CHAPTER 3 How to Calculate Present Values |

57 |

You may not aspire to the Jones family’s way of life, but you will learn about all their activities, from futures contracts to binomial option pricing, later in this book. Meanwhile, you may wish to replicate Johnny’s NPV analysis.

Questions

1.Forecast future cash flows, taking account of the decline in production and the (partially) offsetting forecasted increase in oil prices. How long does production have to continue for the oil wells to be a positive-NPV investment? You can ignore taxes and other possible complications.

C H A P T E R F O U R

T H E V A L U E O F

COMMON STOCKS

58

WE SHOULD WARN you that being a financial expert has its occupational hazards. One is being cornered at cocktail parties by people who are eager to explain their system for making creamy profits by investing in common stocks. Fortunately, these bores go into temporary hibernation whenever the market goes down.

We may exaggerate the perils of the trade. The point is that there is no easy way to ensure superior investment performance. Later in the book we will show that changes in security prices are fundamentally unpredictable and that this result is a natural consequence of well-functioning capital markets. Therefore, in this chapter, when we propose to use the concept of present value to price common stocks, we are not promising you a key to investment success; we simply believe that the idea can help you to understand why some investments are priced higher than others.

Why should you care? If you want to know the value of a firm’s stock, why can’t you look up the stock price in the newspaper? Unfortunately, that is not always possible. For example, you may be the founder of a successful business. You currently own all the shares but are thinking of going public by selling off shares to other investors. You and your advisers need to estimate the price at which those shares can be sold. Or suppose that Establishment Industries is proposing to sell its concatenator division to another company. It needs to figure out the market value of this division.

There is also another, deeper reason why managers need to understand how shares are valued. We have stated that a firm which acts in its shareholders’ interest should accept those investments which increase the value of their stake in the firm. But in order to do this, it is necessary to understand what determines the shares’ value.

We start the chapter with a brief look at how shares are traded. Then we explain the basic principles of share valuation. We look at the fundamental difference between growth stocks and income stocks and the significance of earnings per share and price–earnings multiples. Finally, we discuss some of the special problems managers and investors encounter when they calculate the present values of entire businesses.

A word of caution before we proceed. Everybody knows that common stocks are risky and that some are more risky than others. Therefore, investors will not commit funds to stocks unless the expected rates of return are commensurate with the risks. But we say next to nothing in this chapter about the linkages between risk and expected return. A more careful treatment of risk starts in Chapter 7.

4.1 HOW COMMON STOCKS ARE TRADED

There are 9.9 billion shares of General Electric (GE), and at last count these shares were owned by about 2.1 million shareholders. They included large pension funds and insurance companies that each own several million shares, as well as individuals who own a handful of shares. If you owned one GE share, you would own .000002 percent of the company and have a claim on the same tiny fraction of GE’s profits. Of course, the more shares you own, the larger your “share” of the company.

If GE wishes to raise additional capital, it may do so by either borrowing or selling new shares to investors. Sales of new shares to raise new capital are said to occur in the primary market. But most trades in GE shares take place in existing shares, which investors buy from each other. These trades do not raise new capital for the firm. This market for secondhand shares is known as the secondary market. The principal secondary marketplace for GE shares is the New York Stock Exchange

59

60 |

PART I Value |

(NYSE).1 This is the largest stock exchange in the world and trades, on an average day, 1 billion shares in some 2,900 companies.

Suppose that you are the head trader for a pension fund that wishes to buy 100,000 GE shares. You contact your broker, who then relays the order to the floor of the NYSE. Trading in each stock is the responsibility of a specialist, who keeps a record of orders to buy and sell. When your order arrives, the specialist will check this record to see if an investor is prepared to sell at your price. Alternatively, the specialist may be able to get you a better deal from one of the brokers who is gathered around or may sell you some of his or her own stock. If no one is prepared to sell at your price, the specialist will make a note of your order and execute it as soon as possible.

The NYSE is not the only stock market in the United States. For example, many stocks are traded over the counter by a network of dealers, who display the prices at which they are prepared to trade on a system of computer terminals known as NASDAQ (National Association of Securities Dealers Automated Quotations System). If you like the price that you see on the NASDAQ screen, you simply call the dealer and strike a bargain.

The prices at which stocks trade are summarized in the daily press. Here, for example, is how The Wall Street Journal recorded the day’s trading in GE on July 2, 2001:

YTD |

|

52 Weeks |

|

|

|

|

Vol |

|

Net |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|||

% Chg |

|

Hi |

Lo |

Stock (SYM) |

Div |

Yld % |

PE |

100s |

Last |

Chg |

|

|

|

|

|

|

|

|

|

|

|

4.7 |

60.50 |

36.42 |

General Electric (GE) |

.64 |

1.3 |

38 |

215287 |

50.20 |

1.45 |

|

|

|

|

|

|

|

|

|

|

|

|

You can see that on this day investors traded a total of 215,287 100 21,528,700 shares of GE stock. By the close of the day the stock traded at $50.20 a share, up $1.45 from the day before. The stock had increased by 4.7 percent from the start of 2001. Since there were about 9.9 billion shares of GE outstanding, investors were placing a total value on the stock of $497 billion.

Buying stocks is a risky occupation. Over the previous year, GE stock traded as high as $60.50, but at one point dropped to $36.42. An unfortunate investor who bought at the 52-week high and sold at the low would have lost 40 percent of his or her investment. Of course, you don’t come across such people at cocktail parties; they either keep quiet or aren’t invited.

The Wall Street Journal also provides three other facts about GE’s stock. GE pays an annual dividend of $.64 a share, the dividend yield on the stock is 1.3 percent, and the ratio of the stock price to earnings (P/E ratio) is 38. We will explain shortly why investors pay attention to these figures.

4.2 HOW COMMON STOCKS ARE VALUED

Think back to the last chapter, where we described how to value future cash flows. The discounted-cash-flow (DCF) formula for the present value of a stock is just the same as it is for the present value of any other asset. We just discount the cash flows

1GE shares are also traded on a number of overseas exchanges.

CHAPTER 4 The Value of Common Stocks |

61 |

by the return that can be earned in the capital market on securities of comparable risk. Shareholders receive cash from the company in the form of a stream of dividends. So

PV(stock) PV(expected future dividends)

At first sight this statement may seem surprising. When investors buy stocks, they usually expect to receive a dividend, but they also hope to make a capital gain. Why does our formula for present value say nothing about capital gains? As we now explain, there is no inconsistency.

Today’s Price

The cash payoff to owners of common stocks comes in two forms: (1) cash dividends and (2) capital gains or losses. Suppose that the current price of a share is P0, that the expected price at the end of a year is P1, and that the expected dividend per share is DIV1. The rate of return that investors expect from this share over the next year is defined as the expected dividend per share DIV1 plus the expected price appreciation per share P1 P0, all divided by the price at the start of the year P0:

Expected return r DIV1 P1 P0

P0

This expected return is often called the market capitalization rate.

Suppose Fledgling Electronics stock is selling for $100 a share (P0 100). Investors expect a $5 cash dividend over the next year (DIV1 5). They also expect the stock to sell for $110 a year hence (P1 110). Then the expected return to the stockholders is 15 percent:

r 5 110 100 .15, or 15% 100

On the other hand, if you are given investors’ forecasts of dividend and price and the expected return offered by other equally risky stocks, you can predict today’s price:

Price P0 |

DIV1 P1 |

|

|

r |

|

|

1 |

|

For Fledgling Electronics DIV1 5 and P1 110. If r, the expected return on securities in the same risk class as Fledgling, is 15 percent, then today’s price should be $100:

P0 5 110 $100 1.15

How do we know that $100 is the right price? Because no other price could survive in competitive capital markets. What if P0 were above $100? Then Fledgling stock would offer an expected rate of return that was lower than other securities of equivalent risk. Investors would shift their capital to the other securities and in the process would force down the price of Fledgling stock. If P0 were less than $100, the process would reverse. Fledgling’s stock would offer a higher rate of return than comparable securities. In that case, investors would rush to buy, forcing the price up to $100.

62 |

PART I Value |

The general conclusion is that at each point in time all securities in an equivalent risk class are priced to offer the same expected return. This is a condition for equilibrium in well-functioning capital markets. It is also common sense.

But What Determines Next Year’s Price?

We have managed to explain today’s stock price P0 in terms of the dividend DIV1 and the expected price next year P1. Future stock prices are not easy things to forecast directly. But think about what determines next year’s price. If our price formula holds now, it ought to hold then as well:

P1 |

DIV2 P2 |

|

|

r |

|

|

1 |

|

That is, a year from now investors will be looking out at dividends in year 2 and price at the end of year 2. Thus we can forecast P1 by forecasting DIV2 and P2, and we can express P0 in terms of DIV1, DIV2, and P2:

P0 |

|

|

1 |

1DIV1 |

P1 |

2 |

|

1 |

aDIV1 |

|

DIV2 |

P2 |

b |

DIV1 |

|

DIV2 P2 |

|

|

r |

|

|

1 r |

1 r |

|

r 22 |

||||||||||

|

1 |

|

|

1 |

r |

|

|

11 |

|||||||||

Take Fledgling Electronics. A plausible explanation why investors expect its stock price to rise by the end of the first year is that they expect higher dividends and still more capital gains in the second. For example, suppose that they are looking today for dividends of $5.50 in year 2 and a subsequent price of $121. That would imply a price at the end of year 1 of

P1 5.50 121 $110 1.15

Today’s price can then be computed either from our original formula

|

|

P0 |

|

DIV1 P1 |

|

|

5.00 110 |

$100 |

|

|||||

|

|

|

|

|

||||||||||

|

|

|

|

|

1 r |

|

|

|

1.15 |

|

|

|

||

or from our expanded formula |

|

|

|

|

|

|

|

|

|

|||||

P0 |

|

DIV1 |

|

|

DIV2 P2 |

|

|

5.00 |

|

5.50 121 |

$100 |

|||

1 r |

|

11 r 2 |

2 |

|

1.15 |

11.1522 |

||||||||

|

|

|

|

|

|

|

|

|||||||

We have succeeded in relating today’s price to the forecasted dividends for two years (DIV1 and DIV2) plus the forecasted price at the end of the second year (P2). You will probably not be surprised to learn that we could go on to replace P2 by (DIV3 P3)/(1 r) and relate today’s price to the forecasted dividends for three years (DIV1, DIV2, and DIV3) plus the forecasted price at the end of the third year (P3). In fact we can look as far out into the future as we like, removing P’s as we go. Let us call this final period H. This gives us a general stock price formula:

P0 |

|

DIV1 |

|

DIV2 |

… |

DIVH PH |

|||||||

1 r |

|

|

r 22 |

|

r 2H |

||||||||

|

|

11 |

|

11 |

|||||||||

|

|

H |

DIVt |

|

|

|

PH |

|

|

|

|

||

|

a |

|

|

|

|

|

|

|

|||||

|

11 r 2 |

t |

|

r 2 |

H |

|

|||||||

|

|

t 1 |

|

11 |

|

|

|

|

|||||

H

The expression a simply means the sum of the discounted dividends from year

1 to year H. |

t 1 |

|

|

|

|

|

|

|

CHAPTER 4 |

The Value of Common Stocks |

63 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T A B L E |

4 . 1 |

|

|

|

|

Expected Future Values |

Present Values |

|

|||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

Applying the stock |

||

|

Horizon |

|

|

|

|

Cumulative |

Future |

|

|

|||

|

|

|

|

|

|

|

valuation formula to |

|||||

|

Period (H ) |

Dividend (DIVt) |

Price (Pt) |

Dividends |

Price |

Total |

|

|||||

|

|

fledgling electronics. |

||||||||||

|

0 |

|

— |

100 |

— |

— |

100 |

|

|

|

||

|

|

|

Assumptions: |

|||||||||

|

1 |

5.00 |

110 |

4.35 |

95.65 |

100 |

|

1. Dividends increase at |

||||

|

2 |

5.50 |

121 |

8.51 |

91.49 |

100 |

|

10 percent per year, |

||||

|

|

compounded. |

||||||||||

|

3 |

6.05 |

133.10 |

12.48 |

87.52 |

100 |

|

|||||

|

|

2. Capitalization rate is |

||||||||||

|

4 |

6.66 |

146.41 |

16.29 |

83.71 |

100 |

|

15 percent. |

||||

|

10 |

11.79 |

259.37 |

35.89 |

64.11 |

100 |

|

|

|

|

||

|

20 |

30.58 |

672.75 |

58.89 |

41.11 |

100 |

|

|

|

|

||

|

50 |

533.59 |

11,739.09 |

89.17 |

10.83 |

100 |

|

|

|

|

||

|

100 |

62,639.15 |

1,378,061.23 |

98.83 |

1.17 |

100 |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

dollars |

|

|

|

|

|

|

|

|

|

value,Present |

50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

1 |

2 |

3 |

4 |

10 |

20 |

50 |

100 |

|

0 |

||||||||

|

|

|

|

Horizon period |

|

|

|

|

|

PV (dividends for 100 years)

PV (price at year 100)

F I G U R E 4 . 1

As your horizon recedes, the present value of the future price (shaded area) declines but the present value of the stream of dividends (unshaded area) increases. The total present value (future price and dividends) remains the same.

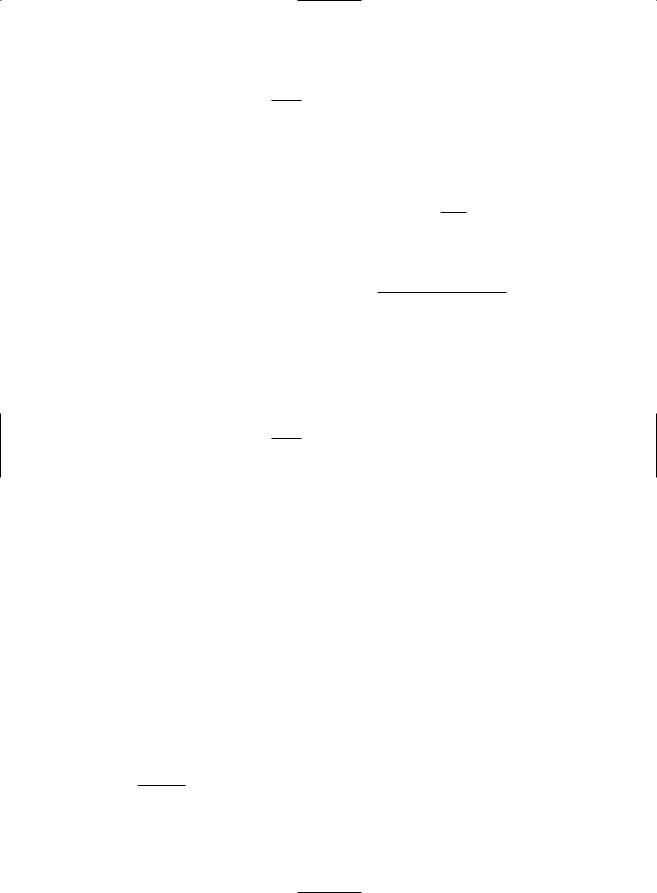

Table 4.1 continues the Fledgling Electronics example for various time horizons, assuming that the dividends are expected to increase at a steady 10 percent compound rate. The expected price Pt increases at the same rate each year. Each line in the table represents an application of our general formula for a different value of H. Figure 4.1 provides a graphical representation of the table. Each column shows the present value of the dividends up to the time horizon and the present value of the price at the horizon. As the horizon recedes, the dividend stream accounts for an increasing proportion of present value, but the total present value of dividends plus terminal price always equals $100.

64 |

PART I Value |

How far out could we look? In principle the horizon period H could be infinitely distant. Common stocks do not expire of old age. Barring such corporate hazards as bankruptcy or acquisition, they are immortal. As H approaches infinity, the present value of the terminal price ought to approach zero, as it does in the final column of Figure 4.1. We can, therefore, forget about the terminal price entirely and express today’s price as the present value of a perpetual stream of cash dividends. This is usually written as

∞ DIVt

P0 ta1 11 r 2t

where indicates infinity.

This discounted-cash-flow (DCF) formula for the present value of a stock is just the same as it is for the present value of any other asset. We just discount the cash flows—in this case the dividend stream—by the return that can be earned in the capital market on securities of comparable risk. Some find the DCF formula implausible because it seems to ignore capital gains. But we know that the formula was derived from the assumption that price in any period is determined by expected dividends and capital gains over the next period.

Notice that it is not correct to say that the value of a share is equal to the sum of the discounted stream of earnings per share. Earnings are generally larger than dividends because part of those earnings is reinvested in new plant, equipment, and working capital. Discounting earnings would recognize the rewards of that investment (a higher future dividend) but not the sacrifice (a lower dividend today). The correct formulation states that share value is equal to the discounted stream of dividends per share.

4.3 A SIMPLE WAY TO ESTIMATE THE CAPITALIZATION RATE

In Chapter 3 we encountered some simplified versions of the basic present value formula. Let us see whether they offer any insights into stock values. Suppose, for example, that we forecast a constant growth rate for a company’s dividends. This does not preclude year-to-year deviations from the trend: It means only that expected dividends grow at a constant rate. Such an investment would be just another example of the growing perpetuity that we helped our fickle philanthropist to evaluate in the last chapter. To find its present value we must divide the annual cash payment by the difference between the discount rate and the growth rate:

DIV1

P0 r g

Remember that we can use this formula only when g, the anticipated growth rate, is less than r, the discount rate. As g approaches r, the stock price becomes infinite. Obviously r must be greater than g if growth really is perpetual.

Our growing perpetuity formula explains P0 in terms of next year’s expected dividend DIV1, the projected growth trend g, and the expected rate of return on other securities of comparable risk r. Alternatively, the formula can be used to obtain an estimate of r from DIV1, P0, and g:

CHAPTER 4 The Value of Common Stocks |

65 |

r DIV1 g P0

The market capitalization rate equals the dividend yield (DIV1/P0) plus the expected rate of growth in dividends (g).

These two formulas are much easier to work with than the general statement that “price equals the present value of expected future dividends.”2 Here is a practical example.

Using the DCF Model to Set Gas and Electricity Prices

The prices charged by local electric and gas utilities are regulated by state commissions. The regulators try to keep consumer prices down but are supposed to allow the utilities to earn a fair rate of return. But what is fair? It is usually interpreted as r, the market capitalization rate for the firm’s common stock. That is, the fair rate of return on equity for a public utility ought to be the rate offered by securities that have the same risk as the utility’s common stock.3

Small variations in estimates of this return can have a substantial effect on the prices charged to the customers and on the firm’s profits. So both utilities and regulators devote considerable resources to estimating r. They call r the cost of equity capital. Utilities are mature, stable companies which ought to offer tailor-made cases for application of the constant-growth DCF formula.4

Suppose you wished to estimate the cost of equity for Pinnacle West Corp. in May 2001, when its stock was selling for about $49 per share. Dividend payments for the next year were expected to be $1.60 a share. Thus it was a simple matter to calculate the first half of the DCF formula:

Dividend yield DIV1 1.60 .033, or 3.3%

P0 49

The hard part was estimating g, the expected rate of dividend growth. One option was to consult the views of security analysts who study the prospects for each company. Analysts are rarely prepared to stick their necks out by forecasting dividends to kingdom come, but they often forecast growth rates over the next five years, and these estimates may provide an indication of the expected long-run growth path. In the case of Pinnacle West, analysts in 2001 were forecasting an

2These formulas were first developed in 1938 by Williams and were rediscovered by Gordon and Shapiro. See J. B. Williams, The Theory of Investment Value (Cambridge, Mass.: Harvard University Press, 1938); and M. J. Gordon and E. Shapiro, “Capital Equipment Analysis: The Required Rate of Profit,” Management Science 3 (October 1956), pp. 102–110.

3This is the accepted interpretation of the U.S. Supreme Court’s directive in 1944 that “the returns to the equity owner [of a regulated business] should be commensurate with returns on investments in other enterprises having corresponding risks.” Federal Power Commission v. Hope Natural Gas Company, 302 U.S. 591 at 603.

4There are many exceptions to this statement. For example, Pacific Gas & Electric (PG&E), which serves northern California, used to be a mature, stable company until the California energy crisis of 2000 sent wholesale electric prices sky-high. PG&E was not allowed to pass these price increases on to retail customers. The company lost more than $3.5 billion in 2000 and was forced to declare bankruptcy in 2001. PG&E is no longer a suitable subject for the constant-growth DCF formula.

66 |

PART I Value |

annual growth of 6.6 percent.5 This, together with the dividend yield, gave an estimate of the cost of equity capital:

r DIV1 g .033 .066 .099, or 9.9%

P0

An alternative approach to estimating long-run growth starts with the payout ratio, the ratio of dividends to earnings per share (EPS). For Pinnacle, this was forecasted at 43 percent. In other words, each year the company was plowing back into the business about 57 percent of earnings per share:

Plowback ratio 1 payout ratio 1 DIVEPS 1 .43 .57

Also, Pinnacle’s ratio of earnings per share to book equity per share was about 11 percent. This is its return on equity, or ROE:

EPS

Return on equity ROE book equity per share .11

If Pinnacle earns 11 percent of book equity and reinvests 57 percent of that, then book equity will increase by .57 .11 .063, or 6.3 percent. Earnings and dividends per share will also increase by 6.3 percent:

Dividend growth rate g plowback ratio ROE .57 .11 .063

That gives a second estimate of the market capitalization rate:

r DIV1 g .033 .063 .096, or 9.6%

P0

Although this estimate of the market capitalization rate for Pinnacle stock seems reasonable enough, there are obvious dangers in analyzing any single firm’s stock with the constant-growth DCF formula. First, the underlying assumption of regular future growth is at best an approximation. Second, even if it is an acceptable approximation, errors inevitably creep into the estimate of g. Thus our two methods for calculating the cost of equity give similar answers. That was a lucky chance; different methods can sometimes give very different answers.

Remember, Pinnacle’s cost of equity is not its personal property. In wellfunctioning capital markets investors capitalize the dividends of all securities in Pinnacle’s risk class at exactly the same rate. But any estimate of r for a single common stock is “noisy” and subject to error. Good practice does not put too much weight on single-company cost-of-equity estimates. It collects samples of similar companies, estimates r for each, and takes an average. The average gives a more reliable benchmark for decision making.

Table 4.2 shows DCF cost-of-equity estimates for Pinnacle West and 10 other electric utilities in May 2001. These utilities are all stable, mature companies for which the constant-growth DCF formula ought to work. Notice the variation in the cost-of-equity estimates. Some of the variation may reflect differences in the risk, but some is just noise. The average estimate is 10.7 percent.

5In this calculation we’re assuming that earnings and dividends are forecasted to grow forever at the same rate g. We’ll show how to relax this assumption later in this chapter. The growth rate was based on the average earnings growth forecasted by Value Line and IBES. IBES compiles and averages forecasts made by security analysts. Value Line publishes its own analysts’ forecasts