- •Examination questions for discipline Microeconomics

- •Production Efficiency

- •The ppf and Marginal Cost

- •Markets and Prices

- •The law of demand

- •The Factors that Influence the Elasticity of Supply

- •New Ways of Explaining Consumer Choices

- •Consumption Possibilities

- •Work-Leisure Choices

- •The Firm and Its Economic Problem

- •Markets and the Competitive Environment

- •Product Curves

- •Short-Run Cost

- •Marginal Cost and Average Costs

- •Marginal Cost and Average Costs

- •The Long-Run Average Cost Curve

- •Perfect competition

- •What is Perfect Competition?

- •The Firm’s Output Decision

- •Output, Price, and Profit in the Short Run

- •Price Discrimination

- •Marginal Revenue and Elasticity

- •63. Single-Price Monopoly and Competition Compared

- •Monopoly Regulation

- •Monopolistic Competition and Perfect Competition comparison

- •What is Oligopoly?

- •Two Traditional Oligopoly Models

- •Oligopoly Games: An Oligopoly Price-Fixing Game

- •Antitrust Law

- •Classifying Goods and Resources

- •Public Goods

- •Common Resources

- •The Anatomy of Factor Markets

- •The Demand for a Factor of Production

- •Capital and Natural Resource Markets

- •Nonrenewable Natural Resource Markets

- •Property Rights and the Coase Theorem

- •Achieving an Efficient Outcome

Work-Leisure Choices

Labor Supply

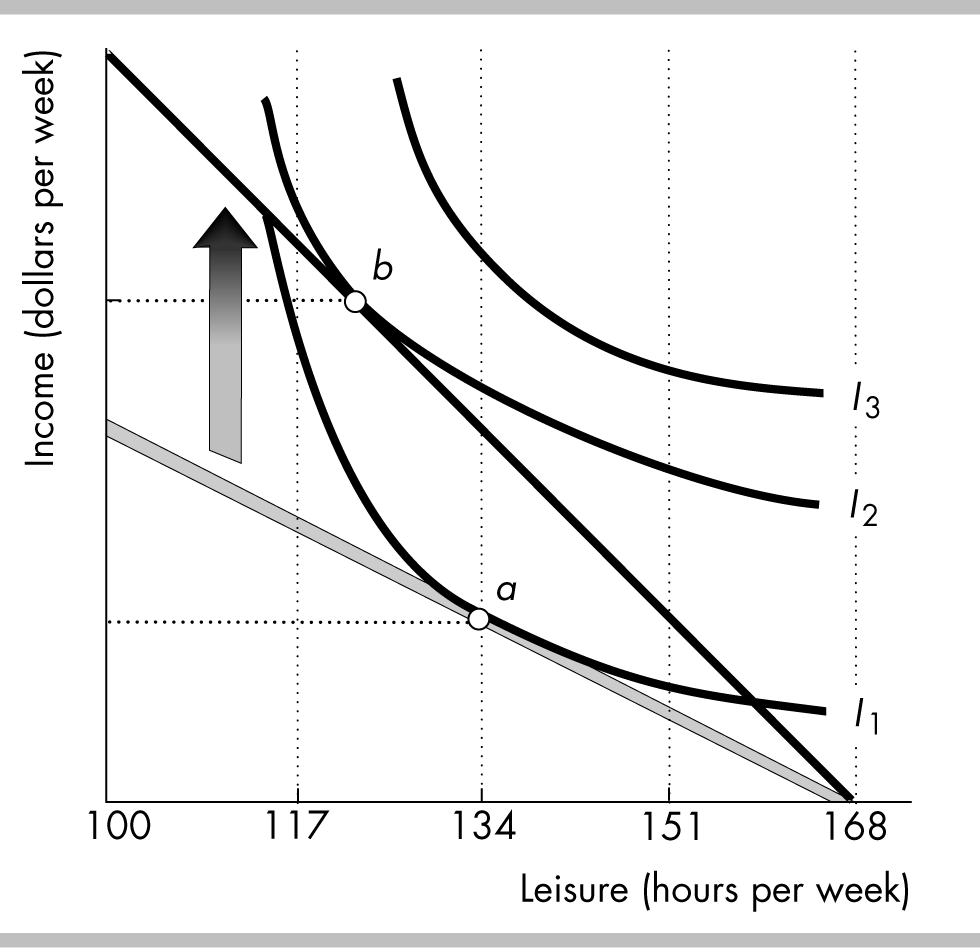

A household’s labor supply decisions can be analyzed using the same model of consumer choice. In this case, the two “goods” are leisure and income (from working). The income generated from working can then be used to purchase all other goods.

The household must allocate its time between leisure and work. The opportunity cost of an hour of leisure (that is, not working for an hour) is the wage rate.

A

figure showing the indifference curves and the income-time budget

line is to the right. The maximum leisure is 168 hours a week, in

which case the person’s income is zero. The initial budget line is

the gray line.

A

figure showing the indifference curves and the income-time budget

line is to the right. The maximum leisure is 168 hours a week, in

which case the person’s income is zero. The initial budget line is

the gray line.

The person’s best affordable point is point a. The person has 134 hours of leisure a week, which means the person supplies 34 hours of labor a week.

An increase in the wage rate rotates the budget line upward, as shown in the figure. With the new, higher budget line, the person moves to the new best point, point b. At this point, the quantity of leisure consumed decreases, which means that the quantity of labor supplied increases.

The increase in the wage rate has a substitution effect and an income effect. The substitution effect occurs because an increase in the wage rate increases the opportunity cost of leisure, so people respond by substituting away from leisure. But the higher wage rate also increases the household’s income and the income effect leads to an increase in the demand for leisure, which is a normal good.

Between points a and b in the figure, the substitution effect dominates, so an increase in the wage rate increases the quantity of labor supplied. But if the wage rate increased more, so that the household could reach indifference curve I3, the income effect would dominate and the increase in wage rate would decrease the quantity of labor supplied.

The Firm and Its Economic Problem

A firm is an institution that hires factors of production and organizes those factors to produce and sell goods and services

The firm’s goal is to maximize its profit. If a firm fails to maximize profit it is either eliminated through competition or bought out by other firms seeking to maximize profit.

Accounting Profit and Economic Profit

A firm’s accounting profit is the firm’s revenues minus expenses and depreciation.

A firm’s economic profit is equal to total revenue minus total cost, with total cost measured as the opportunity cost of production.

A Firm’s Opportunity Cost of Production

A firm’s decisions respond to opportunity cost and economic profit. A firm’s opportunity cost of production is the value of the best alternative use of the resources that a firm uses in production.

Opportunity costs of production include the cost of resources that are bought in the market, owned by the firm, or supplied by the firm’s owner.

A Firm’s Opportunity Cost of Production

A firm’s decisions respond to opportunity cost and economic profit. A firm’s opportunity cost of production is the value of the best alternative use of the resources that a firm uses in production.

Opportunity costs of production include the cost of resources that are bought in the market, owned by the firm, or supplied by the firm’s owner.

For example, renting capital means the firm is paying a rental cost reflecting the opportunity cost to the owner of the capital when someone else using the capital. However, if the firm buys capital it incurs an opportunity cost of using its own capital, which is called the implicit rental rate of capital. The implicit rental rate includes economic depreciation, which is the change in the market value of capital over a given period, and the interest forgone, which is the lost potential return on the funds that were used to acquire the capital.

The return to the owner for the owner’s entrepreneurial ability is profit. The return for this input that an entrepreneur can expect to receive on the average is called normal profit. The normal profit is part of the firm’s opportunity cost. Economic profit is a firm’s total revenue minus its opportunity cost. Because normal profit is part of the firm’s opportunity costs, economic profit is profit over and above normal profit.

Technological and Economic Efficiency

There typically are many different combinations of inputs that can produce a specific level of output. Technological efficiency occurs when a firm produces a given output by using the least amount of inputs. Economic efficiency occurs when the firm produces a given output at the least possible cost. An economically efficient production process is always technologically efficient. But, a technologically efficient process might not be economically efficient.

The table has 4 different methods of producing a unit of output. The columns show the number of units of labor and capital needed to produce 1 unit of output.

Method 2 is technologically inefficient because it uses the same amount of capital but more labor than does Method 1.

Which method is economically efficient depends on the prices of labor and capital. If labor is $10 per unit and capital is $1, then Method 1 is economically efficient (with a cost of $60 per unit of output). If labor is $1 per unit and capital is $10 per unit, then Method 4 is economically efficient (with a cost of $30 per unit of output).

Information and Organization

A firm organizes production by combining and coordinating productive resources using a mixture of command systems and incentive systems.

A command system uses a managerial hierarchy. Commands pass downward through the hierarchy and information (feedback) passes upward.

An incentive system uses a market-like mechanism inside the firm.

The principal-agent problem is the problem of devising compensation rules that induce an agent to act in the best interests of a principal. For example, the stockholders of a firm are the principals and the managers of the firm are their agents. Stockholders wish to provide incentives to the managers to bring the manager’s decisions in line with profit maximization. Firms cope with the principal-agent problem in many ways:

Ownership: Firms’ owners often offer managers partial ownership of the firm to give the managers an incentive to maximize the firm’s profits, which is the goal of the owners.

Incentive pay: Firms’ owners can links managers’ or workers’ pay to the firm’s performance, such as its sales, to help align the managers’ and workers’ interests with those of the owners.

Long-term contracts: Firms’ owners can tie managers’ or workers’ long-term rewards to the long-term performance of the firm.

Types of Business Organization

A proprietorship is a firm with a single owner. This owner has unlimited legal liability, which means the owner has legal responsibility for all debts incurred by the firm up to an amount equal to the entire wealth of the owner. The proprietor is the only one who makes management decisions and is the sole claimant of the firm’s profit. Profits are taxed the same as the owner’s other income.

A partnership is a firm with two or more owners. Each partner has unlimited legal liability. The partners must agree upon a management structure and agree how to divide up the profits from the firm. Profits from partnerships are taxed as the personal income of the owners.

A corporation is a firm that is owned by one or more stockholders with limited liability, which means the owners have legal liability only for the initial value of their investment so the personal wealth of the stockholders is not at risk if the firm goes bankrupt. The profit of corporations is taxed twice—once as a corporate tax on the firm’s profits, and then again as income taxes paid by stockholders receiving their after-tax profits distributed as dividends.

Proprietorships are the most common form of business organization but corporations account for the majority of revenue received by all types of business organization