- •In praise of the fourth edition

- •CONTENTS

- •FOREWORD

- •The concept of consulting

- •Purpose of the book

- •Terminology

- •Plan of the book

- •ABBREVIATIONS AND ACRONYMS

- •1.1 What is consulting?

- •Box 1.1 On giving and receiving advice

- •1.2 Why are consultants used? Five generic purposes

- •Figure 1.1 Generic consulting purposes

- •Box 1.2 Define the purpose, not the problem

- •1.3 How are consultants used? Ten principal ways

- •Box 1.3 Should consultants justify management decisions?

- •1.4 The consulting process

- •Figure 1.2 Phases of the consulting process

- •1.5 Evolving concepts and scope of management consulting

- •2 THE CONSULTING INDUSTRY

- •2.1 A historical perspective

- •2.2 The current consulting scene

- •2.3 Range of services provided

- •2.4 Generalist and specialist services

- •2.5 Main types of consulting organization

- •2.6 Internal consultants

- •2.7 Management consulting and other professions

- •Figure 2.1 Professional service infrastructure

- •2.8 Management consulting, training and research

- •Box 2.1 Factors differentiating research and consulting

- •3.1 Defining expectations and roles

- •Box 3.1 What it feels like to be a buyer

- •3.2 The client and the consultant systems

- •Box 3.2 Various categories of clients within a client system

- •Box 3.3 Attributes of trusted advisers

- •3.4 Behavioural roles of the consultant

- •Box 3.4 Why process consultation must be a part of every consultation

- •3.5 Further refinement of the role concept

- •3.6 Methods of influencing the client system

- •3.7 Counselling and coaching as tools of consulting

- •Box 3.5 The ICF on coaching and consulting

- •4 CONSULTING AND CHANGE

- •4.1 Understanding the nature of change

- •Figure 4.1 Time span and level of difficulty involved for various levels of change

- •Box 4.1 Which change comes first?

- •Box 4.2 Reasons for resistance to change

- •4.2 How organizations approach change

- •Box 4.3 What is addressed in planning change?

- •Box 4.4 Ten overlapping management styles, from no participation to complete participation

- •4.3 Gaining support for change

- •4.4 Managing conflict

- •Box 4.5 How to manage conflict

- •4.5 Structural arrangements and interventions for assisting change

- •5 CONSULTING AND CULTURE

- •5.1 Understanding and respecting culture

- •Box 5.1 What do we mean by culture?

- •5.2 Levels of culture

- •Box 5.2 Cultural factors affecting management

- •Box 5.3 Japanese culture and management consulting

- •Box 5.4 Cultural values and norms in organizations

- •5.3 Facing culture in consulting assignments

- •Box 5.5 Characteristics of “high-tech” company cultures

- •6.1 Is management consulting a profession?

- •6.2 The professional approach

- •Box 6.1 The power of the professional adviser

- •Box 6.2 Is there conflict of interest? Test your value system.

- •Box 6.3 On audit and consulting

- •6.3 Professional associations and codes of conduct

- •6.4 Certification and licensing

- •Box 6.4 International model for consultant certification (CMC)

- •6.5 Legal liability and professional responsibility

- •7 ENTRY

- •7.1 Initial contacts

- •Box 7.1 What a buyer looks for

- •7.2 Preliminary problem diagnosis

- •Figure 7.1 The consultant’s approach to a management survey

- •Box 7.2 Information materials for preliminary surveys

- •7.3 Terms of reference

- •Box 7.3 Terms of reference – checklist

- •7.4 Assignment strategy and plan

- •Box 7.4 Concepts and terms used in international technical cooperation projects

- •7.5 Proposal to the client

- •7.6 The consulting contract

- •Box 7.5 Confidential information on the client organization

- •Box 7.6 What to cover in a contract – checklist

- •8 DIAGNOSIS

- •8.1 Conceptual framework of diagnosis

- •8.2 Diagnosing purposes and problems

- •Box 8.1 The focus purpose – an example

- •Box 8.2 Issues in problem identification

- •8.3 Defining necessary facts

- •8.4 Sources and ways of obtaining facts

- •Box 8.3 Principles of effective interviewing

- •8.5 Data analysis

- •Box 8.4 Cultural factors in data-gathering – some examples

- •Box 8.5 Difficulties and pitfalls of causal analysis

- •Figure 8.1 Force-field analysis

- •Figure 8.2 Various bases for comparison

- •8.6 Feedback to the client

- •9 ACTION PLANNING

- •9.1 Searching for possible solutions

- •Box 9.1 Checklist of preliminary considerations

- •Box 9.2 Variables for developing new forms of transport

- •9.2 Developing and evaluating alternatives

- •Box 9.3 Searching for an ideal solution – three checklists

- •9.3 Presenting action proposals to the client

- •10 IMPLEMENTATION

- •10.1 The consultant’s role in implementation

- •10.2 Planning and monitoring implementation

- •10.3 Training and developing client staff

- •10.4 Some tactical guidelines for introducing changes in work methods

- •Figure 10.1 Comparison of the effects on eventual performance when using individualized versus conformed initial approaches

- •Figure 10.2 Comparison of spaced practice with a continuous or massed practice approach in terms of performance

- •Figure 10.3 Generalized illustration of the high points in attention level of a captive audience

- •10.5 Maintenance and control of the new practice

- •11.1 Time for withdrawal

- •11.2 Evaluation

- •11.3 Follow-up

- •11.4 Final reporting

- •12.1 Nature and scope of consulting in corporate strategy and general management

- •12.2 Corporate strategy

- •12.3 Processes, systems and structures

- •12.4 Corporate culture and management style

- •12.5 Corporate governance

- •13.1 The developing role of information technology

- •13.2 Scope and special features of IT consulting

- •13.3 An overall model of information systems consulting

- •Figure 13.1 A model of IT consulting

- •Figure 13.2 An IT systems portfolio

- •13.4 Quality of information systems

- •13.5 The providers of IT consulting services

- •Box 13.1 Choosing an IT consultant

- •13.6 Managing an IT consulting project

- •13.7 IT consulting to small businesses

- •13.8 Future perspectives

- •14.1 Creating value

- •14.2 The basic tools

- •14.3 Working capital and liquidity management

- •14.4 Capital structure and the financial markets

- •14.5 Mergers and acquisitions

- •14.6 Finance and operations: capital investment analysis

- •14.7 Accounting systems and budgetary control

- •14.8 Financial management under inflation

- •15.1 The marketing strategy level

- •15.2 Marketing operations

- •15.3 Consulting in commercial enterprises

- •15.4 International marketing

- •15.5 Physical distribution

- •15.6 Public relations

- •16 CONSULTING IN E-BUSINESS

- •16.1 The scope of e-business consulting

- •Figure 16.1 Classification of the connected relationship

- •Box 16.1 British Telecom entering new markets

- •Box 16.2 Pricing models

- •Box 16.3 EasyRentaCar.com breaks the industry rules

- •Box 16.4 The ThomasCook.com story

- •16.4 Dot.com organizations

- •16.5 Internet research

- •17.1 Developing an operations strategy

- •Box 17.1 Performance criteria of operations

- •Box 17.2 Major types of manufacturing choice

- •17.2 The product perspective

- •Box 17.3 Central themes in ineffective and effective development projects

- •17.3 The process perspective

- •17.4 The human aspects of operations

- •18.1 The changing nature of the personnel function

- •18.2 Policies, practices and the human resource audit

- •Box 18.1 The human resource audit (data for the past 12 months)

- •18.3 Human resource planning

- •18.4 Recruitment and selection

- •18.5 Motivation and remuneration

- •18.6 Human resource development

- •18.7 Labour–management relations

- •18.8 New areas and issues

- •Box 18.2 Current issues in Japanese human resource management

- •Box 18.3 Current issues in European HR management

- •19.1 Managing in the knowledge economy

- •Figure 19.1 Knowledge: a key resource of the post-industrial area

- •19.2 Knowledge-based value creation

- •Figure 19.2 The competence ladder

- •Figure 19.3 Four modes of knowledge transformation

- •Figure 19.4 Components of intellectual capital

- •Figure 19.5 What is your strategy to manage knowledge?

- •19.3 Developing a knowledge organization

- •Figure 19.6 Implementation paths for knowledge management

- •Box 19.1 The Siemens Business Services knowledge management framework

- •20.1 Shifts in productivity concepts, factors and conditions

- •Figure 20.1 An integrated model of productivity factors

- •Figure 20.2 A results-oriented human resource development cycle

- •20.2 Productivity and performance measurement

- •Figure 20.3 The contribution of productivity to profits

- •20.3 Approaches and strategies to improve productivity

- •Figure 20.4 Kaizen building-blocks

- •Box 20.1 Green productivity practices

- •Figure 20.5 Nokia’s corporate fitness rating

- •Box 20.2 Benchmarking process

- •20.4 Designing and implementing productivity and performance improvement programmes

- •Figure 20.6 The performance improvement planning process

- •Figure 20.7 The “royal road” of productivity improvement

- •20.5 Tools and techniques for productivity improvement

- •Box 20.3 Some simple productivity tools

- •Box 20.4 Multipurpose productivity techniques

- •Box 20.5 Tools used by most successful companies

- •21.1 Understanding TQM

- •21.2 Cost of quality – quality is free

- •Figure 21.1 Typical quality cost reduction

- •Box 21.1 Cost items of non-conformance associated with internal and external failures

- •Box 21.2 The cost items of conformance

- •21.3 Principles and building-blocks of TQM

- •Figure 21.2 TQM business structures

- •21.4 Implementing TQM

- •Box 21.3 The road to TQM

- •Figure 21.3 TQM process blocks

- •21.5 Principal TQM tools

- •Box 21.4 Tools for simple tasks in quality improvement

- •Figure 21.4 Quality tools according to quality improvement steps

- •Box 21.5 Powerful tools for company-wide TQM

- •21.6 ISO 9000 as a vehicle to TQM

- •21.7 Pitfalls and problems of TQM

- •21.8 Impact on management

- •21.9 Consulting competencies for TQM

- •22.1 What is organizational transformation?

- •22.2 Preparing for transformation

- •Figure 22.1 The change-resistant organization

- •22.3 Strategies and processes of transformation

- •Figure 22.2 Linkage between transformation types and organizational conditions

- •Figure 22.3 Relationships between business performance and types of transformation

- •Box 22.1 Eight stages for transforming an organization

- •22.4 Company turnarounds

- •Box 22.2 Implementing a turnaround plan

- •22.5 Downsizing

- •22.6 Business process re-engineering (BPR)

- •22.7 Outsourcing and insourcing

- •22.8 Joint ventures for transformation

- •22.9 Mergers and acquisitions

- •Box 22.3 Restructuring through acquisitions: the case of Cisco Systems

- •22.10 Networking arrangements

- •22.11 Transforming organizational structures

- •22.12 Ownership restructuring

- •22.13 Privatization

- •22.14 Pitfalls and errors to avoid in transformation

- •23.1 The social dimension of business

- •23.2 Current concepts and trends

- •Box 23.1 International guidelines on socially responsible business

- •23.3 Consulting services

- •Box 23.2 Typology of corporate citizenship consulting

- •23.4 A strategic approach to corporate responsibility

- •Figure 23.1 The total responsibility management system

- •23.5 Consulting in specific functions and areas of business

- •23.6 Future perspectives

- •24.1 Characteristics of small enterprises

- •24.2 The role and profile of the consultant

- •24.4 Areas of special concern

- •24.5 An enabling environment

- •24.6 Innovations in small-business consulting

- •25.1 What is different about micro-enterprises?

- •Box 25.1 Consulting in the informal sector – a mini case study

- •25.3 The special skills of micro-enterprise consultants

- •Box 25.2 Private consulting services for micro-enterprises

- •26.1 The evolving role of government

- •Box 26.1 Reinventing government

- •26.2 Understanding the public sector environment

- •Figure 26.1 The public sector decision-making process

- •Box 26.2 The consultant–client relationship in support of decision-making

- •Box 26.3 “Shoulds” and “should nots” in consulting to government

- •26.3 Working with public sector clients throughout the consulting cycle

- •26.4 The service providers

- •26.5 Some current challenges

- •27.1 The management challenge of the professions

- •27.2 Managing a professional service

- •Box 27.1 Challenges in people management

- •27.3 Managing a professional business

- •Box 27.2 Leverage and profitability

- •Box 27.3 Hunters and farmers

- •27.4 Achieving excellence professionally and in business

- •28.1 The strategic approach

- •28.2 The scope of client services

- •Box 28.1 Could consultants live without fads?

- •28.3 The client base

- •28.4 Growth and expansion

- •28.5 Going international

- •28.6 Profile and image of the firm

- •Box 28.2 Five prototypes of consulting firms

- •28.7 Strategic management in practice

- •Box 28.3 Strategic audit of a consulting firm: checklist of questions

- •Box 28.4 What do we want to know about competitors?

- •Box 28.5 Environmental factors affecting strategy

- •29.1 The marketing approach in consulting

- •Box 29.1 Marketing of consulting: seven fundamental principles

- •29.2 A client’s perspective

- •29.3 Techniques for marketing the consulting firm

- •Box 29.2 Criteria for selecting consultants

- •Box 29.3 Branding – the new myth of marketing?

- •29.4 Techniques for marketing consulting assignments

- •29.5 Marketing to existing clients

- •Box 29.4 The cost of marketing efforts: an example

- •29.6 Managing the marketing process

- •Box 29.5 Information about clients

- •30 COSTS AND FEES

- •30.1 Income-generating activities

- •Table 30.1 Chargeable time

- •30.2 Costing chargeable services

- •30.3 Marketing-policy considerations

- •30.4 Principal fee-setting methods

- •30.5 Fair play in fee-setting and billing

- •30.6 Towards value billing

- •30.7 Costing and pricing an assignment

- •30.8 Billing clients and collecting fees

- •Box 30.1 Information to be provided in a bill

- •31 ASSIGNMENT MANAGEMENT

- •31.1 Structuring and scheduling an assignment

- •31.2 Preparing for an assignment

- •Box 31.1 Checklist of points for briefing

- •31.3 Managing assignment execution

- •31.4 Controlling costs and budgets

- •31.5 Assignment records and reports

- •Figure 31.1 Notification of assignment

- •Box 31.2 Assignment reference report – a checklist

- •31.6 Closing an assignment

- •32.1 What is quality management in consulting?

- •Box 32.1 Primary stakeholders’ needs

- •Box 32.2 Responsibility for quality

- •32.2 Key elements of a quality assurance programme

- •Box 32.3 Introducing a quality assurance programme

- •Box 32.4 Assuring quality during assignments

- •32.3 Quality certification

- •32.4 Sustaining quality

- •33.1 Operating workplan and budget

- •Box 33.1 Ways of improving efficiency and raising profits

- •Table 33.2 Typical structure of expenses and income

- •33.2 Performance monitoring

- •Box 33.2 Monthly controls: a checklist

- •Figure 33.1 Expanded profit model for consulting firms

- •33.3 Bookkeeping and accounting

- •34.1 Drivers for knowledge management in consulting

- •34.2 Factors inherent in the consulting process

- •34.3 A knowledge management programme

- •34.4 Sharing knowledge with clients

- •Box 34.1 Checklist for applying knowledge management in a small or medium-sized consulting firm

- •35.1 Legal forms of business

- •35.2 Management and operations structure

- •Figure 35.1 Possible organizational structure of a consulting company

- •Figure 35.2 Professional core of a consulting unit

- •35.3 IT support and outsourcing

- •35.4 Office facilities

- •36.1 Personal characteristics of consultants

- •36.2 Recruitment and selection

- •Box 36.1 Qualities of a consultant

- •36.3 Career development

- •Box 36.2 Career structure in a consulting firm

- •36.4 Compensation policies and practices

- •Box 36.3 Criteria for partners’ compensation

- •Box 36.4 Ideas for improving compensation policies

- •37.1 What should consultants learn?

- •Box 37.1 Areas of consultant knowledge and skills

- •37.2 Training of new consultants

- •Figure 37.1 Consultant development matrix

- •37.3 Training methods

- •Box 37.2 Training in process consulting

- •37.4 Further training and development of consultants

- •37.5 Motivation for consultant development

- •37.6 Learning options available to sole practitioners

- •38 PREPARING FOR THE FUTURE

- •38.1 Your market

- •Box 38.1 Change in the consulting business

- •38.2 Your profession

- •38.3 Your self-development

- •38.4 Conclusion

- •APPENDICES

- •4 TERMS OF A CONSULTING CONTRACT

- •5 CONSULTING AND INTELLECTUAL PROPERTY

- •7 WRITING REPORTS

- •SUBJECT INDEX

Management consulting

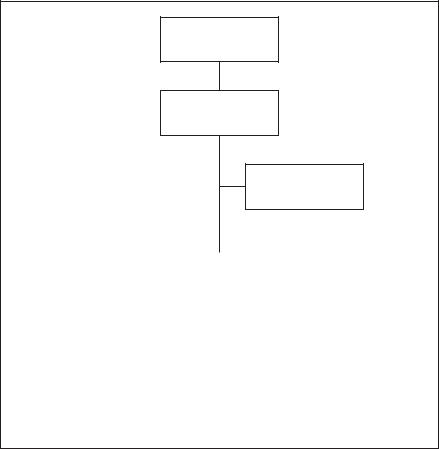

35.2 Management and operations structure

Corporate governance and top management

The pattern of the consulting organization’s top management depends very much upon its legal statute. In firms constituted as corporations (limited companies) there will be a board of directors. In a small firm the directors would generally be the general manager (managing director) and the senior consultants (partners). In a large firm there may also be external board members who, being non-executive, can play a useful role in the sense that they may preserve the same detachment in guiding the firm as the consultants have in advising their clients. They also tend to be chosen because of their range of business interests and contacts. In partnerships, decisions on key policy matters may be reserved for periodical meetings of all partners.

Consulting units that are not independent firms may have a governing body comprising a cross-section of managers from private and public enterprises, representatives of chambers of commerce and employers’ associations, senior government officials, and possibly other members in addition to one or more senior managers from the unit.

The key position in the management hierarchy is that of the chief executive officer (CEO), who may be called principal, general manager, president, managing director, managing partner, director-general, or simply manager or director. In a partnership, the CEO would be elected by a partners’ meeting for a fixed period.

The CEO may use a management committee in the usual way for involving other managers or designated senior partners in dealing with issues requiring collective discussion or decision. Other committees may be established for dealing with issues such as strategy, quality, business promotion and marketing, IT, or staff compensation. They may be permanent or ad hoc. As in other businesses and public organizations, there may be a tendency to create a committee each time an issue cannot be immediately resolved or needs to be examined in a collective. A proliferation of overlapping committees, and meetings of the same people under different committee denominations, are not signs of effective management.

The individual at the top will most probably be a career consultant (a senior partner) with considerable experience and managerial talent. On reaching the top, he or she may experience problems similar to those faced by managers of research and other professional services – he or she must stop thinking and operating primarily as a technician and concentrate on managing (see also Chapter 27). Some consulting organizations have recruited top managers from outside, from among individuals who have been excellent business managers but not necessarily practising consultants. There is no universal rule – the candidate’s competence and personality will determine whether he or she will be able to cope with the challenge of the job, provide strategic leadership and strengthen the firm by subtle but persistent coordination and control.

768

Structuring a consulting firm

Operating core

Consultants spend most of their time working for clients on specific assignments. Normally they do most of their work at clients’ premises, and once an assignment is completed, they move physically to another client. In the management system of a consulting firm, individual assignments are treated as basic management cells with precisely defined terms of reference, resources and responsibilities. However, assignments are only temporary management cells and structuring by assignments would not provide for stability and continuity of internal organization. Most consulting firms therefore structure their operating core – the professional staff – in more or less permanent “home” units (called “practice groups” in some professions). Consultants are attached to these units according to some common characteristics in their background, clientele served, or areas of intervention.

Functional units. Functional units, the most common type of internal structure in the past and still quite widespread, used to be organized by the basic functions of management, such as general management, finance, marketing, production and personnel. A consulting assignment may be fully within the function area covered and the unit can therefore staff and supervise the assignment from its own resources. In other cases, the unit would “borrow” staff from other units for the duration of the assignment. This is particularly common in complex assignments dealing with various aspects of a business.

Service line units. Recently, consulting firms have started to give priority to units established by technical problem areas and new product lines, such as strategy and policy, organization development, total quality management, business restructuring, mergers and acquisitions, knowledge management or customer relationship management (CRM). As a rule (though not always), these service lines cut across functions and disciplines and focus on a particular approach or method of business improvement. Such units are regarded as more flexible and dynamic structures that can be closer to clients, enjoy more autonomy within a larger firm, change and innovate more easily and behave as entrepreneurs.

Sectoral units. Units that are sectorally specialized (e.g. for construction, banking, insurance, road transport, health) are often established if this is justified by the volume of business done in a sector and by the need to have teams that are recognized as sectoral experts. It is impossible to suggest a minimum size for such a unit. Even a smallish unit with all-round experts in a sector may play a useful role in developing and managing assignments, which can also make use of specialists from other units. If a certain sector generates a sizeable amount of work, a sectoral unit may become more or less selfcontained and employ a wider range of specialists on a permanent basis in addition to its sector generalists.

Geographical units. Geographical (territorial) units are often established when a consulting firm decides to decentralize in order to get closer to the

769

Management consulting

clients and increase efficiency (e.g. by reducing transport and communication expenses). They exist in two basic forms:

–offices whose main purpose is marketing and liaison with clients in a delimited geographical area; these units tend to be small, staffed by a few generalists, and equipped by certain services for supporting operating assignments; assignments can thus be staffed by consultants from the unit and from headquarters;

–fully staffed local (area) branches that can take care of most assignments using their own personnel; these units are effective if the volume and structure of business done in the area concerned are relatively stable, or if the business is expanding steadily. A major advantage for the consultants is that they do not have to be absent from their homes for long periods.

Geographically decentralized units are most common in large consulting firms. A small firm must weigh the advantages of getting close to the clientele against the cost of the operation and the firm’s ability to keep technical and administrative control over geographically distant units. There are, in addition, various combinations. For example, a decentralized geographical unit may specialize in the sector or sectors featuring most prominently in the area covered by the unit.

Some examples

Figure 35.1 shows a general organizational structure used by a number of large consulting companies in various countries. In contrast, figure 35.2 shows the structure of the professional core of a consulting unit employing 29 consultants. It is a hypothetical example, which we will use to illustrate typical organizational considerations. A unit of this size can make up a whole consulting company, or constitute a division in a larger company or a management services department in an industrial concern.

The unit employs six senior consultants, of whom four work as team leaders and supervisors of operating assignments, and two concentrate on marketing and management surveys. The 20 operating consultants will, as a rule, be specialists in various management functions. Among the supervisors in the unit, three may also specialize in managing assignments in functional areas, while the fourth may be an all-round general management expert, able to manage assignments covering several functional areas. The 20 operating consultants can work in assignment teams or individually on small assignments. Thus, the supervisors will either work as team leaders on large assignments, or supervise several operating consultants working individually for different clients.

The general criteria concerning the firm’s leverage (section 27.3) should be kept in mind. Significant factors determining expansion are market demand, and the availability of operating consultants with sufficient experience and knowledge to be appointed as supervisors or team leaders. At least three to five

770

Structuring a consulting firm

Figure 35.1 Possible organizational structure of a consulting company

Board of directors

Managing director

Management committee (policy-making)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Geographical |

|

Functional |

|

Sectoral units |

|

Service line |

|

Internal |

|||||||||

|

|

|

|

services and |

|||||||||||||

units |

|

units |

|

|

units |

|

|||||||||||

|

|

|

|

|

|

administration |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign |

|

|

Production and |

|

Banking |

|

|

Strategy and |

|

Information |

||||||

|

|

|

|

||||||||||||||

|

operations |

|

|

engineering |

|

|

|

|

governance |

|

and library |

||||||

|

|

|

|

|

|||||||||||||

|

|

|

|

|

Marketing |

|

Government |

|

|

Knowledge |

|

Personnel |

|||||

|

|

|

|

|

|

|

|

|

|||||||||

|

Regional |

|

|

|

|

|

|

management |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

offices |

|

|

Finance |

|

Chemical |

|

|

Total quality |

|

Finance and |

||||||

|

|

|

|

|

|

processing |

|

|

management |

|

accounting |

||||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Affiliates |

|

|

Human |

|

Construction |

|

|

B2B markets |

|

General |

||||||

|

|

|

resources |

|

|

|

|

administration |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

years of experience, encompassing both a range of assignments with companies and a variety of techniques, are required. To replace the operating consultants as they rise to higher levels or leave, new consultants must be already trained. For this reason a stable organization includes two or three trainee consultants in every group of 25 to 30, as shown in figure 35.2.

Another factor affecting expansion is the ratio of specialist to generalist consultants. Where an assignment calls for several disciplines, the supervising consultant may accept overall responsibility but call on a specialist to oversee special techniques as required. To meet the full range of client demands, the consulting firm may have to call on some highly specialized consultants, e.g. in productivity measurement, logistics, operations research or franchising. It is of course difficult to find a constant demand for these types of service within a smaller unit.

771