- •ORGANIZATIONS AND THEIR GOALS

- •THE MANAGEMENT PROCESS

- •Decision Making

- •Accounting System

- •Cost Accounting System

- •MANAGERIAL ACCOUNTING

- •FINANCIAL ACCOUNTING

- •Managers at all levels

- •Counsel

- •Treasurer

- •Personnel Director

- •Chief of

- •Chief of

- •Surgery

- •Chief of

- •Director of

- •Director of

- •Chief of Medical

- •Chief of

- •Internal

- •Chief of

- •Chief of

- •Production

- •Stage 1

- •Production

- •Stage II

- •Input

- •Process

- •Output

- •A particular

- •Work-in- Process

- •Inventory

- •Cost of

- •until the

- •Cost

- •Cost

- •Cost

- •Costs

- •Simplified decision

way in which Sydney Sailing Supplies’ management answers these questions can profoundly affect its marketing and pricing strategies.

Costs

The role of costs in price setting varies widely among industries. In some industries, prices are determined almost entirely by market forces. An example is the agricultural industry, where grain and meat prices are market-driven. Farmers must meet the market price. To make a profit, they must produce at a cost below the market price. This is not always possible, so some periods of loss inevitably result. In other industries, managers set prices at least partially on the basis of production costs. For example, cost-basing pricing is used in the automobile, household appliance, and gasoline industries. Prices are set by adding a markup to production costs. Managers have some latitude in determining the markup, so market forces can influence prices as well. In public utilities, such as electricity and natural gas companies, prices generally are set by a regulatory agency of the state government. Production costs are of prime importance in justifying utility rates. Typically, a public utility will make a request to the Public Utility Commission for a rate increase on the basis of its current and projected production costs.

Balance of Market Forces and Cost-Based Pricing In most industries, both market forces and cost considerations heavily influence prices. No organization or industry can price its products below their production costs indefinitely. And no company’s management can set prices blindly at cost plus a markup without keeping an eye on the market. In most cases, pricing can be viewed in either of the following ways.

Prices are determined by the market, subject to the constraint that costs must be covered in the long run

How Are Prices Set?

Market

Costs Forces

Prices are based on costs, subject to the constraint that the reactions of customers and competitors must be heeded

In our illustration of Sydney Sailing Supplies’ pricing policies, we will assume the company responds to both market forces and costs.

Political, Legal, and Image-Related Issues

Beyond the important effect on prices of market forces and costs are a range of environmental considerations. In the legal area, managers must adhere to certain laws. The law generally prohibits companies from discriminating among their customers in setting prices. Also prohibited is collusion in price setting, where the major firms in an industry all agree to set their prices at high levels.

Political considerations also can be relevant. For example, if the firms in an industry are perceived by the public as reaping unfairly large profits, there may be political pressure on legislators to tax those profits differentially or to intervene in some way to regulate prices.

Companies also consider their public image in the price-setting process. A firm with a reputation for very highquality products may set the price of a new product high to be consistent with its image. As we have all discovered, the same brand-name product may be available in a discount store at half the price charged in amore exclusive store.

ECONOMIC PROFIT-MAXIMIZING. PRICING

Companies are sometimes price takers, which means their product’s prices are determined totally by the market. Some agricultural commodities and precious metals are examples of such products. In most cases, however, firms have some flexibility in setting prices. Generally speaking, as the price of a product or service is increased; the quantity demanded declines, and vice versa.

Dollars

Total revenue

Curve is increasing throughout its range, but at a declining rate

Quantity sold per month

(A) Total revenue curve

Dollars per unit

Demand (or average revenue) |

Marginal revenue |

Quantity sold |

per month |

(B) Demand (or average revenue) curve and marginal revenue curve |

Quantity |

|

|

|

Sold |

|

|

|

Per |

Unit |

Total Revenue |

Changes in |

Month |

Sales Price |

per Month |

Total Revenue |

10 ......... |

$ 1,000 ............ |

$ 10,000 |

|

|

|

...... |

$ 9,500 |

20 ......... |

975 ........... |

19,500 |

|

|

|

...... |

9,000 |

30 ......... |

950 ............ |

28,500 |

|

|

|

...... |

8,500 |

40 ........ |

925 ............ |

37,000 |

|

|

|

...... |

8,000 |

50 ......... |

900 ............ |

45,000 |

|

60 ........ |

875 ............ |

52,500 ...... |

7,500 |

Related to |

Related to |

Related to |

demand |

total revenue |

marginal revenue |

curve |

curve |

curve |

(C) Tabulated price, quantity, and revenue data

Total Revenue, Demand, and Marginal Revenue Curves

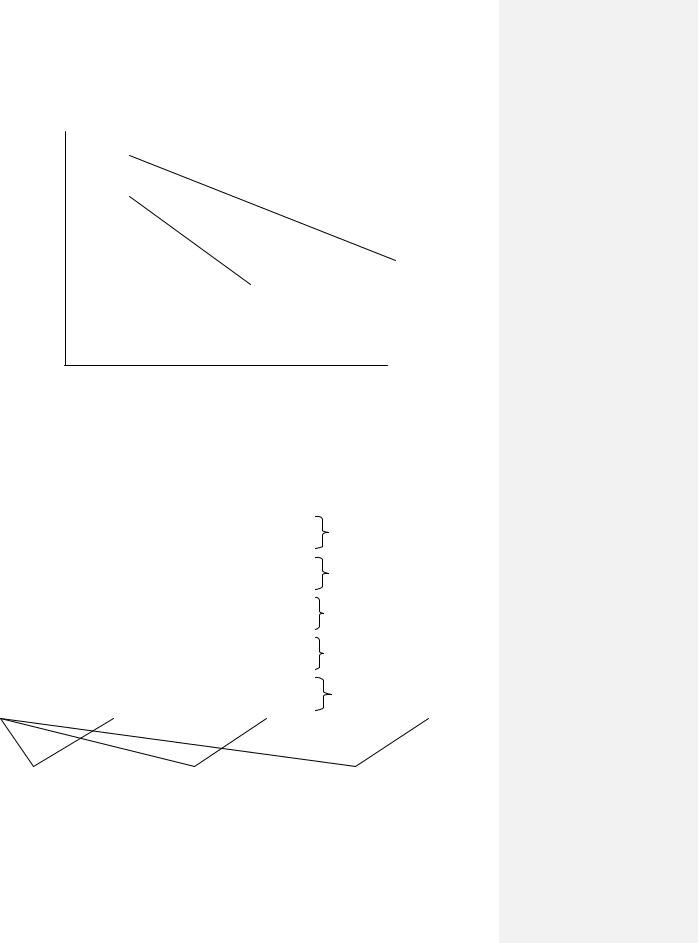

The trade-off between a higher price and a higher sales quantity can be shown in the shape of the firm’s total revenue curve, which graphs the functional relationship between total sales revenue and quantity sold.

The demand curve shows the relationship between the sales price and the quantity of units demanded. The demand curve decreases throughout its range, because any decrease in the sale price brings about an increase in the monthly sales quantity. The demand curve is also called the average revenue curve, since it shows the average price at which any particular quantity can be sold.

The marginal revenue curve shows the change in total revenue that accompanies a change in the quantity sold. The marginal revenue curve is decreasing throughout its range to show that total revenue increases at a declining rate as monthly sales quantity increases.

Price Elasticity

The impact of price changes on sales volume is called the price elasticity. Demand is elastic if a price increase has a large negative impact on sales volume, and vice versa. Demand is inelastic if price changes have little or no impact on sales quantity. Cross-elasticity refers to the extent to which a change in a product’s price affects the demand for other substitute products. For example, if Sydney Sailing Supplies raises the price of its two-person sailboat, there may be an increase in demand for substitute recreational craft, such as small power boats, canoes, or windsurfers.

Measuring price elasticity and cross-elasticity is an important objective of market research. Having a good understanding of these economic concepts helps managers to determine the profit-maximizing price.

Limitations of the Profit-Maximizing Model

The economic model of the pricing decision serves as a useful framework for approaching a pricing problem. However, it does have several limitations. First, the firm’s demand and marginal revenue curves are difficult to discern with precision. Although market research is designed to gather data about product demand, it rarely will enable management to predict completely the effects of price changes on the quantity demanded. Many other factors affect product demand in addition to price. Product design and quality, advertising and promotion, and company reputation also significantly influence consumer demand for a product.

Second, the marginal-revenue, marginal-cost paradigm is not valid for all forms of market organization. In an oligopolistic market, where a small number of sellers compete among themselves, the simple economic pricing model is no