- •Lecture 1-4. Imitating modelling

- •Introduction

- •1 Prior to the next nearest event (synchronous-event-method):

- •Verification and validation of the model

- •Verification

- •Lecture 5-9. Econometric modelingОбобщенная The linear model of multiple regressionОсновные Modeling stage:

- •In each cluster, find the sample variance:,

- •It may be, for example, errors associated autoregression model of the 1st order (ar (1)):

- •If you test the hypothesis

- •In both cases, the estimates of the coefficients can be obtained by ols with covariates:

In each cluster, find the sample variance:,

where  .

.

Then, to

test the hypothesis ![]() the criterion of the equality G Bartlett dispersions.

the criterion of the equality G Bartlett dispersions.

If ![]() is rejected, we use OLS:

is rejected, we use OLS:

![]() ,

where g –

cluster number to which it belongs n.

,

where g –

cluster number to which it belongs n.

2) autocorrelated errors.

It may be, for example, errors associated autoregression model of the 1st order (ar (1)):

![]() ,

,

![]() –white noise:

–white noise:

![]() ,

,

![]() ,

,

![]() –Kronecker

delta.

–Kronecker

delta.

(autocorrelation

decay with increasing lag),

(autocorrelation

decay with increasing lag),

![]() .

.

Note: to test the hypothesis about the presence / absence of autocorrelation of errors (criterion Durbin - Watson)

![]() .

.

the test

statistic:  ,

,

Obvious

that ![]()

, so,

if:

, so,

if:

1)

![]() ;

;

2)

![]() .

.

So that,

![]() ?

?

![]()

![]() ?

?

![]()

| |

| | |

| |

| | |

![]()

![]() 2

2

![]()

![]() .

.

If there is

autocorrelation, а ![]() is unknown, it is possible:

is unknown, it is possible:

а) roughly

assume that ![]() (and substitute it in

(and substitute it in ![]() );

);

б) Use the procedure Cochrane - Orcutt:

–find

![]() ;

;

–

![]() ;

;

– value

![]() as is the OLS estimator of the regression coefficient in the model

as is the OLS estimator of the regression coefficient in the model

![]() ;

;

–

![]() ;

;

To continue

the cycle until ![]() stabilizes.

stabilizes.

The

disadvantage of the algorithm is that there is a risk to go to a

local minimum ![]() .

.

Prognosis OLMMR

Evaluation of a new yN (T) according to known factors produced by the formulas:

1. Heteroscedastic errors:

![]() .

.

2. Autocorrelated errors:

![]() .

.

Dichotomous resultant parameters. Logit and probit models

Often the dependent variable - the variable is binary otklika- in nature, ie. E. Can take only two values. For example, the patient may recover, but maybe not, the candidate for the post can go, and can fail the test when applying for a job, the person may be unemployed, and maybe have a job and so on. N. In all these cases, we may want to search according to between one or more "continuous" variables (for example, in the latter case x1 - age, x2 - income in the last year, x3 - work experience and so on. n.) and one dependent upon them a binary variable.

Of course, you can use standard multiple regression and compute the standard regression coefficients. For example, a variable can be set to the values y 1 'and 0, where 1 indicates that the corresponding person is unemployed, and 0 - it is busy. But here comes the problem: multiple regression "does not know" that the response variable is binary in nature. Therefore, it will inevitably lead to a model with predicted values greater than 1 and less than 0. But these values do not permissible for the original problem, so multiple regression ignores restrictions on the range of values for y.

Regression

problem can be formulated differently: instead of describing a binary

variable, we describe a continuous variable with values in the

interval [0, 1], which is interpreted as the probability

![]() .

(4)

.

(4)

Here ![]() – vector of covariates,

– vector of covariates, ![]() – vector of regression coefficients.

– vector of regression coefficients.

–logistic

function.

–logistic

function.

Easy to see

that regardless of the regression coefficients and values ![]() p values will always belong to the segment [0, 1]:

p values will always belong to the segment [0, 1]:

Thus, the model logit regression has the form

![]() ,

(5)

,

(5)

where En - random error in the n-th dimension. obviously,

En

heteroscedasticity, since their dispersion depends on the ![]() .

.

If, instead

of ![]() use

use ![]() – the function of the standard normal distribution, it is probit

model.

– the function of the standard normal distribution, it is probit

model.

Model (5)

is nonlinear in the parameters And

before applying OLS should be linearized. Will move to the left and

the error is applicable to both sides of the inverse transformation

to ![]() .

Only the first terms of the expansion of the left by Taylor's

formula, we obtain:

.

Only the first terms of the expansion of the left by Taylor's

formula, we obtain:

![]() ,

,

where ![]() ,

error heteroscedasticity.

,

error heteroscedasticity.

To the

practical application of the MNE last expression to be meaningful,

must be considered grouped or duplicate data, replacing ![]() the average value is not equal to 0 and 1.

the average value is not equal to 0 and 1.

Due to the above difficulties, an assessment of the vector of regression coefficients is better to find the maximum likelihood method. If the probability of getting 1 is (4), the probability of getting 0 is 1- p and the probability of obtaining a chain of 1, 0, 0, ... is the product of the probability p (1-p) (1-p) ....

The likelihood function is:

The result

is determined by ![]() such that the probability of getting at the available factors

available responses will be maximum. To check the quality of the

simulation (the significance of the effects of factors) to test the

hypothesis

such that the probability of getting at the available factors

available responses will be maximum. To check the quality of the

simulation (the significance of the effects of factors) to test the

hypothesis

The test statistic - logarithm of the square of the likelihood ratio for models H1 and H0 - is under H0 is approximately chi-square distribution with K degrees of freedom, so the level of significance:

.

.

The marginal effect of the factor

The marginal effect of factor xi shows the change in the probability

{Y = 1} xi factor changing unit.

Can show that it has the form:

.

.

Example (continued): the percentage will increase the probability of success in the task with increasing experience (from its mean value = 16.88 m.) At 1 month?

Marginal effect = 0.4 * 0.6 * 0.161 = 0.038, ie, the probability of success is increased by 0.038, or about 10%.

Stochastic Explanatory Variables

This model has the form

![]() ,

(6)

,

(6)

Where now

![]() –

random variables;

–

random variables;

Z - random matrix plan.

We consider three cases.

1. Random

errors ![]() doesn’t depend from

doesn’t depend from ![]() .

.

In this case, all the results of the usual regression analysis retained. In particular, the OLS estimator is unbiased.

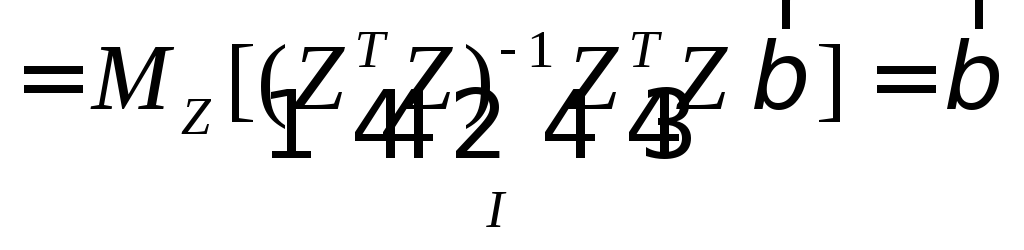

proof:![]()

![]()

.

.

2 Random

errors depend on![]() .

.

![]() ,

and evaluation

,

and evaluation ![]() – biased and inconsistent.

– biased and inconsistent.

The method

of instrumental variables. Suppose that there are some variables

![]() ,

correlated with

,

correlated with![]() and independent with

and independent with ![]() ,

– "Instrumental variables":

,

– "Instrumental variables":

;

;

![]() ;

;

![]() ;

;

![]() ;

;

![]() –consistent

estimate of the coefficient vector in (6).

–consistent

estimate of the coefficient vector in (6).

Note: a similar way could be "print" and the usual formula of OLS.

Example (model Keynes):

![]() –consumption

in the country in the ith year;

–consumption

in the country in the ith year;

![]() –aggregate

output;

–aggregate

output;

![]() –random

feature th year;

–random

feature th year;

![]() –investment.

–investment.

(7, 8)

(7, 8)

(4) –> (5):

.

.

It can be

seen that ![]() Dependds on

Dependds on ![]() ,

so

,

so ![]() ,

estimated according to equation (7), - biased and inconsistent. Lets

take

,

estimated according to equation (7), - biased and inconsistent. Lets

take ![]() as an instrument by: (8) it is correlated with not dependent, as

investment - an exogenous variable, and is determined by other

factors (maybe the political decisions) than

as an instrument by: (8) it is correlated with not dependent, as

investment - an exogenous variable, and is determined by other

factors (maybe the political decisions) than ![]() :

:

![]() .

.

Example: measurement of non-random variables (factors) with errors (stochastics - a consequence of imperfect measurements):

![]() .

zn

– not random, but by measuring them, we get

.

zn

– not random, but by measuring them, we get

![]() .

.

![]() –

random measurement error;

–

random measurement error;

![]() .

.

As far as

![]() and

and ![]() depends on

depends on ![]() ,

they are dependent, which means that the usual OLS

,

they are dependent, which means that the usual OLS ![]() on

on ![]() – biased and inconsistent (look. [2], с. 248 – 251; [1],

с. 729 – 732).

– biased and inconsistent (look. [2], с. 248 – 251; [1],

с. 729 – 732).

3. Explanatory variables and random errors are uncorrelated simultaneously (although at different moments and dependent).

Example

: ![]() ,

,

![]() –the lag

explanatory variable, it is clear that it depends on

–the lag

explanatory variable, it is clear that it depends on ![]() ,

but not from

,

but not from ![]() .

.

![]() –only

asymptotically (in large samples) unbiased.

–only

asymptotically (in large samples) unbiased.

Modeling adequacy. wealthy methods

The objective of modeling are of two types:

Forecast (algoritmic modeling): for example, neural networks.

Knowledge

of the mechanism (data modeling):

![]()

Example: danger (insolvency) simplified data modeling.

System

![]() ,

,

![]()

Mpdel

![]() .

.

Using data![]() value

value![]() .

.

,

,

;

(9)

;

(9)

![]()

![]()

![]()

![]() ;

;

–unbiased

and consistent estimator

–unbiased

and consistent estimator ![]() ,

т.е. covariance

is equal 0, then, (9)

,

т.е. covariance

is equal 0, then, (9)![]() .

.

,

And may think that Y does not depend on X1

and X2

!

,

And may think that Y does not depend on X1

and X2

!