- •In praise of the fourth edition

- •CONTENTS

- •FOREWORD

- •The concept of consulting

- •Purpose of the book

- •Terminology

- •Plan of the book

- •ABBREVIATIONS AND ACRONYMS

- •1.1 What is consulting?

- •Box 1.1 On giving and receiving advice

- •1.2 Why are consultants used? Five generic purposes

- •Figure 1.1 Generic consulting purposes

- •Box 1.2 Define the purpose, not the problem

- •1.3 How are consultants used? Ten principal ways

- •Box 1.3 Should consultants justify management decisions?

- •1.4 The consulting process

- •Figure 1.2 Phases of the consulting process

- •1.5 Evolving concepts and scope of management consulting

- •2 THE CONSULTING INDUSTRY

- •2.1 A historical perspective

- •2.2 The current consulting scene

- •2.3 Range of services provided

- •2.4 Generalist and specialist services

- •2.5 Main types of consulting organization

- •2.6 Internal consultants

- •2.7 Management consulting and other professions

- •Figure 2.1 Professional service infrastructure

- •2.8 Management consulting, training and research

- •Box 2.1 Factors differentiating research and consulting

- •3.1 Defining expectations and roles

- •Box 3.1 What it feels like to be a buyer

- •3.2 The client and the consultant systems

- •Box 3.2 Various categories of clients within a client system

- •Box 3.3 Attributes of trusted advisers

- •3.4 Behavioural roles of the consultant

- •Box 3.4 Why process consultation must be a part of every consultation

- •3.5 Further refinement of the role concept

- •3.6 Methods of influencing the client system

- •3.7 Counselling and coaching as tools of consulting

- •Box 3.5 The ICF on coaching and consulting

- •4 CONSULTING AND CHANGE

- •4.1 Understanding the nature of change

- •Figure 4.1 Time span and level of difficulty involved for various levels of change

- •Box 4.1 Which change comes first?

- •Box 4.2 Reasons for resistance to change

- •4.2 How organizations approach change

- •Box 4.3 What is addressed in planning change?

- •Box 4.4 Ten overlapping management styles, from no participation to complete participation

- •4.3 Gaining support for change

- •4.4 Managing conflict

- •Box 4.5 How to manage conflict

- •4.5 Structural arrangements and interventions for assisting change

- •5 CONSULTING AND CULTURE

- •5.1 Understanding and respecting culture

- •Box 5.1 What do we mean by culture?

- •5.2 Levels of culture

- •Box 5.2 Cultural factors affecting management

- •Box 5.3 Japanese culture and management consulting

- •Box 5.4 Cultural values and norms in organizations

- •5.3 Facing culture in consulting assignments

- •Box 5.5 Characteristics of “high-tech” company cultures

- •6.1 Is management consulting a profession?

- •6.2 The professional approach

- •Box 6.1 The power of the professional adviser

- •Box 6.2 Is there conflict of interest? Test your value system.

- •Box 6.3 On audit and consulting

- •6.3 Professional associations and codes of conduct

- •6.4 Certification and licensing

- •Box 6.4 International model for consultant certification (CMC)

- •6.5 Legal liability and professional responsibility

- •7 ENTRY

- •7.1 Initial contacts

- •Box 7.1 What a buyer looks for

- •7.2 Preliminary problem diagnosis

- •Figure 7.1 The consultant’s approach to a management survey

- •Box 7.2 Information materials for preliminary surveys

- •7.3 Terms of reference

- •Box 7.3 Terms of reference – checklist

- •7.4 Assignment strategy and plan

- •Box 7.4 Concepts and terms used in international technical cooperation projects

- •7.5 Proposal to the client

- •7.6 The consulting contract

- •Box 7.5 Confidential information on the client organization

- •Box 7.6 What to cover in a contract – checklist

- •8 DIAGNOSIS

- •8.1 Conceptual framework of diagnosis

- •8.2 Diagnosing purposes and problems

- •Box 8.1 The focus purpose – an example

- •Box 8.2 Issues in problem identification

- •8.3 Defining necessary facts

- •8.4 Sources and ways of obtaining facts

- •Box 8.3 Principles of effective interviewing

- •8.5 Data analysis

- •Box 8.4 Cultural factors in data-gathering – some examples

- •Box 8.5 Difficulties and pitfalls of causal analysis

- •Figure 8.1 Force-field analysis

- •Figure 8.2 Various bases for comparison

- •8.6 Feedback to the client

- •9 ACTION PLANNING

- •9.1 Searching for possible solutions

- •Box 9.1 Checklist of preliminary considerations

- •Box 9.2 Variables for developing new forms of transport

- •9.2 Developing and evaluating alternatives

- •Box 9.3 Searching for an ideal solution – three checklists

- •9.3 Presenting action proposals to the client

- •10 IMPLEMENTATION

- •10.1 The consultant’s role in implementation

- •10.2 Planning and monitoring implementation

- •10.3 Training and developing client staff

- •10.4 Some tactical guidelines for introducing changes in work methods

- •Figure 10.1 Comparison of the effects on eventual performance when using individualized versus conformed initial approaches

- •Figure 10.2 Comparison of spaced practice with a continuous or massed practice approach in terms of performance

- •Figure 10.3 Generalized illustration of the high points in attention level of a captive audience

- •10.5 Maintenance and control of the new practice

- •11.1 Time for withdrawal

- •11.2 Evaluation

- •11.3 Follow-up

- •11.4 Final reporting

- •12.1 Nature and scope of consulting in corporate strategy and general management

- •12.2 Corporate strategy

- •12.3 Processes, systems and structures

- •12.4 Corporate culture and management style

- •12.5 Corporate governance

- •13.1 The developing role of information technology

- •13.2 Scope and special features of IT consulting

- •13.3 An overall model of information systems consulting

- •Figure 13.1 A model of IT consulting

- •Figure 13.2 An IT systems portfolio

- •13.4 Quality of information systems

- •13.5 The providers of IT consulting services

- •Box 13.1 Choosing an IT consultant

- •13.6 Managing an IT consulting project

- •13.7 IT consulting to small businesses

- •13.8 Future perspectives

- •14.1 Creating value

- •14.2 The basic tools

- •14.3 Working capital and liquidity management

- •14.4 Capital structure and the financial markets

- •14.5 Mergers and acquisitions

- •14.6 Finance and operations: capital investment analysis

- •14.7 Accounting systems and budgetary control

- •14.8 Financial management under inflation

- •15.1 The marketing strategy level

- •15.2 Marketing operations

- •15.3 Consulting in commercial enterprises

- •15.4 International marketing

- •15.5 Physical distribution

- •15.6 Public relations

- •16 CONSULTING IN E-BUSINESS

- •16.1 The scope of e-business consulting

- •Figure 16.1 Classification of the connected relationship

- •Box 16.1 British Telecom entering new markets

- •Box 16.2 Pricing models

- •Box 16.3 EasyRentaCar.com breaks the industry rules

- •Box 16.4 The ThomasCook.com story

- •16.4 Dot.com organizations

- •16.5 Internet research

- •17.1 Developing an operations strategy

- •Box 17.1 Performance criteria of operations

- •Box 17.2 Major types of manufacturing choice

- •17.2 The product perspective

- •Box 17.3 Central themes in ineffective and effective development projects

- •17.3 The process perspective

- •17.4 The human aspects of operations

- •18.1 The changing nature of the personnel function

- •18.2 Policies, practices and the human resource audit

- •Box 18.1 The human resource audit (data for the past 12 months)

- •18.3 Human resource planning

- •18.4 Recruitment and selection

- •18.5 Motivation and remuneration

- •18.6 Human resource development

- •18.7 Labour–management relations

- •18.8 New areas and issues

- •Box 18.2 Current issues in Japanese human resource management

- •Box 18.3 Current issues in European HR management

- •19.1 Managing in the knowledge economy

- •Figure 19.1 Knowledge: a key resource of the post-industrial area

- •19.2 Knowledge-based value creation

- •Figure 19.2 The competence ladder

- •Figure 19.3 Four modes of knowledge transformation

- •Figure 19.4 Components of intellectual capital

- •Figure 19.5 What is your strategy to manage knowledge?

- •19.3 Developing a knowledge organization

- •Figure 19.6 Implementation paths for knowledge management

- •Box 19.1 The Siemens Business Services knowledge management framework

- •20.1 Shifts in productivity concepts, factors and conditions

- •Figure 20.1 An integrated model of productivity factors

- •Figure 20.2 A results-oriented human resource development cycle

- •20.2 Productivity and performance measurement

- •Figure 20.3 The contribution of productivity to profits

- •20.3 Approaches and strategies to improve productivity

- •Figure 20.4 Kaizen building-blocks

- •Box 20.1 Green productivity practices

- •Figure 20.5 Nokia’s corporate fitness rating

- •Box 20.2 Benchmarking process

- •20.4 Designing and implementing productivity and performance improvement programmes

- •Figure 20.6 The performance improvement planning process

- •Figure 20.7 The “royal road” of productivity improvement

- •20.5 Tools and techniques for productivity improvement

- •Box 20.3 Some simple productivity tools

- •Box 20.4 Multipurpose productivity techniques

- •Box 20.5 Tools used by most successful companies

- •21.1 Understanding TQM

- •21.2 Cost of quality – quality is free

- •Figure 21.1 Typical quality cost reduction

- •Box 21.1 Cost items of non-conformance associated with internal and external failures

- •Box 21.2 The cost items of conformance

- •21.3 Principles and building-blocks of TQM

- •Figure 21.2 TQM business structures

- •21.4 Implementing TQM

- •Box 21.3 The road to TQM

- •Figure 21.3 TQM process blocks

- •21.5 Principal TQM tools

- •Box 21.4 Tools for simple tasks in quality improvement

- •Figure 21.4 Quality tools according to quality improvement steps

- •Box 21.5 Powerful tools for company-wide TQM

- •21.6 ISO 9000 as a vehicle to TQM

- •21.7 Pitfalls and problems of TQM

- •21.8 Impact on management

- •21.9 Consulting competencies for TQM

- •22.1 What is organizational transformation?

- •22.2 Preparing for transformation

- •Figure 22.1 The change-resistant organization

- •22.3 Strategies and processes of transformation

- •Figure 22.2 Linkage between transformation types and organizational conditions

- •Figure 22.3 Relationships between business performance and types of transformation

- •Box 22.1 Eight stages for transforming an organization

- •22.4 Company turnarounds

- •Box 22.2 Implementing a turnaround plan

- •22.5 Downsizing

- •22.6 Business process re-engineering (BPR)

- •22.7 Outsourcing and insourcing

- •22.8 Joint ventures for transformation

- •22.9 Mergers and acquisitions

- •Box 22.3 Restructuring through acquisitions: the case of Cisco Systems

- •22.10 Networking arrangements

- •22.11 Transforming organizational structures

- •22.12 Ownership restructuring

- •22.13 Privatization

- •22.14 Pitfalls and errors to avoid in transformation

- •23.1 The social dimension of business

- •23.2 Current concepts and trends

- •Box 23.1 International guidelines on socially responsible business

- •23.3 Consulting services

- •Box 23.2 Typology of corporate citizenship consulting

- •23.4 A strategic approach to corporate responsibility

- •Figure 23.1 The total responsibility management system

- •23.5 Consulting in specific functions and areas of business

- •23.6 Future perspectives

- •24.1 Characteristics of small enterprises

- •24.2 The role and profile of the consultant

- •24.4 Areas of special concern

- •24.5 An enabling environment

- •24.6 Innovations in small-business consulting

- •25.1 What is different about micro-enterprises?

- •Box 25.1 Consulting in the informal sector – a mini case study

- •25.3 The special skills of micro-enterprise consultants

- •Box 25.2 Private consulting services for micro-enterprises

- •26.1 The evolving role of government

- •Box 26.1 Reinventing government

- •26.2 Understanding the public sector environment

- •Figure 26.1 The public sector decision-making process

- •Box 26.2 The consultant–client relationship in support of decision-making

- •Box 26.3 “Shoulds” and “should nots” in consulting to government

- •26.3 Working with public sector clients throughout the consulting cycle

- •26.4 The service providers

- •26.5 Some current challenges

- •27.1 The management challenge of the professions

- •27.2 Managing a professional service

- •Box 27.1 Challenges in people management

- •27.3 Managing a professional business

- •Box 27.2 Leverage and profitability

- •Box 27.3 Hunters and farmers

- •27.4 Achieving excellence professionally and in business

- •28.1 The strategic approach

- •28.2 The scope of client services

- •Box 28.1 Could consultants live without fads?

- •28.3 The client base

- •28.4 Growth and expansion

- •28.5 Going international

- •28.6 Profile and image of the firm

- •Box 28.2 Five prototypes of consulting firms

- •28.7 Strategic management in practice

- •Box 28.3 Strategic audit of a consulting firm: checklist of questions

- •Box 28.4 What do we want to know about competitors?

- •Box 28.5 Environmental factors affecting strategy

- •29.1 The marketing approach in consulting

- •Box 29.1 Marketing of consulting: seven fundamental principles

- •29.2 A client’s perspective

- •29.3 Techniques for marketing the consulting firm

- •Box 29.2 Criteria for selecting consultants

- •Box 29.3 Branding – the new myth of marketing?

- •29.4 Techniques for marketing consulting assignments

- •29.5 Marketing to existing clients

- •Box 29.4 The cost of marketing efforts: an example

- •29.6 Managing the marketing process

- •Box 29.5 Information about clients

- •30 COSTS AND FEES

- •30.1 Income-generating activities

- •Table 30.1 Chargeable time

- •30.2 Costing chargeable services

- •30.3 Marketing-policy considerations

- •30.4 Principal fee-setting methods

- •30.5 Fair play in fee-setting and billing

- •30.6 Towards value billing

- •30.7 Costing and pricing an assignment

- •30.8 Billing clients and collecting fees

- •Box 30.1 Information to be provided in a bill

- •31 ASSIGNMENT MANAGEMENT

- •31.1 Structuring and scheduling an assignment

- •31.2 Preparing for an assignment

- •Box 31.1 Checklist of points for briefing

- •31.3 Managing assignment execution

- •31.4 Controlling costs and budgets

- •31.5 Assignment records and reports

- •Figure 31.1 Notification of assignment

- •Box 31.2 Assignment reference report – a checklist

- •31.6 Closing an assignment

- •32.1 What is quality management in consulting?

- •Box 32.1 Primary stakeholders’ needs

- •Box 32.2 Responsibility for quality

- •32.2 Key elements of a quality assurance programme

- •Box 32.3 Introducing a quality assurance programme

- •Box 32.4 Assuring quality during assignments

- •32.3 Quality certification

- •32.4 Sustaining quality

- •33.1 Operating workplan and budget

- •Box 33.1 Ways of improving efficiency and raising profits

- •Table 33.2 Typical structure of expenses and income

- •33.2 Performance monitoring

- •Box 33.2 Monthly controls: a checklist

- •Figure 33.1 Expanded profit model for consulting firms

- •33.3 Bookkeeping and accounting

- •34.1 Drivers for knowledge management in consulting

- •34.2 Factors inherent in the consulting process

- •34.3 A knowledge management programme

- •34.4 Sharing knowledge with clients

- •Box 34.1 Checklist for applying knowledge management in a small or medium-sized consulting firm

- •35.1 Legal forms of business

- •35.2 Management and operations structure

- •Figure 35.1 Possible organizational structure of a consulting company

- •Figure 35.2 Professional core of a consulting unit

- •35.3 IT support and outsourcing

- •35.4 Office facilities

- •36.1 Personal characteristics of consultants

- •36.2 Recruitment and selection

- •Box 36.1 Qualities of a consultant

- •36.3 Career development

- •Box 36.2 Career structure in a consulting firm

- •36.4 Compensation policies and practices

- •Box 36.3 Criteria for partners’ compensation

- •Box 36.4 Ideas for improving compensation policies

- •37.1 What should consultants learn?

- •Box 37.1 Areas of consultant knowledge and skills

- •37.2 Training of new consultants

- •Figure 37.1 Consultant development matrix

- •37.3 Training methods

- •Box 37.2 Training in process consulting

- •37.4 Further training and development of consultants

- •37.5 Motivation for consultant development

- •37.6 Learning options available to sole practitioners

- •38 PREPARING FOR THE FUTURE

- •38.1 Your market

- •Box 38.1 Change in the consulting business

- •38.2 Your profession

- •38.3 Your self-development

- •38.4 Conclusion

- •APPENDICES

- •4 TERMS OF A CONSULTING CONTRACT

- •5 CONSULTING AND INTELLECTUAL PROPERTY

- •7 WRITING REPORTS

- •SUBJECT INDEX

Entry

–the practice of some consultants of using free diagnostic surveys as a marketing tool (since the consultant cannot really work for nothing, another client will then pay for this “free” survey); and

–the practice of some clients of collecting a large amount of information and ideas from several consultants, who are all invited to make the same survey, without paying anything.

Free diagnostic surveys used to be quite common in some countries in the past, but have recently been much less so.

7.2Preliminary problem diagnosis

The preliminary diagnosis should start from the moment the consultant is in touch with the client. Everything is relevant: who made the initial contact and how; how the consultant is received at the first meeting; what sort of questions the client asks; if there are any undertones in those questions; what the client says about the business and his competitors; if the client is relaxed or tense; and so on. The consultant has to sort out this information and then complete the picture by getting some hard data and looking at the problem from new angles – for example, by talking to people other than those involved in the first meetings.

Scope of the diagnosis

The purpose of the preliminary problem diagnosis is not to propose measures for solving the problem, but to define and plan a consulting assignment or project which will have this effect. The scope of the preliminary diagnosis is limited to a quick gathering and analysis of essential information which, according to the consultant’s experience and judgement, is needed to understand the problem correctly, to see it in the wider context of the client organization’s activities, achievements, goals, and other existing or potential business and management problems, and realistically to assess opportunities for helping the client.

The scale of this preliminary diagnosis depends very much on the nature of the problem. Very specific and technical issues do not normally require a comprehensive survey of the whole client organization. On the other hand, the consultant must avoid the trap of accepting a client’s narrow definition of a problem as technical without looking into the constraints and factors that may impede the solution of that problem, or may show that the problem is much more or much less serious than the client thinks. Therefore even if the problem lies in one functional area only, or concerns the application of some specific techniques, the consultant should always be interested in the more general characteristics of the client organization.

If the consultant is brought in to deal with a general and major problem, such as deteriorating financial results, or inability to maintain the same pace of innovation as competitors, a general and comprehensive diagnosis or management survey of the client organization is essential.

159

Management consulting

The time allocated to preliminary problem diagnosis is relatively short. As a rule, one to four days would be required. In the case of more complex assignments concerning several aspects of the client’s business, five to ten days may be needed. If a more extensive survey is required (e.g. in preparing company turnarounds, major reorganizations, buy-outs or mergers, or for any other reason), this can no longer be considered a preliminary diagnosis, but an indepth diagnostic survey (see Chapter 12).

Some methodological guidelines

The basic rules, procedures and analytical techniques used in the preliminary problem diagnosis are the same as those of the later diagnosis, as reviewed in detail in Chapter 8. Many consulting firms have developed their own approaches and guidelines for a quick assessment of clients’ businesses.

The diagnosis includes the gathering and analysis of information on the client’s activities, performance and perspectives. It also includes discussions with selected managers and other key people, and in certain cases also with people outside the client organization. Basically, the consultant is not interested in fine details, but is looking for trends, relationships and proportions. An experienced consultant needs to be observant and can often sense potential problems or opportunities that are not immediately apparent: the way people talk to and about each other, the respect for hierarchical relations, the cleanliness of workshops and offices, the handling of confidential information, the courtesy of the receptionist, and so on.

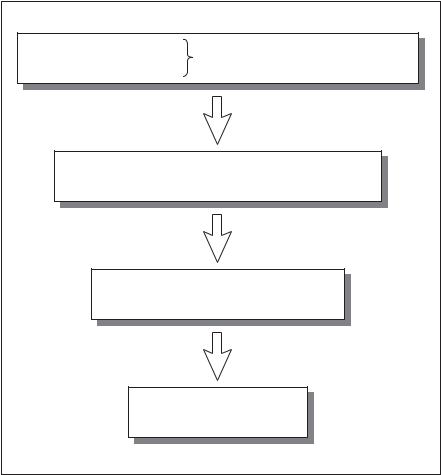

It is essential to take a dynamic and comprehensive view of the organization, its environment, resources, goals, activities, achievements and perspectives. Dynamism in this context means examining key achievements and events in the life of the organization and probable future trends as reflected in existing plans and assessed by the consultant personally. The client’s strengths and weaknesses ought to be viewed in a time perspective – a present strength may be merely short-term, while a weakness, hidden at present, may become a threat to the client’s organization in the long term. The consultant should look particularly at future opportunities – indeed, the detailed diagnosis and further work to be proposed to the client should be oriented towards these opportunities above all. This approach is summarized in figure 7.1.

As already mentioned, even if the problem is, or is likely to be, in a single functional area, the consultant should take a comprehensive view of the organization. How comprehensive is a matter of experience and judgement, and no universal recipe can be given. Most management consultants emphasize the need for some sort of wider appraisal of the organization before confirming the existence even of a fairly limited problem, and the feasibility of handling it within certain terms of reference.

It is recommended that the consultant should proceed from the general to the particular: from overall objectives and global performance indicators to the reasons for substandard performance or missed opportunities (or to interesting

160

Entry

Figure 7.1 The consultant’s approach to a management survey

Past

Present state of client affairs

Future

Strengths and weaknesses

Possible improvements, opportunities

Action needed and help proposed

future opportunities), and then to an examination in some detail of selected areas of the organization’s activities. An approach that starts the other way round, by examining each management function or process (production, purchasing, marketing, etc.) in turn and hoping for a balanced synthesis at the end, will entail much unnecessary work and might well prove misdirected. The movement from the general to the particular helps the consultant to limit the preliminary diagnostic survey to matters of critical concern, or conversely may indicate that, to stand the best chance of achieving the results expected, the inquiry must take into account every aspect of the enterprise’s operation.

Such an approach implies that the consultant’s analysis will focus on basic relationships and proportions in the client organization, such as the following:

161

Management consulting

●relationships and proportions between major processes, functions and activity areas (e.g. allocation of human and financial resources to marketing, research and development, production, administration);

●relationships between main inputs and outputs (e.g. sales related to materials consumed, the wage bill and the total workforce);

●relationships between the principal indicators of performance, effectiveness and efficiency (e.g. productivity, profitability, resource utilization, growth);

●relationships between global performance indicators and main factors affecting their magnitude in a positive or negative way (e.g. influence of the volume of work in progress on working capital and profitability);

●the contribution of the main divisions and product (service) lines to the results (profitability, image, etc.) achieved by the organization as a whole.

The comprehensive, overall approach should be combined with a functional approach as necessary. For example, the precarious financial situation of a company may be caused by problems in any functional area: by badly organized production, by costly or ineffective marketing, by excessive spending on unproductive research, by the shortage or high cost of capital, or something else. As already mentioned, if an assignment is likely to be exclusively or mainly in one technical area, this area will need to be examined in greater depth than other areas, and the examination of the organization as a whole will be limited to what is necessary.

In summary, this approach will tell the consultant if the work envisaged can make a meaningful contribution to the principal objectives of the client organization and what critical relationships and linkages are likely to affect the course of the assignment.

Using comparison

While recognizing that every client organization is unique and has to be treated as such, the consultant needs reference points that can guide him or her in a preliminary quick assessment of strengths, weaknesses, development prospects and desirable improvements. The consultant will find these by making comparisons with:

–past achievements (if the organization’s performance has deteriorated and the problem is essentially corrective);

–the client’s own objectives, plans and standards (if real performance does not measure up to them);

–other comparable organizations (to assess what has been achieved elsewhere and whether the same thing would be possible in the client organization);

–sectoral standards (available in the consulting firm or from another source).

A comparison of well-selected data with sectoral standards or with data from specific similar organizations is a powerful diagnostic tool. It helps not only in quick orientation, but also in making the client aware of the situation, which may be quite different from what he or she believes.

162

Entry

The comparisons should encompass not only figures, but also qualitative information (e.g. the organizational structure, the corporate culture, the computer applications, or the market-research techniques used). In other words, the consultant should determine what levels of sophistication and performance and what sorts of problems he or she would normally expect to find in an organization of the type of the client enterprise.

Such a consideration is meaningful if the consultant has some method of classifying and comparing organizations (e.g. by sector, product type, size, ownership, market served and the like). For each class there would be a list of various attributes that are characteristic of it. Many well-established consulting firms provide their consultants with such data and guide them by means of manuals and checklists for management surveys and company appraisals. It is in the interest of the new firms to acquire or develop such documentation.3

Notwithstanding certain general rules, senior consultants undertaking diagnostic surveys tend to have their personal priorities and specific approaches. Many of them start by looking at important financial data, since these reflect the level and results of the activities of the enterprise in a way that lends itself to synthesis. Others emphasize production: they believe that a simple factory tour is most revealing and tells an experienced observer a great deal about the quality of management. Still others prefer to examine markets, products and services before turning to a financial appraisal and further investigations. These are just different starting-points reflecting personal experience and preferences: eventually the consultant has to study all areas and questions needed for a global diagnosis in order to see the problem in context and perspective.

The client’s involvement

The dialogue with the client should be pursued during problem diagnosis. The consultant should find out how the client feels about various aspects of the business: what its goals, objectives and technical and human capabilities are, what its potential is for making changes, and what style of consulting should be applied. The client, on the other hand, gets to know the consultant better and has an opportunity to appreciate his or her way of obtaining information, establishing contacts with people, grasping the overall situation, making judgements and distilling essential facts from the vast amount of data that can be found in any organization.

Sources of information

A successful diagnostic survey is based on the rapid collection of selective information that reveals the type and extent of help that the consultant can give to the client. Diagnostic data tend to be global in nature. The main sources of information for a preliminary diagnostic survey are published material and records (box 7.2), observation and interviewing by the consultant, and contacts outside the client organization.

163