- •Foreword

- •Table of contents

- •Figures

- •Tables

- •Boxes

- •1. Executive summary

- •Energy system transformation

- •Special focus 1: The cost-effectiveness of climate measures

- •Special focus 2: The Electricity Market Reform

- •Special focus 3: Maintaining energy security

- •Key recommendations

- •2. General energy policy

- •Country overview

- •Institutions

- •Supply and demand trends

- •Primary energy supply

- •Energy production

- •Energy consumption

- •Energy policy framework

- •Energy and climate taxes and levies

- •Assessment

- •Recommendations

- •3. Energy and climate change

- •Overview

- •Emissions

- •GHG emissions

- •Projections

- •Institutions

- •Climate change mitigation

- •Emissions targets

- •Clean Growth Strategy

- •The EU Emissions Trading System

- •Low-carbon electricity support schemes

- •Climate Change Levy

- •Coal phase-out

- •Energy efficiency

- •Low-carbon technologies

- •Adaptation to climate change

- •Legal and institutional framework

- •Evaluation of impacts and risks

- •Response measures

- •Assessment

- •Recommendations

- •4. Renewable energy

- •Overview

- •Supply and demand

- •Renewable energy in the TPES

- •Electricity from renewable energy

- •Heat from renewable energy

- •Institutions

- •Policies and measures

- •Targets and objectives

- •Electricity from renewable energy sources

- •Heat from renewable energy

- •Renewable Heat Incentive

- •Renewable energy in transport

- •Assessment

- •Electricity

- •Transport

- •Heat

- •Recommendations

- •5. Energy efficiency

- •Overview

- •Total final energy consumption

- •Energy intensity

- •Overall energy efficiency progress

- •Institutional framework

- •Energy efficiency data and monitoring

- •Regulatory framework

- •Energy Efficiency Directive

- •Other EU directives

- •Energy consumption trends, efficiency, and policies

- •Residential and commercial

- •Buildings

- •Heat

- •Transport

- •Industry

- •Assessment

- •Appliances

- •Buildings and heat

- •Transport

- •Industry and business

- •Public sector

- •Recommendations

- •6. Nuclear

- •Overview

- •New nuclear construction and power market reform

- •UK membership in Euratom and Brexit

- •Waste management and decommissioning

- •Research and development

- •Assessment

- •Recommendations

- •7. Energy technology research, development and demonstration

- •Overview

- •Energy research and development strategy and priorities

- •Institutions

- •Funding on energy

- •Public spending

- •Energy RD&D programmes

- •Private funding and green finance

- •Monitoring and evaluation

- •International collaboration

- •International energy innovation funding

- •Assessment

- •Recommendations

- •8. Electricity

- •Overview

- •Supply and demand

- •Electricity supply and generation

- •Electricity imports

- •Electricity consumption

- •Institutional and regulatory framework

- •Wholesale market design

- •Network regulation

- •Towards a low-carbon electricity sector

- •Carbon price floor

- •Contracts for difference

- •Emissions performance standards

- •A power market for business and consumers

- •Electricity retail market performance

- •Smart grids and meters

- •Supplier switching

- •Consumer engagement and vulnerable consumers

- •Demand response (wholesale and retail)

- •Security of electricity supply

- •Legal framework and institutions

- •Network adequacy

- •Generation adequacy

- •The GB capacity market

- •Short-term electricity security

- •Emergency response reserves

- •Flexibility of the power system

- •Assessment

- •Wholesale electricity markets and decarbonisation

- •Retail electricity markets for consumers and business

- •The transition towards a smart and flexible power system

- •Recommendations

- •Overview

- •Supply and demand

- •Production, import, and export

- •Oil consumption

- •Retail market and prices

- •Infrastructure

- •Refining

- •Pipelines

- •Ports

- •Storage capacity

- •Oil security

- •Stockholding regime

- •Demand restraint

- •Assessment

- •Oil upstream

- •Oil downstream

- •Recommendations

- •10. Natural gas

- •Overview

- •Supply and demand

- •Domestic gas production

- •Natural gas imports and exports

- •Largest gas consumption in heat and power sector

- •Natural gas infrastructure

- •Cross-border connection and gas pipelines

- •Gas storage

- •Liquefied natural gas

- •Policy framework and markets

- •Gas regulation

- •Wholesale gas market

- •Retail gas market

- •Security of gas supply

- •Legal framework

- •Adequacy of gas supply and demand

- •Short-term security and emergency response

- •Supply-side measures

- •Demand-side measures

- •Gas quality

- •Recent supply disruptions

- •Interlinkages of the gas and electricity systems

- •Assessment

- •Recommendations

- •ANNEX A: Organisations visited

- •Review criteria

- •Review team and preparation of the report

- •Organisations visited

- •ANNEX B: Energy balances and key statistical data

- •Footnotes to energy balances and key statistical data

- •ANNEX C: International Energy Agency “Shared Goals”

- •ANNEX D: Glossary and list of abbreviations

- •Acronyms and abbreviations

- •Units of measure

7. ENERGY TECHNOLOGY RESEARCH, DEVELOPMENT AND DEMONSTRATION

network regulation, with up to GBP 720 million of regulated expenditure available to gas and electric companies to support smarter, more flexible, efficient, and resilient networks.

The Energy Innovation Board (EIB) was established in November 2016 to replace the work of the Low Carbon Innovation Coordination Group (LCICG). The EIB plays a strategic role in aligning domestic and international clean technology investments across the government. The EIB is chaired by the government Chief Scientific Advisor. The EIB is attended by senior civil servants across BEIS, UKRI, Department for Communities and Local government, Department for International Development (DFID), DFT, and Ofgem, with Her Majesty’s Treasury (HMT) as observers. The EIB is internal to the government, but is seeking external members with industry insights to provide external challenge.

The Department for International Development (DFID) defines the United Kingdom’s Overseas Development Aid (ODA) funding. The United Kingdom’s EIB has an International Working Group (subgroup to the EIB) tasked with developing crossgovernment co-operation opportunities and knowledge sharing related to international research and innovation collaboration.

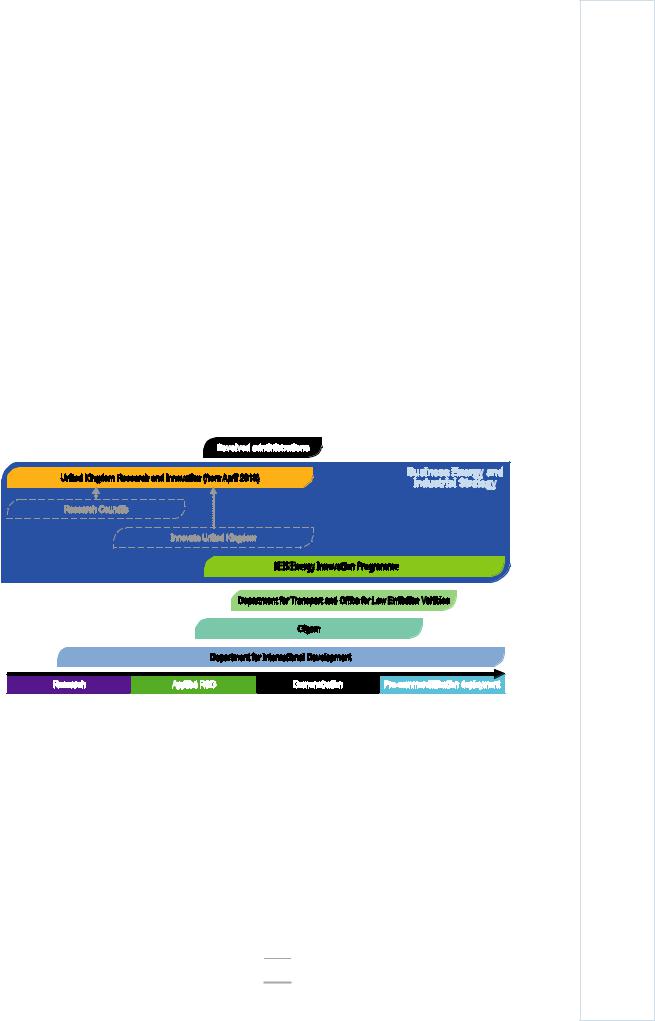

Figure 7.1 provides an overview of the landscape of energy RD&D in the United Kingdom.

Figure 7.1 The United Kingdom’s institutional structure for public RD&D

Source: IEA, 2019. All rights reserved.

Funding on energy

Public spending

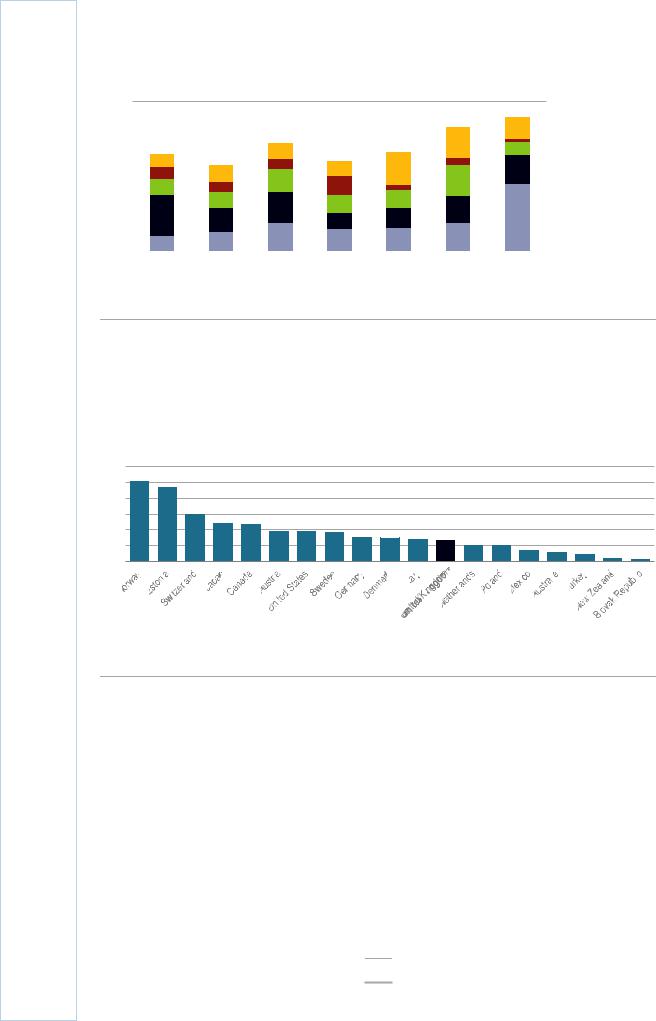

In 2017, the government’s provisional estimates of spending was GBP 536 million on energy-related RD&D. Energy efficiency made up 21%, followed by nuclear energy (16%), and renewables (2%), but a large part is allocated to other technologies. The total amount of energy-related RD&D spending has steadily increased since 2014 (Figure 7.2). By international comparison, the United Kingdom has a relatively low energy RD&D budget as a percentage of GDP (Figure 7.3). In 2017, the UK spending on energy RD&D was below the median among the IEA member countries, at 0.26% of GDP.

117

ENERGY SYSTEM TRANSFORMATION

IEA. All rights reserved.

7. ENERGY TECHNOLOGY RESEARCH, DEVELOPMENT AND DEMONSTRATION

Figure 7.2 Government energy RD&D spending by category, 2011-17

Million GBP (2017 price)

600

Nuclear

Nuclear

500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Fossil fuels |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Renewables |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy efficiency |

|

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Other* |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 |

|

2012 |

2013 |

2014 |

2015 |

2016 |

2017 |

|

|

|

|

|||

The United Kingdom’s energy RD&D covers a broad spectrum of activities and nuclear research has the highest share of total spending.

* Other includes hydrogen and fuel cells, other power and storage technologies, and cross-cutting research. Note: 2017 figures are estimated.

Source: IEA (2018), Energy Technology RD&D Budgets 2018, www.iea.org/statistics/.

Figure 7.3 Public energy RD&D spending as a ratio of GDP in IEA countries, 2017

Energy RD&D spending per thousand units of GDP

1.2

1.0

0.8

0.6

0.4

0.2

0.0

The United Kingdom’s spending on energy RD&D as a ratio of GDP was slightly below the median among IEA countries in 2017.

Note: Data are not available for Belgium, Czech Republic, Finland, France, Greece, Hungary, Ireland, Korea, Luxembourg, Portugal, and Spain at the time of publishing.

Source: IEA (2018), Energy Technology RD&D Budgets 2018, www.iea.org/statistics/.

Under the Clean Growth Strategy, the government is committed to invest in low-carbon innovation a total budget of GBP 2.5 billion over the period 2015-21 (Table 7.1) to support RD&D in low-carbon transport (33%), power (25%), smart systems (10%), homes (7%), agriculture land use and waste (4%), industry (6%), and cross-sector projects (15%).

118

IEA. All rights reserved.

7. ENERGY TECHNOLOGY RESEARCH, DEVELOPMENT AND DEMONSTRATION

Energy RD&D programmes

Several programmes and funds are available to the energy sector, including:

BEIS’s Energy Innovation Programme supporting the commercialisation of innovative clean energy technologies and processes (GBP 505 million).

UKRI energy research and development funding, including support for the Energy Systems Catapult and the Offshore Renewable Energy Catapult (GBP 1.2 billion).

The Faraday Challenge funding for the design, development, and manufacture of electric batteries (GBP 246 million).

Up to GBP 620 million from a range of departments, including BEIS, DFT, DFID, and Defra and additional Industrial Strategy Challenge Fund support.

Ofgem makes up to GBP 720 million of regulated expenditure available to gas and electric companies in Great Britain to support smarter, more flexible, efficient, and resilient networks.

Table 7.1 The United Kingdom’s investments (GBP million) in clean growth technology 2015-21

|

Sector |

|

Basic and |

|

Technology |

|

Technology |

|

|

Total |

|

|

|

applied research |

|

development |

|

demonstration |

|

|

|

||

|

|

|

|

|

|||||||

|

Smart systems (including energy storage) |

175 |

43 |

47 |

|

265 |

|

||||

|

|

|

|

|

|

|

|

||||

|

Power sector (including renewables) |

|

209 |

|

276 |

|

154 |

|

|

638 |

|

|

Homes (including heat and energy |

100 |

31 |

53 |

|

184 |

|

||||

|

efficiency) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Transport (including EVs and batteries) |

|

296 |

|

413 |

|

132 |

|

|

841 |

|

|

Business and Industry (including industrial |

57 |

47 |

58 |

|

162 |

|

||||

|

fuels and CCUS) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Natural resources (including land use and |

|

69 |

|

30 |

|

0 |

|

|

99 |

|

|

waste) |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Cross-sectoral clean technology |

234 |

62 |

91 |

|

387 |

|

||||

|

innovation (including for entrepreneurs) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Total |

|

1 140 |

|

902 |

|

534 |

|

|

2 576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Sources: Based on the information provided in the UK government’s Clean Growth Strategy.

The BEIS Energy Innovation Programme (GBP 505 million) is allocated to smart systems (GBP 70 million), the built environment – energy efficiency and heating (GBP 90 million), industrial decarbonisation and CCUS (GBP 100 million), nuclear innovation and fission (GBP 180 million, renewables innovation (GBP 15 million), and support for energy entrepreneurs and green financing (GBP 50 million).

The United Kingdom has created the Offshore Renewable Innovation Hub (with a budget of up to GBP 1.3 million), led by the Offshore Renewable Energy Catapult and Knowledge Transfer Network, to bring the offshore wind industry together to solve common innovation challenges. The United Kingdom is working with other countries to develop shared solutions to reduce the cost of renewable energy technologies, which includes through the European Research Area Networks (ERA-NETs), with a focus on demonstration projects for bioenergy (GBP 700 000) and offshore wind (GBP 8 million).

119

ENERGY SYSTEM TRANSFORMATION

IEA. All rights reserved.

7. ENERGY TECHNOLOGY RESEARCH, DEVELOPMENT AND DEMONSTRATION

Similarly, the UK Smart Systems Innovation programme focuses on reducing the cost of energy storage technologies (including electricity storage, thermal storage, and power-to- gas technologies) with a total budget of GBP 9 million. This includes feasibility studies to implement the government’s ‘Upgrading our Energy System: Smart Systems and Flexibility Plan’, a potential first-of-a-kind large-scale future energy storage demonstrator (up to GBP 600 million), innovative energy demand-side response (DSR) technologies in UK businesses or public sector organisations to reduce their energy use in peak times and provide flexibility to the energy system (GBP 7.6 million), and innovative domestic applications of DSR technologies and business models (up to GBP 7.75 million from 2018-21). Up to GBP 8.8 million is available to develop innovative approaches to energy management using smart meter data, tailored to the needs of smaller non-domestic sites.

Low-carbon |

transport spending includes |

an allocation of GBP 30 million, with funding |

|||

from the |

BEIS |

Energy |

Innovation |

Programme (GBP 18 million) |

and OLEV |

(GBP 12 million) |

for an |

electric vehicle (EV)-to-grid programme |

to invest in |

||

demonstrators and feasibility studies. Further Department for Transport funding is available for low carbon fuels: on the Advanced Biofuels Demonstration Competition (ABDC), designed to support the construction of demonstration scale advanced biofuels plants (GBP 16 m), on the Future Fuels for Flight and Freight Competition (F4C), intended to encourage private investment and support the construction of advanced biofuels plants for aviation and heavy goods vehicles sectors (TRL 7-8, GBP 22 m). DfT’s low carbon fuels team collaborates with universities through the Supergen Bioenergy Hub (SBH), focusing at TRL 2-3. SBH and DfT have awarded GBP 200 000 in research into CCUS solutions for transport.

Built Environment Innovation provides GBP 9.8 million for the second phase of work led by the Energy Systems Catapult in the Smart Systems and Heat programme, which supports the development of local energy plans and low-carbon heating projects across the United Kingdom. The programme supports RD&D into potential uses of hydrogen gas for heating (up to GBP 25 million) and the development of technologies that reduce the carbon emissions associated with providing heat and hot water to UK buildings (GBP 10 million), alongside investment in technologies and approaches to improve the energy efficiency of existing UK buildings (GBP 10 million).

The United Kingdom maintains a strong focus on Nuclear Innovation and invested GBP 20 million over 2016-18 to support innovation in the civil nuclear sector and training and capacity building of UK regulators to support the development of advanced technologies (GBP 7 million).

As part of its focus on Industrial Innovation, the BEIS Energy Programme is investing GBP 9.2 million in an Industrial Energy Efficiency Accelerator to seek industry-specific solutions that are close to commercialisation by leveraging private sector investment and strengthening UK supply chains to reduce the energy costs for UK industry. The United Kingdom also promotes the design and construction of CCUS demonstration projects (GBP 20 million), early investment in fuel switching processes and technologies (GBP 20 million), bulk low-carbon hydrogen supply (GBP 20 million), and innovation to reduce the cost of CCUS (GBP 15 million).

The BEIS Energy Entrepreneurs Fund promotes ideas from the public and private sector, notably from small and medium-sized enterprises, and supports the demonstration of

120

IEA. All rights reserved.