Amundi_AM_Cross_Asset_Invt_Strategy

.pdf

Monthly 9 November 2018 |

November 2018 |

# 11 |

Finalised at |

|

|

vk.com/id446425943 |

|

|

|

|

|

CROSS ASSET

INVESTMENT STRATEGY

2019 Outlook

SPECIAL ISSUE

Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry

vk.com/id446425943

#11 |

November 2018 |

CROSS ASSET |

|

|

|||

|

|

|

|

|

2019 Outlook Special Issue |

INVESTMENT STRATEGY |

|

Table of contents

CIO VIEWS FOR 2019

• Mind the sustainability of returns as the cycle ages p. 3

MACROECONOMIC CONTEXT

• Our convictions and our scenarios p. 7

STRATEGIST VIEW

• Not yet the end of the cycle, but be aware of the sentinels |

p. 10 |

MULTI-ASSET

• Markets at a crossroads! Be cautious and focus on quality |

p. 12 |

EQUITY DEVELOPED MARKETS

• Sustainability of earnings under watch in a tactical year |

p. 14 |

FACTOR INVESTING

• Combining quality and value: the winning solution |

p. 16 |

FIXED INCOME DEVELOPED MARKETS

• Global liquidity, US outlook and politics are the drivers |

p. 17 |

CURRENCIES

• Geopolitical risks will continue to play a key role |

p. 19 |

EMERGING MARKETS

• Seek for entry points and search for carry |

p. 20 |

COMMODITIES

• Supply side will remain key in 2019 |

p. 23 |

REAL ASSETS

• Appeal for long-term sources of diversification |

p. 24 |

MACROECONOMIC AND FINANCIAL FORECASTS

• Tables |

p. 25 |

2 Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry

vk.com/id446425943

CROSS ASSET |

November 2018 |

#11 |

|

||

|

|

|

INVESTMENT STRATEGY |

2019 Outlook Special Issue |

CIO VIEWS FOR 2019

Mind the sustainability of returns as the cycle ages

PASCAL BLANQUÉ, Group Chief Investment Officer

VINCENT MORTIER, Deputy Group Chief Investment Officer

With late cycle features continuing to materialise and a higher level of vulnerability developing due to the uncertain geopolitical backdrop, 2019 will require investors to embrace a more prudent approach, despite the benign global economic outlook. In our view, this new investment landscape will translate into not only the need for more cautious risk allocation through the year, but also more selective exposure to countries/sectors and names that could prove to be more resilient: less indebted, less exposed to geopolitical frictions, and to financial and economic imbalances. The sustainability of future returns will be the name of the game in 2019. It will also be a year of higher focus on portfolio construction and diversification to balance risk, avoid crowded trades, and deal with multiple divergences that will likely materialise. Meanwhile, liquidity management will be even more critical as we enter uncharted waters associated with central bank (CB) liquidity tightening for the first time post the last financial crisis. With limited market directionality, and as swings are expected to be frequent, investors should seek tactical opportunities throughout the year that will emerge on the basis of the evolution of three main themes, as noted below.

1 - From economic acceleration to deceleration with further divergences, but no drama

The phase of synchronised acceleration that characterised 1H18 has left room for a mild deceleration in the global economy over 2019 and 2020. In particular in the US, the fiscal stimulus that helped to extend the cycle and significantly boost earnings growth should start to lose momentum in the second part of the year. This should lead to a healthy deceleration from the current upbeat outlook, preventing further overheating of the economy in a full employment phase. On the other hand, Europe is already bearing the burden (economically and on financial assets) of Brexit and fragile Italian fiscal discipline, and it is vulnerable to emerging markets (EM) and global geopolitical risks (ie, higher oil prices).

A look back at our 2018 Outlook:

What went as expected and what did not

What went according to our expectations? On the economy

•Global GDP growth to stabilise around 2017 levels (above potential)

•Core inflation, while accelerating in some region, should remain subdued

•Towards a rebalancing of monetary and fiscal policies in some key countries, CB progressively removing excessive accommodation.

On financial markets

•Transition from an asset reflation regime towards a late financial cycle regime

•Lower risk-adjusted returns compared to previous years

•Interest rates direction (expected to increase only moderately).

What were the surprises?

On the economy

•Stronger growth in the US thanks to fiscal policy and desynchronisation of growth

•Idiosyncratic stories in EM (Turkey, Argentina)

•European renaissance cooled down with lack of development on reforms and rising populism

•Trade war escalation with retaliation.

On financial markets

•Strong appeal of US assets (equity market outperformance on strong EPS expansion, USD strength)

•Interest rates somewhat higher than expected in US, less so in Europe

•EM broad based weakness.

Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry 3

vk.com/id446425943

#11 |

November 2018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CROSS ASSET |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

2019 Outlook Special Issue |

|

|

|

|

|

|

|

|

INVESTMENT STRATEGY |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

MACRO |

31% |

|

|

|

INVESTMENT STRATEGY |

|||||||||||||||||

|

13% |

|

|

45% |

77% |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

EQUITIES |

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

Explore quality |

|

in range-bound markets |

|

|

|||||

From economic acceleration to deceleration |

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

with further divergences, but no drama. |

|

FIXED INCOME |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add duration |

and reduce credit risk |

|

|

||||||

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

From CB abundant liquidity to further |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

EMERGING |

MARKETS |

|

|

|

|||||||||||||

normalisation and liquidity shrinkage. |

|

|

|

Seek entry points and search for carry |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

CURRENCIES |

|

|

|

|||||||

|

From political noise to the dominance |

|

|

|

|

|||||||||||||||||

|

|

|

Diversify currency exposure amid rising |

|

volatility |

|||||||||||||||||

3 of politics. |

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

MULTI-ASSET |

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Dynamic risk allocation and hedging at the forefront |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The outlook for Europe remains uncertain and highly dependent from the political landscape, but markets seem to have already priced in most of the bad news. Japan may emerge as a more insulated area among big global players as domestic conditions hold up well and political uncertainty is limited. Deceleration will continue in EM, especially in 1H19 as a legacy of 2018 weakenesses, with further divergences ahead as rising US interest rates and the strong dollar amplify the areas of fragility at a country level. Furthermore, US dollar lending to non-bank EM residents has more than doubled since the Great Recession. The rise in oil prices also creates further divergences within EM, with oil exporters benefitting vs oil importers. Across EM, we do not expect major disruptions, as we believe China’s economy will remain resilient and the government will continue to implement fiscal and monetary actions to manage a slowdown in an orderly way. The domestic economic engines and the resilience to global trade deceleration will be key themes to watch among these countries to identify more sustainable stories. Overall, the global economic picture will be more scattered, leaving room to play different speeds of growth and economic adjustments during the year.

2 - From abundant liquidity from CB to further normalisation and liquidity shrinkage.

While in 2018, CB were still injecting liquidity into the system, 2019 could be the first year of negative asset purchases by developed market CB. As a result, financial conditions should continue to tighten globally, resulting in challenges for more leveraged economies and sectors in a world which continues to see a high level of debt. A stronger focus on various CB’s different domestic targets will drive more asynchrony in monetary policies. In DM, the Federal Reserve will likely end the hiking cycle in 2019; the European Central Bank will be just at the beginning of it; while the Bank of Japan will remain broadly accommodative. In EM, tighter monetary policies will dominate amid rising inflation expectations, with different intensities. Overall, uncertainty regarding future CB actions will further increase as the cycle matures, making the overall market environment more vulnerable to possible policy mistakes.

3 - From political noise to the dominance of politics.

This year has marked the beginning of the era of the dominance of politics in the financial markets. Political factors were generally perceived as a risk or market noise until last year; currently, these represent a key market driver in a more fragile economic and market environment. In Europe, parliamentary elections in May 2019 will be crucial to identifying the prevailing political dynamics and to understanding the integration potential and ultimately the potential survival of the euro in the long term. In addition, the protectionist policies of US President Trump will continue to be under scrutiny: even though in the short term, the US has been relatively immune to the effects of tariffs, the consequences of these policies should soon be visible in lower company margins and unintended medium term effects on prices. A retreat of global trade is already under way after decades of openness, and the return to more domestic-focussed trends could be the natural evolution of trade war risk.

What are the implications of these themes for investors?

US government bonds and equities continue to be favoured in 2019, although the strong dominance of the US is likely to fade away as profit growth will converge across major economies. Instead, we expect the

4 Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry

vk.com/id446425943

CROSS ASSET |

November 2018 |

#11 |

|

||

|

|

|

INVESTMENT STRATEGY |

2019 Outlook Special Issue |

repricing of the “large periphery” (EM and Europe) witnessed in 2H18 will open up new opportunities to diversify risk exposure in 2019 at reasonable prices based on an overall neutral to cautious stance on risk assets. As the reflation trade driven by excess market liquidity is ending, investors will have to lower their performance expectations. Investors in a 50% equities/50% bonds portfolio should expect low single digit returns, especially euro-based investors, where the investment landscape remains more clouded and investors lack the bond income engine, as rates remain very low. In this area, seeking opportunities across the credit continuum (including liquid and illiquid investment vehicles) and adding uncorrelated sources of returns will help, in our view, to enhance the risk/return profile of an overall allocation. All in all, we think that 2019 will be the year of focus on fundamentals to find sustainable returns and avoid areas of major risk across asset classes.

•Multi-asset - Dynamic risk allocation and hedging at the forefront. Investors will need to manage multiple risks. CB policy mistakes is one of these, as the unintended negative effects of trade tensions on prices could be underestimated. The slowdown generated by excessive tightening could be particularly challenging for the highly indebted corporate sector, and a potential widening of credit spreads could trigger negative reactions in equity markets, which it is clearly worth hedging against. A deterioration of the macroeconomic environment that could become more evident in 2H19 and into 2020 will instead call for risk reduction in asset allocation.

• Equities – Explore quality in range-bound markets. |

In 2019, the focus on alpha |

|

We don’t point to any major directional calls, but would |

generation will be key, |

|

focus more on selection, led by sustainability as a parameter, |

||

as we expect limited |

||

in terms of earnings growth, debt structure and business |

||

models. This will be key to navigating the late cycle phase in |

directional upside in |

|

equities. The outlook for earnings should remain supportive, |

markets. This will point |

|

with some deceleration especially in US, where earnings |

to the importance of |

|

growth should start to revert from the extraordinary highs |

tactically playing rotation |

|

of 2018 as higher input costs start to have a negative effect. |

of geographies/themes and |

|

In a more balanced world, investors could explore selective |

||

carefully selecting securities |

||

opportunities in the cheapest areas of the market, namely |

||

Europe. If, as we believe, the Italian situation will be fixed |

based on their sustainability |

|

in the medium term, it should become an investment |

of returns. There could |

|

opportunity for repositioning portfolios in European equities |

possibly be a case made |

|

with appealing valuations and where most of bad news has |

for a more defensive |

|

already been priced in. In the US market, we expect investors |

||

stance later in the year, when |

||

to become more selective, and we favour rotation of styles |

||

from the stretched growth style to a combination of quality |

the extension of the cycle |

|

and value styles. Risk management becomes crucial here |

will move closer to its |

|

in order to avoid concentration due to higher uncertainty. |

endpoint. |

•Fixed income – Add duration and reduce credit risk. The upward movement of rates will lose momentum as the Fed

moves closer to the end of its tightening cycle. With higher yields in US Treasuries, this area will return to focus in the search for income and investors should add duration to benefit from higher rates (US) and as protection in case of risk-off situations. As liquidity shrinks and CB retreat, investors should adopt a very selective approach regarding credit markets. Among the major risks investors are facing, we see decreasing liquidity, the change in the structure of some markets, or monetary policy mistakes (in particular, a more aggressive Fed ahead of an overheating US economy). Defaults are low and should not materially rise in 2019, but this is an area requiring increasing attention as economic conditions progressively deteriorate and financial conditions tighten.

•Emerging markets – Seek entry points and search for carry. Emerging markets continue to be key mid to long term areas of opportunity. Some areas of EM that have already repriced offer interesting income sources, but selection remains vital, given different profiles in terms of vulnerability among EM countries. At the same time, the end of the Fed’s tightening cycle should bring some relief to oversold EM assets.

•FX – Diversify currency exposure amid rising volatility. As currency will be the first mechanism used to make adjustments in flows, we expect volatility to remain high, suggesting a diversified currency exposure among DM. We maintain a cautious view on EM which are more vulnerable in the current phase. The US dollar has been the main beneficiary of investor appetite, due to repatriation of assets, a trend that could weaken later in the year, when fundamentals (ie, larger fiscal deficits) could resurface as the effects of fiscal stimulus will decline.

Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry 5

vk.com/id446425943

#11 |

November 2018 |

CROSS ASSET |

|

|

|||

|

|

|

|

|

2019 Outlook Special Issue |

INVESTMENT STRATEGY |

|

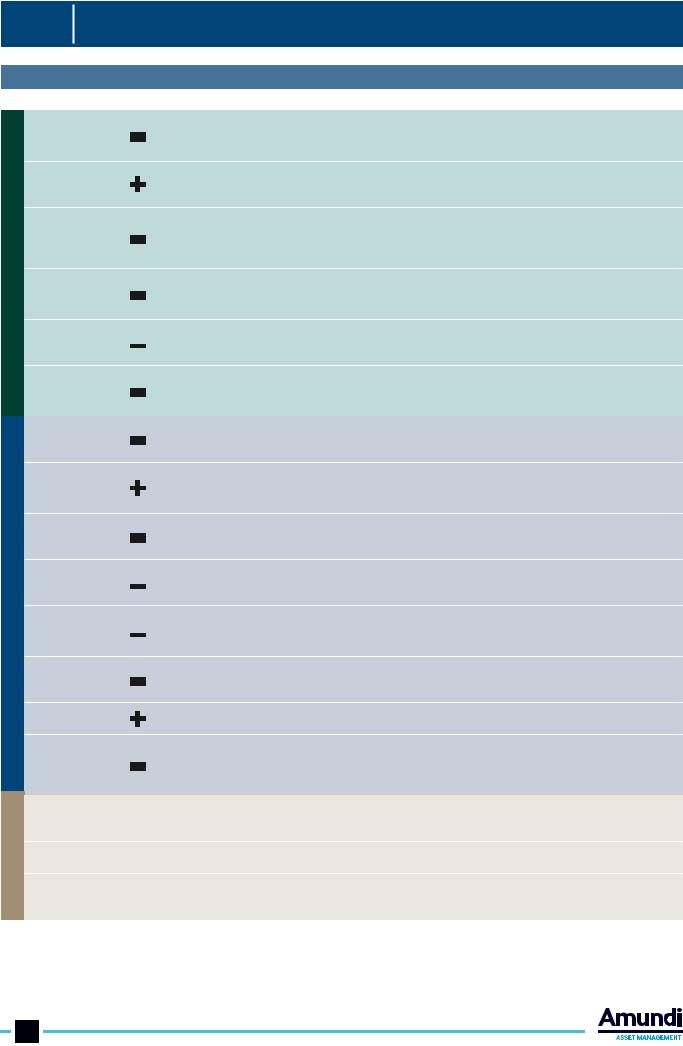

AMUNDI INVESTMENT CONVICTIONS FOR 2019

Equities

Fixed income

Other

Asset class Views Rationale

Global |

Global growth of more than 3% is perfectly acceptable for corporate profits . But the economic slowdown, |

|

combined with the withdrawal of CB cash injections, is a risky cocktail for equities . Regional diversification, |

||

equities |

||

selection of quality companies and tactical allocation based on regional dynamics will be key. |

||

|

||

US |

The US market is expected to continue to outperform other equity markets in terms of profit growth, even if its |

|

outperformance could slow in 2019. However, the climax of the US cycle is an obstacle to a P/E ratio uptrend, so |

||

|

the market should perform in line with EPS growth. |

|

|

Political issues will weigh on the markets, calling for a risk premium. Profit growth is subdued in comparison |

|

Europe |

with the US market, but valuations are appealing and could potentially benefit the market should the political |

|

risks fade away. Once Brexit is behind us and the cycle matures further, the UK could benefit from high dividend |

||

|

||

|

yields . |

|

Japan |

The political situation in Japan is a lot clearer than in Europe, but the profit recovery is much more mature and |

|

the growth forecast for 2019 is among the weakest of all the major markets . The performance of this market |

||

|

depends significantly on Yen dynamics, thus amplifying risk-on/risk-off market trends . |

|

Asia-Pacific |

This region (57% Australia, 29% Hong Kong) is highly sensitive to the impact of China, especially on industrial |

|

commodity prices and trade. More visibility on the Chinese stimulus package, particularly in terms of |

||

ex Japan |

||

infrastructure, could set this market on a rebound during the year (more of a temporary trend). |

||

|

||

Emerging |

Some headwinds will remain in 2019: the tight Fed policy in H1, more hawkish EM central banks, the decelerating |

|

global economy and ongoing trade issues . The political agenda will also be busy. Yet, the recent correction on |

||

markets |

||

GEM has been too abrupt, so even with a decelerating cycle some upside could be justified. |

||

|

||

Global bonds |

2019 calls for an active and tactical approach in global fixed income with a strong focus on quality. The short |

|

duration stance, which has characterised most of 2018, will be replaced by a more constructive view on duration |

||

|

(especially in the US), partly as a hedge to global risks . |

|

US govies |

In H1 2019 interest rates should stabilise or increase only slightly. Hence, the 10-year yield will remain around |

|

current levels in the coming months . In H2 2019 we see some slight downside risk on bond yields, together with |

||

|

the slowdown in US growth and the Fed reaching its target on rates normalisation. |

|

US IG |

Valuations look generally more stretched in high beta $US denominated bonds, where the risks of market |

|

complacency are higher in case of negative surprises on economic trends and tightening financial conditions . |

||

Corporate |

||

Preference goes to high grade, low duration corporates in the US. |

||

|

||

US HY |

While the defaults outlook is benign in the near term, elevated corporate leverage increases the negative |

|

impact of a turn in the economic cycle. US HY bonds valuations are not appealing in light of the rising risks |

||

Corporate |

||

ahead. |

||

|

||

European |

The ECB is likely to stick to its cautious forward guidance on rates . We expect 10Y Bunds to rise but in a limited |

|

way. A dovish ECB keeps the search for yield alive in the two to five year curve bucket, the segment in which |

||

govies |

||

Italian spreads also offer more chances of normalisation in case of an earlier confrontation with the EU. |

||

|

||

Euro IG |

Political risks and less brilliant macro growth, together with the end of the corporate sector purchase |

|

programme, will pose some challenges for European IG credit. Yet this remains more attractive vs Euro core |

||

|

bonds . |

|

Euro HY |

Euro HY fundamentals remain very strong and also the supply/demand dynamics should be supportive. We seek |

|

a tactical approach on financials and Euro HY in general, depending on the evolution of political risks . |

||

|

||

Emerging |

After a challenging year, we believe that conditions will progressively improve, especially in the second half |

|

markets |

of 2019. In local currency debt, we see currency valuations as not being particularly attractive for the asset |

|

bonds |

class . Our preference for the year ahead is for USD debt and with a focus on selective best risk/adjusted yields . |

|

Commodities |

The performances of base metals and oil diverged quite significantly in 2018 and we think this will continue in |

|

2019. Our target ranges for 2019 are $65-$75 for W TI and $70-$ 80 for Brent. On gold we think it should still be |

||

|

considered as a meaningful hedge to protect from a financial crisis . |

|

Real Assets |

Against a backdrop of lower expected returns, investors with a sufficiently long time horizon could enhance |

|

diversification and return potential through liquidity premium that real assets investment can offer. |

||

|

||

Currencies |

Brexit and political noise in the Eurozone might weigh on GBP and EUR for some time. We expect the USD to |

|

remain strong in the short term, and weaken with a medium-term horizon as, in addition to other factors, the |

||

|

economy might reach the mature phase of its cycle, a situation that usually leads to a weaker USD. |

Legend:

Negative,

Negative,  Slightly Negative,

Slightly Negative,  Neutral,

Neutral,  Slightly Positive,

Slightly Positive,

Positive

Positive

Source: Amundi, as of 1 November 2018. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research, investment advice or a recommendation regarding any fund or any security in particular. This information is strictly for illustrative and educational purposes and is subject to change. This information does not represent the actual current, past or future asset allocation or portfolio of any Amundi product.

6 Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry

vk.com/id446425943

CROSS ASSET |

November 2018 |

#11 |

|

||

|

|

|

INVESTMENT STRATEGY |

2019 Outlook Special Issue |

MACROECONOMIC CONTEXT

Our convictions and scenarios

Central scenario (70% probability): “multi-speed” slowdown that risks becoming a synchronised slowdown, due to the multiplication of risks

REGIONAL VIEWS

•In the world economy, 2018 began based on the theme of a synchronised global recovery. But, this did not last. Since the spring, the protectionist measures taken by Donald Trump have changed the game. Emerging economies, some of which are heavily indebted in dollars, have been weakened due to the broad-based appreciation of the US currency. The depreciation of their currencies has generated local inflation and led their central banks to tighten monetary policies, which has weighed on economies already negatively affected by massive capital outflows. Advanced economies have begun to slow down. In our view, the year will end with a global economy that is evolving in a disjointed fashion, with increased downside risks.

•In the United States, the economy has been driven by very accommodative fiscal policy that is likely to continue to produce effects for some time; but, the fiscal multipliers should progressively erode next year. We expect growth to decelerate to its potential, but not before late 2019/ 2020, meaning that the US economy should lose 1pp of growth by 2020. This situation will have a negative impact on corporate profits, especially if inflationary pressures intensify by then, which is possible, given the fact that the economy is operating at close to full employment.

•In Europe, despite a recovery that started well after that in the US, national economies have begun to slow in 2018. The output gap has closed in most countries, and Italy is the only one in the Eurozone (excluding Greece) where GDP has not recovered to pre-crisis levels. Several factors have contributed to the slowdown in growth in 2018: the rise in oil prices, the slowdown in world trade, and the slowdown in emerging economies. In addition, political uncertainties have muddied the waters (Brexit, Italian budget). The possibility of a coalition change in Germany following the defeat of the two major government coalition parties (CDU and SPD) in local elections marks the end of the Merkel era. The loss of the chancellor’s leadership may hinder initiatives to strengthen the integration of the Eurozone that were under consideration. It will probably be necessary to wait for European elections in May 2019 and a new parliament, a new European Commission, a

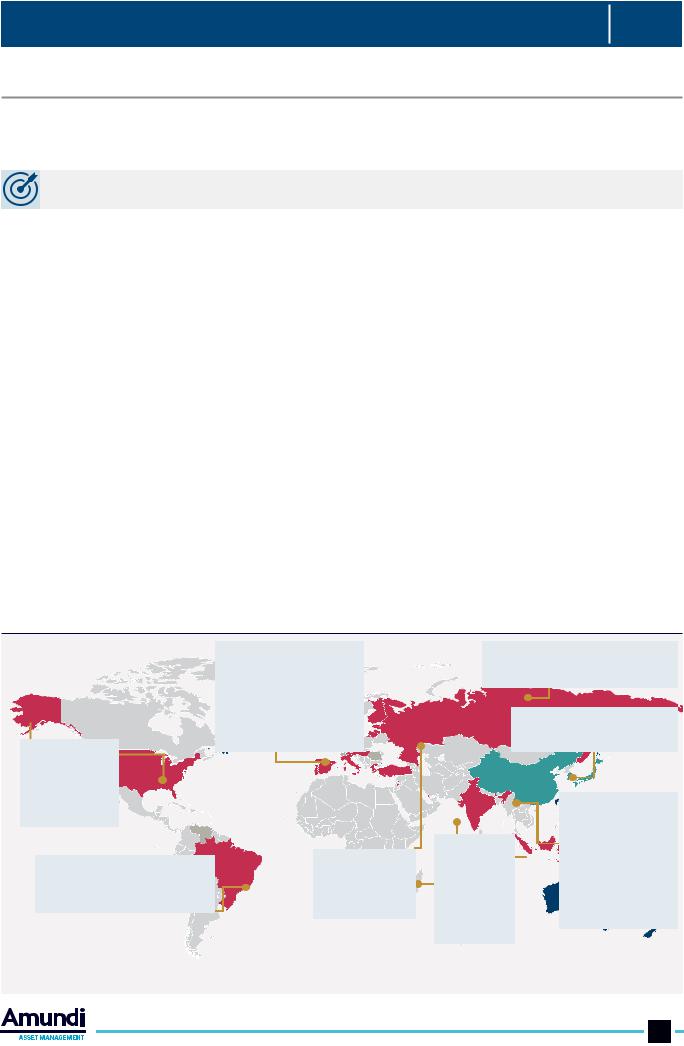

1/ Monetary policy: more asynchrony in Central Banks actions in 2019

FED: We expect  one more hike in

one more hike in

2018. Additional hikes in 1H19, end of the tightening cycle.

BCB: Marginal tightening ahead. Inflation expected to marginally increase over 2018-19 although remaining within BCB target.

ECB: End of the asset purchasing programme

by year end and first rate  hike not before H2 2019. BoE: We do not expect

hike not before H2 2019. BoE: We do not expect  any further rate hikes in 2018, entering in a critical

any further rate hikes in 2018, entering in a critical  period for Brexit.

period for Brexit.

EM: Monetary  policy has shifted to tightening to combat inflation and weaker FX.

policy has shifted to tightening to combat inflation and weaker FX.

|

Hold |

|

Easing |

|

Tightening |

|

|

|

CBR: We expect tighter monetary policy, due to a rise in the inflation outlook.

BoJ: We expect continued accommodation at least until the first quarter of 2019.

RBI: Further

tightening

tightening  expected,

expected,

due to inflation outlook and currency depreciation.

PBoC: Policy stance changed over the summer to be more directional vs just fine-tuning, in responses to higher near term risks  regarding growth and US/China trade tensions.

regarding growth and US/China trade tensions.

Source: Amundi, as of 5 October 2018. Indicative map for monetary policies. A reduction or end of QE interpreted as Tightening. Terms used: Federal Reserve (Fed), Swiss National Bank (SNB), Bank of England (BOE), People Bank of China (PBoC), Bank of Japan (BOJ), Riksbank (Swedish Central bank). BCB= Central bank of Brazil. CBR= Central Bank of Russia. European Central Bank (ECB). Emerging Markets (EM), RBI= Reserve Bank of India.

Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry 7

vk.com/id446425943

#11 |

November 2018 |

CROSS ASSET |

|

|

|||

|

|

|

|

|

2019 Outlook Special Issue |

INVESTMENT STRATEGY |

|

new Chancellor in Germany, and clarification regarding leadership of the institutions of the EU (Commission, ECB) to make significant progress in strengthening the financial architecture of the Eurozone. The Italian government, sensitive to market pressure, seems ready to postpone some costly measures. The UK continues to see an uncertain future due to Brexit. It seems very likely that the British government and the EU will reach an agreement on the Irish border that will allow the UK to benefit from a transition period (from March 2019 to December 2020) during which negotiations would continue.

•In Japan, the outlook remains favourable. The weakness seen since mid-2018 should be short-lived. We think that Japan is relatively immune to US-China trade disputes. Exports to the US and China account for around 3% of GDP. This means that a decelerating Chinese economy on the heels of sanctions should be roughly covered by the strength of the US economy (in the short run). In addition, it is somewhat surprising that companies plan to increase investment spend at rates not seen since 2007, despite the threats to global trade. The labour market has not been this tight since 1974 and wages are growing at the highest rate in more than 20 years (+1.8% yoy in 1H18). The increase in VAT scheduled for October 2019 (from 8% to 10%) should boost consumption before weighing on household spending, once the measure is in place. However, we anticipate a 30% lower impact than that caused by the last VAT increase in 2014. Despite these factors, GDP growth should mechanically fall in late 2019 and early 2020, to well below its potential. But, we do not expect this slowdown to last.

•In China, the rise of protectionist threats has weakened the economy and the risk of a sharp slowdown has increased during the year. The Chinese authorities changed their policy mix during the summer, opting for a counter-cyclical stabilisation policy. China will use all the levers that are available to avoid a hard landing. Keep in mind that the local authorities have more room for manoeuvre than the American authorities. Under these conditions, we still expect a gradual and controlled slowdown in China. All eyes are, naturally, on the G20 meeting that will take place in Argentina in late November 2018, during which Presidents Trump and Xi have planned to meet. This meeting may result in an easing of the pressure on trade, at least temporarily.

•In other emerging economies, the deterioration of domestic conditions – particularly related to the risks posed by US protectionist measures – may continue to weigh on the business climate and investment (particularly in North Asia and Mexico). Other countries, on the other hand, are likely to continue to be able to meet their infrastructure needs (Indonesia and the Philippines, for example). Consumption should remain strong in economies with close to full employment. Although many emerging economies are fragile (Argentina, Turkey, South Africa) and/or heavily indebted, we would point out that nominal potential growth remains very much in favour of emerging economies relative to advanced economies.

GLOBAL THEMES

On a global scale, the macrofinancial situation remains very unbalanced. Even if the economic outlook is generally satisfactory (growth close to or even higher than potential over the next two years), the rise in the number of risk factors – especially those of a political nature – are tending to increase global uncertainty, with this potentially higher uncertainty affecting investment decisions.

United States/China trade war, US sanctions on Iran, tensions in the Middle East and political challenges in Europe are here to stay, not to mention the associated problems that persist. Indeed, growth continues to be driven largely by global debt. And, nominal potential growth is being weakened on a global scale by the aging of the population, the (observed) slowdown in productivity gains, and the structural weakening of inflation of goods and services. In other words, the current global “growth regime” seems unsustainable in the medium and long term. The world economy continues to expand, but this expansion is based on very fragiles underpinnings, especially in the event of a sharp rise in interest rates (higher risk premia). This fragility is all the more worrisome since the room for manoeuvre of central banks and governments has decreased in many countries: those that still have the means to put in place stabilisation (counter-cyclical) policy mixes are becoming increasingly rare.

In particular, in the United States, pro-cyclical fiscal policy leaves little room for manoeuvre in the event of a turning point, especially since the Congress is now divided (with the Democrats controlling the House of Representatives and the Republicans having a majority in the Senate). In Europe, there is less room for manoeuvre in terms of both fiscal and monetary policy. The ECB has not started to normalise its policy but growth is already slowing. It will be difficult for it to raise interest rates later in 2019 if the Fed chooses to reverse its policy trajectory in the next 12 months (in anticipation of an economic slowdown).

The world economy operates in a scattered order. The disruptions in value chains brought about by the trade war are reshaping global trade to the benefit of China. Global trade will no longer be the engine that it has been in recent decades. That said, this is not a step backwards, in our view. Trade in services is growing, economies remain tightly intertwined, and Donald Trump is isolated internationally. Moreover, it is particularly important to note that the interests of populist/nationalist regimes do not automatically converge: there are indeed many countries where their economies are still dependent on relations with the rest of the world in order to develop (Eastern Europe, Turkey, Brazil, among others).

8 Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry

vk.com/id446425943

CROSS ASSET |

November 2018 |

#11 |

|

||

|

|

|

INVESTMENT STRATEGY |

2019 Outlook Special Issue |

Against this backdrop, economies are more likely to experience more autonomous economic cycles in the future because they are more dependent on domestic demand. In a world that is increasingly unstable politically, a lasting desynchronisation of business cycles would be good news. That said, the US could well drag the world economy into recession if Donald Trump continues his trade offensive. A stronger confrontation with China on trade would only result in losers, starting with the protagonists in the conflict. However, the world economy should continue to grow in a “scattered manner” (ie, expansion at different speeds, with possibly some isolated downturns). But, to date, the risks are clearly skewed to the downside, including the possibility of a global synchronised slowdown.

Downside risk scenario (25% probability): a significant trade war-driven economic slowdown, a geopolitical crisis

Downside risk scenario (25% probability): a significant trade war-driven economic slowdown, a geopolitical crisis

The risk of further protectionist measures from the US, followed by retaliation from the rest of the world, remains high. China and the EU are particularly exposed to this risk.

•Aggravation of geopolitical tensions in the Middle East. Oil prices could rise above $100/bbl.

•Uncertainty regarding rising trade tensions (primarily between the United States and China) against a backdrop of geopolitical risks (with Iran, for example), crises in several large emerging economies (eg, Turkey, Argentina), political risk in Brazil, a slowdown in China, and political tensions in Europe (a deterioration in the budget situation in Italy, Brexit) is encouraging companies to remain cautious.

Consequences:

•All things being equal, a trade war would drag down global trade and trigger a synchronised slowdown in growth and, in the short term, inflation. That said, a global trade war would quickly become deflationary by creating a shock to global demand.

•An abrupt repricing of risk on fixed income markets, with an across-the-board rise in spreads on govies and credit, for both developed and emerging markets, and a decline in market liquidity.

•Amid the resulting financial turbulence, the cycle-end story would resurface in the US.

•Central banks would cease recalibrating their monetary policies and, in the worst – albeit highly unlikely – case would once again resort to unconventional tools, such as expanding their balance sheets.

Upside risk scenario (5% probability):

Upside risk scenario (5% probability):  a pick-up in global growth in 2019

a pick-up in global growth in 2019

Donald Trump makes an about-turn after the US midterm election, reducing barriers to trade and engaging in bilateral negotiations with China. Domestically, the theme of increasing infrastructure spending could return to centre stage and extend the cycle in the United States.

•Acceleration driven by business investment and a rebound in global growth.

•Pro-cyclical US fiscal policy generating a greater-than-expected acceleration in domestic growth. Growth reaccelerates in the Eurozone after a dip. Growth picks up again in China on the back of a stimulative policy mix in the first half.

•Central banks would react late, initially maintaining accommodative monetary conditions.

Consequences:

•An acceleration in global growth would boost inflation expectations, forcing central banks to consider normalising their monetary policies more rapidly.

•An increase in real key rates, particularly in the US.

•Risk of boom/bust.

Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry 9

vk.com/id446425943

#11 |

November 2018 |

CROSS ASSET |

|

|

|||

|

|

|

|

|

2019 Outlook Special Issue |

INVESTMENT STRATEGY |

|

STRATEGIST VIEW

The cyclical peak is behind us, be aware of the sentinels

The essential

Moving towards 2019, as the cycle further progresses, it is vital to assess the potential areas of excesses in the market and detect possible indicators that could signal when market conditions are starting to reach the tipping point. In our view, the key sentinels to watch, those which in the past have proved to be good leading indicators of market correction, are global liquidity, EPS revisions and momentum and riskadjusted valuations.

We entered 2018 conscious that the asset reflation regime would have switched to a late financial cycle in H1, with central banks finally recalibrating their monetary policy stance and the global environment becoming progressively more challenging. As a consequence, we adjusted allocations to prepare for less liquidity, higher volatility and, eventually, gradually lifting interest rates. Our rationale to investing was risk rotation and progressive mitigation, however, at the end of Q1, rising tensions on global trade and the US’s unexpected fiscal supercharging shifted our attention from inflation expectations and rates to the global trade slowdown and its spillover to global growth, EM in particular. At the same time, in the US the fiscal policy measures supported further profit expansion and eventually boosted the US financial market. The USD strenghend, treasury yields and oil prices increased, putting pressure on EM.

We note that excesses have been accumulating over time amid liquidity abundance, while financial imbalances continued to build up. We now see a potentially dangerous configuration of financial forces related to the late credit cycle deterioration, a stronger USD, an elevated leverage (both in public and private sectors, with different distributions in DM and EM between the two sectors) and less supportive equity and credit valuations. Tariffs and raising trade barriers, tighter labour market conditions and the consequently higher unit labour cost, and the higher producer price index (higher oil prices) are starting to weigh on profit margins, more so than on headline inflation. In the EM, financial conditions have broadly tightened. The intensification of domestic political concerns in some cases, a stronger USD and higher US rates generated capital outflows (for the time being these are largely contained in the fixed income space and more evident in equities). This could prove to be potentially risky for those countries that have large borrowings without adequate capital buffers (Poland, Chile, South Africa, Turkey).

Key sentinels to watch in 2019

Looking ahead, investors should acknowledge that the longer the late cycle and the tighter the financial conditions, given the current level of valuations, the higher the risk of a material market correction generated by financial market turmoil, even though economic conditions remain sound. In fact, financial volatility, mainly inspired by the poor state of global politics, has shaken investors’ spirits but has not yet destabilised economic and macro fundamentals.

In our view, financial risk dominates economic risk

As happened in the last two cycles, we think that financial risk dominates

economic risk. Therefore, it is crucial to monitor financial and financing conditions along the profit cycle evolution. In fact, in this late phase of the cycle, asset prices will move on fundamentals rather than on abundant liquidity, as has been the case over the last years.

In our view, the key sentinels to watch, those which in the past proved to be good leading indicators of market correction, are global liquidity, EPS revisions and momentum and risk-adjusted valuations.

1 - Global liquidity

We think real rates, credit spreads and the trade-weighted US dollar index are, broadly, good trackers of global liquidity conditions. In particular, an appreciation of the USD is a strain on EM external credit conditions, which could propagate to EM FX first but also potentially create global stress in the financial markets. At the same time, there has been a preponderance of global rates increases in the EM on a gradually tighter Fed policy, which together with trade concerns and some idiosyncratic stories (ie. Argentina, Turkey, Brazil, South Africa), has resulted in much tighter financial conditions in EM. In the DM, the US Treasury moves in real terms did not point to higher inflation expectations (structurally anchored in our expectations) and financial conditions remain broadly easy. We expect that as central banks continue in their normalisation process global liquidity will tighten. At the same time, as the Fed is probably at the end of the tightening cycle, we could expect less pressure on EM.

10 Document for the exclusive attention of professional clients, investment services providers and any other professional of the financial industry