inventory at Mills |

60 |

|||

55 |

|

|

|

|

|

|

55 |

50 |

|

|

|

|

|

|

50 |

45 |

|

|

|

|

|

|

45 |

40 |

|

|

|

|

|

|

40 |

35 |

|

|

|

|

|

|

35 |

30 |

|

|

|

|

|

|

30 |

25 |

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

20 |

15 |

|

|

|

|

|

|

15 |

10 |

|

|

|

|

|

|

10 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Mysteel, Bloomberg, Haver Analytics, Goldman Sachs Global Investment Research |

Source: Mysteel |

5 November 2018 |

23 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

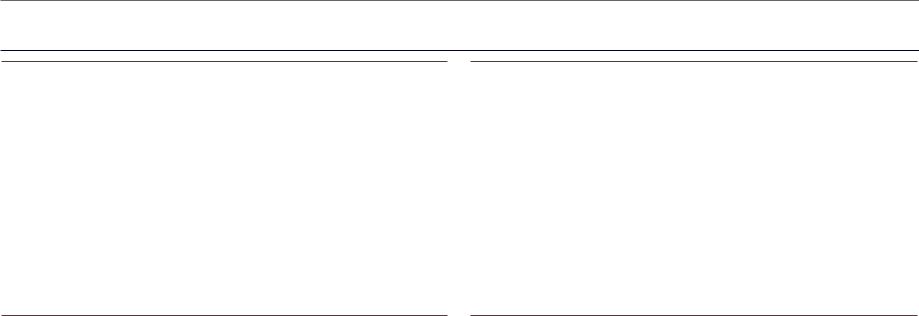

Exhibit 82: Iron ore price and Chinese domestic iron ore mine utilization rate

Rmb/t |

|

|

Iron Ore Price in Tangshan (left) |

|

|

% |

||

900 |

|

|

|

|

80 |

|||

|

|

Domestic Mine Utilisation Rate (right) |

|

|||||

850 |

|

|

|

|

||||

|

|

|

|

|

|

|

75 |

|

800 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

70 |

|

750 |

|

|

|

|

|

|

|

|

700 |

|

|

|

|

|

|

|

65 |

650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 |

|

600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

550 |

|

|

|

|

|

|

|

55 |

500 |

|

|

|

|

|

|

|

50 |

450 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 |

Feb-15 |

|

Feb-16 |

|

Feb-17 |

|

Feb-18 |

45 |

Aug-14 |

Aug-15 |

Aug-16 |

Aug-17 |

Aug-18 |

||||

Source: Mysteel

Exhibit 84: Share of profitable steel mills in China

Share |

|

|

Share of Profitable Mills |

|

Share |

|

1.0 |

|

|

|

1.0 |

||

|

|

|

|

|

||

0.8 |

|

|

|

|

|

0.8 |

0.6 |

|

|

|

|

|

0.6 |

0.4 |

|

|

|

|

|

0.4 |

0.2 |

|

|

|

|

|

0.2 |

0.0 |

|

|

|

|

|

0.0 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Exhibit 83: Reduction of liquid iron ore from cuts and halts

Kt/d |

|

Reduction of Liquid Iron Output from Cuts and Halts |

Kt/d |

|

|

|

800 |

|

|

|

|

800 |

700 |

|

|

|

|

700 |

600 |

|

|

|

|

600 |

500 |

|

|

|

|

500 |

400 |

|

|

|

|

400 |

300 |

|

|

|

|

300 |

200 |

|

|

|

|

200 |

100 |

|

|

|

|

100 |

0 |

|

|

|

|

0 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Mysteel

Exhibit 85: Margins of Chinese steel mills

US$/t |

|

|

Steel Margins |

|

US$/t |

|

|

|

|

|

|

||

240 |

|

|

Rebar |

Hot Rolled Steel |

240 |

|

200 |

|

|

|

|

|

200 |

160 |

|

|

|

|

|

160 |

120 |

|

|

|

|

|

120 |

80 |

|

|

|

|

|

80 |

40 |

|

|

|

|

|

40 |

0 |

|

|

|

|

|

0 |

-40 |

|

|

|

|

|

-40 |

-80 |

|

|

|

|

|

-80 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Mysteel |

Source: Bloomberg, Goldman Sachs Global Investment Research |

5 November 2018 |

24 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 86: Iron ore and China rebar steel price

US$/t |

|

Iron Ore (left) |

Rebar Steel (right) |

RMB/t |

||

200 |

|

6,000 |

||||

|

|

|

|

|

||

180 |

|

|

|

|

|

5,500 |

160 |

|

|

|

|

|

5,000 |

|

|

|

|

|

|

|

140 |

|

|

|

|

|

4,500 |

|

|

|

|

|

4,000 |

|

120 |

|

|

|

|

|

|

|

|

|

|

|

3,500 |

|

100 |

|

|

|

|

|

|

|

|

|

|

|

3,000 |

|

80 |

|

|

|

|

|

|

|

|

|

|

|

2,500 |

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

2,000 |

|

|

|

|

|

|

|

40 |

|

|

|

|

|

1,500 |

20 |

|

|

|

|

|

1,000 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg

Exhibit 88: Hard coking coal and coke price

US$/t |

|

Hard Coking Coal (left) |

|

Taiyuan Coke (right) |

RMB/t |

||

300 |

|

|

2,500 |

||||

|

|

|

|

|

|

||

250 |

|

|

|

|

|

|

2,000 |

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

1,500 |

|

|

|

|

|

|

|

|

150 |

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

1,000 |

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

500 |

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

0 |

Jul-13 |

Apr-14 |

Jan-15 |

Oct-15 |

Jul-16 |

Apr-17 |

Jan-18 |

Oct-18 |

Exhibit 87: Rebar and Scrap

RMB/t |

|

|

|

|

|

RMB/t |

6,000 |

|

|

Rebar Steel |

Scrap Jinan |

6,000 |

|

5,000 |

|

|

|

|

|

5,000 |

4,000 |

|

|

|

|

|

4,000 |

3,000 |

|

|

|

|

|

3,000 |

2,000 |

|

|

|

|

|

2,000 |

1,000 |

|

|

|

|

|

1,000 |

0 |

|

|

|

|

|

0 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg

Exhibit 89: Freight from Australia and Brazil to China

US$/wmt |

|

|

|

|

|

|

US$/wmt |

35 |

|

Australia-China Freight |

|

Brazil-China Freight |

35 |

||

30 |

|

|

|

|

|

|

30 |

25 |

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

20 |

15 |

|

|

|

|

|

|

15 |

10 |

|

|

|

|

|

|

10 |

5 |

|

|

|

|

|

|

5 |

0 |

|

|

|

|

|

|

0 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Source: Bloomberg |

Source: Platts |

5 November 2018 |

25 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 90: Iron ore grade premium 62 vs 58 |

|

Exhibit 91: Iron Ore grade premium 65 vs 62 |

|

||

$/t |

Iron Ore Grade Premium: 62% vs. 58% Fe |

$/t |

$/t |

Iron Ore Grade Premium: 65% vs. 62% Fe |

$/t |

45 |

|

|

Actual |

|

Model Fitted |

|

45 |

|

|

|

|

|

|

||

40 |

|

|

|

|

|

|

40 |

35 |

|

|

|

|

|

|

35 |

30 |

|

|

|

|

|

|

30 |

25 |

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

20 |

15 |

|

|

|

|

|

|

15 |

10 |

|

|

|

|

|

|

10 |

5 |

|

|

|

|

|

|

5 |

0 |

|

|

|

|

|

|

0 |

Jan-15 |

Jul-15 |

Jan-16 |

Jul-16 |

Jan-17 |

Jul-17 |

Jan-18 |

Jul-18 |

30 |

|

|

Actual |

|

Model Fitted |

|

30 |

|

|

|

|

|

|

||

25 |

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

20 |

15 |

|

|

|

|

|

|

15 |

10 |

|

|

|

|

|

|

10 |

5 |

|

|

|

|

|

|

5 |

0 |

|

|

|

|

|

|

0 |

Jan-15 |

Jul-15 |

Jan-16 |

Jul-16 |

Jan-17 |

Jul-17 |

Jan-18 |

Jul-18 |

Source: Bloomberg

Exhibit 92: Iron ore pellet premium

$/t |

Iron Ore Pellet Premium |

$/t |

100 |

|

Actual |

Model Fitted |

100 |

|

|

|

|

|||

90 |

|

|

|

|

90 |

80 |

|

|

|

|

80 |

70 |

|

|

|

|

70 |

60 |

|

|

|

|

60 |

50 |

|

|

|

|

50 |

40 |

|

|

|

|

40 |

30 |

|

|

|

|

30 |

20 |

|

|

|

|

20 |

10 |

|

|

|

|

10 |

0 |

|

|

|

|

0 |

Jan-17 |

May-17 |

Sep-17 |

Jan-18 |

May-18 |

Sep-18 |

Source: Bloomberg

Exhibit 93: Iron ore lump premium

$/t |

|

Iron Ore Lump Premium |

|

$/t |

|

0.50 |

|

Actual |

Model Fitted |

0.50 |

|

|

|

|

|||

0.45 |

|

|

|

|

0.45 |

0.40 |

|

|

|

|

0.40 |

0.35 |

|

|

|

|

0.35 |

0.30 |

|

|

|

|

0.30 |

0.25 |

|

|

|

|

0.25 |

0.20 |

|

|

|

|

0.20 |

0.15 |

|

|

|

|

0.15 |

0.10 |

|

|

|

|

0.10 |

0.05 |

|

|

|

|

0.05 |

0.00 |

|

|

|

|

0.00 |

Jan-17 |

May-17 |

Sep-17 |

Jan-18 |

May-18 |

Sep-18 |

Source: Bloomberg |

Source: Bloomberg |

5 November 2018 |

26 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 94: Iron ore historical price and futures curve

US$/t |

|

|

Iron Ore Price (62% Fe) |

|

|

US$/t |

||

200 |

|

|

|

|

200 |

|||

|

|

Actual |

|

Futures Curve |

|

|||

180 |

|

|

|

|

180 |

|||

|

|

|

|

|

|

|

||

160 |

|

|

|

|

|

|

|

160 |

140 |

|

|

|

|

|

|

|

140 |

120 |

|

|

|

|

|

|

|

120 |

100 |

|

|

|

|

|

|

|

100 |

80 |

|

|

|

|

|

|

|

80 |

60 |

|

|

|

|

|

|

|

60 |

40 |

|

|

|

|

|

|

|

40 |

20 |

|

|

|

|

|

|

|

20 |

0 |

|

|

|

|

|

|

|

0 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

2019 |

2020 |

Source: Bloomberg

Exhibit 96: Model iron ore price vs actual

US$/t |

Iron Ore Price |

US$/t |

|

|

200 |

|

|

Actual |

|

Model Fitted |

200 |

180 |

|

|

|

|

|

180 |

160 |

|

|

|

|

|

160 |

140 |

|

|

|

|

|

140 |

120 |

|

|

|

|

|

120 |

100 |

|

|

|

|

|

100 |

80 |

|

|

|

|

|

80 |

60 |

|

|

|

|

|

60 |

40 |

|

|

|

|

|

40 |

20 |

|

|

|

|

|

20 |

0 |

|

|

|

|

|

0 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Exhibit 95: Iron ore timespreads

% |

|

Iron Ore Timespreads |

% |

||

7 |

|

2 to 3 month (left) |

|

3 to 15 month (right) |

40 |

6 |

|

|

|

|

35 |

5 |

|

|

|

|

30 |

|

|

|

|

|

|

4 |

|

|

|

|

25 |

|

|

|

|

20 |

|

3 |

|

|

|

|

|

|

|

|

|

15 |

|

2 |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

1 |

|

|

|

|

5 |

|

|

|

|

|

|

0 |

|

|

|

|

0 |

-1 |

|

|

|

|

-5 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg

Exhibit 97: Iron Ore cost curve and current price

$/t |

|

IO total cash cost |

|

|

IO spot price |

|

$/t |

|

80 |

|

|

|

|

80 |

|||

|

|

|

|

|

|

|

||

70 |

|

|

|

|

|

|

|

70 |

60 |

|

|

|

|

|

|

|

60 |

50 |

|

|

|

|

|

|

|

50 |

40 |

|

|

|

|

|

|

|

40 |

30 |

|

|

|

|

|

|

|

30 |

20 |

|

|

|

|

|

|

|

20 |

10 |

|

|

|

|

|

|

|

10 |

0 |

|

|

|

|

|

|

|

0 |

0 |

200 |

400 |

600 |

800 |

1000 |

1200 |

1400 |

1600 |

Source: Bloomberg, Goldman Sachs Global Investment Research |

Source: AME, Bloomberg, Goldman Sachs Global Investment Research |

5 November 2018 |

27 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

GS Forecasts

Exhibit 98: GS aluminum supply and demand balance

|

(’000t) |

2016 |

2017 |

2018E |

2019E |

2020E |

|

|

Refined Production |

58734 |

62778 |

65497 |

68536 |

71032 |

|

|

% Change YoY |

3.2 |

6.9 |

4.3 |

4.6 |

3.6 |

|

|

Of which China |

31938 |

36007 |

37523 |

39558 |

41141 |

|

|

% change |

4.0 |

12.7 |

4.2 |

5.4 |

4.0 |

|

|

Refined Consumption |

59214 |

62823 |

65648 |

68010 |

70097 |

|

|

% change |

5.4 |

6.1 |

4.5 |

3.6 |

3.1 |

|

|

Of which China |

31667 |

34295 |

36010 |

37450 |

38761 |

|

|

% change |

8.2 |

8.3 |

5.0 |

4.0 |

3.5 |

|

|

Of which ex-China |

27547 |

28528 |

29638 |

30560 |

31335 |

|

|

% change |

2.3 |

3.6 |

3.9 |

3.1 |

2.5 |

|

|

Balance |

-480 |

-45 |

-151 |

526 |

936 |

|

|

LME Price ($/t) |

1605 |

1968 |

2196 |

2075 |

2000 |

|

|

|

|

|

|

|

|

|

Exhibit 99: GS copper supply and demand balance

|

(’000t) |

2016 |

2017 |

2018E |

2019E |

2020E |

|

|

Mine Supply |

20169 |

20086 |

20272 |

20743 |

21504 |

|

|

% change |

5.1 |

-0.4 |

0.9 |

2.3 |

3.7 |

|

|

|

|

|

|

|

|

|

|

Refined Supply |

22743 |

23094 |

23449 |

23977 |

24537 |

|

|

% change |

3.4 |

1.5 |

1.5 |

2.3 |

2.3 |

|

|

|

|

|

|

|

|

|

|

Refined Consumption |

22569 |

23040 |

23576 |

23978 |

24430 |

|

|

% change |

2.9 |

2.1 |

2.3 |

1.7 |

1.9 |

|

|

Of which China |

10706 |

11030 |

11262 |

11481 |

11654 |

|

|

% change |

5.0 |

3.0 |

2.1 |

1.9 |

1.5 |

|

|

Of which ex-China |

11741 |

11891 |

11986 |

12050 |

12239 |

|

|

% change |

-0.4 |

1.3 |

0.8 |

0.5 |

1.6 |

|

|

Balance |

174 |

54 |

-126 |

-1 |

107 |

|

|

LME Price ($/t) |

4862 |

6166 |

6550 |

6885 |

7023 |

|

|

|

|

|

|

|

|

|

Source: Goldman Sachs Global Investment Research |

Source: Goldman Sachs Global Investment Research |

Exhibit 100: GS nickel supply and demand balance

|

(’000t) |

2016 |

2017 |

2018E |

2019E |

2020E |

|

|

Refined Production |

2000 |

2072 |

2136 |

2255 |

2346 |

|

|

% change |

0.6 |

3.6 |

3.1 |

5.6 |

4.0 |

|

|

Of which China NPI |

374 |

400 |

450 |

500 |

550 |

|

|

Of which Indonesia NPI |

97 |

180 |

223 |

241 |

249 |

|

|

Refined Consumption |

1956 |

2139 |

2287 |

2360 |

2405 |

|

|

% change |

6.6 |

9.3 |

6.9 |

3.2 |

1.9 |

|

|

Of which China+Indonesia |

1050 |

1206 |

1330 |

1389 |

1417 |

|

|

% change |

8.5 |

14.8 |

10.3 |

4.4 |

2.0 |

|

|

Of which ROW |

906 |

933 |

957 |

971 |

988 |

|

|

% change |

4.5 |

3.0 |

2.6 |

1.4 |

1.7 |

|

|

Balance |

44 |

-67 |

-152 |

-105 |

-59 |

|

|

LME Price ($/t) |

9606 |

10405 |

14065 |

17250 |

17250 |

|

|

|

|

|

|

|

|

|

Exhibit 101: GS zinc supply and demand balance

|

(’000t) |

2016 |

2017 |

2018E |

2019E |

2020E |

|

|

Mine Supply |

12445 |

12991 |

13467 |

14341 |

15131 |

|

|

% change |

-5.4 |

4.4 |

3.7 |

6.5 |

5.5 |

|

|

|

|

|

|

|

|

|

|

Refined Supply |

13900 |

13700 |

14100 |

14750 |

15300 |

|

|

% change |

0.6 |

-1.4 |

2.9 |

4.6 |

3.7 |

|

|

|

|

|

|

|

|

|

|

Refined Consumption |

14038 |

14344 |

14622 |

14870 |

15114 |

|

|

% change |

1.9 |

2.2 |

1.9 |

1.7 |

1.6 |

|

|

Of which China |

6624 |

6823 |

6959 |

7064 |

7170 |

|

|

% change |

3.0 |

3.0 |

2.0 |

1.5 |

1.5 |

|

|

Of which ex-China |

7414 |

7521 |

7662 |

7807 |

7944 |

|

|

% change |

0.9 |

1.4 |

1.9 |

1.9 |

1.8 |

|

|

Balance |

-138 |

-644 |

-522 |

-120 |

186 |

|

|

LME Price ($/t) |

2094 |

2893 |

3024 |

2975 |

2700 |

|

|

|

|

|

|

|

|

|

Source: Goldman Sachs Global Investment Research |

Source: Goldman Sachs Global Investment Research |

5 November 2018 |

28 |