- •Foreword

- •Table of contents

- •Figures

- •Tables

- •Boxes

- •1. Executive summary

- •Energy system transformation

- •Special focus 1: The cost-effectiveness of climate measures

- •Special focus 2: The Electricity Market Reform

- •Special focus 3: Maintaining energy security

- •Key recommendations

- •2. General energy policy

- •Country overview

- •Institutions

- •Supply and demand trends

- •Primary energy supply

- •Energy production

- •Energy consumption

- •Energy policy framework

- •Energy and climate taxes and levies

- •Assessment

- •Recommendations

- •3. Energy and climate change

- •Overview

- •Emissions

- •GHG emissions

- •Projections

- •Institutions

- •Climate change mitigation

- •Emissions targets

- •Clean Growth Strategy

- •The EU Emissions Trading System

- •Low-carbon electricity support schemes

- •Climate Change Levy

- •Coal phase-out

- •Energy efficiency

- •Low-carbon technologies

- •Adaptation to climate change

- •Legal and institutional framework

- •Evaluation of impacts and risks

- •Response measures

- •Assessment

- •Recommendations

- •4. Renewable energy

- •Overview

- •Supply and demand

- •Renewable energy in the TPES

- •Electricity from renewable energy

- •Heat from renewable energy

- •Institutions

- •Policies and measures

- •Targets and objectives

- •Electricity from renewable energy sources

- •Heat from renewable energy

- •Renewable Heat Incentive

- •Renewable energy in transport

- •Assessment

- •Electricity

- •Transport

- •Heat

- •Recommendations

- •5. Energy efficiency

- •Overview

- •Total final energy consumption

- •Energy intensity

- •Overall energy efficiency progress

- •Institutional framework

- •Energy efficiency data and monitoring

- •Regulatory framework

- •Energy Efficiency Directive

- •Other EU directives

- •Energy consumption trends, efficiency, and policies

- •Residential and commercial

- •Buildings

- •Heat

- •Transport

- •Industry

- •Assessment

- •Appliances

- •Buildings and heat

- •Transport

- •Industry and business

- •Public sector

- •Recommendations

- •6. Nuclear

- •Overview

- •New nuclear construction and power market reform

- •UK membership in Euratom and Brexit

- •Waste management and decommissioning

- •Research and development

- •Assessment

- •Recommendations

- •7. Energy technology research, development and demonstration

- •Overview

- •Energy research and development strategy and priorities

- •Institutions

- •Funding on energy

- •Public spending

- •Energy RD&D programmes

- •Private funding and green finance

- •Monitoring and evaluation

- •International collaboration

- •International energy innovation funding

- •Assessment

- •Recommendations

- •8. Electricity

- •Overview

- •Supply and demand

- •Electricity supply and generation

- •Electricity imports

- •Electricity consumption

- •Institutional and regulatory framework

- •Wholesale market design

- •Network regulation

- •Towards a low-carbon electricity sector

- •Carbon price floor

- •Contracts for difference

- •Emissions performance standards

- •A power market for business and consumers

- •Electricity retail market performance

- •Smart grids and meters

- •Supplier switching

- •Consumer engagement and vulnerable consumers

- •Demand response (wholesale and retail)

- •Security of electricity supply

- •Legal framework and institutions

- •Network adequacy

- •Generation adequacy

- •The GB capacity market

- •Short-term electricity security

- •Emergency response reserves

- •Flexibility of the power system

- •Assessment

- •Wholesale electricity markets and decarbonisation

- •Retail electricity markets for consumers and business

- •The transition towards a smart and flexible power system

- •Recommendations

- •Overview

- •Supply and demand

- •Production, import, and export

- •Oil consumption

- •Retail market and prices

- •Infrastructure

- •Refining

- •Pipelines

- •Ports

- •Storage capacity

- •Oil security

- •Stockholding regime

- •Demand restraint

- •Assessment

- •Oil upstream

- •Oil downstream

- •Recommendations

- •10. Natural gas

- •Overview

- •Supply and demand

- •Domestic gas production

- •Natural gas imports and exports

- •Largest gas consumption in heat and power sector

- •Natural gas infrastructure

- •Cross-border connection and gas pipelines

- •Gas storage

- •Liquefied natural gas

- •Policy framework and markets

- •Gas regulation

- •Wholesale gas market

- •Retail gas market

- •Security of gas supply

- •Legal framework

- •Adequacy of gas supply and demand

- •Short-term security and emergency response

- •Supply-side measures

- •Demand-side measures

- •Gas quality

- •Recent supply disruptions

- •Interlinkages of the gas and electricity systems

- •Assessment

- •Recommendations

- •ANNEX A: Organisations visited

- •Review criteria

- •Review team and preparation of the report

- •Organisations visited

- •ANNEX B: Energy balances and key statistical data

- •Footnotes to energy balances and key statistical data

- •ANNEX C: International Energy Agency “Shared Goals”

- •ANNEX D: Glossary and list of abbreviations

- •Acronyms and abbreviations

- •Units of measure

8. ELECTRICITY

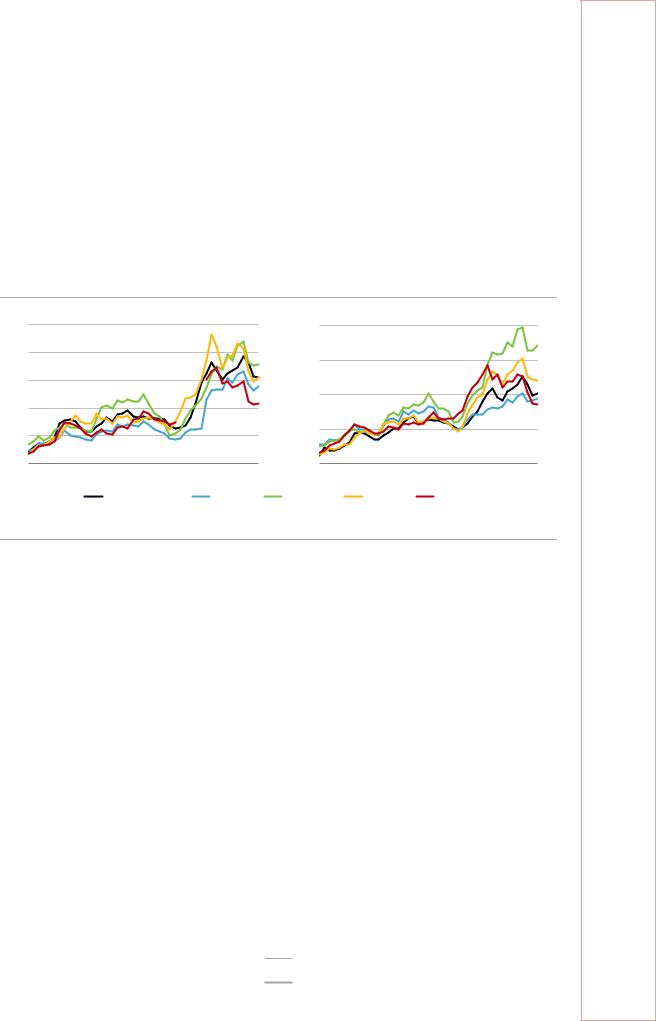

The household price was United State Dollars (USD) 193/MWh on average or the tenthhighest price. However, taxes on electricity prices are very low in the United Kingdom. Electricity price trends have been similar in the neighbouring countries (Figure 8.13). During 2000-14, retail energy prices went up, while energy household consumption came down.

The final electricity retail price is composed of the wholesale energy costs, which account for almost 50%, transmission and system operation costs (25%), environmental costs (15%), and retail cost (20%), which includes the retail profit margin, according to the CMA investigation (CMA, 2016).

Figure 8.13 Electricity prices in selected IEA countries, 1973-2017

|

|

Industry |

|

|

|

|

Households |

|

|

|

200 |

USD/MWh |

|

|

|

400 |

USD/MWh |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

160 |

|

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

120 |

|

|

|

|

200 |

|

|

|

|

|

80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

0 |

|

|

|

|

|

1973 |

1984 |

1995 |

2006 |

2017 |

1973 |

1984 |

1995 |

2006 |

2017 |

|

|

|

United Kingdom |

|

France |

Germany |

|

Ireland |

Netherlands |

|

|

UK electricity prices have followed similar trends to those in other neighbouring countries.

Source: IEA (2018b), Energy Prices and Taxes 2018, www.iea.org/statistics/.

Electricity retail market performance

The energy market investigation of the CMA from 2014 to 2016 found that the GB retail market needs to improve as consumers on standard variable or default tariffs and prepayment meters are penalised for their loyalty, notably vulnerable consumers. The CMA recommended a suite of remedies, which include the introduction of a half-hourly settlement for small users, faster switching, and consumer engagement. The CMA also suggested reforms towards variable transmission losses and locational signals (CMA, 2016).

The government agreed with the majority of these recommendations and, along with Ofgem, is implementing the remedies proposed by the CMA (UK Government, 2018). In addition, the government agreed with the minority opinion of the CMA that a temporary cap on energy prices until 31 December 2020 would provide protection to consumers while the remedies are implemented, smart meters are rolled out, and the conditions for effective competition are established. Professor Stephen Littlechild offers a different view point on competition – that competition was working reasonably well and that price differentiation or discrimination is a reflection of competition rather than of market power (Littlechild, 2018).

147

ENERGY SECURITY

IEA. All rights reserved.

8. ELECTRICITY

The United Kingdom has around 5 million households on regulated prices with three types of price caps in place. Since April 2017, a price cap for customers on prepayment meters (PPMs) (around 4 million customers), the so-called safeguard tariff, was put in place, which was extended by Ofgem in February 2018 to include another million vulnerable customers who receive the “Warm Home” discount. From 1 October 2018, the level of the safeguard tariff will rise by GBP 47 per year for dual fuel customers to GBP 1 136. As of 1 January 2019, a default price cap entered into force which applies to another 6 million consumers on standard electricity and gas tariffs in addition to consumers on permanent meters, as a temporary measure until 2020. In 2019, a total of 11 million households are under price cap. In 2019, Ofgem reviewed the caps and decided to increase them from April 2019 onwards because of higher wholesale prices.

The Domestic Gas & Electricity (Energy Tariff Cap) Bill requires Ofgem to review retail prices and the level of the cap at least every six months to ensure that the level takes account of external factors such as wholesale energy costs. The default price cap is planned to be temporary until conditions are in place for a truly competitive market, notably smart meters. The cap expires in 2020, with the possibility of a one-year extension period for up to three years. The decision on whether or not to extend the cap will be taken by the Secretary of State for BEIS and informed by a review by Ofgem.

In 2018, Ofgem and BEIS launched a joint review into the future UK retail market.

Smart grids and meters

GB is in the process of rolling out smart meters by the end of 2020. Over 50 energy suppliers are required to install smart and advanced meters. Ofgem has the authority to fine energy suppliers who do not implement advanced meters. Smart meters are not mandatory and the customer has the right to refuse their installation.

BEIS is monitoring the smart meter roll-out and the number of meters in operation in Great Britain on a quarterly basis until the end of 2020. According to BEIS statistics, at the end of March 2018, over 11 million smart and advanced meters operated in homes and businesses across GB. Overall, so far around 21% of all domestic meters are smart.

However, almost all the smart meters that have been installed to date are first-generation (SMETS1) meters. SMETS1 smart meters often lose their “smart” capabilities after switching to another energy supplier and essentially revert to a traditional meter as they cannot send the meter readings automatically to the new supplier. Second-generation smart meters (SMETS2) are beginning to be installed and allow customers to switch energy provider without losing their smart features as they operate via a new central data and communications network (the Data Communications Company). Work is underway to integrate SMETS1 meters into the Data Communications Company's systems. This means that they are interoperable and smart services will be retained when consumers switch supplier; therefore, the consumer will have broadly the same experience as if they had a SMETS2 meter.

As smart meters are not yet rolled out everywhere, consumers are largely settled based on a profile of an average consumer. UK suppliers offer a large number of time-of-use pricing and innovative pricing with specific electric vehicle (EV) tariffs or dynamic tariffs; however, their share is very small in the retail market amid the slow progress of smart meter roll-out. By mid2019, Ofgem is working on a mandatory market-wide half-hourly settlement that will increase consumer information, awareness, and engagement on their energy bills.

148

IEA. All rights reserved.