- •Analyze the case study “The Economics of the Black Death”.

- •Please, give your detailed explanation why a worker’s wage might be above the level that balances supply and demand. Minimum wage, Market power of labor unions and Efficiency wages.

- •Explain the role Customers and Government play in perpetuating discrimination in Labor markets. Moreover, when and why sometimes Employers discriminate in the Labor market. Examples are a must.

- •1)In-kind transfers

- •The Economic Life Cycle

- •3 Transitory versus Permanent Income

- •Briefly explain Policies to Reduce Poverty. Minimum-wage laws, Welfare Negative Income Tax and In-kind transfers.

- •Explain why for some parents “scrimping is legal but saving is not always good” in the usa. Express your understanding of the News about “Saving and Welfare”.

Chapter 17

Entry of firms in a monopolistically competitive industry is characterized by two "external" effects. List these effects (The product-variety externality and The business-stealing externality) and briefly describe in detail how consumers and incumbent firms are influenced by these externalities.

Those “external” effects are The Product-variety externality and Business-stealing externality. Now let us describe them.

Product-variety externality: Because consumers get some consumer surplus from the introduction of a new product, entry of a new firm conveys a positive externality on consumers. This externality arises because a new firm would offer a product different from those of the existing firms.

Business-stealing externality: Because other firms lose customers and Profits from the entry of a new competitor, entry of a new firm imposes a negative externality on existing firms. This externality arises because firms post a price above marginal cost and, therefore, are always eager to sell additional units

Assume the role of a critic of advertising.

1)Firms advertise to manipulate people’s tastes. Many advertisements are psychological rather than informational. For example, advertising of Fanta, by that advertisement they give message which is not said in advertisement “If you drink Fanta you will be happy and have many friends, life will be better”

2)We critics think argue that advertisement impedes competition. Firms convince seller that products are more different than they truly are. After that people are less concerned with price differences among similar products. And elastic demand curve causes all firms to charge a larger markup over marginal cost.

Assume the role of a defender of advertising.

1)Advertising gives information about products in the market. And prices for that product are shown in advertisement. So customers will be more informed about product in the market. It helps customers to make better choice in buying the particular product.

2)We also argue that advertisement fosters competition. Because as we said many people will be informed of products in the market so people will buy product concerning the price differences. It attracts another firm to enter the market and customers of existing firms will have another variant of product. Thus firms will have lower market power.

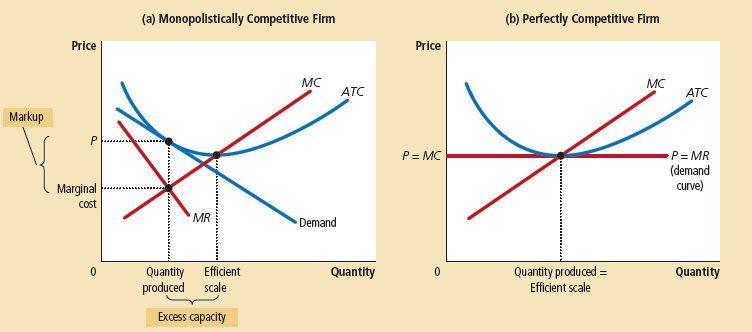

How does the long-term equilibrium in monopolistic competition differ from the long-run equilibrium in perfect competition? Use graphs to demonstrate why a profit-maximizing monopolistically competitive firm must operate at Excess Capacity and Markup over Marginal Cost. Explain why a perfectly competitive firm is not subject to the same constraint.

First differences: MCF produce at the tangency of demand and ATC, where the ATC is only declining, unlike the PCF which produces at the minimum of ATC. In the long run firms in monopolistically competitive market operate at the excess capacity because of it production below the efficient scale in the point when the ATC curve decreases. It do so because it were need to cut it prices to produce more units, so it’s more profitable produce at this level, unlike with perfectly competitive market, who doesn’t care.

Second differences: For a monopolistically competitive firms price exceed MC because firms always have some market power. In the long term equilibrium the market operate at the zero profit, it tell us that the price equals ATC. Thus for MCF which operate on the declining portion of the ATC price might be above MC, in order to gain profit, unlike the PCF which operate on the minimum of ATC.

Because: MCF need to cut it price to produce more, unlike with perfectly competitive market, who doesn’t care ( P=MC)For a PCF profit from the additional unit sold is zero, unlike for the MCF is not.

For many years, Pepsi operated a "taste test" booth at local fairs across the United States. Visitors to the booth would be encouraged to take a blind "taste test" between Pepsi and its primary market competitor, Coke. Pepsi then used the taste test results in advertising Pepsi. What advertising theory does such an approach support? Pepsi no longer uses this as an advertising strategy, but rather, relies on celebrity endorsements and other forms of advertising. What advertising theory do you think now dominates the market between Pepsi and Coke? Explain.

What advertising theory does the “taste test” of Pepsi support?

Advertising may be seen as the Signal of Quality. By making the taste test across the country, and then publishing the results. People may think like: If so many people try it, and assume it as the better then another ones. It should be better, I must try it. And through this advertising Pepsi say: Our product is best product, we are better then, for example, Coke.

What advertising theory dominates between Pepsi and Coke?

I think it is Brand Name theory. Because as you can go to the typical store you usually find Pepsi or Coke, in a similar quantity as the worldwide recognized brand names. Both of this product spends large amount of money on advertising, even by use black advertising, and have an incentive to maintain quality to safe his name.

In the absence of price signals, communist countries rely on brand names to signal market "value." Briefly discuss how brand names (or trademarks) can be used to discipline manufacturers in command and control type economies. As part of your answer, explain how brand names improve economic efficiency. (Case study)

Advertising is related to brand names. Some firms sell products with widely recognized brand names, other sell substitutes. Firm with brand name spends more on advertising and charges a higher price. Critics argue that brand names cause consumers to perceive differences that do not really exist. Generic good is indistinguishable from the brand-name good. Consumers’ willingness to pay more for the brand-name good, these critics assert, is a form of irrationality fostered by advertising. Brand names are way for consumers to ensure that goods are of high quality. Brand names provide consumers with information about quality when quality cannot be easily judged in advance of purchase. Brand names give firms incentive to maintain high quality because firms have financial stake in maintaining reputation of their brand names. Brand names are result of irrational consumer response to advertising. Consumers have good reason to pay more for brand-name products because they can be more confident in the quality.

Chapter 18

Describe the difference between a diminishing marginal product of labor and a negative marginal product of labor. Why would a profit-maximizing firm always choose to operate where marginal product of labor is decreasing (but not negative)?

Diminishing marginal product of labor means that the last worker hired contributes less to the total output of the firm than the worker that was hired just previous to her. Negative marginal product of labor suggests that the last person hired actually causes total output of the firm to decline. If wages are constant and marginal product is decreasing, it forces the firm to evaluate the benefit of hiring (added revenue) versus the added cost of hiring (wage). In competitive markets, the cost and benefit converge only when marginal product declines. If marginal product of labor is negative, hiring an additional worker would actually decrease revenue.

List the factors which are key determinants of the productivity of labor. For each one, describe how each specifically influences labor productivity. Physical capital: Human capital: Technological knowledge:

Three key determinants of productivity:

1.Physical capital: When workers work with a larger quantity of equipment and structures, they produce more.

2. Human capital: When workers are more educated, they produce more.

3.Technological knowledge: When workers have access to more sophisticated technologies, they produce more.

Physical capital, human capital, and technological knowledge are the ultimate sources of most of the differences in productivity, wages, and standards of living.

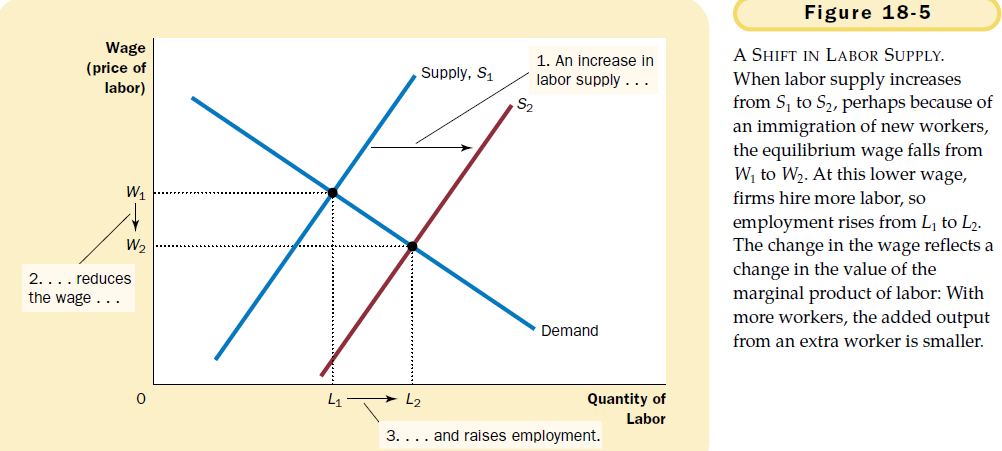

Give two examples of events that could shift the demand for labor and the supply of labor. Use two graphs to demonstrate your answers in detail, please.

Shifts in labor supply. Suppose that immigration increases the number of workers willing to pick apples. As Figure 18-5 shows, the supply of labor shifts to the right from S1 to S2. At the initial wage W1, the quantity of labor supplied now exceeds the quantity demanded. This surplus of labor puts downward pressure on the wage of apple pickers, and the fall in the wage from W1 to W2 in turn makes it profitable for firms to hire more workers. As the number of workers employed in each apple orchard rises, the marginal product of a worker falls, and so does the value of the marginal product. In the new equilibrium, both the wage and the value of the marginal product of labor are lower than they were before the influx of new workers.

An episode from Israel illustrates how a shift in labor supply can alter the equilibrium in a labor market. During most of the 1980s, many thousands of Palestinians regularly commuted from their homes in the Israeli-occupied West Bank and Gaza Strip to jobs in Israel, primarily in the construction and agriculture industries. In 1988, however, political unrest in these occupied areas induced the Israeli government to take steps that, as a by-product, reduced this supply of workers. Curfews were imposed, work permits were checked more thoroughly, and a ban on overnight stays of Palestinians in Israel was enforced more rigorously. The economic impact of these steps was exactly as theory predicts: The number of Palestinians with jobs in Israel fell by half, while those who continued to work in Israel enjoyed wage increases of about 50 percent. With a reduced number of Palestinian workers in Israel, the value of the marginal product of the remaining workers was much higher.

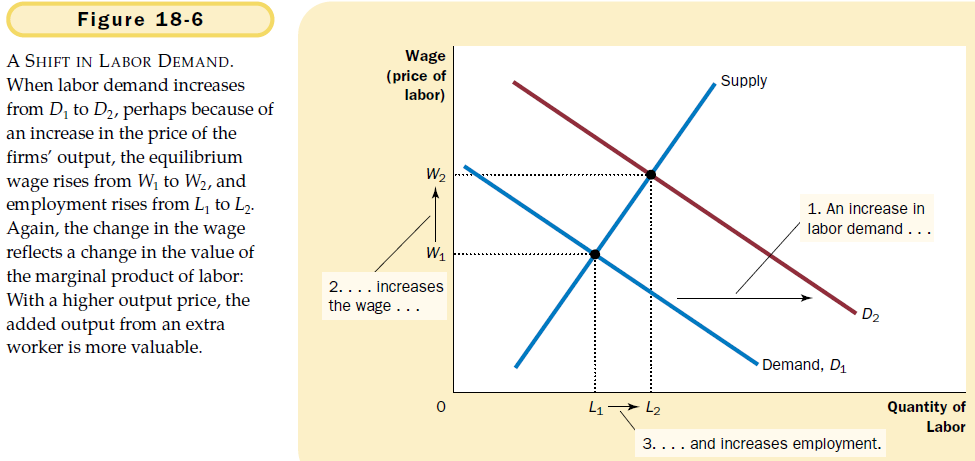

Shifts in labor demand. Now suppose that an increase in the popularity of apples causes their price to rise. This price increase does not change the marginal product of labor for any given number of workers, but it does raise the value of the marginal product. With a higher price of apples, hiring more apple pickers is now profitable. As Figure 18-6 shows, when the demand for labor shifts to the right from D1 to D2, the equilibrium wage rises from W1 to W2, and equilibrium employment rises from L1 to L2.

Once again, the wage and the value of the marginal product of labor move together. This analysis shows that prosperity for firms in an industry is often linked to prosperity for workers in that industry. When the price of apples rises, apple producers make greater profit, and apple pickers earn higher wages. When the price of apples falls, apple producers earn smaller profit, and apple pickers earn lower wages. This lesson is well known to workers in industries with highly volatile prices. Workers in oil fields, for instance, know from experience that their earnings are closely linked to the world price of crude oil.

From these examples, you should now have a good understanding of how wages are set in competitive labor markets. Labor supply and labor demand together determine the equilibrium wage, and shifts in the supply or demand curve for labor cause the equilibrium wage to change. At the same time, profit maximization by the firms that demand labor ensures that the equilibrium wage always equals the value of the marginal product of labor.

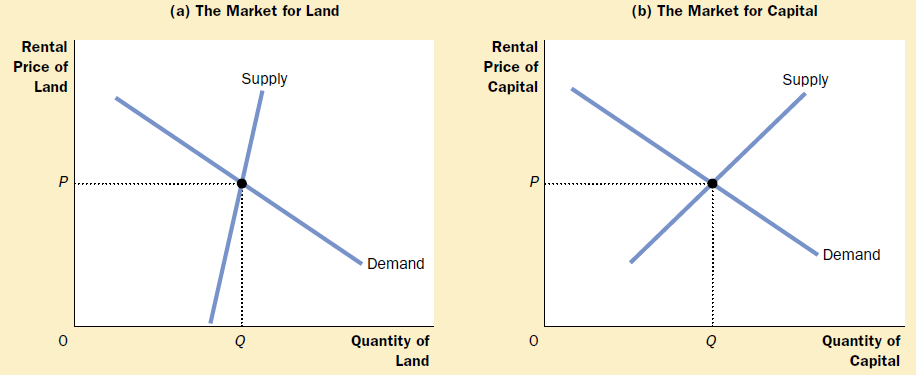

Describe the process by which the market for capital and the market for land reach equilibrium. Also expand your answer describing in detail the value of marginal product for these factors relative to their supply. As part of your description, elaborate on the role of the stock of the resource versus the flow of services from the resource. In other words, describe the difference between the purchase price of capital and the rental price of capital as well.

The markets for land and capital. Supply and demand determine the compensation paid to the owners of land, as shown in panel (a), and the compensation paid to the owners of capital, as shown in panel (b). The demand for each factor, in turn, depends on the value of the marginal product of that factor.

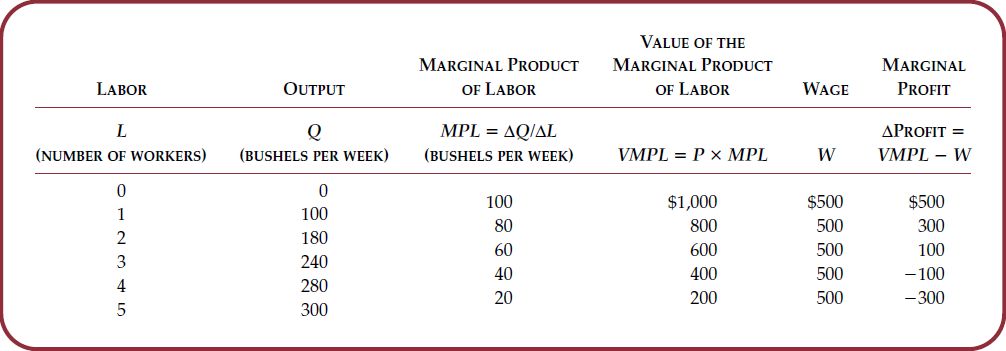

The value of the marginal product of any input is the marginal product of that input multiplied by the market price of the output. The fourth column in this table shows the value of the marginal product of labor in our example, assuming the price of apples is $10 per bushel. Because the market price is constant for a competitive firm, the value of the marginal product (like the marginal product itself) diminishes as the number of workers rises.

Distinguish between two prices: the purchase price and the rental price. The purchase price of land or capital is the price a person pays to own that factor of production indefinitely. The rental price is the price a person pays to use that factor for a limited period of time. It is important to keep this distinction in mind because, as we will see, these prices are determined by somewhat different economic forces.

Analyze the case study “The Economics of the Black Death”.

In fourteenth-century Europe, the bubonic plague wiped out about one-third of the population within a few years. This event, called the Black Death, provides a grisly natural experiment to test the theory of factor markets that we have just developed. Consider the effects of the Black Death on those who were lucky enough to survive. What do you think happened to the wages earned by workers and the rents earned by landowners? To answer this question, let’s examine the effects of a reduced population on the marginal product of labor and the marginal product of land. With a smaller supply of workers, the marginal product of labor rises. (This is simply diminishing marginal product working in reverse.) Thus, we would expect the Black Death to raise wages. Because land and labor are used together in production, a smaller supply of workers also affects the market for land, the other major factor of production in medieval Europe. With fewer workers available to farm the land, an additional unit of land produced less additional output. In other words, the marginal product of land fell. Thus, we would expect the Black Death to lower rents. In fact, both predictions are consistent with the historical evidence. Wages approximately doubled during this period, and rents declined 50 percent or more. The Black Death led to economic prosperity for the peasant classes and reduced incomes for the landed classes.

Chapter 19

Explain the determinants (Compensating Differentials and Ability, Efforts, and Chance) of Equilibrium wages. Please, demonstrate your explanations with some of your examples. Compensating S of labor for easy, fun + safe greater than S of labor for hard, dull + dangerous jobs.

Ex: you are looking for job. 2 kinds of jobs are available. You can take job in lib-y in university or you can take job as garbage collector in this university. Wages are the same. You will choose 1st job. It clear, safer + easier. Comp-ting diff-al difference in wages that arises to offset nonmonetary characterisics of diff-t job.

Ex: Electron paid more than workers, because it more dangerous. Doctors, who work of night paid more than simple doctor. Surgeon gets higher wage than podiatrist. City teachers ability to teach students more efficiently. They have stable knowledge, experience + they were educated by great professors abroad

Effort. Some people work hard, other lazy. We shouldn’t be surprised to find that those who work hard are more productive and earn higher wage. Companies give bonus to wage if their worker work very good.

Chance- plays role in determining wages. If person attended trade school to learn how to repair refrigerators with vacuum tubes, then found this skill made obsolete by the invention of solid-state refrigerators, he would end up earning low wage compared to others with similar years of training. Low wage of this worker due to change-phenomenon that economists recognize but don’t shed much light on.

Explain in detail what Human Capital and Signaling mean. Expand your answer by differentiating the relationship of these two to the productivity. As an example, you can explain the theory that education acts as a signaling device. How does this contrast to the theory of education as an investment in human capital?

human capital. In most developed countries relationship between the level of wages and education is highly interdependent. Many young people and their parents spent a lot of money for their education in the hope that in the future all of the costs will be paid back. f\ex., college graduates in the US earn almost twice as much as those workers who ended their education with a high school diploma. Signaling. Signaling it is opposite of human capital. According to this alternative view, when people earn a college degree, for instance, they do not become more productive, but they do signal their high ability to prospective employers. Because it is easier for high-ability people to earn a college degree than it is for low-ability people, more high-ability people get college degrees. As a result, it is rational for firms to interpret a college degree as a signal of ability