- •Table of Contents

- •Foreword

- •Chapter 1. A Quick Walk Through

- •Workfile: The Basic EViews Document

- •Viewing an individual series

- •Looking at different samples

- •Generating a new series

- •Looking at a pair of series together

- •Estimating your first regression in EViews

- •Saving your work

- •Forecasting

- •What’s Ahead

- •Chapter 2. EViews—Meet Data

- •The Structure of Data and the Structure of a Workfile

- •Creating a New Workfile

- •Deconstructing the Workfile

- •Time to Type

- •Identity Noncrisis

- •Dated Series

- •The Import Business

- •Adding Data To An Existing Workfile—Or, Being Rectangular Doesn’t Mean Being Inflexible

- •Among the Missing

- •Quick Review

- •Appendix: Having A Good Time With Your Date

- •Chapter 3. Getting the Most from Least Squares

- •A First Regression

- •The Really Important Regression Results

- •The Pretty Important (But Not So Important As the Last Section’s) Regression Results

- •A Multiple Regression Is Simple Too

- •Hypothesis Testing

- •Representing

- •What’s Left After You’ve Gotten the Most Out of Least Squares

- •Quick Review

- •Chapter 4. Data—The Transformational Experience

- •Your Basic Elementary Algebra

- •Simple Sample Says

- •Data Types Plain and Fancy

- •Numbers and Letters

- •Can We Have A Date?

- •What Are Your Values?

- •Relative Exotica

- •Quick Review

- •Chapter 5. Picture This!

- •A Simple Soup-To-Nuts Graphing Example

- •A Graphic Description of the Creative Process

- •Picture One Series

- •Group Graphics

- •Let’s Look At This From Another Angle

- •To Summarize

- •Categorical Graphs

- •Togetherness of the Second Sort

- •Quick Review and Look Ahead

- •Chapter 6. Intimacy With Graphic Objects

- •To Freeze Or Not To Freeze Redux

- •A Touch of Text

- •Shady Areas and No-Worry Lines

- •Templates for Success

- •Point Me The Way

- •Your Data Another Sorta Way

- •Give A Graph A Fair Break

- •Options, Options, Options

- •Quick Review?

- •Chapter 7. Look At Your Data

- •Sorting Things Out

- •Describing Series—Just The Facts Please

- •Describing Series—Picturing the Distribution

- •Tests On Series

- •Describing Groups—Just the Facts—Putting It Together

- •Chapter 8. Forecasting

- •Just Push the Forecast Button

- •Theory of Forecasting

- •Dynamic Versus Static Forecasting

- •Sample Forecast Samples

- •Facing the Unknown

- •Forecast Evaluation

- •Forecasting Beneath the Surface

- •Quick Review—Forecasting

- •Chapter 9. Page After Page After Page

- •Pages Are Easy To Reach

- •Creating New Pages

- •Renaming, Deleting, and Saving Pages

- •Multi-Page Workfiles—The Most Basic Motivation

- •Multiple Frequencies—Multiple Pages

- •Links—The Live Connection

- •Unlinking

- •Have A Match?

- •Matching When The Identifiers Are Really Different

- •Contracted Data

- •Expanded Data

- •Having Contractions

- •Two Hints and A GotchYa

- •Quick Review

- •Chapter 10. Prelude to Panel and Pool

- •Pooled or Paneled Population

- •Nuances

- •So What Are the Benefits of Using Pools and Panels?

- •Quick (P)review

- •Chapter 11. Panel—What’s My Line?

- •What’s So Nifty About Panel Data?

- •Setting Up Panel Data

- •Panel Estimation

- •Pretty Panel Pictures

- •More Panel Estimation Techniques

- •One Dimensional Two-Dimensional Panels

- •Fixed Effects With and Without the Social Contrivance of Panel Structure

- •Quick Review—Panel

- •Chapter 12. Everyone Into the Pool

- •Getting Your Feet Wet

- •Playing in the Pool—Data

- •Getting Out of the Pool

- •More Pool Estimation

- •Getting Data In and Out of the Pool

- •Quick Review—Pools

- •Chapter 13. Serial Correlation—Friend or Foe?

- •Visual Checks

- •Testing for Serial Correlation

- •More General Patterns of Serial Correlation

- •Correcting for Serial Correlation

- •Forecasting

- •ARMA and ARIMA Models

- •Quick Review

- •Chapter 14. A Taste of Advanced Estimation

- •Weighted Least Squares

- •Heteroskedasticity

- •Nonlinear Least Squares

- •Generalized Method of Moments

- •Limited Dependent Variables

- •ARCH, etc.

- •Maximum Likelihood—Rolling Your Own

- •System Estimation

- •Vector Autoregressions—VAR

- •Quick Review?

- •Chapter 15. Super Models

- •Your First Homework—Bam, Taken Up A Notch!

- •Looking At Model Solutions

- •More Model Information

- •Your Second Homework

- •Simulating VARs

- •Rich Super Models

- •Quick Review

- •Chapter 16. Get With the Program

- •I Want To Do It Over and Over Again

- •You Want To Have An Argument

- •Program Variables

- •Loopy

- •Other Program Controls

- •A Rolling Example

- •Quick Review

- •Appendix: Sample Programs

- •Chapter 17. Odds and Ends

- •How Much Data Can EViews Handle?

- •How Long Does It Take To Compute An Estimate?

- •Freeze!

- •A Comment On Tables

- •Saving Tables and Almost Tables

- •Saving Graphs and Almost Graphs

- •Unsubtle Redirection

- •Objects and Commands

- •Workfile Backups

- •Updates—A Small Thing

- •Updates—A Big Thing

- •Ready To Take A Break?

- •Help!

- •Odd Ending

- •Chapter 18. Optional Ending

- •Required Options

- •Option-al Recommendations

- •More Detailed Options

- •Window Behavior

- •Font Options

- •Frequency Conversion

- •Alpha Truncation

- •Spreadsheet Defaults

- •Workfile Storage Defaults

- •Estimation Defaults

- •File Locations

- •Graphics Defaults

- •Quick Review

- •Index

- •Symbols

232—Chapter 8. Forecasting

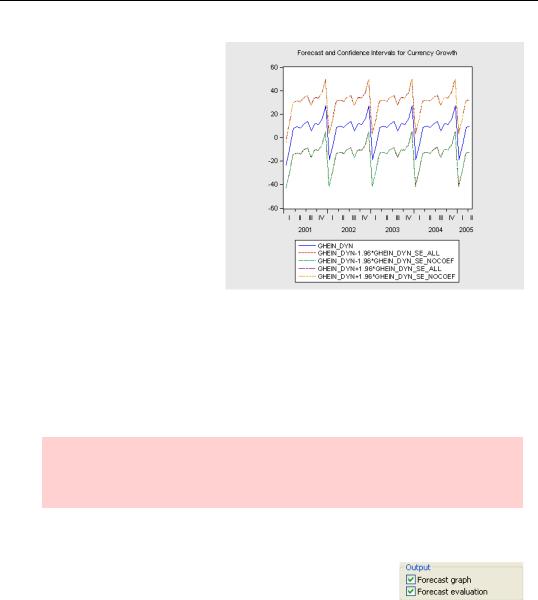

We’ve stored the standard error for our dynamic forecast including coefficient uncertainty as GHEIN_DYN_SE_ALL and analogously, without coefficient uncertainty, under GHEIN_DYN_SE_NOCOEF. Here’s a plot of the forecast value and confidence bands, measured as the forecast minus 1.96 standard errors through the forecast plus 1.96 standard errors. You can see that the difference between the confidence intervals with and without coefficient uncertainty is all but invisible to the eye. That’s one

reason people often don’t bother including coefficient uncertainty.

For the record, here’s the command that produced the plot (before we added the title and tidied it up):

plot ghein_dyn ghein_dyn-1.96*ghein_dyn_se_all ghein_dyn- 1.96*ghein_dyn_se_nocoef ghein_dyn+1.96*ghein_dyn_se_all ghein_dyn+1.96*ghein_dyn_se_nocoef

Hint: This plot shows two forecasts and two associated sets of confidence intervals. Usually, you want to see a single forecast and its confidence intervals. EViews can do that graph automatically, as we’ll see next.

Forecast Evaluation

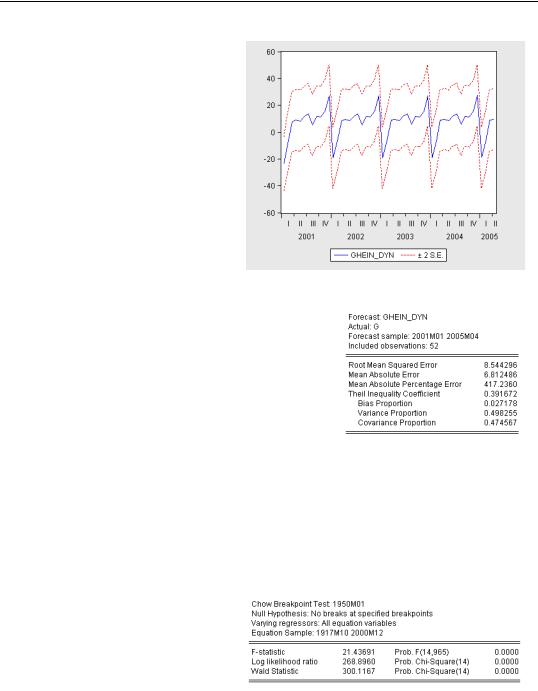

EViews provides two built-in tools to help with forecast evaluation: the Output field checkboxes Forecast graph and Forecast evaluation.

Forecast Evaluation—233

The Forecast graph option automates the 95% confidence interval plot.

The Forecast evaluation option generates a small table with a variety of statistics for comparing forecast and actual values. The Root Mean Squared Error (or RMSE) is the standard deviation of the forecast errors. (See the User’s Guide for explanations of the other statistics.)

Our forecasts aren’t bad, but the confidence intervals shown in the graph above are fairly wide given the observed movement of G. Similarly, the RMSE is not

small compared to the standard deviation of G. Looking back at our plot of out-of-sample forecasts versus actuals, one is struck with the fact that the forecasts take wider swings than the data. In the data plot that opened the chapter, you can see that the volatility of currency growth was much greater in the pre-War period than it was post-War. The HERODOTUS sample includes both periods. To get an accurate estimate, and thus an accurate forecast, we like to use as much data as possible. On the other hand, we don’t want to include old data if the parameters have changed.

We can rely on a visual inspection of the plots we’ve made, or we can use a more formal Chow test, which confirms that a change has occurred. (Once again, see the

User’s Guide).

If we define an “alternate history” with:

234—Chapter 8. Forecasting

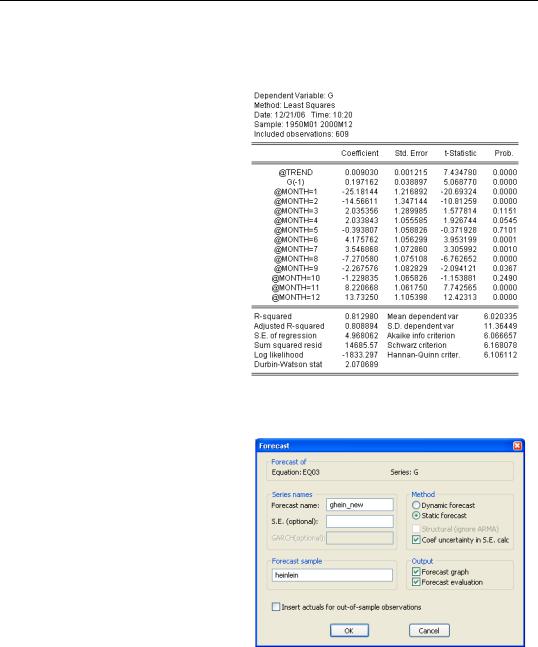

sample turtledove 1950 2000

smpl turtledove

and re-estimate, we find much smaller seasonal effects and a much higher R2 in the TURTLEDOVE world than there was according to HEROTODUS.

Glance back at the data plot which opened the chapter. It shows an enormous increase in currency holdings right before the turn of the millennium and a huge drop immediately thereafter. This means that a dynamic forecast starting in the beginning of 2000 uses an anomalous value for lagged G, a problem which is carried forward. In contrast, a static forecast should only have difficulty at the beginning of the forecast period, since thereafter actual lagged G picks up non-anom- alous data.

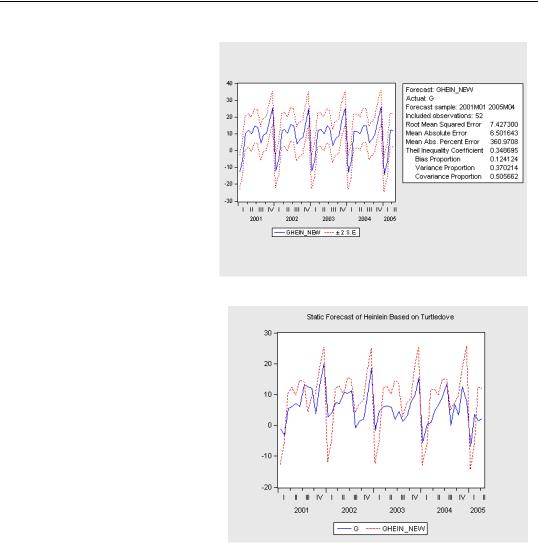

Using this new estimate, shown above to the right, as a basis for a static forecast through the HEINLEIN period, we can set the Forecast dialog to save a new forecast, to plot the forecast and confidence intervals, and to show us a new forecast evaluation.

Forecasting Beneath the Surface—235

When the Forecast graph and the Forecast evaluation options are both checked, EViews puts the confidence interval graph and statistics together in one window. We’ve definitely gotten a bit of improvement from changing the sample.

One last plot. The seasonal forecast swings are still somewhat larger than the actual seasonal effects, but the forecast is really pretty good for such a simple model.

Forecasting Beneath the Surface

Sometimes the variable you want to forecast isn’t quite the variable on the left of your estimating equation. There are often statistical or economic modeling reasons for estimating a transformed version of the variable you really care about. Two common examples are using logs (rather than levels) of the variable of interest, and using first differences of the variable of interest.

236—Chapter 8. Forecasting

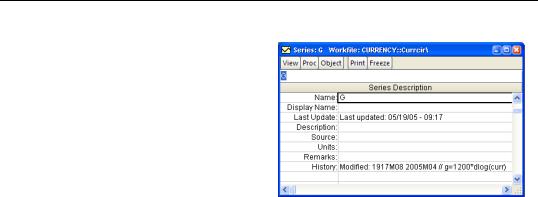

In the example we’ve been using, we’ve taken our task to be forecasting currency growth. If you look at the label for our series G (see Label View in Chapter 2, “EViews—Meet Data”), you’ll see it was derived from an underlying series for the level of currency, CURR, using the command “series g=1200*dlog(curr)”. Since the function dlog takes first differences of logarithms, we actually made both of the transformations just mentioned.

Instead of forecasting growth rates, we could have been asked to forecast the level of currency. In principle, if you know today’s currency level and have a forecast growth rate, you can forecast next period’s level by adding projected growth to today’s level. In practice, doing this can be a little hairy because for more complicated functions it’s not so easy to work backward from the estimated function to the original variable, and because forecast confidence intervals (see below) are nonlinear. Fortunately, EViews will handle all the hard work if you’ll cooperate in one small way:

•Estimate the forecasting equation using an auto-series on the left in place of a regular series.

As a regular series, the information that G was created from “g=1200*dlog(curr)” is a historical note, but there isn’t any live connection. If we use an auto-series, then EViews understands—and can work with—the connection between CURR and the auto-series. We could use the following commands to define an auto-series and then estimate our forecasting equation:

frml currgrowth=1200*dlog(curr)

ls currgrowth @trend currgrowth(-1) @expand(@month)

Forecasting Beneath the Surface—237

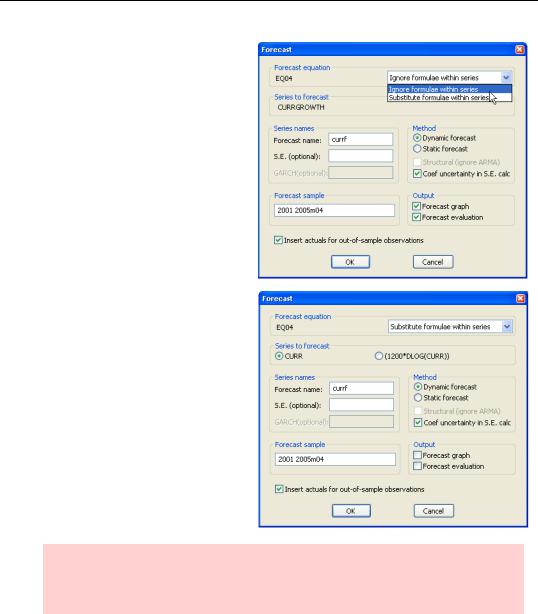

When we hit  in the equation window, we get a Forecast dialog that looks just a little different. The default choice in the dropdown menu is Ignore formulae within series, which means to forecast the auto-series, currency growth in this case.

in the equation window, we get a Forecast dialog that looks just a little different. The default choice in the dropdown menu is Ignore formulae within series, which means to forecast the auto-series, currency growth in this case.

The alternative choice is Substitute formulae within series. Choose this option and you’re offered the choice of forecasting either the underlying series or the auto-series. We’ve chosen to forecast the level of currency (and set the forecast sample to match the forecast sample in the previous example).

Hint: If you use an expression, for example “1200*dlog(curr)”, rather than a named auto-series as the dependent variable, you get pretty much the same choices, although the dialogs look a little different.