- •Inventory basics

- •Internal Controls and Taking a Physical Count

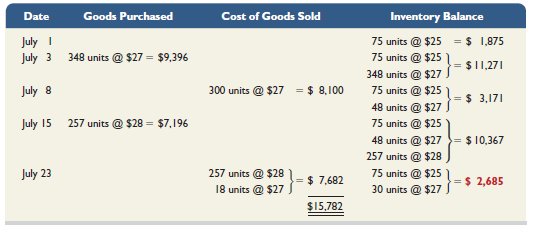

- •Inventory costing under a perpetual system

- •Inventory Cost Flow Assumptions

- •Inventory Costing Illustration

- •Valuing inventory at lcm and the effects of inventory errors

- •Inventory Turnover

- •Icon denotes assignments that involve decision making.

Icon denotes assignments that involve decision making.

Discussion Questions

Describe how costs flow from inventory to cost of goods sold for the following methods: (a) FIFO and (b) LIFO.

Where is the amount of merchandise inventory disclosed in the financial statements?

Why are incidental costs sometimes ignored in inventory costing? Under what accounting constraint is this permitted?

If

costs are declining, will the LIFO or FIFO method of inventory

valuation yield the lower cost of goods sold? Why?

If

costs are declining, will the LIFO or FIFO method of inventory

valuation yield the lower cost of goods sold? Why?What does the full-disclosure principle prescribe if a company changes from one acceptable accounting method to another?

Can a company change its inventory method each accounting period? Explain.

Does the accounting concept of consistency preclude any changes from one accounting method to another?

If inventory errors are said to correct themselves, why are accounting users concerned when such errors are made?

Explain the following statement: “Inventory errors correct themselves.”

What is the meaning of market as it is used in determining the lower of cost or market for inventory?

What guidance does the accounting constraint of conservatism offer?

What factors contribute to (or cause) inventory shrinkage?

B When preparing interim financial statements, what two methods can companies utilize to estimate cost of goods sold and ending inventory?

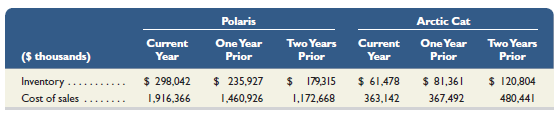

Refer to Polaris' financial statements in Appendix A. On December 31, 2011, what percent of current assets are represented by inventory?

Refer to Arctic Cat's financial statements in Appendix A and compute its cost of goods available for sale for the year ended March 31, 2011.

![]()

Refer to KTM's financial statements in Appendix A. Compute its cost of goods available for sale for the year ended December 31, 2011.

![]()

Refer to Piaggio's financial statements in Appendix A. What percent of its current assets are inventory as of December 31, 2011 and 2010?

![]()

![]() QUICK

STUDY

QUICK

STUDY

QS 6-1

Perpetual: Inventory costing with FIFO P1

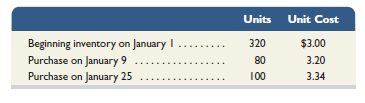

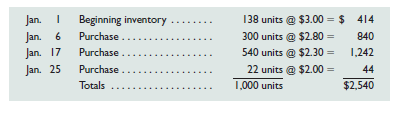

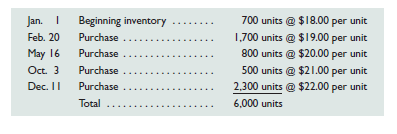

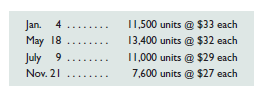

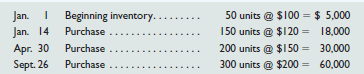

Information: A company reports the following beginning inventory and purchases for the month of January. On January 26, the company sells 350 units. 150 units remain in ending inventory at January 31.

D

Required

Assume the perpetual inventory system is used and then determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-2

Perpetual: Inventory costing with LIFO P1

Refer to the information in QS 6-1 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on LIFO. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-3

Perpetual: Inventory costing with weighted average P1

Check $465

Refer to the information in QS 6-1 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-4A

Periodic: Inventory costing with FIFO P3

Refer to the information in QS 6-1 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. (Round per unit costs and inventory amounts to dollars and cents.)

Page 259

QS 6-5A

Periodic: Inventory costing with LIFO P3

Refer to the information in QS 6-1 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-6A

Periodic: Inventory costing with weighted average P3

Refer to the information in QS 6-1 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-7

Computing goods available for sale P1

Wattan Company reports beginning inventory of 10 units at $60 each. Every week for four weeks it purchases an additional 10 units at respective costs of $61, $62, $65 and $70 per unit for weeks 1 through 4. Calculate the cost of goods available for sale and the units available for sale for this four-week period. Assume that no sales occur during those four weeks.

QS 6-8

Perpetual: Assigning costs with FIFO P1

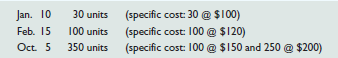

Information: Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. During December, Monson sells 15 units for $20 each on December 15.

Purchases on December 7 |

10 units @ $ 6.00 cost |

Purchases on December 14 |

20 units @ $12.00 cost |

Purchases on December 21 |

15 units @ $14.00 cost |

Required

Monson uses a perpetual inventory system. Determine the costs assigned to the December 31 ending inventory based on the FIFO method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-9

Perpetual: Inventory costing with LIFO P1

Refer to the information in QS 6-8 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-10

Perpetual: Inventory costing with weighted average P1

Check End. Inv. = $360

Refer to the information in QS 6-8 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-11

Perpetual: Inventory costing with specific identification P1

Refer to the information in QS 6-8 and assume the perpetual inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on specific identification. Of the units sold, eight are from the December 7 purchase and seven are from the December 14 purchase. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-12A

Periodic: Inventory costing with FIFO P3

Refer to the information in QS 6-8 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the FIFO method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-13

Periodic: Inventory costing with LIFO P3

Refer to the information in QS 6-8 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the LIFO method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-14A

Periodic: Inventory costing with weighted average P3

Refer to the information in QS 6-8 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on the weighted average method. (Round per unit costs and inventory amounts to dollars and cents.)

QS 6-15A

Periodic: Inventory costing with specific identification P3

Refer to the information in QS 6-8 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory when costs are assigned based on specific identification. Of the units sold, eight are from the December 7 purchase and seven are from the December 14 purchase. (Round per unit costs and inventory amounts to dollars and cents.)

Page 260

QS 6-16

Contrasting inventory costing methods A1

Identify the inventory costing method best described by each of the following separate statements. Assume a period of increasing costs.

Yields a balance sheet inventory amount often markedly less than its replacement cost.

Results in a balance sheet inventory amount approximating replacement cost.

Provides a tax advantage (deferral) to a corporation when costs are rising.

Recognizes (matches) recent costs against net sales.

The preferred method when each unit of product has unique features that markedly affect cost.

QS 6-17

Inventory ownership C1

Homestead Crafts, a distributor of handmade gifts, operates out of owner Emma Finn's house. At the end of the current period, Emma reports she has 1,300 units (products) in her basement, 20 of which were damaged by water and cannot be sold. She also has another 350 units in her van, ready to deliver per a customer order, terms FOB destination, and another 80 units out on consignment to a friend who owns a retail store. How many units should Emma include in her company's period-end inventory?

QS 6-18

Inventory costs C2

A car dealer acquires a used car for $14,000, terms FOB shipping point. Additional costs in obtaining and offering the car for sale include $250 for transportation-in, $900 for import duties, $300 for insurance during shipment, $150 for advertising, and $1,250 for sales staff salaries. For computing inventory, what cost is assigned to the used car?

QS 6-19

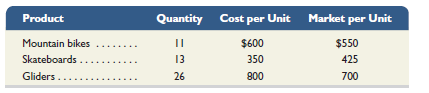

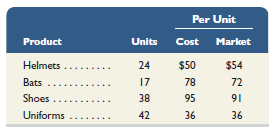

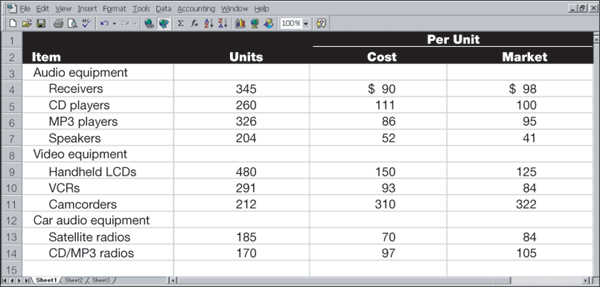

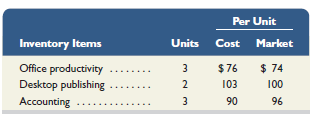

Applying LCM to inventories P2

Ames Trading Co. has the following products in its ending inventory. Compute lower of cost or market for inventory applied separately to each product.

D

QS 6-20

Inventory errors A2

In taking a physical inventory at the end of year 2013, Grant Company forgot to count certain units. Explain how this error affects the following: (a) 2013 cost of goods sold, (b) 2013 gross profit, (c) 2013 net income, (d) 2014 net income, (e) the combined two-year income, and (f) income for years after 2014.

QS 6-21

Analyzing inventory A3

Endor Company begins the year with $150,000 of goods in inventory. At year-end, the amount in inventory has increased to $180,000. Cost of goods sold for the year is $1,200,000. Compute Endor's inventory turnover and days' sales in inventory. Assume that there are 365 days in the year.

QS 6-22B

Estimating inventories—gross profit method P4

Kauai Store's inventory is destroyed by a fire on September 5, 2013. The following data for year 2013 are available from the accounting records. Estimate the cost of the inventory destroyed.

Jan. 1 inventory |

$190,000 |

Jan. 1 through Sept. 5 purchases (net) |

$352,000 |

Jan. 1 through Sept. 5 sales (net) |

$685,000 |

Year 2013 estimated gross profit rate |

44% |

QS 6-23

International

accounting standards C1 C2 P2 ![]()

Answer each of the following questions related to international accounting standards.

Explain how the accounting for items and costs making up merchandise inventory is different between IFRS and U.S. GAAP.

Can companies reporting under IFRS apply a cost flow assumption in assigning costs to inventory? If yes, identify at least two acceptable cost flow assumptions.

Both IFRS and U.S. GAAP apply the lower of cost or market method for reporting inventory values. If inventory is written down from applying the lower of cost or market method, explain in general terms how IFRS and U.S. GAAP differ in accounting for any subsequent period reversal of that reported decline in inventory value.

Page 261

EXERCISES

Exercise 6-1

Inventory ownership C1

Harris Company has shipped $20,000 of goods to Harlow Co., and Harlow Co. has arranged to sell the goods for Harris. Identify the consignor and the consignee. Which company should include any unsold goods as part of its inventory?

At year-end, Harris Co. had shipped $12,500 of merchandise FOB destination to Harlow Co. Which company should include the $12,500 of merchandise in transit as part of its year-end inventory?

Exercise 6-2

Guided Example for Exercise 06-2

Inventory costs C2

Walberg Associates, antique dealers, purchased the contents of an estate for $75,000. Terms of the purchase were FOB shipping point, and the cost of transporting the goods to Walberg Associates' warehouse was $2,400. Walberg Associates insured the shipment at a cost of $300. Prior to putting the goods up for sale, they cleaned and refurbished them at a cost of $980. Determine the cost of the inventory acquired from the estate.

Exercise 6-3

Guided Example for Exercise 06-3 pt. 1

Guided Example for Exercise 06-3 pt. 2

Guided Example for Exercise 06-3 pt. 3

Guided Example for Exercise 06-3 pt. 4

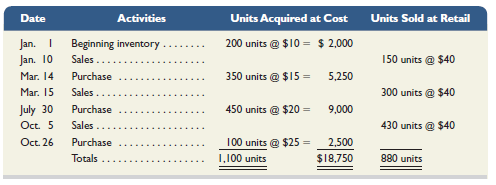

Perpetual: Inventory costing methods P1

Information: Laker Company reported the following January purchases and sales data for its only product.

D

Required

The Company uses a perpetual inventory system. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. (Round per unit costs and inventory amounts to dollars and cents.) For specific identification, ending inventory consists of 200 units, where 180 are from the January 30 purchase, 5 are from the January 20 purchase, and 15 are from beginning inventory.

Check Ending inventory: LIFO, $930; WA, $918

Exercise 6-4

Guided Example for Exercise 06-4

Perpetual: Income effects of inventory methods A1

Use the data in Exercise 6-3 to prepare comparative income statements for the month of January for Laker Company similar to those shown in Exhibit 6.8 for the four inventory methods. Assume expenses are $1,250, and that the applicable income tax rate is 40%. (Round amounts to dollars and cents.)

Which method yields the highest net income?

Does net income using weighted average fall between that using FIFO and LIFO?

If costs were rising instead of falling, which method would yield the highest net income?

Exercise 6-5A

Guided Example for Exercise 06-5

Periodic: Inventory costing P3

Refer to the information in Exercise 6-3 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. (Round per unit costs and inventory amounts to dollars and cents.)

Exercise 6-6A

Guided Example for Exercise 06-6

Periodic: Income effects of inventory methods A1

Use the data in Exercise 6-5 to prepare comparative income statements for the month of January for the company similar to those shown in Exhibit 6.8 for the four inventory methods. Assume expenses are $1,250, and that the applicable income tax rate is 40%. (Round amounts to dollars and cents.)

Required

Which method yields the highest net income?

Does net income using weighted average fall between that using FIFO and LIFO?

If costs were rising instead of falling, which method would yield the highest net income?

Page 262

Exercise 6-7

Guided Example for Exercise 06-7

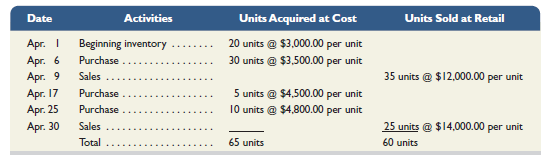

Perpetual: Inventory costing methods—FIFO and LIFO P1

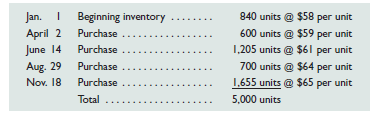

Information: Hemming Co. reported the following current-year purchases and sales for its only product.

D

Required

Check Ending inventory: LIFO, $4,150

Hemming uses a perpetual inventory system. Determine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. Compute the gross margin for each method. (Round amounts to dollars and cents.)

Exercise 6-8

Guided Example for Exercise 06-8

Specific identification P1

Refer to the information in Exercise 6-7. Ending inventory consists of 45 units from the March 14 purchase, 75 units from the July 30 purchase, and all 100 units from the October 26 purchase. Using the specific identification method, calculate (a) the cost of goods sold and (b) the gross profit. (Round amounts to dollars and cents.)

Exercise 6-9A

Guided Example for Exercise 06-9

Periodic: Inventory costing P3

Refer to the information in Exercise 6-7 and assume the periodic inventory system is used. Determine the costs assigned to ending inventory and to cost of goods sold using (a) FIFO and (b) LIFO. Then (c) compute the gross margin for each method.

Exercise 6-10

Guided Example for Exercise 06-10

Lower of cost or market P2

Martinez Company's ending inventory includes the following items. Compute the lower of cost or market for ending inventory applied separately to each product.

D

Check LCM = $7,394

Exercise 6-11

Guided Example for Exercise 06-11

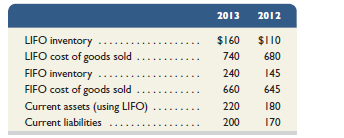

Comparing LIFO numbers to FIFO numbers; ratio analysis A1 A3

Cruz Company uses LIFO for inventory costing and reports the following financial data. It also recomputed inventory and cost of goods sold using FIFO for comparison purposes.

D

Check (1) FIFO: Current ratio, 1.5; Inventory turnover, 3.4 times

Compute its current ratio, inventory turnover, and days' sales in inventory for 2013 using (a) LIFO numbers and (b) FIFO numbers. (Round answers to one decimal.)

Comment on and interpret the results of part 1.

Page 263

Exercise 6-12

Guided Example for Exercise 06-12

Analysis of inventory errors A2

Vibrant Company had $850,000 of sales in each of three consecutive years 2012–2014, and it purchased merchandise costing $500,000 in each of those years. It also maintained a $250,000 physical inventory from the beginning to the end of that three-year period. In accounting for inventory, it made an error at the end of year 2012 that caused its year-end 2012 inventory to appear on its statements as $230,000 rather than the correct $250,000.

Check 2012 reported gross profit, $330,000

Determine the correct amount of the company's gross profit in each of the years 2012 – 2014.

Prepare comparative income statements as in Exhibit 6.11 to show the effect of this error on the company's cost of goods sold and gross profit for each of the years 2012 – 2014.

Exercise 6-13

Guided Example for Exercise 06-13

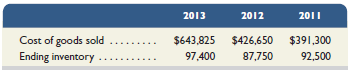

Inventory turnover and days' sales in inventory A3

Use the following information for Palmer Co. to compute inventory turnover for 2013 and 2012, and its days' sales in inventory at December 31, 2013 and 2012. (Round answers to one decimal.) Comment on Palmer's efficiency in using its assets to increase sales from 2012 to 2013.

D

Exercise 6-14A

Guided Example for Exercise 06-14

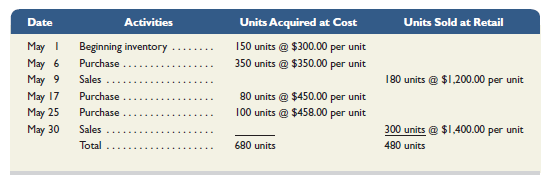

Periodic: Cost flow assumptions P3

Martinez Co. reported the following current-year data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 150 units—50 from each of the last three purchases. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. (Round per unit costs and inventory amounts to dollars and cents.) Which method yields the highest net income?

D

Check Inventory; LIFO, $313.50; FIFO, $435.00

Exercise 6-15

Guided Example for Exercise 06-15

Cost flow assumptions P3

Flora's Gifts reported the following current-monthly data for its only product. The company uses a periodic inventory system, and its ending inventory consists of 60 units—50 units from the January 6 purchase, and 10 units from the January 25 purchase. Determine the cost assigned to ending inventory and to cost of goods sold using (a) specific identification, (b) weighted average, (c) FIFO, and (d) LIFO. (Round per unit costs and inventory amounts to dollars and cents.) Which method yields the lowest net income?

D

Check Inventory: LIFO, $180.00; FIFO, $131.40

Exercise 6-16B

Guided Example for Exercise 06-16

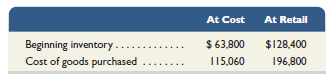

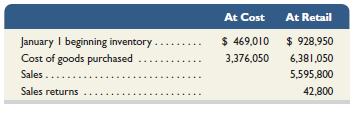

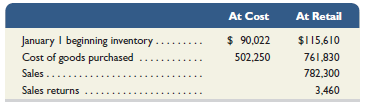

Estimating ending inventory—retail method P4

In 2013, Dakota Company had net sales (at retail) of $260,000. The following additional information is available from its records at the end of 2013. Use the retail inventory method to estimate Dakota's 2013 ending inventory at cost.

D

Check End. Inventory, $35,860

Page 264

Exercise 6-17B

Guided Example for Exercise 06-17

Estimating ending inventory—gross profit method P4

On January 1, JKR Shop had $225,000 of inventory at cost. In the first quarter of the year, it purchased $795,000 of merchandise, returned $11,550, and paid freight charges of $18,800 on purchased merchandise, terms FOB shipping point. The company's gross profit averages 30%, and the store had $1,000,000 of net sales (at retail) in the first quarter of the year. Use the gross profit method to estimate its cost of inventory at the end of the first quarter.

Exercise 6-18

Accounting for inventory following IFRS P2

Samsung Electronics reports the following regarding its accounting for inventories.

Inventories are stated at the lower of cost or net realizable value. Cost is determined using the average cost method, except for materials-in-transit. Inventories are reduced for the estimated losses arising from excess, obsolescence, and the decline in value. This reduction is determined by estimating market value based on future customer demand. The losses on inventory obsolescence are recorded as a part of cost of sales.

What cost flow assumption(s) does Samsung apply in assigning costs to its inventories?

If at year-end 2011 there was an increase in the value of its inventories such that there was a reversal of W550 (W is Korean won) million for the 2010 write-down, how would Samsung account for this under IFRS? Would Samsung's accounting be different for this reversal if it reported under U.S. GAAP? Explain.

PROBLEM SET A

Problem 6-1A

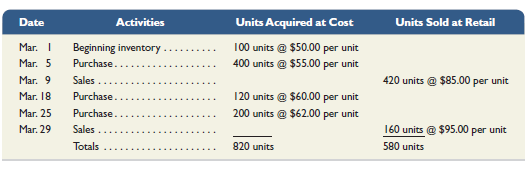

Perpetual: Alternative cost flows P1

Information: Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. (For specific identification, the March 9 sale consisted of 80 units from beginning inventory and 340 units from the March 5 purchase; the March 29 sale consisted of 40 units from the March 18 purchase and 120 units from the March 25 purchase.)

D

Required

Compute cost of goods available for sale and the number of units available for sale.

Compute the number of units in ending inventory.

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to dollars and cents.)

Check (3) Ending Inventory: FIFO, $14,800; LIFO, $13,680, WA, $14,352

(4) LIFO gross profit, $17,980

Compute gross profit earned by the company for each of the four costing methods in part 3.

Problem 6-2AA

Periodic: Alternative cost flows P1

Refer to the information in Problem 6-1A and assume the periodic inventory system is used.

Required

Compute cost of goods available for sale and the number of units available for sale.

Compute the number of units in ending inventory.

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to dollars and cents.)

Compute gross profit earned by the company for each of the four costing methods in part 3.

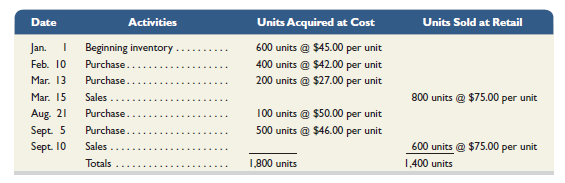

Problem 6-3A

Perpetual: Alternative cost flows P1

Information: Montoure Company uses a perpetual inventory system. It entered into the following calendar-year 2013 purchases and sales transactions. (For specific identification, units sold consist of 600 units from beginning inventory, 300 from the February 10 purchase, 200 from the March 13 purchase, 50 from the August 21 purchase, and 250 from the September 5 purchase.)

D

Page 265

Required

Compute cost of goods available for sale and the number of units available for sale.

Compute the number of units in ending inventory.

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to dollars and cents.)

Check (3) Ending inventory: FIFO, $18,400; LIFO, $18,000; WA, $17,760;

(4) LIFO gross profit, $45,800

Compute gross profit earned by the company for each of the four costing methods in part 3.

Analysis Component

If the company's manager earns a bonus based on a percent of gross profit, which method of inventory costing will the manager likely prefer?

Problem 6-4AA

Periodic: Alternative cost flows P1

Refer to the information in Problem 6-3A and assume the periodic inventory system is used.

Required

Compute cost of goods available for sale and the number of units available for sale.

Compute the number of units in ending inventory.

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to dollars and cents.)

Compute gross profit earned by the company for each of the four costing methods in part 3.

Analysis Component

If the company's manager earns a bonus based on a percentage of gross profit, which method of inventory costing will the manager likely prefer?

Problem 6-5A

Lower of cost or market P2

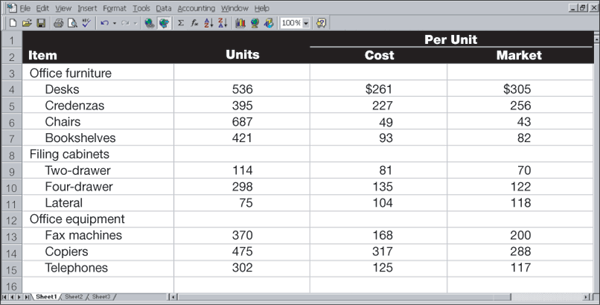

A physical inventory of Liverpool Company taken at December 31 reveals the following.

D

Required

Calculate the lower of cost or market for the inventory applied separately to each item.

Check (1) $273,054

If the market amount is less than the recorded cost of the inventory, then record the LCM adjustment to the Merchandise Inventory account.

Page 266

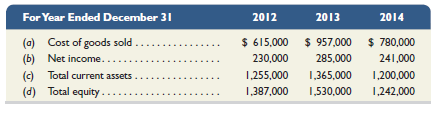

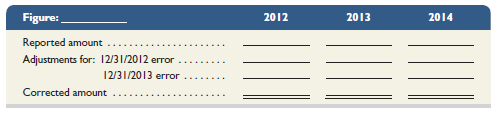

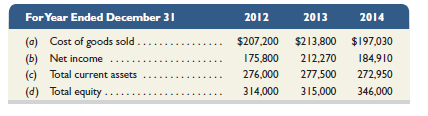

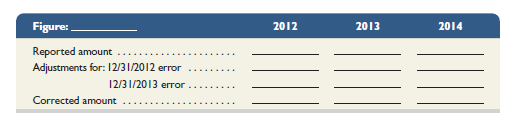

Problem 6-6A

Analysis of inventory errors A2

Navajo Company's financial statements show the following. The company recently discovered that in making physical counts of inventory, it had made the following errors: Inventory on December 31, 2012, is understated by $56,000, and inventory on December 31, 2013, is overstated by $20,000.

D

Required

For each key financial statement figure — (a), (b), (c), and (d) above — prepare a table similar to the following to show the adjustments necessary to correct the reported amounts.

D

Check (1) Corrected net income: 2012, $286,000; 2013, $209,000; 2014, $261,000

Analysis Component

What is the error in total net income for the combined three-year period resulting from the inventory errors? Explain.

Explain why the understatement of inventory by $56,000 at the end of 2012 results in an understatement of equity by the same amount in that year.

Problem 6-7AA

Periodic: Alternative cost flows P3

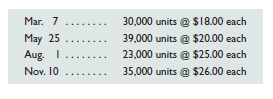

Information: Seminole Company began year 2013 with 23,000 units of product in its January 1 inventory costing $15 each. It made successive purchases of its product in year 2013 as follows. The company uses a periodic inventory system. On December 31, 2013, a physical count reveals that 40,000 units of its product remain in inventory.

D

Required

Compute the number and total cost of the units available for sale in year 2013.

Compute the amounts assigned to the 2013 ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted average. (Round all amounts to dollars and cents.)

Check (2) Cost of goods sold: FIFO, $2,115,000; LIFO, $2,499,000; WA, $2,310,000

Problem 6-8AA

Periodic: Income comparisons and cost flows A1 P3

Information: QP Corp. sold 4,000 units of its product at $50 per unit in year 2013 and incurred operating expenses of $5 per unit in selling the units. It began the year with 700 units in inventory and made successive purchases of its product as follows.

D

Page 267

Required

Prepare comparative income statements similar to Exhibit 6.8 for the three inventory costing methods of FIFO, LIFO, and weighted average. (Round all amounts to dollars and cents.) Include a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system, and its income tax rate is 40%.

Check (1) Net income: FIFO, $61,200; LIFO, $57,180; WA, $59,196

How would the financial results from using the three alternative inventory costing methods change if the Company had been experiencing declining costs in its purchases of inventory?

What advantages and disadvantages are offered by using (a) LIFO and (b) FIFO? Assume the continuing trend of increasing costs.

Problem 6-9AB

Retail inventory method P4

The records of Alaska Company provide the following information for the year ended December 31.

D

Required

Use the retail inventory method to estimate the company's year-end inventory at cost.

Check (1) Inventory, $924,182 cost;

(2) Inventory shortage at cost, $36,873

A year-end physical inventory at retail prices yields a total inventory of $1,686,900. Prepare a calculation showing the company's loss from shrinkage at cost and at retail.

Problem 6-10AB

Gross profit method P4

Wayward Company wants to prepare interim financial statements for the first quarter. The company wishes to avoid making a physical count of inventory. Wayward's gross profit rate averages 34%. The following information for the first quarter is available from its records.

January 1 beginning inventory |

302,580 $ |

Cost of goods purchased |

941,040 |

Sales |

1,211,160 |

Sales returns |

8,410 |

D

Required

Use the gross profit method to estimate the company's first quarter ending inventory.

Check Estimated ending inventory, $449,805

PROBLEM SET B

Problem 6-1B

Perpetual: Alternative cost flows P1

Information: TDS Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for April. (For specific identification, the April 9 sale consisted of 8 units from beginning inventory and 27 units from the April 6 purchase; the April 30 sale consisted of 12 units from beginning inventory 3 units from the April 6 purchase and 10 units from the April 25 purchase.)

D

Page 268

Required

Compute cost of goods available for sale and the number of units available for sale.

Compute the number of units in ending inventory.

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to dollars and cents.)

Compute gross profit earned by the company for each of the four costing methods in part 3.

Check (3) Ending inventory: FIFO, $24,000; LIFO, $15,000; WA, $20,000;

(4) LIFO gross profit, $549,500

Problem 6-2BA

Periodic: Alternative cost flows P1

Refer to the information in Problem 6-1B and assume the periodic inventory system is used.

Required

Compute cost of goods available for sale and the number of units available for sale.

Compute the number of units in ending inventory.

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to dollars and cents.)

Compute gross profit earned by the company for each of the four costing methods in part 3.

Problem 6-3B

Perpetual: Alternative cost flows P1

Information: Aloha Company uses a perpetual inventory system. It entered into the following calendar-year 2013 purchases and sales transactions. (For specific identification, the May 9 sale consisted of 80 units from beginning inventory and 100 units from the May 6 purchase; the May 30 sale consisted of 200 units from the May 6 purchase and 100 units from the May 25 purchase.)

D

Required

Compute cost of goods available for sale and the number of units available for sale.

Compute the number of units in ending inventory.

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to dollars and cents.)

Compute gross profit earned by the company for each of the four costing methods in part 3.

Check (3) Ending inventory: FIFO, $88,800; LIFO, $62,500; WA, $75,600;

(4) LIFO gross profit, $449,200

Analysis Component

If the company's manager earns a bonus based on a percent of gross profit, which method of inventory costing will the manager likely prefer?

Problem 6-4BA

Periodic: Alternative cost flows P1

Refer to the information in Problem 6-3B and assume the periodic inventory system is used.

Required

Compute cost of goods available for sale and the number of units available for sale.

Compute the number of units in ending inventory.

Compute the cost assigned to ending inventory using (a) FIFO, (b) LIFO, (c) weighted average, and (d) specific identification. (Round all amounts to dollars and cents.)

Compute gross profit earned by the company for each of the four costing methods in part 3.

Analysis Component

If the company's manager earns a bonus based on a percentage of gross profit, which method of inventory costing will the manager likely prefer?

Page 269

Problem 6-5B

Lower of cost or market P2

A physical inventory of Office Necessities taken at December 31 reveals the following.

D

Required

Compute the lower of cost or market for the inventory applied separately to each item.

Check (1) $580,054

If the market amount is less than the recorded cost of the inventory, then record the LCM adjustment to the Merchandise Inventory account.

Problem 6-6B

Analysis of inventory errors A2

Hallam Company's financial statements show the following. The company recently discovered that in making physical counts of inventory, it had made the following errors: Inventory on December 31, 2012, is overstated by $18,000, and inventory on December 31, 2013, is understated by $26,000.

D

Required

For each key financial statement figure — (a), (b), (c), and (d) above — prepare a table similar to the following to show the adjustments necessary to correct the reported amounts.

D

Check (1) Corrected net income: 2012, $157,800; 2013, $256,270; 2014, $158,910

Analysis Component

What is the error in total net income for the combined three-year period resulting from the inventory errors? Explain.

Explain why the overstatement of inventory by $18,000 at the end of 2012 results in an overstatement of equity by the same amount in that year.

Page 270

Problem 6-7BA

Periodic: Alternative cost flows P3

Information: Seneca Co. began year 2013 with 6,500 units of product in its January 1 inventory costing $35 each. It made successive purchases of its product in year 2013 as follows. The company uses a periodic inventory system. On December 31, 2013, a physical count reveals that 8,500 units of its product remain in inventory.

D

Required

Compute the number and total cost of the units available for sale in year 2013.

Check (2) Cost of goods sold: FIFO, $1,328,700; LIFO, $1,266,500; WA, $1,294,800

Compute the amounts assigned to the 2013 ending inventory and the cost of goods sold using (a) FIFO, (b) LIFO, and (c) weighted average. (Round all amounts to dollars and cents.)

Problem 6-8BA

Periodic: Income comparisons and cost flows A1 P3

Information: Shepard Company sold 4,000 units of its product at $100 per unit in year 2013 and incurred operating expenses of $15 per unit in selling the units. It began the year with 840 units in inventory and made successive purchases of its product as follows.

D

Required

Check (1) Net income: LIFO, $52,896; FIFO, $57,000; WA, $55,200

Prepare comparative income statements similar to Exhibit 6.8 for the three inventory costing methods of FIFO, LIFO, and weighted average. (Round all amounts to dollars and cents.) Include a detailed cost of goods sold section as part of each statement. The company uses a periodic inventory system, and its income tax rate is 40%.

How would the financial results from using the three alternative inventory costing methods change if the company had been experiencing decreasing prices in its purchases of inventory?

What advantages and disadvantages are offered by using (a) LIFO and (b) FIFO? Assume the continuing trend of increasing costs.

Problem 6-9BB

Retail inventory method P4

The records of Macklin Co. provide the following information for the year ended December 31.

D

Required

Use the retail inventory method to estimate the company's year-end inventory.

Check (1) Inventory, $66,555 cost; (2) Inventory shortage at cost, $12,251.25

A year-end physical inventory at retail prices yields a total inventory of $80,450. Prepare a calculation showing the company's loss from shrinkage at cost and at retail.

Problem 6-10BB

Gross profit method P4

Otingo Equipment Co. wants to prepare interim financial statements for the first quarter. The company wishes to avoid making a physical count of inventory. Otingo's gross profit rate averages 35%. The following information for the first quarter is available from its records.

January 1 beginning inventory |

802,880 $ |

Cost of goods purchased |

2,209,636 |

Sales |

3,760,260 |

Sales returns |

79,300 |

D

Page 271

Required

Use the gross profit method to estimate the company's first quarter ending inventory.

Check Estim. ending inventory, $619,892

SERIAL PROBLEM

Success Systems P2 A3

(This serial problem began in Chapter 1 and continues through most of the book. If previous chapter segments were not completed, the serial problem can begin at this point.)

SP 6

Part A

Adria Lopez of Success Systems is evaluating her inventory to determine whether it must be adjusted based on lower of cost or market rules. Her company has three different types of software in its inventory and the following information is available for each.

D

Required

Compute the lower of cost or market for ending inventory assuming Lopez applies the lower of cost or market rule to inventory as a whole. Must Lopez adjust the reported inventory value? Explain.

Assume that Lopez had instead applied the lower of cost or market rule to each product in inventory. Under this assumption, must Lopez adjust the reported inventory value? Explain.

Part B

Selected accounts and balances for the three months ended March 31, 2014, for Success Systems follow.

January 1 beginning inventory |

0 $ |

Cost of goods sold |

14,052 |

March 31 ending inventory |

704 |

D

Required

Compute inventory turnover and days' sales in inventory for the three months ended March 31, 2014.

Assess the company's performance if competitors average 15 times for inventory turnover and 29 days for days' sales in inventory.

Beyond the Numbers

REPORTING IN ACTIONC2 A3

BTN 6-1 Refer to Polaris' financial statements in Appendix A to answer the following.

Required

What amount of inventories did Polaris report as a current asset on December 31, 2011? On December 31, 2010?

Inventories represent what percent of total assets on December 31, 2011? On December 31, 2010?

Comment on the relative size of Polaris' inventories compared to its other types of assets.

What accounting method did Polaris use to compute inventory amounts on its balance sheet?

Compute inventory turnover for fiscal year ended December 31, 2011, and days' sales in inventory as of December 31, 2011.

Page 272

Fast Forward

Access Polaris' financial statements for fiscal years ended after December 31, 2011, from its Website (Polaris.com) or the SEC's EDGAR database (www.SEC.gov). Answer questions 1 through 5 using the current Polaris information and compare results to those prior years.

COMPARATIVE ANALYSISA3

BTN 6-2 Comparative figures for Polaris and Arctic Cat follow.

D

Required

Compute inventory turnover for each company for the most recent two years shown.

Compute days' sales in inventory for each company for the three years shown.

Comment on and interpret your findings from parts 1 and 2. Assume an industry average for inventory turnover of 5.

ETHICS

CHALLENGEA1 ![]()

BTN 6-3 Golf Challenge Corp. is a retail sports store carrying golf apparel and equipment. The store is at the end of its second year of operation and is struggling. A major problem is that its cost of inventory has continually increased in the past two years. In the first year of operations, the store assigned inventory costs using LIFO. A loan agreement the store has with its bank, its prime source of financing, requires the store to maintain a certain profit margin and current ratio. The store's owner is currently looking over Golf Challenge's preliminary financial statements for its second year. The numbers are not favorable. The only way the store can meet the required financial ratios agreed on with the bank is to change from LIFO to FIFO. The store originally decided on LIFO because of its tax advantages. The owner recalculates ending inventory using FIFO and submits those numbers and statements to the loan officer at the bank for the required bank review. The owner thankfully reflects on the available latitude in choosing the inventory costing method.

Required

How does Golf Challenge's use of FIFO improve its net profit margin and current ratio?

Is the action by Golf Challenge's owner ethical? Explain.

COMMUNICATING IN PRACTICEA1

BTN 6-4 You are a financial adviser with a client in the wholesale produce business that just completed its first year of operations. Due to weather conditions, the cost of acquiring produce to resell has escalated during the later part of this period. Your client, Javonte Gish, mentions that because her business sells perishable goods, she has striven to maintain a FIFO flow of goods. Although sales are good, the increasing cost of inventory has put the business in a tight cash position. Gish has expressed concern regarding the ability of the business to meet income tax obligations.

Required

Prepare a memorandum that identifies, explains, and justifies the inventory method you recommend your client, Ms. Gish, adopt.

Page 273

TAKING

IT TO THE NETA3

![]()

BTN 6-5 Access the September 24, 2011, 10-K report for Apple, Inc. (Ticker AAPL), filed on October 26, 2011, from the EDGAR filings at www.SEC.gov.

Required

What products are manufactured by Apple?

What inventory method does Apple use? (Hint: See the Note 1 to its financial statements.)

Compute its gross margin and gross margin ratio for the 2011 fiscal year. Comment on your computations—assume an industry average of 40% for the gross margin ratio.

Compute its inventory turnover and days' sales in inventory for the year ended September 24, 2011. Comment on your computations—assume an industry average of 40 for inventory turnover and 9 for days' sales in inventory.

TEAMWORK IN ACTIONA1 P1

BTN 6-6 Each team member has the responsibility to become an expert on an inventory method. This expertise will be used to facilitate teammates' understanding of the concepts relevant to that method.

Each learning team member should select an area for expertise by choosing one of the following inventory methods: specific identification, LIFO, FIFO, or weighted average.

Form expert teams made up of students who have selected the same area of expertise. The instructor will identify where each expert team will meet.

Using the following data, each expert team must collaborate to develop a presentation that illustrates the relevant concepts and procedures for its inventory method. Each team member must write the presentation in a format that can be shown to the learning team.

Point: Step 1 allows four choices or areas for expertise. Larger teams will have some duplication of choice, but the specific identification method should not be duplicated.

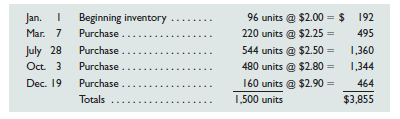

Data

The company uses a perpetual inventory system. It had the following beginning inventory and current year purchases of its product.

D

The company transacted sales on the following dates at a $350 per unit sales price.

D

Concepts and Procedures to Illustrate in Expert Presentation

Identify and compute the costs to assign to the units sold. (Round per unit costs to three decimals.)

Identify and compute the costs to assign to the units in ending inventory. (Round inventory balances to the dollar.)

How likely is it that this inventory costing method will reflect the actual physical flow of goods? How relevant is that factor in determining whether this is an acceptable method to use?

What is the impact of this method versus others in determining net income and income taxes?

How closely does the ending inventory amount reflect replacement cost?

4.

Re-form learning teams. In rotation, each expert is to present to the team the presentation developed in part 3. Experts are to encourage and respond to questions.

Page 274

ENTREPRENEURIAL DECISIONA3

BTN 6-7 Review the chapter's opening feature highlighting Derick Pearson and Felecia Hatcher and their company, Feverish Ice Cream. Assume that Feverish Ice Cream consistently maintains an inventory level of $30,000, meaning that its average and ending inventory levels are the same. Also assume its annual cost of sales is $120,000. To cut costs, Derick and Felecia propose to slash inventory to a constant level of $15,000 with no impact on cost of sales. They plan to work with suppliers to get quicker deliveries and to order smaller quantities more often.

Required

Compute the company's inventory turnover and its days' sales in inventory under (a) current conditions and (b) proposed conditions.

Evaluate and comment on the merits of their proposal given your analysis for part 1. Identify any concerns you might have about the proposal.

HITTING THE ROADC1 C2

BTN 6-8 Visit four retail stores with another classmate. In each store, identify whether the store uses a bar-coding system to help manage its inventory. Try to find at least one store that does not use bar-coding. If a store does not use bar-coding, ask the store's manager or clerk whether he or she knows which type of inventory method the store employs. Create a table that shows columns for the name of store visited, type of merchandise sold, use or nonuse of bar-coding, and the inventory method used if bar-coding is not employed. You might also inquire as to what the store's inventory turnover is and how often physical inventory is taken.

GLOBAL DECISIONA3

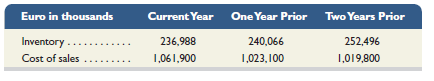

BTN 6-9 Following are key figures (Euro in thousands) for Piaggio (www.piaggio.com), which is a leading manufacturer of two-, three- and four-wheel vehicles, and is Europe's leading manufacturer of motorcycles and scooters.

D

Required

Use these data and those from BTN 6-2 to compute (a) inventory turnover and (b) days' sales in inventory for the most recent two years shown for Piaggio, Polaris, and Arctic Cat.

Comment on and interpret your findings from part 1.

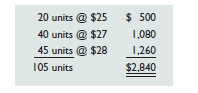

ANSWERS TO MULTIPLE CHOICE QUIZ

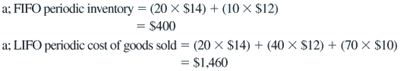

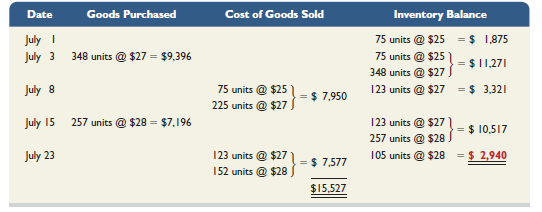

a; FIFO perpetual

D

Page 275

b; LIFO perpetual

D

e; Specific identification (perpetual & periodic are identical)—Ending inventory computation.

D

a; FIFO periodic—Ending inventory computation.

105

units @ $28 each = ![]() ;

The FIFO periodic inventory computation is identical to the FIFO

perpetual inventory computation (see question 1).

;

The FIFO periodic inventory computation is identical to the FIFO

perpetual inventory computation (see question 1).

D

D