Kazakh University of International Relations and World Languages

СРС

Theme: How does government bond market work in Kazakhstan?

Completed by- Lim Dmitry,

Kozhaev Abilhair(Marketing 212 gr.)

Checked by-Ainur Baitelessova

Almaty 2013

The securities market is currently one of the most important areas of the economy. The development of the securities market is characterized by a positive trend and against the background of the continuing long-term equilibrium of the underlying factors, including the stable dynamics of the exchange rate and relatively low inflation. For many decades, in Kazakhstan, in fact, there was no financial market, nor any of its infrastructure: private, commercial and investment banks, stock exchanges, insurance companies, etc. In the country there was no competition between the producers of goods and services, including financial, that are the engine of social progress. A market economy requires a potential financial market, which is a major source of growth. According to the structure of financial market of the country consists of three interrelated and complementary markets: money, credit and equity markets. Against the background of a strong market for government securities market shares in Kazakhstan still underdeveloped. One of the main problems in the securities market - the lack of free float, despite the large number of public companies. Shares of companies concentrated in the control package of strategic investors who are not interested in losing control of the business and financial disclosure. Therefore, the market becomes a limited number of shares. State of the financial market depends on several factors, among which the main role is played by the rate of inflation. The fact that the drop in production and rampant inflation, many of the benefits of the stock market has always been considered a reliable way to protect savings from inflation, are absurd. When inflation is high, typical of the initial stages of the transition, income securities do not compensate for inflation losses. Investors are willing to invest money in a foreign currency. Today it is clear that without raising the real sector of the economy of Kazakhstan has no future. Economic recovery is impossible without investment. Growing investment demand, restructuring the economy and its radical technological innovation - all of which should be the basis for the reforms. In the current economic situation in Kazakhstan requires a rapid and scientifically create financial market and its key component - of the securities market, able to quickly adjust the structure of the national economy, to stop the decline in production, to develop the most promising industries. The significant role of the securities market and play in the stabilization of the national currency of Kazakhstan, reducing the rate of inflation. Securities market - this is not an isolated system, and the segment of the market, which can not function without the full development of a market economy. Thus, the stock market - the regulator of many natural processes taking place in a market economy. This applies above all to the process of capital investment. Securities market allows specific forms of capital concentration and quickly sell the necessary funds for specific projects at prices that suits both lenders and borrowers. Different kinds of crises and shocks are inevitable companions of the market economy - without them it would be impossible to develop and progress. But they have a very strong impact on the economy of the entire world economy, as well as the stock market is one of the most important parts of the infrastructure of a market economy, that, accordingly, he first takes on the "impact" of the next crisis erupted. Thus, we can conclude that the subject of the influence of the securities market for economic development is now quite relevant in this term paper attempts to analyze the impact of economic cycles and the various shocks to the stock market.

Model and type of economic growth

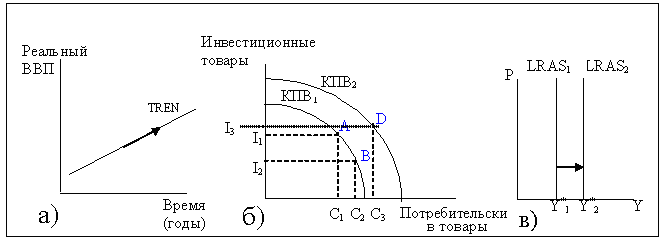

As you know, the main criterion of economic development is economic growth. The importance of studying the problems of economic growth is that economic growth is the basis for increasing wealth, and analysis of the factors that determine it, can explain the differences in the level and pace of development in different countries (cross-country differences) in the same period of time and in a single the same country at different periods of time (intertemporal differences). Under economic growth means increase in aggregate output and consumption in the country, characterized by the firstall such macroeconomic indicators, such as gross domestic product, gross domestic product, national income. Growth is a long-term upward trend in real GDP. In this definition are the key words:1) The trend, which means that real GDP is not necessarily to increase each year, and only indicate the direction of motion of the economy, the so-called "trend", and 2) long-term, as economic growth is the indicator of the long-term, and therefore it comes to increasing potential GDP (ie GDP at full employment of resources), the growth of productive capacity of the economy, real GDP (not nominal growth which can occur due to an increase in the price level, even if the reduction in real output). Therefore, an important indicator of economic growth is the indicator value of real GDP . Graphically, economic growth can be presented in three ways: through the curve of real GDP by production possibility curve, using the model of aggregate demand - aggregate supply (model AD-AS). In Pic. 1. (A) the curve (trend) reflects the long-term upward trend in real GDP. In Figure 1. (B) economic growth shown by the production possibility curve. Figure 1 (a) is presented as a shift to the right long-run aggregate supply curve (LRAS) and the growth of islands of Y1 to Y2.. The state plays a significant role in the regulation of growth and to consider what measures of state regulation can best encourage this process. Neoclassical growth models overcome some limitations of Keynesian models and can more accurately describe the features of macroeconomic processes. Solow best depicts the relationship between RZB and economic growth.

Pic.1 - Economic growth (graphic interpretation)

The purpose of the Solow model is to answer the questions: what are the factors of balanced economic growth, what growth rate the economy can afford at the given parameters of the economic system and how it maximized income and consumption. In general, the amount of national output Y is a function of 3 factors of production: labor L, capital K, Land N:

Y = f (L, K, N) (1)

Factor of land in the Solow model has been omitted due to the low efficiency in economic systems with a high level of technology, and therefore depends on the volume of labor and production factors:

Y = f (L, K), (2)