- •Foreword

- •Table of contents

- •Figures

- •Tables

- •Boxes

- •1. Executive summary

- •Energy system transformation

- •Special focus 1: The cost-effectiveness of climate measures

- •Special focus 2: The Electricity Market Reform

- •Special focus 3: Maintaining energy security

- •Key recommendations

- •2. General energy policy

- •Country overview

- •Institutions

- •Supply and demand trends

- •Primary energy supply

- •Energy production

- •Energy consumption

- •Energy policy framework

- •Energy and climate taxes and levies

- •Assessment

- •Recommendations

- •3. Energy and climate change

- •Overview

- •Emissions

- •GHG emissions

- •Projections

- •Institutions

- •Climate change mitigation

- •Emissions targets

- •Clean Growth Strategy

- •The EU Emissions Trading System

- •Low-carbon electricity support schemes

- •Climate Change Levy

- •Coal phase-out

- •Energy efficiency

- •Low-carbon technologies

- •Adaptation to climate change

- •Legal and institutional framework

- •Evaluation of impacts and risks

- •Response measures

- •Assessment

- •Recommendations

- •4. Renewable energy

- •Overview

- •Supply and demand

- •Renewable energy in the TPES

- •Electricity from renewable energy

- •Heat from renewable energy

- •Institutions

- •Policies and measures

- •Targets and objectives

- •Electricity from renewable energy sources

- •Heat from renewable energy

- •Renewable Heat Incentive

- •Renewable energy in transport

- •Assessment

- •Electricity

- •Transport

- •Heat

- •Recommendations

- •5. Energy efficiency

- •Overview

- •Total final energy consumption

- •Energy intensity

- •Overall energy efficiency progress

- •Institutional framework

- •Energy efficiency data and monitoring

- •Regulatory framework

- •Energy Efficiency Directive

- •Other EU directives

- •Energy consumption trends, efficiency, and policies

- •Residential and commercial

- •Buildings

- •Heat

- •Transport

- •Industry

- •Assessment

- •Appliances

- •Buildings and heat

- •Transport

- •Industry and business

- •Public sector

- •Recommendations

- •6. Nuclear

- •Overview

- •New nuclear construction and power market reform

- •UK membership in Euratom and Brexit

- •Waste management and decommissioning

- •Research and development

- •Assessment

- •Recommendations

- •7. Energy technology research, development and demonstration

- •Overview

- •Energy research and development strategy and priorities

- •Institutions

- •Funding on energy

- •Public spending

- •Energy RD&D programmes

- •Private funding and green finance

- •Monitoring and evaluation

- •International collaboration

- •International energy innovation funding

- •Assessment

- •Recommendations

- •8. Electricity

- •Overview

- •Supply and demand

- •Electricity supply and generation

- •Electricity imports

- •Electricity consumption

- •Institutional and regulatory framework

- •Wholesale market design

- •Network regulation

- •Towards a low-carbon electricity sector

- •Carbon price floor

- •Contracts for difference

- •Emissions performance standards

- •A power market for business and consumers

- •Electricity retail market performance

- •Smart grids and meters

- •Supplier switching

- •Consumer engagement and vulnerable consumers

- •Demand response (wholesale and retail)

- •Security of electricity supply

- •Legal framework and institutions

- •Network adequacy

- •Generation adequacy

- •The GB capacity market

- •Short-term electricity security

- •Emergency response reserves

- •Flexibility of the power system

- •Assessment

- •Wholesale electricity markets and decarbonisation

- •Retail electricity markets for consumers and business

- •The transition towards a smart and flexible power system

- •Recommendations

- •Overview

- •Supply and demand

- •Production, import, and export

- •Oil consumption

- •Retail market and prices

- •Infrastructure

- •Refining

- •Pipelines

- •Ports

- •Storage capacity

- •Oil security

- •Stockholding regime

- •Demand restraint

- •Assessment

- •Oil upstream

- •Oil downstream

- •Recommendations

- •10. Natural gas

- •Overview

- •Supply and demand

- •Domestic gas production

- •Natural gas imports and exports

- •Largest gas consumption in heat and power sector

- •Natural gas infrastructure

- •Cross-border connection and gas pipelines

- •Gas storage

- •Liquefied natural gas

- •Policy framework and markets

- •Gas regulation

- •Wholesale gas market

- •Retail gas market

- •Security of gas supply

- •Legal framework

- •Adequacy of gas supply and demand

- •Short-term security and emergency response

- •Supply-side measures

- •Demand-side measures

- •Gas quality

- •Recent supply disruptions

- •Interlinkages of the gas and electricity systems

- •Assessment

- •Recommendations

- •ANNEX A: Organisations visited

- •Review criteria

- •Review team and preparation of the report

- •Organisations visited

- •ANNEX B: Energy balances and key statistical data

- •Footnotes to energy balances and key statistical data

- •ANNEX C: International Energy Agency “Shared Goals”

- •ANNEX D: Glossary and list of abbreviations

- •Acronyms and abbreviations

- •Units of measure

9. OIL

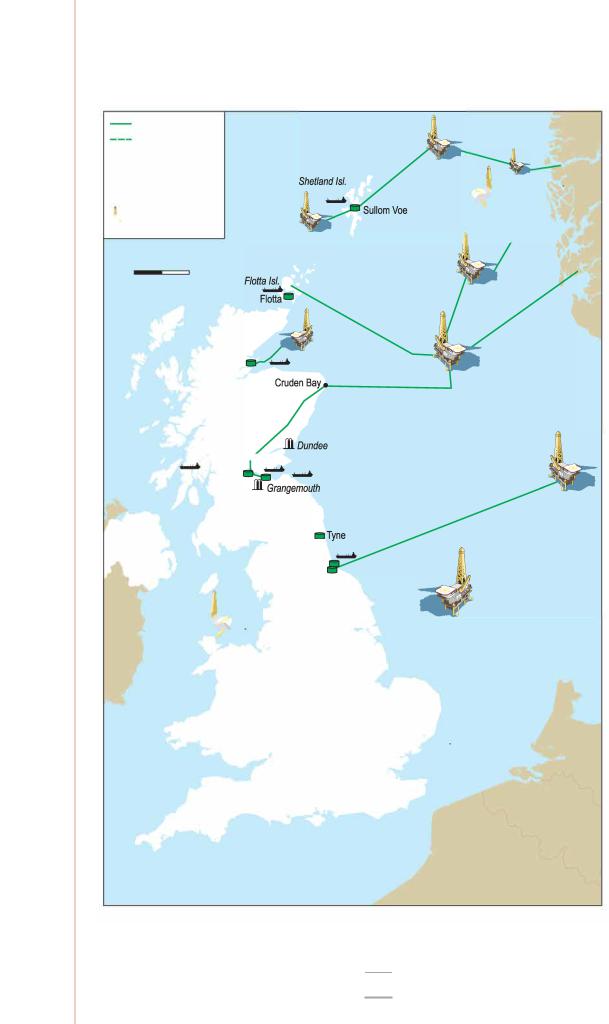

point for the Brent and Ninian pipeline systems), Flotta on the Orkney Islands of Scotland, Kinneil (at the end of the Forties pipeline system), and Teesside (landing point for Norwegian Ekofisk production) on the east coast. Figure 9.9 shows the oil infrastructure of the United Kingdom.

Ports

The United Kingdom has six major oil ports with crude and product import capacity colocated with the six main refineries. These ports have a combined oil and product import capacity of 73 million tonnes per year (Mt/yr). Another two specialist refineries also have crude and product port facilities with a combined import capacity of 4 Mt/yr. In addition to the oil ports co-located with refineries, the United Kingdom has 36 coastal product distribution terminals (with a combined storage capacity of 7.8 million cubic metres [Mm3]). The combined import capacity of all the United Kingdom’s oil and product port facilities is 89.4 Mt/yr.

Storage capacity

A total of 83.4 million barrels (mb) of oil and product stocks were held on UK territory as of end-June 2018. The main storage facilities for crude and oil products in the United Kingdom are located at the six main refineries. In addition to the refineries, there are 49 coastal and inland terminals with a total oil and product storage capacity of 8.4 Mm3 or 125.1 mb (32.3 mb of crude oil and 92.7 mb of product). These facilities are owned by major oil companies, independent operators, and joint ventures, and are generally located near major population centres.

Oil security

Stockholding regime

The United Kingdom meets its IEA stockholding obligation by placing compulsory stocking requirements on oil companies under powers in the Energy Act 1976. The Act allows the Secretary of State for BEIS to direct companies that produce, supply, or use petroleum products within the UK market to hold minimum levels of stocks and to release them to the market if directed to do so during an emergency. The stockholding obligation applies to companies who supply more than 50 000 tonnes of oil per year to the UK market. Refiners are obligated to hold 67.5 days of supply, while importing companies must hold stocks equivalent to 58 days.

There are no public stocks and the country does not have a public stockholding agency.

Stocks are either held as physical stocks by the company in their own facilities within the European Union, or via “tickets” with other companies – either in the United Kingdom or in other EU member countries – under a number of different arrangements (memorandum of understanding [MOU], bilateral agreements, or less formal arrangements between governments). The United Kingdom has such arrangements in place with Belgium, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Malta, Netherlands, Portugal, Slovakia, Slovenia, and Sweden. Although the United Kingdom is unable to count stocks held outside the European Community under the terms of the EU Oil Stocks Directive (Council Directive 2009/119/EC), the United Kingdom has single-direction MOUs with both New Zealand and Australia.

175

ENERGY SECURITY

IEA. All rights reserved.

9. OIL

Figure 9.9 Map of oil infrastructure

|

Crude oil Pipeline |

|

|

Oil products pipeline |

|

fil |

Refinery |

|

• |

Oil storage site |

|

........ |

Tanker Terminal |

|

Oil rig |

|

|

0 |

km |

100 |

50 |

||

Nigg

Finnart---- |

.r |

Glasgow a

UNITED

KINGDOM

Belfast• |

Teeside |

Workington • |

r7NORWAY

:r,, .

''

|

|

F: |

|

|

|

......., |

Barrow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

@ |

......,. |

|

__, ootle T |

,.,,,; |

u,¾sey |

|

|

...,.. |

|

|

|

||||||||||||||||

Dublin |

\ |

|

|

|

|

|

|

|

|

||||||||||||||||||

|

Almwch |

|

|

|

....,. • |

|

|

|

|

|

|

|

|

|

|

\ |

|

|

|

|

|

|

|||||

|

|

|

|

- |

|

:l)L----'-• |

|

|

|

|

|

|

fil |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

||||||||||

|

|

|

|

|

--am |

· JI |

\' |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

Easth |

|

|

|

|

|

|

|

|

|

|

\ |

/ Killingholme |

|

|

|

||||||||||

IRELAND |

|

|

|

|

|

Stanlow |

|

\\ |

r-Warrington |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

1,', |

|

|

|

/ |

|

|

\ / |

|

• |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

\ |

/ |

|

|

Il |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

|

|

\ |

IS ec I |

; |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

\ |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

L--" |

|

|

|

|

|

\/W.bhY.; |

|

|

|||||

|

|

|

|

|

|

|

|

|

... |

|

|

1 |

\ |

( |

|

|

|

|

|

|

THE |

||||||

|

|

|

|

|

|

|

|

|

,,,... |

|

|

|

----)f--,........ |

|

,,,-... \ |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

,.,,(î |

|

|

|

|

|

\ |

|

|

1 |

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

' .._ |

|

|

|

|

|

|

|

|

|

|

|

||

........ |

4- |

_____,.., |

|

|

|

|

1 |

\ |

|

|

|

|

|

,, |

' |

|

f -- |

|

|

||||||||

Milford Haven |

|

|

|

|

|

|

|

|

) |

\ |

|

|

|

|

/ ' " |

|

|

1 |

a ...,.. |

|

NETHERLANDS |

||||||

......., Pembroke |

'· |

|

|

|

|

|

|

|

/ |

|

|

\ |

|

|

|

I |

|

1--, |

|

1 |

Harwtch |

|

|||||

|

|

Barry•......., Il / |

|

|

1 |

\l.ShellHaven |

......,. |

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

, |

\ |

|

1 |

r~-A--?•lsle of Grain |

• |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

' |

\ |

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

\\ |

|

f,/ --- |

|

|

- |

|

|

Zeebrugge |

|||||

|

|

|

|

|

|

|

|

|

|

|

Fawley'ji,_ |

|

|

|

__\/ |

|

• |

|

|

||||||||

St. Mawgal |

.,::routh |

|

|

|

|

|

|

|

C- |

|

|

|

|

|

|

|

Dunkerque |

BELGIUM |

|||||||||

Folmouth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FRANCE

This map is without prejudice to the status of or sovereignty over any territory, to the delimitation of international frontiers and boundanes and to the name of any territory, city or area.

Note: km = kilometre.

176

IEA. All rights reserved.

9. OIL

The United Kingdom has a strong record of compliance with its 90-day obligation. As of June 2018, the country held stocks of almost 110 mb (or 14 Mt), equivalent to 238 days of net imports (all of which are industry stocks). It held 68 mb (8.7 Mt) in excess of the IEA’s required minimum (41 mb (or 5.3 Mt)). Around one-third of the stocks that make up the United Kingdom’s total are held abroad (around 37 mb in June 2018 – equivalent to 79 days of net imports).

As the United Kingdom’s oil production is decreasing, net imports are set to rise significantly in the short-to-medium term and, consequently, its stockholding obligations to the IEA and European Union are expected to rise progressively. Under the EU Directive, the United Kingdom is obliged to hold “90 days of average daily net imports or 61 days of average daily inland consumption, whichever of the two quantities is greater”. The country’s 90 day IEA/EU obligation is not expected to overtake the consumptionbased EU obligation until the early-to-mid-2020s. Once this takes place and the United Kingdom switches to calculating its minimum stockholding requirements on the basis of the IEA/EU 90 day obligation, the country will need to hold progressively more stocks than it has previously.

In addition, the storage capacity for oil products in the United Kingdom is limited, which means that, with an increased obligation, the United Kingdom needs to hold more stocks overseas. According to industry, the incentives to invest in new storage capacity in the United Kingdom are limited. Given these issues, in April 2013 BEIS (then the Department of Energy and Climate Change [DECC]) launched a public consultation on the future management of the Compulsory Oil Stocking Obligation in the United Kingdom, which sought views on the possible establishment of an industry-owned and operated Central Stocking Entity (CSE) in the United Kingdom. DECC published the government response to the consultation in April 2014 and concluded that the government was willing to consider the establishment of such a CSE, with mandatory membership for obligated companies. However, the government communicated to the industry in 2015 that a CSE was no longer being pursued. In October 2015, a further consultation on oil stocking was issued by DECC that considered a range of possible options to amend the UK approach to company obligations to enable the United Kingdom to ensure compliance with the EU Directive. The process is on hold pending the United Kingdom’s exit from the EU.

United Kingdom Petroleum Industry Association, the trade association that represents the main oil refining, distribution, and marketing companies in the United Kingdom, has reportedly shown concerns about the implications of Brexit, which include the potential loss of flexibility if cross-border ticketing is no longer possible, and it has reiterated calls to create a centralised stock holding agency.

Demand restraint

Under the Energy Act 1976, the government has the authority to regulate or prohibit the production, supply, acquisition, or use of oil or petroleum products. The demand restraint measures available in the United Kingdom are set out in the National Emergency Plan for Fuel (NEP-F). The NEP-F is intended for use by the downstream oil supply industry, Local Resilience Fora (in England and Wales), Regional Resilience Partnerships (in Scotland), and resilience planners for essential services. It specifies the role each should play to prepare for or respond to a fuel supply crisis, clarifies the government’s approach, and sets the context for the level of fuel resilience appropriate to the essential services. The NEP-F contains a range of measures for the administration to consider as part of its response to any fuel supply disruption, which range from light-handed measures to the allocation and rationing of oil products. In a disruption that requires central government action, light-handed measures are preferred.

177

ENERGY SECURITY

IEA. All rights reserved.