- •Financial market: notion, structure and infrastructure.

- •Notion, functions, types of financial intermediaries. Financial intermediaries in Russia.

- •International foreign exchange market: functions, participants, operations.

- •Foreign exchange risks: definition, types, insurance methods.

- •3 Types of currency risk:

- •Definition and types of exchange rates. Exchange rate forecasting, currency parity. Factors of exchange rates.

- •Foreign exchange regulation: purposes and instruments.

- •International securities market: definition, structure, participants.

- •Financial system of a country: structure, interrelation between the elements.

- •Budgetary system of a country: principles of construction, structure, Russian and foreign experience.

- •12. State budget revenues and expenditures.

- •Income distribution

- •13. Public debt and sources of its formation.

- •14. Federal budget of the Russian Federation: revenues, expenditures, modern peculiarities.

- •Imf's main responsibilities:

- •2.1 Over the counter (otc) and exchange-traded derivatives

- •2.2 Forward contracts

- •2.3 Futures contracts and their difference to forwards

- •2.4 Options

- •2.5 Swaps

- •Interest rate swaps,

- •19. Securities market regulation in Russia and abroad.

- •20. Professional activity on securities market.

- •21. The problem of risk and the notion of insurance. Functions of insurance company.

- •Insurance aids economic development in at least seven ways.

- •22. Features of corporate insurance products. Commercial insurance.

- •23. Notion and purpose of reinsurance. Types of reinsurance contracts.

- •25. Obligatory and voluntary types of insurance in Russia and abroad.

- •Voluntary:

- •Voluntary:

- •27. Bank liquidity: notion, analysis, regulation.

- •29. Bank’s credit risks: methods of evaluation and minimization.

- •Interest Rate Risk

- •30. International banks: transactions and risks.

- •31. Monetary policy: purpose, types, tools.

- •32. International credit: notion, functions, forms, tendencies.

- •33. Credit market: functions, participants, instruments, indicators.

- •34. Analysis of a borrower’s creditworthiness by banks.

- •7 Functions of financial management:

- •37. Structure of a company’s balance sheet. Analysis of assets and liabilities structure

- •39. Capital structure and company’s cost of capital.

- •42. Classification of sources of corporate financing.

- •Instruments

- •Issuing and trading

- •Valuation

- •Ipo via foreign bank

- •44. Corporate credit policy.

- •Various Types of Corporate Credit and Corporate Credit Policy

- •45. Types of financial risks, quantitative analysis.

- •46. Investment portfolio construction: calculation and analysis of risk and return.

- •48. Types of bonds, calculation of present value of discount and coupon bonds. Types of bond yield.

- •50. Capital Assets Pricing Model (capm).

- •52. Price structure and its components. Factors of a price.

- •53. Methods of pricing.

- •55. Profit taxation in Russia.

- •56. Taxation of foreign corporate entities in Russia.

- •57. Income taxation of individuals.

- •59. Tax planning: notion, purposes, stages.

2.5 Swaps

Swaps are transactions in which two parties agree to exchange payment streams based on a specified notional amount for a specified period. These streams are called the legs of the swap.

Usually, at least one of the legs has a rate that is variable.

The most important criterion is that it comes from an independent third party, to avoid any conflict of interest. For instance, LIBOR (London Interbank Offered Rate)

Swaps can be used to hedge certain risks or to speculate on changes in the underlying prices. Most swaps are traded over-the-counter (OTC), "tailor-made" for the counterparties. Some types of swaps are also exchanged on futures markets.

The five generic types of swaps, in order of their quantitative importance, are:

Interest rate swaps,

currency swaps,

credit swaps,

commodity swaps and

equity swaps.

Under an interest rate swap counterparties agree to pay either a fixed or floating rate denominated in a particular currency to the other counterparty. The fixed or floating rate is multiplied by a notional principal amount. This notional amount is generally not exchanged between counterparties, but is used only for calculating the size of cash flows to be exchanged.

By far the most common are fixed-for-floating or floating-for-floating swaps. The legs of the swap can be in the same currency or in different currencies (a sort of combination with a currency swap).

Fixed-for-fixed swaps in different currencies are also quite common. It is a form of a currency swap, to be discussed later. Thus it generally exists only in different currencies and helps to reduce the currency risk.

A currency swap (or cross currency swap) is a foreign exchange agreement between two parties to exchange a given amount of one currency for another and, after a specified period of time, to give back the original amounts swapped. Unlike interest rate swaps, currency swaps involve the exchange of the principal amount.

An equity swap is a swap where a set of future cash flows are exchanged between two counterparties. One of these cash flow streams will typically be based on a reference interest rate. The other will be based on the performance of a share of stock or stock market index.

A credit default swap (CDS) is a credit derivative between two counterparties, whereby one makes periodic payments to the other and receives the promise of a payoff if a third party defaults. The party that makes payments receives credit protection and is said to be the buyer, whilst the other party provides credit protection and is said to be the seller. The third party is called a reference entity.

Simply put, the risk of default is transferred from the holder of the fixed income security to the seller of the swap. Credit default swaps resemble an insurance policy, as they can be used by debt owners to hedge, or insure against credit events such as a default on a debt obligation.

A total return swap (TRORS) is a swap in which party A pays the total return of an asset, and party B makes periodic interest payments. The total return is the capital gain or loss, plus any interest or dividend payments. Note that if the total return is negative, then party A receives this amount from party B.

The TRORS, then, allows one party to derive the economic benefit of owning an asset without putting that asset on its balance sheet, and allows the other (which does retain that asset on its balance sheet) to buy protection against a potential decline in its value.

5. World

derivatives market

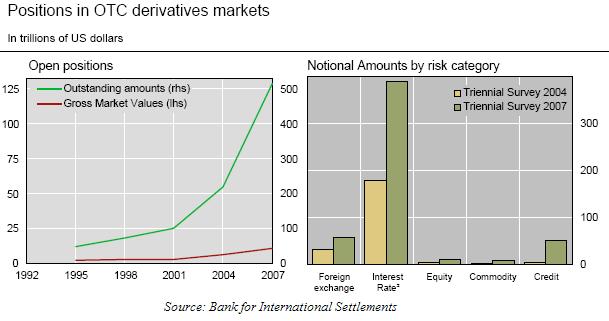

According to the survey by Bank for International Settlements, positions in the OTC derivatives market increased at a rapid pace during the last 3 years. Notional amounts outstanding of such instruments totaled $516 trillion at the end of June 2007, 135% higher than the level recorded in the 2004.ii

The statistical surveys shows that the volumes of both OTC and ET derivatives markets show exponential growth and are likely to continue enlarging with a rapid pace in future.