JPM_Global Asset Allocation_watermark

.pdf

vk.com/id446425943

vk.com/id446425943

vk.com/id446425943

Nikolaos Panigirtzoglou |

John Normand |

(44-20) 7134-7815 |

(44-20) 7134-1816 |

nikolaos panigirtzoglou@jpmorgan.com john.normand@jpmorgan.com

Marko Kolanovic, PhD (1-212) 272-1438

marko.kolanovic@jpmorgan.com

19 Sep. Target of $0.4/bbl and stop loss of $0/bbl. Closed the trade on 18 Oct at a loss of $0.17/bbl and 0.26% of the underlying.

Abhishek DeshpandeAC (1-212) 834-3102

J.P. Morgan Securities LLC

Close long Dec’19-Jan’20 ICE Brent spread at $0.34/bbl

We closed the trade as it reached our stop loss.

Abhishek DeshpandeAC (1-212) 834-3102

J.P. Morgan Securities LLC

Global Cross-Asset Strategy

07 December 2018

23

vk.com/id446425943

vk.com/id446425943

Nikolaos Panigirtzoglou |

John Normand |

Global Cross-Asset Strategy |

(44-20) 7134-7815 |

(44-20) 7134-1816 |

07 December 2018 |

nikolaos panigirtzoglou@jpmorgan.com john.normand@jpmorgan.com

Marko Kolanovic, PhD (1-212) 272-1438

marko.kolanovic@jpmorgan.com

Global Economic Outlook Summary

|

|

|

|

Real GDP |

|

|

|

|

|

|

|

|

Real GDP |

|

|

|

|

|

|

|

|

|

|

Consumer prices |

|

|

|

|

|

|||||||||||||

|

|

|

% over a year ago |

|

|

|

% over previous period, saar |

|

|

|

|

|

|

|

|

|

|

% over a year ago |

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

2018 |

|

2019 |

|

2020 |

|

2Q18 |

|

3Q18 |

|

4Q18 |

|

1Q19 |

|

2Q19 |

|

3Q19 |

|

|

|

|

2Q18 |

|

|

|

4Q18 |

|

|

|

2Q19 |

|

|

|

4Q19 |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

2.9 |

|

2.4 |

|

1.5 |

|

4.2 |

|

3.5 |

|

2.5 |

|

2.3 |

|

2.0 |

|

1.8 |

|

2.6 |

2.3 |

|

1.7 |

|

1.8 |

|

|||||||||||||||||

Canada |

2.1 |

|

2.2 |

|

1.6 |

|

2.9 |

|

2.0 |

|

2.5 |

|

2.2 |

|

2.2 |

|

1.9 |

|

2.3 |

2.2 |

|

2.1 |

|

2.2 |

|

|||||||||||||||||

Latin America |

1.2 |

|

1.8 |

|

2.2 |

|

-1.2 |

|

2.2 |

|

-0.7 |

|

1.9 |

|

3.7 |

|

3.1 |

|

3.5 |

4.1 |

|

4.1 |

|

3.8 |

|

|||||||||||||||||

Argentina |

-2.7 |

|

-1.5 |

|

2.6 |

|

-15.2 |

|

-0.5 |

-13.0 |

|

-1.0 |

|

8.0 |

|

5.0 |

|

27.1 |

47.4 |

|

48.1 |

|

27.7 |

|

||||||||||||||||||

Brazil |

1.2 |

|

2.3 |

|

2.2 |

|

0.7 |

|

3.1 |

|

0.6 |

|

2.6 |

|

3.2 |

|

3.2 |

|

3.3 |

4.2 |

|

4.3 |

|

4.0 |

|

|||||||||||||||||

Chile |

3.8 |

|

3.5 |

|

3.0 |

|

2.7 |

|

1.1 |

|

3.0 |

|

4.0 |

|

4.2 |

|

4.0 |

|

2.2 |

3.0 |

|

3.6 |

|

3.6 |

|

|||||||||||||||||

Colombia |

2.7 |

|

3.1 |

|

3.1 |

|

2.4 |

|

0.9 |

|

3.0 |

|

2.8 |

|

4.5 |

|

3.5 |

|

3.2 |

3.4 |

|

3.6 |

|

3.8 |

|

|||||||||||||||||

Ecuador |

0.2 |

|

-0.7 |

|

-0.8 |

|

1.5 |

|

-2.5 |

|

0.8 |

|

-1.5 |

|

0.0 |

|

-2.0 |

|

-0.8 |

0.0 |

|

0.3 |

|

0.5 |

|

|||||||||||||||||

Mex ico |

2.0 |

|

1.9 |

|

1.7 |

|

-0.4 |

|

3.4 |

|

1.0 |

|

1.5 |

|

2.0 |

|

1.8 |

|

4.6 |

4.6 |

|

4.1 |

|

3.6 |

|

|||||||||||||||||

Peru |

4.0 |

|

3.9 |

|

3.6 |

|

5.4 |

|

1.0 |

|

3.0 |

|

4.5 |

|

4.0 |

|

4.0 |

|

0.9 |

2.4 |

|

2.6 |

|

2.7 |

|

|||||||||||||||||

Venezuela |

-10.0 |

|

|

|

|

… |

|

0.0 |

|

0.0 |

|

1.0 |

|

2.0 |

|

… |

|

… |

|

… |

|

28250 |

600000 |

|

.. |

|

.. |

|

||||||||||||||

Asia/Pacific |

4.9 |

|

4.6 |

|

4.5 |

|

5.2 |

|

3.9 |

|

4.8 |

|

4.6 |

|

4.5 |

|

5.0 |

|

2.0 |

2.3 |

|

2.7 |

|

2.4 |

|

|||||||||||||||||

Japan |

1.0 |

|

1.2 |

|

0.6 |

|

3.0 |

|

-1.2 |

|

3.0 |

|

1.5 |

|

1.0 |

|

2.5 |

|

0.6 |

0.9 |

|

0.7 |

|

0.7 |

|

|||||||||||||||||

Australia |

2.9 |

|

2.5 |

|

2.7 |

|

3.6 |

|

1.0 |

|

1.9 |

|

2.8 |

|

3.0 |

|

2.8 |

|

2.1 |

2.1 |

|

2.4 |

|

2.2 |

|

|||||||||||||||||

New Zealand |

2.7 |

|

2.5 |

|

2.6 |

|

3.9 |

|

2.8 |

|

1.5 |

|

2.8 |

|

2.5 |

|

2.5 |

|

1.5 |

2.4 |

|

2.5 |

|

2.1 |

|

|||||||||||||||||

EM Asia |

6.0 |

|

5.6 |

|

5.6 |

|

5.8 |

|

5.4 |

|

5.5 |

|

5.5 |

|

5.5 |

|

5.8 |

|

2.3 |

2.6 |

|

3.3 |

|

2.9 |

|

|||||||||||||||||

China |

6.6 |

|

6.1 |

|

6.1 |

|

6.6 |

|

6.0 |

|

6.1 |

|

5.9 |

|

5.9 |

|

6.3 |

|

1.8 |

2.6 |

|

3.4 |

|

2.7 |

|

|||||||||||||||||

India |

7.3 |

|

7.2 |

|

7.1 |

|

7.6 |

|

6.9 |

|

6.8 |

|

6.6 |

|

7.1 |

|

7.5 |

|

4.8 |

3.4 |

|

4.6 |

|

5.0 |

|

|||||||||||||||||

Ex China/India |

3.7 |

|

3.5 |

|

3.5 |

|

2.9 |

|

2.9 |

|

3.4 |

|

3.8 |

|

3.5 |

|

3.7 |

|

2.1 |

2.1 |

|

2.2 |

|

2.2 |

|

|||||||||||||||||

Hong Kong |

3.3 |

|

2.7 |

|

2.6 |

|

-0.8 |

|

0.4 |

|

2.0 |

|

4.0 |

|

3.5 |

|

3.3 |

|

2.1 |

2.6 |

|

2.8 |

|

3.0 |

|

|||||||||||||||||

Indonesia |

5.1 |

|

4.8 |

|

4.9 |

|

5.8 |

|

4.8 |

|

4.7 |

|

5.0 |

|

4.8 |

|

4.9 |

|

3.3 |

3.0 |

|

3.2 |

|

3.4 |

|

|||||||||||||||||

Korea |

2.6 |

|

2.7 |

|

2.6 |

|

2.4 |

|

2.3 |

|

2.4 |

|

2.8 |

|

2.8 |

|

2.9 |

|

1.5 |

1.8 |

|

1.7 |

|

1.7 |

|

|||||||||||||||||

Malay sia |

4.7 |

|

4.7 |

|

4.5 |

|

1.2 |

|

6.7 |

|

4.0 |

|

4.7 |

|

4.5 |

|

4.5 |

|

1.3 |

0.3 |

|

1.3 |

|

1.8 |

|

|||||||||||||||||

Philippines |

6.3 |

|

6.2 |

|

6.3 |

|

6.3 |

|

5.9 |

|

6.6 |

|

5.7 |

|

6.1 |

|

6.6 |

|

4.8 |

6.5 |

|

4.5 |

|

2.5 |

|

|||||||||||||||||

Singapore |

3.0 |

|

2.4 |

|

3.0 |

|

1.0 |

|

3.0 |

|

0.9 |

|

4.4 |

|

1.0 |

|

2.8 |

|

0.3 |

0.9 |

|

1.4 |

|

1.6 |

|

|||||||||||||||||

Taiw an |

2.7 |

|

2.1 |

|

2.1 |

|

1.1 |

|

1.5 |

|

2.7 |

|

1.9 |

|

2.1 |

|

2.2 |

|

1.7 |

1.5 |

|

1.7 |

|

2.0 |

|

|||||||||||||||||

Thailand |

4.2 |

|

3.8 |

|

3.8 |

|

3.7 |

|

-0.1 |

|

4.5 |

|

4.4 |

|

3.5 |

|

4.5 |

|

1.3 |

1.1 |

|

1.2 |

|

1.3 |

|

|||||||||||||||||

Western Europe |

1.9 |

|

1.9 |

|

1.9 |

|

1.8 |

|

1.0 |

|

2.3 |

|

1.9 |

|

2.0 |

|

2.0 |

|

1.8 |

2.1 |

|

1.6 |

|

1.4 |

|

|||||||||||||||||

Euro area |

2.0 |

|

1.9 |

|

1.9 |

|

1.8 |

|

0.7 |

|

2.5 |

|

2.0 |

|

2.0 |

|

2.0 |

|

1.7 |

2.0 |

|

1.4 |

|

1.2 |

|

|||||||||||||||||

Germany |

1.7 |

|

2.1 |

|

1.9 |

|

1.8 |

|

-0.8 |

|

3.5 |

|

2.5 |

|

2.3 |

|

2.0 |

|

1.9 |

2.2 |

|

1.9 |

|

1.5 |

|

|||||||||||||||||

France |

1.6 |

|

1.9 |

|

1.9 |

|

0.6 |

|

1.6 |

|

2.0 |

|

2.0 |

|

2.0 |

|

2.0 |

|

2.1 |

2.2 |

|

1.4 |

|

1.3 |

|

|||||||||||||||||

Italy |

1.0 |

|

0.6 |

|

0.9 |

|

0.7 |

|

-0.5 |

|

1.0 |

|

0.5 |

|

0.8 |

|

0.8 |

|

1.0 |

1.6 |

|

1.1 |

|

1.0 |

|

|||||||||||||||||

Spain |

2.5 |

|

2.3 |

|

1.9 |

|

2.3 |

|

2.4 |

|

2.5 |

|

2.3 |

|

2.3 |

|

2.0 |

|

1.8 |

1.9 |

|

1.1 |

|

1.1 |

|

|||||||||||||||||

Norw ay |

2.4 |

|

2.1 |

|

2.0 |

|

2.7 |

|

1.1 |

|

2.8 |

|

2.1 |

|

2.1 |

|

2.1 |

|

2.4 |

3.1 |

|

2.2 |

|

1.1 |

|

|||||||||||||||||

Sw eden |

2.4 |

|

1.9 |

|

1.8 |

|

2.0 |

|

-0.9 |

|

3.3 |

|

2.0 |

|

2.0 |

|

2.0 |

|

1.9 |

2.6 |

|

2.6 |

|

2.5 |

|

|||||||||||||||||

United Kingdom |

1.3 |

|

1.8 |

|

1.8 |

|

1.6 |

|

2.5 |

|

1.0 |

|

1.5 |

|

2.0 |

|

2.3 |

|

2.4 |

2.2 |

|

2.2 |

|

2.1 |

|

|||||||||||||||||

EMEA EM |

2.7 |

|

1.9 |

|

2.5 |

|

3.1 |

|

0.0 |

|

1.0 |

|

1.0 |

|

2.8 |

|

3.3 |

|

4.6 |

7.1 |

|

7.1 |

|

5.5 |

|

|||||||||||||||||

Czech Republic |

2.9 |

|

2.8 |

|

3.1 |

|

2.8 |

|

2.3 |

|

4.2 |

|

3.5 |

|

3.3 |

|

3.3 |

|

2.3 |

2.2 |

|

2.7 |

|

2.3 |

|

|||||||||||||||||

Hungary |

4.7 |

|

3.8 |

|

2.8 |

|

4.4 |

|

5.5 |

|

3.0 |

|

4.0 |

|

4.0 |

|

3.5 |

|

2.7 |

3.4 |

|

3.3 |

|

2.5 |

|

|||||||||||||||||

Israel |

3.4 |

|

3.4 |

|

3.5 |

|

1.2 |

|

2.3 |

|

2.0 |

|

3.8 |

|

4.1 |

|

4.2 |

|

0.7 |

1.2 |

|

1.0 |

|

1.4 |

|

|||||||||||||||||

Poland |

|

5.1 |

|

|

|

|

4.0 |

|

|

|

3.5 |

|

4.5 |

|

7.0 |

|

3.0 |

|

3.8 |

|

3.8 |

|

3.8 |

|

|

|

|

1.7 |

|

|

|

1.6 |

|

|

|

2.3 |

|

|

|

2.5 |

|

|

Romania |

4.2 |

|

3.0 |

|

1.5 |

|

6.0 |

|

7.8 |

|

1.2 |

|

2.0 |

|

2.0 |

|

2.7 |

|

5.3 |

4.0 |

|

3.2 |

|

3.9 |

|

|||||||||||||||||

Russia |

1.6 |

|

1.4 |

|

1.6 |

|

3.1 |

|

0.0 |

|

1.3 |

|

0.3 |

|

2.0 |

|

2.5 |

|

2.5 |

3.8 |

|

5.0 |

|

4.6 |

|

|||||||||||||||||

South Africa |

0.5 |

|

1.2 |

|

1.1 |

|

-0.4 |

|

2.2 |

|

2.5 |

|

0.0 |

|

1.3 |

|

1.5 |

|

4.5 |

5.0 |

|

5.5 |

|

5.5 |

|

|||||||||||||||||

Turkey |

3.3 |

|

0.2 |

|

3.7 |

|

3.8 |

|

-9.6 |

|

-2.8 |

|

-1.6 |

|

3.8 |

|

5.0 |

|

12.8 |

22.5 |

|

20.0 |

|

12.6 |

|

|||||||||||||||||

Global |

3.3 |

|

3.0 |

|

2.8 |

|

3.6 |

|

2.8 |

|

3.0 |

|

2.9 |

|

3.1 |

|

3.2 |

|

2.4 |

2.6 |

|

2.5 |

|

2.3 |

|

|||||||||||||||||

Dev eloped markets |

2.3 |

|

2.1 |

|

1.6 |

|

3.1 |

|

1.9 |

|

2.5 |

|

2.1 |

|

1.9 |

|

2.0 |

|

2.1 |

2.0 |

|

1.6 |

|

1.6 |

|

|||||||||||||||||

Emerging markets |

4.7 |

|

4.4 |

|

4.6 |

|

4.3 |

|

4.0 |

|

3.8 |

|

4.2 |

|

4.8 |

|

5.0 |

|

2.8 |

3.5 |

|

4.0 |

|

3.4 |

|

|||||||||||||||||

Source: J.P. Morgan

25

vk.com/id446425943

Nikolaos Panigirtzoglou |

|

John Normand |

|

Global Cross-Asset Strategy |

|

|

|

|

|

||||

(44-20) 7134-7815 |

|

(44-20) 7134-1816 |

07 December 2018 |

|

|

|

|

|

|||||

nikolaos panigirtzoglou@jpmorgan.com john.normand@jpmorgan.com |

|

|

|

|

|

|

|

|

|||||

Marko Kolanovic, PhD |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1-212) 272-1438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

marko.kolanovic@jpmorgan.com |

|

|

|

|

|

|

|

|

|

|

|

||

Central Bank Policy Rate Watch |

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

Forecast (%pa) |

|

|||

|

Official |

Current |

Change since (bp) |

Last change |

Next meeting |

Forecast |

|

|

|||||

|

rate |

|

|

|

|

|

|

|

|

|

|||

|

rate (%pa) |

05-07 avg |

oya |

next change |

Dec 18 |

Mar 19 |

Jun 19 |

Sep 19 |

Dec 19 |

||||

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Global |

|

2.65 |

-145 |

44 |

|

|

|

|

2.73 |

2.83 |

2.93 |

3.05 |

3.19 |

ex cluding US |

|

2.81 |

-140 |

67 |

|

|

|

|

2.82 |

2.86 |

2.90 |

2.97 |

3.07 |

Dev eloped |

|

1.04 |

-205 |

36 |

|

|

|

|

1.16 |

1.28 |

1.42 |

1.59 |

1.80 |

Emerging |

|

5.35 |

-167 |

50 |

|

|

|

|

5.37 |

5.43 |

5.46 |

5.50 |

5.53 |

Latin America |

|

6.35 |

-456 |

2 |

|

|

|

|

6.43 |

6.55 |

6.84 |

7.38 |

7.88 |

EMEA EM |

|

9.11 |

262 |

258 |

|

|

|

|

9.11 |

9.26 |

9.07 |

8.58 |

7.97 |

EM Asia |

|

4.28 |

-142 |

9 |

|

|

|

|

4.29 |

4.32 |

4.34 |

4.39 |

4.46 |

The Americas |

|

2.86 |

-228 |

87 |

|

|

|

|

3.07 |

3.30 |

3.56 |

3.85 |

4.14 |

United States |

Fed funds |

2.25 |

-208 |

100 |

26 Sep 18 (+25bp) |

19 Dec 18 |

19 Dec 18 (+25bp) |

2.50 |

2.75 |

3.00 |

3.25 |

3.50 |

|

Canada |

O/N rate |

1.75 |

-188 |

75 |

24 Oct 18 (+25bp) |

9 Jan 19 |

|

Jan 19 (+25bp) |

1.75 |

2.00 |

2.25 |

2.50 |

2.75 |

Brazil |

SELIC O/N |

6.50 |

-894 |

-50 |

21 Mar 18 (-25bp) |

12 Dec 18 |

|

Jun 19 (+25bp) |

6.50 |

6.50 |

6.75 |

7.75 |

8.75 |

Mex ico |

Repo rate |

8.00 |

6 |

93 |

15 Nov 18 (+25bp) |

20 Dec 18 |

20 Dec 18 (+25bp) |

8.25 |

8.50 |

8.75 |

8.75 |

8.75 |

|

Chile |

Disc rate |

2.75 |

-175 |

25 |

18 Oct 18 (+25bp) |

1 Feb 19 |

|

Jan 19 (+25bp) |

2.75 |

3.00 |

3.25 |

3.50 |

3.50 |

Colombia |

Repo rate |

4.25 |

-300 |

-50 |

29 Jan 18 (-25bp) |

21 Dec 18 |

|

Mar 19 (+25bp) |

4.25 |

4.50 |

5.00 |

5.25 |

5.25 |

Peru |

Reference |

2.75 |

-123 |

-50 |

8 Mar 18 (-25bp) |

13 Dec 18 |

|

Jan 19 (+25bp) |

2.75 |

3.00 |

3.50 |

3.75 |

4.00 |

Europe/Africa |

|

1.68 |

-200 |

42 |

|

|

|

|

1.68 |

1.72 |

1.72 |

1.72 |

1.80 |

Euro area |

Depo rate |

-0.40 |

-238 |

0 |

10 Mar 16 (-5bp) |

13 Dec 18 |

|

3Q 19 (+15bp) |

-0.40 |

-0.40 -0.40 |

-0.25 |

0.00 |

|

United Kingdom |

Bank rate |

0.75 |

-417 |

25 |

2 Aug 18 (+25bp) |

20 Dec 18 |

|

May 19 (+25bp) |

0.75 |

0.75 |

1.00 |

1.00 |

1.25 |

Norw ay |

Dep rate |

0.75 |

-233 |

25 |

20 Sep 18 (+25bp) |

13 Dec 18 |

|

1Q 19 (+25bp) |

0.75 |

1.00 |

1.00 |

1.25 |

1.25 |

Sw eden |

Repo rate |

-0.50 |

-302 |

0 |

11 Feb 16 (-15bp) |

20 Dec 18 |

|

4Q 18 (+25bp) |

-0.25 |

-0.25 |

0.00 |

0.00 |

0.25 |

Czech Republic |

2-w k repo |

1.75 |

-65 |

125 |

1 Nov 18 (+25bp) |

20 Dec 18 |

|

1Q 19 (+25bp) |

1.75 |

2.00 |

2.25 |

2.25 |

2.25 |

Hungary |

3-m dep |

0.90 |

-641 |

0 |

21 May 16 (-15bp) |

18 Dec 18 |

|

3Q 19 (+20bp) |

0.90 |

0.90 |

0.90 |

1.10 |

1.50 |

Israel |

Base rate |

0.25 |

-397 |

15 |

26 Nov 18 (+15bp) |

- |

|

1Q 19 (+25bp) |

0.25 |

0.50 |

0.75 |

1.00 |

1.00 |

Poland |

7-day interv |

1.50 |

-317 |

0 |

4 Mar 15 (-50bp) |

9 Jan 19 |

|

4Q 19 (+25bp) |

1.50 |

1.50 |

1.50 |

1.50 |

1.75 |

Romania |

Base rate |

2.50 |

-644 |

75 |

7 May 18 (+25bp) |

- |

|

2Q 19 (+25bp) |

2.50 |

2.50 |

2.75 |

3.25 |

3.75 |

Russia |

Repo rate |

7.50 |

550 |

-75 |

14 Sep 18 (+25bp) |

14 Dec 18 |

|

Mar 19 (+25bp) |

7.50 |

7.75 |

7.75 |

7.75 |

7.75 |

South Africa |

Repo rate |

6.75 |

-148 |

0 |

22 Nov 18 (+25bp) |

17 Jan 19 |

|

Mar 19 (+25bp) |

6.75 |

7.00 |

7.00 |

7.25 |

7.25 |

Turkey |

1-w k repo |

24.00 |

799 |

1175 |

13 Sep 18 (+625bp) |

13 Dec 18 |

|

Jun 19 (-100bp) |

24.00 |

24.00 |

23.00 |

20.50 |

17.50 |

Asia/Pacific |

|

3.28 |

-34 |

11 |

|

|

|

|

3.28 |

3.30 |

3.32 |

3.36 |

3.41 |

Australia |

Cash rate |

1.50 |

-438 |

0 |

2 Aug 16 (-25bp) |

5 Feb 19 |

|

On hold |

1.50 |

1.50 |

1.50 |

1.50 |

1.50 |

New Zealand |

Cash rate |

1.75 |

-556 |

0 |

11 Aug 16 (-25bp) |

13 Feb 18 |

|

On hold |

1.75 |

1.75 |

1.75 |

1.75 |

1.75 |

Japan |

O/N call rat |

-0.10 |

-33 |

-6 |

28 Jan 16 (-20bp) |

23 Jan 19 |

|

On hold |

-0.10 |

-0.10 -0.10 |

-0.10 |

-0.10 |

|

Hong Kong |

Disc. w ndw |

2.50 |

-331 |

100 |

26 Sep 18 (+25bp) |

- |

|

19 Dec 18 (+25bp) |

2.75 |

3.00 |

3.25 |

3.50 |

3.75 |

China |

1-y r w orkin |

4.35 |

-175 |

0 |

23 Oct 15 (-25bp) |

- |

|

On hold |

4.35 |

4.35 |

4.35 |

4.35 |

4.35 |

Korea |

Base rate |

1.75 |

-233 |

25 |

30 Nov 18 (+25bp) |

- |

|

4Q 19 (+25bp) |

1.75 |

1.75 |

1.75 |

1.75 |

2.00 |

Indonesia |

BI rate |

6.00 |

-368 |

175 |

15 Nov 18 (+25bp) |

20 Dec 18 |

|

1Q 19 (+25bp) |

6.00 |

6.25 |

6.50 |

6.75 |

7.00 |

India |

Repo rate |

6.50 |

-31 |

50 |

1 Aug 18 (+25bp) |

9 Feb 19 |

|

3Q 19 (+25bp) |

6.50 |

6.50 |

6.50 |

6.75 |

7.00 |

Malay sia |

O/N rate |

3.25 |

5 |

25 |

25 Jan 18 (+25bp) |

- |

|

On hold |

3.25 |

3.25 |

3.25 |

3.25 |

3.25 |

Philippines |

Rev repo |

4.75 |

-229 |

175 |

15 Nov 18 (+50bp) |

13 Dec 18 |

|

1Q 19 (+25bp) |

4.75 |

5.00 |

5.00 |

5.00 |

5.00 |

Thailand |

1-day repo |

1.50 |

-219 |

0 |

29 Apr 15 (-25bp) |

19 Dec 18 |

|

4Q 18 (+25bp) |

1.75 |

2.00 |

2.00 |

2.00 |

2.00 |

Taiw an |

Official disc. |

1.38 |

-114 |

138 |

30 Jun 16 (-12.5bp) |

20 Dec 18 |

|

2Q 19 (+13bp) |

1.38 |

1.38 |

1.50 |

1.63 |

1.75 |

Source: J.P. Morgan. 1BoJ targets ¥80tn/year expansion in monetary base and sets the IOER (O/N) as policy guidance. Bold denotes move since last GDW and forecast changes. Underline denotes policy meeting during upcoming week.

Aggregates are GDP-weighted averages. 2The BI rate for Indonesia reflects announced recalibration effective August 19, 2016. 3 The Philippines introduced a recalibrated reverse repo rate effective June 3 at a level of 3.00% .

Rather than the refi rate, we now display the 1-wk dep rate, which better represents CBR policy stance and is closer to interbank market rates.

26

vk.com/id446425943

Nikolaos Panigirtzoglou |

|

John Normand |

|

|

Global Cross-Asset Strategy |

|

|

|

|

|

|

|||||

(44-20) 7134-7815 |

|

(44-20) 7134-1816 |

|

|

07 December 2018 |

|

|

|

|

|

|

|||||

nikolaos panigirtzoglou@jpmorgan.com john.normand@jpmorgan.com |

|

|

|

|

|

|

|

|

|

|||||||

Marko Kolanovic, PhD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1-212) 272-1438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

marko.kolanovic@jpmorgan.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Global Rates Forecast |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

YTD chg. |

|

|

|

|

|

|

|

|

YTD chg. |

|

|

07-Dec* |

Mar-19 Jun-19 S ep-19 |

Dec-19 |

(bp) |

|

|

|

07-Dec* |

Mar-19 Jun-19 Sep-19 Dec-19 |

(bp) |

|||||

US |

Fed funds |

2.00-2.25 2.50-2.75 2.75-3.00 3.00-3 25 3.25-3 50 |

75 |

|

UK |

Base rate |

0.75 |

1.00 |

1.00 |

1.25 |

1 25 |

25 |

||||

|

3M Libor |

2.77 |

2.95 |

3.20 |

3.45 |

3.70 |

108 |

|

|

3M Libor |

0 91 |

1.05 |

1.05 |

1.30 |

1 30 |

39 |

|

2Y bmk yield |

2.76 |

3.25 |

3.45 |

3.60 |

3.70 |

87 |

|

|

2Y bmk yield |

0.75 |

0.95 |

1.10 |

1.20 |

1 35 |

31 |

|

5Y bmk yield |

2.75 |

3.30 |

3.45 |

3.55 |

3.60 |

54 |

|

|

5Y bmk yield |

0.80 |

1.05 |

1.20 |

1.30 |

1.40 |

9 |

|

10Y bmk yield |

2.89 |

3.35 |

3.50 |

3.55 |

3.60 |

48 |

|

|

10Y bmk yield |

1 28 |

1.65 |

1.75 |

1.85 |

1 90 |

9 |

|

30Y bmk yield |

3.17 |

3.45 |

3.55 |

3.55 |

3 55 |

43 |

|

|

30Y bmk yield |

1.84 |

2.10 |

2.15 |

2.20 |

2 25 |

9 |

|

2s/10s bmk curve |

13 |

10 |

5 |

-5 |

-10 |

-39 |

|

|

2s/10s bmk curve |

53 |

70 |

65 |

65 |

55 |

-22 |

|

10s/30s bmk curve |

28 |

10 |

5 |

0 |

-5 |

-6 |

|

|

10s/30s bmk curve |

57 |

45 |

40 |

35 |

35 |

0 |

|

2s/30s bmk curve |

41 |

20 |

10 |

-5 |

-15 |

-44 |

|

|

2s/30s bmk curve |

110 |

115 |

105 |

100 |

90 |

-22 |

|

2Y swap spread |

16 |

17 |

18 |

20 |

21 |

-2 |

|

|

2Y swap spread |

21 |

30 |

35 |

40 |

40 |

-8 |

|

5Y swap spread |

13 |

15 |

17 |

18 |

19 |

10 |

|

|

5Y swap spread |

47 |

40 |

40 |

45 |

50 |

18 |

|

10Y swap spread |

6 |

9 |

10 |

11 |

11 |

8 |

|

|

10Y swap spread |

19 |

10 |

15 |

20 |

25 |

10 |

|

30Y swap spread |

-13 |

-2 |

0 |

2 |

4 |

8 |

|

|

30Y swap spread |

-21 |

-20 |

-15 |

-10 |

0 |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Euro area |

Refi rate |

0.00 |

0.00 |

0.00 |

0.00 |

0 25 |

- |

|

Japan |

Policy rate |

-0.10 |

-0.10 |

-0.10 |

-0.10 |

-0.10 |

- |

|

Depo rate |

-0.40 |

-0.40 |

-0.40 |

-0.25 |

0.00 |

- |

|

|

10Y yield target |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

- |

|

3M Euribor |

-0 31 |

-0.32 |

-0.32 |

-0.17 |

0.08 |

1 |

|

|

2Y bmk yield |

-0.16 |

-0.10 |

-0.10 |

-0.05 |

-0.05 |

-2 |

|

2Y bmk yield |

-0.60 |

-0.50 |

-0.45 |

-0.30 |

-0.15 |

2 |

|

|

5Y bmk yield |

-0.13 |

-0.05 |

-0.05 |

0.00 |

0.00 |

-3 |

|

5Y bmk yield |

-0 30 |

-0.05 |

0.05 |

0.30 |

0.45 |

-10 |

|

|

10Y bmk yield |

0.05 |

0.15 |

0.20 |

0.20 |

0 20 |

0 |

|

10Y bmk yield |

0 26 |

0.55 |

0.65 |

0.90 |

1.00 |

-16 |

|

|

20Y bmk yield |

0 56 |

0.75 |

0.80 |

0.85 |

0 90 |

-1 |

|

30Y bmk yield |

0 90 |

1.20 |

1.25 |

1.40 |

1.45 |

-34 |

|

|

30Y bmk yield |

0.78 |

0.95 |

1.00 |

1.05 |

1.10 |

-3 |

|

2s/10s bmk curve |

86 |

105 |

110 |

120 |

115 |

-18 |

|

|

2s/10s bmk curve |

21 |

25 |

30 |

25 |

25 |

2 |

|

10s/30s bmk curve |

64 |

65 |

60 |

50 |

45 |

-18 |

|

|

10s/30s bmk curve |

73 |

80 |

80 |

85 |

90 |

-3 |

|

2s/30s bmk curve |

150 |

170 |

170 |

170 |

160 |

-36 |

|

|

2s/30s bmk curve |

94 |

105 |

110 |

110 |

115 |

-1 |

|

2Y swap spread |

46 |

50 |

48 |

46 |

44 |

1 |

|

|

|

|

|

|

|

|

|

|

5Y swap spread |

55 |

52 |

48 |

46 |

46 |

7 |

|

Australia |

Cash rate |

1 50 |

1.50 |

1.50 |

1.50 |

1 50 |

- |

|

10Y swap spread |

57 |

52 |

48 |

46 |

46 |

15 |

|

|

3Y bmk yield |

1 93 |

2.15 |

2.25 |

2.20 |

2 35 |

-21 |

|

30Y swap spread |

53 |

46 |

42 |

42 |

40 |

27 |

|

|

10Y bmk yield |

2.45 |

2.80 |

2.90 |

2.90 |

3.00 |

-19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Zealand Cash rate |

1.75 |

1.75 |

1.75 |

1.75 |

1.75 |

- |

|

10Y spread |

Austria |

31 |

25 |

25 |

20 |

20 |

13 |

|

|

3Y bmk yield |

1.79 |

1.90 |

2.05 |

2.00 |

2.05 |

-19 |

to Germany |

Belgium |

50 |

50 |

45 |

40 |

35 |

29 |

|

|

10Y bmk yield |

2.43 |

2.80 |

2.90 |

2.90 |

3.00 |

-37 |

(curve adj.) |

Finland |

28 |

30 |

25 |

20 |

20 |

12 |

|

|

|

|

|

|

|

|

|

|

France |

40 |

40 |

35 |

30 |

30 |

14 |

|

Sweden |

Repo rate |

-0 50 |

-0.25 |

-0.25 |

0.00 |

0 25 |

- |

|

Ireland |

67 |

55 |

50 |

45 |

45 |

32 |

|

|

2-year govt |

-0.44 |

-0.25 |

-0.15 |

0.05 |

0.15 |

-2 |

|

Italy |

285 |

325 |

300 |

240 |

225 |

133 |

|

|

10-year govt |

0.46 |

0.85 |

0.95 |

1.15 |

1 20 |

-29 |

|

Netherlands |

15 |

15 |

15 |

10 |

10 |

4 |

|

|

|

|

|

|

|

|

|

|

Portugal |

153 |

150 |

145 |

130 |

115 |

6 |

|

Norway |

Depo rate |

0.75 |

1.00 |

1.00 |

1.25 |

1 25 |

25 |

|

Spain |

120 |

120 |

115 |

110 |

100 |

14 |

|

|

2-year govt |

1.14 |

1.40 |

1.50 |

1.70 |

1 90 |

27 |

|

Wtd. peri. spread |

223 |

243 |

225 |

187 |

174 |

90 |

|

|

10-year govt |

1.74 |

2.15 |

2.30 |

2.60 |

2.70 |

18 |

Source: J.P. Morgan

27

vk.com/id446425943

Nikolaos Panigirtzoglou |

|

John Normand |

|

|

|

|

Global Cross-Asset Strategy |

|

|

|

|

|

||||||||

(44-20) 7134-7815 |

|

|

(44-20) 7134-1816 |

|

|

|

07 December 2018 |

|

|

|

|

|

|

|||||||

nikolaos panigirtzoglou@jpmorgan.com john.normand@jpmorgan.com |

|

|

|

|

|

|

|

|

|

|

||||||||||

Marko Kolanovic, PhD |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

(1-212) 272-1438 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

marko.kolanovic@jpmorgan.com |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

FX Forecasts vs. Forwards & Consensus |

|

|

|

|

|

|||||||||||||||

Exchange rates vs. U.S dollar |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

Current |

|

|

|

|

|

|

|

|

|

JPM forecast gain/loss vs December 19* |

|

Actual change in local FX vs USD |

|||||

Majors |

|

|

7-Dec |

Mar 19 |

|

Jun 19 |

|

Sep 19 |

|

Dec 19 |

|

|

Spot |

Forwards |

Consensus** |

|

Past 1mo |

Past 3mo |

YTD |

Past 12mos |

|

EUR |

1.14 |

1.11 |

|

1.13 |

|

1.16 |

|

1.18 |

|

|

3.7% |

0.2% |

-1.7% |

|

-0.4% |

-1.5% |

-5.3% |

-3.3% |

|

|

JPY |

112.8 |

116.0 |

|

118.0 |

|

115.0 |

|

112.0 |

|

0.7% |

-2.7% |

-2.7% |

0.7% |

-1.6% |

-0.1% |

0.3% |

|||

|

GBP |

1.27 |

1.31 |

|

1.33 |

|

1.36 |

|

1.37 |

|

|

7.8% |

5.7% |

0.9% |

|

-3.0% |

-1.4% |

-5.7% |

-5.5% |

|

|

AUD |

0.72 |

0.70 |

|

0.69 |

|

0.68 |

|

0.68 |

|

-5.9% |

-6.6% |

-9.3% |

-0.7% |

1.7% |

-7.4% |

-3.8% |

|||

|

CAD |

1.33 |

1.33 |

|

1.30 |

|

1.28 |

|

1.26 |

|

|

5.4% |

4.7% |

0.0% |

|

-1.3% |

-0.9% |

-5.5% |

-3.2% |

|

|

NZD |

0.69 |

0.64 |

|

0.63 |

|

0.62 |

|

0.61 |

|

-11.2% |

-11.8% |

-10.3% |

1.2% |

5.1% |

-3.3% |

0.6% |

|||

JPM USD index |

123.1 |

125.3 |

|

125.5 |

|

124.7 |

|

123.8 |

|

|

0.6% |

0.4% |

2.9% |

|

0.8% |

1.5% |

5.7% |

4.8% |

||

DXY |

|

|

96.7 |

98.3 |

|

97.0 |

|

94.7 |

|

93.1 |

|

-3.8% |

-0.9% |

1.4% |

0.8% |

1.4% |

4.9% |

3.1% |

||

Europe, Middle East & Africa |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

CHF |

0.99 |

1.01 |

|

1.00 |

|

0.98 |

|

0.975 |

|

|

1.9% |

-2.0% |

0.0% |

|

1.0% |

-2.4% |

-1.8% |

0.2% |

|

|

ILS |

3.74 |

3.65 |

|

3.65 |

|

3.60 |

|

3.55 |

|

5.3% |

2.1% |

2.5% |

-1.8% |

-3.9% |

-7.0% |

-5.9% |

|||

|

SEK |

9.03 |

9.10 |

|

8.89 |

|

8.66 |

|

8.52 |

|

|

6.0% |

2.6% |

-4.1% |

|

0.0% |

0.4% |

-9.4% |

-6.0% |

|

|

NOK |

8.49 |

8.51 |

|

8.32 |

|

8.10 |

|

7.97 |

|

6.6% |

4.9% |

-4.0% |

-1.7% |

-0.5% |

-3.5% |

-2.1% |

|||

|

CZK |

22.73 |

23.24 |

|

22.83 |

|

22.24 |

|

21.86 |

|

|

4.0% |

2.5% |

-4.3% |

|

-0.4% |

-2.2% |

-6.5% |

-4.4% |

|

|

PLN |

3.77 |

3.87 |

|

3.81 |

|

3.66 |

|

3.60 |

|

4.6% |

3.4% |

-1.7% |

-0.4% |

-0.9% |

-7.5% |

-5.1% |

|||

|

HUF |

284 |

297 |

|

296 |

|

293 |

|

292 |

|

|

-2.9% |

-5.4% |

-7.9% |

|

-0.9% |

-0.9% |

-8.8% |

-5.8% |

|

|

RUB |

66.19 |

68.50 |

|

68.00 |

|

67.50 |

|

67.00 |

|

-1.2% |

3.8% |

0.0% |

0.2% |

5.6% |

-12.9% |

-10.6% |

|||

|

TRY |

5.29 |

5.70 |

|

6.00 |

|

6.50 |

|

7.00 |

|

|

-24.5% |

-9.9% |

-10.3% |

|

1.4% |

21.3% |

-28.3% |

-26.9% |

|

|

ZAR |

14.00 |

15.00 |

|

15.50 |

|

16.00 |

|

16.50 |

|

-15.2% |

-11.0% |

-17.6% |

-0.7% |

8.8% |

-11.5% |

-1.9% |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas |

ARS |

37.31 |

40.00 |

|

42.00 |

|

44.00 |

|

46.00 |

|

|

-18.9% |

15.9% |

0.0% |

|

-4.4% |

-0.9% |

-50.1% |

-53.7% |

|

|

BRL |

3.87 |

3.80 |

|

4.00 |

|

4.10 |

|

4.10 |

|

-5.5% |

-2.6% |

-9.5% |

-3.5% |

4.8% |

-14.6% |

-15.0% |

|||

|

CLP |

674 |

710 |

|

720 |

|

745 |

|

760 |

|

|

-11.3% |

-11.3% |

-11.6% |

|

0.3% |

-2.7% |

-8.7% |

-2.7% |

|

|

COP |

3155 |

3125 |

|

3150 |

|

3175 |

|

3200 |

|

-1.4% |

0.3% |

-5.8% |

-0.4% |

-2.7% |

-5.3% |

-4.6% |

|||

|

MXN |

20.22 |

20.25 |

|

20.50 |

|

20.75 |

|

20.75 |

|

|

-2.5% |

3.9% |

-4.6% |

|

-1.7% |

-4.5% |

-2.8% |

-6.2% |

|

|

PEN |

3.37 |

3.36 |

|

3.38 |

|

3.39 |

|

3.40 |

|

-1.0% |

0.5% |

-2.9% |

-0.1% |

-1.3% |

-3.9% |

-3.9% |

|||

|

VES† |

|

188 |

10000 |

|

50000 |

|

100000 |

|

500000 |

|

|

na |

na |

na |

|

-65.6% |

-67.3% |

na |

na |

LACI |

|

|

54.2 |

53.8 |

|

52.3 |

|

51.2 |

|

50.8 |

|

-6.2% |

0.7% |

-6.6% |

-2.2% |

0.0% |

-13.7% |

-14.8% |

||

Asia |

CNY |

6.87 |

7.09 |

|

7.15 |

|

7.19 |

|

7.20 |

|

-4.5% |

-3.7% |

-5.0% |

0.7% |

-0.4% |

-5.3% |

-3.7% |

|||

|

HKD |

7.82 |

7.83 |

|

7.83 |

|

7.84 |

|

7.84 |

|

|

-0.3% |

-0.9% |

-0.4% |

|

0.2% |

0.4% |

0.0% |

-0.1% |

|

|

IDR |

14480 |

15000 |

|

15200 |

|

15400 |

|

15450 |

|

-6.3% |

-0.8% |

-5.0% |

0.8% |

2.3% |

-6.3% |

-6.4% |

|||

|

INR |

70.81 |

73.50 |

|

74.25 |

|

75.00 |

|

75.50 |

|

|

-6.2% |

-1.5% |

-5.6% |

|

3.1% |

1.3% |

-10.1% |

-8.8% |

|

|

KRW |

1120 |

1145 |

|

1155 |

|

1145 |

|

1130 |

|

-0.9% |

-2.6% |

-0.2% |

0.3% |

0.3% |

-4.4% |

-2.3% |

|||

|

MYR |

4.17 |

4.24 |

|

4.28 |

|

4.27 |

|

4.26 |

|

|

-2.2% |

-1.7% |

-1.4% |

|

-0.1% |

-0.5% |

-2.9% |

-1.9% |

|

|

PHP |

52.71 |

54.00 |

|

54.75 |

|

55.00 |

|

55.25 |

|

-4.6% |

-2.2% |

-2.3% |

0.5% |

1.9% |

-5.3% |

-3.9% |

|||

|

SGD |

1.37 |

1.40 |

|

1.41 |

|

1.40 |

|

1.39 |

|

|

-1.5% |

-2.5% |

-2.9% |

|

0.2% |

0.6% |

-2.5% |

-1.3% |

|

|

TWD |

30.84 |

31.30 |

|

31.50 |

|

31.40 |

|

31.00 |

|

-0.5% |

-3.7% |

0.0% |

-0.3% |

-0.2% |

-3.4% |

-2.6% |

|||

|

THB |

32.81 |

33.50 |

|

33.70 |

|

33.50 |

|

33.40 |

|

|

-1.8% |

-3.0% |

-0.3% |

|

-0.1% |

0.0% |

-0.7% |

-0.5% |

|

ADXY |

|

|

104.8 |

102.2 |

|

101.5 |

|

101.3 |

|

101.5 |

|

-3.2% |

-2.7% |

-2.7% |

0.2% |

0.0% |

-4.5% |

-3.4% |

||

EMCI |

|

|

62.1 |

60.4 |

|

59.4 |

|

58.4 |

|

57.8 |

|

|

-6.9% |

-3.8% |

-7.3% |

|

-0.7% |

2.4% |

-10.9% |

-9.0% |

Exchange rates vs Euro |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Actual change in local FX vs EUR |

|||||

|

JPY |

128.3 |

128.8 |

|

133.3 |

|

133.4 |

|

132.2 |

|

|

-2.9% |

-2.9% |

-1.0% |

|

1.1% |

-0.1% |

5.4% |

3.8% |

|

|

GBP |

0.894 |

0.850 |

|

0.850 |

|

0.855 |

|

0.860 |

|

3.9% |

5.5% |

2.6% |

-2.6% |

0.0% |

-0.6% |

-2.2% |

|||

|

CHF |

1.13 |

1.12 |

|

1.13 |

|

1.14 |

|

1.15 |

|

|

-1.8% |

-2.2% |

1.7% |

|

1.4% |

-0.9% |

3.6% |

3.6% |

|

|

SEK |

10.27 |

10.10 |

|

10.05 |

|

10.05 |

|

10.05 |

|

2.2% |

2.4% |

-2.5% |

0.4% |

1.9% |

-4.3% |

-2.7% |

|||

|

NOK |

9.67 |

9.45 |

|

9.40 |

|

9.40 |

|

9.40 |

|

|

2.8% |

4.7% |

-2.3% |

|

-1.3% |

1.0% |

1.9% |

1.3% |

|

|

CZK |

25.87 |

25.80 |

|

25.80 |

|

25.80 |

|

25.80 |

|

0.3% |

2.3% |

-2.7% |

0.0% |

-0.7% |

-1.3% |

-1.1% |

|||

|

PLN |

4.29 |

4.30 |

|

4.30 |

|

4.25 |

|

4.25 |

|

|

0.9% |

3.3% |

0.0% |

|

0.0% |

0.6% |

-2.5% |

-1.8% |

|

|

HUF |

323 |

330 |

|

335 |

|

340 |

|

345 |

|

-6.4% |

-5.6% |

-6.4% |

-0.5% |

0.6% |

-3.9% |

-2.5% |

|||

|

RON |

4.65 |

4.75 |

|

4.85 |

|

4.95 |

|

4.95 |

|

|

-6.1% |

-2.2% |

-4.0% |

|

0.3% |

-0.5% |

0.7% |

-0.4% |

|

|

TRY |

6.02 |

6.33 |

|

6.78 |

|

7.54 |

|

8.26 |

|

-27.1% |

-10.0% |

-8.8% |

1.8% |

23.1% |

-24.3% |

-24.4% |

|||

|

RUB |

75.32 |

76.04 |

|

76.84 |

|

78.30 |

|

79.06 |

|

|

-4.7% |

3.6% |

1.7% |

|

0.5% |

7.3% |

-7.5% |

-7.5% |

|

|

BRL |

4.41 |

4.22 |

|

4.52 |

|

4.76 |

|

4.84 |

|

-8.9% |

-2.7% |

-8.0% |

-2.9% |

6.9% |

-9.7% |

-12.0% |

|||

|

MXN |

23.01 |

22.48 |

|

23.17 |

|

24.07 |

|

24.49 |

|

|

-6.0% |

3.8% |

-3.0% |

|

-1.4% |

-3.0% |

2.6% |

-2.9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

indicates a revision resulting in a stronger currency forecast, indicates a revision resulting in a weaker currency forecast. Source: J.P.Morgan

*Positive indicates JPM more bullish on local currency than spot, consensus or forward rates. ** BloombergFX Consensus Forecasts. *** JPM USD Index caluclations assume flat VES forecasts

† DICOM

Source: J.P. Morgan

28

vk.com/id446425943

Nikolaos Panigirtzoglou |

John Normand |

Global Cross-Asset Strategy |

(44-20) 7134-7815 |

(44-20) 7134-1816 |

07 December 2018 |

nikolaos.panigirtzoglou@jpmorgan.com john.normand@jpmorgan.com

Marko Kolanovic, PhD (1-212) 272-1438

marko.kolanovic@jpmorgan.com

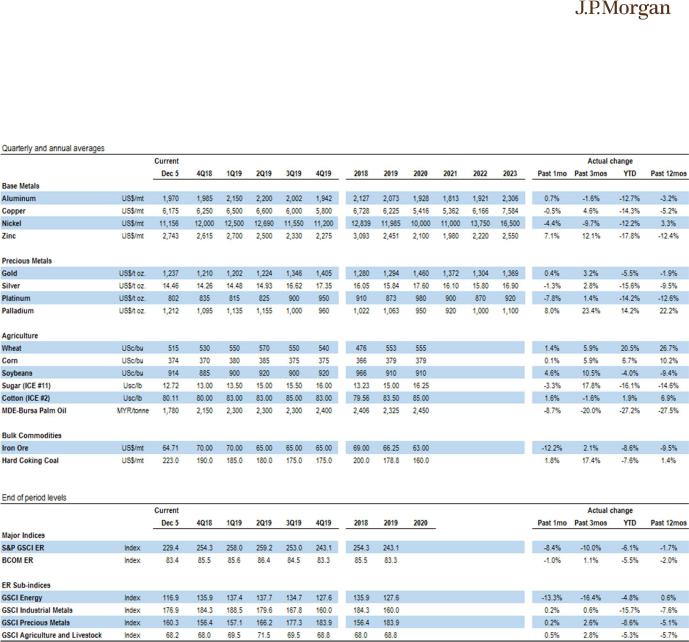

Global Commodities Price Forecasts

Source: J.P. Morgan

29

vk.com/id446425943