- •Examination card № 1

- •Examination card №2

- •Examination card №3

- •Examination card №4

- •Examination card №5

- •Examination card №6

- •Examination card №7

- •Examination card №8

- •Examination card №9

- •Examination card №10

- •Examination card №11

- •Examination card №12

- •Examination card № 13

- •Examination card № 14

- •Examination card № 15

- •Examination card № 16

- •Examination card № 17

- •Examination card № 18

- •Examination card № 19

- •Examination card № 20

- •Examination card № 21

- •Examination card № 22

- •Examination card № 23

- •Examination card № 24

- •Examination card № 25

- •Examination card № 26

- •Examination card № 27

Examination card №2

on the discipline “Financial Accounting II”

for the 3rd year students

What are the essential characteristics of liabilities for purposes of financial reporting?

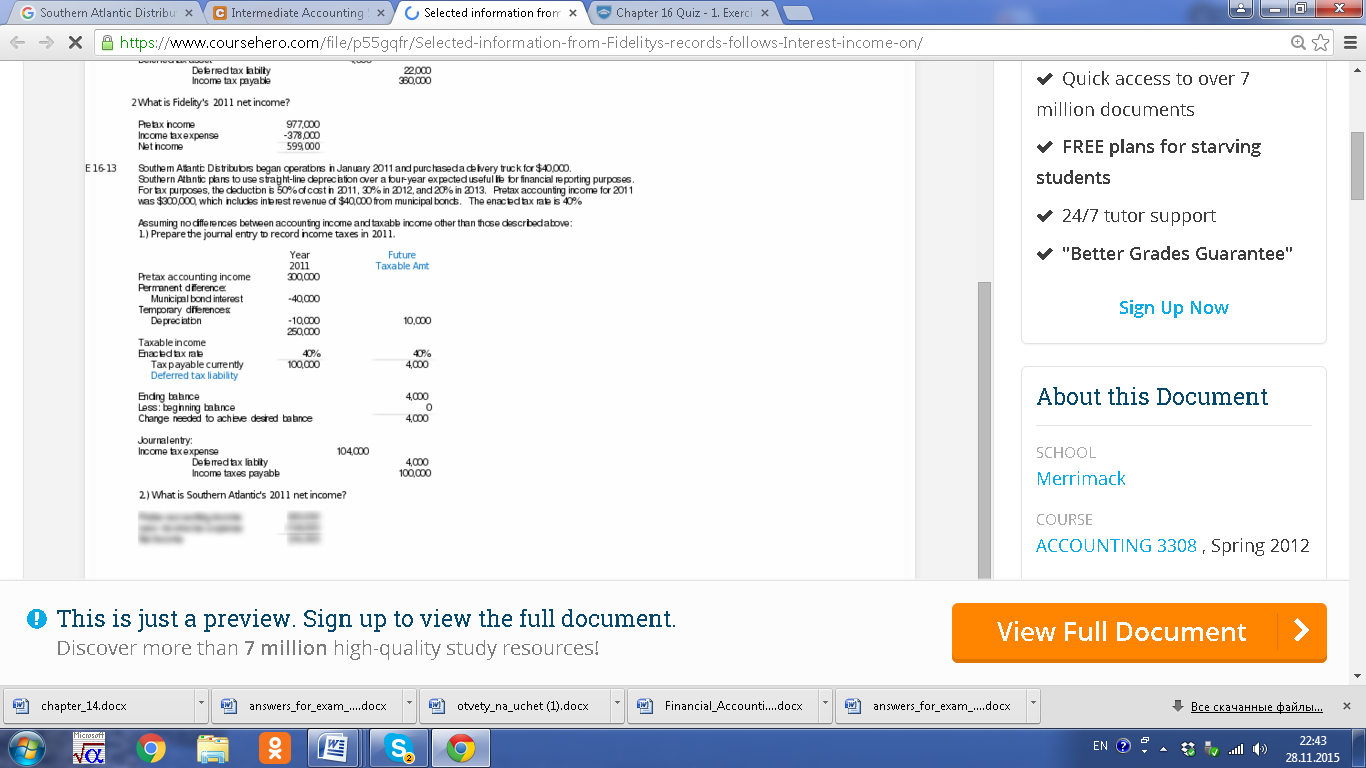

Southern Atlantic Distributors began operations in January 2013 and purchased a delivery truck for $40,000. Southern Atlantic plans to use straight-line depreciation over a four-year expected useful life for financial reporting purposes. For tax purposes, the deduction is 50% of cost in 2013, 30% in 2014, and 20% in 2015. Pretax accounting income for 2013 was $300,000, which includes interest revenue of $40,000 from municipal bonds. The enacted tax rate is 40%.

Required:

Assuming no differences between accounting income and taxable income other than those described above:

1. Prepare the journal entry to record income taxes in 2013.

2. What is Southern Atlantic’s 2013 net income?

On January 1, 2013, Nath-Langstrom Services, Inc., a computer software training firm, leased several computers from Computer World Corporation under a two-year operating lease agreement. The contract calls for four rent payments of $10,000 each, payable semiannually on June 30 and December 31 each year. The computers were acquired by Computer World at a cost of $90,000 and were expected to have a useful life of six years with no residual value.

Required:

Prepare the appropriate entries for) the lessor from the inception of the lease through the end of 2013. (Use straight-line depreciation.)

Solution:

(Lessee) 1/1/13 No entry

6/30/13

Rent expense 10,000

Cash 10,000

12/31/13

Rent expense 10,000 Cash 10,000

(Lessor)

1/1/13 No entry

6/30/13 Cash 10,000

Rent revenue 10,000

12/31/13 Cash 10,000

Rent revenue 10,000

12/31/13 Depreciation expense 15,000 Accumulated Depreciation 15,000 (90,000 ÷6)

Lecturer A. Kaldarova ______________________

Confirmed at the meeting of the department of "Socio-Economic Disciplines"

Minute №____ from ____ of 2015.

The dean of the faculty "International Educational Programs"

Ronald Voogdt _____________

name signature

Examination card №3

on the discipline “Financial Accounting II”

for the 3rd year students

Describe types of temporary differences. Provide examples for each type.

Information from the financial statements of Ames Fabricators, Inc., included the following:

|

|

December 31 |

December 31 |

|

|

2013 |

2012 |

|

Common shares |

100,000 |

100,000 |

|

Convertible preferred shares( convertible into 32,000 shares of common) |

12,000 |

12,000 |

|

10% convertible bonds ( convertible into 30,000 shares of common) |

1,000,000 |

1,000,000 |

Ames’s net income for the year ended December 31, 2013, is $500,000. The income tax

rate is 40%. Ames paid dividends of $5 per share on its preferred stock during 2013.

Required:

Compute basic and diluted earnings per share for the year ended December 31, 2013.

Pin Corporation paid $1,800,000 for a 90 percent interest in San Corporation on January 1, 2011; San’s total book value was $1,800,000. The excess was allocated as follows: $60,000 to undervalued equipment with a three-year remaining useful life and $140,000 to goodwill. The income statements of Pin and San for 2011 are summarized as follows (in thousands):

|

|

Pin |

San |

|

Sales |

4000 |

1600 |

|

Income from San |

180 |

|

|

Cost of sale |

(2000) |

(800) |

|

Depreciation expense |

(400) |

(240) |

|

Other expense |

(800) |

(360) |

|

Net income |

980 |

200 |

Required:

1. Calculate the goodwill that should appear in the consolidated balance sheet of Pin and Subsidiary at December 31, 2011.

2. Calculate consolidated net income for 2011.

Lecturer A. Kaldarova ______________________

Confirmed at the meeting of the department of "Socio-Economic Disciplines"

Minute №____ from ____ of 2015.

The dean of the faculty "International Educational Programs"

Ronald Voogdt _____________

name signature