- •Foreword

- •Table of contents

- •Figures

- •Tables

- •Boxes

- •1. Executive summary

- •Energy system transformation

- •Special focus 1: The cost-effectiveness of climate measures

- •Special focus 2: The Electricity Market Reform

- •Special focus 3: Maintaining energy security

- •Key recommendations

- •2. General energy policy

- •Country overview

- •Institutions

- •Supply and demand trends

- •Primary energy supply

- •Energy production

- •Energy consumption

- •Energy policy framework

- •Energy and climate taxes and levies

- •Assessment

- •Recommendations

- •3. Energy and climate change

- •Overview

- •Emissions

- •GHG emissions

- •Projections

- •Institutions

- •Climate change mitigation

- •Emissions targets

- •Clean Growth Strategy

- •The EU Emissions Trading System

- •Low-carbon electricity support schemes

- •Climate Change Levy

- •Coal phase-out

- •Energy efficiency

- •Low-carbon technologies

- •Adaptation to climate change

- •Legal and institutional framework

- •Evaluation of impacts and risks

- •Response measures

- •Assessment

- •Recommendations

- •4. Renewable energy

- •Overview

- •Supply and demand

- •Renewable energy in the TPES

- •Electricity from renewable energy

- •Heat from renewable energy

- •Institutions

- •Policies and measures

- •Targets and objectives

- •Electricity from renewable energy sources

- •Heat from renewable energy

- •Renewable Heat Incentive

- •Renewable energy in transport

- •Assessment

- •Electricity

- •Transport

- •Heat

- •Recommendations

- •5. Energy efficiency

- •Overview

- •Total final energy consumption

- •Energy intensity

- •Overall energy efficiency progress

- •Institutional framework

- •Energy efficiency data and monitoring

- •Regulatory framework

- •Energy Efficiency Directive

- •Other EU directives

- •Energy consumption trends, efficiency, and policies

- •Residential and commercial

- •Buildings

- •Heat

- •Transport

- •Industry

- •Assessment

- •Appliances

- •Buildings and heat

- •Transport

- •Industry and business

- •Public sector

- •Recommendations

- •6. Nuclear

- •Overview

- •New nuclear construction and power market reform

- •UK membership in Euratom and Brexit

- •Waste management and decommissioning

- •Research and development

- •Assessment

- •Recommendations

- •7. Energy technology research, development and demonstration

- •Overview

- •Energy research and development strategy and priorities

- •Institutions

- •Funding on energy

- •Public spending

- •Energy RD&D programmes

- •Private funding and green finance

- •Monitoring and evaluation

- •International collaboration

- •International energy innovation funding

- •Assessment

- •Recommendations

- •8. Electricity

- •Overview

- •Supply and demand

- •Electricity supply and generation

- •Electricity imports

- •Electricity consumption

- •Institutional and regulatory framework

- •Wholesale market design

- •Network regulation

- •Towards a low-carbon electricity sector

- •Carbon price floor

- •Contracts for difference

- •Emissions performance standards

- •A power market for business and consumers

- •Electricity retail market performance

- •Smart grids and meters

- •Supplier switching

- •Consumer engagement and vulnerable consumers

- •Demand response (wholesale and retail)

- •Security of electricity supply

- •Legal framework and institutions

- •Network adequacy

- •Generation adequacy

- •The GB capacity market

- •Short-term electricity security

- •Emergency response reserves

- •Flexibility of the power system

- •Assessment

- •Wholesale electricity markets and decarbonisation

- •Retail electricity markets for consumers and business

- •The transition towards a smart and flexible power system

- •Recommendations

- •Overview

- •Supply and demand

- •Production, import, and export

- •Oil consumption

- •Retail market and prices

- •Infrastructure

- •Refining

- •Pipelines

- •Ports

- •Storage capacity

- •Oil security

- •Stockholding regime

- •Demand restraint

- •Assessment

- •Oil upstream

- •Oil downstream

- •Recommendations

- •10. Natural gas

- •Overview

- •Supply and demand

- •Domestic gas production

- •Natural gas imports and exports

- •Largest gas consumption in heat and power sector

- •Natural gas infrastructure

- •Cross-border connection and gas pipelines

- •Gas storage

- •Liquefied natural gas

- •Policy framework and markets

- •Gas regulation

- •Wholesale gas market

- •Retail gas market

- •Security of gas supply

- •Legal framework

- •Adequacy of gas supply and demand

- •Short-term security and emergency response

- •Supply-side measures

- •Demand-side measures

- •Gas quality

- •Recent supply disruptions

- •Interlinkages of the gas and electricity systems

- •Assessment

- •Recommendations

- •ANNEX A: Organisations visited

- •Review criteria

- •Review team and preparation of the report

- •Organisations visited

- •ANNEX B: Energy balances and key statistical data

- •Footnotes to energy balances and key statistical data

- •ANNEX C: International Energy Agency “Shared Goals”

- •ANNEX D: Glossary and list of abbreviations

- •Acronyms and abbreviations

- •Units of measure

10. NATURAL GAS

(CPF), the price of gas, and the impacts of EU environmental directives, significantly displaced the use of coal.

Gas consumption in power generation saw a large fluctuation over time; the share fell rapidly from 31 Mtoe in 2010 to 18 Mtoe in 2013. Since 2016, gas power generation has picked up again and, in 2017, gas power accounted for 41% of the total power generation. This is slightly below the peak share of 46% in 2010, but higher than 27% in 2013.

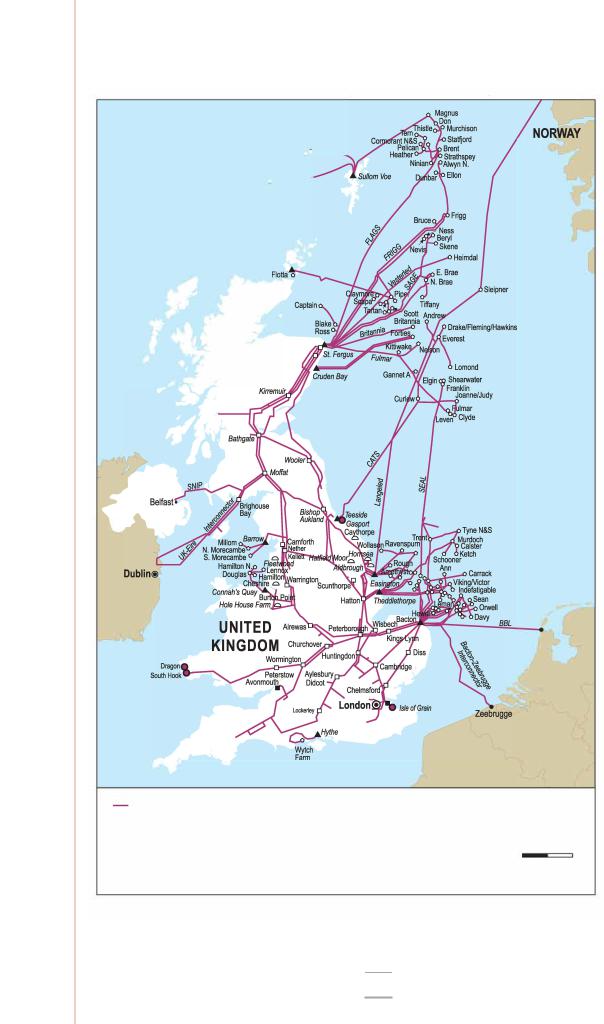

Natural gas infrastructure

The United Kingdom has an extensive natural gas supply infrastructure (Figure 10.5). This includes the production capacity offshore, which provides about half of the United Kingdom’s demand, and an extensive import infrastructure from Norway and continental Europe, capable of importing around 100 billion cubic meters per year (bcm/yr) compared to actual imports of less than 40 bcm/yr. The United Kingdom has a LNG import capacity of around 49 bcm/yr but the actual annual imports are around 10 bcm. Besides having a significant export capability to continental Europe (20 bcm/yr) and to Ireland (11 bcm/yr), the United Kingdom has gas storage of a total capacity of around 1.4 bcm or around 2% of annual demand. Total storage deliverability is at over 116 mcm/d and thus capable, in principle, of providing nearly one-quarter of the gas supply on 1-in-20 peak days.

NGG is the system operator that owns and operates the National Gas Transmission System. Ownership unbundled, NGG has the right to buy, sell, and store gas only to keep the system in balance across Great Britain. Besides NGG, there are four other certified transmission system operators in the United Kingdom that own and operate an interconnector:

Balgzand Bacton Leiding Company (BBL) operates the Balgzand Bacton Line, a gas interconnector between Julianadrop near Balgzand in the Netherlands and Bacton in GB. The interconnector provides services for physical gas flow from the Netherlands to Bacton in Great Britain and non-physical interruptible reverse flow services from Great Britain to the Netherlands.

Interconnector (UK) Limited (IUK) owns and operates a subsea pipeline and terminal facilities that link Bacton in the United Kingdom and Zeebrugge in Belgium.

Premier Transmission Limited (PTL) owns the gas interconnector between Twynholm in Scotland and Ballylumford in Northern Ireland, otherwise known as Scottish Northern Ireland Pipeline. PTL is a wholly owned subsidiary of Mutual Energy Limited.

GNI (UK) is the owner of the high-pressure interconnector between Moffat in Scotland and the end of the UK Territorial Waters. GNI (UK) is a wholly owned subsidiary of Gas Networks Ireland, which is within the Ervia Group.

185

ENERGY SECURITY

IEA. All rights reserved.

10. NATURAL GAS

Figure 10.5 United Kingdom natural gas infrastructure

Laggancr>---

Tormore

Schiehallion

,.,_

Beartnc'ï'

NiggV

IRELAND

|

Existing pipeline |

0 Production |

|

• |

Reception terminal |

0 |

Salt cavern |

□ |

Compresser station |

• |

LNG import facility |

■ |

LNG storage |

|

|

Balgzand

THE

NETHERLANDS

BELGIUM

FRANCE

km

0 50 100

This map is without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundanes and to the name of any territory, city or area.

Note: km = kilometre.

186

IEA. All rights reserved.

10. NATURAL GAS

In 2018, there were 27 gas distribution system operators (DSOs) – eight regional, regulated monopolies, owned and managed by four companies after National Grid (NG) sold its majority stakes in distribution activities in 2016, as well as 19 smaller gas DSOs:

Cadent Gas Ltd – West Midlands, North West, East of England, and North London

Northern Gas Networks Limited – North East England (including Yorkshire and Northern Cumbria)

Wales & West Utilities Limited – Wales and South West England.

SGN – Scotland and Southern England (including South London).

Cross-border connection and gas pipelines

Besides import pipelines from Norway (Vesterled, Langeled and Tampen Link, Gjøa, SAGE, and CATS), the GB gas system is well interconnected with neighbouring countries – Belgium, the Netherlands, Northern Ireland, and the Republic of Ireland. Great Britain has bidirectional capacity (around 20 bcm/yr) with Belgium via the IUK, and import capacity from the Netherlands through the interconnector BBL, and exports gas to the Republic of Ireland via the Moffatt Interconnector. Since 2011, the Moffatt Interconnector has virtual reverse flows (around 30 mcm/d) from Ireland to Great Britain on an interruptible basis. In 2017, the BBL changed its access regime to support the market merger between BBL and Gasunie Transport in the Netherlands.

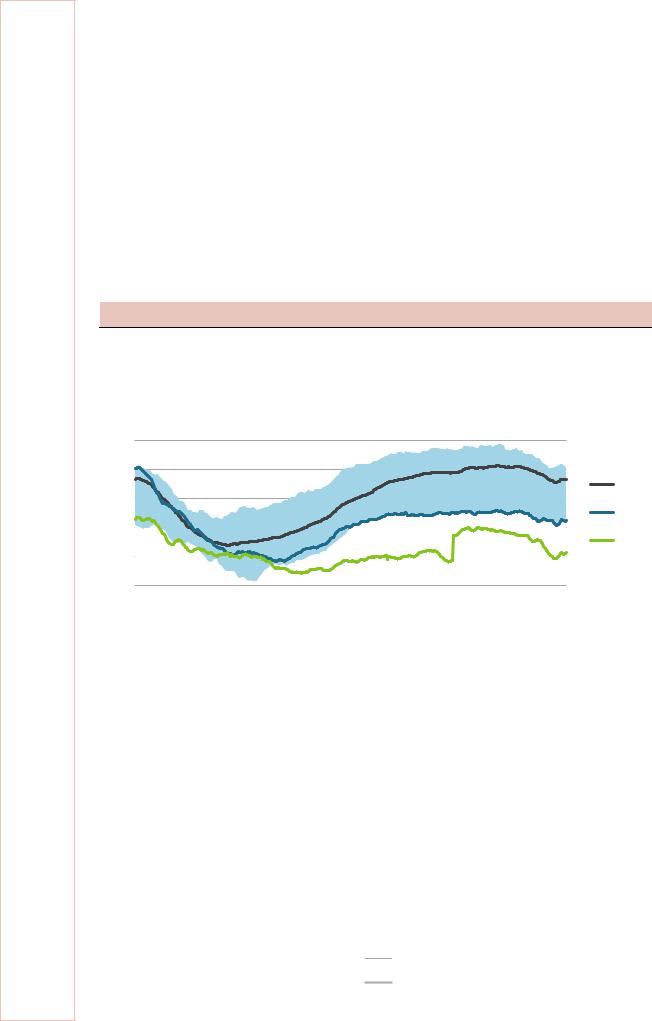

Gas storage

In 2017, the United Kingdom had a total gas storage capacity of 1.44 bcm/yr or 1.6% of the country’s annual gas consumption (Table 10.1). This is a significant decline from the UK gas storage capacity five years ago, which was 4.5 bcm or 6% of annual demand, as illustrated in the total gas storage compared to a six year average (Figure 10.6). Moreover, all of today’s capacity comes from short-range gas storages, after the closure of Rough seasonal gas storage.

Owing to the lower seasonal spread in prices, higher maintenance costs, and the lower integrity of the wells, Centrica Storage Ltd decided in 2017 to end operations permanently at Rough storage, the United Kingdom’s only long-range seasonal gas storage. Rough was also the United Kingdom’s largest gas storage facility with 42 mcm/d deliverable gas during winter (Table 10.1). Centrica will be gradually drawing down the remaining cushion gas from the facility.

In 2018, Électricité de France (EDF) announced the withdrawal of the Hole House Farm storage facility (the smallest gas storage in the United Kingdom) from commercial operation. BEIS concluded in its recent assessments of gas security that Great Britain has adequate gas supplies to meet a high gas demand even in the absence of Rough (UK Government, 2017a).

187

ENERGY SECURITY

IEA. All rights reserved.

10. NATURAL GAS

Table 10.1 UK operating gas storage sites, 2018

|

Site |

|

Operator/Developer |

|

Location |

|

Space (bcm) |

|

Approximate |

|

|

|

|

|

|

|

|

|

|

maximum delivery |

|

|

|

|

|

|

|

|

|

|

(mcm/d) |

|

|

Aldborough |

|

SSE/Statoil |

|

East Yorkshire |

0.3 |

40 |

|

||

|

|

|

|

|

|

|

|

|

||

|

Hatfield Moor |

|

Scottish Power |

|

South Yorkshire |

|

0.07 |

|

1.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Holford |

|

E.ON UK |

|

Cheshire |

0.2 |

22 |

|

||

|

|

|

|

|

|

|

|

|

||

|

Hornsea |

|

SSE |

|

East Yorkshire |

|

0.3 |

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Humbly Grove |

|

Humbly Grove Energy |

|

Hampshire |

0.3 |

7 |

|

||

|

|

|

|

|

|

|

|

|

||

|

Hill Top Farm |

|

EDF Energy |

|

Cheshire |

|

0.05 |

|

12 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stublach |

|

Storenergy |

|

Cheshire |

0.2 |

15 |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

1.442 |

120.8 |

|

||

Note: SSE = Scottish and Southern Energy.

Figure 10.6 Total Great Britain gas in storage, 2016 and 2017, compared to the prior six year (6Y) average

mcm

5000

4000

3000

2000

1000

0

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Source: Based on data from Ofgem (2018a) and NG.

Prior 6Y range

Prior 6Y range

Prior 6Y average

2016

2017

A number of new gas storage and expansion projects have been developed recently, which include the expansion of Storengy’s underground gas storage Stublach, a new gas project by Halite Energy, the Keuper Gas Storage Project, and a large storage facility in Northern Ireland (Islandmagee). Apart from Stublach, no final investment decisions (FIDs) have been taken; there is no guarantee that the proposed projects will go on to be operational.

The Stublach facility in Cheshire near the town of Northwich will see its capacity grow by 74 mcm in October 2018 and 37 mcm by January 2019. However, additional compressors are needed to increase the rate of extraction. According to Storengy (2018), once fully developed the facility will have a capacity of approximately 450 mcm, enough to supply 270 000 homes for 12 months.

Halite Energy is developing a new facility near Preesall, for which the company obtained permission in 2015 but faces delays. Although Halite Energy has permission to drill 19 caverns in the salt strata, just nine will be created and come online between 2020 and 2025 with 600 mcm.

188

IEA. All rights reserved.