- •Preface

- •Part IV. Basic Single Equation Analysis

- •Chapter 18. Basic Regression Analysis

- •Equation Objects

- •Specifying an Equation in EViews

- •Estimating an Equation in EViews

- •Equation Output

- •Working with Equations

- •Estimation Problems

- •References

- •Chapter 19. Additional Regression Tools

- •Special Equation Expressions

- •Robust Standard Errors

- •Weighted Least Squares

- •Nonlinear Least Squares

- •Stepwise Least Squares Regression

- •References

- •Chapter 20. Instrumental Variables and GMM

- •Background

- •Two-stage Least Squares

- •Nonlinear Two-stage Least Squares

- •Limited Information Maximum Likelihood and K-Class Estimation

- •Generalized Method of Moments

- •IV Diagnostics and Tests

- •References

- •Chapter 21. Time Series Regression

- •Serial Correlation Theory

- •Testing for Serial Correlation

- •Estimating AR Models

- •ARIMA Theory

- •Estimating ARIMA Models

- •ARMA Equation Diagnostics

- •References

- •Chapter 22. Forecasting from an Equation

- •Forecasting from Equations in EViews

- •An Illustration

- •Forecast Basics

- •Forecasts with Lagged Dependent Variables

- •Forecasting with ARMA Errors

- •Forecasting from Equations with Expressions

- •Forecasting with Nonlinear and PDL Specifications

- •References

- •Chapter 23. Specification and Diagnostic Tests

- •Background

- •Coefficient Diagnostics

- •Residual Diagnostics

- •Stability Diagnostics

- •Applications

- •References

- •Part V. Advanced Single Equation Analysis

- •Chapter 24. ARCH and GARCH Estimation

- •Basic ARCH Specifications

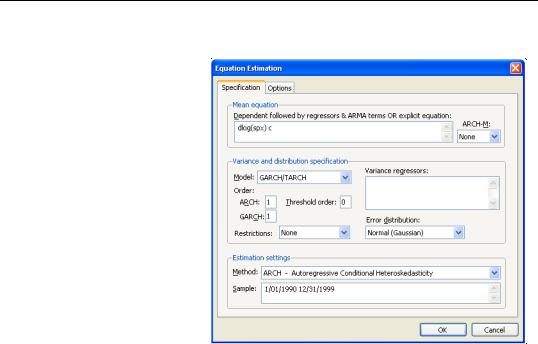

- •Estimating ARCH Models in EViews

- •Working with ARCH Models

- •Additional ARCH Models

- •Examples

- •References

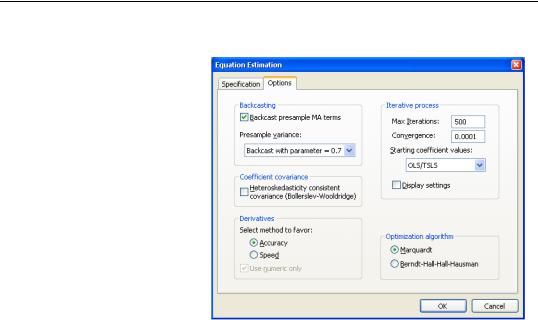

- •Chapter 25. Cointegrating Regression

- •Background

- •Estimating a Cointegrating Regression

- •Testing for Cointegration

- •Working with an Equation

- •References

- •Binary Dependent Variable Models

- •Ordered Dependent Variable Models

- •Censored Regression Models

- •Truncated Regression Models

- •Count Models

- •Technical Notes

- •References

- •Chapter 27. Generalized Linear Models

- •Overview

- •How to Estimate a GLM in EViews

- •Examples

- •Working with a GLM Equation

- •Technical Details

- •References

- •Chapter 28. Quantile Regression

- •Estimating Quantile Regression in EViews

- •Views and Procedures

- •Background

- •References

- •Chapter 29. The Log Likelihood (LogL) Object

- •Overview

- •Specification

- •Estimation

- •LogL Views

- •LogL Procs

- •Troubleshooting

- •Limitations

- •Examples

- •References

- •Part VI. Advanced Univariate Analysis

- •Chapter 30. Univariate Time Series Analysis

- •Unit Root Testing

- •Panel Unit Root Test

- •Variance Ratio Test

- •BDS Independence Test

- •References

- •Part VII. Multiple Equation Analysis

- •Chapter 31. System Estimation

- •Background

- •System Estimation Methods

- •How to Create and Specify a System

- •Working With Systems

- •Technical Discussion

- •References

- •Vector Autoregressions (VARs)

- •Estimating a VAR in EViews

- •VAR Estimation Output

- •Views and Procs of a VAR

- •Structural (Identified) VARs

- •Vector Error Correction (VEC) Models

- •A Note on Version Compatibility

- •References

- •Chapter 33. State Space Models and the Kalman Filter

- •Background

- •Specifying a State Space Model in EViews

- •Working with the State Space

- •Converting from Version 3 Sspace

- •Technical Discussion

- •References

- •Chapter 34. Models

- •Overview

- •An Example Model

- •Building a Model

- •Working with the Model Structure

- •Specifying Scenarios

- •Using Add Factors

- •Solving the Model

- •Working with the Model Data

- •References

- •Part VIII. Panel and Pooled Data

- •Chapter 35. Pooled Time Series, Cross-Section Data

- •The Pool Workfile

- •The Pool Object

- •Pooled Data

- •Setting up a Pool Workfile

- •Working with Pooled Data

- •Pooled Estimation

- •References

- •Chapter 36. Working with Panel Data

- •Structuring a Panel Workfile

- •Panel Workfile Display

- •Panel Workfile Information

- •Working with Panel Data

- •Basic Panel Analysis

- •References

- •Chapter 37. Panel Estimation

- •Estimating a Panel Equation

- •Panel Estimation Examples

- •Panel Equation Testing

- •Estimation Background

- •References

- •Part IX. Advanced Multivariate Analysis

- •Chapter 38. Cointegration Testing

- •Johansen Cointegration Test

- •Single-Equation Cointegration Tests

- •Panel Cointegration Testing

- •References

- •Chapter 39. Factor Analysis

- •Creating a Factor Object

- •Rotating Factors

- •Estimating Scores

- •Factor Views

- •Factor Procedures

- •Factor Data Members

- •An Example

- •Background

- •References

- •Appendix B. Estimation and Solution Options

- •Setting Estimation Options

- •Optimization Algorithms

- •Nonlinear Equation Solution Methods

- •References

- •Appendix C. Gradients and Derivatives

- •Gradients

- •Derivatives

- •References

- •Appendix D. Information Criteria

- •Definitions

- •Using Information Criteria as a Guide to Model Selection

- •References

- •Appendix E. Long-run Covariance Estimation

- •Technical Discussion

- •Kernel Function Properties

- •References

- •Index

- •Symbols

- •Numerics

Chapter 24. ARCH and GARCH Estimation

Most of the statistical tools in EViews are designed to model the conditional mean of a random variable. The tools described in this chapter differ by modeling the conditional variance, or volatility, of a variable.

There are several reasons that you may wish to model and forecast volatility. First, you may need to analyze the risk of holding an asset or the value of an option. Second, forecast confidence intervals may be time-varying, so that more accurate intervals can be obtained by modeling the variance of the errors. Third, more efficient estimators can be obtained if heteroskedasticity in the errors is handled properly.

Autoregressive Conditional Heteroskedasticity (ARCH) models are specifically designed to model and forecast conditional variances. The variance of the dependent variable is modeled as a function of past values of the dependent variable and independent, or exogenous variables.

ARCH models were introduced by Engle (1982) and generalized as GARCH (Generalized ARCH) by Bollerslev (1986) and Taylor (1986). These models are widely used in various branches of econometrics, especially in financial time series analysis. See Bollerslev, Chou, and Kroner (1992) and Bollerslev, Engle, and Nelson (1994) for surveys.

In the next section, the basic ARCH model will be described in detail. In subsequent sections, we consider the wide range of specifications available in EViews for modeling volatility. For brevity of discussion, we will use ARCH to refer to both ARCH and GARCH models, except where there is the possibility of confusion.

Basic ARCH Specifications

In developing an ARCH model, you will have to provide three distinct specifications—one for the conditional mean equation, one for the conditional variance, and one for the conditional error distribution. We begin by describing some basic specifications for these terms. The discussion of more complicated models is taken up in “Additional ARCH Models” on page 208.

The GARCH(1, 1) Model

We begin with the simplest GARCH(1,1) specification:

Yt = Xt |

¢v + et |

|

(24.1) |

jt2 = q + aet2 |

– 1 + bjt2 |

– 1 |

(24.2) |

in which the mean equation given in (24.1) is written as a function of exogenous variables with an error term. Since j2t is the one-period ahead forecast variance based on past infor-

196—Chapter 24. ARCH and GARCH Estimation

mation, it is called the conditional variance. The conditional variance equation specified in (24.2) is a function of three terms:

•A constant term: q .

•News about volatility from the previous period, measured as the lag of the squared residual from the mean equation: e2t – 1 (the ARCH term).

•Last period’s forecast variance: j2t – 1 (the GARCH term).

The (1, 1) in GARCH(1, 1) refers to the presence of a first-order autoregressive GARCH term (the first term in parentheses) and a first-order moving average ARCH term (the second term in parentheses). An ordinary ARCH model is a special case of a GARCH specification in which there are no lagged forecast variances in the conditional variance equation—i.e., a GARCH(0, 1).

This specification is often interpreted in a financial context, where an agent or trader predicts this period’s variance by forming a weighted average of a long term average (the constant), the forecasted variance from last period (the GARCH term), and information about volatility observed in the previous period (the ARCH term). If the asset return was unexpectedly large in either the upward or the downward direction, then the trader will increase the estimate of the variance for the next period. This model is also consistent with the volatility clustering often seen in financial returns data, where large changes in returns are likely to be followed by further large changes.

There are two equivalent representations of the variance equation that may aid you in interpreting the model:

•If we recursively substitute for the lagged variance on the right-hand side of Equation (24.2), we can express the conditional variance as a weighted average of all of the lagged squared residuals:

2 |

|

|

q |

|

• |

|

j – 1 |

2 |

|

= |

|

+ a |

|

b |

(24.3) |

||||

jt |

----------------- |

|

et – j . |

||||||

|

|

(1 |

– b) |

|

|

|

|

|

|

|

|

|

|

|

j = 1 |

|

|

|

|

We see that the GARCH(1,1) variance specification is analogous to the sample variance, but that it down-weights more distant lagged squared errors.

•The error in the squared returns is given by ut = e2t – j2t . Substituting for the variances in the variance equation and rearranging terms we can write our model in

terms of the errors:

et2 = q + (a + b)et2 |

– 1 + ut – bnt – 1 . |

(24.4) |

Thus, the squared errors follow a heteroskedastic ARMA(1,1) process. The autoregressive root which governs the persistence of volatility shocks is the sum of a plus b . In many applied settings, this root is very close to unity so that shocks die out rather slowly.

Basic ARCH Specifications—197

The GARCH(q, p) Model

Higher order GARCH models, denoted GARCH(q, p ), can be estimated by choosing either q or p greater than 1 where q is the order of the autoregressive GARCH terms and p is the order of the moving average ARCH terms.

The representation of the GARCH(q, p ) variance is:

q |

p |

|

|

jt2 = q + Â bjjt2 |

– j + Â aiet2 |

– i |

(24.5) |

j = 1 |

i = 1 |

|

|

The GARCH-M Model

The Xt in equation Equation (24.2) represent exogenous or predetermined variables that are included in the mean equation. If we introduce the conditional variance or standard deviation into the mean equation, we get the GARCH-in-Mean (GARCH-M) model (Engle, Lilien and Robins, 1987):

Yt = Xt¢v + ljt2 + et . |

(24.6) |

The ARCH-M model is often used in financial applications where the expected return on an asset is related to the expected asset risk. The estimated coefficient on the expected risk is a measure of the risk-return tradeoff.

Two variants of this ARCH-M specification use the conditional standard deviation or the log of the conditional variance in place of the variance in Equation (24.6).

Yt |

= Xt¢v + ljt + et . |

(24.7) |

Yt = |

Xt¢v + llog(jt2) + et |

(24.8) |

Regressors in the Variance Equation

Equation (24.5) may be extended to allow for the inclusion of exogenous or predetermined regressors, z , in the variance equation:

q |

|

p |

|

|

jt2 = q + Â bjjt2 |

– j + |

aiet2 |

– i + Zt¢p . |

(24.9) |

j = 1 |

|

i = 1 |

|

|

Note that the forecasted variances from this model are not guaranteed to be positive. You may wish to introduce regressors in a form where they are always positive to minimize the possibility that a single, large negative value generates a negative forecasted value.

Distributional Assumptions

To complete the basic ARCH specification, we require an assumption about the conditional distribution of the error term e . There are three assumptions commonly employed when working with ARCH models: normal (Gaussian) distribution, Student’s t-distribution, and

198—Chapter 24. ARCH and GARCH Estimation

the Generalized Error Distribution (GED). Given a distributional assumption, ARCH models are typically estimated by the method of maximum likelihood.

For example, for the GARCH(1, 1) model with conditionally normal errors, the contribution

to the log-likelihood for observation t |

is: |

|

|

|

|

|

|

|

|

|

|

|

||||

l |

|

= |

1 |

|

1 |

2 |

1 |

(y |

|

– X |

¢v) |

2 |

§ j |

2 |

, |

(24.10) |

|

–--log(2p) |

– --logj |

|

–-- |

|

|

|

|||||||||

|

t |

|

2 |

|

2 |

t |

2 |

|

t |

t |

|

|

|

t |

|

|

where j2t is specified in one of the forms above.

For the Student’s t-distribution, the log-likelihood contributions are of the form:

lt = |

– |

1 |

p(n – 2)G(v § 2)2 |

1 |

2 |

(n + 1) |

|

+ |

(yt |

– Xt¢v)2 |

(24.11) |

||

-- |

log |

------------------------------------------- |

|

– --logjt |

–----------------log 1 |

----------------------------jt2 |

- |

||||||

|

|

2 |

|

G((v + 1) § 2)2 |

|

2 |

|

2 |

|

|

(n – 2) |

|

|

where the degree of freedom n > 2 controls the tail behavior. The t-distribution approaches the normal as n Æ •.

For the GED, we have:

l |

|

= |

1 |

|

G(1 § r)3 |

1 |

2 |

G(3 § r)(yt – Xt¢v)2 r § 2 |

(24.12) |

||

t |

–--log |

------------------------------------ |

– --logj |

t |

– |

------------------------------------------------ |

|||||

|

|

2 |

G(3 § r)(r § 2)2 |

2 |

|

jt2G(1 § r) |

|

|

|||

where the tail parameter r > 0 . The GED is a normal distribution if r |

= 2 , and fat-tailed if |

||||||||||

r < 2 . |

|

|

|

|

|

|

|

|

|

|

|

By default, ARCH models in EViews are estimated by the method of maximum likelihood under the assumption that the errors are conditionally normally distributed.

Estimating ARCH Models in EViews

To estimate an ARCH or GARCH model, open the equation specification dialog by selecting

Quick/Estimate Equation…, by selecting Object/New Object.../Equation…. Select ARCH from the method combo box at the bottom of the dialog. Alternately, typing the keyword arch in the command line both creates the object and sets the estimation method.

The dialog will change to show you the ARCH specification dialog. You will need to specify both the mean and the variance specifications, the error distribution and the estimation sample.

Estimating ARCH Models in EViews—199

The Mean Equation

In the dependent variable edit box, you should enter the specification of the mean equation. You can enter the specification in list form by listing the dependent variable followed by the regressors. You should add the C to your specification if you wish to include a constant. If you have a more complex mean specification, you can enter your mean equation using an explicit expression.

If your specification includes an ARCH-M term, you should select the appro-

priate item of the combo box in the upper right-hand side of the dialog. You may choose to include the Std. Dev., Variance, or the Log(Var) in the mean equation.

The Variance Equation

Your next step is to specify your variance equation.

Class of models

To estimate one of the standard GARCH models as described above, select the GARCH/ TARCH entry in the Model combo box. The other entries (EGARCH, PARCH, and Component ARCH(1, 1)) correspond to more complicated variants of the GARCH specification. We discuss each of these models in “Additional ARCH Models” on page 208.

In the Order section, you should choose the number of ARCH and GARCH terms. The default, which includes one ARCH and one GARCH term is by far the most popular specification.

If you wish to estimate an asymmetric model, you should enter the number of asymmetry terms in the Threshold order edit field. The default settings estimate a symmetric model with threshold order 0.

200—Chapter 24. ARCH and GARCH Estimation

Variance regressors

In the Variance regressors edit box, you may optionally list variables you wish to include in the variance specification. Note that, with the exception of IGARCH models, EViews will always include a constant as a variance regressor so that you do not need to add C to this list.

The distinction between the permanent and transitory regressors is discussed in “The Component GARCH (CGARCH) Model” on page 211.

Restrictions

If you choose the GARCH/TARCH model, you may restrict the parameters of the GARCH model in two ways. One option is to set the Restrictions combo to IGARCH, which restricts the persistent parameters to sum up to one. Another is Variance Target, which restricts the constant term to a function of the GARCH parameters and the unconditional variance:

|

|

|

q |

p |

|

q = |

ˆ 2 |

bj – |

ai |

(24.13) |

|

j |

1 – |

||||

|

|

|

j = 1 |

i = 1 |

|

where jˆ 2 is the unconditional variance of the residuals.

The Error Distribution

To specify the form of the conditional distribution for your errors, you should select an entry from the Error Distribution combo box.You may choose between the default Normal (Gaussian), the Student’s t, the Generalized Error (GED), the Student’s t with fixed d.f., or the GED with fixed parameter. In the latter two cases, you will be prompted to enter a value for the fixed parameter. See “Distributional Assumptions” on page 197 for details on the supported distributions.

Estimation Options

EViews provides you with access to a number of optional estimation settings. Simply click on the Options tab and fill out the dialog as desired.

Estimating ARCH Models in EViews—201

Backcasting

By default, both the innovations used in initializing MA estimation and the initial variance required for the GARCH terms are computed using backcasting methods. Details on the MA backcasting procedure are provided in “Backcasting MA terms” on page 102.

When computing backcast initial variances for GARCH, EViews first uses the coefficient values to compute the residuals of the mean equation, and then computes an exponential smoothing estimator of the initial values,

2 |

|

2 |

|

|

T |

ˆ 2 |

|

|

|

T |

T – j – 1 |

ˆ2 |

|

||

= |

= |

|

+ (1 |

– l) Â l |

(24.14) |

||||||||||

j0 |

e0 |

l |

|

j |

|

|

|

(eT – j), |

|||||||

|

|

|

|

|

|

|

|

|

|

j = 0 |

|

|

|

|

|

where eˆ are the residuals from the mean equation, jˆ 2 |

is the unconditional variance esti- |

||||||||||||||

mate: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

T |

|

|

|

|

|

|

|

|

|

|

|

|

ˆ |

= |

ˆ2 |

§ T |

|

|

|

(24.15) |

||

|

|

|

|

|

|

j |

|

et |

|

|

|

|

|||

|

|

|

|

|

|

|

|

t |

= 1 |

|

|

|

|

|

|

and the smoothing parameter l = 0.7 . However, you have the option to choose from a number of weights from 0.1 to 1, in increments of 0.1, by using the Presample variance drop-down list. Notice that if the parameter is set to 1, then the initial value is simply the unconditional variance, e.g. backcasting is not calculated:

2 |

= |

ˆ |

2 |

. |

(24.16) |

j0 |

j |

|

Using the unconditional variance provides another common way to set the presample variance.

Our experience has been that GARCH models initialized using backcast exponential smoothing often outperform models initialized using the unconditional variance.

202—Chapter 24. ARCH and GARCH Estimation

Heteroskedasticity Consistent Covariances

Click on the check box labeled Heteroskedasticity Consistent Covariance to compute the quasi-maximum likelihood (QML) covariances and standard errors using the methods described by Bollerslev and Wooldridge (1992). This option is only available if you choose the conditional normal as the error distribution.

You should use this option if you suspect that the residuals are not conditionally normally distributed. When the assumption of conditional normality does not hold, the ARCH parameter estimates will still be consistent, provided the mean and variance functions are correctly specified. The estimates of the covariance matrix will not be consistent unless this option is specified, resulting in incorrect standard errors.

Note that the parameter estimates will be unchanged if you select this option; only the estimated covariance matrix will be altered.

Derivative Methods

EViews uses both numeric and analytic derivatives in estimating ARCH models. Fully analytic derivatives are available for GARCH(p, q) models with simple mean specifications assuming normal or unrestricted t-distribution errors.

Analytic derivatives are not available for models with ARCH in mean specifications, complex variance equation specifications (e.g. threshold terms, exogenous variance regressors, or integrated or target variance restrictions), models with certain error assumptions (e.g. errors following the GED or fixed parameter t-distributions), and all non-GARCH(p, q) models (e.g. EGARCH, PARCH, component GARCH).

Some specifications offer analytic derivatives for a subset of coefficients. For example, simple GARCH models with non-constant regressors allow for analytic derivatives for the variance coefficients but use numeric derivatives for any non-constant regressor coefficients.

You may control the method used in computing numeric derivatives to favor speed (fewer function evaluations) or to favor accuracy (more function evaluations).

Iterative Estimation Control

The likelihood functions of ARCH models are not always well-behaved so that convergence may not be achieved with the default estimation settings. You can use the options dialog to select the iterative algorithm (Marquardt, BHHH/Gauss-Newton), change starting values, increase the maximum number of iterations, or adjust the convergence criterion.

Starting Values

As with other iterative procedures, starting coefficient values are required. EViews will supply its own starting values for ARCH procedures using OLS regression for the mean equation. Using the Options dialog, you can also set starting values to various fractions of the

Estimating ARCH Models in EViews—203

OLS starting values, or you can specify the values yourself by choosing the User Specified option, and placing the desired coefficients in the default coefficient vector.

GARCH(1,1) examples

To estimate a standard GARCH(1,1) model with no regressors in the mean and variance equations:

Rt |

= |

c + et |

|

(24.17) |

|

jt2 |

= |

q + aet2 |

– 1 + bjt2 |

||

– 1 |

you should enter the various parts of your specification:

•Fill in the Mean Equation Specification edit box as r c

•Enter 1 for the number of ARCH terms, and 1 for the number of GARCH terms, and select GARCH/TARCH.

•Select None for the ARCH-M term.

•Leave blank the Variance Regressors edit box.

To estimate the ARCH(4)-M model:

Rt = g0 + g1DUMt + g2jt + et

(24.18)

j2t = q + a1e2t – 1 + a2e2t – 2 + a3e2t – 3 + a4e2t – 4 + g3DUMt

you should fill out the dialog in the following fashion:

•Enter the mean equation specification “R C DUM”.

•Enter “4” for the ARCH term and “0” for the GARCH term, and select GARCH (symmetric).

•Select Std. Dev. for the ARCH-M term.

•Enter DUM in the Variance Regressors edit box.

Once you have filled in the Equation Specification dialog, click OK to estimate the model. ARCH models are estimated by the method of maximum likelihood, under the assumption that the errors are conditionally normally distributed. Because the variance appears in a non-linear way in the likelihood function, the likelihood function must be estimated using iterative algorithms. In the status line, you can watch the value of the likelihood as it changes with each iteration. When estimates converge, the parameter estimates and conventional regression statistics are presented in the ARCH object window.

As an example, we fit a GARCH(1,1) model to the first difference of log daily S&P 500 (DLOG(SPX)) in the workfile “Stocks.WF1”, using backcast values for the initial variances and computing Bollerslev-Wooldridge standard errors. The output is presented below:

204—Chapter 24. ARCH and GARCH Estimation

Dependent Variable: DLOG(SPX)

Method: ML - ARCH (Marquardt) - Normal distribution Date: 08/11/09 Time: 10:57

Sample: 1/02/1990 12/31/1999 Included observations: 2528

Convergence achieved after 18 iterations Bollerslev-Wooldridge robust standard errors & covariance Presample variance: backcast (parameter = 0.7)

GARCH = C(2) + C(3)*RESID(-1)^2 + C(4)*GARCH(-1)

Variable |

Coefficient |

Std. Error |

z-Statistic |

Prob. |

|

|

|

|

|

|

|

|

|

|

C |

0.000597 |

0.000143 |

4.172934 |

0.0000 |

|

|

|

|

|

|

|

|

|

|

|

Variance Equation |

|

|

|

|

|

|

|

|

C |

5.83E-07 |

1.93E-07 |

3.021074 |

0.0025 |

RESID(-1)^2 |

0.053313 |

0.011686 |

4.562031 |

0.0000 |

GARCH(-1) |

0.939959 |

0.011201 |

83.91654 |

0.0000 |

|

|

|

|

|

|

|

|

|

|

R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat

-0.000014 |

Mean dependent var |

0.000564 |

|

-0.000014 |

S.D. dependent var |

0.008888 |

|

0.008889 |

Akaike info criterion |

-6.807476 |

|

0.199649 |

Schwarz criterion |

-6.798243 |

|

8608.650 |

Hannan-Quinn criter. |

-6.804126 |

|

1.964029 |

|

|

|

|

|

|

|

By default, the estimation output header describes the estimation sample, and the methods used for computing the coefficient standard errors, the initial variance terms, and the variance equation. Also noted is the method for computing the presample variance, in this case backcasting with smoothing parameter l = 0.7 .

The main output from ARCH estimation is divided into two sections—the upper part provides the standard output for the mean equation, while the lower part, labeled “Variance Equation”, contains the coefficients, standard errors, z-statistics and p-values for the coefficients of the variance equation.

The ARCH parameters correspond to a and the GARCH parameters to b in Equation (24.2) on page 195. The bottom panel of the output presents the standard set of regression statistics using the residuals from the mean equation. Note that measures such as R2 may not be meaningful if there are no regressors in the mean equation. Here, for example, the R2 is negative.

In this example, the sum of the ARCH and GARCH coefficients (a + b ) is very close to one, indicating that volatility shocks are quite persistent. This result is often observed in high frequency financial data.