- •In many cases it is not up to owners to undertake these decisions – rather to managers.

- •Initial sale of shares called flotation or ipo

- •Various forms in practice. There is no right or wrong structure, provided that it reflect the needs of company and allows to communicate and work effectively and achieve business objectives.

- •Informal

- •Integrated international enterprise – international company pursues a single business strategy – coordinates activities of various other subsidiaries accross different countries.

- •Various difficulties in translation of physical assets into numbers …..

- •Investment sites on the web

- •Inventory accounting: fifo (first-in, first-out) or other methods to determine inventory value?

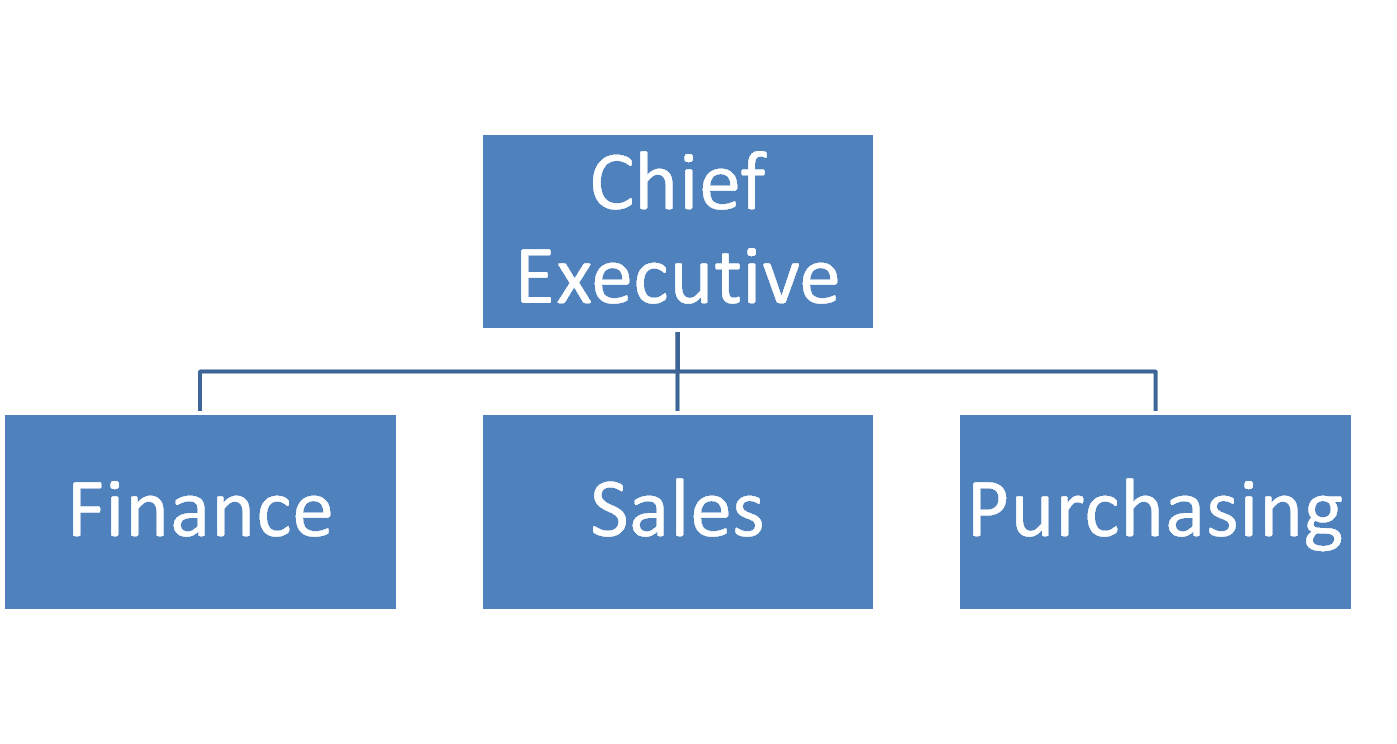

Hierarchical (follow)

Matrix – based around tasks or projects and involve creation of team that include required specialists

Entrepreneurial structures – for small business – core team of decision makers is supported by a number of general employees with little or no decision-making power.

Informal

U(unitary)-form

U-form

One in which the central organization of the firm (CEO or management board) is responsible both for the firm’s day-to-day operations and for formulating its business strategy.

Communication relies on the central part.

Often inefficient as problems with bounded rationality – limits in ability to absorb and process information by management.

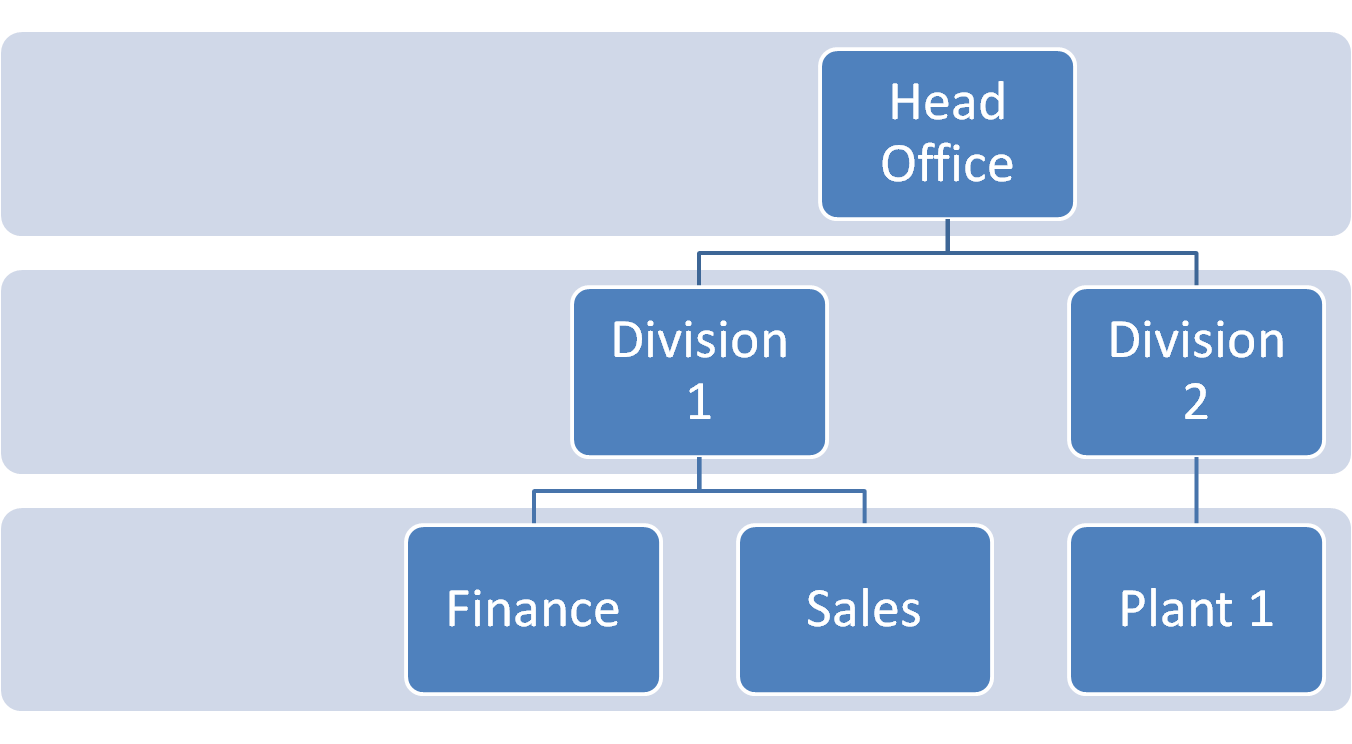

M-form

One in which the business is organized into separate departments, such that responsibility for the day-to-day management is separated from the formulation of business’s strategic plan.

Medium to large firms

Advantages:

Reduced length of information flows

CEO can concentrate on overall planning

Enhanced level of control – each division may become „mini-firm” competing with other – when introducing properly designed budgeting and controlling procedures

Flat organization

One in which technology enables senior managers to communicate directly with those lower in the organizational structure. Middle managers are bypassed.

Problems similar as with U-form:

Communication cost (now lower)

Misinterpretation of information or decisions

Managers may focus on their own departmental goals rather than overall goals of the company.

Multinationals

H-form (or holding company) – variation of M-structure. Parent company holds interest in a number of other companies or subsidiaries. These subsidiaries can in turn control other companies.

Integrated international enterprise – international company pursues a single business strategy – coordinates activities of various other subsidiaries accross different countries.

Transnational associations

A form of business in which the subsidiaries (often with little investment from the parent company) are contractually bound to the parent company to provide output to or receive inputs from other subsidiaries.

Global sourcing – company uses production sites in different part of the world to provide particular component for a final product.

Business plan

Business plan is a document compiled in order to plan for the future, allocate resources, identify key decisions and prepare for problems and opportunities.

Purposes:

help for plan the future by thinking carefully about business and commiting information and ideas to paper. This helps understand market better.

Present a request of extra funding (banks etc)

Planning tool – check on progress.

Wikipedia: A business plan is a formal statement of a set of business goals, the reasons why they are believed attainable, and the plan for reaching those goals. It may also contain background information about the organization or team attempting to reach those goals.

No strict rules on how to organise/design

However, some issues are indispensable!

What must be included?

Goals/vision

Market/competition

Product

Marketing/sales

Operations

Financials

Often opening page: executive summary (one/two pages in lenght)

Suggested order of content

Executive summary

Business description (start date, type of business, legal structure, vision of future)

Product/service (how different from competitors, benefits for customers, product/service development, info on copyrights, designs or trademarks)

Market analysis (market – size, growth, customer-who they are and where they are, competition – who, strengths and weaknesses, the future – how might market change)

Strategy and implementation – key decisions including pricing, promotion, sales strategies and on side of production: location, technology, systems – IT, financial management, stock control etc.

Management team: key members skills and experience, data on other employees, structure and salaries

Financial plan: financial statements and their forecast, key financial ratios, assumptions made in putting financial forecast together.

Who can help?

Business advisors (e.g. www.businesslink.co.uk, bytestart.co.uk)

Accountants and bank managers

Government agencies (e.g. www.parp.gov.pl)

Resources required for b-p:

Time

Determination

Vision

Numbers

Planning

Rationale behind financial statements

Pieces of paper with numbers – but what is behind?

Historically, development of specialization leaded to creation of loan (merchant lending and then banking) as a aid in business expansion.

Eventually production more and more complex so that lenders could not physically inspect all borrowers assets and judge on default risk. Also some investment on the basis of profit sharing.

So profits had to be determined accurately. Moreover: owners needed to see how effective is their business.

Currently:

Owners (and lenders need) financial information to make decisions,

managers to operate efficiently,

government to learn on economic performance

and to tax L