- •Putting CO2 to Use

- •Abstract

- •Highlights

- •Executive summary

- •CO2 is a valuable commodity

- •Early markets are emerging but the future scale of CO2 use is uncertain

- •Using CO2 can support climate goals, but with caveats

- •Cultivating early opportunities while planning for the long term

- •Findings and recommendations

- •Millions of tonnes of CO2 are being used today

- •New pathways for CO2 are generating global interest

- •CO2 use can contribute to climate goals, but with caveats

- •The future scale of CO2 use is highly uncertain

- •Where are the emerging market opportunities?

- •1. CO2-derived fuels

- •2. CO2-derived chemicals

- •3. Building materials from minerals and CO2

- •4. Building materials from waste and CO2

- •5. Crop yield boosting with CO2

- •CO2 use can complement CO2 storage, but is not an alternative

- •References

- •Policy recommendations

- •Technical analysis

- •Introduction

- •Setting the scene

- •What is CO2 use?

- •CO2-derived fuels

- •CO2-derived chemicals

- •CO2-derived building materials

- •Where is CO2 being used today?

- •What has spurred renewed interest in CO2 use?

- •Who is currently investing in CO2 use, and why?

- •How can CO2-derived products and services deliver climate benefits?

- •Understanding the future market for CO2-derived products and services

- •Which factors influence the future market?

- •Scalability

- •Competitiveness

- •The price and availability of hydrogen

- •The price and availability of CO2

- •Climate benefits

- •Origin of the CO2

- •Displaced product or service (reference system)

- •Energy input

- •Retention time of carbon in the product

- •Is it possible to assess the future market size?

- •Scaling up the market

- •CO2-derived fuels

- •What are CO2-derived fuels?

- •Are CO2-derived fuels scalable?

- •Under what conditions would CO2-derived fuels be competitive?

- •Can CO2-derived fuels deliver climate benefits?

- •What are the regulatory requirements?

- •CO2-derived chemicals

- •What are CO2-derived chemicals?

- •Are CO2-derived chemicals scalable?

- •Under what conditions would CO2-derived chemicals be competitive?

- •Can CO2-derived chemicals deliver climate benefits?

- •What are the regulatory requirements?

- •CO2-derived building materials from natural minerals

- •What are CO2-derived building materials?

- •Are CO2-derived building materials scalable?

- •Under what conditions would CO2-derived building materials be competitive?

- •Can CO2-derived building materials deliver climate benefits?

- •What are the regulatory requirements?

- •CO2-derived building materials from waste

- •What are building materials made from waste?

- •Are building materials from waste scalable?

- •Under what conditions are building materials from waste competitive?

- •Can building materials from waste deliver climate benefits?

- •What are the regulatory requirements?

- •CO2 use to enhance the yield of biological processes

- •What is yield boosting?

- •Is CO2 yield boosting scalable?

- •Under what conditions is CO2 yield boosting competitive?

- •Can CO2 yield boosting deliver climate benefits?

- •What are the regulatory requirements?

- •Where are suitable locations for an early market?

- •Implications for policy

- •Public procurement

- •Mandates

- •Economic incentives

- •Labelling, certification and testing

- •Research development and demonstration

- •Recommendations

- •References

- •General annex

- •Abbreviations and acronyms

- •Acknowledgements

- •Table of contents

- •List of figures

- •List of boxes

- •List of tables

Putting CO2 to Use: Creating Value from Emissions |

Technical analysis |

Scalability

The potential market for CO2-derived products and services will depend on both supply and demand-side factors. Demand can vary considerably by region and by specific type of product and service. While some CO2-derived products and services could be traded on large commodity markets (for example, fuels), others would target specific niche markets with limited demand (for example, polymers). On top of existing demand for conventional products, CO2-derived products and services could also unlock new demand, due to lower production costs or superior attributes.

On the supply side, constraints in the availability of key inputs, particularly low-cost renewable energy, CO2, hydrogen, or other raw materials could determine the speed and scale with which CO2-derived products can enter the market.5 Implicit in this is the availability of infrastructure, including transporting hydrogen and CO2 to processing facilities (see Box 3). Similarly to the demand side, limitations on supply can vary significantly by region as well as by type of product or service.

Box 3. Infrastructure needed to deliver hydrogen and CO2

The extensive use of hydrogen and CO2 for conversion into fuels and chemicals would require the deployment of a large-scale transport infrastructure, including pipelines and, in some places, terminals, ships and trucks. A common transport network would benefit individual CO2 use companies, especially small ones, as it delivers economies of scale and provides access to hydrogen and CO2 sources that are not necessarily located close to demand. Further benefits could be achieved by combining CO2 transport for use in products (and services) and geological storage. Similarly, by pooling hydrogen demand coming from several sectors (e.g. industry, transport and heating) and transporting this in one common infrastructure can deliver considerable economies of scale.

Despite the economic benefits, securing investment for infrastructure networks is challenging. Investors must be confident of a large long-term market for hydrogen and CO2 to underpin their investment case. However, such a market is unlikely to emerge without the transport options already available. Given the potential impasse, public support will probably be necessary. In the United States, an extensive network of over 6 000 km of pipelines transports around 60 MtCO2 for EOR. The US EOR industry has grown at a rate unmatched globally, in large part due to the development of its transport network. While EOR is a profitable undertaking, policies have encouraged its development.

Competitiveness

The market for CO2-derived products and services will expand if they are competitive. This is determined by their relative cost compared to their conventionally-produced counterparts and other low-carbon alternatives. The main factors affecting the cost of CO2-derived products and services are the costs of technology, energy, CO2 and other raw materials. The contribution of each factor in the total costs varies according to product and service. While capital costs for

5 Potential constraints on the availability of key inputs are discussed below.

PAGE | 29

IEA. All rights reserved.

Putting CO2 to Use: Creating Value from Emissions |

Technical analysis |

catalysts are typically product-specific, the availability and price of hydrogen and CO2 are relevant for multiple CO2-derived product groups and will be key determinants of the final cost of these products. Therefore, these are discussed in further detail below.

The price and availability of hydrogen

If CO2-derived fuels or chemical intermediates that require hydrogen are to contribute to climate change mitigation, hydrogen has to be produced in a low-carbon manner. The main production route today is steam methane reforming (SMR) using natural gas, but this pathway results in around 10 kgCO2 per kgH2. This process can be decarbonised by applying CCS, which would result in production costs of around USD 1.5-2.5/kgH2 (40-90% higher than conventional SMR production), but depends on availability of suitable geological storage sites (IEA, 2019a).

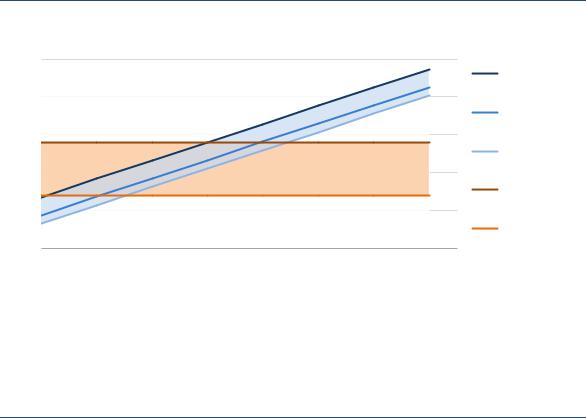

Electrolysis using renewable electricity can also produce low-carbon hydrogen, with costs in the range of USD 2.5-6/kgH2. The competitiveness of clean hydrogen from natural gas with CCS or from renewable electricity (from solar PV or onshore wind) mainly depends on capacity factor and gas and electricity prices (Figure 17). In the short term, hydrogen production from fossil fuels will remain the most cost-competitive option in most regions around the world. Nevertheless, already today, in countries with good renewable resources but dependent on natural gas imports, producing hydrogen from renewables may be more attractive than natural gas SMR with CCS. In regions with cheap domestic gas or coal resources and availability of CO2 storage, production from natural gas or coal may be the more attractive option. In addition to price and availability of resources, local hydrogen transmission and distribution costs might play an important role in the market price for delivered hydrogen as well. Overall, the future hydrogen price will vary widely from region to region.

Figure 17.

2 |

5 |

H |

|

USD/kg |

4 |

|

|

|

3 |

2

1

0

0

Comparison of hydrogen production costs from electricity and natural gas with CCS in the near term

Electrolysis, 30% capacity factor

Electrolysis, 50% capacity factor

Electrolysis, 70% capacity factor

Natural gas with CCS, 11 USD/MBtu

Natural gas with CCS, 3 USD/MBtu

10 |

20 |

30 |

40 |

50 |

60 |

70 |

Electricity price (USD/MWh)

Notes: CAPEX: electrolyser USD 700/kWel, SMR w CCS USD 1 360/kWH2; full load hours of hydrogen from natural gas 8 300 h; efficiencies (LHV): electrolyser 70%, gas with CCS 69%; capture rate for gas with CCS of 90%; discount rate: 8%.

Source: IEA (2019a), The Future of Hydrogen: Seizing Today’s Opportunities.

Depending on local gas prices, electricity at USD 10/MWh to USD 40/MWh and at full load hours of around 4 000 h is needed for water electrolysis to become cost competitive with natural gas with CCUS.

PAGE | 30

IEA. All rights reserved.

Putting CO2 to Use: Creating Value from Emissions |

Technical analysis |

Regions that are less endowed with renewable resources, such as Japan, can import low-carbon hydrogen from regions with good solar or wind resources, such as Australia. IEA analysis shows that hydrogen imports can be substantially cheaper than domestic production for a number of supply routes, including from Australia to Japan, especially if hydrogen is incorporated into ammonia during transport (IEA, 2019a).

The price and availability of CO2

CO2 needs to be captured, purified and transported. The costs of CO2 capture and purification vary greatly by point source, ranging from USD 15 to 60/tCO2 for concentrated CO2 streams, USD 40 to 80/tCO2 for coal and gas-fired power plants, to over USD 100/tCO2 for small, dilute point sources (e.g. industrial furnaces) (Table 1). Capturing CO2 directly from the air is the most expensive method, with costs reported in academic literature ranging from roughly USD 94 to 232/tCO2, as it implies a much greater energy input than CO2 capture from concentrated point sources (Ishimoto et al., 2017; Keith et al., 2018).6 Over time, capture costs are expected to decrease for most of these applications as a result of technological learning that would arise from wide deployment. Most of the indicated cost figures apply to large-scale CCS applications. The volumes of CO2 anticipated for CO2 use applications are much smaller and could increase capture cost.

Table 1. |

Selected CO2 capture cost ranges for industrial production |

|

||

|

|

|

|

|

CO2 source |

|

|

CO2 concentration [%] |

Capture cost [USD/tCO2] |

|

|

|

|

|

Natural gas processing |

|

96 - 100 |

15 - 25 |

|

|

|

|

|

|

Coal to chemicals (gasification) |

98 - 100 |

15 - 25 |

||

|

|

|

|

|

Ammonia |

|

|

98 - 100 |

25 - 35 |

|

|

|

|

|

Bioethanol |

|

98 - 100 |

25 - 35 |

|

|

|

|

||

Ethylene oxide |

|

98 - 100 |

25 - 35 |

|

|

|

|

|

|

Hydrogen (SMR) |

30 - 100 |

15 - 60 |

||

|

|

|

||

Iron and steel |

|

21 - 27 |

60 - 100 |

|

|

|

|

|

|

Cement |

|

15 - 30 |

60 - 120 |

|

Notes: Some cost estimates refer to chemical sector and fuel transformation processes that generate relatively pure CO2 streams, for which emissions capture costs are lower; in these cases, capture costs are mostly related to further purification and compression of CO2 required for transport. Depending on the product, dilute energy-related emissions, which can have substantially higher capture costs, can still make up an important share of overall direct emissions. Costs estimates are based on capture in the United States. Hydrogen refers to production via steam reforming; the broad cost range reflects varying levels of CO2 concentration: the lower end of the CO2 concentration range applies to CO2 capture from the pressure swing adsorption off-gas, while the higher end applies to hydrogen manufacturing processes in which CO2 is inherently separated as part of the production process. Iron and steel and cement capture costs are based on ‘Nth of a kind’ plants, reflecting projected cost reductions as technology is applied more broadly. Iron and steel and cement costs are based on capture using existing production routes – however, innovative industry sector technologies under development have the potential to allow for reduced costs in the long term. The low end of the cost range for cement production applies to CO2 capture from precalciner emissions, while the high end refers to capture of all plant CO2 emissions. For CO2 capture from iron and steel manufacturing, the low end of the cost range corresponds to CO2 capture from the blast furnace, while the high end corresponds to capture from other small point sources. Costs associated with CCUS in industry are not yet fully understood and can vary by region; ongoing analysis of practical application is needed as development continues. SMR = steam methane reforming.

Source: Analysis based on own estimates and GCCSI (2017), Global Costs of Carbon Capture and Storage, 2017 Update; IEAGHG (2014), CO2 Capture at Coal-Based Power and Hydrogen Plants; NETL (2014), Cost of Capturing CO2 from Industrial Sources.

6 Capture costs reported by direct air capture start-up companies and technology providers are in the range of USD 10/tCO2 to USD 200 /tCO2, which is significantly lower than values in the academic literature (Ishimoto et al., 2017). However, as the assumptions underpinning these cost estimates are often not available, these claims cannot be substantiated. One possible (partial) explanation for the discrepancy in costs is that companies and academics are examining different system designs.

PAGE | 31

IEA. All rights reserved.