- •Preface

- •Part IV. Basic Single Equation Analysis

- •Chapter 18. Basic Regression Analysis

- •Equation Objects

- •Specifying an Equation in EViews

- •Estimating an Equation in EViews

- •Equation Output

- •Working with Equations

- •Estimation Problems

- •References

- •Chapter 19. Additional Regression Tools

- •Special Equation Expressions

- •Robust Standard Errors

- •Weighted Least Squares

- •Nonlinear Least Squares

- •Stepwise Least Squares Regression

- •References

- •Chapter 20. Instrumental Variables and GMM

- •Background

- •Two-stage Least Squares

- •Nonlinear Two-stage Least Squares

- •Limited Information Maximum Likelihood and K-Class Estimation

- •Generalized Method of Moments

- •IV Diagnostics and Tests

- •References

- •Chapter 21. Time Series Regression

- •Serial Correlation Theory

- •Testing for Serial Correlation

- •Estimating AR Models

- •ARIMA Theory

- •Estimating ARIMA Models

- •ARMA Equation Diagnostics

- •References

- •Chapter 22. Forecasting from an Equation

- •Forecasting from Equations in EViews

- •An Illustration

- •Forecast Basics

- •Forecasts with Lagged Dependent Variables

- •Forecasting with ARMA Errors

- •Forecasting from Equations with Expressions

- •Forecasting with Nonlinear and PDL Specifications

- •References

- •Chapter 23. Specification and Diagnostic Tests

- •Background

- •Coefficient Diagnostics

- •Residual Diagnostics

- •Stability Diagnostics

- •Applications

- •References

- •Part V. Advanced Single Equation Analysis

- •Chapter 24. ARCH and GARCH Estimation

- •Basic ARCH Specifications

- •Estimating ARCH Models in EViews

- •Working with ARCH Models

- •Additional ARCH Models

- •Examples

- •References

- •Chapter 25. Cointegrating Regression

- •Background

- •Estimating a Cointegrating Regression

- •Testing for Cointegration

- •Working with an Equation

- •References

- •Binary Dependent Variable Models

- •Ordered Dependent Variable Models

- •Censored Regression Models

- •Truncated Regression Models

- •Count Models

- •Technical Notes

- •References

- •Chapter 27. Generalized Linear Models

- •Overview

- •How to Estimate a GLM in EViews

- •Examples

- •Working with a GLM Equation

- •Technical Details

- •References

- •Chapter 28. Quantile Regression

- •Estimating Quantile Regression in EViews

- •Views and Procedures

- •Background

- •References

- •Chapter 29. The Log Likelihood (LogL) Object

- •Overview

- •Specification

- •Estimation

- •LogL Views

- •LogL Procs

- •Troubleshooting

- •Limitations

- •Examples

- •References

- •Part VI. Advanced Univariate Analysis

- •Chapter 30. Univariate Time Series Analysis

- •Unit Root Testing

- •Panel Unit Root Test

- •Variance Ratio Test

- •BDS Independence Test

- •References

- •Part VII. Multiple Equation Analysis

- •Chapter 31. System Estimation

- •Background

- •System Estimation Methods

- •How to Create and Specify a System

- •Working With Systems

- •Technical Discussion

- •References

- •Vector Autoregressions (VARs)

- •Estimating a VAR in EViews

- •VAR Estimation Output

- •Views and Procs of a VAR

- •Structural (Identified) VARs

- •Vector Error Correction (VEC) Models

- •A Note on Version Compatibility

- •References

- •Chapter 33. State Space Models and the Kalman Filter

- •Background

- •Specifying a State Space Model in EViews

- •Working with the State Space

- •Converting from Version 3 Sspace

- •Technical Discussion

- •References

- •Chapter 34. Models

- •Overview

- •An Example Model

- •Building a Model

- •Working with the Model Structure

- •Specifying Scenarios

- •Using Add Factors

- •Solving the Model

- •Working with the Model Data

- •References

- •Part VIII. Panel and Pooled Data

- •Chapter 35. Pooled Time Series, Cross-Section Data

- •The Pool Workfile

- •The Pool Object

- •Pooled Data

- •Setting up a Pool Workfile

- •Working with Pooled Data

- •Pooled Estimation

- •References

- •Chapter 36. Working with Panel Data

- •Structuring a Panel Workfile

- •Panel Workfile Display

- •Panel Workfile Information

- •Working with Panel Data

- •Basic Panel Analysis

- •References

- •Chapter 37. Panel Estimation

- •Estimating a Panel Equation

- •Panel Estimation Examples

- •Panel Equation Testing

- •Estimation Background

- •References

- •Part IX. Advanced Multivariate Analysis

- •Chapter 38. Cointegration Testing

- •Johansen Cointegration Test

- •Single-Equation Cointegration Tests

- •Panel Cointegration Testing

- •References

- •Chapter 39. Factor Analysis

- •Creating a Factor Object

- •Rotating Factors

- •Estimating Scores

- •Factor Views

- •Factor Procedures

- •Factor Data Members

- •An Example

- •Background

- •References

- •Appendix B. Estimation and Solution Options

- •Setting Estimation Options

- •Optimization Algorithms

- •Nonlinear Equation Solution Methods

- •References

- •Appendix C. Gradients and Derivatives

- •Gradients

- •Derivatives

- •References

- •Appendix D. Information Criteria

- •Definitions

- •Using Information Criteria as a Guide to Model Selection

- •References

- •Appendix E. Long-run Covariance Estimation

- •Technical Discussion

- •Kernel Function Properties

- •References

- •Index

- •Symbols

- •Numerics

478—Chapter 32. Vector Autoregression and Error Correction Models

If you switch the view of the VAR window, you can come back to the previous results (without reestimating) by selecting View/Estimation Output from the VAR window. In addition, some of the SVAR estimation results can be retrieved as data members of the VAR; see “Var Data Members” on page 638 of the Command and Programming Reference for a list of available VAR data members.

Vector Error Correction (VEC) Models

A vector error correction (VEC) model is a restricted VAR designed for use with nonstationary series that are known to be cointegrated. You may test for cointegration using an estimated Var object, Equation object estimated using nonstationary regression methods, or using a Group object (see Chapter 38. “Cointegration Testing,” on page 685).

The VEC has cointegration relations built into the specification so that it restricts the longrun behavior of the endogenous variables to converge to their cointegrating relationships while allowing for short-run adjustment dynamics. The cointegration term is known as the error correction term since the deviation from long-run equilibrium is corrected gradually through a series of partial short-run adjustments.

To take the simplest possible example, consider a two variable system with one cointegrating equation and no lagged difference terms. The cointegrating equation is:

y2, t = by1, t |

(32.22) |

The corresponding VEC model is:

Dy1, t = a1(y2, t – 1 – by1, t – 1) + e1, t

(32.23)

Dy2, t = a2(y2, t – 1 – by1, t – 1) + e2, t

In this simple model, the only right-hand side variable is the error correction term. In long run equilibrium, this term is zero. However, if y1 and y2 deviate from the long run equilibrium, the error correction term will be nonzero and each variable adjusts to partially restore the equilibrium relation. The coefficient ai measures the speed of adjustment of the i-th endogenous variable towards the equilibrium.

How to Estimate a VEC

As the VEC specification only applies to cointegrated series, you should first run the Johansen cointegration test as described above and determine the number of cointegrating relations. You will need to provide this information as part of the VEC specification.

To set up a VEC, click the Estimate button in the VAR toolbar and choose the Vector Error Correction specification from the VAR/VEC Specification tab. In the VAR/VEC Specification tab, you should provide the same information as for an unrestricted VAR, except that:

Vector Error Correction (VEC) Models—479

•The constant or linear trend term should not be included in the Exogenous Series edit box. The constant and trend specification for VECs should be specified in the Cointegration tab (see below).

•The lag interval specification refers to lags of the first difference terms in the VEC. For example, the lag specification “1 1” will include lagged first difference terms on the right-hand side of the VEC. Rewritten in levels, this VEC is a restricted VAR with two lags. To estimate a VEC with no lagged first difference terms, specify the lag as “0 0”.

•The constant and trend specification for VECs should be specified in the Cointegration tab. You must choose from one of the five Johansen (1995) trend specifications as explained in “Deterministic Trend Specification” on page 686. You must also specify the number of cointegrating relations in the appropriate edit field. This number should be a positive integer less than the number of endogenous variables in the VEC.

•If you want to impose restrictions on the cointegrating relations and/or the adjustment coefficients, use the Restrictions tab. “Imposing Restrictions” on page 481 describes these restriction in greater detail. Note that the contents of this tab are grayed out unless you have clicked the Vector Error Correction specification in the

VAR/VEC Specification tab.

Once you have filled the dialog, simply click OK to estimate the VEC. Estimation of a VEC model is carried out in two steps. In the first step, we estimate the cointegrating relations from the Johansen procedure as used in the cointegration test. We then construct the error correction terms from the estimated cointegrating relations and estimate a VAR in first differences including the error correction terms as regressors.

VEC Estimation Output

The VEC estimation output consists of two parts. The first part reports the results from the first step Johansen procedure. If you did not impose restrictions, EViews will use a default normalization that identifies all cointegrating relations. This default normalization expresses the first r variables in the VEC as functions of the remaining k – r variables, where r is the number of cointegrating relations and k is the number of endogenous variables. Asymptotic standard errors (corrected for degrees of freedom) are reported for parameters that are identified under the restrictions. If you provided your own restrictions, standard errors will not be reported unless the restrictions identify all cointegrating vectors.

The second part of the output reports results from the second step VAR in first differences, including the error correction terms estimated from the first step. The error correction terms are denoted CointEq1, CointEq2, and so on in the output. This part of the output has the same format as the output from unrestricted VARs as explained in “VAR Estimation Output” on page 461, with one difference. At the bottom of the VEC output table, you will see two log likelihood values reported for the system. The first value, labeled Log Likelihood (d.f. adjusted), is computed using the determinant of the residual covariance matrix (reported as

480—Chapter 32. Vector Autoregression and Error Correction Models

Determinant Residual Covariance), using small sample degrees of freedom correction as in (32.3). This is the log likelihood value reported for unrestricted VARs. The Log Likelihood value is computed using the residual covariance matrix without correcting for degrees of freedom. This log likelihood value is comparable to the one reported in the cointegration test output.

Views and Procs of a VEC

Views and procs available for VECs are mostly the same as those available for VARs as explained above. Here, we only mention those that are specific to VECs.

Cointegrating Relations

View/Cointegration Graph displays a graph of the estimated cointegrating relations as used in the VEC. To store these estimated cointegrating relations as named series in the workfile, use Proc/Make Cointegration Group. This proc will create and display an untitled group object containing the estimated cointegrating relations as named series. These series are named COINTEQ01, COINTEQ02 and so on.

Forecasting

Currently forecasts from a VAR or VEC are not available from the VAR object. Forecasts can be obtained by solving a model created from the estimated VAR/VEC. Click on Proc/Make Model from the VAR window toolbar to create a model object from the estimated VAR/VEC. You may then make any changes to the model specification, including modifying the ASSIGN statement before solving the model to obtain the forecasts. See Chapter 34. “Models,” on page 511, for further discussion on how to forecast from model objects in EViews.

Data Members

Various results from the estimated VAR/VEC can be retrieved through the command line data members. “Var Data Members” on page 638 of the Command and Programming Reference provides a complete list of data members that are available for a VAR object. Here, we focus on retrieving the estimated coefficients of a VAR/VEC.

Obtaining Coefficients of a VAR

Coefficients of (unrestricted) VARs can be accessed by referring to elements of a two dimensional array C. The first dimension of C refers to the equation number of the VAR, while the second dimension refers to the variable number in each equation. For example, C(2,3) is the coefficient of the third regressor in the second equation of the VAR. The C(2,3) coefficient of a VAR named VAR01 can then be accessed by the command

var01.c(2,3)

To examine the correspondence between each element of C and the estimated coefficients, select View/Representations from the VAR toolbar.

Vector Error Correction (VEC) Models—481

Obtaining Coefficients of a VEC

For VEC models, the estimated coefficients are stored in three different two dimensional arrays: A, B, and C. A contains the adjustment parameters a , B contains the cointegrating vectors b¢, and C holds the short-run parameters (the coefficients on the lagged first difference terms).

•The first index of A is the equation number of the VEC, while the second index is the number of the cointegrating equation. For example, A(2,1) is the adjustment coefficient of the first cointegrating equation in the second equation of the VEC.

•The first index of B is the number of the cointegrating equation, while the second index is the variable number in the cointegrating equation. For example, B(2,1) is the coefficient of the first variable in the second cointegrating equation. Note that this indexing scheme corresponds to the transpose of b .

•The first index of C is the equation number of the VEC, while the second index is the variable number of the first differenced regressor of the VEC. For example, C(2, 1) is the coefficient of the first differenced regressor in the second equation of the VEC.

You can access each element of these coefficients by referring to the name of the VEC followed by a dot and coefficient element:

var01.a(2,1)

var01.b(2,1)

var01.c(2,1)

To see the correspondence between each element of A, B, and C and the estimated coefficients, select View/Representations from the VAR toolbar.

Imposing Restrictions

Since the cointegrating vector b is not fully identified, you may wish to impose your own identifying restrictions when performing estimation.

482—Chapter 32. Vector Autoregression and Error Correction Models

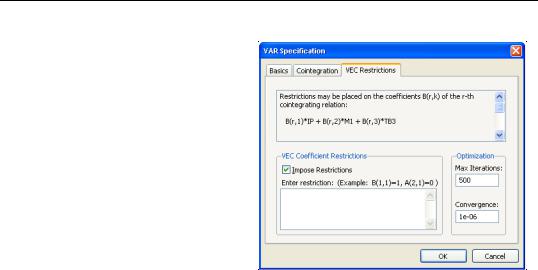

Restrictions can be imposed on the cointegrating vector (elements of the b matrix) and/or on the adjustment coefficients (elements of the a matrix). To impose restrictions in estimation, open the test, select Vector Error Correction in the main VAR estimation dialog, then click on the VEC Restrictions tab. You will enter your restrictions in the edit box that appears when you check the Impose Restrictions box:

Restrictions on the Cointegrating

Vector

To impose restrictions on the cointegrating vector b , you must refer to the (i,j)-th element of the transpose of the b matrix by B(i,j). The i-th cointegrating relation has the representation:

B(i,1)*y1 + B(i,2)*y2 + ... + B(i,k)*yk

where y1, y2, ... are the (lagged) endogenous variable. Then, if you want to impose the restriction that the coefficient on y1 for the second cointegrating equation is 1, you would type the following in the edit box:

B(2,1) = 1

You can impose multiple restrictions by separating each restriction with a comma on the same line or typing each restriction on a separate line. For example, if you want to impose the restriction that the coefficients on y1 for the first and second cointegrating equations are 1, you would type:

B(1,1) = 1

B(2,1) = 1

Currently all restrictions must be linear (or more precisely affine) in the elements of the b matrix. So for example

B(1,1) * B(2,1) = 1

will return a syntax error.

Restrictions on the Adjustment Coefficients

To impose restrictions on the adjustment coefficients, you must refer to the (i,j)-th elements of the a matrix by A(i,j). The error correction terms in the i-th VEC equation will have the representation:

Vector Error Correction (VEC) Models—483

A(i,1)*CointEq1 + A(i,2)*CointEq2 + ... + A(i,r)*CointEqr

Restrictions on the adjustment coefficients are currently limited to linear homogeneous restrictions so that you must be able to write your restriction as R vec(a) = 0 , where R is a known qk ¥ r matrix. This condition implies, for example, that the restriction,

A(1,1) = A(2,1)

is valid but:

A(1,1) = 1

will return a restriction syntax error.

One restriction of particular interest is whether the i-th row of the a matrix is all zero. If this is the case, then the i-th endogenous variable is said to be weakly exogenous with respect to the b parameters. See Johansen (1995) for the definition and implications of weak exogeneity. For example, if we assume that there is only one cointegrating relation in the VEC, to test whether the second endogenous variable is weakly exogenous with respect to b you would enter:

A(2,1) = 0

To impose multiple restrictions, you may either separate each restriction with a comma on the same line or type each restriction on a separate line. For example, to test whether the second endogenous variable is weakly exogenous with respect to b in a VEC with two cointegrating relations, you can type:

A(2,1) = 0

A(2,2) = 0

You may also impose restrictions on both b and a . However, the restrictions on b and a must be independent. So for example,

A(1,1) = 0

B(1,1) = 1

is a valid restriction but:

A(1,1) = B(1,1)

will return a restriction syntax error.

Identifying Restrictions and Binding Restrictions

EViews will check to see whether the restrictions you provided identify all cointegrating vectors for each possible rank. The identification condition is checked numerically by the rank of the appropriate Jacobian matrix; see Boswijk (1995) for the technical details. Asymptotic standard errors for the estimated cointegrating parameters will be reported only if the restrictions identify the cointegrating vectors.