UBS - Emerging markets_watermark

.pdf

vk.Investingcom/id446425943 in emerging markets

A monthly guide to investing in emerging market financial assets

June 2019

29 May 2019 – 5:00 pm GMT

Chief Investment Office GWM Investment Research

Tweet quakes and their aftershocks

Equities: |

Credit: |

Currencies: |

Focus: |

Economy: |

Stay invested |

Trade war back in |

Collect carry in a |

Argentina: |

The economics of |

|

focus |

measured way |

Political waters |

US-China trade |

|

|

|

stirred by |

tensions |

|

|

|

Kirchner's |

|

|

|

|

announcement |

|

This report has been prepared by UBS AG, UBS Financial Services Inc. (UBS FS), and UBS Switzerland AG.

Please see important disclaimers and disclosures at the end of the document.

vk.com/id446425943

Contents

Investing in emerging markets

Editors-in-Chief

Alejo Czerwonko

Michael Bolliger

Project management

Brennan Azevedo

Editors

Abe De Ramos

Editorial deadline

28 May 2019

Desktop Publishing

Srinivas Addugula*

Contact wmrfeedback@ubs.com

* An employee of Cognizant Group. Cognizant staff provides support services to UBS.

Editorial |

|

Tweet quakes and their aftershocks............................................................. |

3 |

Global investment views......................................................................... |

5 |

Emerging market investment strategy |

|

Shifting from growth assets to carry assets.................................................. |

6 |

Focus |

|

Argentina: Political waters stirred by Kirchner’s announcement.................... |

8 |

Economy |

|

The economics of US-China trade tensions.................................................. |

9 |

Equities |

|

Stay invested............................................................................................. |

11 |

USD bonds strategy |

|

Trade war back in focus............................................................................. |

12 |

Currencies |

|

Collect carry in a measured way................................................................ |

13 |

Emerging market electoral monitor...................................................... |

14 |

Emerging markets publications............................................................. |

16 |

Important disclosure

Please note there may be changes to our house view and tactical asset allocation strategies prior to the next edition of Investing in Emerging Markets. For all updated views, please refer to the latest UBS House View.

UBS CIO GWM June 2019 2

vk.com/id446425943

Editorial

Tweet quakes and their aftershocks

Mark Haefele |

Alejo Czerwonko, Ph.D. |

|

Chief Investment |

||

Strategist |

||

Officer |

||

|

April economic data gave cause for cautious optimism on emerging economies. GDP growth trackers started to point to an improvement from modest levels; aggregate purchasing managers’ indices continued to indicate expansion; and lending conditions showed signs of easing. But then, President Donald Trump made his early May tweets. The result: higher tariffs on USD 200bn of US imports of Chinese goods from 10% to 25%.

Since then, volatility in foreign exchange has remained surprisingly low and emerging market currencies have been resilient, down less than 1% since 3 May. Lower benchmark interest rates and slightly wider yield spreads have also helped USD-denominated bonds post flat returns over the same period. But emerging market stocks have lost 8.5% (although they are still up over 3% year-to-date).

Our baseline scenario continues to envision a trade truce between the US and China. We believe both parties have their own incentives to agree to a ceasefire. President Trump’s 2020 reelection bid would be better supported by a strong economy than one stifled by tariffs, and Beijing policymakers want to be able to refocus on the rebalancing of the Chinese economy. Beijing’s retaliation measures have so far been disproportionally smaller, and its trade leaders continue to show willingness to negotiate.

We need to acknowledge, however, that when world leaders play with fire, they could get burned. We thus assign a 30% probability to a breakdown in the trade negotiations. Tensions have already escalated beyond trade and broadened to China’s access to US technology, largely through the telecom networking giant Huawei. The US Department of Commerce is reportedly looking at 14 technology categories that could be subject to export and investment controls involving China. And domestic rhetoric and sentiment in China is turning sour. “If the US wants to negotiate, the door is always open; if the US wants to fight, we will fight to the last,” said a recent piece in Chinese state media that was quickly amplified on social networks.

Presidents Trump and Xi will have an opportunity to meet at the G20 summit in Japan at the end of June, but we think it is unlikely that they will shake hands on a deal there. We will be on the lookout for new deadlines the US might announce

about imposing 25% tariffs on an additional c. USD 300bn of Chinese goods. As we have seen from the NAFTA renegotiations, such deadlines could bring about progress at the eleventh hour, but also come with obvious risk. We will also watch for any potential monetary or fiscal easing by global policymakers in reaction to the trade uncertainty.

The increased risk of a breakdown in talks and likely bumpy negotiation process and elevated uncertainty from here has made us reassess our outlook on emerging markets. Their economic recovery has likely been pushed out, as we discuss in the Economy section of this report. Emerging market equities are attractively valued, in our view, and should benefit from our base case of a global recovery in the second half of the year, but the path will likely be bumpy, given the trade dispute.

Outside of the trade uncertainty, domestic developments are also important drivers of emerging market assets. As recently as last week, we have seen market-friendly electoral outcomes in some of the larger countries. In India, after six weeks of voting for the general election, Prime Minister Narendra Modi officially clinched a stronger-than-expected mandate. In Indonesia, the election commission confirmed the second mandate for President Joko following the vote in April. And in South Africa, the ruling ANC retained its absolute majority in the legislature, extending the term of President Cyril Ramaphosa. Meanwhile, Brazil’s pension reform remains on track for approval this year despite some disaccord between Congress and the new government of Jair Bolsonaro.

The political outliers remain Argentina and Turkey. In the former, former populist President Cristina Kirchner announced she will participate in the August primary elections, running as vice president to a presidential candidate she handpicked. We delve deeper into the implications of this development in the Focus section. We also expect the rerun of the mayoral election in Istanbul to exacerbate political uncertainty.

As we look forward, the US-China dispute will remain the overriding driver for emerging market assets until its resolution, so investors must be appropriately positioned. In our view, trade uncertainty increases the chance that growth and inflation stay muted and central banks stay accommodative – this seems apt for carry strategies. We therefore overweight a basket of equally weighted high-yielding emerging market

UBS CIO GWM June 2019 3

vk.com/id446425943

Editorial

currencies (Indonesian rupiah, Indian rupee, South African rand) against a basket of low-yielding, high-beta ones (Australian, New Zealand, and Taiwan dollars). Our selection of currencies in the short basket is designed to mitigate the risk that a further escalation in trade tensions would represent for long positions in high-carry currencies.

We also see long-term value in USD-denominated emerging market bonds. For a historical understanding of this asset class, a recent NBER research paper examining 200 years of data shows that, notwithstanding defaults, wars, and global crises, a diversified portfolio of these bonds has delivered two centuries of attractive risk-adjusted returns.

We hope this report gives you the tools to navigate the tumultuous times in the emerging world and beyond.

Mark Haefele

Chief Investment Officer

Alejo Czerwonko

Strategist

UBS CIO GWM June 2019 4

vk.com/id446425943

Global investment views

Asset allocation

In our base case, global growth should stabilize in the second half of the year. However, the rhetoric around US-China trade has deteriorated recently, raising downside risk for the global economy and financial markets. In our base case, we expect a USChina trade deal or truce over the next six months, though only after a bumpy negotiation process that potentially leads to spikes in market volatility. In a scenario of prolonged uncertainty with lower consumer confidence and slowing investments, we see risk of the global economy growing below trend rather than above it. We recommend an overweight to equities, while managing downside risks through an overweight to long-duration Treasuries.

Bonds

We continue to hold an overweight to US long-duration Treasuries, which should help protect the portfolio against unanticipated equity market weakness. This month we closed our overweight to emerging market USD sovereign bonds. The spreads on emerging market bonds have remained resilient even as trade tensions have escalated, but spreads are likely to widen from here should additional tariffs raise concerns around the global growth outlook.

Equities

We overweight emerging market and Japanese equities versus US government bonds. We believe EM and Japan are set to play catch-up, having been the weakest equity markets so far in 2019. Since the start of the year, Japanese and EM stocks are both up about 3%, compared to nearly 12% for global equities and almost 14% for the S&P 500. The rising trade tensions between the US and China has had a more adverse effect so far on EM and Japan. Uncertainty about the impact of trade negotiations on global growth is likely to weigh on sentiment in the near term. But assuming the risk scenarios we are monitoring do not materialize, we believe EM and Japanese equities offer the best upside. Both are heavily geared to the global cycle and improvements in China‘s growth, and we don’t think either have priced in a macro recovery, whereas US equities have already priced in the recent improvement in economic data.

Foreign exchange

With our FX strategy we add a basket of EM currencies (South African rand, Indian rupee, Indonesian rupiah) vs developed market currencies (Australian dollar, New Zealand dollar, Taiwanese dollar) to harvest the interest rate advantage without being too strongly exposed to US-China trade tensions and other global risk-on vs. risk-off considerations. We keep our short AUD vs long USD. The AUD is a cyclical currency that tends to suffer when risk aversion rises and foreign investors repatriate assets. Australia is also heavily exposed to Chinese trade flows, and with a slowing Australian economy we think the RBA may be preparing for a rate cut. We maintain our overweights in the Norwegian krone against the Canadian dollar and the Swiss franc, and our overweight in the euro vs the Swiss franc.

UBS CIO GWM June 2019 5

vk.com/id446425943

Emerging market investment strategy

Michael Bolliger

Head of EM Asset

Allocation

Shifting from growth assets to carry assets

Renewed tensions between the US and China have been weighing on the global growth outlook and risk appetite lately. That’s not an environment for growth assets—such as emerging market equities and currencies—to do well. Emerging market stocks have corrected meaningfully (–8%) over the last month, followed by fixed income assets in local currency (around –2%). Sovereign and corporate bonds in US dollars were once more the bright spot, up roughly 0.5%, mainly thanks to the rally in US Treasury yields. If we look at the bigger picture, however, it’s worth recognizing that emerging market assets have had a good year so far, with all of them posting positive returns year-to-date.

US-China trade tensions to weigh on assets through various channels

The renewed escalation in the US-China trade conflict took markets by surprise; coming after a significant rally, it resulted in a meaningful correction. An imminent solution, such as an agreement at the G20 leaders’ summit in June, looks less and less likely, so we expect the prolonged period of uncertainty to weigh on sentiment.

A second channel of contagion is through more muted economic growth. While economic data for April showed signs of stabilization, the recovery started from a soft and fragile base. The renewed tensions will likely delay the recovery well into the second half of 2019 and lead to lower growth for the full year than previously expected. This lukewarm growth picture is not favorable for emerging market stocks, despite their more favorable valuations now. Absent a further escalation, however, we think the trade conflict will not lead to a sharp, global growth slowdown.

Beyond China: Turkey, Argentina, South Africa, Brazil, and India

Lately, Argentina and Turkey have brought back not-too-distant memories from 2018, when they were both exposed to market turmoil. Their situation remains challenging—both countries are in recession and struggling with rising unemployment and high inflation—although some things have improved, most notably their current account balances, which used to be their Achilles’ heel. We wouldn’t rule out more downside in local assets, especially in the run-up to their respective elections (23 June in Turkey; 27 October and 24 November in Argentina), but we think they are unlikely to trigger a broader emerging market crisis. Investors

Tactical asset allocation deviations from benchmark*

underweight |

neutral |

overweight |

Equities |

|

EM equities total |

|

|

|

||

|

|

|

|

|

EM Asia |

|

|

|

|

|

|

|

|

EM LatAm |

|

|

|

|

|

|

|

|

|

|

|

EM EMEA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EM sovereign bonds (USD) |

|

|

|

|

|

USD |

|

EM sovereign bonds IG (USD) |

|

|

EM sovereign bonds HY (USD) |

|

|

in |

|

|

|

|

|

|

|

Bonds |

|

EM corporate bonds (USD) |

|

|

|

|

|

|

|

EM corporate bonds IG (USD) |

|

|

|

|

|

|

|

|

|

|

|

EM corporate bonds HY (USD) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

instruments |

EM currencies / money market |

|

currency |

|

||

Local |

|

EM government bonds |

|

|

|

||

|

|

|

|

|

|

|

|

EM in ation-linked bonds

new old

Most Preferred |

|

|

Least Preferred |

|

••China |

|

|

••Thailand |

|

••Malaysia |

|

|

••HongKong |

|

••High yield sovereigns |

|

••Investment grade sovereigns |

||

••GCC sovereign and quasi- |

|

|

||

sovereign bonds |

|

|

|

|

••Select LatAm corporates |

|

|

||

|

|

|

||

EM FX |

|

• Long ZAR vs. short USD |

||

|

||||

|

• Long basket of IDR, INR, ZAR vs. |

|||

Views |

|

|||

|

short basket AUD, NZD, TWD |

|||

|

|

|||

|

|

|

|

|

**Short-term recommendation (1–2 months) |

||||

Source: UBS, as of 23 May 2019. Green/Red arrows indicate new upgrades/downgrades. Grey up/down arrows indicate increase/reduction to existing positions.

* Please note that the bar charts show total portfolio preferences. Thus, it can be interpreted as the recommended deviation from the relevant portfolio benchmark for any given asset class and sub-asset class. These charts were formulated at the Emerging Markets Investment Committee. These preferences are designed for global investors. For models that are tailored to US investors, please see our flagship publication, UBS House View.

UBS CIO GWM June 2019 6

vk.com/id446425943

Emerging market investment strategy

should stay fairly selective and focus on short-duration instruments from higher-quality issuers. We caution against exposure to currencies like the Turkish lira, despite the high interest rates.

On the more positive side, we highlight South Africa, India, and Brazil, where reforms should support local assets. To be clear, the road to successful reforms is long and winding in all three countries. For South Africa and India, however, our conviction is high enough to increase exposure following their benign election outcomes. The victory for the ruling party and the incumbent head of state—the ANC and Cyril Ramaphosa in South Africa in March, and the BJP and Narendra Modi in India in May—bodes well for policy continuity and further reforms in both countries. For this reason, we favor the rand and selected South African bonds in US dollars, and have a favorable view of the Indian rupee. For Brazil, we still believe that pension reform will pass this year, but we are more cautious given increased uncertainty around politics (which could affect the pace of reforms), the economic recovery, and a more dovish central bank.

Three safety nets in place

The combination of prolonged uncertainty, slower growth, and idiosyncratic risks on one hand, and fair to attractive—but not cheap—valuations for emerging market assets on the other, provides a challenging backdrop for investors. Still, we see several safety nets in place that provide downside protection.

First, the Federal Reserve, the European Central Bank, and the Bank of Japan have tilted their policy stance from tightening to easing. This has relaxed financial conditions, which should help cushion the potential decline in economic growth.

Second, a weaker economy might bring forth more stimulus measures in China, according to policymakers. Compared to previous downturns, such measures are likely to be less generous and more targeted toward domestic sectors, but they should be enough to support market and business sentiment.

Third, we think that ultimately Presidents Donald Trump and Xi Jinping are interested in a resolution. Trump has shown he is sensitive to US stock market corrections, and the US will hold general elections about a year from now. We also think China would welcome a deal to ensure domestic stability.

How to invest in a measured way: FX carry, leverage in bonds

Investors can take shelter from higher volatility by moving to a more defensive allocation and adding emphasis on investment strategies that benefit from interest rate carry. In our asset allocation, we moved to a more defensive allocation by closing our overweight in emerging market hard currency sovereign bonds versus US government bonds.

Harvesting interest rate carry, however, should remain an attractive approach, if done in the right way. In the emerging markets, we have identified two opportunities:

First, we add a long/short basket of currencies for carry in our FX strategy. On the long side, we include selected high-yielding emerging market currencies: the Indonesian rupiah, the Indian rupee, and the South African rand. On the short side, we choose low-yielding, high-beta currencies: the Australian, New Zealand, and Taiwan dollars. The trade has one distinct objective: to harvest the interest rate carry in markets where we expect stable to stronger currencies over the next six months. We protect the downside of the basket by positioning in currencies that would cushion the impact from potential global headwinds like an escalation in the US-China trade spat.

Second, we advise investors to also consider leverage as an additional dimension of how to increase yields in emerging market bonds. Using leverage, investors can achieve similarly high yields with a better average credit quality and a lower duration risk. Moreover, we find that the low and flat US interest rate curve provides a favorable opportunity to lock in benign funding conditions. The bottom-up selection is of course important, especially for investors who follow a buy-and-hold strategy.

Finding Value in EM equities: Although valuation metrics still favor EM value stocks over growth stocks by a significant margin, the more uncertain global outlook and the large sectoral mismatch make it more difficult to find clear catalysts for value to outperform growth in emerging markets. As we no longer expect value stocks to systematically outperform growth peers, we are closing our investment theme and advise investors to move back to a benchmark allocation in emerging market equities. Investors looking for a thematic angle to their equity allocation should consider our “Sustainable value creation in emerging markets” investment theme.

UBS CIO GWM June 2019 7

vk.com/id446425943

Focus

Argentina: Political waters stirred by Kirchner’s announcement

For Argentina, the most likely outcome of the election is policy continuity toward fiscal consolidation, tight monetary policy, cooperation with the IMF, and being current on debt obligations. But Cristina Kirchner is running, and the risk of her coming back to power is real.

In emerging market politics, figures from an unpleasant past tend to find interesting ways to rear their heads back in the present. This happened on 18 May in Argentina, when former President Cristina Kirchner announced she will participate in the August primary elections, running as vice president to a presidential candidate she handpicked. Cristina succeeded her late husband Nestor in 2007, and the policies they espoused during their combined 12year rule rendered the Argentine economy vulnerable to a crisis that helped precipitate a recession and ultimately resulted in a sizable rescue package from the IMF in mid-2018. It is therefore no surprise for observers to wonder if Kirchnerism could come back.

We don’t think Kirchner’s surprise candidacy will garner much traction with the electorate. How many marginal voters, who would not tolerate her as a presidential candidate, would do so as a running-mate of a relative unknown, considering it is obvious she is running the show? It may be inevitable, however, that Kirchner’s announcement will rejig the competing coalitions, forcing a number of centrist candidates to pick a side. This is what we are watching most closely since it will have an impact on the race. By sharing the ticket with a moderate and a former critic of her own administration, Kirchner is likely trying to attract influential centrist Peronist politicians into her coalition. Will they join her? Most have distanced themselves from her, so it’s unlikely, though possible. The ruling Cambiemos is also attempting to lure non-Kirchner Peronists into its own umbrella.

With five months to go, the presidential race remains wide open. In our baseline scenario, however, we expect a number of the policies implemented by incumbent President Mauricio Macri to remain in place under his successor, and of course if he is reelected. These include fiscal consolidation efforts toward a primary surplus, tight monetary policy to rein in inflation, and a cooperative relationship with the IMF, as well as “willingness” to remain current on debt obligations.

Kirchner’s ticket does not represent continuity, in our view. We see her odds of winning around 35% given that she is facing severe corruption allegations; Argentine macroeconomic numbers are set to look less dire in the coming months; the global macro and political backdrop is supportive, with key partners the US, Brazil, and Chile all backing policy continuity; and the fact that incumbent presidents in Latin America have historically had a distinct advantage in winning reelections.

In our view, current Argentine asset prices overestimate the likelihood of a return to populism in the upcoming elections. We maintain our favorable view of a number of Argentine US dollar-denominated bonds, though we warn against making too large of an allocation to the country. Our favorable view on its electoral outlook is far from guaranteed, and Argentina’s still-large twin deficits leave its assets vulnerable to sharp changes in the external financial environment in the near term. Longer term, the country will continue to face economic and political challenges.

Alejo Czerwonko, Ph.D. Ronaldo Patah

Strategist Analyst

Table 1

Argentina Political Calendar

Date |

Election type |

12-Jun-19 |

Deadline - Electoral alliances |

22-Jun-19 |

Deadline - Presidential candidates |

11-Aug-19 |

Presidential - Primary |

|

Legislative - Primary |

13-Oct-19 |

First debate |

20-Oct-19 |

Second debate |

27-Oct-19 |

Presidential - General |

|

Legislative - General |

24-Nov-19 |

Presidential - Runoff |

Ongoing |

C. Kirchner's corruption trials |

"Source: Ministerio del Interior, Obras Públicas y Vivienda, La Nación, UBS. As of May 2019."

Argentina and Brazil tied at the hip

Economic and political channels keep the fates of both countries aligned with each other. Although Brazil’s economy is over three times the size of Argentina’s, the 50% collapse in Argentine imports of Brazilian cars since the beginning of the year has been weighing on the industry. We don’t expect meaningful improvements in this area before the October elections, and 2020 looks markedly different depending on who wins. At the same time, Brazil’s muted economic activity so far this year—we expect a mere 1.1% GDP growth for the whole year—isn’t contributing to a faster rebound in Argentina, either.

On the political front, Argentine presidential hopefuls are surely studying Brazil’s 2018 elections, during which social media campaigns proved significantly more effective than traditional channels. The outcome of the crucial social-security vote in Brazil may also have an impact on Argentina’s election results. Its approval may be perceived through a “reformist against populist” lens, and Brazilian and Argentine financial assets would fare well, which may have an effect on voter preferences. The Argentine electoral result will influence Brazilian politics as well. A populist win could revive the opposition voice in Brazil, which could raise the bar for reform approvals in the coming years. A reformist win, in turn, would reinforce the strength of the current government in Brazil, increasing its political power in the region.

UBS CIO GWM June 2019 8

vk.com/id446425943

Economy

The economics of US-China trade tensions

The nascent optimism about growth in emerging economies, led by in China, has again been clouded by the sudden escalation of US-China trade tensions. Our baseline scenario foresees some kind of agreement over our six-month tactical horizon, but we still expect lower growth and more policy stimulus in China. Other emerging economies will also be negatively affected, but we don’t expect growth to deteriorate significantly. We favor smart carry strategies in this environment.

China: Lower growth, more stimulus

The US upped the ante in its continuing trade conflict with China by increasing its tariffs from 10% to 25% on USD 200bn of Chinese imports. It also threatens to impose additional tariffs of 25% on the remaining USD 300bn worth Chinese goods its buys. In our base case, we expect a trade deal or truce over the next six months, though only after a bumpy negotiation process. With new tariffs already in place and uncertainty running high, we downgraded our growth outlook for the Chinese economy from 6.4% to 6.2% for 2019.

The renewed trade tensions come at a time when Chinese economic data for April failed to live up to the good March readings and the bet- ter-than-expected 1Q19 GDP. Manufacturing PMIs receded to levels just above 50; exports contracted compared to a year ago; and urban investments, industrial production, and retail sales growth came in weaker than feared. With the added weight of tariffs, China is likely to shift its policy bias in favor of easing again. The Chinese central bank may ease liquidity conditions through various channels, including additional cuts to the reserve requirement ratio for banks. Fiscal policy will likely become more expansive as well, with measures to stimulate consumption, speed up infrastructure spending, or further ease credit. This should help keep China’s economic growth running above 6%, despite the trade headwinds.

The situation changes if the US imposes the full suite of tariffs. Even with additional stimulus, Chinese GDP growth would likely fall below 6%. We assume a roughly 1-percentage-point decline in growth, with some uncertainty with regards to the potential multiplier impact on consumption and investment.

Other emerging markets: Affected by direct and indirect channels

A weaker China does not bode well for other emerging economies, specifically for export-driven countries with strong trade links to China, such as South Korea. Last year, the Korean economy grew 2.7%, the slowest pace in six years, marked by a decline in exports led mainly by semiconductors and other China-bound shipments. The fresh escalation of US-China trade tensions will also likely be felt by other export-oriented Asian economies that had shown signs of improvement toward the end of 1Q19. Accordingly, we have lowered our 2019 GDP forecasts for some economies, including Taiwan and Singapore.

Meanwhile, commodity exporters will feel the pinch if China’s hunger for raw materials weakens. And even among economies that have no meaningful direct links to China, softer risk sentiment could expose the external vulnerabilities of those that have high current account deficits or weak bud-

Tilmann Kolb |

Xingchen Yu |

Analyst |

Strategist |

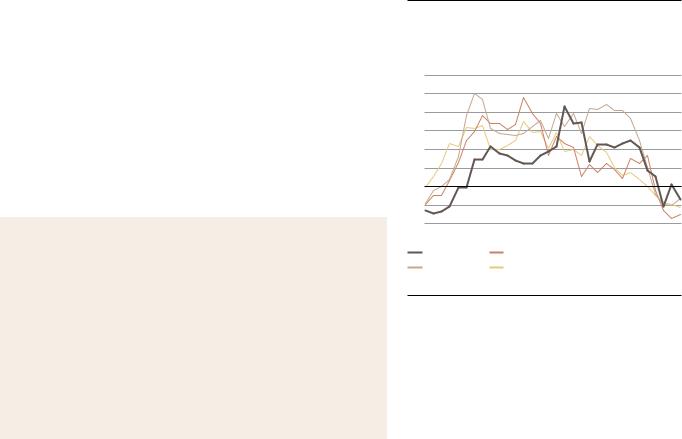

Figure 1

Latest Chinese data have not sustained recent gains

Industrial production, retail sales, urban investment, and GDP growth (in % y/y)

12 |

6.9 |

11 |

6.8 |

|

|

10 |

|

9 |

6.7 |

|

|

8 |

6.6 |

7 |

6.5 |

|

|

6 |

|

5 |

6.4 |

|

|

4 |

6.3 |

Mar-16 Sep-16 Mar-17 Sep-17 Mar-18 Sep-18 Mar-19

Industrial production |

|

Urban investments |

|

||

Retail sales |

|

GDP (rhs) |

Source: Bloomberg, UBS, as of 24 May 2019.

UBS CIO GWM June 2019 9

vk.com/id446425943

Economy

get balances, or are highly dependent on portfolio capital inflows. Some of China’s stimulus may find its way into other emerging markets, but at this point we only expect marginal effects given its likely more domestic focus.

Investment implications: Look for carry amid uncertainty

What does this all mean for investors? An all-out trade war could trigger the end of the global growth cycle. Luckily, we’re not there yet, and we expect cooler heads to prevail in the end. In the meantime, moderate global growth, combined with the readiness of policymakers to step in when needed, favors smart carry trades, in our view. One such trade is our newly introduced basket of high-yielding emerging market currencies against a basket of low-yielding, high-beta currencies.

Winning losers

On a macro level, everybody loses from restrictions to trade. On a micro level, some may benefit. Recent reports and surveys show that some companies are already shifting their supply chains in response to the trade tensions. High-value-added products tend to relocate from China to Taiwan or Korea, while lower-value-added ones are more likely to move to Southeast Asia. The trade conflict, therefore, would probably only accelerate the already existing trend of migrating low-value manufacturing to China’s neighbors, while also reinforcing China’s goal to focus on more sophisticated production. Apart from Asia, other countries and companies may be able to book small wins, namely those that can serve as a substitute supplier of goods (e.g. Brazil for agricultural produce) or base of production (e.g. Mexico for the US, thanks to North American trade links).

Figure 2

Trade connects, in good and bad times

Export and import growth for China, South Korea, and Taiwan (in % y/y, 3mma)

30

25

20

15

10

5 |

|

0 |

|

–5 |

|

–10 |

|

Mar-16 Sep-16 |

Mar-17 Sep-17 Mar-18 Sep-18 Mar-19 |

China exports |

South Korea exports |

China imports |

Taiwan exports |

Source: Bloomberg, UBS, as of 24 May 2019.

UBS CIO GWM June 2019 10