Wypych Handbook of Solvents

.pdf14.23 Printing industry |

1021 |

nated hydrocarbons.3 An additional requirement was to optimize the solvent mixture to prevent swelling of the rubber in blanket cylinders and rollers. It is predicted that the European industry will increase rate of the introduction of radiation-cured inks and eliminate isopropanol from fountain solutions.4 It is expected that radiation-cured flexographic inks will grow by 30%/year in the next five years.5 In Germany, 70-80% of emissions or 47,000 ton/year will have to be eliminated by the year 2007.6 Beginning in 1999, the UK industry must keep VOC concentration below 5 tonnes/year per plant.7 VOC concentration in outside atmosphere must not exceed 150 mg/m3 (50 mg/m3 if there is more than 5% aromatic solvents). Reactive hot melts are being used in book binding.8 This will eliminate emissions from currently used solvent adhesives.

Solvent replacements are not the only solution at hand. Solvent-containing systems often give better quality than replacement systems, therefore methods have been developed to make the solvent based materials more acceptable. A soil bed biofiltration system was tested in California with excellent results.9 This biofilter is a bed of soil impregnated with microorganisms which use VOC as their food. Present California regulations require that such a treatment system has a 67% capture and VOC destruction efficiency. The new method was proven to have 95.8% efficiency. In addition to environmental issues with solvents, the printing industry has addressed the source of their raw materials. Present systems are based on petroleum products which are not considered renewable resources. Terpenes are natural products which are now finding applications in the print industry.10 In Denmark, of 70% cleaning solvents are vegetable oil based. These and other such innovations will continue to be applied to reduce solvent use and emissions. It is also reported10 that wa- ter-based system replaces fountain solutions.

Other factors are driving changes. Odors in packaging materials and the migration of solvent to foods are unacceptable. Most odors in packaging materials are associated with process and coalescing solvents.11 Foods which do not contain fat are more susceptible to the retaining the taste of solvents. Printing inks which may be acceptable for foods containing fat may not be suitable for fat-free applications (see more on this subject in Chapter 16.1).12

Many recent inventions have also been directed at solving the current environmental problems of printing industry.13-21 The solvent in gravure printing inks not only contribute to pollution but also to the cost of solvent recovery and/or degradation. A new technology is proposed in which a solvent free ink with a low melting point can be processed in liquid state and then be solidified on cooling.13 A non-volatile solvent for printing inks was developed based on a cyclic keto-enol tautomer and a drying oil.14 An alcohol soluble polyamide for rotary letterpress printing inks was developed15 and subsequently adapted to flexographic/gravure inks.18 A polyamide was also used in a rotary letterpress ink which enabled low alcohols to be used as the solvent with some addition of an ester.16 This new ink is compatible with water-based primers and adhesives which could not be used with sol- vent-based inks. Inks for jet printers are water sensitive. One solvent-based technology was developed using esters and glycols17 and the other using low alcohols.20 Another recent invention describes aqueous ink containing some low alcohols.19 UV and electron beam cured ink concentrates were also developed.21

This information from open and patent literature clearly indicates that industry is actively working on the development of new technological processes to reduce emissions of solvents.

1022 |

George Wypych |

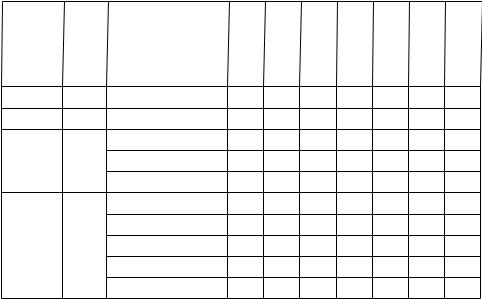

Table 14.23.1. Reported solvent releases from the printing and publishing industry in 1995 [Data from Ref. 2]

Solvent |

Amount, kg/year |

Solvent |

Amount, kg/year |

|

|

|

|

n-butyl alcohol |

43,000 |

methyl isobutyl ketone |

170,000 |

|

|

|

|

dichloromethane |

59,000 |

N-methyl-2-pyrrolidone |

31,000 |

|

|

|

|

1,4-dioxane |

8,000 |

tetrachloroethylene |

34,000 |

|

|

|

|

ethylene glycol |

46,000 |

1,1,1-trichloroethane |

180,000 |

|

|

|

|

ethylbenzene |

23,000 |

trichloroethylene |

13,000 |

|

|

|

|

hexane |

50,000 |

1,2,4-trimethylbenzene |

36,000 |

|

|

|

|

isopropyl alcohol |

27,000 |

toluene |

12,200,000 |

|

|

|

|

methanol |

170,000 |

xylene |

700,000 |

|

|

|

|

methyl ethyl ketone |

960,000 |

|

|

|

|

|

|

Table 14.23.2. Reported solvent transfers from the printing and publishing industry in 1995 [Data from Ref. 2]

Solvent |

Amount, kg/year |

Solvent |

Amount, kg/year |

|

|

|

|

n-butyl alcohol |

7,000 |

methyl isobutyl ketone |

63,000 |

|

|

|

|

dichloromethane |

43,000 |

N-methyl-2-pyrrolidone |

28,000 |

|

|

|

|

1,4-dioxane |

340 |

tetrachloroethylene |

27,000 |

|

|

|

|

ethylene glycol |

16,000 |

1,1,1-trichloroethane |

39,000 |

|

|

|

|

ethylbenzene |

9,200 |

trichloroethylene |

4,000 |

|

|

|

|

hexane |

12,000 |

1,2,4-trimethylbenzene |

33,000 |

|

|

|

|

isopropyl alcohol |

12,000 |

toluene |

2,800,000 |

|

|

|

|

methanol |

17,000 |

xylene |

240,000 |

|

|

|

|

methyl ethyl ketone |

700,000 |

|

|

|

|

|

|

REFERENCES

1EPA Office of Compliance Sector Notebook Project. Profile of the Printing and Publishing Industry. US Environmental Protection Agency, 1995.

2EPA Office of Compliance Sector Notebook Project. Sector Notebook Data Refresh - 1997. US Environmental Protection Agency, 1998.

3 N C M Beers, M J C M Koppes, L A M Rupert, Pigment & Resin Technol., 27, No.5, 289-97 (1998). 4 D Blanchard, Surface Coatings International, 80, No.10, 476-8 (1997).

5 B Gain, Chem. Week, 160, No.14, 28-30 (1998).

6W Fleck, Coating, 31(1), 23-25 (1998).

7C H Williams, Converter, 34, No.9, 11-2 (1997).

14.24 Pulp and paper |

1023 |

8Hughes F, TAPPI 1997 Hot Melt Symposium. Conference Proceedings. TAPPI. Hilton Head, SC, 15th-18th June 1997, p.15-21.

9A Mykytiuk, Paper, Film & Foil Converter, 72, No.8, 120-3 (1998).

10A Harris, Paper, Film & Foil Converter, 72, No.5, 198-9 (1998).

11R M Podhajny, Paper, Film & Foil Converter, 72, No.12, 24 (1998).

12T Clark, Paper, Film & Foil Converter, 70, No.11, 48-50 (1996).

13R Griebel, K A Kocherscheid, K Stammen, US Patent 5,496,879, Siegwerk Druckfarben GmbH, 1996.

14D Westerhoff, US Patent 5,506,294, 1996.

15P D Whyzmuzis, K Breindel, R A Lovald, US Patent 5,523,335, Henkel Corporation, 1996.

16R J Catena, M C Mathew, S E Barreto, N Marinelli, US Patent 5,658,968, Sun Chemical Corporation, 1997.

17J M Kruse, US Patent 5,663,217, XAAR Ltd., 1997

18P D Whymusis, US Patent 5,714,526, Henkel Corporation, 1998.

19H Yanagi, S Wakabayashi, K Kaida, US Patent 5,736,606, Kao Corporation, 1998.

20M Shinozuka, Y Miyazawa, M Fujino, T Ito, O Ishibashi, US Patent 5,750,592, Seiko Epson Corporation, 1998.

21W R Likavec, C R Bradley, US Patent 5,866,628, Day-Glo Color Corporation, 1999.

14.24PULP AND PAPER

George Wypych

ChemTec Laboratories, Inc., Toronto, Canada

The US pulp and paper industry operates over 550 facilities which employ over 200,000 people. Total shipments are $60 billion with an additional $80 billion in converted products. Several processes contribute to the emission of solvents. These include chemical pulping kraft process (terpenes, alcohols, methanol, acetone, chloroform), bleaching (acetone, dichloromethane, chloroform, methyl ethyl ketone, carbon disulfide, chloromethane, and trichloroethane), wastewater treatment (terpenes, alcohols, methanol, acetone, chloroform and methyl ethyl ketone), and evaporators in chemical recovery systems (alcohols and terpenes).

Table 14.24.1. Reported solvent releases from the pulp and paper industry in 1995 [Data from Ref. 2]

Solvent |

Amount, kg/year |

Solvent |

Amount, kg/year |

|

|

|

|

benzene |

320,000 |

methanol |

63,000,000 |

|

|

|

|

n-butyl alcohol |

46,000 |

methyl ethyl ketone |

700,000 |

|

|

|

|

chloroform |

4,500,000 |

methyl isobutyl ketone |

10,000 |

|

|

|

|

chloromethane |

260,000 |

1,2,4-trimethylbenzene |

17,000 |

|

|

|

|

cresol |

410,000 |

toluene |

580,000 |

|

|

|

|

ethylbenzene |

22,000 |

xylene |

49,000 |

|

|

|

|

ethylene glycol |

37,000 |

o-xylene |

260 |

|

|

|

|

hexane |

150,000 |

|

|

|

|

|

|

1024 |

George Wypych |

Table 14.24.2. Reported solvent transfers from the pulp and paper industry in 1995 [Data from Ref. 2]

Solvent |

Amount, kg/year |

Solvent |

Amount, kg/year |

|

|

|

|

benzene |

24,000 |

hexane |

8,600 |

|

|

|

|

n-butyl alcohol |

16,000 |

methanol |

23,000,000 |

|

|

|

|

chloroform |

150,000 |

methyl ethyl ketone |

36,000 |

|

|

|

|

chloromethane |

120 |

1,2,4-trimethylbenzene |

1,400 |

|

|

|

|

cresol |

3,600 |

toluene |

23,000 |

|

|

|

|

ethylene glycol |

190,000 |

xylene |

4,000 |

|

|

|

|

Table 14.25.1. Reported solvent releases from the rubber and plastics industry in 1995 [Data from Ref. 2]

Solvent |

Amount, kg/year |

Solvent |

Amount, kg/year |

|

|

|

|

benzene |

5,800 |

ethylene glycol |

120,000 |

n-butyl alcohol |

380,000 |

hexane |

1,700,000 |

sec-butyl alcohol |

17,000 |

isopropyl alcohol |

28,000 |

tert-butyl alcohol |

240 |

methanol |

4,000,000 |

carbon disulfide |

5,500,000 |

methyl ethyl ketone |

5,500,000 |

chlorobenzene |

5,000 |

methyl isobutyl ketone |

1,100,000 |

chloroform |

46,000 |

N-methyl-2-pyrrolidone |

32,000 |

chloromethane |

47,000 |

tetrachloroethylene |

160,000 |

cresol |

9,000 |

1,1,1-trichloroethane |

3,000,000 |

cyclohexane |

480,000 |

trichloroethylene |

660,000 |

dichloromethane |

11,700,000 |

1,2,4-trimethylbenzene |

260,000 |

N,N-dimethylformamide |

350,000 |

toluene |

7,600,000 |

1,4-dioxane |

2,600 |

xylene |

2,200,000 |

ethylbenzene |

210,000 |

m-xylene |

6,000 |

Tables 14.24.1 and 14.24.2 give the reported releases and transfers of solvent data for the US pulp and paper industry. If not for the emissions of methanol and chloroform the industry would be a much less serious polluter. It is 7th in VOC contributions and 8th in total releases and transfers.

REFERENCES

1EPA Office of Compliance Sector Notebook Project. Profile of the Pulp and Paper Industry. US Environmental Protection Agency, 1995.

2EPA Office of Compliance Sector Notebook Project. Sector Notebook Data Refresh - 1997. US Environmental Protection Agency, 1998.

14.25 Rubber and plastics |

1025 |

Table 14.25.2. Reported solvent transfers from the rubber and plastics industry in 1995 [Data from Ref. 2]

Solvent |

Amount, kg/year |

Solvent |

Amount, kg/year |

|

|

|

|

benzene |

15,000 |

hexane |

50,000 |

|

|

|

|

n-butyl alcohol |

370,000 |

isopropyl alcohol |

14,000 |

|

|

|

|

sec-butyl alcohol |

1,100 |

methanol |

1,400,000 |

|

|

|

|

tert-butyl alcohol |

85,000 |

methyl ethyl ketone |

3,500,000 |

|

|

|

|

carbon disulfide |

150,000 |

methyl isobutyl ketone |

450,000 |

|

|

|

|

chloroform |

1,200 |

N-methyl-2-pyrrolidone |

120,000 |

|

|

|

|

chloromethane |

330 |

tetrachloroethylene |

47,000 |

|

|

|

|

cresol |

3,000 |

1,1,1-trichloroethane |

160,000 |

|

|

|

|

cyclohexane |

350,000 |

trichloroethylene |

170,000 |

|

|

|

|

dichloromethane |

900,000 |

1,2,4-trimethylbenzene |

14,000 |

|

|

|

|

N,N-dimethylformamide |

570,000 |

toluene |

2,200,000 |

|

|

|

|

1,4-dioxane |

49,000 |

xylene |

940,000 |

|

|

|

|

ethylbenzene |

350,000 |

m-xylene |

5,700 |

|

|

|

|

ethylene glycol |

15,300,000 |

|

|

|

|

|

|

14.25 RUBBER AND PLASTICS

George Wypych

ChemTec Laboratories, Inc., Toronto, Canada

The US rubber and plastics industry employs over 800,000 people and operates over 12,000 plants. Its total production output is estimated at over $90 billion. The industry produces a wide diversity of products some of which do not contain solvents but many of which require the use of process solvents. Solvents are contained in adhesives used in finishing operations. Large quantities of solvents are used for surface cleaning and cleaning of equipment.

Tables 14.25.1 and 14.25.2 provide data on the reported releases and transfers of solvents by the US rubber and plastics industry. These industries contribute small amounts of VOC which are in the range of 0.00001-0.00005 kg VOC/kg of processed rubber. It was the ninth largest contributor to releases and transfers of all US industries. Dichloromethane, toluene, carbon disulfide, methyl ethyl ketone, methanol, 1,1,1-trichloroethane, hexane, methyl isobutyl ketone, and xylene are emitted in very large quantities.

REFERENCES

1EPA Office of Compliance Sector Notebook Project. Profile of the Rubber and Plastics Industry. US Environmental Protection Agency, 1995.

2EPA Office of Compliance Sector Notebook Project. Sector Notebook Data Refresh - 1997. US Environmental Protection Agency, 1998.

1026 |

Mohamed Serageldin, Dave Reeves |

14.26USE OF SOLVENTS IN THE SHIPBUILDING AND SHIP REPAIR INDUSTRY

Mohamed Serageldin

U.S. Environmental Protection Agency, Research Triangle Park, NC, USA

Dave Reeves

Midwest Research Institute, Cary, NC, USA

14.26.1 INTRODUCTION

The focus of this chapter will be on the use of solvents in the shipbuilding and ship repair industry. This industrial sector is involved in building, repairing, repainting, converting, or alteration of marine and fresh water vessels. These vessels include self-propelled vessels, those propelled by other vessels (barges), military and Coast Guard vessels, commercial cargo and passenger vessels, patrol and pilot boats, and dredges. The industry sector is also involved in repairing and coating navigational aids such as buoys. This chapter begins with an overview of operations in a typical shipbuilding and/or ship repair facility (shipyard), to identify those operations that generate significant volatile organic compound (VOC) emissions and/or hazardous air pollutant (HAP) emissions from the use of organic solvents. Organic solvents that are VOCs contribute to formation of ozone in the troposphere. Other organic solvents such as chlorinated fluorocarbons (CFCs) cause depletion of the ozone layer in the stratosphere. Therefore, VOCs and other air toxics, such as those compounds listed as HAPs, are both indirectly and directly detrimental to the general public’s health. Because many solvents are VOCs and often contain large amounts of HAPs, many state agencies1,2 and the United States Environmental Protection Agency (U.S. EPA) have issued regulations to limit their content in materials used for surface coating and cleaning operations at shipyards.3-7

14.26.2 SHIPBUILDING AND SHIP REPAIR OPERATIONS

Most facilities engaged in shipbuilding or ship repair activities (shipyards) have several manufacturing areas in common, each including one or more “unit operations”. These areas include: (a) surface preparation of primarily steel surfaces, which may include cleaning with multiple organic solvents; (b) assembly operations, which involve assembly of blocks that were constructed from sub-assembled parts (this step involves steel cutting and material movement using heavy equipment such as cranes); (c) cleaning operations (other than surface preparation) such as equipment and parts cleaning; and (d) coating operations.8,9 There are secondary operations such as chrome plating, asbestos removal, fuel combustion, carpentry, and, to various degrees, polyester lay-up operations (composite materials construction activities). We will next discuss those operations that involve the use of organic cleaning solvents.

14.26.3 COATING OPERATIONS

Marine coatings can be applied by the use of spraying equipment, brushes, or rollers. Coating operations at shipyards are typically conducted at two primary locations: (1) outdoor work areas or (2) indoor spray booths. The outdoor work areas can include ship exteriors and interiors. Most shipyards report that typically only a small percentage (10%) of the coating operations are done indoors. However, in large construction yards a larger propor-

14.26 Use of solvents in the shipbuilding |

1027 |

tion (up to 30 %) of the coatings are applied indoors.10 Coating and cleaning operations constitute the major source of VOC and HAP emissions from shipyards. If the metal surface is not well prepared before a coating is applied or if the coating is applied at the wrong ambient conditions, the coating system may fail and the work may have to be redone. The amount of cleaning necessary will depend on the type and extent of the problem and the coating system that is being used.

14.26.4 CLEANING OPERATIONS USING ORGANIC SOLVENTS

In most industrial applications involving metal substrates, organic cleaning solvents are used to remove contaminants or undesirable materials from surfaces before a coating is applied to clean equipment and parts utilized to apply the coating or soiled during that operation. Solvents are used for general maintenance of equipment parts. These surfaces are typically made of steel. However, vessels may also be made from natural materials such as wood and synthetic materials such as fiberglass. Therefore, a solvent must be selected that will not attack the substrate being cleaned.

For material accounting purposes, we can classify cleaning (unit) operations as follows:11,12

1.Surface preparation of large manufactured components (stage before a coating is applied).

2.Surface preparation of small manufactured components (stage before a coating is applied).

3.Line cleaning (includes piping network and any associated tanks).

4.Gun cleaning (manually or in a machine).

5.Spray booth cleaning (walls and floor).

6.Tank cleaning (mostly inner tank surfaces and any associated pipes).

7.Parts (machine) cleaning (simple dip tanks and large machines).

8.Cleaning of equipment and other items (e.g., bearings, buckets, brushes, contact switches).

9.Floor cleaning (organic solvents are no longer used).

These categories are similar to those found in other industries involved in the application of surface coating. However, the number of cleaning categories varies from one industry to another. For example, the automotive manufacturing industry (SIC code 3711) and the furniture industry are involved to various degrees in all nine types of cleaning operations. On the other hand, the photographic supplies (chemicals) industry will not include the first three listed cleaning operations.11

14.26.4.1 Surface preparation and initial corrosion protection

Large manufactured ship components are often cleaned with an organic solvent as the first of a number of cleaning steps that are required before a coating is applied. The method of surface preparation is selected to work with a chosen coating system. Surface preparation may include application of chemicals such as etching agents, organic solvents cleaners, and alkaline cleaners. Organic solvents such as mineral spirits, chlorinated solvents, and coal tar solvents are used to remove unwanted materials such as oil and grease.13 If a ship is being repaired, existing coatings usually need to be removed. Solvents such as dichloromethane are commonly used for removing (stripping off) old or damaged coatings. However, aqueous systems involving caustic compounds are now being used more frequently for such purposes.14 Pressure washing and hydro blasting are other cleaning techniques used. But, the

1028 |

Mohamed Serageldin, Dave Reeves |

predominant method is still particulate blasting (using abrasive media), which is used to remove mil scale, extra weld material, rust, and old coatings.

The angle at which the surface is blasted is chosen to generate the desired peaks and valleys on the substrate, that will accommodate the viscosity, chemistry (polar groups) of the primer coating. The surface profiling will also help the primer coating adhere mechanically to the substrate, contributing to the longevity of the coating system.15 Pre-construction primers are sometimes used immediately following surface preparation (blasting) to prevent steel from oxidizing (rusting). This primer is removed by particulate blasting, before the protective coating system (one or more coatings) is applied to the assembled parts or blocks. Removal of such primers (when they cannot be welded-through) can result in emissions of VOCs and HAPs.

14.26.4.2 Cleaning operations after coatings are applied

Surface coating operations at shipyards use predominantly solvent-based coatings. Hence, relatively large amounts of organic solvents are used for cleaning and thinning activities. Table 14.26.1 shows the most common organic solvents used for thinning and cleaning, based on 1992 data.16 Table 14.26.2 gives examples of solvent products that can be used for both thinning coatings and for cleaning surfaces after coatings are applied and for maintenance cleaning. The solvent products are listed in decreasing order of evaporative rate. Acetone, a ketone solvent is commonly used for cleaning and thinning polyester resins and gel coats. However, it is also used in formulating low-VOC and low-HAP products. Methyl ethyl ketone (MEK) and methyl isobutyl ketone (MIBK) are fast evaporative solvents that are used for thinning and cleaning vinyl coatings, epoxy coatings, and many other high performance coatings. Fast evaporative coatings that can improve application properties for a good finish may also be formulated by blending different solvents. Examples are shown in Table 14.26.2. The fast evaporative mix includes solvents varying in polarity and solubility parameters. They include an oxygenated solvent (MIBK), aromatic hydrocarbon solvents that contain less than 10 percent (by mass) HAPs, and aromatic hydrocarbons like xylene that are 100 percent HAPs as will be shown later. Together they produce the correct solvency for the polymer (resin).

Table 14.26.1. Predominant solvents used in marine coatings [from ref. 16 ] and EPA regulatory classifications

Organic solvent |

VOC |

HAP, Sec. 112 (d) |

Toxic chemicals, Sec. 313 |

|

|

|

|

ALCOHOLS |

|

|

|

|

|

|

|

Butyl alcohol |

Y |

Y |

Y |

|

|

|

|

Ethyl alcohol |

Y |

N |

N |

|

|

|

|

Isopropyl alcohol |

Y |

N |

Ya |

AROMATICS |

|

|

|

|

|

|

|

Xylene |

Y |

Y |

Y |

|

|

|

|

Toluene |

Y |

Y |

Y |

|

|

|

|

Ethyl benzene |

Y |

Y |

Y |

|

|

|

|