- •Foreword

- •Table of contents

- •Figures

- •Tables

- •Boxes

- •1. Executive summary

- •Energy system transformation

- •Special focus 1: The cost-effectiveness of climate measures

- •Special focus 2: The Electricity Market Reform

- •Special focus 3: Maintaining energy security

- •Key recommendations

- •2. General energy policy

- •Country overview

- •Institutions

- •Supply and demand trends

- •Primary energy supply

- •Energy production

- •Energy consumption

- •Energy policy framework

- •Energy and climate taxes and levies

- •Assessment

- •Recommendations

- •3. Energy and climate change

- •Overview

- •Emissions

- •GHG emissions

- •Projections

- •Institutions

- •Climate change mitigation

- •Emissions targets

- •Clean Growth Strategy

- •The EU Emissions Trading System

- •Low-carbon electricity support schemes

- •Climate Change Levy

- •Coal phase-out

- •Energy efficiency

- •Low-carbon technologies

- •Adaptation to climate change

- •Legal and institutional framework

- •Evaluation of impacts and risks

- •Response measures

- •Assessment

- •Recommendations

- •4. Renewable energy

- •Overview

- •Supply and demand

- •Renewable energy in the TPES

- •Electricity from renewable energy

- •Heat from renewable energy

- •Institutions

- •Policies and measures

- •Targets and objectives

- •Electricity from renewable energy sources

- •Heat from renewable energy

- •Renewable Heat Incentive

- •Renewable energy in transport

- •Assessment

- •Electricity

- •Transport

- •Heat

- •Recommendations

- •5. Energy efficiency

- •Overview

- •Total final energy consumption

- •Energy intensity

- •Overall energy efficiency progress

- •Institutional framework

- •Energy efficiency data and monitoring

- •Regulatory framework

- •Energy Efficiency Directive

- •Other EU directives

- •Energy consumption trends, efficiency, and policies

- •Residential and commercial

- •Buildings

- •Heat

- •Transport

- •Industry

- •Assessment

- •Appliances

- •Buildings and heat

- •Transport

- •Industry and business

- •Public sector

- •Recommendations

- •6. Nuclear

- •Overview

- •New nuclear construction and power market reform

- •UK membership in Euratom and Brexit

- •Waste management and decommissioning

- •Research and development

- •Assessment

- •Recommendations

- •7. Energy technology research, development and demonstration

- •Overview

- •Energy research and development strategy and priorities

- •Institutions

- •Funding on energy

- •Public spending

- •Energy RD&D programmes

- •Private funding and green finance

- •Monitoring and evaluation

- •International collaboration

- •International energy innovation funding

- •Assessment

- •Recommendations

- •8. Electricity

- •Overview

- •Supply and demand

- •Electricity supply and generation

- •Electricity imports

- •Electricity consumption

- •Institutional and regulatory framework

- •Wholesale market design

- •Network regulation

- •Towards a low-carbon electricity sector

- •Carbon price floor

- •Contracts for difference

- •Emissions performance standards

- •A power market for business and consumers

- •Electricity retail market performance

- •Smart grids and meters

- •Supplier switching

- •Consumer engagement and vulnerable consumers

- •Demand response (wholesale and retail)

- •Security of electricity supply

- •Legal framework and institutions

- •Network adequacy

- •Generation adequacy

- •The GB capacity market

- •Short-term electricity security

- •Emergency response reserves

- •Flexibility of the power system

- •Assessment

- •Wholesale electricity markets and decarbonisation

- •Retail electricity markets for consumers and business

- •The transition towards a smart and flexible power system

- •Recommendations

- •Overview

- •Supply and demand

- •Production, import, and export

- •Oil consumption

- •Retail market and prices

- •Infrastructure

- •Refining

- •Pipelines

- •Ports

- •Storage capacity

- •Oil security

- •Stockholding regime

- •Demand restraint

- •Assessment

- •Oil upstream

- •Oil downstream

- •Recommendations

- •10. Natural gas

- •Overview

- •Supply and demand

- •Domestic gas production

- •Natural gas imports and exports

- •Largest gas consumption in heat and power sector

- •Natural gas infrastructure

- •Cross-border connection and gas pipelines

- •Gas storage

- •Liquefied natural gas

- •Policy framework and markets

- •Gas regulation

- •Wholesale gas market

- •Retail gas market

- •Security of gas supply

- •Legal framework

- •Adequacy of gas supply and demand

- •Short-term security and emergency response

- •Supply-side measures

- •Demand-side measures

- •Gas quality

- •Recent supply disruptions

- •Interlinkages of the gas and electricity systems

- •Assessment

- •Recommendations

- •ANNEX A: Organisations visited

- •Review criteria

- •Review team and preparation of the report

- •Organisations visited

- •ANNEX B: Energy balances and key statistical data

- •Footnotes to energy balances and key statistical data

- •ANNEX C: International Energy Agency “Shared Goals”

- •ANNEX D: Glossary and list of abbreviations

- •Acronyms and abbreviations

- •Units of measure

9. OIL

In the fourth quarter of 2018, the household price for automotive diesel was US dollars (USD) 1.7 per litre (USD/L), the fifth highest among the IEA member countries (Figure 9.7). Petrol and diesel are charged an equal fixed duty, currently 57.95 pence per litre. Petrol and diesel are also subject to value-added tax (VAT) at a rate of 20% since March 2011. When VAT is included, tax represents 62% of the final pump price for petrol and 60% of the final pump price for diesel (as of fourth quarter 2018), which are among the highest levels in the IEA countries. The gasoline price was 1.6 USD/L, which was close to the median among IEA countries, despite the high tax level.

In heating, oil boilers for heating have a reduced VAT rate of 5%; by contrast, renewable technology installations tend to be subject to the full 20% rate. The United Kingdom maintains, and recently extended, its Rural Fuel Duty Relief scheme, which in essence reduces road fuel taxes in certain rural areas. The Rural Fuel Duty Relief provides support for motorists by compensating fuel retailers in specific rural areas with high road fuel prices. The rebate provides a 5 pence per litre reduction to fuel retailers in the specified rural areas on the standard UK rate of Excise Duty of 57.95 pence per litre for unleaded petrol and for diesel sold for use in road vehicles. As of 1 April 2015, further changes were made to extend the relief to more specified rural areas, which allowed an additional 125 000 people living in the selected areas to benefit from cheaper fuel. This followed a year-long EU approvals process – although the United Kingdom’s most rural islands already received this discount, this was the first time that the European Union approved this fuel discount anywhere in mainland Europe.

Infrastructure

Refining

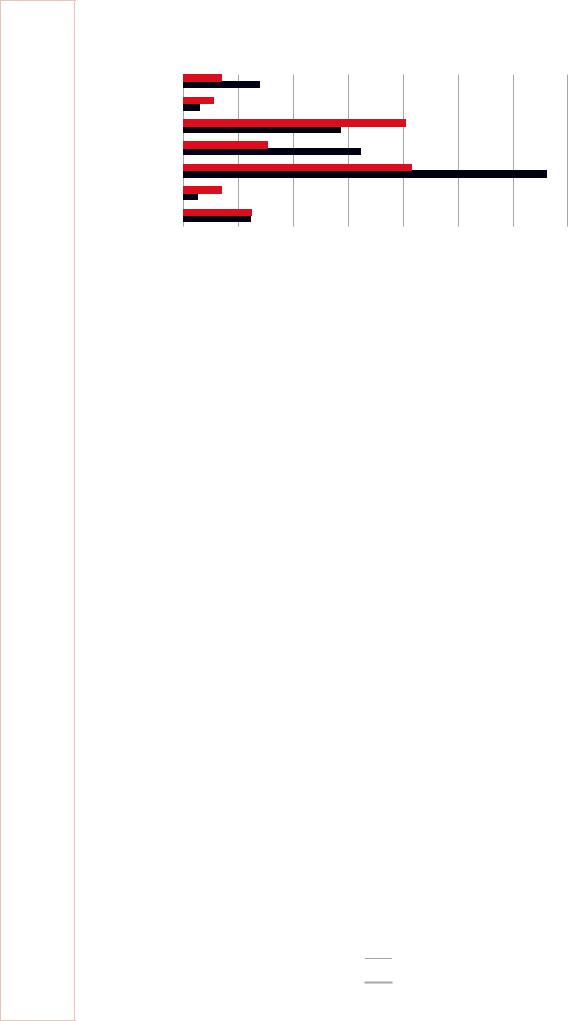

Six major crude oil refineries operate in the United Kingdom and supply the bulk of the inland market for petroleum products. There are also two smaller speciality refineries that produce bitumen and other specialised products. The refineries are situated around the coast and most are connected to pipelines for product distribution. The refinery gross output in 2017 averaged 59.9 Mt (1.3 mb/d), down from 81.2 Mt (1.6 mb/d) in 2007, principally owing to production losses from the closure of the Coryton refinery in 2012 and the Milford Haven refinery in 2014 and to capacity reductions. Gas and diesel oil accounted for around 32% of the refining output in 2017, followed by gasoline at 31% (Figure 9.8).

With regard to the supply and demand imbalance of refined products, the United Kingdom imported a net 397 kb/d of middle distillates in 2017, and exported a net 174 kb/d of gasoline. As the demand for middle distillates continues to increase and with no plans to increase the domestic production, it is anticipated that the United Kingdom will rely increasingly heavily on imports to meet future supply – particularly in the case of diesel and jet fuel. Import dependency for diesel has increased from 13% in 2012 to 37% in 2017. The largest source of imported diesel was Russia at 30% of the total diesel imports in 2017, followed by the Netherlands (24%). Import dependency of jet fuel is higher (more than two-thirds of the demand must be met by imports) and has a higher security concern for its relatively long supply lines. Middle Eastern countries accounted for 60% of jet fuel imports in 2017, with the United Arab Emirates and Kuwait being the main suppliers at 22% and 21%, respectively. Another 19% was imported from Asia (8% from India, 6% from Korea, and 4% from Singapore). Significant demand for jet fuel is accounted for by activities at Heathrow, the world’s third-largest airport.

173

ENERGY SECURITY

IEA. All rights reserved.

9. OIL

Figure 9.8 UK refinery output, 2017

LPG and ethane

Naphtha

Gasolines

Jet and kerosene

Gas/diesel oil

Residual fuels

Other products

0 |

100 |

200 |

300 |

400 |

500 |

600 |

700 |

|

|

|

Thousand barrels per day |

|

|

|

|

Source: IEA (2018b) Oil Market Report 2018, www.iea.org/statistics/.

Refinery output

Refinery output

Demand

Demand

To help identify and address the challenges that face the UK refining sector, a Midstream Oil Sector Government and Industry Taskforce was set up in 2014. As one of its conclusions, the Taskforce identified the need for a greater understanding of the resilience of the country’s fuel supply chain and the risk that rationalisation of the infrastructure could erode the downstream oil resilience over time. Also, the need for increased collaboration between government and industry was identified. Since the end of the Taskforce, relationships have been maintained through the biannual Downstream Oil Industry Forum, which is attended by the major trade associations that represent companies in the fuel supply chain. In October 2017, the Department for Business, Energy and Industrial Strategy (BEIS) launched a consultation on possible new measures to maintain security of fuel supply to consumers. As part of this consultation, the government provided an economic impact assessment by setting out indicative examples of the costs of disruptions of different durations on two major types of infrastructure: refineries and terminals. The government’s response to this consultation was published in April 2018 and work is underway on possible legislation.

Pipelines

The major oil terminals (about 50) are supplied by pipeline (51% of the volume) and rail (15%) from UK refineries, and by sea (34%) from a mixture of domestic production and imports. The United Kingdom has a 4 800-kilometre-long domestic oil pipeline network – all of which are privately owned and operated. The pipelines are used both for shortdistance transport, e.g. from jetty or import terminal to storage terminal or refinery, and over longer distances to supply inland distribution terminals. Pipelines also connect the United Kingdom to offshore North Sea oil production platforms, both from domestic and Norwegian fields.

Around half of the UK oil pipeline network comprises assets that were part of the government Pipeline and Storage System (GPSS). In March 2015 the GPSS was sold to CLH Pipeline System (CLH-PS) Ltd, a wholly owned company of the Spanish company, Compania Logistica de Hidrocarburos. CLH-PS supplies 35% of the demand for aviation fuel in the United Kingdom. Heathrow, Gatwick, Stansted, and Manchester are among the main airports it supplies, in addition to another ten regional airports that are supplied by road tanker.

The United Kingdom has four major land-based terminals through which about two-thirds of the country’s crude oil production flows and which are an integral to parts of the pipeline systems. These are Sullom Voe on the Shetland Islands of Scotland (landing

174

IEA. All rights reserved.