- •Contents

- •Contributors

- •Acknowledgements

- •Introduction

- •What is corporate governance?

- •Corporate responsibility and ethics

- •Role of the board

- •Is corporate governance working?

- •Contribution of non-executive directors

- •Sanctions

- •The future of corporate governance

- •Challenges

- •1 The role of the board

- •Introduction

- •The executive/non-executive relationship

- •The board agenda and the number of meetings

- •Board committees

- •Size and composition of the board

- •The board and the shareholders

- •The dual role of British boards

- •What value does the board add?

- •Some unresolved questions

- •2 The role of the Chairman

- •Introduction

- •Due diligence

- •Professionalism

- •Setting the agenda and running the board meeting

- •Promoting good governance

- •Creating an effective relationship with the Chief Executive

- •Sustaining the company’s reputation

- •Succession planning

- •Building an effective board

- •Finding the right people

- •Getting the communications right

- •Making good use of non-executive directors

- •Using board committees effectively

- •Protecting the unitary board

- •Creating a climate of trust

- •Making good use of external advisers

- •Promoting the use of board evaluation and director appraisal

- •Qualities of an effective chairman

- •3 The role of the non-executive director

- •Introduction

- •Role of a non-executive director

- •Importance of the role of non-executive director

- •Personal skills and attributes of an effective non-executive director

- •Technical

- •Interpersonal

- •Importance of independence

- •Non-executive director dilemmas

- •Engaged and non-executive

- •Challenge and support

- •Independence and involvement

- •Barriers to NED effectiveness

- •The senior independent director (SID)

- •NEDs and board committees

- •Board evaluation

- •Training for NEDs

- •Diversity

- •Conclusion

- •References

- •4 The role of the Company Secretary

- •Introduction

- •The background

- •The advent of corporate governance

- •Role of the board

- •Strategic versus compliance

- •Reputation oversight

- •Governance systems

- •The Company Secretary

- •The challenges

- •5 The role of the shareholder

- •Recent history – growing pressure on shareholders to act responsibly

- •Governance as an alternative to regulation

- •Where shareholders make a difference

- •What happens in practice

- •The international dimension

- •Progress to date

- •The challenges ahead

- •6 The role of the regulator

- •Introduction

- •The market-based approach to promoting good governance

- •Advantages of the market-based approach and comply-or-explain

- •The role of governments and regulators

- •How does the regulator carry out this role in practice?

- •Challenges to comply-or-explain

- •Conclusion

- •Perspective

- •Individual and collective board responsibility

- •Enlightened shareholder value versus pluralism

- •Core duties

- •The duty to act within powers

- •The duty to promote the success of the company

- •The duty to exercise independent judgement

- •The duty to exercise reasonable care, skill and diligence

- •The duty to disclose interests in proposed transactions or arrangements

- •Additional obligations

- •The obligation to declare interests in existing transactions or arrangements

- •The obligation to comply with the Listing, Disclosure and Transparency Rules

- •The obligation to disclose and certify disclosure of relevant audit information to auditors

- •Reporting

- •The link between directors’ duties and narrative reporting

- •Business reviews

- •Enhanced business reviews by quoted companies

- •Transparency Rules

- •Safe harbours

- •Shareholder derivative actions

- •8 What sanctions are necessary?

- •Introduction

- •The Virtuous Circle of corporate governance

- •Law and regulation in the Virtuous Circle

- •The Courts in the Virtuous Circle

- •Shareholder and market pressure in the Virtuous Circle

- •Good corporate citizenship in the Virtuous Circle

- •The sanctions: law and regulation – policing the boundaries

- •Sanctions under the Companies Acts

- •Sanctions and corporate reporting

- •The role of auditors

- •Plugging the ‘expectations gap’

- •Shareholders and legislative sanctions

- •FSMA: sanctions in a regulatory context

- •Sanctions for listed companies, directors and PDMRs

- •Suspensions and cancellations

- •The Listing Principles – facilitating the enforcement process

- •Sanctions for AIM listed companies

- •Sanctions for sponsors and nomads

- •Misleading statements and practices

- •The sanctions: the role of the Courts

- •Consequences of breach of duty

- •The position of non-executive directors

- •Protecting directors

- •The impact of the 2006 Act

- •Adequacy of civil sanctions for breach of duty

- •The sanctions: shareholder and market pressure – power in the hands of the owners

- •Shareholders and their agents

- •Codes versus law and regulation

- •What sanctions apply under codes and guidelines?

- •Proposals for reform

- •The sanctions: good corporate citizenship – the power of public opinion

- •Adverse press comment

- •Peer pressure

- •Corporate social responsibility

- •Conclusion

- •9 Regulatory trends and their impact on corporate governance

- •Introduction and overarching market trends

- •Regulatory trends in the EU

- •Transparency

- •Comply-or-explain

- •Annual disclosures

- •Interim and ad hoc disclosures

- •Hedge fund and stock lending

- •Accountability

- •Shareholder rights and participation

- •The market for corporate control

- •One-share-one-vote

- •Shareholder communications

- •Trends in the US

- •Transparency

- •Executive remuneration

- •Accountability

- •Concluding remarks

- •10 Corporate governance and performance: the missing links

- •Introduction

- •Governance-ranking-based research into the link between corporate governance and performance

- •Overview of governance-ranking research

- •Assessment of governance-ranking research

- •Further evidence for a link between corporate governance and performance: effectiveness of shareholder engagement

- •Performance of companies in focus lists

- •Performance of shareholder engagement funds

- •Shareholder engagement in practice: Premier Oil plc

- •Assessment of the research and evidence for a link between corporate governance and performance

- •Conclusion

- •Investors play an important role in using corporate governance as an investment technique

- •References

- •11 Is the UK model working?

- •The evolution of UK corporate governance

- •Other governance principles

- •Cross-border harmony

- •UK versus US governance environments

- •Quality of corporate governance disclosures in the UK

- •Have UK companies embraced the principles of the Combined Code?

- •Do they do what they say they do?

- •Resources and investor interest

- •Governance versus performance and listings

- •Alternative Investment Market (AIM) quoted companies

- •Roles and responsibilities

- •Institutional investors

- •Shareholder rights in the UK versus the US

- •Shareholder responsibilities

- •Board effectiveness

- •Review of board performance under the Code

- •Results of evaluations

- •What makes a company responsible?

- •Is the UK model of corporate governance working?

- •Index

Is the UK model working?

member of the audit committee provided he was independent when appointed as Chairman.

The current UK principles-based model appears to be having a positive impact on governance practice. However it still has some way to go in meeting the needs of all stakeholders, a primary requirement being the transparency of directors’ activities. So what are the alternatives?

Cross-border harmony

There are different approaches to corporate governance throughout the world, often reflecting the local cultural and economic realities. Should the UK be looking to define and pursue what it considers to be the best approach or should it be working to a common global corporate governance model in order to enable increased global comparability?

The European Corporate Governance Institute (ECGI) is seeking to address the issue of cross-border inconsistencies between governance models within Europe by leading a project: Modernising Company Law and Enhancing Corporate Governance in the European Union.

UK versus US governance environments

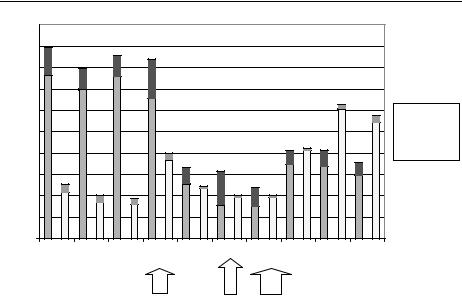

The US practice in the field of corporate governance and risk management is to implement a highly regulated environment. Since the introduction of SOX, there has been a decrease in new listings in the US, with only 354 companies listing in 20065 compared to 856 companies in 1999 (see Figure 11.1).

This is in stark contrast to the UK’s practice, now overseen by the Financial Reporting Council (FRC) which, through the Combined Code, promotes the principles-based approach.

It is this lighter touch to regulation which many believe stimulated the significant increase in the total number of flotations (domestic and foreign) on the LSE which increased to 576 companies in 2006 from 187 companies in 1999.6 This is also mirrored in the number of new foreign listings, where we are once again seeing growing confidence in UK markets – thirty-two new foreign listings in 2006.7 This no doubt reflects the liquidity of the UK market (there was a notable decrease in total UK listings from 2000 to 2003). However, the revision of the UK’s Combined Code in 2003, at the same time as an apparent market reaction against what is seen as the prohibitively expensive cost of complying with SOX, has turned the spotlight on the issue of principles-based regulation versus prescriptive rules. Recent announcements from the SEC and

5From World Federation of Exchanges, www.world-exchanges.org.

6From World Federation of Exchanges, www.world-exchanges.org.

7From World Federation of Exchanges, www.world-exchanges.org.

225

Simon Lowe

|

1000 |

|

|

|

|

|

|

|

|

|

|

900 |

|

|

|

|

|

|

|

|

|

|

800 |

|

|

|

|

|

|

|

|

|

listings |

700 |

|

|

|

|

|

|

|

|

|

600 |

|

|

|

|

|

|

|

|

|

|

new |

500 |

|

|

|

|

|

|

|

|

|

of |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number |

400 |

|

|

|

|

|

|

|

|

|

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

200 |

|

|

|

|

|

|

|

|

|

|

100 |

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

1997 |

1998 |

1999 |

2000 |

2001 |

2002 |

2003 |

2004 |

2005 |

2006 |

Ye ar

UK foreign

UK foreign

UK domestic

UK domestic

US foreign

US foreign

US domestic

US domestic

UK Combined |

|

SOX |

Revised UK Combined Code |

Code issued |

|

issued |

issued |

|

|

|

|

|

|

|

|

Figure 11.1 Comparison of US and UK listings 1997–2006

PCAOB suggest that the US is seeking to soften its stance, but this may be a case of too little too late.

Figure 11.1 shows the number of Initial Public Offerings (IPO) – both domestic and foreign – in the UK and the US from 1997 to 2006, together with the relevant dates when the UK and US corporate governance guidance was issued.8

The decline in US listings is commonly blamed both on the cost and demand SOX places on management resources and also on the reluctance of management, in the heavily litigious environment of the US, to adopt a more riskbased approach to controls assessment. What is reasonable risk to the informed director may not be viewed in the same light by the courts. But other factors are starting to drive a change in governance practice; the competition for new capital is coming from the more loosely regulated emerging markets – China, India, Middle East – not to mention the actual cost of the listing process in the US, where underwriting fees and professional advisory services’ costs are considerably more expensive. Economic consultants Oxera found that the same bank would charge higher fees for a listing in the US than in Europe.9 For

8From World Federation of Exchanges, www.world-exchanges.org.

9The Cost of Capital: An International Comparison, Oxera Consulting and London Stock Exchange, June 2006.

226