GS Metals Monitor_watermark

.pdf

vk.com/id446425943

Goldman Sachs

Metals Monitor

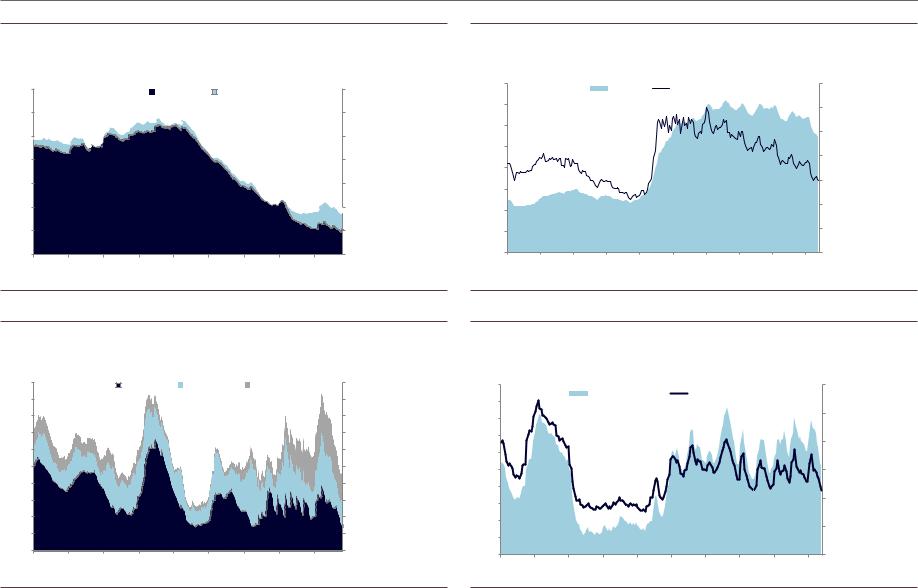

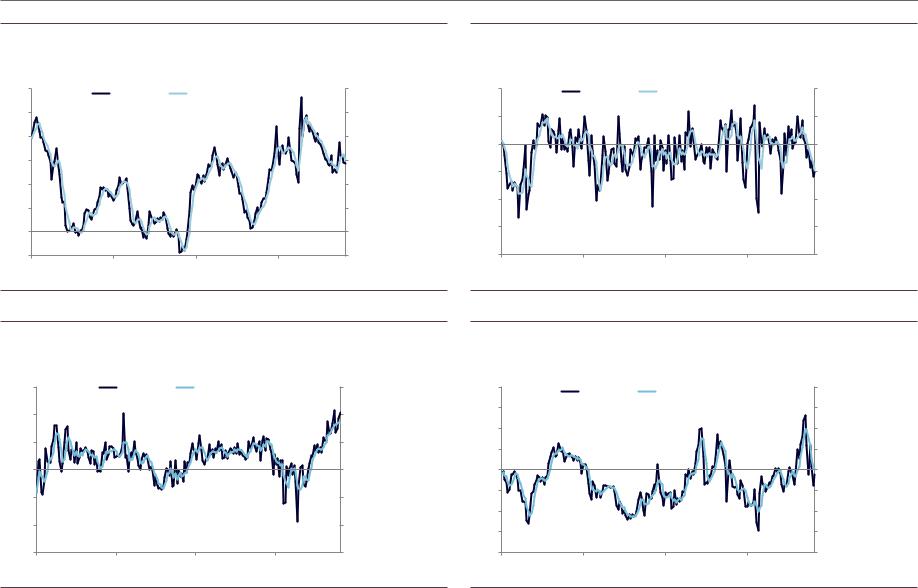

Exhibit 30: Aluminum exchange inventory

kt |

Aluminum Exchange Inventory |

kt |

7,000 |

|

|

|

LME |

SHFE |

|

7,000 |

|

6,000 |

|

|

|

|

|

|

|

6,000 |

5,000 |

|

|

|

|

|

|

|

5,000 |

4,000 |

|

|

|

|

|

|

|

4,000 |

3,000 |

|

|

|

|

|

|

|

3,000 |

2,000 |

|

|

|

|

|

|

|

2,000 |

1,000 |

|

|

|

|

|

|

|

1,000 |

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg, Goldman Sachs Global Investment Research

Exhibit 32: Copper exchange inventory

kt |

Copper Exchange Inventory |

kt |

1,000 |

|

|

LME |

|

SHFE |

COMEX |

1,000 |

|

900 |

|

|

|

|

|

|

|

900 |

800 |

|

|

|

|

|

|

|

800 |

700 |

|

|

|

|

|

|

|

700 |

600 |

|

|

|

|

|

|

|

600 |

500 |

|

|

|

|

|

|

|

500 |

400 |

|

|

|

|

|

|

|

400 |

300 |

|

|

|

|

|

|

|

300 |

200 |

|

|

|

|

|

|

|

200 |

100 |

|

|

|

|

|

|

|

100 |

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Exhibit 31: Aluminum total inventory

kt |

|

|

Global Aluminum Inventory |

|

|

Days |

|||

16,000 |

|

|

Level |

|

Days of Use (RHS) |

|

140 |

||

|

|

|

|

|

|

||||

14,000 |

|

|

|

|

|

|

|

|

120 |

|

|

|

|

|

|

|

|

|

|

12,000 |

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

10,000 |

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

8,000 |

|

|

|

|

|

|

|

|

|

6,000 |

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

|

4,000 |

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

2,000 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

0 |

2000 |

2002 |

2004 |

2006 |

2008 |

2010 |

2012 |

2014 |

2016 |

2018 |

Source: CRU, Goldman Sachs Global Investment Research

Exhibit 33: Copper total inventory

kt |

|

|

Refined Copper Inventory |

|

|

Days |

|||

2,500 |

|

|

|

|

60 |

||||

|

|

Global Total |

|

Days of Use (right) |

|

||||

2,300 |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

2,100 |

|

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

|

1,900 |

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

1,700 |

|

|

|

|

|

|

|

|

|

1,500 |

|

|

|

|

|

|

|

|

30 |

1,300 |

|

|

|

|

|

|

|

|

|

1,100 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

900 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

700 |

|

|

|

|

|

|

|

|

|

500 |

|

|

|

|

|

|

|

|

0 |

2000 |

2002 |

2004 |

2006 |

2008 |

2010 |

2012 |

2014 |

2016 |

2018 |

Source: Bloomberg, Goldman Sachs Global Investment Research |

Source: CRU, Goldman Sachs Global Investment Research |

5 November 2018 |

<< |

vk.com/id446425943

Goldman Sachs

Metals Monitor

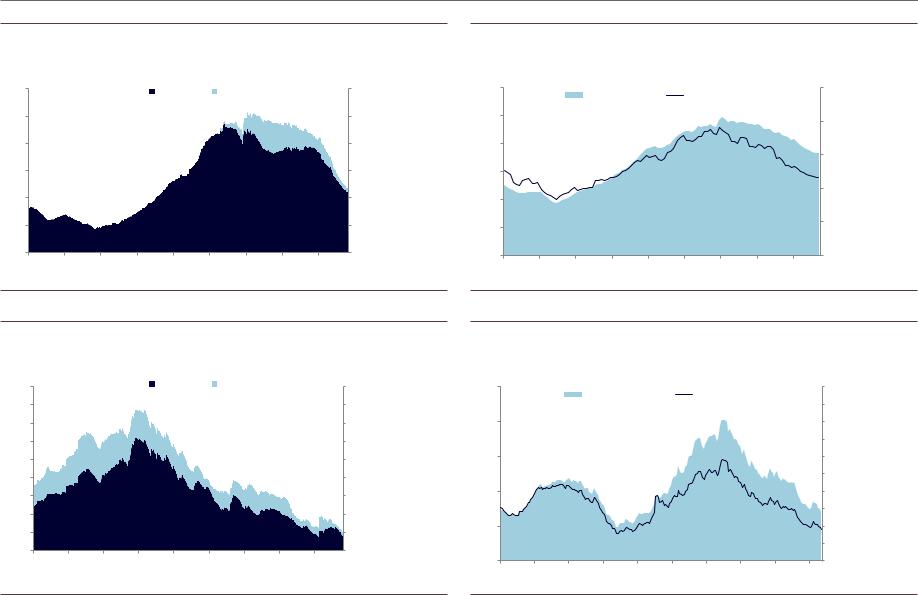

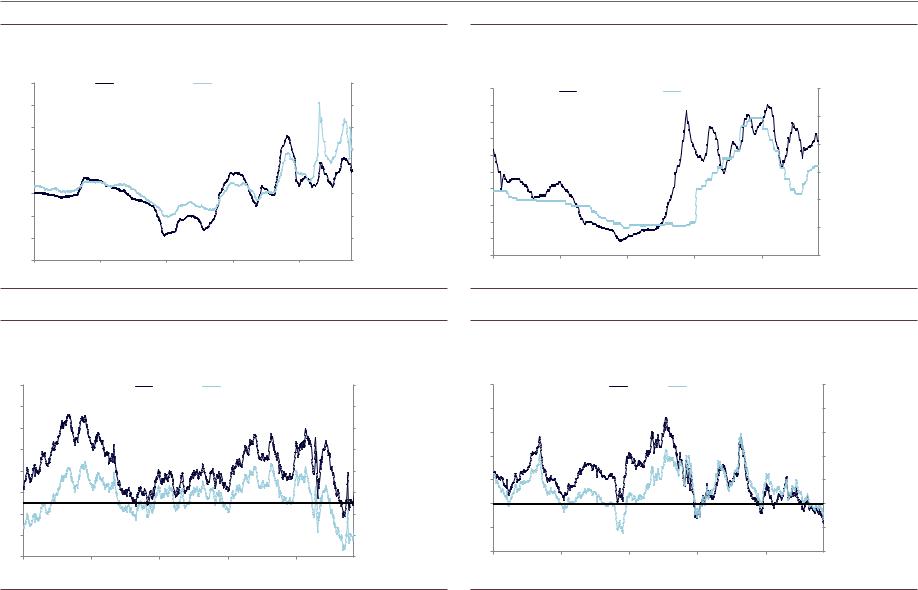

Exhibit 34: Nickel exchange inventory

kt |

Nickel Exchange Inventory |

kt |

600 |

|

|

|

LME |

SHFE |

|

600 |

|

500 |

|

|

|

|

|

|

|

500 |

400 |

|

|

|

|

|

|

|

400 |

300 |

|

|

|

|

|

|

|

300 |

200 |

|

|

|

|

|

|

|

200 |

100 |

|

|

|

|

|

|

|

100 |

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Exhibit 35: Nickel total inventory

kt |

Days |

Refined Nickel Inventory

1,200 |

|

Global Total |

|

Days of Use (right) |

250 |

|||

|

|

|

|

|||||

1,000 |

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

|

|

800 |

|

|

|

|

|

|

|

150 |

|

|

|

|

|

|

|

|

|

600 |

|

|

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

50 |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg, Goldman Sachs Global Investment Research

Exhibit 36: Zinc exchange inventory

kt |

Zinc Exchange Inventory |

kt |

1,800 |

|

|

|

LME |

SHFE |

|

1,800 |

|

1,600 |

|

|

|

|

|

|

|

1,600 |

1,400 |

|

|

|

|

|

|

|

1,400 |

1,200 |

|

|

|

|

|

|

|

1,200 |

1,000 |

|

|

|

|

|

|

|

1,000 |

800 |

|

|

|

|

|

|

|

800 |

600 |

|

|

|

|

|

|

|

600 |

400 |

|

|

|

|

|

|

|

400 |

200 |

|

|

|

|

|

|

|

200 |

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: CRU, Goldman Sachs Global Investment Research

Exhibit 37: Zinc total inventory

kt |

Refined Zinc Inventory |

Days |

2,500 |

|

|

Global Reported |

|

Days of Use (right) |

|

100 |

||

|

|

|

|

|

90 |

||||

|

|

|

|

|

|

|

|

|

|

2,000 |

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

70 |

1,500 |

|

|

|

|

|

|

|

|

60 |

|

|

|

|

|

|

|

|

|

50 |

1,000 |

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

30 |

500 |

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

10 |

0 |

|

|

|

|

|

|

|

|

0 |

2000 |

2002 |

2004 |

2006 |

2008 |

2010 |

2012 |

2014 |

2016 |

2018 |

Source: Bloomberg, Goldman Sachs Global Investment Research |

Source: CRU , Goldman Sachs Global Investment Research |

5 November 2018 |

<2 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

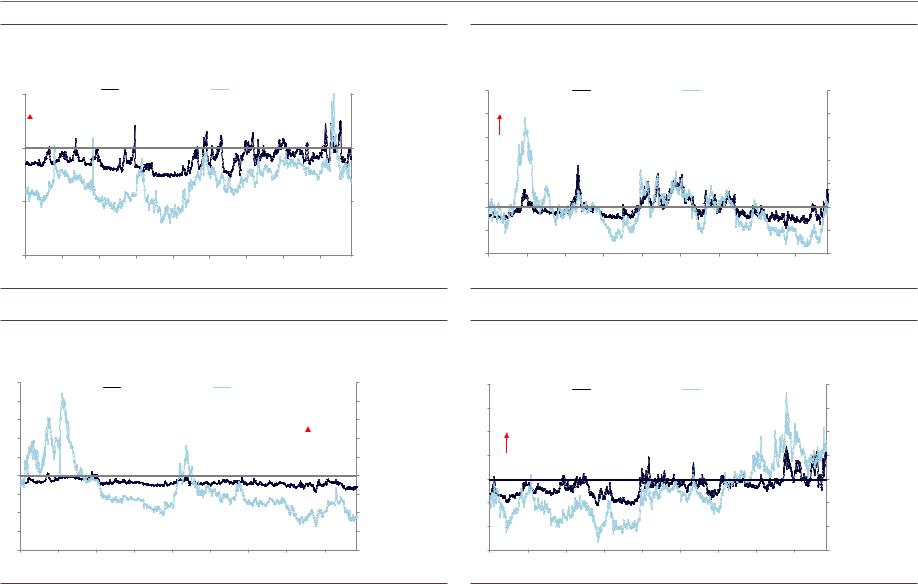

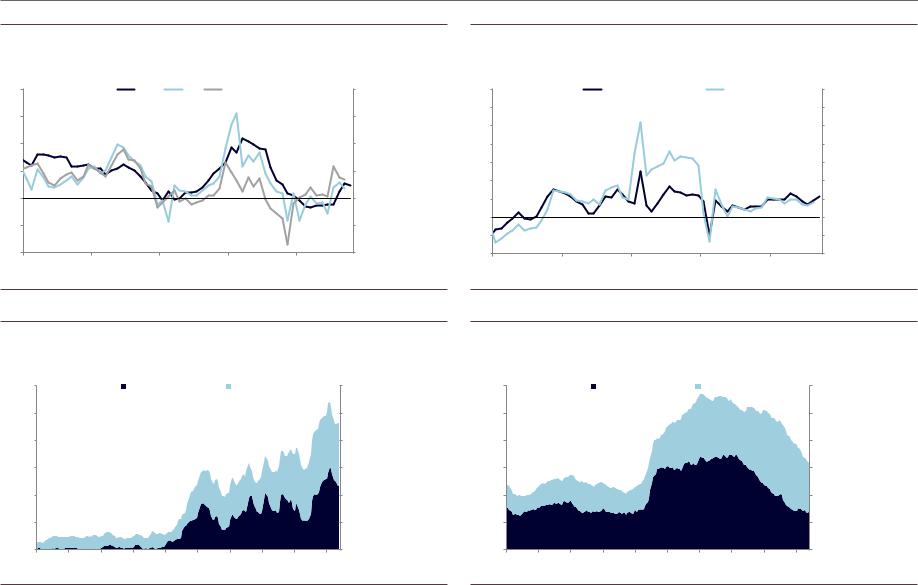

Exhibit 38: Aluminum timespreads

% |

|

|

Aluminum Timespreads |

|

% |

|||

|

|

|

|

|

||||

5 |

|

|

Spot to 3-month |

|

3 to 15-month |

5 |

||

|

|

|

|

|

|

|

||

Backwardation |

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

0 |

-5 |

|

|

|

|

|

|

|

-5 |

-10 |

|

|

|

|

|

|

|

-10 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg, Goldman Sachs Global Investment Research

Exhibit 40: Nickel timespreads

% |

|

|

|

Nickel Timespreads |

|

|

|

% |

|

5 |

|

|

|

|

|

|

5 |

||

|

|

Spot to 3-month |

|

3 to 15-month |

|

||||

|

|

|

|

|

|

||||

4 |

|

|

|

|

|

|

|

|

4 |

3 |

|

|

|

|

|

|

Backwardation |

3 |

|

2 |

|

|

|

|

|

|

|

|

2 |

1 |

|

|

|

|

|

|

|

|

1 |

0 |

|

|

|

|

|

|

|

|

0 |

-1 |

|

|

|

|

|

|

|

|

-1 |

-2 |

|

|

|

|

|

|

|

|

-2 |

-3 |

|

|

|

|

|

|

|

|

-3 |

-4 |

|

|

|

|

|

|

|

|

-4 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Exhibit 39: Copper timespreads

% |

|

|

|

Copper Timespreads |

|

% |

|||

|

|

|

|

|

|

||||

5 |

|

|

|

Spot to 3-month |

|

3 to 15-month |

5 |

||

4 |

Backwardation |

|

|

|

|

|

4 |

||

|

|

|

|

|

|

|

|

||

3 |

|

|

|

|

|

|

|

|

3 |

2 |

|

|

|

|

|

|

|

|

2 |

1 |

|

|

|

|

|

|

|

|

1 |

0 |

|

|

|

|

|

|

|

|

0 |

-1 |

|

|

|

|

|

|

|

|

-1 |

-2 |

|

|

|

|

|

|

|

|

-2 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Source: Bloomberg, Goldman Sachs Global Investment Research

Exhibit 41: Zinc timespreads

% |

|

|

|

Zinc Timespreads |

|

|

% |

|

|

|

|

|

|

|

|

||

8 |

|

|

Spot to 3-month |

|

3 to 15-month |

8 |

||

|

|

|

|

|

||||

6 |

|

|

|

|

|

|

|

6 |

4 |

Backwardation |

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

||

2 |

|

|

|

|

|

|

|

2 |

0 |

|

|

|

|

|

|

|

0 |

-2 |

|

|

|

|

|

|

|

-2 |

-4 |

|

|

|

|

|

|

|

-4 |

-6 |

|

|

|

|

|

|

|

-6 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg, Goldman Sachs Global Investment Research |

Source: Bloomberg, Goldman Sachs Global Investment Research |

5 November 2018 |

<3 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 42: Aluminum physical premium

US$/t |

Aluminum Physical Premium |

c/lb |

|

|

600 |

|

Japan Ingot Western (Spot) CIF |

|

25 |

||

|

|

Rotterdam Ingot Duty Paid |

|

|

||

500 |

|

US Midwest Ingot P1020 (right) |

|

20 |

||

|

|

|

|

|

|

|

400 |

|

|

|

|

|

15 |

|

|

|

|

|

|

|

300 |

|

|

|

|

|

|

200 |

|

|

|

|

|

10 |

|

|

|

|

|

|

|

100 |

|

|

|

|

|

5 |

|

|

|

|

|

|

|

0 |

|

|

|

|

|

0 |

2000 |

2003 |

2006 |

2009 |

2012 |

2015 |

2018 |

Exhibit 43: Copper physical premium

USD/t |

Refined Copper Physical Premium |

USDc/lb |

250 |

Shanghai CIF |

|

Rotterdam CIF |

US East Coast (right) |

14 |

||||

200 |

|

|

|

|

|

|

|

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

150 |

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

50 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Source: CRU

Exhibit 44: Nickel physical premium

c/lb |

Nickel Physical Premium |

$/tonne |

40 |

|

Rotterdam Melting Grade |

20 |

35 |

|

US Midwest Melting Grade |

18 |

|

China Full Plate Cathode CIF (right) |

||

|

|

||

|

|

16 |

|

30 |

|

|

|

|

|

14 |

|

|

|

|

|

25 |

|

|

12 |

|

|

|

|

20 |

|

|

10 |

15 |

|

|

8 |

|

|

|

|

10 |

|

|

6 |

|

|

4 |

|

|

|

|

|

5 |

|

|

2 |

|

|

|

|

0 |

|

|

0 |

2015 |

2016 |

2017 |

2018 |

Source: CRU

Exhibit 45: Zinc physical premium

USD/t |

|

|

Refined Zinc Physical Premium |

|

USD/t |

|||

250 |

|

|

|

250 |

||||

|

|

Asia |

|

Europe |

US |

|

||

|

|

|

|

|

|

|||

200 |

|

|

|

|

|

|

|

200 |

150 |

|

|

|

|

|

|

|

150 |

100 |

|

|

|

|

|

|

|

100 |

50 |

|

|

|

|

|

|

|

50 |

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: CRU |

Source: CRU |

5 November 2018 |

<4 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

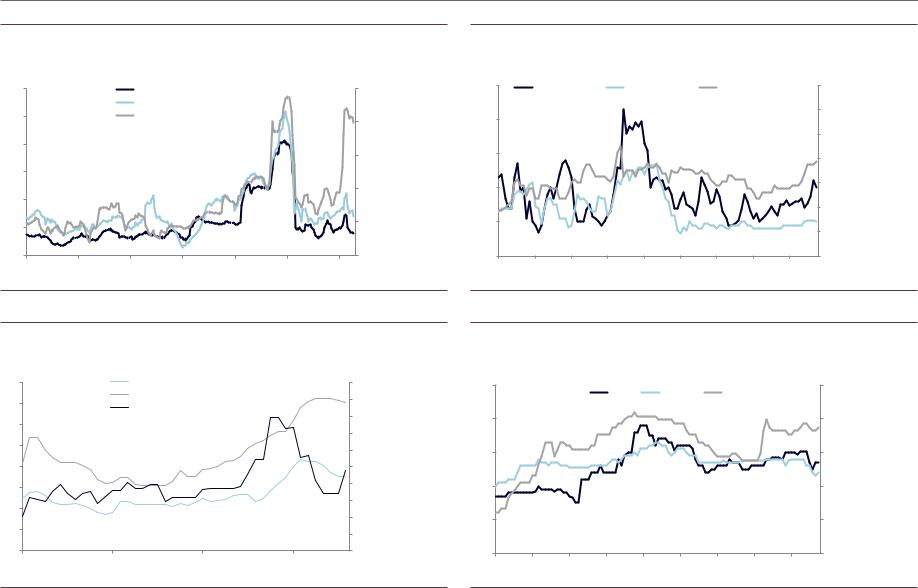

Exhibit 46: Aluminum money manager positioning

$Bn |

Aluminum Money Manager Positioning |

$Bn |

||

|

|

|||

20 |

Long |

Short |

Net |

20 |

15 |

|

|

|

15 |

10 |

|

|

|

10 |

5 |

|

|

|

5 |

0 |

|

|

|

0 |

-5 |

|

|

|

-5 |

-10 |

|

|

|

-10 |

-15 |

|

|

|

-15 |

*data break on 2/22/2018 due to LME reporting changes.

-20 |

|

|

|

|

|

|

-20 |

|

|

|

|

|

|

||

Aug-14 |

May-15 |

Feb-16 |

Nov-16 |

Aug-17 |

May-18 |

||

Exhibit 47: Copper money manager positioning

$Bn |

|

Copper Money Manager Positioning |

$Bn |

||

|

|

|

|||

40 |

|

Long |

Short |

Net |

40 |

30 |

|

|

|

|

30 |

20 |

|

|

|

|

20 |

10 |

|

|

|

|

10 |

0 |

|

|

|

|

0 |

-10 |

|

|

|

|

-10 |

-20 |

|

|

|

|

-20 |

-30 *data break on 2/22/2018 due to LME reporting changes. |

|

-30 |

|||

Aug-14 |

May-15 |

Feb-16 |

Nov-16 |

Aug-17 |

May-18 |

Source: Bloomberg, Goldman Sachs Global Investment Research |

Source: Bloomberg, Goldman Sachs Global Investment Research |

Exhibit 48: Nickel money manager positioning

$Bn |

|

|

Nickel Money Manager Positioning |

$Bn |

||

50 |

|

|

50 |

|||

|

|

Long |

Short |

Net |

||

|

|

|

|

|||

40 |

|

|

|

|

|

40 |

30 |

|

|

|

|

|

30 |

20 |

|

|

|

|

|

20 |

10 |

|

|

|

|

|

10 |

0 |

|

|

|

|

|

0 |

-10 |

|

|

|

|

|

-10 |

-20 |

|

|

|

|

|

-20 |

-30 |

*data break on 2/22/2018 due to LME reporting changes. |

|

-30 |

|||

|

|

|

|

|

||

Aug-14 |

May-15 |

Feb-16 |

Nov-16 |

Aug-17 |

May-18 |

|

Exhibit 49: Zinc money manager positioning

$Bn |

|

Zinc Money Manager Positioning |

$Bn |

||

16 |

|

16 |

|||

|

Long |

Short |

Net |

||

|

|

|

|||

12 |

|

|

|

|

12 |

8 |

|

|

|

|

8 |

4 |

|

|

|

|

4 |

0 |

|

|

|

|

0 |

-4 |

|

|

|

|

-4 |

*data break on 2/22/2018 due to LME reporting changes. |

|

-8 |

|||

-8 |

|

|

|

|

|

Aug-14 |

May-15 |

Feb-16 |

Nov-16 |

Aug-17 |

May-18 |

Source: Bloomberg, Goldman Sachs Global Investment Research |

Source: Bloomberg, Goldman Sachs Global Investment Research |

5 November 2018 |

<5 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 50: Aluminum realized and implied volatility

% |

Aluminum Price Volatility |

Index |

|

|

40 |

|

VIX (right) |

|

3m Implied Vol |

3m Realized Vol |

50 |

||

35 |

|

|

45 |

|||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

25 |

15 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Goldman Sachs Global Investment Research

Exhibit 52: Nickel realized and implied price volatility

% |

|

|

Nickel Price Volatility |

|

|

Index |

||

60 |

|

|

|

|

50 |

|||

|

VIX (right) |

|

3m Implied Vol |

3m Realized Vol |

||||

|

|

|

45 |

|||||

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Exhibit 51: Copper realized and implied volatility

% |

|

|

Copper Price Volatility |

|

|

Index |

||

60 |

|

|

|

|

50 |

|||

|

VIX (right) |

|

3m Implied Vol |

3m Realized Vol |

||||

|

|

|

45 |

|||||

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Goldman Sachs Global Investment Research

Exhibit 53: Zinc realized and implied price volatility

% |

|

|

|

Zinc Price Volatility |

|

|

Index |

|

60 |

|

|

|

|

|

50 |

||

|

VIX (right) |

|

3m Implied Vol |

3m Realized Vol |

||||

|

|

|

45 |

|||||

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

35 |

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

15 |

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

0 |

2010 |

2011 |

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Goldman Sachs Global Investment Research |

Source: Goldman Sachs Global Investment Research |

5 November 2018 |

<6 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 54: Aluminum SHFE/LME arbitrage

$/t |

Profits of Exporting Aluminum Semis from China to LME |

$/t |

|||

600 |

600 |

||||

Weekly |

4-Week Moving Average |

||||

|

|

||||

500 |

|

|

|

500 |

|

400 |

|

|

|

400 |

|

300 |

|

|

|

300 |

|

200 |

|

|

|

200 |

|

100 |

|

|

|

100 |

|

0 |

|

|

|

0 |

|

-100 |

|

|

|

-100 |

|

2015 |

2016 |

2017 |

2018 |

|

|

Source: Bloomberg, CRU, Goldman Sachs Global Investment Research

Exhibit 56: Nickel LME/SHFE arbitrage

$/t |

Profits of Importing LME Nickel into China |

$/t |

||

|

|

|||

1,500 |

Weekly |

4-Week Moving Average |

1,500 |

|

1,000 |

|

|

|

1,000 |

500 |

|

|

|

500 |

0 |

|

|

|

0 |

-500 |

|

|

|

-500 |

-1,000 |

|

|

|

-1,000 |

-1,500 |

|

|

|

-1,500 |

2015 |

2016 |

2017 |

2018 |

|

Exhibit 55: Copper LME/SHFE arbitrage

$/t |

Profits of Importing LME Copper into China |

$/t |

|

|

200 |

Weekly |

4-Week Moving Average |

200 |

|

100 |

|

|

|

100 |

0 |

|

|

|

0 |

-100 |

|

|

|

-100 |

-200 |

|

|

|

-200 |

-300 |

|

|

|

-300 |

-400 |

|

|

|

-400 |

2015 |

2016 |

2017 |

2018 |

|

Source: Bloomberg, CRU, Goldman Sachs Global Investment Research

Exhibit 57: Zinc LME/SHFE arbitrage

$/t |

$/t |

Profits of Importing LME Zinc into China

400 |

Weekly |

4-Week Moving Average |

400 |

|

|

|

|||

300 |

|

|

|

300 |

200 |

|

|

|

200 |

100 |

|

|

|

100 |

0 |

|

|

|

0 |

-100 |

|

|

|

-100 |

-200 |

|

|

|

-200 |

-300 |

|

|

|

-300 |

-400 |

|

|

|

-400 |

2015 |

2016 |

2017 |

2018 |

|

Source: Bloomberg, CRU, Goldman Sachs Global Investment Research |

Source: Bloomberg, CRU, Goldman Sachs Global Investment Research |

5 November 2018 |

<7 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 58: China and ex-China alumina price

Rmb/t |

|

China and Ex-China Alumina Price |

$/t |

|

5000 |

|

China Average |

Australia FOB (right) |

800 |

4500 |

|

|

|

700 |

4000 |

|

|

|

600 |

3500 |

|

|

|

500 |

3000 |

|

|

|

400 |

2500 |

|

|

|

300 |

2000 |

|

|

|

200 |

1500 |

|

|

|

100 |

1000 |

|

|

|

0 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg

Exhibit 60: Ex-China aluminum smelter margins

% |

|

Ex-China Smelter Profit Margins |

% |

|

55 |

|

US |

Germany |

55 |

45 |

|

|

|

45 |

35 |

|

|

|

35 |

25 |

|

|

|

25 |

15 |

|

|

|

15 |

5 |

|

|

|

5 |

-5 |

|

|

|

-5 |

-15 |

|

|

|

-15 |

-25 |

|

|

|

-25 |

2014 |

2015 |

2016 |

2017 |

2018 |

Exhibit 59: China coal and anode price

Rmb/t |

Coal and Anode Price in China |

Rmb/t |

800 |

|

Qinhuangdao 5500 |

Prebaked Anode (right) |

5000 |

|

750 |

|

|

|

|

|

700 |

|

|

|

|

4500 |

|

|

|

|

|

|

650 |

|

|

|

|

4000 |

|

|

|

|

|

|

600 |

|

|

|

|

|

550 |

|

|

|

|

3500 |

500 |

|

|

|

|

|

450 |

|

|

|

|

3000 |

|

|

|

|

|

|

400 |

|

|

|

|

2500 |

|

|

|

|

|

|

350 |

|

|

|

|

|

300 |

|

|

|

|

2000 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Source: Bloomberg

Exhibit 61: China aluminum smelter margins

% |

|

Chinese Smelter Profit Margins |

% |

|

50 |

|

Captive |

On-Grid |

50 |

40 |

|

|

|

40 |

30 |

|

|

|

30 |

20 |

|

|

|

20 |

10 |

|

|

|

10 |

0 |

|

|

|

0 |

-10 |

|

|

|

-10 |

-20 |

|

|

|

-20 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: Bloomberg, Wood Mackenzie, Goldman Sachs Global Investment Research |

Source: Bloomberg, Wood Mackenzie, CEIC, Goldman Sachs Global Investment Research |

5 November 2018 |

<8 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 62: China aluminum production |

|

|

|||

% |

YoY Percent Change in China Aluminum Production |

% |

|||

40 |

|

CRU |

IAI |

NBS |

40 |

30 |

|

|

|

|

30 |

20 |

|

|

|

|

20 |

10 |

|

|

|

|

10 |

0 |

|

|

|

|

0 |

-10 |

|

|

|

|

-10 |

-20 |

|

|

|

|

-20 |

2014 |

2015 |

2016 |

|

2017 |

2018 |

Source: CRU, IAI, Haver Analytics, Goldman Sachs Global Investment Research

Exhibit 64: China aluminum inventory

kt |

|

|

|

China Aluminum Inventory |

|

|

kt |

||

6,000 |

|

|

Reported |

|

Unreported |

|

6,000 |

||

5,000 |

|

|

|

|

|

|

|

|

5,000 |

4,000 |

|

|

|

|

|

|

|

|

4,000 |

3,000 |

|

|

|

|

|

|

|

|

3,000 |

2,000 |

|

|

|

|

|

|

|

|

2,000 |

1,000 |

|

|

|

|

|

|

|

|

1,000 |

0 |

|

|

|

|

|

|

|

|

0 |

2000 |

2002 |

2004 |

2006 |

2008 |

2010 |

2012 |

2014 |

2016 |

2018 |

Exhibit 63: Ex-china aluminum production

% |

YoY Percent Change in Ex-China Aluminum Production |

% |

14 |

|

CRU |

IAI |

14 |

12 |

|

|

|

12 |

10 |

|

|

|

10 |

8 |

|

|

|

8 |

6 |

|

|

|

6 |

4 |

|

|

|

4 |

2 |

|

|

|

2 |

0 |

|

|

|

0 |

-2 |

|

|

|

-2 |

-4 |

|

|

|

-4 |

2014 |

2015 |

2016 |

2017 |

2018 |

Source: CRU, IAI, Goldman Sachs Global Investment Research

Exhibit 65: Ex-China aluminum inventory

kt |

|

|

Ex-China Aluminum Inventory |

|

kt |

||||

|

|

|

|

|

|||||

12,000 |

|

|

Reported |

|

Unreported |

|

12,000 |

||

10,000 |

|

|

|

|

|

|

|

|

10,000 |

8,000 |

|

|

|

|

|

|

|

|

8,000 |

6,000 |

|

|

|

|

|

|

|

|

6,000 |

4,000 |

|

|

|

|

|

|

|

|

4,000 |

2,000 |

|

|

|

|

|

|

|

|

2,000 |

0 |

|

|

|

|

|

|

|

|

0 |

2000 |

2002 |

2004 |

2006 |

2008 |

2010 |

2012 |

2014 |

2016 |

2018 |

Source: CRU, Goldman Sachs Global Investment Research |

Source: CRU, Goldman Sachs Global Investment Research |

5 November 2018 |

<9 |

vk.com/id446425943

Goldman Sachs

Metals Monitor

Exhibit 66: YoY growth in copper mine production in Chile and Peru

% |

Year-over-Year Growth in Copper Mine Production |

% |

|||

40 |

|

Chile |

Peru (right) |

|

80 |

30 |

|

|

|

|

70 |

|

|

|

|

60 |

|

|

|

|

|

|

|

20 |

|

|

|

|

50 |

10 |

|

|

|

|

40 |

|

|

|

|

30 |

|

0 |

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

-10 |

|

|

|

|

10 |

-20 |

|

|

|

|

0 |

|

|

|

|

-10 |

|

|

|

|

|

|

|

-30 |

|

|

|

|

-20 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Source: Haver Analytics, Goldman Sachs Global Investment Research

Exhibit 68: Copper TCRC

c/lb |

2003-11 Median |

|

2015 |

|

2016 |

2017 |

|

c/lb |

|||

|

|

|

2018 |

||||||||

30 |

|

|

|

|

|

|

|

|

|

|

30 |

25 |

|

|

|

|

|

|

|

|

|

|

25 |

20 |

|

|

|

|

|

|

|

|

|

|

20 |

15 |

|

|

|

|

|

|

|

|

|

|

15 |

10 |

|

|

|

|

|

|

|

|

|

|

10 |

5 |

|

|

|

|

|

|

|

|

|

|

5 |

0 |

|

|

|

|

|

|

|

|

|

|

0 |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Exhibit 67: Combined Chile and Peru copper mine production

kt |

Chile and Peru Copper Production |

% |

850 |

Monthly Production Level |

Year-over-Year Growth (right) |

25 |

||

800 |

|

|

|

|

20 |

750 |

|

|

|

|

15 |

700 |

|

|

|

|

10 |

650 |

|

|

|

|

5 |

600 |

|

|

|

|

0 |

550 |

|

|

|

|

-5 |

500 |

|

|

|

|

-10 |

450 |

|

|

|

|

-15 |

400 |

|

|

|

|

-20 |

2014 |

2015 |

2016 |

2017 |

2018 |

|

Source: Haver Analytics, Goldman Sachs Global Investment Research

Exhibit 69: Time-varying correlation between daily changes in copper and USD

Correlation |

|

60-Day Rolling Correlation between Copper and |

Correlation |

|||

0.4 |

|

USD Daily Changes |

|

|

0.4 |

|

0.2 |

|

|

|

|

|

0.2 |

0.0 |

|

|

|

|

|

0.0 |

-0.2 |

|

|

|

|

|

-0.2 |

-0.4 |

|

|

|

|

|

-0.4 |

-0.6 |

|

|

|

|

|

-0.6 |

-0.8 |

|

|

|

|

|

-0.8 |

-1.0 |

|

|

|

|

|

-1.0 |

2000 |

2003 |

2006 |

2009 |

2012 |

2015 |

2018 |

Source: Wood Mackenzie |

Source: Bloomberg, Goldman Sachs Global Investment Research |

5 November 2018 |

20 |