- •Lecture 1-4. Imitating modelling

- •Introduction

- •1 Prior to the next nearest event (synchronous-event-method):

- •Verification and validation of the model

- •Verification

- •Lecture 5-9. Econometric modelingОбобщенная The linear model of multiple regressionОсновные Modeling stage:

- •In each cluster, find the sample variance:,

- •It may be, for example, errors associated autoregression model of the 1st order (ar (1)):

- •If you test the hypothesis

- •In both cases, the estimates of the coefficients can be obtained by ols with covariates:

Lecture 5-9. Econometric modelingОбобщенная The linear model of multiple regressionОсновные Modeling stage:

1: Identification of the system. Formulate the objective of the study (analysis, forecasting, simulation development, management decision, and so on. Etc..), We determine the economic variables of the model. A summary of the phenomenon under study: forming and formalize the information known prior to the simulation. Determine the type of economic model, we express in the form of mathematical relationships between variables, we formulate the underlying assumptions and limitations of the model. Collect the necessary statistical information

2. Identification of the model. We perform a statistical analysis of the model, evaluate the quality of its parameters

3. Estimation of the model. Check the validity of the model, we determine how the constructed model corresponds to the real process. Construction of the estimated model.

In the simulation of many real systems KLLMR conditions are violated.

Example:

![]() ,

,

![]() –feature

of the n-th observation,

–feature

of the n-th observation, ![]() – number of observation.

– number of observation.

![]() –heteroscedasticity

errors

–heteroscedasticity

errors ![]() .

For example, the variance of the features may be dependent on the

scale of the objects, that is, the values of the factors

.

For example, the variance of the features may be dependent on the

scale of the objects, that is, the values of the factors ![]() :

:

Example:

if you use the time samples (no

space):![]() ,

it is often particularly

,

it is often particularly ![]() neighboring points are correlated.

neighboring points are correlated.

Definition: ОЛММР –

(1)

(1)

![]() ;

;

![]() ;

;

–plan matrix;

–plan matrix;

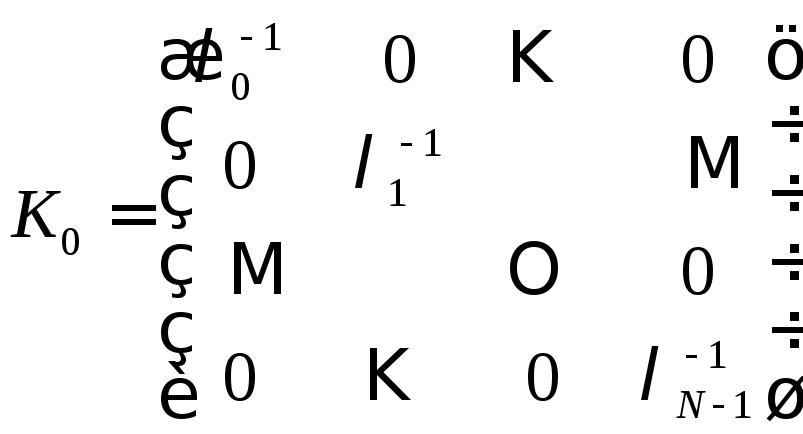

![]() –some

symmetric non-singular matrix (assumed to be known):

–some

symmetric non-singular matrix (assumed to be known):

- diagonal

– ![]() ;

;

- off the diagonal – nonzero error covariance.

Assumptions

for selection ![]() :

:

1. The linear model with heteroscedastic errors:

2. The linear model with autocorrelated errors:

![]() (correlation

coefficients of neighboring errors)

(correlation

coefficients of neighboring errors)

Note:

conventional OLS ( )remain

unbiased and consistent and OLMMR, but ineffective, that is, there

are better obtained by OLS; ordinary least squares estimation error

variance () is shifted (low), that is, giving lozhnooptimistichnye

implications for the standard errors of regression

coefficients.Обобщенный МНК

)remain

unbiased and consistent and OLMMR, but ineffective, that is, there

are better obtained by OLS; ordinary least squares estimation error

variance () is shifted (low), that is, giving lozhnooptimistichnye

implications for the standard errors of regression

coefficients.Обобщенный МНК

It is

necessary to find ![]() и

и ![]() with given z

и

with given z

и ![]() .

.

We reduce OLMMR to KLMMR.

It is known

that every symmetric nonsingular matrix A admits the representation![]() ,

where C –

some non-singular matrix. We expand

,

where C –

some non-singular matrix. We expand![]() .

.

Multiply (1) on the left C-1:

![]() .

relabel

.

relabel

![]() .

.

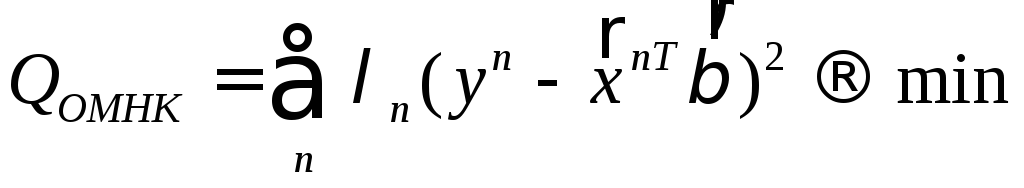

Minimizing![]() ,(1*)

,(1*)

As earlier

we have: ![]() and, returning to the original observations:

and, returning to the original observations:

![]() .

(1**)

.

(1**)

Let us show that, as in KLMMR:

![]()

![]()

![]() ,

so the covariance matrix of regression coefficients for OLS:

,

so the covariance matrix of regression coefficients for OLS:

![]() .

.

Nonshifted coefficient

estimate

![]() :

:

.

.

The coefficient of determination:

,

not nessesary

,

not nessesary ![]() ,

have accessory, the heuristic value.

,

have accessory, the heuristic value.

![]() ,

obtain a criterion

,

obtain a criterion

![]() (2)

(2)

the initial data OLMMR. decision know: (1**).

Note:

situations when ![]() known, are extremely rare (

known, are extremely rare (![]() ).

).

In

practically feasible GLS is necessary to introduce a priori

restrictions on the structure of the matrix ![]()

heteroscedastic errors.

Substituting

в (2),we have

в (2),we have

.

(3)

.

(3)

Therefore,

OLS in this case is called the weighted least squares (![]() ).

).

(3) it

follows that for the production of ![]() more strongly influenced by the data with less error variance.

more strongly influenced by the data with less error variance.

Note: to test the hypothesis of homo / heteroscedasticity errors:

![]() (homo);

(homo);

![]() (heteroscedasticity).

(heteroscedasticity).

break the

sample {![]() }

onG

clusters (g

= 1, ..., G)

}

onG

clusters (g

= 1, ..., G)