CFA Level 1 (2009) - 3

.pdf

Study Session 10

Cross-Reference to CFA Institute Assigned Reading 1139 - Financial Analysis Techniques

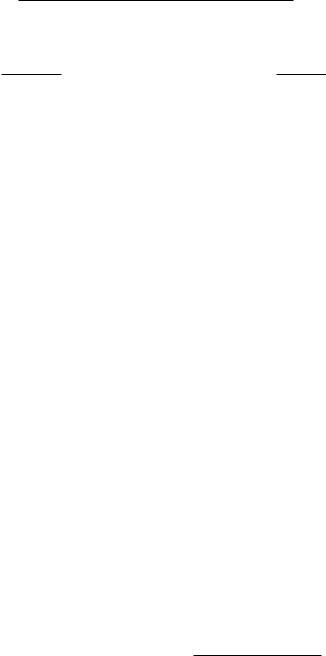

Sample Balance Sheet

Current Previous

--- --- ----- ---------- ------~-~____~I_-

Assets

Cash and marketahle securities |

$105 |

$')S |

|||||

Receivables |

205 |

195 |

|||||

Inventories |

310 |

290 |

|||||

|

|

|

|

|

|

|

SRO |

Total curreut assets |

620 |

||||||

|

|

|

|

|

|

|

|

Gross propeny, planr, and equipmelll |

1,800 |

$1,700 |

|||||

Accunlldated depreciation |

360 |

340 |

|||||

|

Net propeny, plant, and cquipmclll |

1,440 |

1,36U |

||||

To tal assets |

$2,060 |

$1,940 |

|||||

|

Liahilities |

|

|

|

|

||

|

|

|

|

|

|

|

--- ~ ----- |

|

Payables |

$110 |

.s9 () |

||||

Short-tCl"IIl debt |

160 |

1'1() |

|||||

Currenr portion of long-teflll ,lcbt |

|

55 |

45 |

||||

|

Current liabilities |

|

325 |

$275 |

|||

|

Long-term debt |

610 |

%90 |

||||

|

Defen-ed taxes |

105 |

95 |

||||

|

Common stock |

300 |

300 |

||||

|

Additional paid in capital |

400 |

400 |

||||

|

Retained earnings |

|

320 |

IRO |

|||

|

Common shareholders equiry |

1,020 |

8RO |

||||

|

Total liabilities and equity |

$2,060 |

$1,940 |

||||

|

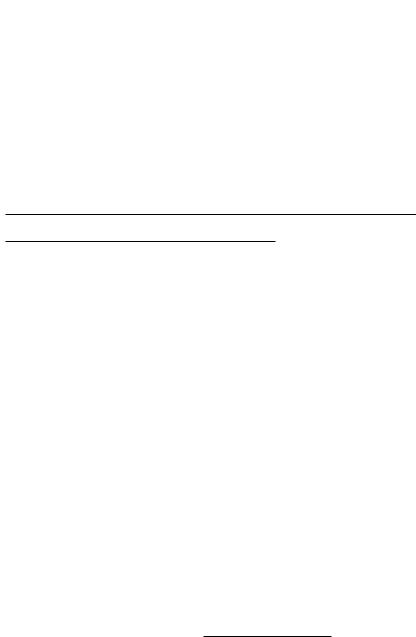

Sample Income Statement |

|

|

|

|

||

|

|

|

|

Current |

|

||

|

|

----------~ |

|

||||

|

Sales |

$4,000 |

|

|

|||

|

Cost of goods sold |

|

3,000 |

|

|

||

|

Gross profit |

1,000 |

|

|

|||

|

Operating expenses |

|

650 |

|

|

||

|

Operating profit |

350 |

|

|

|||

|

Interest expense |

|

50 |

|

|

||

|

Earnings before taxes |

300 |

|

|

|||

|

Taxes |

|

100 |

|

|

||

|

Net income |

|

200 |

|

|

||

|

Common dividends |

|

60 |

|

|

||

Page 270 |

©2008 Kaplan Schweser |

SllIdy Session 1()

Cross-Rdcrcncc to CFA Institutc Assigncd Reading #39 - Financial Analysis Tcchnicilics

Financial Ratio TCITll)latc

|

|

|

|

|

(:,IJ'l'CI1I YC"" |

Last Year |

Inc! usery |

|

|

|

---------- . |

|

|

|

|||

(~urrellt ratill |

|

|

|

|

2.1 |

1.5 |

|

|

Quick ralin |

|

|

|

|

1.1 |

D.') |

||

|

|

|

|

|||||

|

|

|

1R.'J |

I R.D |

||||

Days of sales outslanding |

|

|||||||

Invcnlory lurnover |

|

|

|

|

I D. 7 |

12.0 |

|

|

|

|

|

|

|

||||

'J(l!al aSSCl |

lurnovcr |

|

|

|

|

2.3 |

Vi |

|

|

|

|

|

|||||

|

|

|

14.5 |

11.8 |

|

|||

Working capilallurnover |

|

|

||||||

Cross profit margin |

|

|

|

|

27.4% |

2').3% |

|

|

|

|

|

|

|

||||

Nel profit margin |

|

|

|

|

').8% |

6.5°;b |

||

|

|

|

|

|||||

RClurn on |

LOul L.lpilal |

|

|

|

|

2 I. I'M, |

22.4% |

|

|

|

|

|

|

||||

|

|

|

|

24.1% |

l'U\o\, |

|||

RClllrll 011 |

cOl1ll1lon "'[lIil)' |

|

||||||

|

|

|

|

|

|

')<).4% |

35. 7~'() |

|

|

|

|

|

|

|

|

||

[nlncsl coverage |

|

|

|

|

') t) |

9.2 |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||

Answer: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

• curren t ratio = |

current assets |

|

|

|

||||

current liabilities |

|

|

|

|||||

|

|

|

|

|

||||

current ratio |

620 = 1.9 |

|

|

|

||||

|

|

325 |

|

|

|

|

|

|

The current ratio indicates lower liquidity levels when compared to last year and |

||||||||

more liquidity than the industry average. |

. |

|

|

|||||

|

cash + receivables + marketable securities |

|

|

|||||

• quick ratio = ---------- |

_ |

|

|

|||||

|

|

|

|

current liabilities |

|

|

|

|

quick ratio = |

(105+205) |

'. |

|

|

|

|||

. |

|

=0.95 |

|

|

|

|||

|

. |

325 |

|

|

|

|

|

|

The quick ratio is lower than last year and is in lin~with the industry average.

• DSO (days of sales outstanding) = |

365 |

revenue/

/ average receivables

365

DSO = ---,-4---=-,0-=-00-::--;-1---- = 18.25

/[(205+195)/2]

©2008 Kaplan Schwcser |

Page 271 |

Study St:ssion 10

CrossReference to erA Institute Assigned Reading #39 - Financial Analysis Techniques

The DSO is a bit lower relative to thc company's past performance but slightly higher than the industry average.

• lI1ventory turnovcr = |

COSt of goods sold |

||

avcragc inventories |

|||

|

|||

inventory turnover = |

3,000 |

= 10.0 |

|

(310+290)/2 |

|||

|

|

||

Inventory turnovcr is much lower than last year and the industry average. This suggests that the company is not managing inventory efficiently and may have obsoletc stock.

total assct turnover = __re_v_c_n_u_e_ average assets

total asset turnover = |

4_,_0_0_0 |

= 2.0 |

|

(2,060 + 1,940) 1 2 |

|

Total asset tUrnover is sligh r1y lower than last year and the industry average.

• |

· |

. I |

turnover = |

|

revenue |

|

|

workmg capita |

|

|

|

|

|||

|

|

|

|

||||

|

|

|

average working capital |

||||

|

beginning working capital = 580 - |

275 = 305 |

|

||||

|

ending working capital = 620 - |

325 = 295 |

|

|

|||

|

' |

. |

I |

4000 |

= |

13.3 |

|

|

work109 capita |

turnover = |

. , |

|

|||

|

|

|

(305 + 295) / 2 |

|

|

||

Working capital turnover is lower than last year, but still above the industry average.

•gross profit margin = gross profit

revenue

gross profit margin = 1,000 =25.0% 4,000

Page 272 |

©2008 Kaplan Schweser |

|

Scully Session ] 0 |

|

Cross-Referell\;e to eFA Institutc Assigned Re,tding #39 - Financial Analysis Techniqucs |

The gross profit margin is lower than last year and much lower than the industry |

|

average. |

|

• net pro fiIt margin = |

net income |

_ |

|

|

revenue |

. |

200 |

net pro fiIt margin = -- = 5.0% 4,000

The net profit margin is lower than last year and much lower than the industry average.

• return on totol copi tol = |

EBIT |

|

|

shortand long-term debt + equity |

|||

|

|||

beginning total capital = |

140 + 45 + G90 + 880 = 1,755 |

||

ending total capital = 1GO + 55 + GIO + 1,020 = 1,845 |

|||

return on total capital = |

3_5_0 |

= 19.4% |

|

|

(1,755 + 1,845) /2 |

|

|

The return on total capital is below last year and below the industry average. This suggests a problem stemming from the low asset turnover and low profit margin.

• |

. |

net income - preferred dividends |

||

return on common equity = |

--'-- |

|

_ |

|

|

|

average common equity |

|

|

|

return on common equity = |

200 |

=21.1% |

|

|

(1,020 + 880) /2 |

|

||

|

|

|

|

|

The return on equity is lower than last year but better than the industry average. The reason it is higher than the industry average is probably because of greater use of leverage.

• debt-to-eq uity ratio = |

total debt |

|

total equity |

debt-to-equity ratio = |

GI0 +160 +55 = 80.9% |

|

1,020 |

Note that preferred equity would be included in the denominator if there were any, and that we have included short-term debt and the current portion of long-term debt in calculating total (interest-bearing) debt.

©2008 Kaplan Schwcser |

Page 2Tl |

Sludy Session 10

Cross-Reference to CI'A Institute Assigned Reading #39 - Financial Analysis Techniques

The deDr-ro-equiry rario is lower rhan lasr year bur srill much higher rhan rhe indusrry average. This suggesrs rhe company is rrying [0 ger irs debr level marc in line wirh rhe industry.

• inreresr coverage = |

- |

EBJT |

_ |

|

|||

|

Inreresr payments |

||

inreresr coverage = |

350 |

= 7.0 |

|

|

50 |

|

|

The il1leresr coverage is Derrer rhan lasr year bur sri II worse rhan rhe indusrry average. This, along wirh rhe slip in profir margin and relllrn on assers, miglll cause some concern.

lOS .)CJ.c: Dcmonsrrarc the application or and intcrprd changes in the

('ol11pol1cnt part' uf ,he DuPont :ll1;dysis (Ill<.' decompositio1i of rc(urn 011

('(Illill')'

. _ ---------- -- _ .

The DuPonr sysrem of analysis is an approach rhar can be used [0 analyze rClllrn on equiry (ROE). Ir uses basic algebra lO break down ROE inro a funcrion of different rarios, so an analyst can sec the impact of leverage, profir margins, and turnover on shareholder returns. There are rwo varial1ls of rhe DuPonr system: The original threeparr approach and the exrended five-ran s)'srem.

For rhe original approach, sran wirh ROE de!-ined as:

. |

[ ner ll1come J |

rerum on equIty = |

. |

|

. eqUIty |

Average or year-end values for equiry can be used. Multiplying ROE by (revenue/revenue) and rearranging rerms produces:

. |

[ner lllcome) [ reven ue 1 |

|

return on eqUlry = |

|

. |

|

revenue |

equllY |

The firsr rerm is rhe profit margin and the second rerm is rhe equity lUrnover:

. |

(ncr profir)[ |

equiry ) |

return on equity = |

. |

rurnover |

|

margm |

We can expand this furrher by multiplying rhese rerms Dy (assers/assers), and rearranging rerms:

rerurn on equiry = [ ner income) [~1[ ass~rs 1 |

|

sales |

assers) equity |

Professor's Note: For the exam, remember that (net income / sales) x

(sales / assets) = return on assets (ROA).

Page 274 |

©2008 Kaplan Schweser |

Study Session 10

Cross-Reference to CrA Institute Assigned Reading #39 - Financial Analysis Techniques

The first term is still thc profit margin, thc sccond tcrm is now asset turnover, and the third tcrm is a f-inanciallevcrage ratio that will increase as the use of debt financing Incrcases:

rct urn 0/1 cq UI ry = |

( |

nct pr~fitJ( |

assct |

)(Icverage) |

|

marglll |

turnovcr |

ratio |

This is the original DuPont equation. It is arguably thc most important equation in ratio analysis, since it breaks down a very important ratio (ROE) into three key componcnts. If ROE is relatively low, it must be that at Icast one of the following is true: The company has a poor profit margin, thc company has poor asset turnover, or the firm has lOa little leverage.

Proj{'ssor's Note: Often candidates gct confilsed and think the DuPont method is a way to calculate ROE. While you can calculatc ROE given the components of either the originf/I or extolt/cd DuPolit cqllatio/IJ, this im't IIccessal:Y lyoll halle the .fi'nancial statcments. Ifyoll hallc lIet income and equity, yon Ctln clllcttlilte

ROF. Ihc DuPont ml'thod is a lUay to decomposc ROE, to !Jetter sec lI!hflt change) are drilling the changes in ROE.

Example: Decomposition of ROE with original DuPont

Staret Inc. has maintained a stable and relatively high ROE of approximately 18% over the last three years. Use traditional DuPont analysis to decompose this ROE into its three components and comment on trends in company performance.

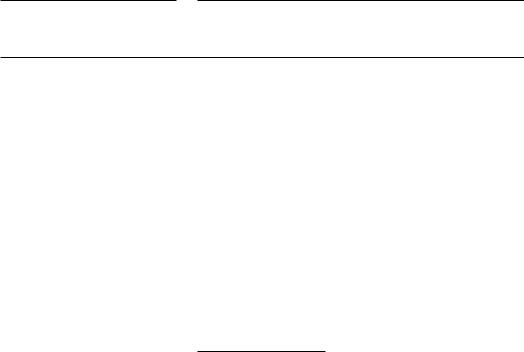

Staret Inc. Selected Balance Sheet and Income Statemmt Items (MiffiollS)

Year |

20X3 |

20X4 |

20X5 |

Net Income |

21.5 |

22.3 |

21.9 |

Sales |

305 |

350 |

410 |

Equity |

119 |

124 |

126 |

Assets |

230 |

290 |

350 |

|

|

|

|

©2008 Kaplan Schweser |

Page 275 |

Study Session 10

Cross-Reference to CFA Institute Assigned Reading #39 - Financial Analysis Techniques

Answer:

ROE 20X3: 21.5 / 119 = 18.1% 20X4: 22.3 / 124 = 18.0% 20X5: 21.9/ 126 = 17.4%

DuPont 20X3: 7.0% x 1.33 x 1.93 20X4: 6.4% x 1.21 x 2.34 20X5: 5.3% x 1.17 x 2.78

(some rounding in values)

While the ROE has dropped only slightly, both the total asset turnover and the net profit margin have declined. The effects of declining net margins and turnover on ROE have been offset by a significant increase in leverage. The analyst should be concerned aboU[ the net margin and find our what combination of pricing pressure and/or increasing expenses have caused this. Also, the analyst must nore that the company has become more risky due to increased debt financing.

Example: Computing ROE using original DuPont

A company has a net profit margin of 4%, asset turnover of 2.0, and a debt-to-assets ratio of 60%. What is the ROE?

Answer:

Oebt-to-assets =60%, which means equity to assets is 40%; this implies assets to equity (the leverage ratio) is 1 /0.4 = 2.5

ROE = (net pr~firJ(totalassetJ[ assets 1= (0.04)(2.00)(2.50) = 0.20, or 20% margll1 turnover equity

The extended (5-way) DuPont equation takes the net profit margin and breaks it down further.

ROE = rnet incomel[ EBT J( |

EElT )( |

revenue |

)[ toral assets) |

l EBT I EBIT |

revenue |

total assers |

total cq uiry |

Page 276 |

©2008 Kaplan Schweser |

Study Session 10

Cross-Reference to CFA Institute Assigned Reading #39 - financial Analysis Techniques

Note that the first term in the 3-pan DuPont equation, net profit margin, has been

decomposed into three terms: |

I |

||

|

net ll1come |

(1 - tax rate). |

|

|

|

is called the ta.x burden and is equal to |

|

|

|

||

EST

[~BT

is called the intaest burden.

EBIT

EBIT |

|

|

|

--- is called the EBIT margin. |

|

|

|

revenue |

|

|

|

We then have: |

|

|

|

ROE ~-= ( tax |

J(interestJ( EBlT J[ |

asset |

J(financialJ |

~ .burden |

burden margin |

turnover |

leverage |

An increase in interest expensc as proportion of £BIT will increase the interest burdcll. Increases in either the tax burdcll or the interest burden will lend to decreasc ROE.

EBIT in the second two expressions can be replaced by operating earnings. In this case, we have the operating margin rather than the EBIT margin. The interest burden term would then show the effects of nonoperating income as well as the effect of interest expense.

Note that in general, high profit margins, leverage, and asset turnover will lead to high levels of ROE. However, this version of the formula shows that more leverage does not always lead to higher ROE. As leverage rises, so does the interest burden. Hence, the positive effects of leverage can be offset by the higher interest payments that accompany more debt. Note that higher taxes will always lead to lower levels of ROE.

Example: Extended DuPont analysis

An analyst has gathered data from two companies in the same industry. Calculate the ROE for both companies and use the extended DuPont analysis to explain the critical factors that account for the differences in the two companies' ROEs.

Selected Income and Balance Sheet Data

|

|

Company A |

Company B |

|

|

|

|

|

|

|

Revenues |

$500 |

$900 |

|

|

EBIT |

35 |

100 |

|

|

In terest expense |

5 |

0 |

|

|

EBT |

30 |

100 |

|

|

Taxes |

10 |

40 |

|

|

Net income |

20 |

60 |

|

Total assets |

250 |

300 |

|

|

|

Total debt |

100 |

50 |

|

|

Owners' equity |

$150 |

$250 |

|

©2008 Kaplan Schweser |

Page 277 |

Study Session 10

Cross-Reference to CFA Institute Assigned Reading #,,9 - Financial Analysis Techniques

Answer:

EBIT = EBIT I revenue

Company A: EBIT margin = 35 I 500 = 7.0%

Company B: EBIT margin = 100 I 900 = 11.1 %

asset turnover'"' revenue I assets

Company A: asset turnover = 500 1250 = 2.0 Company B: asset turnover = 900 I 300 = 3.0

interest burden = EBT I EBIT

Company A: interest burden = 30 I 35 = 85.7% Company B: interest burden = 100 I 100 = 1

financial leverage = assets I equity

Company A: financial leverage = 250 I 150 = 1.67 Company B: financial leverage = 300 I 250 = 1.2

tax burden = net income I EBT

Company A: tax burden = 20 I 30 = 66.7% Company B: tax burden = 60 /100 = 60.0%

Company A: ROE = 0.667 x 0.857 x 0.07 x 2.0 x 1.67 = 13.4%

Company B: ROE = 0.608 x 1.0 x 0.111 x 3.0 x 1.2 = 24%

Company B has a higher tax burden but a lower interest burden (a lower ratio indicates a higher burden). Company B has better EBIT margins and better asset utilization (perhaps management of inventory, receivables, or payables, or a lower cost basis in its fixed assets due to their age), and less leverage. Its higher EBIT margins and asset turnover are the main factors leading to its significantly higher ROE, which it achieves with less leverage than Company A.

LOS .19.f: Calculate ~1Ilc\ inlerpret the ratios w.cd in Clluii)' analysis, credil analysis, and segmellt an:dysis.

Valuation ratios are used in analysis for investment in common equity. The most widely used valuation ratio is the price-to-earnings (PIE) ratio, the ratio of the current market price of a share of stock divided by the company's earnings per share. Related measures based on price per share are the price-to-cash flow, the price-to-sales, and the price-to-book value ratios.

Professor's Note: The use ofthe above valuation ratios is covered in detail in the review ofprice multiples in the Study Session on Equity Securities.

Per-share valuation measures include earnings per share (EPS). Basic EPS is net income available to common divided by the weighted average number of common shares

outstanding.

Page 278 |

©2008 Kaplan Schwcser |

Study Scssion 1()

Cross-Refercncc to CFA Institute Assigned Reading 11.19 - Financial Analysis Tcchni']llCS

/Jiluted FPS is a "what if' value. Ie is calculated co be the lowest IlllssilJle EPS that coldd have been reponed if all lin11 securities that can be converLeo into cOl11l11on sLOck, allLl that would decrease basic FPS if they had been, were converted. Thai is, if all dilutive securities h;ld been converted. Potentially dilutive securities include convertible debt and convcrtible preferred stock, as well as options and warrants issued by the company. The 11l1l1lcraror of diluted EPS is increased by the after-tax intcrest savings on any dilutive debt securities and by the dividends on ;1Il)' dilutive convertible preferred stock. The denominator is increased by the cOl11mon shares that would result from conversion or exchange of dillltive securities into cOl11mon shares.

~\ j)roji'ssor'r NII/I~: Re/i'l" !Jilek to our /lipic I"l'l'il'lIl lin UlIl/en/fllidillg t!Je Incollle \":!J!~ S!fl/ell/I'll! .liJr detilils illld ('Xf/illp/n 1Ij'!JOW /0 CtdCll/illi~ /}(/sic ilnd di/llted I:'PS.

Other per-share measures include: cilsh/loU' /'('/" ,!Jare, FBIFpeF shilre, and

iI'flre. Per-sh;lre measures for differcnt conlpanil's cannot he comparl'd. A flrm with ;1

S1()() share price un he expectl·d 10 [.',enCl;lle much greater earnings, cash Ilow, FBlll );\. ami EBiT pl'l'share than a firm wit haS I () sh:1re pricc.

Dividends

Divioends are declared on a per-common-share hasis. Tot;ll dividends on a firm-wide basis are referred co as dilJidends dec/a red. Neither EPS nor net income is reduced by the payment of common stock dividends. Net income minus dividends c1ecbred is retained earnings, the e;lrnings th;lt ;lre used to grow the corporation rather th;ln being disrribllted to equit)' holders. Thc proportion of a firm's net income that is ret;lined to fUl1d glOwth is an imp0rL<l1ll oettrminanr of the firm's .iUs/flillabie growth mte.

'1'0calculate I he sustainahle growth rate for a firm, the ratc of retllll1 on resources is measured as the return on equity capital, or the ROE. The proportion of earnings reinvested is known as the retention ratc (RR).

©2008 Kaplan Schweser |

Page 27') |