- •Foreword

- •Table of contents

- •Figures

- •Tables

- •Boxes

- •1. Executive summary

- •Energy system transformation

- •Special focus 1: The cost-effectiveness of climate measures

- •Special focus 2: The Electricity Market Reform

- •Special focus 3: Maintaining energy security

- •Key recommendations

- •2. General energy policy

- •Country overview

- •Institutions

- •Supply and demand trends

- •Primary energy supply

- •Energy production

- •Energy consumption

- •Energy policy framework

- •Energy and climate taxes and levies

- •Assessment

- •Recommendations

- •3. Energy and climate change

- •Overview

- •Emissions

- •GHG emissions

- •Projections

- •Institutions

- •Climate change mitigation

- •Emissions targets

- •Clean Growth Strategy

- •The EU Emissions Trading System

- •Low-carbon electricity support schemes

- •Climate Change Levy

- •Coal phase-out

- •Energy efficiency

- •Low-carbon technologies

- •Adaptation to climate change

- •Legal and institutional framework

- •Evaluation of impacts and risks

- •Response measures

- •Assessment

- •Recommendations

- •4. Renewable energy

- •Overview

- •Supply and demand

- •Renewable energy in the TPES

- •Electricity from renewable energy

- •Heat from renewable energy

- •Institutions

- •Policies and measures

- •Targets and objectives

- •Electricity from renewable energy sources

- •Heat from renewable energy

- •Renewable Heat Incentive

- •Renewable energy in transport

- •Assessment

- •Electricity

- •Transport

- •Heat

- •Recommendations

- •5. Energy efficiency

- •Overview

- •Total final energy consumption

- •Energy intensity

- •Overall energy efficiency progress

- •Institutional framework

- •Energy efficiency data and monitoring

- •Regulatory framework

- •Energy Efficiency Directive

- •Other EU directives

- •Energy consumption trends, efficiency, and policies

- •Residential and commercial

- •Buildings

- •Heat

- •Transport

- •Industry

- •Assessment

- •Appliances

- •Buildings and heat

- •Transport

- •Industry and business

- •Public sector

- •Recommendations

- •6. Nuclear

- •Overview

- •New nuclear construction and power market reform

- •UK membership in Euratom and Brexit

- •Waste management and decommissioning

- •Research and development

- •Assessment

- •Recommendations

- •7. Energy technology research, development and demonstration

- •Overview

- •Energy research and development strategy and priorities

- •Institutions

- •Funding on energy

- •Public spending

- •Energy RD&D programmes

- •Private funding and green finance

- •Monitoring and evaluation

- •International collaboration

- •International energy innovation funding

- •Assessment

- •Recommendations

- •8. Electricity

- •Overview

- •Supply and demand

- •Electricity supply and generation

- •Electricity imports

- •Electricity consumption

- •Institutional and regulatory framework

- •Wholesale market design

- •Network regulation

- •Towards a low-carbon electricity sector

- •Carbon price floor

- •Contracts for difference

- •Emissions performance standards

- •A power market for business and consumers

- •Electricity retail market performance

- •Smart grids and meters

- •Supplier switching

- •Consumer engagement and vulnerable consumers

- •Demand response (wholesale and retail)

- •Security of electricity supply

- •Legal framework and institutions

- •Network adequacy

- •Generation adequacy

- •The GB capacity market

- •Short-term electricity security

- •Emergency response reserves

- •Flexibility of the power system

- •Assessment

- •Wholesale electricity markets and decarbonisation

- •Retail electricity markets for consumers and business

- •The transition towards a smart and flexible power system

- •Recommendations

- •Overview

- •Supply and demand

- •Production, import, and export

- •Oil consumption

- •Retail market and prices

- •Infrastructure

- •Refining

- •Pipelines

- •Ports

- •Storage capacity

- •Oil security

- •Stockholding regime

- •Demand restraint

- •Assessment

- •Oil upstream

- •Oil downstream

- •Recommendations

- •10. Natural gas

- •Overview

- •Supply and demand

- •Domestic gas production

- •Natural gas imports and exports

- •Largest gas consumption in heat and power sector

- •Natural gas infrastructure

- •Cross-border connection and gas pipelines

- •Gas storage

- •Liquefied natural gas

- •Policy framework and markets

- •Gas regulation

- •Wholesale gas market

- •Retail gas market

- •Security of gas supply

- •Legal framework

- •Adequacy of gas supply and demand

- •Short-term security and emergency response

- •Supply-side measures

- •Demand-side measures

- •Gas quality

- •Recent supply disruptions

- •Interlinkages of the gas and electricity systems

- •Assessment

- •Recommendations

- •ANNEX A: Organisations visited

- •Review criteria

- •Review team and preparation of the report

- •Organisations visited

- •ANNEX B: Energy balances and key statistical data

- •Footnotes to energy balances and key statistical data

- •ANNEX C: International Energy Agency “Shared Goals”

- •ANNEX D: Glossary and list of abbreviations

- •Acronyms and abbreviations

- •Units of measure

9. OIL

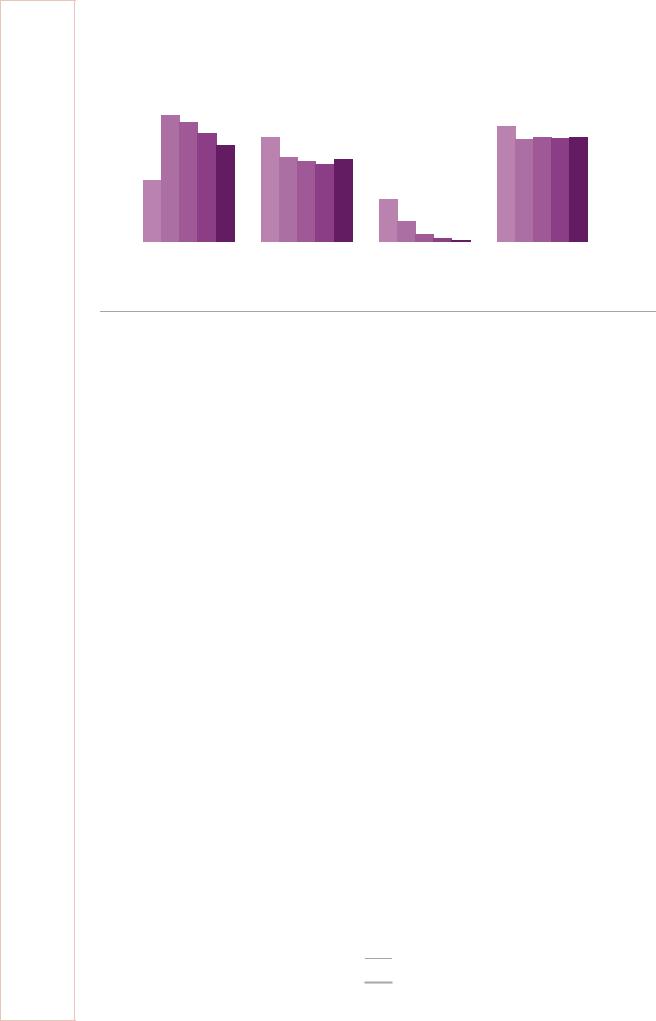

Figure 9.1 Share of oil in different energy metrics, 1977-2017

60% |

Share of oil |

|

|

|

|

|

|

|

|

|

|

|

|

|

1977 |

||

|

|

|

|

|

|

|||

50% |

|

|

|

|

|

|||

|

|

|

|

|||||

|

|

|

|

|

|

1987 |

||

|

|

|

|

|

||||

40% |

|

|

|

|

|

1997 |

||

|

|

|

|

|||||

|

|

|

|

|||||

|

|

|

|

|

|

2007 |

||

30% |

|

|

|

|

|

|||

|

|

|

|

|||||

|

|

|

|

|||||

|

|

|

|

|

|

2017 |

||

|

|

|

|

|

|

|||

20% |

|

|

|

|

|

|||

|

|

|

|

|||||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

||

10% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

0% |

|

|

|

|

|

|

|

|

Domestic energy production |

TPES |

Electricity generation |

TFC |

|||||

|

||||||||

Domestic oil production has decreased over the past decades, while the shares of oil in TPES and TFC have remained relatively stable.

Note: TPES does not include bunkering fuel.

Source: IEA (2019a), World Energy Balances 2019 First edition (database), www.iea.org/statistics/.

Supply and demand

Production, import, and export

The United Kingdom has significant levels of domestic crude oil production – it ranks highest in the European Union and fourth among the International Energy Agency (IEA) member countries, after the United States, Canada, and Norway. However, the country’s oil production is on a long-term declining trend at an average rate of 6% per annum since its peak at 137 million tonnes (Mt) (2.8 million barrels per day [mb/d]) in 1999. Bucking the trend, thanks to government interventions and higher oil prices, recent production increased slightly to 46.5 Mt (1 mb/d) in 2017 from 40 Mt (0.8 mb/d) in 2014 (Figure 9.2), but in the longer run a further decline seems unavoidable due to the lack of new investments. Almost all UK oil is produced from offshore fields, mainly in the North Sea where petroleum development projects generally have long lead times. Despite the large drop over the past decades, in 2017 the United Kingdom’s domestic crude oil production still corresponded to around two-thirds of its total consumption and more than 70% of its refinery intake.

The latest estimates of the remaining recoverable hydrocarbon resources from the United Kingdom’s offshore resources is in the range of 10-20 billion barrels of oilequivalent, which could potentially sustain production for the next 20 years and beyond. Compared with historical oil and gas exploitation, to extract the remaining reserves is likely to be more technically challenging and therefore expensive. In response to this challenge, the government established the Oil and Gas Authority (OGA), with the objective to maximise economic recovery from the UK continental shelf (UKCS). In 2016, the OGA released the strategy for enhanced oil recovery (EOR) with a monitoring system to support the Maximising Economic Recovery (MER) Strategy (UK Government, 2016). The government also provided several packages of fiscal support and funding, including effectively abolishing the petroleum revenue tax and reducing the marginal rate of tax levied on company’s upstream profits from 81% to 40% to attract more upstream investments. A unique mechanism, the transferable tax history, was also introduced to

168

IEA. All rights reserved.

9. OIL

give companies that buy UK oil and gas fields greater certainty that they will be able to obtain tax relief to decommission the field at the end of its life.

The United Kingdom became a net importer of crude oil in late 2005 due to decreasing production; by 2017 its import dependency accounted for 36% with net imports of 571 kilobarrels per day (kb/d) (which includes both crude and products). As for its crude oil imports, Norwegian oil from pipelines in the North Sea represented around 44%, followed by Nigeria (8%), the Russia Federation (8%), and Algeria (8%) (Figure 9.3).

The United Kingdom is also producing fewer oil products in domestic refineries. In 2017, the gross refinery output was 60 Mt, down from 82 Mt in 2007. The United Kingdom became a net importer of refined products in 2013 for the first time – with a net 1.5 Mt (31 kb/d) that year, which increased to 10 Mt (210 kb/d) in 2017 (Figure 9.4). The United Kingdom has a well-developed infrastructure for the trade of oil products from a diverse range of countries. The largest trading partners are the Netherlands, Russia (mainly imports), Ireland (mainly exports), the United States, Sweden, and Belgium.

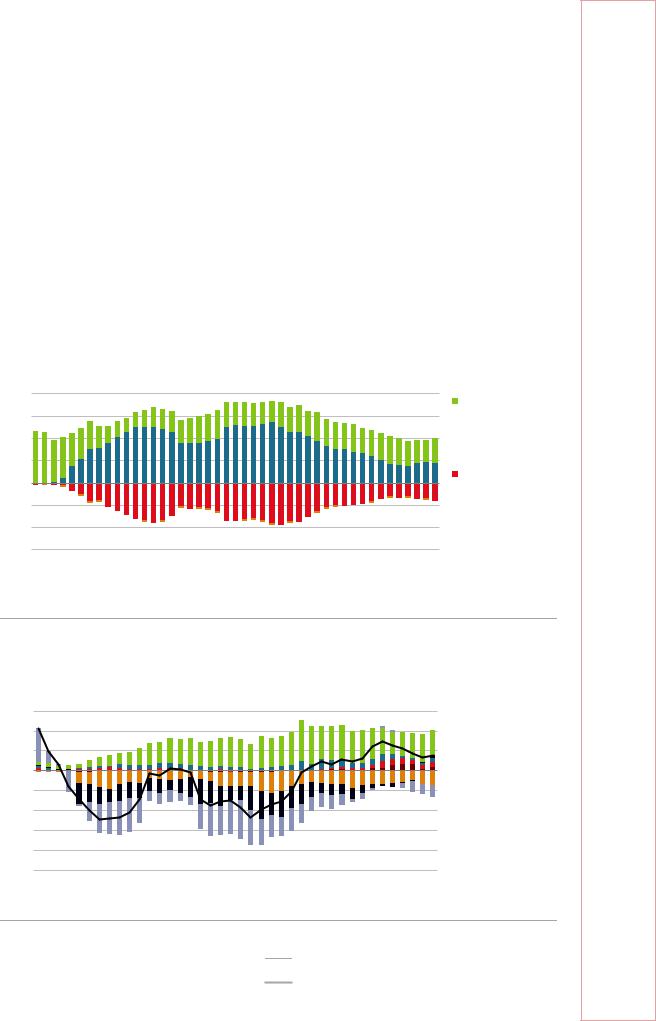

Figure 9.2 Crude oil supply by source, 1973-2017

200 |

Mt |

|

Import |

||

|

150

Indigenous production

Indigenous production

100

Stock changes

Stock changes

50

Exports

0 -50 -100 -150

1973 |

1977 |

1981 |

1985 |

1989 |

1993 |

1997 |

2001 |

2005 |

2009 |

2013 |

2017 |

The United Kingdom’s oil production has decreased since 1999, and the country has become more dependent on imports of crude oil.

Source: IEA (2018a), Oil Information 2018, www.iea.org/statistics/.

Figure 9.3 Crude oil imports by country, 1978-2017

60 Mt |

|

|

|

|

|

|

|

|

|

|

|

Net imports |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

- 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

- 40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

- 60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

- 80 |

|

|

|

|

|

|

|

|

|

|

|

Net exports |

|

- 100 1978 |

|

|

|

|

|

|

|

|

|

|

|

||

1981 |

1984 |

1987 |

1990 |

1993 |

1996 |

1999 |

2002 |

2005 |

2008 |

2011 |

2014 |

2017 |

|

Other

Other

Norway

Norway

United States

United States

Russian

Russian

Federation

Nigeria

Nigeria

Algeria

Algeria

Netherlands

Netherlands

Crude oil imports have increased with the largest source consistently from Norway.

Source: IEA (2018a), Oil Information 2018, www.iea.org/statistics/.

169

ENERGY SECURITY

IEA. All rights reserved.

9. OIL

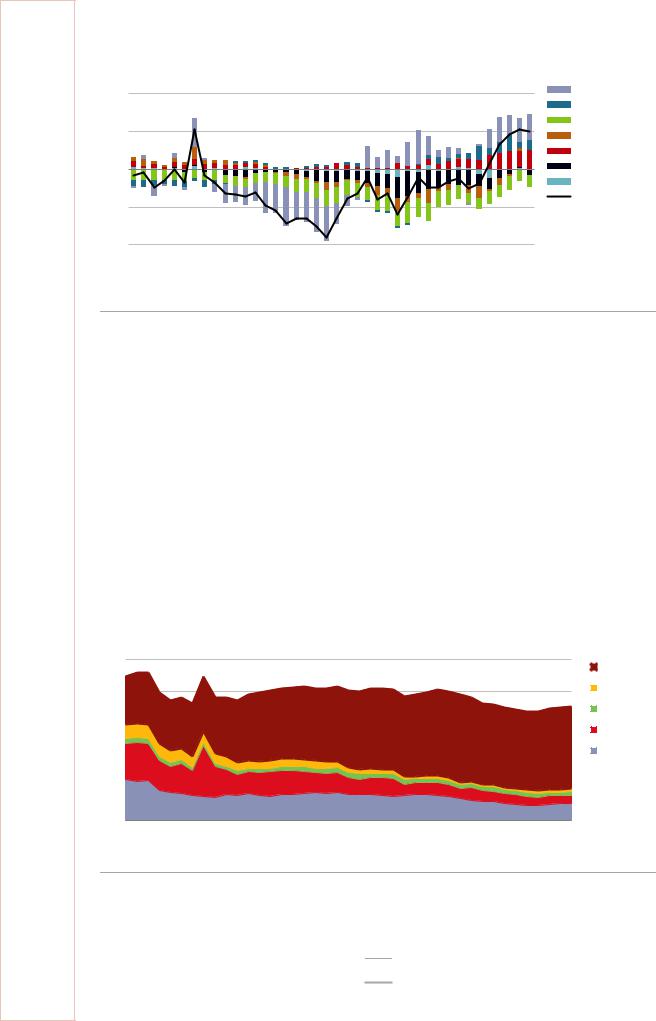

Figure 9.4 Oil product imports and exports by country, 1978-2017

20 |

Mt |

|

|

|

|

|

|

|

|

|

Net imports |

|

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Sweden |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Ireland |

|

|

|

|

|

|

|

|

|

|

|

|

|

Netherlands |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russian Federation |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

United States |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Belgium |

- 10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net trade |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- 20 1978 |

|

|

|

|

|

|

|

|

|

Net exports |

|

|

||

1981 |

1984 |

1987 |

1990 |

1993 |

1996 |

1999 |

2002 |

2005 |

2008 |

2011 |

2014 |

2017 |

||

The United Kingdom became a net importer of oil products in 2013, and has a well-diversified trade.

Source: IEA (2018a), Oil Information 2018, www.iea.org/statistics/.

Oil consumption

Oil consumption in the United Kingdom has declined over the past decade, but it has picked up slightly since 2013. In 2017, the total oil consumption was 71.0 Mt, a 9% decrease from 2007 (Figure 9.5). The transport sector is the largest oil-consuming sector at 72% of the total in 2016. Road transport accounts for more than half of the total consumption (54%) and aviation also accounts for a significant share (17%, more than doubled from the share of 8% in 1990). Oil use for transport has been relatively stable, while consumption in other sectors has declined.

The industry sector was a distant second at 15% of the total oil consumption. In the past decade, oil use in industry decreased by 22% in line with an overall decline in industrial energy consumption. The rest of the oil is used in the energy transformation sector (7%), the residential sector (3%) and the commercial sector (3%).

Figure 9.5 Oil consumption by sector, 1977-2017

100 |

Mt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transport |

|

|

|

|

|

|

|

|

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

Commercial* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residential |

60 |

|

|

|

|

|

|

|

|

|

|

Energy sectors |

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

|

|

|

|

|

Industry |

|

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

1977 |

1981 |

1985 |

1989 |

1993 |

1997 |

2001 |

2005 |

2009 |

2013 |

2017 |

|

Recent increase in oil consumption was mainly driven by the demand for transport fuels.

* Includes agriculture, forestry and fishing.

Note: Total consumption comprises refinery fuels, bunker backflows from the petrochemical sector, and international aviation (which does not appear in the TPES) and excludes international marine bunkers.

Source: IEA (2018a) Oil Information 2018, www.iea.org/statistics/.

170

IEA. All rights reserved.