- •Introduction

- •Concepts and kinds of bankruptcy

- •Essence and principles of anti-recessionary management

- •1.3 Methodology of forecasting of probability of bankruptcy of the enterprise.

- •Income from realization

- •2.1 The economic characteristic and an estimation of a financial condition of joint-stock company “National Bank rk”

- •2.2 The analysis of financial stability, liquidity and solvency of jsс “Halyk Bank Republic Of Kazakhstan”

- •3.1 Perfection of system of diagnostics of bankruptcy of the enterprise

- •3.2 Prospects of development of anti-recessionary management at threat of bankruptcy

- •Conclusion

- •The list of the references

Essence and principles of anti-recessionary management

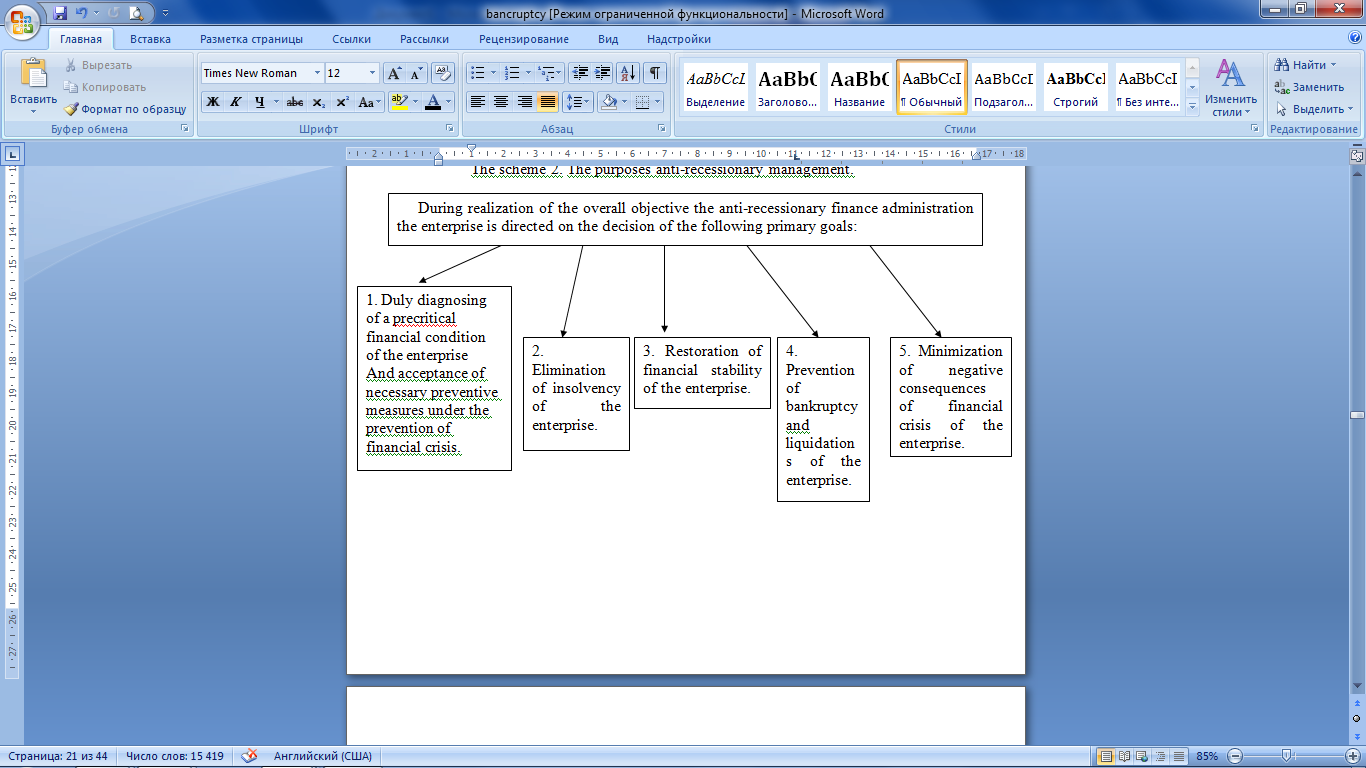

The anti-recessionary finance administration is directed on the prevention and overcoming of financial crises of the enterprise, and also minimization of their negative financial consequences. An overall objective of an anti-recessionary finance administration is restoration of financial balance and minimization of the sizes of decrease in its market cost. This system is under construction on following basic stages. The anti-recessionary finance administration represents system of principles and methods of development and realization of a complex of the special administrative decisions directed on the prevention and overcoming of financial crises of the enterprise, and also minimization of their negative financial consequences. An overall objective of an anti-recessionary finance administration is restoration of financial balance of the enterprise and minimization of the sizes of decrease in its market cost, caused by financial crises. During realization of the overall objective the anti-recessionary finance administration the enterprise is directed on the decision of the following primary goals:

Duly diagnosing a precritical financial condition of the enterprise and acceptance of necessary preventive measures under the prevention of financial crisis. This problem is realized by realization of constant monitoring a financial condition of the enterprise and the factors of the external financial environment rendering the most essential influence on results of financial activity. Diagnostics of a precritical financial condition of the enterprise by results of such monitoring in many cases allows to avoid financial crisis due to realization of preventive protective measures or, at least, it is essential to soften character of its subsequent course

Figire 2 - The purposes anti-recessionary management.

Note – Compiled by author on the basis of J. Mart

Acceptance of preventive measures under the prevention of financial crisis of the enterprise is the most economic direction of the anti-recessionary finance administration providing the greatest effect (in the form of decrease in forthcoming losses) on unit of the financial resources spent in these purposes. [19, page 134].

Elimination of insolvency of the enterprise. This problem is the most urgent in system of problems. In some cases realization only this problem allows to stop a deepening of financial crisis of the enterprise, to restore its image among economic partners and to receive a necessary stock of time for realization of other actions. At the same time, it is necessary to remember, that infringement of solvency it only one of external symptoms of display of financial crises of the enterprise, therefore elimination of insolvency should be carried out not so much due to liquidation of symptoms, how many by elimination of their reasons.

Restoration of financial stability of the enterprise. It is one of the primary goals providing realization of an overall objective, demanding greatest efforts and expenses of financial resources. Realization of this problem is carried out by stage-by-stage structural reorganization of all financial activity of the enterprise. During such financial re-structuring the enterprise optimization of structure of the capital, turnaround actives and monetary streams first of all is provided, and on occassion to decrease its investment activity.

Prevention of bankruptcy and liquidation of the enterprise. Such problem faces to a finance administration at diagnosing deep or catastrophic system financial crisis. As a rule, internal mechanisms of financial stabilization and volume of own resources of the enterprise appear insufficient for overcoming such financial crisis. Therefore for prevention of bankruptcy and liquidation of the enterprise effective its external sanitation (with development of the corresponding investment project of sanitation) should be provided.

Minimization of negative consequences of financial crisis of the enterprise.

This problem is realized by fastening positive results of a conclusion of the enterprise from a condition of financial crisis and stabilization of qualitative structural transformations of its financial activity in view of long-term prospect. Efficiency of actions on overcoming negative consequences is estimated by criterion of minimization of losses of market cost of the enterprise in comparison to a pre-crisis level.

Overall objective of an anti-recessionary finance administration is restoration of financial balance of the enterprise and minimization of the sizes of decrease in its market cost, caused by financial crises. The system of an anti-recessionary finance administration is based on the certain principles. [20, page 87].

1. A principle of constant readiness of reaction. The theory of an anti-recessionary finance administration approves, that achieved as a result of effective financial management financial balance of the enterprise very much changeable in dynamics. Its possible change at any stage of economic development of the enterprise is defined by the natural response to changes of external and internal conditions of its economic activities. A number of these changes strengthen a competitive position of the enterprise, raise its financial potential and market cost; others - on the contrary, cause the crisis phenomena in its financial development. Objectivity of display of these conditions in dynamics (i.e. objective probability of occurrence of financial crises of the enterprise) define necessity of maintenance of constant readiness of financial managers to possible infringement of financial balance of the enterprise at any stage of its economic development.

2. A principle prevention actions. This principle assumes, that it is better to prevent threat of financial crisis, than to carry out its sanction and to provide neutralization of its negative consequences. Realization of this principle is provided with early diagnostics of a precritical financial condition of the enterprise and duly use of opportunities of neutralization of financial crisis. In this case the anti-recessionary finance administration uses methodology «managements on weak signals «.

3. A principle of promptness of reaction. Each of negative displays of financial crisis not only tends to expansion with each new economic cycle of the enterprise, but also generates new negative financial consequences accompanying it. Therefore the earlier anti-recessionary financial mechanisms on each diagnosed crisis symptom will be included, the greater opportunities on restoration of the broken balance the enterprise will have.

4. A principle of adequacy of reaction. The used system of financial mechanisms on neutralization or the sanction of financial crisis in an overwhelming part is connected with expenses of financial resources or the losses connected with non-realized opportunities (caused by reduction of volumes of operational activity, stay of realization of investment projects, etc.). Thus the level of these expenses and losses is in direct dependence on purposefulness of financial mechanisms of such neutralization and scales of their use. Therefore "inclusion" of separate mechanisms of neutralization of threat of financial crisis and its sanction should start with a real level of such threat and to be adequate to this level.

5. A principle of integrated approach of accepted decisions. Practically each financial crisis of the enterprise on sources of factors generating it, and accordingly and under forms of display of the negative consequences has complex character. Similar complex character should carry system of developed and sold anti-recessionary actions.

6. A principle of alternativeness of actions. This principle assumes, that each of accepted anti-recessionary financial decisions should be based on consideration of the greatest possible number of their alternative projects with definition of a level of their productivity and an estimation of expenses.

7. A principle of adaptibility of management. During development of financial crisis factors generating it are characterized by usually high dynamics. It predetermines necessity of a high level of flexibility of an anti-recessionary finance administration, its fast adaptation to varying conditions of the external and internal financial environment.

8. A principle priorit uses of internal resources. During anti-recessionary management, especially at early stages of diagnostics of financial crisis, the enterprise should count mainly on internal financial opportunities of its neutralization. In this case the enterprise can avoid loss of controllability and procedures of the external control of the financial activity.

9. A principle of an optimality of external sanitation. The principle of an optimality of external sanitation assumes, that at a choice of its forms and structure external sanator it is necessary to start with system of the certain criteria developed during an anti-recessionary finance administration. Such criteria can be preservation of operation of business by its initial founders, minimization of loss of market cost of the enterprise and others.

10. A principle of efficiency. Realization of this principle is provided with comparison of effect of an anti-recessionary finance administration and its actions of financial resources connected with realization [21, page 757].