- •Table of Contents

- •Foreword

- •Chapter 1. A Quick Walk Through

- •Workfile: The Basic EViews Document

- •Viewing an individual series

- •Looking at different samples

- •Generating a new series

- •Looking at a pair of series together

- •Estimating your first regression in EViews

- •Saving your work

- •Forecasting

- •What’s Ahead

- •Chapter 2. EViews—Meet Data

- •The Structure of Data and the Structure of a Workfile

- •Creating a New Workfile

- •Deconstructing the Workfile

- •Time to Type

- •Identity Noncrisis

- •Dated Series

- •The Import Business

- •Adding Data To An Existing Workfile—Or, Being Rectangular Doesn’t Mean Being Inflexible

- •Among the Missing

- •Quick Review

- •Appendix: Having A Good Time With Your Date

- •Chapter 3. Getting the Most from Least Squares

- •A First Regression

- •The Really Important Regression Results

- •The Pretty Important (But Not So Important As the Last Section’s) Regression Results

- •A Multiple Regression Is Simple Too

- •Hypothesis Testing

- •Representing

- •What’s Left After You’ve Gotten the Most Out of Least Squares

- •Quick Review

- •Chapter 4. Data—The Transformational Experience

- •Your Basic Elementary Algebra

- •Simple Sample Says

- •Data Types Plain and Fancy

- •Numbers and Letters

- •Can We Have A Date?

- •What Are Your Values?

- •Relative Exotica

- •Quick Review

- •Chapter 5. Picture This!

- •A Simple Soup-To-Nuts Graphing Example

- •A Graphic Description of the Creative Process

- •Picture One Series

- •Group Graphics

- •Let’s Look At This From Another Angle

- •To Summarize

- •Categorical Graphs

- •Togetherness of the Second Sort

- •Quick Review and Look Ahead

- •Chapter 6. Intimacy With Graphic Objects

- •To Freeze Or Not To Freeze Redux

- •A Touch of Text

- •Shady Areas and No-Worry Lines

- •Templates for Success

- •Point Me The Way

- •Your Data Another Sorta Way

- •Give A Graph A Fair Break

- •Options, Options, Options

- •Quick Review?

- •Chapter 7. Look At Your Data

- •Sorting Things Out

- •Describing Series—Just The Facts Please

- •Describing Series—Picturing the Distribution

- •Tests On Series

- •Describing Groups—Just the Facts—Putting It Together

- •Chapter 8. Forecasting

- •Just Push the Forecast Button

- •Theory of Forecasting

- •Dynamic Versus Static Forecasting

- •Sample Forecast Samples

- •Facing the Unknown

- •Forecast Evaluation

- •Forecasting Beneath the Surface

- •Quick Review—Forecasting

- •Chapter 9. Page After Page After Page

- •Pages Are Easy To Reach

- •Creating New Pages

- •Renaming, Deleting, and Saving Pages

- •Multi-Page Workfiles—The Most Basic Motivation

- •Multiple Frequencies—Multiple Pages

- •Links—The Live Connection

- •Unlinking

- •Have A Match?

- •Matching When The Identifiers Are Really Different

- •Contracted Data

- •Expanded Data

- •Having Contractions

- •Two Hints and A GotchYa

- •Quick Review

- •Chapter 10. Prelude to Panel and Pool

- •Pooled or Paneled Population

- •Nuances

- •So What Are the Benefits of Using Pools and Panels?

- •Quick (P)review

- •Chapter 11. Panel—What’s My Line?

- •What’s So Nifty About Panel Data?

- •Setting Up Panel Data

- •Panel Estimation

- •Pretty Panel Pictures

- •More Panel Estimation Techniques

- •One Dimensional Two-Dimensional Panels

- •Fixed Effects With and Without the Social Contrivance of Panel Structure

- •Quick Review—Panel

- •Chapter 12. Everyone Into the Pool

- •Getting Your Feet Wet

- •Playing in the Pool—Data

- •Getting Out of the Pool

- •More Pool Estimation

- •Getting Data In and Out of the Pool

- •Quick Review—Pools

- •Chapter 13. Serial Correlation—Friend or Foe?

- •Visual Checks

- •Testing for Serial Correlation

- •More General Patterns of Serial Correlation

- •Correcting for Serial Correlation

- •Forecasting

- •ARMA and ARIMA Models

- •Quick Review

- •Chapter 14. A Taste of Advanced Estimation

- •Weighted Least Squares

- •Heteroskedasticity

- •Nonlinear Least Squares

- •Generalized Method of Moments

- •Limited Dependent Variables

- •ARCH, etc.

- •Maximum Likelihood—Rolling Your Own

- •System Estimation

- •Vector Autoregressions—VAR

- •Quick Review?

- •Chapter 15. Super Models

- •Your First Homework—Bam, Taken Up A Notch!

- •Looking At Model Solutions

- •More Model Information

- •Your Second Homework

- •Simulating VARs

- •Rich Super Models

- •Quick Review

- •Chapter 16. Get With the Program

- •I Want To Do It Over and Over Again

- •You Want To Have An Argument

- •Program Variables

- •Loopy

- •Other Program Controls

- •A Rolling Example

- •Quick Review

- •Appendix: Sample Programs

- •Chapter 17. Odds and Ends

- •How Much Data Can EViews Handle?

- •How Long Does It Take To Compute An Estimate?

- •Freeze!

- •A Comment On Tables

- •Saving Tables and Almost Tables

- •Saving Graphs and Almost Graphs

- •Unsubtle Redirection

- •Objects and Commands

- •Workfile Backups

- •Updates—A Small Thing

- •Updates—A Big Thing

- •Ready To Take A Break?

- •Help!

- •Odd Ending

- •Chapter 18. Optional Ending

- •Required Options

- •Option-al Recommendations

- •More Detailed Options

- •Window Behavior

- •Font Options

- •Frequency Conversion

- •Alpha Truncation

- •Spreadsheet Defaults

- •Workfile Storage Defaults

- •Estimation Defaults

- •File Locations

- •Graphics Defaults

- •Quick Review

- •Index

- •Symbols

378—Chapter 15. Super Models

Our new graph (which we have prettied-up) shows both baseline and scenario 1 results. Putting the deviation on a separate scale makes it easier to see the effect of this fiscal policy experiment. With a little luck, these results will get us a very good grade.

Simulating VARs

Models can be used for solving complicated systems of equations under different scenarios, as we’ve done above. Models can also be used for forecasting dynamic systems of equations. This is especially useful in forecasting from vector autoregressions.

Hint: The  feature in equations handles dynamic forecasting from a single equation quite handily. Here we’re talking about forecasting from multiple equation models.

feature in equations handles dynamic forecasting from a single equation quite handily. Here we’re talking about forecasting from multiple equation models.

Open the workfile “currencymodel.wf1” which contains the vector autoregression estimated in Chapter 14, “A Taste of Advanced Estimation.” Create a new model object named CURRENCY_FORECAST. Copy

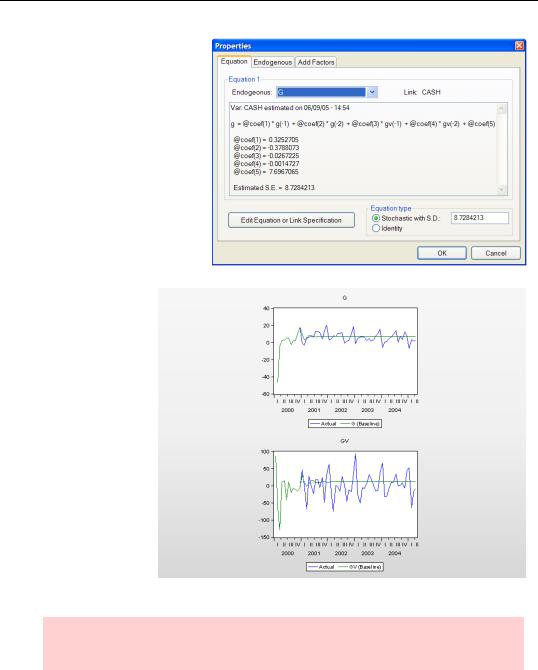

the VAR object CASH from the workfile window and paste it into the model, which now looks as shown to the right.

Simulating VARs—379

Double-click on the equation. The equation for G (growth in currency in the hands of the public) has been copied in together with the estimated coefficients and the estimated standard error of the error terms in the equation. Remember, this is a live link, so:

•If you re-estimate the VAR, the model will know to use the reestimated coefficients.

We can now use the model to forecast from the VAR. Click  , set the Solution sample to 2001 2005, and hit

, set the Solution sample to 2001 2005, and hit  . Then do

. Then do

Proc/Make Graph…. Check both Actuals and Active and set the

Sample for Graph to 2000M1 2005M4.

In this particular example, the vector autoregres-

sion did a good job of forecasting for several periods and essentially flatlined by a year out.

Hint: If you prefer, instead of creating a model and then copying in a VAR you can use Proc/Make Model from inside the VAR to do both at once.

The model taught in our introductory economics course was linear because it’s hard for people to solve nonlinear models. Computers are generally fine with nonlinear models,

380—Chapter 15. Super Models

although there are some nonlinear models that are too hard for even a computer to solve. For the most part though, the steps we just walked through would have worked just as well for a set of nonlinear equations.

Rich Super Models

The model object provides a rich set of facilities for everything from solving intro homework problems to solving large scale macroeconometric models. We’ve only been able to touch the surface. To help you explore further on your own, we list a few of the most prominent features:

•Models can be nonlinear. Various controls over the numerical procedures used are provided for hard problems. Diagnostics to track the solution process are also available when needed.

•Add factors can be used to adjust the value of a specified variable. You can even use add factors to adjust the solution for a particular variable to match a desired target.

•Equations can be implicit. Given an equation such as logy = x2 , EViews can solve for y. Add factors can be used for implicit equations as well.

•Stochastic simulations in which you specify the nature of the random error term for each equation are a built-in feature. This allows you to produce a statistical distribution of solutions in place of a point estimate.

•Equations can contain future values of variables. This means that EViews can solve dynamic perfect foresight models.

•Single-variable control problems of the following sort can be solved automatically. You can specify a target path for one endogenous variable and then instruct EViews to change the value of one exogenous variable that you specify in order to make the solved-for values of the endogenous variable match the target path.

Quick Review

A model is a collection of equations, either typed in directly or linked from objects in the workfile. The central feature of the model object is the ability to find the simultaneous solution of the equations it contains. Models also include a rich set of facilities for exploring various assumptions about the exogenous driving variables of the model and the effect of shocks to equations.