- •Foreword

- •Table of contents

- •Figures

- •Tables

- •Boxes

- •1. Executive summary

- •Energy system transformation

- •Special focus 1: The cost-effectiveness of climate measures

- •Special focus 2: The Electricity Market Reform

- •Special focus 3: Maintaining energy security

- •Key recommendations

- •2. General energy policy

- •Country overview

- •Institutions

- •Supply and demand trends

- •Primary energy supply

- •Energy production

- •Energy consumption

- •Energy policy framework

- •Energy and climate taxes and levies

- •Assessment

- •Recommendations

- •3. Energy and climate change

- •Overview

- •Emissions

- •GHG emissions

- •Projections

- •Institutions

- •Climate change mitigation

- •Emissions targets

- •Clean Growth Strategy

- •The EU Emissions Trading System

- •Low-carbon electricity support schemes

- •Climate Change Levy

- •Coal phase-out

- •Energy efficiency

- •Low-carbon technologies

- •Adaptation to climate change

- •Legal and institutional framework

- •Evaluation of impacts and risks

- •Response measures

- •Assessment

- •Recommendations

- •4. Renewable energy

- •Overview

- •Supply and demand

- •Renewable energy in the TPES

- •Electricity from renewable energy

- •Heat from renewable energy

- •Institutions

- •Policies and measures

- •Targets and objectives

- •Electricity from renewable energy sources

- •Heat from renewable energy

- •Renewable Heat Incentive

- •Renewable energy in transport

- •Assessment

- •Electricity

- •Transport

- •Heat

- •Recommendations

- •5. Energy efficiency

- •Overview

- •Total final energy consumption

- •Energy intensity

- •Overall energy efficiency progress

- •Institutional framework

- •Energy efficiency data and monitoring

- •Regulatory framework

- •Energy Efficiency Directive

- •Other EU directives

- •Energy consumption trends, efficiency, and policies

- •Residential and commercial

- •Buildings

- •Heat

- •Transport

- •Industry

- •Assessment

- •Appliances

- •Buildings and heat

- •Transport

- •Industry and business

- •Public sector

- •Recommendations

- •6. Nuclear

- •Overview

- •New nuclear construction and power market reform

- •UK membership in Euratom and Brexit

- •Waste management and decommissioning

- •Research and development

- •Assessment

- •Recommendations

- •7. Energy technology research, development and demonstration

- •Overview

- •Energy research and development strategy and priorities

- •Institutions

- •Funding on energy

- •Public spending

- •Energy RD&D programmes

- •Private funding and green finance

- •Monitoring and evaluation

- •International collaboration

- •International energy innovation funding

- •Assessment

- •Recommendations

- •8. Electricity

- •Overview

- •Supply and demand

- •Electricity supply and generation

- •Electricity imports

- •Electricity consumption

- •Institutional and regulatory framework

- •Wholesale market design

- •Network regulation

- •Towards a low-carbon electricity sector

- •Carbon price floor

- •Contracts for difference

- •Emissions performance standards

- •A power market for business and consumers

- •Electricity retail market performance

- •Smart grids and meters

- •Supplier switching

- •Consumer engagement and vulnerable consumers

- •Demand response (wholesale and retail)

- •Security of electricity supply

- •Legal framework and institutions

- •Network adequacy

- •Generation adequacy

- •The GB capacity market

- •Short-term electricity security

- •Emergency response reserves

- •Flexibility of the power system

- •Assessment

- •Wholesale electricity markets and decarbonisation

- •Retail electricity markets for consumers and business

- •The transition towards a smart and flexible power system

- •Recommendations

- •Overview

- •Supply and demand

- •Production, import, and export

- •Oil consumption

- •Retail market and prices

- •Infrastructure

- •Refining

- •Pipelines

- •Ports

- •Storage capacity

- •Oil security

- •Stockholding regime

- •Demand restraint

- •Assessment

- •Oil upstream

- •Oil downstream

- •Recommendations

- •10. Natural gas

- •Overview

- •Supply and demand

- •Domestic gas production

- •Natural gas imports and exports

- •Largest gas consumption in heat and power sector

- •Natural gas infrastructure

- •Cross-border connection and gas pipelines

- •Gas storage

- •Liquefied natural gas

- •Policy framework and markets

- •Gas regulation

- •Wholesale gas market

- •Retail gas market

- •Security of gas supply

- •Legal framework

- •Adequacy of gas supply and demand

- •Short-term security and emergency response

- •Supply-side measures

- •Demand-side measures

- •Gas quality

- •Recent supply disruptions

- •Interlinkages of the gas and electricity systems

- •Assessment

- •Recommendations

- •ANNEX A: Organisations visited

- •Review criteria

- •Review team and preparation of the report

- •Organisations visited

- •ANNEX B: Energy balances and key statistical data

- •Footnotes to energy balances and key statistical data

- •ANNEX C: International Energy Agency “Shared Goals”

- •ANNEX D: Glossary and list of abbreviations

- •Acronyms and abbreviations

- •Units of measure

10. NATURAL GAS

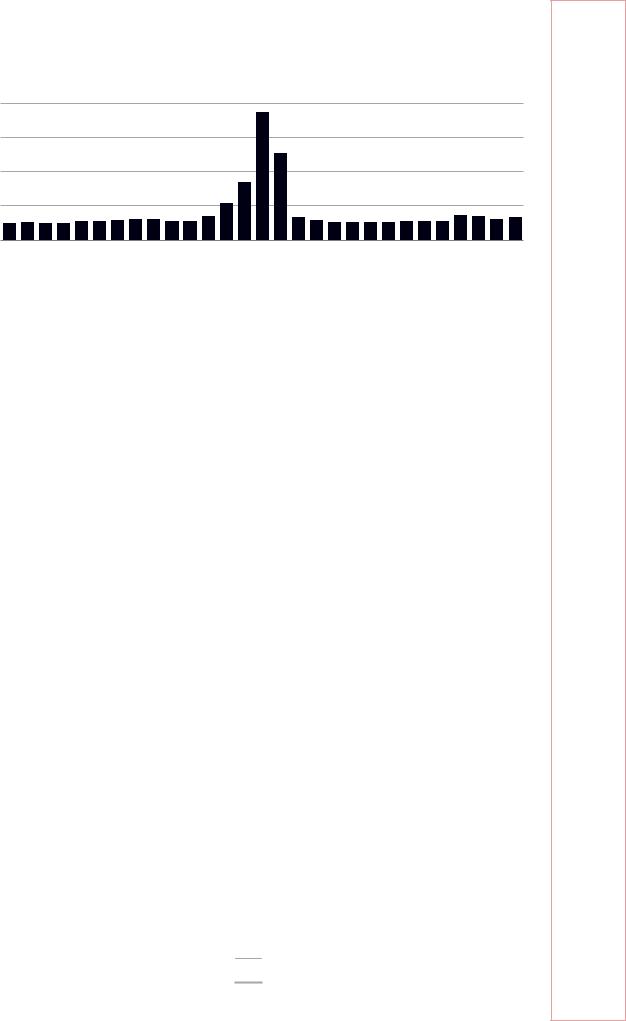

Figure 10.11 UK system average price (SAP), 15 February to 15 March 2018

Pence/therm

400

300

200

100

0 Feb15 Feb16 Feb17 Feb18 Feb19 Feb20 Feb21 Feb22 Feb23 Feb24 Feb25 Feb26 Feb27 Feb28 Mar01 Mar02 Mar03 Mar04 Mar05 Mar06 Mar07 Mar08 Mar09 Mar10 Mar11 Mar12 Mar13 Mar14 Mar15

Source: NGG (National Grid Gas) (2018a), Transmission Operational Data, NG, Warwick, www.nationalgridgas.com/data-and-operations/transmission-operational-data.

On the demand side:

Exports to Ireland were cut from 33.7 mcm on 28 February to 11.8 mcm on 1 March 2018.

The power sector diminished its gas burn from 58 Mm3 on 27 February to 38 Mm3 on 1 March 2018, with gas further losing its price competitiveness vis-à-vis other supply sources. Coal power generation increased to 25% of the system supply. Electricity imports increased by over 60% between 28 February and 3 March 2018 as electricity prices soared to reach a 10-year high.

Flows to industrial gas consumers decreased by around 2 mcm/d between 27 February and 1 March 2018. NG scaled back the off-peak exit capacity on the day, exercising a right included in the industrial users’ commercial contracts for capacity allocation.

The supply side reacted quickly as well:

Flows from the European continent through the BBL and the IUK interconnector pipelines rose by 150% from 32 Mm3 on 28 February to 80.3 Mm3 on 1 March 2018.

Norwegian deliveries to Easington through Langeled rose by ~20%, from 63 Mm3 on 28 February to 75 Mm3 on 1 March 2018.

Rough storage added 5 Mm3 to the market on 2 March 2018 (produced from cushion gas).

Simultaneously, weather conditions also started to improve, as shown by the CWW rising from -4 on 1 March to +4 on 5 March 2018. Heating demand fell and prices returned to typical seasonal levels.

Interlinkages of the gas and electricity systems

During the “Beast from the East” significant wind and coal-fired generation was able to support the high heating and power demand. This favourable outcome in 2018 may not be replicated in the future. Planned coal and nuclear closures, and cold but less windy weather, could diminish the power system’s support in a future event. The question arises as to the level of gas price and power system flexibility (interconnections and

197

ENERGY SECURITY

IEA. All rights reserved.