posobie

.pdfIII. Read the text. Explain the usage of the words in bold type.

Text I. Farm expenses

A fixed expense is a set amount of money due on a set date. As a rule, fixed expenses must be paid when due. Although we do not have control over the types of fixed expenses, we do have some control on their amounts. Mortgage or rent payment obviously is an unavoidable expense once you "get out on your own." This could also include income and property taxes and insurance if these are a part of your house payment. Your rent or house payments should not exceed 25 to 35 percent of your income. Other real estate payments could include a second mortgage, home improvement loan, storage rental, pasture for horses, or some other item.

Variable expenses vary in amount and frequency and offer the best opportunities for adjustments in terms of money. Variable costs are the costs of inputs that are used up during one production period, with changes in the number of heads or acres (or other units) of the enterprise. Operating costs may be classified as cash or non-cash.

In livestock budgets, operating costs include costs of hay and feed, salt and minerals, veterinary and medical expenses, hauling and marketing expenses, personal taxes, labor, fuel, lubricants and repairs for machinery, and equipment and interest on operating funds (annual operating capital). In stocker budgets, the money spent purchasing feeder cattle and for trucking expenses is also an operating cost. In crop budgets, operating costs may include seed, fertilizer, insecticide, custom harvest, labor, fuel, lubricants, repairs, and interest on operating funds (annual operating capital).

In horticultural crop budgets, operating inputs may include seed or transplants, herbicide, fertilizer, insecticide, labor (for transplanting, harvesting, sorting, and grading), irrigation fuel, lubricants, repairs, rented machinery or equipment, and annual operating capital.

For any type of farm machinery operating costs include fuel, lubricants and repairs. Operating costs per acre change very little as machinery size is increased or decreased. Using larger machinery consumes more fuel and lubricants per hour, but this is essentially offset by the fact that more acres are covered per hour. Much the

61

same is true of repair costs. Thus, operating costs are of minor importance when deciding what size machinery is best suited to a certain farming operation.

Lease or rental payments and other costs such as housing and insurance are generally included in operating inputs. Custom hire of machine operations or hauling should be included as an operating input rather than as a fixed machinery input.

Operating costs should include the value of inputs produced on the farm that have a market value (for instance, homegrown feed or seed, and family labor) that are used in production. These inputs have an opportunity cost; they would be sold if not used in production.

1.Answer the following questions:

1)What kinds of taxes are mentioned in this text?

2)What are examples of property taxes?

3)Who pays dues to professional organizations?

4)What items could real estate payments include?

5)What are variable costs?

6)How many operating costs be classified?

7)What items do operating costs in livestock budgets include?

8)What items do machinery operating costs include?

2.Complete the following sentences:

1)______________ could also include property tax and insurance.

2)______________ payments include car payments, _________, appliances and other items.

3)Many hourly workers pay dues to _____________.

4)In _______, operating costs may include seed, fertilizer, custom harvest and other items.

5)Using larger machinery consumes more _______ per hour.

6)Housing and insurance are included in ______.

62

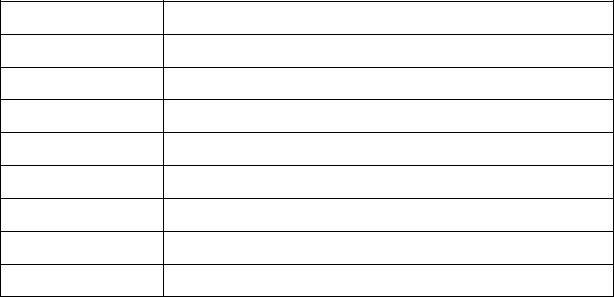

3. Provide the definitions of the given terms.

Term |

Definition |

Expenses

Mortgage

Installment

Due

Savings

Insurance

Insecticide

Lubricant

4. Make a summary of the Text I.

IV.Look through the text and translate the words in bold type. Explain the usage of the words in bold type.

Text II. Farm machinery costs

Machinery and equipment are major cost items in farm businesses. Larger machines, new technology, higher prices for parts and new machinery, and higher energy prices have all caused machinery costs to rise in recent years.

However, good machinery managers can control machinery costs per acre. Making smart decisions about how to acquire machinery, when to trade, and how much capacity to invest in can reduce machinery costs as much as $25 per acre. All of these decisions require accurate estimates of the costs of owning and operating farm machinery.

Farm machinery costs can be divided into two categories: annual ownership costs, which occur regardless of machine use, and operating costs, which vary directly with the amount of machine use. The true value of these costs is not known until the machine is sold or worn out. But the costs can be estimated by making a few assumptions about machine life, annual use, and fuel and labor prices.

The example is a 180-PTO horsepower diesel tractor with a list price of $110,000. Dealer discounts are assumed to reduce the actual purchase price to

63

$93,500. An economic life of 15 years and an interest rate of 8 percent are selected. The tractor is expected to be used 400 hours per year.

Ownership costs (also called fixed costs) include depreciation, interest (opportunity cost), taxes, insurance, and housing and maintenance facilities.

Depreciation is a cost resulting from wear, obsolescence, and age of a machine. The degree of mechanical wear may cause the value of a particular machine to be somewhat above or below the average value for similar machines when it is traded or sold. The introduction of new technology or a major design change may make an older machine suddenly obsolete, causing a sharp decline in its remaining value. But age and accumulated hours of use are usually the most important factors in determining the remaining value of a machine.

Before an estimate of annual depreciation can be calculated, an economic life for the machine and a salvage value at the end of the economic life need to be specified. The economic life of a machine is the number of years for which costs are to be estimated. It is often less than the machine's service life because most farmers trade a machine for a different one before it is completely worn out. A good rule of thumb is to use an economic life of 10 to 12 years for most farm machines and a 15year life for tractors, unless you know you will trade sooner.

Salvage value is an estimate of the sale value of the machine at the end of its economic life. It is the amount you can expect to receive as a trade-in allowance, an estimate of the used market value if you expect to sell the machine outright, or zero if you plan to keep the machine until it is worn out.

Note that for tractors, combines and forage harvesters the number of hours of annual use is also considered when estimating the remaining value. The factors were developed from published reports of used equipment auction values, and are estimates of the average "as-is" value of a class of machines in average mechanical condition at the farm. Actual market value will vary from these values depending on the condition of the machine, the current market for new machines, and local preferences or dislikes for certain models. For the 180-hp tractor with 400 hours of annual use in the example, the salvage value after 15 years is estimated as 23 percent

of the new list price.

64

1.Answer the questions:

1)What is the difference between “economic life” and “age” of the equipment?

2)What is the difference between “salvage value” and “remaining value” of the machine?

3)What is the difference between “market value”, “list price” and “purchase price”?

4)How can you depict the tractor after 16 years of operation in terms of machinery costs?

5)Depict the trade-in procedure.

2.Provide the terms after their definitions.

Term |

Definition |

|

|

|

a period over which an asset is expected to be usable, with normal |

|

repairs and maintenance |

|

|

|

a price for the item with no expressed or implied warranty |

|

|

|

a value of a depreciable property at the end of its economical life |

|

|

|

durability of a machine |

|

|

|

expenses that remain more or less unchanged irrespective of the |

|

output level or sales revenue |

|

|

|

the estimated present value of the property after some period of |

|

operation |

|

|

|

the expenses which are related to the operation of a business |

|

|

|

the highest estimated price for an item that a buyer would pay and a |

|

seller would accept |

|

|

|

the manufacturer's suggested retail price |

|

|

|

to purchase, to buy |

|

|

3.Explain the following numbers from this text: $110,000; 15; $25; 180; 400; 10; 23.

65

V.Read the text. Name it. Make a diagram that shows costs proportion.

Text III. ________________

If you borrow money to buy a machine, the lender will determine the interest rate to charge. But if you use your own capital, the rate to charge will depend on the opportunity cost for that capital elsewhere in your farm business. If only part of the money is borrowed, an average of the two rates should be used. For the example we will assume an average interest rate of 8 percent.

Inflation reduces the real cost of investing capital in farm machinery; however, since loans can be repaid with cheaper dollars. The interest rate can be adjusted by subtracting the expected rate of inflation. For our example we will assume a 3 percent inflation rate, so the adjusted or "real" interest rate is 5 percent.

The joint costs of depreciation and interest can be calculated by using a capital recovery factor. Capital recovery is the number of dollars that would have to be set aside each year to just repay the value lost of the interest rate and the salvage value to it.

For the example values given above: $7,812 per year

These three costs are usually much smaller than depreciation and interest, but they need to be considered. Property taxes on farm machinery have been phased out in Iowa, except for very large inventories. For states that do have property taxes on farm machinery, a cost estimate equal to 1 percent of the purchase price is often used.

Insurance should be carried on farm machinery to allow for replacement in case of a disaster such as a fire or tornado. If insurance is not carried, the risk is assumed by the rest of the farm business. Current rates for farm machinery insurance in Iowa range from $4 to $6 per $1,000 of valuation, or about 0.5 percent of the purchase price.

There is a tremendous variation in housing provided for farm machinery. Providing shelter, tools, and maintenance equipment for machinery will result in fewer repairs in the field and less deterioration of mechanical parts and appearance from weathering. That should produce greater reliability in the field and a higher

66

trade-in value. An estimated charge of 0.5 percent of the purchase price is suggested for housing costs.

To simplify calculating TIH costs, they can be lumped together as 1 percent of the purchase price where property taxes are not significant.

For our tractor example, these three costs would be:

TIH = 0.01 x $93,500= $935 per year

The estimated costs of depreciation, interest, taxes, insurance, and housing are added together to find the total ownership cost. For our example tractor this adds up to $8,747 per year. This is almost 10 percent of the original cost of the tractor.

Total ownership cost = $7,812 + $935= $8,747 per year

If the tractor is used 400 hours per year, the total ownership per hour is:

Ownership cost per hour = $8,747 / 400 hours = $21.87 per hour

1.Answer the following questions:

1)What does the rate to charge depend on?

2)What reduces the real cost of investing capital?

3)What is the capital recovery?

4)How important are these costs by comparison with previous ones?

5)Is it reasonable to neglect them?

2.Explain the following numbers from this text: 0,5%; $8,747; $21,87 per hour; $935 per year; $1,000; 8%.

3.Find the correct English translation of the Russian economic terms:

сельхозтехника, заимодавец, инфляция, амортизация, скидка, катастрофа,

воздействие атмосферных условий, торговый агент, издержки, утилизация.

VI.Look through the text. Find the keywords. Divide the text into the parts

and name them.

Text IV. Machinery services

Purchasing equipment with the use of loans from financial institutions or equipment manufacturers has been the typical method of obtaining machinery services for most farm operations. Producers are increasingly considering other

options for obtaining machinery services. We define four options for obtaining

67

machinery services: 1) lease, 2) custom hire, 3) rental arrangement, or 4) purchase. These options may mean different things to different managers; there are no standard definitions in the industry. Equipment leasing permits control, without ownership, of productive assets. Control, not ownership, is the critical issue in efficient production. Farmers concerned with profitability should consider leasing as an option offering control of farm equipment. Whether or not leasing offers more profit than ownership depends on several financial factors. For many farms, equipment expense is the largest single production expense. As the purchase price of power equipment such as tractors and combines increases, the need for alternative financing systems also increases. Financial institutions and equipment manufacturers are supplying additional financing in the form of equipment leases. Several types of leasing arrangements exist to meet specific needs of farmers seeking control of equipment. Typically, new equipment leases are used for more expensive items such as tractors and combines, although less expensive items such as drills and grain carts can also be leased. Most leases are for new equipment, but leases are also available for used equipment. Whereas national financial institutions lease primarily new equipment, local financial institutions such as banks are also willing to lease used equipment. The person who owns equipment being leased to another is called the lessor. The lessee is the person who actually has possession and control of the equipment for the duration of the lease. In an equipment lease, the farmer is the lessee. A farmer needs to consider the following additional concerns when entering into a lease:

The exact piece of equipment being leased.

The beginning and ending dates of the lease.

The base hours (defined as the annual number of hours the equipment is expected to be used).

The payment due the lessor for use in excess of the base hours.

The amount the farmer must pay to purchase the equipment at the end of the lease if the purchase option is exercised.

The advance payment required.

The periodic payment (monthly, quarterly, semi-annually or annually).

68

Miscellaneous terms of the agreement, including such things as charges for excess wear and tear and evidence of insurance on the equipment. Although a trade-in is often accepted as a downpayment on purchases, some equipment dealers do not allow trade-ins when leasing equipment. Having to sell, rather than trade, used equipment may have adverse effects on tax liabilities. Equipment no longer needed should be traded or sold rather than left to further depreciate on the farm. Leases may offer some cash flow relief by not requiring a downpayment. However, recognize that the first lease payment is due up front, when a downpayment is usually due. Because many leases do not allow trade-ins, cash flow for leases may be no better than for purchases. In most leases the financial institution pays the property tax on the lease. If so, the tax is included in the lease factor used to determine the lease payment. For cash flow reasons, the farmer should clarify who is responsible for paying property tax. When evaluating leases from different companies, make sure they are treating payment of property tax similarly so that a fair comparison can be made. If the farmer (lessee) terminates the lease before the end of the contract, miscellaneous expenses will be incurred. Basically, the financial institution that owns the leased equipment will repossess and dispose of it by sale or another lease and charge the original lessee with any financial loss and costs incurred. In some instances, the end-of- lease purchase price is sufficiently below expected market value that other farmers would be interested in taking over the lease for the privilege of purchasing the equipment at the end of the lease. Equipment leases affect a business's balance sheet differently than ownership does. The purchase of expensive items such as tractors and combines can significantly affect a farmer's borrowing capacity. A purchase may adversely affect a farmer's debt-to-asset ratio, whereas a lease does not. However, annual lease payments are financial obligations and should be disclosed to your banker when evaluating your financial condition. Many bankers ask borrowers to reveal lease obligations and use them to evaluate the borrowers' short-term financial strength. Lease payments are deductible. With a purchase, a farmer deducts depreciation and interest. Purchasing allows the option, which puts much of the tax depreciation deduction at the

beginning of the asset life. Most businesses distinguish a lease from a rental

69

agreement by the duration of control. Equipment leases typically provide control of the equipment for one or more years; rental agreements typically for less than year. Under a typical rental agreement, the farmer agrees to pay a specified rate for every hour registered on the hour meter of the tractor. Frequently a minimum number of hours is also specified. The beginning and ending dates of the rent restrict the duration of the rental period. Some farmers mistake a rollover purchase for a lease. In a rollover purchase, a farmer enters into an arrangement with the equipment dealer to purchase a piece of equipment with the expectation of trading it in after one year for another, newer piece of equipment. Under these arrangements a farmer pays a specified amount each year for the right to "upgrade" each year. The farmer is not obligated to upgrade each year and can decide at any time to keep the current piece of equipment and stop the rollover arrangement. Custom hire is also a shortterm agreement, but the fees are normally for a specific amount of work to be done. Fees may be based on the number of acres covered or bushels per acre harvested. The custom hire charges are tax deductible. Generally, a custom operator provides the machinery, machine operator, and pays for all ownership and operating costs. Like renting equipment, custom hiring specialty operations, or operations that are less common, may be a way of avoiding large ownership costs for equipment used infrequently. While farm managers who custom hire equipment operations do not pay variable costs or ownership costs including market depreciation, interest, taxes, insurance, and housing directly, they do pay these costs indirectly. That is, the manager should keep in mind that the costs of operating and maintaining the equipment are paid in one form or another (actual costs are often near or above custom rates). These differences are important to recognize in the analysis of the options. Purchasing is the traditional method of obtaining machinery or equipment. The farm manager buys a machine using equity or a loan from a dealer or financial institution. Ownership of the machine is transferred to the farm manager, who is responsible for making loan, insurance, tax, and non-warranty repair payments. The owner also provides the labor or hires it and pays for all variable or operating costs such as fuel, lubricants, and routine maintenance. With a purchase, the

machinery is set up on a tax depreciation schedule and the owner takes depreciation

70