- •Financial market: notion, structure and infrastructure.

- •Notion, functions, types of financial intermediaries. Financial intermediaries in Russia.

- •International foreign exchange market: functions, participants, operations.

- •Foreign exchange risks: definition, types, insurance methods.

- •3 Types of currency risk:

- •Definition and types of exchange rates. Exchange rate forecasting, currency parity. Factors of exchange rates.

- •Foreign exchange regulation: purposes and instruments.

- •International securities market: definition, structure, participants.

- •Financial system of a country: structure, interrelation between the elements.

- •Budgetary system of a country: principles of construction, structure, Russian and foreign experience.

- •12. State budget revenues and expenditures.

- •Income distribution

- •13. Public debt and sources of its formation.

- •14. Federal budget of the Russian Federation: revenues, expenditures, modern peculiarities.

- •Imf's main responsibilities:

- •2.1 Over the counter (otc) and exchange-traded derivatives

- •2.2 Forward contracts

- •2.3 Futures contracts and their difference to forwards

- •2.4 Options

- •2.5 Swaps

- •Interest rate swaps,

- •19. Securities market regulation in Russia and abroad.

- •20. Professional activity on securities market.

- •21. The problem of risk and the notion of insurance. Functions of insurance company.

- •Insurance aids economic development in at least seven ways.

- •22. Features of corporate insurance products. Commercial insurance.

- •23. Notion and purpose of reinsurance. Types of reinsurance contracts.

- •25. Obligatory and voluntary types of insurance in Russia and abroad.

- •Voluntary:

- •Voluntary:

- •27. Bank liquidity: notion, analysis, regulation.

- •29. Bank’s credit risks: methods of evaluation and minimization.

- •Interest Rate Risk

- •30. International banks: transactions and risks.

- •31. Monetary policy: purpose, types, tools.

- •32. International credit: notion, functions, forms, tendencies.

- •33. Credit market: functions, participants, instruments, indicators.

- •34. Analysis of a borrower’s creditworthiness by banks.

- •7 Functions of financial management:

- •37. Structure of a company’s balance sheet. Analysis of assets and liabilities structure

- •39. Capital structure and company’s cost of capital.

- •42. Classification of sources of corporate financing.

- •Instruments

- •Issuing and trading

- •Valuation

- •Ipo via foreign bank

- •44. Corporate credit policy.

- •Various Types of Corporate Credit and Corporate Credit Policy

- •45. Types of financial risks, quantitative analysis.

- •46. Investment portfolio construction: calculation and analysis of risk and return.

- •48. Types of bonds, calculation of present value of discount and coupon bonds. Types of bond yield.

- •50. Capital Assets Pricing Model (capm).

- •52. Price structure and its components. Factors of a price.

- •53. Methods of pricing.

- •55. Profit taxation in Russia.

- •56. Taxation of foreign corporate entities in Russia.

- •57. Income taxation of individuals.

- •59. Tax planning: notion, purposes, stages.

2.3 Futures contracts and their difference to forwards

A standardized forward contract that is traded on an exchange is called a futures contract.

Unlike forwards, futures are exclusively exchange-traded derivatives (ETD). The exchange's clearing house acts as counterparty on all contracts, sets margin requirements, and crucially also provides a mechanism for settlement – physical delivery or cash.

By being highly standardized, futures contracts ensure their liquidity (to be freely traded on the futures market). The compliance with standards and implementation of the terms is controlled by the clearing house.

2.4 Options

Options are financial instruments that convey the right, but not the obligation, to engage in a future transaction on some underlying security, or in a futures contract. In other words, the holder does not have to exercise this right, unlike a forward or future.

The strike price is the fixed price at which the owner of an option can purchase (in the case of a call option) or sell (in the case of a put option) the underlying security or commodity.

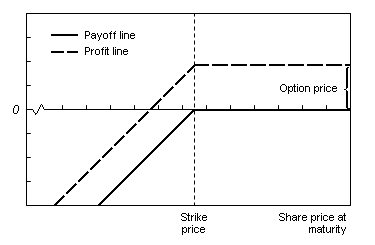

Long Call

A trader who believes that a stock's price will increase might buy the

right to purchase the stock

(a call option) rather than just buy the stock. First he pays a

premium (option price) which he will never get back. Then, if the

price of the goods at maturity date will be less than strike price,

it is not profitable for him to exercise the option (as he can buy

cheaper on the free market). In this case his loss will be the

premium he paid.

trader who believes that a stock's price will increase might buy the

right to purchase the stock

(a call option) rather than just buy the stock. First he pays a

premium (option price) which he will never get back. Then, if the

price of the goods at maturity date will be less than strike price,

it is not profitable for him to exercise the option (as he can buy

cheaper on the free market). In this case his loss will be the

premium he paid.

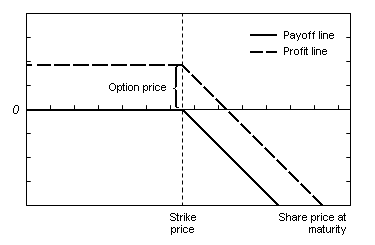

Long Put

A trader who believes that a stock's price will decrease can buy the right to sell the stock at a fixed price (a put option). He will be under no obligation to sell the stock, but has the right to do so until the expiration date. If the stock price at expiration is below the exercise price by more than the premium paid, he will profit. If the stock price at expiration is above the exercise price, he will let the put contract expire worthless and only lose the premium paid.

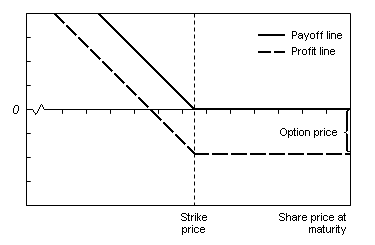

Short Call

A trader who believes that a stock price will decrease, can sell the

stock short or instead sell, or "write,"

a call.

The trader selling a call has

an obligation to sell the stock

to the call buyer at the buyer's option. If the stock price

decreases, the short call position will make a profit in the amount

of the premium. If the stock price increases over the exercise price

by more than the amount of the premium, the short will lose money,

with the potential loss unlimited.

trader who believes that a stock price will decrease, can sell the

stock short or instead sell, or "write,"

a call.

The trader selling a call has

an obligation to sell the stock

to the call buyer at the buyer's option. If the stock price

decreases, the short call position will make a profit in the amount

of the premium. If the stock price increases over the exercise price

by more than the amount of the premium, the short will lose money,

with the potential loss unlimited.

S hort

Put

hort

Put

A trader who believes that a stock price will increase can buy the stock or instead sell a put. The trader selling a put has an obligation to buy the stock from the put buyer at the put buyer's option. The writer anticipates that the prices for the good will not fall lower than the strike price. If they will not, the holder will not exercise the option because he can sell at greater price on the free market. If they do, some of the buyer’s loss will be covered by premium he received in advance, with the potential loss being up to the full value of the stock minus the premium.