CS Investment Outlook 2019_watermark

.pdf

vk.com/id446425943

An extended cycle

Investment

Outlook 2019

THIS IS NOT RESEARCH. PLEASE REFER TO THE IMPORTANT INFORMATION FOR IMPORTANT

DISCLOSURES AND CONTACT YOUR CREDIT SUISSE REPRESENTATIVE FOR MORE INFORMATION.

Important Information

This report represents the views of the Investment Strategy Department of Credit Suisse and has not been prepared in accordance with the legal requirements designed to promote the independence of investment research. It is not a product of the Credit Suisse Research Department and the view of the Investment Strategy Department may differ materially from the views of the Credit Suisse Research Department and other divisions at Credit Suisse, even if it references published research recommendations. Credit Suisse has a number of policies in place to promote the independence of Credit Suisse’s Research Departments from Credit Suisse’s Investment Strategy and other departments and to manage conflicts of interest, including policies relating to dealing ahead of the dissemination of investment research. These policies do not apply to the views of Investment Strategists contained in this report.

vk.com/id446425943

vk.com/id446425943

Investment Outlook2019

An extended cycle

credit-suisse.com/investmentoutlook 3

vk.com/id446425943

The House View is an essential part of the trust we earn and the results we deliver.

The House View is an essential part of the trust we earn and the results we deliver.

4 |

Investment Outlook 2019 |

vk.com/id446425943

Letter from the CEO

From my perspective

Tidjane Thiam

CEO Credit Suisse Group AG

As I present our Investment Outlook 2019, a year that turned out to be much more eventful than we all expected is drawing to a close. Political events have had and continue to have a major impact on financial markets.

Global trade terms are being reshaped: tariffs, something we had grown accustomed to not thinking about, are back with some governments introducing tariffs and other protective measures for some of their trading partners. We have also seen new regional trade arrangements reached. In the past year, I have often discussed these important developments with clients and other stakeholders. In doing so, I have been able to rely not only on my own experience, but also on the Credit Suisse House View.

The House View plays a fundamental role in shaping the advice we give our clients and how we invest on their behalf. Our leading investment strategists analyze global political and economic trends, and distill a wide range of analysis and information from across the bank into one consistent view. In short, the House View is an essential part of the trust we earn and the results we deliver.

Innovation is another key value at Credit Suisse. Our House View also encompasses our five Supertrends: “Angry societies – Multipolar world,” “Infrastructure – Closing the gap,” “Technology at the service of humans,” “Silver economy,” and “Millennials’ values.” They provide compelling themes for long-term investors (see pages 34 – 37 for details). I would like to emphasize sustainable investments this year, included in one of our Supertrends, as this is an area of increasing interest for our clients today and of growing relevance for our world. We at Credit Suisse are committed to playing our part in making our collective investments sustainable, which we believe is also smart investing.

I wish you a prosperous 2019.

Tidjane Thiam

credit-suisse.com/investmentoutlook |

5 |

vk.com/id446425943

Overview

Contents

14 34

Global economy |

Special |

||

16 |

Stimulus fades, but growth remains |

34 |

Supertrends |

20 |

What makes the business cycle go round (Spotlight) |

35 |

Smart sustainable investing |

22 |

World follows US Fed’s tightening path |

36 |

Impact investing |

25Proclaiming the demise of globalization may be premature (Spotlight)

26The global economy’s stress test

32 Regions in focus

6 |

Investment Outlook 2019 |

vk.com/id446425943

04 Letter from the CEO

08 Editorial

10 Review of 2018

12 Key topics 2019

58 Calendar 2019

38

Financial markets

40 Positioning for late cycle growth

45US yield curve inversion: Do we need to worry? (Spotlight)

46The sector standpoint

50 The state of play for currencies

53The twin deficit – boon or bane for the USD? (Spotlight)

54Investment themes 2019

credit-suisse.com/investmentoutlook |

7 |

vk.com/id446425943

Editorial

An extended cycle

Michael Strobaek Global Chief Investment Officer

Nannette Hechler-Fayd’herbe Global Head of Investment Strategy & Research

Most years have a dominant theme that shapes financial markets. In 2017 it was the Goldilocks economy – not too hot, not too cold – and the return of politics as a market driver. Trade conflicts and interest rate concerns dominated 2018. Going into 2019, we believe that a significant focus will be on the factors that can prolong the economic cycle.

Our Investment Outlook 2019 provides a roadmap to navigate the months ahead. For equities, we provide an overview of all sectors. We believe that technology will remain a strong driver. For fixed income, we examine the relatively rare phenomenon of a US yield curve inversion (when US short-term interest rates exceed long-term interest rates). And we discuss how to establish a successful currency strategy comprising carry, value and safe-haven currencies.

From the macroeconomic point of view, several factors may well prolong the economic cycle and speak against an imminent global slowdown. Productivity gains and benign inflation will be key for central banks’ monetary responses and hence financial markets.

Last but not least, our special focus section is devoted to what has excited us most in the last two years: our longterm Supertrends, five investment themes that offer superior return prospects. Furthermore, we showcase education as part of our efforts in sustainable and impact investing, a market that has been seeing rapid growth as investors increasingly seek to combine financial returns with a social and environmental impact.

We wish you a successful year ahead.

8 |

Investment Outlook 2019 |

vk.com/id446425943

A significant focus will be on the factors that can prolong the economic cycle.

A significant focus will be on the factors that can prolong the economic cycle.

credit-suisse.com/investmentoutlook |

9 |

vk.com/id446425943

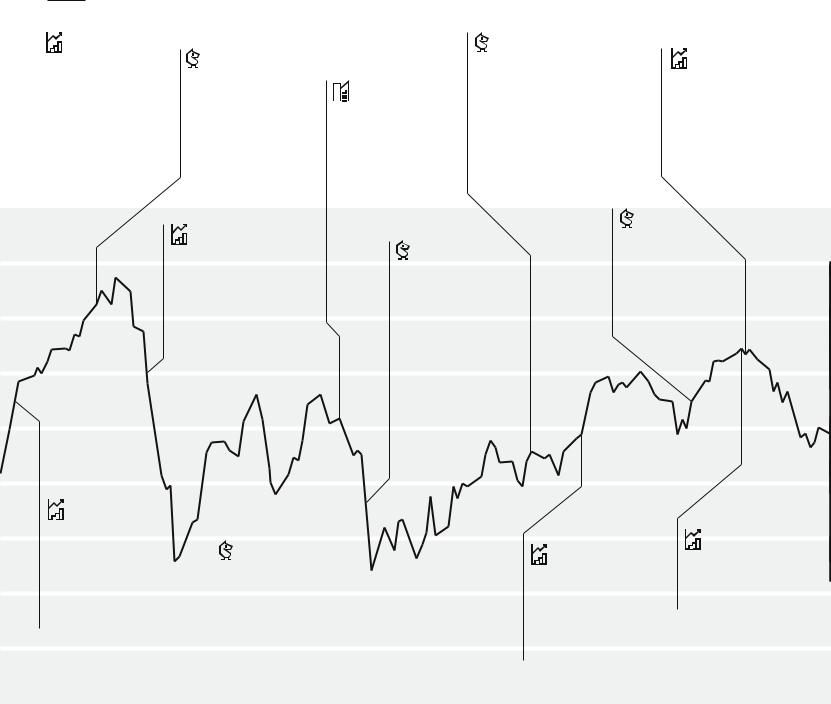

Review of 2018

2018: The year when trade shifted

|

09 January |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

27 April |

|

|

|

||

|

Tightening talk in Japan |

|

|

|

|

|

|

Peace hopes in Korea |

|

13 June |

||

|

|

22 January |

|

|

|

|

||||||

|

The Bank of Japan reduces |

|

|

|

|

The leaders of North and |

|

|||||

|

|

Trade conflicts begin |

|

|

|

|

Fed hikes rates |

|||||

|

its purchase of super-long |

|

|

|

|

South Korea agree to seek |

|

|||||

|

|

The USA unveils tariffs on |

|

|

|

|

The US Fed raises its |

|||||

|

bonds; speculation about |

|

16 March |

talks to reach a peace treaty |

|

|||||||

|

|

imported washing machines |

|

benchmark short-term |

||||||||

|

further monetary tightening |

|

Tech sell-off |

and end a decades |

-long |

|

||||||

|

|

and solar panels, a move |

|

interest rate by a quarter |

||||||||

|

sends bond yields higher. |

|

The Nasdaq falls, beginning |

conflict. |

|

|

||||||

|

|

criticized by China and |

|

|

percent. |

|||||||

|

|

|

an 11% decline during the |

|

|

|

|

|||||

|

|

|

South Korea. |

|

|

|

|

|

||||

|

|

|

month of March, sparked |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

by data privacy concerns |

|

|

|

|

|

||

|

|

|

|

|

surrounding social media |

|

|

|

|

|

||

|

|

|

|

|

companies. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

01 June |

|

|

|

02 February |

|

|

|

|

|

|

Shifting Italian politics |

|||

|

|

Repricing Fed expectations |

|

|

|

|

|

|

New populist Italian |

|||

|

|

22 March |

|

|

|

|||||||

1240 |

|

Equity markets in broad |

|

|

|

government leads to only |

||||||

|

Trade tensions continue |

|

||||||||||

Pts. |

|

sell-off as strong US wage |

|

temporary relief in markets |

||||||||

|

US President Trump imposes |

|

||||||||||

|

|

data leads to a repricing of |

|

after a significant sell-off. |

||||||||

|

|

tariffs on USD 50 bn of |

|

|||||||||

|

|

US Federal Reserve rate hike |

|

|

|

|||||||

|

|

Chinese imports. The next |

|

|

|

|||||||

|

|

expectations. |

|

|

|

|||||||

1220 |

|

day, China unveils tariffs on |

|

|

|

|||||||

|

|

|

|

|

|

|

||||||

Pts. |

|

|

|

|

USD 3 bn of US imports in |

|

|

|

||||

|

|

|

|

|

response to the US tariffs |

|

|

|

||||

|

|

|

|

|

on steel announced a few |

|

|

|

||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

weeks earlier. |

|

|

|

|

|

||

|

01 January |

|

|

|

|

|

|

1140 |

US tax reform |

|

|

|

|

|

|

The US Tax Cuts and Jobs |

|

|

|

|

12 June |

||

Pts. |

Act, which reduces corporate |

|

|

|

|

||

16 February |

08 May |

US/North Korea summit |

|||||

|

tax rates, goes into effect at |

||||||

|

USA targets steel |

Credit for Argentina |

US President Trump meets |

||||

|

the beginning of the year, |

||||||

|

The USA proposes large |

Argentinian President |

with North Korean leader |

||||

|

fueling investor optimism and |

||||||

1120 |

tariffs on steel and aluminum |

Macri asks the International |

Kim Jong-un in Singapore. |

||||

helping push the stock |

|||||||

Pts. |

imports from nations around |

Monetary Fund for a loan |

|

||||

market to new highs. |

|

||||||

|

the world. |

as the economy struggles |

|

||||

|

|

|

|||||

|

with high inflation and |

1100 |

a plunging peso. |

|

|

Pts. |

|

Jan. |

Feb. |

Mar. |

Apr. |

May |

June |

10 |

Investment Outlook 2019 |