Comparison with international markets

The main focus is on the role of the financial sector, including the securities markets in economic development. In the financial sense of anticipatory thinking argued, the rapid development of financial markets, pushed the growth of production. According to calculations B.B.Rubtsova, the indicator "of the world market capitalization of shares of world GDP" has changed from 1990 to 1998. from 23 to 91%. And at the same time on the farms industrialized and developing countries is slowly preparing another economic turn, led to the financial crisis of the late 90's.

In 70 - 80 years of the twentieth century. economic crises usually accepted globally, covering more or less the leading countries of America, Europe and Asia. The practice of the 90s showed uneven and considerable variation in its trajectory from the leading countries of the modern world. In 1993, Germany, France and some other European countries are in decline and in 1995-1996. stagnant economy. Japan in 1997-1999. experienced a real crisis, which is reflected in the reduction of production, financial shocks and other economic difficulties. Countries of South-East Asia and Latin America as well as Russia and some other transition economies in 1997-1998. covered the financial crisis, one of the most profound and far-reaching in modern history. Take a ride on the world's periphery, he practically did not affect the U.S., but has caused concern for the stability of its economy and led to the realization of the need for coordination and management of an international nature of the financial market.

These issues were discussed at a meeting of finance ministers of the Group of Seven (now G8) in June 1999 in Cologne. He decided to focus on four areas:

1) better coordination of action to strengthen and reform the international financial institutions and financial policies;

2) increasing the transparency of global financial markets;

3) strengthening financial regulation in industrialized countries;

4) the development of principles of private sector involvement in crisis management.

Important lever of U.S. influence on the world economy is the export of capital from the country. In recent years significantly increased its scale through direct and portfolio investment, while in the bank, and similar assets are significantly decreased. For example, in 1998 - 2002 years. U.S. direct investments abroad increased from 80.7 billion dollars to 132.8 billion dollars, portfolio - from 60.3 billion to 102.8 billion dollars, and the bank in 2002 - 2003. decreased from 75.1 billion to 24.9 billion dollars It should be noted a steady increase in U.S. direct investment abroad. This is further evidence that the policy of TNCs are not directly related to the cyclic movement of the economy, and their long-term interests do not taper in the period of active growth. But the behavior of portfolio investment is more responsive to dynamic growth: investments in foreign stocks are increasing, while the investments in debt securities abroad in 1998 due to the global financial crisis have dramatically decreased. Remarkable behavior of the banking and other monetary capital. The sharp decline in its export of recorded and unrecorded in 1999, is clearly related to the deterioration of the situation in the global financial sector and increase the reliability and promising investment funds in the United States, where economic growth increased the profitability of investment banking and monetary capital. The dynamic development of the U.S. economy has become a powerful factor in attracting foreign capital into it. Available data indicate a steady increase in virtually all types of foreign investment in the U.S. over the last decade. Thus, the total at the end of the 90s was about 500-600 billion annually. The U.S. remains the largest net importer of capital. Negative balance on the international financial position of the U.S. increased steadily since the second half of the 80's. In 2002, it exceeded 1500 billion which means that the U.S. is acting as the largest and fastest growing centers of the world economy, attract capital from other parts of the world. It is noteworthy that the increased flow of all types of foreign investment in the country, ranging from direct investments and completing bank deposits. The data show that the inflow of foreign capital in the mid 90's is increasing dramatically. This significantly increases and its impact on the national economy. For example, the amount of foreign direct investment in the second half of the 90 years from 20 to 32% of gross investment in the U.S. GDP. Obviously, with such a large scale, their role in the growth of American economy is very high. True, the relatively small amount of inflow of foreign bank in the U.S. capital. This is probably due to the saturation of the U.S. market funds in the 90s and low bank interest rate in the country. At the same time, the amount of foreign portfolio investment are significant, with about 20% invested in U.S. stocks, and 80% - debt securities. And it is important to note a sharp increase in portfolio equity in the late 90's. If in the early 90's they were from 11 billion to 20 billion dollars a year, but in 1999 - 67 billion in 2000 and 2002 - about 44 billion dollars The pressure of foreign capital to the value of U.S. shares was a significant factor and led to an increase in their rate in the stock market. At the same time, significant foreign investment in bonds of various types of debt did the U.S. financial sector, the market is very sensitive to the behavior of foreign investors. On the other hand, the stability of portfolio investments in securities indicates the strength of the economy and the U.S. financial system that serves all these years a hotbed of stability and dynamism in the world. Only in the third quarter of 2002 under the impact of the financial crisis, the inflow in debt assets fell sharply to 1.14 billion U.S. But in the coming quarters, it rose to 60-70 billion dollars, which is meant to restore confidence in the economy and the U.S. financial system . Considerable interest in the impact of the financial sector to economic development. In relation to America is important to distinguish two aspects of this influence: on their part - to the world economy and the financial sector and from the world of finance - the U.S. economy. In early 2000, there were signs of overheating global economy. First to react to their central banks. In early February 2003 the Fed raised the discount rate to 5.5%, the European Central Bank - the refinancing rate to 3.25%, the Bank of England - from 5.75 to 6% (he did it for the fourth time in the last 6 months. ). Raised interest rates as the central bank of Sweden, Denmark, Switzerland and South Korea (the first time in two years - from 4.75 to 5%). These still small anti-inflationary steps are a sign that the central bank felt that the economy is already reeling from the effects of the global financial crisis and is now the main danger is the risk of overheating and inflation growth. This danger is not exaggerated. South Korean economy showed growth for 2003 by 10%, while retail prices have increased by only 1.6%. Abundance of financial resources in the economy and the U.S. financial market has played a large role in the behavior of stock prices of U.S. corporations in the stock market. The rapid growth of the Dow Jones in early 2004, many in the United States is viewed with suspicion. Sober-minded economists and business reasonably believed that early to overcome the cyclicality in the economy. This means that the expectations of the next cyclical crisis, despite all the visible signs of continued growth, remain significant. Not valid real content growth rate securities fraught exchange crisis, which may be the beginning of a cyclical economic downturn. For these reasons, any signs of overheating are seen with obvious suspicion. In the absence of significant inflation, which had previously served as the main feature of this kind, the greatest suspicion is extremely dynamic growth stock indices. Hence any change in the Dow Jones and other stock indices, is viewed with great concern and causes a lot of controversial comments. Literally panic in the world led to a sharp drop in the Dow Jones on the New York Stock Exchange in April 2002 This time the shock was a series of high-tech industry, led by the company "Microsoft". The news of the intention of the U.S. authorities on the basis of a court decision to end the monopoly of "Microsoft" and crush it to several companies for competition due to a desire of investors concerned immediately get rid of the shares of this company is not waiting for the implementation of the division of the company. The fall in share prices, "Microsoft" led to a decrease in the value of shares and other firms.

Table 1 - The inflow of foreign capital into the U.S., billions of dollars

Виды инвестиций |

1995 г. |

1996 г. |

1997 г. |

1998 г. |

1999 г. |

2001 г. |

2002г. |

Прямые |

52,5 |

47,4 |

59,6 |

89,0 |

109,3 |

193,4 |

260,0 |

Портфельные |

111,0 |

139,4 |

237,5 |

367,7 |

384,0 |

266,8 |

300,0 |

Банковский капитал |

39,9 |

108,0 |

64,2 |

22,2 |

171,3 |

29,3 |

80,0 |

Прочие обязательства |

10,5 |

1,3 |

59,5 |

39,4 |

107,8 |

9,4 |

50,0 |

The crisis of the share capital in the technology sector has corrected some trend of movement of stock prices in the stock market, but the risk of similar crises remains in force.

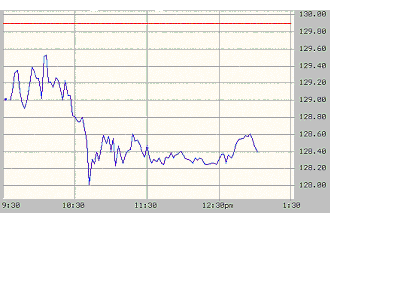

Figure 5 - Performance of the shares of "Microsoft" after the court decision

Also, I would especially like to acknowledge the impact of the stock market scandals and all kinds of other destabilizing factors. So a special place to the accounting scandals corporate reporting in 2005-2006. If you look at the dynamics of stock markets in 2005, it immediately struck a relatively good first quarter and failed the third quarter. In January, it all started with the growth of quotations, which, however, quickly faded away. In February quotations fell, however, at the end of the month, started a short-term growth. This rise continued until March 11, when reports on the audit of the Commission for the Securities and Exchange Commission (SEC) accounting practices WorldCom, and published quarterly loss AOL Time Warner to 54.2 billion - the largest in the company's history, and one of the largest ever corporate history. After that the deep and prolonged recovery, accompanying the process of financial reporting scandals involving companies accused managers of corporations and investment banks in the conspiracy and insider sales. «WorldCom» July 21, 2005 g. say bankruptcy, and on August 9 announced the details of a "correction" of income from prior years of $ 3.8 billion, of course, for the worse. Some days during this protracted decline was accompanied by flashes of growth - so, on July 24 of the same year «Dow» gained 488 points, which is its maximum absolute growth in its history, after reports of the arrest of ruined the Adelphia Communications Managers. However, these individual releases only confirmed volatile market conditions and does not contribute to the change downward trends (Figure 6).

Figure 6 - Dynamics of the major U.S. stock indexes in 2005 are

Stories with fake financial statements resulted in a significant outflow of capital from the stock market - at some point it seemed that all investors have lost confidence in corporations. Bankruptcy «WorldCom» became the largest in the history of corporate America (assets of $ 103,914 million to filing for bankruptcy), and the devastation of Global Crossing ($ 25,511 million) and Adelphia Communications ($ 24,409 million) among the ten largest bankruptcies in history U.S. on the fifth and sixth places respectively. Under suspicion of using various "schemes" and a possible bankruptcy in the future were many corporations, including giants such as Qwest Communications, Merrill Lynch, Citigroup, Xerox, Johnson & Johnson, Halliburton, Goldman Sachs, Salomon Smith Barney, Tyco International. Special attention enjoyed by those companies whose auditor was the now infamous Arthur Andersen. More than 30 major corporate managers were accused of fraudulent corporate reporting. Had lost confidence in the financial analysts, and the 12 largest investment banks were forced to declare a change of methods of assessment of stocks and initial public (IPO) and compensation for the withdrawal of numerous lawsuits. Analyze the behavior of the stock market after the September 11 attacks. Most of Kazakhstan's share in the first half hour of trading fell by 8.4%, prices of the oil market are supported by high world oil prices. Most Western European indices fell 0.8-2.7%. Figure 5 shows the behavior of shares of the Corporation "Boeing" after the news of the terrorist attacks, (Fig. 7). In I quarter of 2008. compared to the same period in 2007. U.S. dollar depreciated against most world currencies. The weakening of the dollar against the euro by 4.9%, the pound sterling, 2.8%, Japanese yen, 2.6%, the Swiss franc, 6.2%. The depreciation of the U.S. dollar in the I quarter of 2008. compared with the corresponding period of the previous year was mainly due to a significant depreciation of the U.S. currency in the IV quarter of 2007. which reasons were the increase in energy prices, increasing the current account deficit of balance of payments, budget deficit and public debt USA.

Figure 7 - Dynamics of shares of the Corporation "Boeing" after the terrorist attacks September 11

Published in I quarter data on volumes of net purchases of U.S. financial assets by non-residents showed that U.S. securities remain attractive for long term investors. However, currency market participants questioned the possibility of funding to further increase the current account deficit in the U.S. balance of payments due to the inflow of capital into the country without adjusting the dollar exchange rate. Very negative impact on the U.S. currency provided frequent statements by the financial authorities of Asian countries need to diversify reserves, traditionally accumulated in dollar assets. Rising interest rates in the U.S. has helped reduce the spreads between yields on U.S. Treasury bonds and riskier financial assets, such as bonds of developing countries. Against this background, in March 2008. in anticipation of the next increase in the federal funds rate increased demand for the U.S. currency from the investment funds. In January-March 2008. compared to the corresponding period in 2007. increased the level of stock prices in major stock markets in different regions of the world, but the rate of growth of most stock indices were significantly lower than in I quarter of 2007. In the U.S., the Dow Jones index rose by 1.6% (in I quarter of 2007. - By 28.9%), NASDAQ-index by 2.9% (in I quarter of 2007. - 45.1%). Index Xetra DAX-30 (Germany) increased by 7.4%, the CAC-40 (France) - by 8.6%, the FTSE-100 (UK) - by 10.7%. The Nikkei 225 (Japan) increased by 5.2%, the Hang Seng (Hong Kong) - by 3.6%, the Kospi (South Korea) - by 10.2%. Remained high growth in share prices on the stock markets of Central Europe and Latin America: the index BUX (Hungary) rose by 61.9%, the PX50 (Czech Republic) - by 52.8%, the IPC (Mexico) - 35, 2%, the index MerVal (Argentina) - by 21.1%, the Bovespa (Brazil) - 17%.

Growth in share prices on the stock markets in the U.S., Europe and Asia in the I quarter was due to an increase in February - early March 2007. The main reason for the growth of stock markets during this period was the publication of reports of U.S., European and some Asian companies for the IV quarter of 2007, most of which contained a message about improving financial performance of corporations. According to analysts, more than two-thirds-reporting companies reported better-than-expected financial results of its activity in the last quarter of 2007. Positive impact on the U.S. stock indices have also been reports of corporate mergers and acquisitions, the largest of which was the acquisition by Procter and Gamble company Gillette for 55 billion U.S. dollars. The growth in share prices on the stock market in the U.S. was limited to still high oil prices, rising interest rates and the strengthening of the U.S. dollar, observed in January and the second half of March 2006. Markets for the shares of European and Asian companies, export-oriented, in this period was more favorable, as the U.S. is one of the major trading partners of these countries and the strengthening of the U.S. dollar contributes to the competitiveness of their products. Situation on world commodity markets contributed to higher prices for the shares of energy, metals and mining companies .Speaking of the country must necessarily be mentioned that the stock market in Kazakhstan began to form in the first half of 1994, when the National Bank began to reduce uncharacteristic for central banks in favor of the standard functions. In particular, the National Bank started providing direct credit to the government to cover the budget deficit at the refinancing rate (and not at a reduced rate), while reducing their volumes. In 1998, the government directed credit is completely phased out, and all the government debt to the National Bank has been reissued in a special ten-year bonds MEAKAM. For its part, in 1994, the Ministry of Finance began its transition to a non-inflationary methods of financing the budget deficit borrowing in the domestic market through the issue of securities. The first three-month Treasury bills were Treasuries. During the first 6 months of auctions for them are rare and irregular, about once a month, but by the end of the year they were held weekly. By 2000, the frequency of auctions of Treasury bills of the Ministry of Finance increased. Significantly increased and the volume of the placement. If not, the special securities and MEAKAM AVMEAKAM, their annual production increased from 1995 to 2000, more than six times, with T10, T61 5 to 2 billion in 1999 in connection with the April interest in the devaluation of the tenge GS fell. The Ministry of Finance in order to support the market began to produce short-term foreign currency securities and to issue special currency bonds AV MEKAM. Currently, short-term foreign currency securities repaid in full, and five years were converted in May 2000 in Eurobonds. Currency Treasury did not bring any excess profits to their owners. They had an increased yield only in the period from April to June 1999 (3-month - September). The period of increased profitability and then replaced by a period very low yields due to the stabilization of the Tenge, then its yield was comparable to the yield of securities tenge. Treasury bills of the Ministry of Finance are not only a tool for government borrowing in the domestic market, but also an instrument regulating the monetary base of the National Bank in the secondary market. Due to the fact that the National Bank can not buy government securities in the primary market, and the volume on the secondary market is still very small, the National Bank's portfolio of government securities is not sufficient for the purposes of regulating the monetary base. Therefore, the National Bank since 1995, was forced to issue its securities - notes. Notes of the National Bank have short treatment - from 7 to 91 days, sufficient to improve control of the monetary base and therefore they do not compete with government securities. In April 1999, during the introduction of a regime of freely floating exchange rate, the National Bank also issued currency notes, including one-off procedure for the protection of special note of pension assets. The increase in revenues to the national budget in 2000 identified the need for a relatively low budget of the borrowing, and in the same year for the first years of the government securities market volume maturity securities exceeded their placement. Furthermore, the Ministry of Finance reduced the amount of borrowing and increased the placement of government treasury bonds. There was a steady decline in the rate of return on the domestic market: during 2000 the yield on short-term securities fell by more than 2 times. High level of liquidity in the financial market with a significant decline in net issuance of government securities has meant that the National Bank to regulate the banks' excess liquidity was forced last year to increase the production of short-term notes tenge more than doubled compared with 1999. Volume of notes was T132, 5 billion, resulting in a significant increase in the proportion of NBK notes in the structure of government securities in circulation Tenge . Since 2002, the volume of production of medium security becomes a significant issue and reached 11.2 billion, or 23.4% of total output tenge RZB Finance Ministry. Since 2004, regularly produces two and three-year discounted and inflation-indexed securities that are the subject fairly steady demand. Thus, in 2006, despite lower yields, for certain types of these securities demand exceeded supply by more than 5-6raz. As for RCB in the crisis in our country? The most important economic task of state of Kazakhstan at the present stage of development is to provide a sustainable and dynamic economic growth primarily intensive type. This problem is closely related to the modernization of production, economic restructuring, investment in the real sector, the development of the securities market. Economic growth observed in recent years in Kazakhstan, not a sustainable, as it occurs on a background of increasing the share of primary sector in the economy, reduce the proportion of high-tech industries. The momentum of economic growth, as a rule, are not associated with an increase in investment, the massive renovation of fixed assets in the existing enterprises, the introduction of high-tech production, and other factors that play an important role in the economic growth of the developed countries. The securities market is the most important mechanism for recovery of the financial system and to overcome the recession, as well as to overcome inflation. RZB allows for the mainstream non-inflationary fiscal policy covering the state budget. According to official data of the Agency of the Republic of Kazakhstan on Statistics inflation in March 2008 was 9% (March 2007 - 18.8%). Keeping inflation promotes appreciation of paid services in this period rose by 3.3% (in Q1 2007 - 2.7%) mainly due to the rise in price of housing services - by 3.6% and health - by 2.5%. In March 2008, the Ministry of Finance placed 7-year MEUKAM amounting to 71.4 million . tenge. The effective yield on the outstanding securities was 6.75%. In this case, redemption of government securities in March 2008, it was made only for interest payments and was 2.2 billion. As a result, the amount of Treasury securities outstanding at the end of March totaled 383.6 billion, virtually unchanged from the previous month (an increase of 0.02%). Volume of issue of notes of National Bank for March 2008 compared to February 2008 increased marginally by 0.3% to 837.5 billion tenge. Yield short-term notes increased from 4.81% in February to 5.68% in March. In this case, the National Bank is aimed at forming the "right" of the yield curve, ie notes with longer maturities should have a higher yield. Since 2002, the volume of production of medium security becomes a significant issue and reached 11.2 billion, or 23.4% of total output tenge RZB Finance Ministry. Since 2004, regularly produces two and three-year discounted and inflation-indexed securities that are the subject fairly steady demand. Thus, in 2006, despite lower yields, for certain types of these securities demand exceeded supply by more than 5-6raz. As for RCB in the crisis in our country? The most important economic task of state of Kazakhstan at the present stage of development is to provide a sustainable and dynamic economic growth primarily intensive type. This problem is closely related to the modernization of production, economic restructuring, investment in the real sector, the development of the securities market. Economic growth observed in recent years in Kazakhstan, not a sustainable, as it occurs on a background of increasing the share of primary sector in the economy, reduce the proportion of high-tech industries. The momentum of economic growth, as a rule, are not associated with an increase in investment, the massive renovation of fixed assets in the existing enterprises, the introduction of high-tech production, and other factors that play an important role in the economic growth of the developed countries. The securities market is the most important mechanism for recovery of the financial system and to overcome the recession, as well as to overcome inflation. RZB allows for the mainstream non-inflationary fiscal policy covering the state budget. According to official data of the Agency of the Republic of Kazakhstan on Statistics inflation in March 2008 was 9% (March 2007 - 18.8%). Keeping inflation promotes appreciation of paid services in this period rose by 3.3% (in Q1 2007 - 2.7%) mainly due to the rise in price of housing services - by 3.6% and health - by 2.5%. In March 2008, the Ministry of Finance placed 7-year MEUKAM amounting to 71.4 million . tenge. The effective yield on the outstanding securities was 6.75%. In this case, redemption of government securities in March 2008, it was made only for interest payments and was 2.2 billion. As a result, the amount of Treasury securities outstanding at the end of March totaled 383.6 billion, virtually unchanged from the previous month (an increase of 0.02%). Volume of issue of notes of National Bank for March 2008 compared to February 2008 increased marginally by 0.3% to 837.5 billion tenge. Yield short-term notes increased from 4.81% in February to 5.68% in March. In this case, the National Bank is aimed at forming the "right" of the yield curve, ie notes with longer maturities should have a higher yield. American crisis made it to the Russian stock market. Indices of Russian companies in one day lost more than 7%, returning to the level of last September. The reason for this, as experts believe, was the fall of the Japanese and Chinese indices by 4-5%, with the result that the holders of Russian securities not lost his nerve, and they preferred to get rid of them with minimal losses. Underdevelopment of the domestic stock market, it seems, once again save us from negative influences. However, and Kazakhstan stock market is not as developed as Russia, also reacted sharply altered quotes on world markets. Thus, according to the results of fixing on May 22 KASE KazPrime indicator value with the previous day decreased by 8 basis points to 12.14% per annum. It should be noted that KazPrime indicator reflects the average value on rates of money on the Kazakhstan market of deposits for a period of 3 months. Decrease by 8 points - is, of course, not the crisis, and not even its forerunner. The basis of the global crisis on the world markets served onset of the recession in the U.S.. The official authorities of America have recognized all the obvious recession and economic slowdown. Statement by George W. Bush, who promised to put Americans back part of the taxes to stimulate the economy, was seen by investors as a recognition by the U.S. in its impotence. It is this statement, and was the last spark that kindled the flames that engulfed the stock markets of the world. August 21, 2008 showed the most significant drop not only Asian and Russian stock markets, and exchanges in Europe. The major European indices fell by 5-7%, and the pan-European index «FTSEurofirst» 300 fell 5.79%. The last time such a sharp drop was observed in September 2001, after the terrorist attack in the United States. "What we see today - quite logical reaction (to slow U.S. economic growth.). One can only hope that the players and investors also pay attention to the real information about the European economy, and the markets will calm down, "- said the EU Commissioner for Economy and Finance Joaquin Almunia. According to him, the current situation in the European financial markets will not have a significant impact on economic growth in Europe in 2008 [21, c.22]. Speaking of our country, we can say that the crisis in the full sense of the word, in Kazakhstan. Economic theory suggests that signs of the financial crisis are defaulted banks, bankruptcy of the borrowers, the collapse of the exchange rate, fiscal default. Such negative processes in the country is not observed, we did not have, and the stock market crash because of its lack of development. Especially since, in spite of a significant slowdown, the positive rate of economic growth in the country still remains. But then the global financial crisis has an impact on Kazakhstan on the following factors. First, the country is a net exporter to a country that is going through this crisis, and imports from there goods. Second, Kazakhstan is very much borrowed abroad. Foreign investors behave very carefully, and when there are signs of a global crisis, just get nervous and pull their assets from developing countries, including Kazakhstan, as well as being denied loans to banks and companies. On the day for today observed slowdown in European economies, they are already in the zone recession, the U.S. is already in the area, as there is a slowdown in economic growth in Russia and China. These are the countries where most of Kazakhstan exports its products - raw materials, which is the main source of growth in the Kazakh economy. That is why we feel the impact of the global crisis. On the other hand, the state is in the 90 years set a goal - integration into the world economic system. And, as we can see, this is already happening. Integration has occurred even faster than we expected. So, Kazakhstan can not remain an island of stability, as such, it could only be with the full closure. Better to be in the global economic system, which at times is in crisis, sometimes in a very difficult, but still located in the progressive development. State, recovering from yet another crisis, again quickly pick up the pace of growth and the next crisis will be met at a higher level. In Kazakhstan the situation still much better than in the developed countries and in Russia. This played a role undertaken and a government crackdown. Among them - the early decisions of the infusion into the economy $ 4 billion after the occurrence of the first difficulties in the financial system - the liquidity crisis in construction companies - to protect the interests of shareholders. Sometimes not our measures and steps taken in time to proactively possible crisis, above all, long before the current panic originating in foreign countries. The funds also for the maintenance of the most vulnerable sectors of the economy - small business. This is the same as the support of the citizens of the country. Government managed to keep from further sharp rise in the price of bread and some foods. National Bank is now a very strong anti-inflation policy: the increase in the money supply does not exceed 10-11%. The state has accumulated a large amount of foreign reserves. It's gold reserves - about $ 21 billion, and the National Fund - about $ 26 billion in total, in my estimation, at the moment they are about 50% of GDP. This is a good margin of safety for the economy, it gives confidence and the public, and investors, and business in general. Still, the authorities managed to not spend and accumulate these reserves to withstand an attack from all sides with calls such as "do not save, and spend" or "enough to save, time to spend." Now the state can to support the financial system and the economy safely use part of the funds of the National Fund, to be used as intended to stabilize the economy in the fall in world oil prices. All these measures have become shock for the Kazakh economy in the midst of the global financial crisis.

Governments have an important effect of reforms aimed at reducing the administrative barriers to active actions of private businesses as well as tax reform, begun in 2006. All these measures significantly stimulate business initiatives in the next year, which, according to experts, will be a difficult period for the world economy, and thus for the Kazakhstan. Thus, the analysis of all expressed may be noted that the Kazakh stock market is in its infancy, neither of which its integration into the global financial sphere can not speak, so the crisis in the stock market or have no effect on the economic situation in the country. The government has taken many steps to raise the level and status of the Kazakhstan Stock Exchange, but most of these measures are limited by the reluctance of the companies for a number of reasons to place their shares on the domestic stock exchange.