JPM_US Equity Markets 2019 Outlook_watermark

.pdf

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943 |

Equity Strategy and Quantitative Research |

Dubravko Lakos-Bujas |

|

(1-212) 622-3601 |

07 December 2018 |

dubravko.lakos-bujas@jpmorgan.com |

|

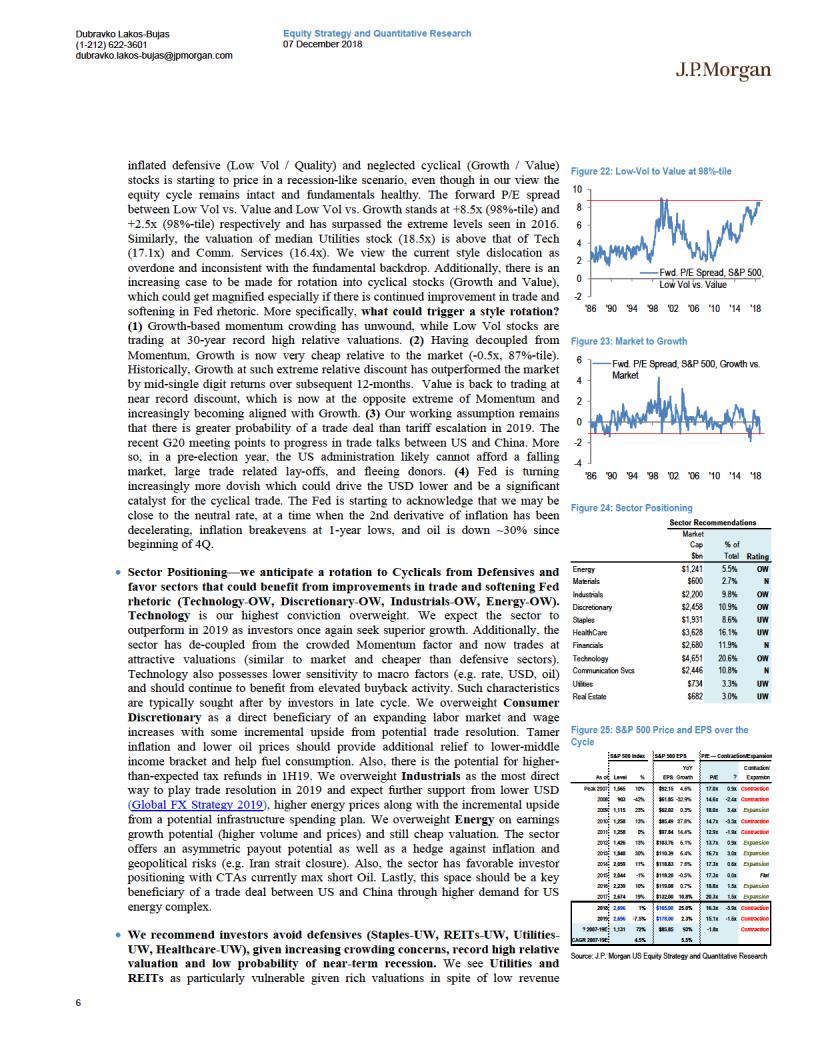

growth and minimal margin expansion opportunities. Both remain sensitive to rising rates and rising capital costs given high capital intensity. Staples are likely to remain in “stagflation” with companies finding it difficult to increase volume and raise prices due to market share erosion and declining pricing power, especially given rising labor, freight, and general overhead costs. We downgrade Healthcare to underweight as the sector has benefited from its defensive growth status and seen its relative valuation expand over the last year. While the sector will continue to provide sustainable growth over the long-term, we believe the political rhetoric could turn increasingly more negative on healthcare leading up to the 2020 presidential elections. We take a neutral view on Financials as the sector will increasingly come under pressure from flattening yield curve, slower loan growth, rising deposit costs, and higher provisions. On the contrary, the sector should remain supported by cheap valuation and elevated buyback as well as dividend payouts.

Investment Themes

Long Ideas

1.J.P. Morgan Oversold Secular Growth Basket (JPAMOSSG)

Many high quality secular growth stocks have seen significant de-rating and are now trading at sharply lower valuations. The JPAMOSGG basket trades at a multiple of 15.6x and is expected to deliver above consensus topline growth (9%) and earnings growth (16%).

2.J.P. Morgan China/Trade Sensitive Basket (JPAMCNEX)

The basket constituents have high China exposure and high mentions per million of trade/tariff concerns (based on textual analysis of ~2,000 earnings transcripts). The basket is underperforming the market by ~10% YTD and trades above market multiple. It is expected to deliver inline topline growth and slightly better bottom line growth. We expect this basket to outperform as we progress towards trade resolution.

3.J.P. Morgan Oil Beneficiaries Basket (JPAMNRGY)

This basket contains high conviction Energy stocks that our fundamental analysts think are best positioned for an environment where oil stays flat or surprises to the upside from current levels.

Short Ideas

4.J.P. Morgan Expensive Defensives Basket (JPAMEXDF)

We recommend shorting the defensive (Low Vol) stocks that are currently trading at extreme valuations and possess relatively low growth profile. As sentiment improves, we expect this extreme style dislocation to reverse and the JAPMEXDF basket to underperform.

7

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943