- •Foreword

- •Table of contents

- •1. Executive summary

- •Transition to a low-carbon energy future

- •Planning consent and engagement with local communities

- •Decarbonisation of heat

- •Interconnections

- •Energy security

- •Key recommendations

- •2. General energy policy

- •Country overview

- •Supply and demand

- •Energy production and self-sufficiency

- •Energy consumption

- •Institutions

- •Policy framework

- •The 2015 White Paper

- •Project Ireland 2040

- •Energy transition

- •Electricity sector

- •Security of supply

- •Electricity

- •Assessment

- •Recommendations

- •Overview

- •Supply and demand

- •Production, import and export

- •Oil and gas exploration and production

- •Oil consumption

- •Biofuels

- •Oil heating

- •Market structure

- •Prices and taxes

- •Fiscal incentives for oil and gas exploration and production

- •Infrastructure

- •Refining

- •Ports and road network

- •Storage

- •Emergency response policy

- •Oil emergency reserves

- •Assessment

- •Recommendations

- •4. Natural gas

- •Overview

- •Supply and demand

- •Production and import

- •Consumption

- •Outlook

- •Biogas

- •Upstream development

- •Institutions

- •Market structure

- •Prices and tariffs

- •Irish balancing point

- •Price regulation for the gas network

- •Gas entry/exit tariff reform

- •Infrastructure

- •Gas networks

- •LNG terminal

- •Storage facilities

- •Infrastructure developments

- •Emergency response

- •Policy and organisation

- •Network resilience

- •Emergency response measures

- •Assessment

- •Recommendations

- •5. Electricity and renewables

- •Overview

- •Supply and demand

- •Generation and trade

- •Renewable electricity

- •Carbon intensity of electricity supply

- •Installed capacity

- •Demand

- •Retail prices and taxes

- •Retail market and prices

- •Institutions

- •Market structure

- •Generation and generation adequacy

- •Wholesale market

- •Retail market

- •Smart metering

- •Market design

- •From the SEM….

- •Networks

- •Transmission

- •Focus area: Interconnectors

- •Existing interconnectors

- •Developing interconnectors in Ireland

- •Renewable electricity

- •Enduring Connection Policy

- •Renewable Electricity Support Scheme

- •Ocean energy prospects

- •Assessment

- •Wholesale market

- •Retail market

- •Smart meters and grids

- •Focus area: Interconnectors

- •Renewable electricity

- •Recommendations

- •6. Energy and climate

- •Overview

- •Energy-related carbon dioxide emissions

- •Emissions by sector and fuel

- •CO2 drivers and carbon intensity

- •Institutions

- •Climate policy framework and targets

- •Progress towards the climate targets

- •Domestic policy frameworks and targets

- •Taxation policy

- •Transport sector emissions

- •Energy consumption and emissions

- •Expanding the use of alternative fuels and technologies

- •Public transport and modal shifting

- •Improving the fuel economy of the vehicle fleet

- •Power sector emissions

- •Assessment

- •Recommendations

- •7. Energy efficiency and residential heating

- •Overview

- •Energy consumption and intensity

- •Energy intensity per capita and GDP

- •Energy consumption by sector

- •Industry

- •Residential and commercial

- •Institutions

- •Energy efficiency targets

- •Energy efficiency funding and advisory services

- •Public sector targets and strategies

- •Industry and commercial sector policies

- •Focus area: Decarbonisation of heat

- •Energy efficiency in buildings

- •Residential buildings stock and energy savings potential

- •Building regulations

- •Building energy rating

- •Energy efficiency programmes for buildings

- •Commercial buildings stock and energy savings potential

- •Renewable heat supply options and support

- •Renewable heat in the non-residential sector

- •District heating

- •Assessment

- •Decarbonisation of heating in buildings

- •Recommendations

- •8. Energy technology research, development and demonstration

- •Overview

- •Public energy RD&D spending

- •Energy RD&D programmes

- •Institutional framework

- •Policies and programmes

- •Ocean energy

- •Sustainable bioenergy

- •Hydrogen

- •Monitoring and evaluation

- •International collaboration

- •Assessment

- •Recommendations

- •ANNEX A: Organisations visited

- •Review criteria

- •Review team and preparation of the report

- •IEA member countries

- •International Energy Agency

- •Organisations visited

- •ANNEX B: Energy balances and key statistical data

- •Footnotes to energy balances and key statistical data

- •ANNEX C: International Energy Agency “Shared Goals”

- •ANNEX D: Glossary and list of abbreviations

4. NATURAL GAS

Price regulation for the gas network

The CRU conducts a review of gas network costs every 5 years to set a 5 year revenue allowance for GNI transmission and distribution. This 5 year allowance is determined by reviewing the expenditures incurred by the network companies and the new business proposals, followed by a public consultation. Once the amount is fixed, the allowance is split into annual allowances that can be recovered through network tariffs with flexibility of adjustments. On average, around one-third of a domestic customer’s gas bill relates to distribution tariffs and 10% to transmission tariffs (CRU, 2018b).

The price control for gas – price control 4 – covers from October 2017 to September 2022, during which the CRU will monitor network companies’ compliance through their licence conditions.

Additionally, the CRU has set up targets to ensure more-efficient cost control. The targets are normally set at a 1% increase in cost efficiency. However, there could be an annual 0.75% addition based on GNI review. The CRU introduced a fiscal incentive that warrants a bonus if the connection target is exceeded, and a penalty for failure, to encourage more ambitious gas network connections for price control 4.

Gas entry/exit tariff reform

With operation of the Corrib gas field, the interconnectors between Ireland and the United Kingdom are no longer the primary supply source of gas, at least in the medium term. The reduced Moffat throughput implied an increase in its entry tariff per unit, pushing up the wholesale gas price in Ireland. The CRU therefore implemented a reform of the existing gas entry/exit tariff methodology, and a new regime has been in place since October 2015. Key changes include:

An entry/exit tariff split implemented at a 33/67 ratio instead of a 50/50 ratio.

Commodity charges apply as a single rate for all entry points and a separate single rate for all exit points. Commodity charges were previously calculated separately for each entry/exit point. The newly applied single rate is based on the new entry/exit tariff split (33/67).

A capacity/commodity split maintained at a 90/10 ratio, with an exit tariff.2

Infrastructure

Gas networks

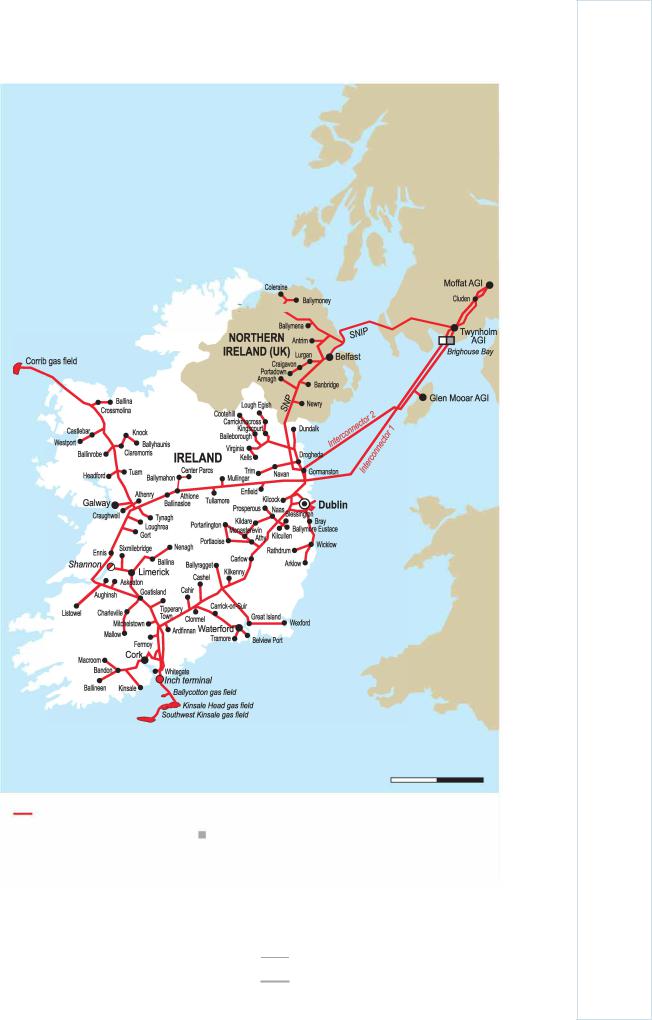

The GNI operates the transmission (2 427 km) and distribution networks (11 527 km) in Ireland. The transmission network transports gas from the entry points at Moffat, Inch and Bellanaboy to the distribution networks and connected loads (e.g. gas-fired power generators). The GNI transmission network also supplies gas to Northern Ireland and the Isle of Man, which are both part of the United Kingdom (Table 4.2).

2 The tariff consists of a capacity and commodity charge that applies for use of the Northern Ireland transmission network system.

61

ENERGY SECURITY

IEA. All rights reserved.

4. NATURAL GAS

The Moffat entry point connects the GNI network to the national grid gas network in the United Kingdom and allows for gas imports to Ireland via two subsea interconnectors (IC1 and IC2) (Figure 4.6) The existing interconnectors do not allow Ireland to export gas to the United Kingdom because they are unidirectional. The landfall installations for the interconnectors entering Ireland are located close to Loughshinny for IC1 and Gormanston for IC2, in the east of Ireland. The Inch entry point connects Kinsale and Seven Heads gas fields to the onshore GNI network, and the Bellanaboy entry point connects the Corrib gas field to the onshore GNI network. The Northern Ireland gas network connects to the GNI network at Twynholm in Scotland and delivers gas to Northern Ireland via the Scotland Northern Ireland Pipeline (SNIP). The South-North Pipeline (SNP) is an onshore gas transmission pipeline from Gormanston to Northern Ireland.

The distribution network delivers gas to over 680 000 customers across Ireland, and the network has been extended to Nenagh and Wexford towns. GNI completed extension of distribution to Listowel in the south-west of Ireland in late 2018. Additionally, GNI also completed the network extension to Center Parcs in the county of Longford in late 2018.

Table 4.2 Major gas network infrastructure in Ireland

|

Infrastructure |

|

Function |

Capacity (GWh/d) |

|

|

|

|

|

|

|

|

Entry point to GNI system serving Ireland via the |

342 |

|

Moffat entry point |

|

onshore system in Scotland and subsea |

|

|

|

interconnectors IC1 and IC2 |

|

|

|

(Scotland, United Kingdom) |

|

|

|

|

|

|

Also serves Northern Ireland via Twynholm |

|

|

|

|

installation and SNIP |

|

|

|

|

Physically unidirectional |

|

|

|

|

|

|

|

South-North CSEP |

|

Exit point to Northern Ireland, supplied from IC2 |

66.3 |

|

(Ireland) |

|

|

|

|

Corrib gas field |

|

Domestic production facility, began commercial |

103.5 |

|

(Ireland) |

|

operation in December 2015 |

|

|

|

|

|

|

|

Southwest Kinsale storage |

|

Underground storage facility (depleted gas field), |

27.3 |

|

(Ireland) |

|

due to decommission in 2021 |

|

|

|

|

|

|

Notes: CSEP = connected system exit point. GWh/d = gigawatt hours per day.

Source: Ireland country submission, 2018.

LNG terminal

Ireland does not yet have an LNG terminal. There is a commercial proposal to construct the country’s first LNG regasification terminal in the Shannon Estuary, on the south-west coast of Ireland. Shannon LNG Ltd received planning permission in 2008 for its proposed LNG terminal and for the associated transmission pipeline to deliver gas into Ireland’s transmission system. In 2017, the Shannon LNG terminal was included in the European Commission’s third list of the projects of common interest (PCIs).If Shannon LNG Ltd decides to take a final investment decision in 2018, the earliest possible start date for commercial operation of an onshore facility would be 2021. The initial phase will include construction of the LNG processing tanks and regasification facilities, with a maximum export capacity of up to 191.1 GWh/d (17.0 million standard cubic metres per day).

62

IEA. All rights reserved.

4. NATURAL GAS

Figure 4.6 Map of natural gas infrastructure

UNITED

KINGDOM

Derry

City•- --y""'-

l.iravad

ENERGY SECURITY

United

Kingdom

North

Atlantic

Ocean

UNITED

KINGDOM

Seven Heads gas field

|

km |

|

0 |

50 |

100 |

|

Existing gas pipeline |

|

Proposed LNG terminal |

• |

Gas treatment terminal |

□ |

Planned compressor station |

□ |

Existing compressor station |

• Gas field |

|

This map is without prejudice to the status of or sovereignty over any territory, to the delimitation of international trontiers and boundaries and to the name of any territory, city or area.

63

IEA. All rights reserved.

4. NATURAL GAS

In July 2017 NextDecade (an LNG export company in the United States) signed a memorandum of understanding with the Port of Cork company to study the possible development of a floating storage and regasification unit (FSRU) and the associated LNG import terminal infrastructure in Cork, in the south of Ireland.

The development of an LNG import terminal, either an onshore facility or an FSRU, would substantially improve the SoS in Ireland by providing direct access to the global LNG market and diversifying gas imports.

Storage facilities

The Southwest Kinsale storage facility was a gas production and seasonal storage facility located off the southern coast of Ireland with a working volume of 230 million standard cubic metres, about 5% of Ireland’s annual gas consumption in 2016/17. After it was depleted, the Southwest Kinsale field became Ireland’s first offshore gas storage facility and operated from 2001 to 2017. Gas injection has ceased since then, and production of cushion gas is also expected to cease in 2020; the field will be decommissioned in 2021. There was no other gas storage facility in operation in Ireland as of 2018.

The decision to stop gas storage operation in the Kinsale reservoirs was a commercial one. The GNI and EirGrid conducted a long-term resilience study in 2018 to assess Ireland’s resilience to a prolonged gas supply disruption. This was to feed into an evaluation of risks and options to deal with gas supply disruptions, including the possible role of gas storage (GNI, 2018b).

Infrastructure developments

The European Commission supports key energy infrastructure projects known as PCIs to improve gas supply security and create an integrated energy market. One Irish gas infrastructure project was on the first PCI list and was completed at the end of 2018. There are two projects on the current third PCI list (Table 4.3).

Table 4.3 Irish gas infrastructure development projects under the PCI, 2017

Project |

Project |

Aim |

Status |

|

promoter |

|

|

Twinning of South |

GNI (UK) Twin unparalleled section of |

Funding provided by Connecting |

|

West Scotland |

Ltd |

pipeline |

Europe Facility (30%) and regulatory |

Onshore System |

|

Increase Moffat capacity to |

capital allowance |

(SWSOS) |

|

375 GWh/d |

|

(first PCI list) |

|

|

|

Physical reverse |

GNI (UK) |

Make Moffat entry point |

Feasibility study ongoing |

flow at Moffat |

Ltd |

bi-directional |

Funding provided by Connecting |

(third PCI list) |

|

|

Europe Facility (50%) |

Shannon LNG |

Shannon |

Construct LNG process tanks and Planning permission received |

|

(third PCI list) |

LNG |

regasification facilities with a |

Earliest commissioning in 2022, if a |

|

|

maximum export capacity of |

final investment decision is taken by |

|

|

191.1 GWh/d |

in 2019 |

Source: Ireland country submission, 2018.

Another project under consideration is the physical reverse flow (bi-directional) of the SNP, led by GNI (UK) Ltd, but not as part of the PCI. The decision of the United Kingdom

64

IEA. All rights reserved.