кейси для індивідуальної роботи 2014 н.р. / METRO AG IN RETAILING (WORLD)

.pdf

METRO AG IN RETAILING (WORLD)

February 2012

SCOPE OF THE REPORT

Scope

All values expressed in this report are in US dollar terms, using a fixed exchange rate (2011). 2011 figures are based on part-year estimates.

All forecast data are expressed in constant terms; inflationary effects are discounted. Conversely, all historical data are expressed in current terms; inflationary effects are taken into account.

Please note: the cash-and-carry business of Metro AG is not included in Euromonitor International’s retailing database, which is why this channel does not appear here.

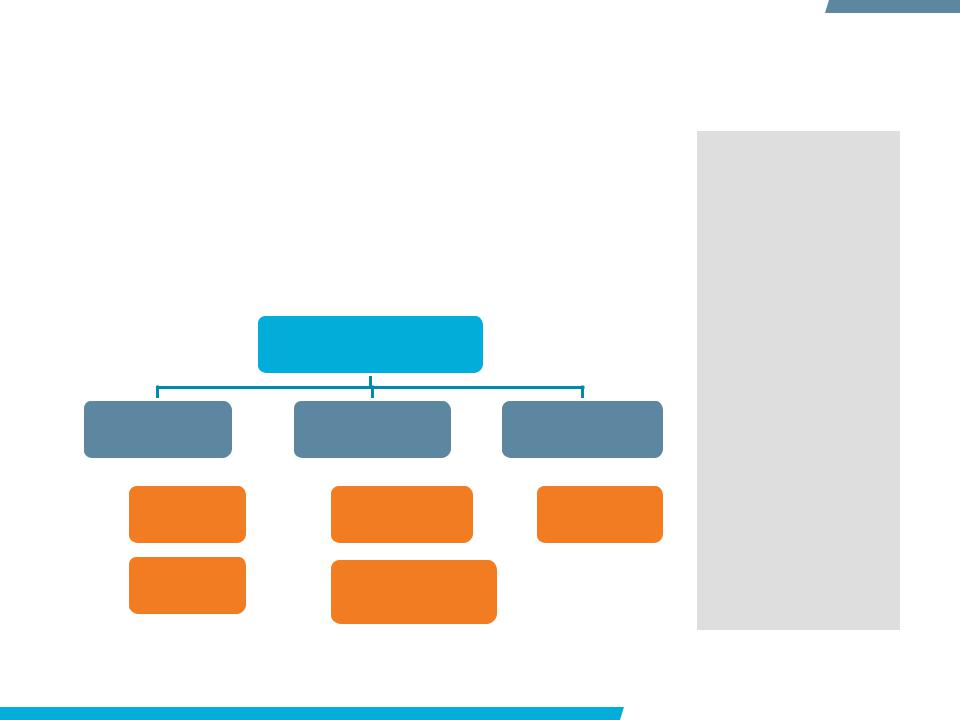

Retailing

Grocery Retailers |

Non-Grocery |

Non-Store retailing |

|||||

|

Retailers |

||||||

|

|

|

|

|

|

|

|

|

|

Convenience |

|

Department |

|

|

Internet |

|

|

|

|

|

|||

|

|

Stores |

|

Stores |

|

|

retailing |

|

|

Hypermarkets |

|

Electronics and |

|

|

|

|

|

|

Appliance Specialist |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retailers |

|

|

|

Disclaimer

Much of the information in this briefing is of a statistical nature and, while every attempt has been made to ensure accuracy and reliability, Euromonitor International cannot be held responsible for omissions or errors.

Figures in tables and analyses are calculated from unrounded data and may not sum. Analyses found in the briefings may not totally reflect the companies’ opinions, reader discretion is advised.

Metro’s core retailing channels, electronics and appliance specialists (Media Markt/Saturn) and hypermarkets (Real), faced a slowdown in growth in Germany as well as in key European markets. However, its recent foray into internet retailing could boost sales. Expansion prospects in Eastern Europe and Asia Pacific remain strong. Beyond retailing, the group’s growing global reach will be supported by the rapid growth of its cash-and- carry division in large emerging markets.

© Euromonitor International |

RETAILING: METRO AG |

PASSPORT 2 |

STRATEGIC EVALUATION

COMPETITIVE POSITIONING

DOMESTIC STRATEGY

INTERNATIONAL STRATEGY

MULTI-CHANNEL STRATEGY

BRAND AND PRIVATE LABEL STRATEGIES OPERATIONS

OPPORTUNITIES AND RECOMMENDATIONS

STRATEGIC EVALUATION

Key company facts

With a less than 1% share of world retailing sales in 2011, Metro is a smaller retailer than key direct European rivals, such as Carrefour and Schwarz.

Expressed in US dollar terms, Metro’s retailing sales, which exclude cash-and-carry, are expected to grow by 4% in 2011, following a 2% decline in 2010, which was mostly due to unfavourable exchange rates.

Sales down slightly in 2011; operating profit stable

For 2011, Metro’s revenues fell by 1% to €66.7 billion, compared to a 3% increase in 2010. Sales in Germany declined by 1% to €25.9 billion, and international sales also fell by 1%, to €40.8 billion.

Among Metro’s main rivals, Carrefour recorded sales of €91.5 billion in 2011, up by 1%, and privately-owned Schwarz, which operates the Kaufland and Lidl banners, saw revenues in the year ending February 2011 rise by almost 10%, to €60 billion.

Metro expects operating profit to fall slightly to around €2.4 billion. This result would see its operating margin remain stable at 3.6% in 2011, a level well above Carrefour‘s margin, which is expected to fall from 1.8% to around 1.5% in 2011.

Metro AG

Headquarters Germany

Regional involvement Western Europe, Eastern Europe, Asia Pacific

Hypermarkets, department stores, electronics and

Category involvement appliance specialist retailers, convenience stores, internet retailing

World retailing value |

0.4% (2010) – 0.4% (2011) |

|

|||

share (2010-2011) |

|

||||

|

|

|

|||

World retailing value |

-1.7% (2010) – 4.4% (2011) |

||||

growth (US$) |

|||||

|

|

|

|||

|

Metro AG: Revenue vs Operating Profit |

|

|||

2007-2011 |

|

profitOperating- € billion |

|||

Revenue-€billion 60 |

2.0 |

||||

75 |

|

|

2.5 |

|

|

72 |

|

|

2.4 |

|

|

69 |

|

|

2.3 |

|

|

66 |

|

|

2.2 |

|

|

|

|

|

|||

63 |

|

|

2.1 |

|

|

|

|

|

|||

2007 |

2008 |

2009 |

2010 |

2011 |

||

|

|

Revenue |

|

|

Operating profit |

|

|

|

|

|

|||

Notes: Financial year end December. 2011 estimated

© Euromonitor International |

RETAILING: METRO AG |

PASSPORT 4 |

STRATEGIC EVALUATION

Q4 2011 and annual sales down in Europe; strong growth in Asia

The Metro/Makro division’s cash-and-carry operations, outside the scope of Euromonitor International’s retailing coverage, accounted for 47% of the group’s sales, at €31.2 billion in 2011, with sales up marginally. The second largest division, Media Saturn, operating in the electronics and appliance specialist and internet retailing channels, saw sales fall by 1% to €20.6 billion in 2011, reflecting the exit from the French market. It recovered slightly in the last quarter thanks to the opening of new outlets in Eastern Europe and Turkey and growth in internet retailing sales.

Germany and Eastern Europe sales decline slightly

By core geographies, the group’s sales in Germany in 2011 accounted for 39% of revenues in 2011. For the last quarter of 2011, total sales in Germany declined only marginally, with an improved performance for Media Saturn.

Sales in Metro’s Eastern Europe division, which includes

Greece and Turkey, fell by 1% in Q4, an improvement on the 2% fall seen in Q3, as the opening of new cash-and- carry outlets in Poland, Russia and Turkey minimised the negative impact of the low consumer confidence in some markets, notably Poland and Romania. Sales in Asia Pacific, which are almost exclusively through cash-and- carry, continued to see double-digit growth in Q4 2011, driven by new outlet openings, notably in China.

|

Metro AG: Annual Sales 2011 |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Net sales 2011 (World) |

|

€66.7 billion |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-on-year growth (%) |

-0.8 |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Net sales 2011 (Germany) |

|

€25.9 billion |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-on-year growth (%) |

-1.0 |

|

|

|

|

|||||||||

|

|

Metro AG: Quarterly Sales Q4 2011 |

|

||||||||||||

|

|

9.0 |

|

|

|

|

|

|

|

|

|

|

4.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

million€ |

7.5 |

|

|

|

|

|

|

|

|

|

|

2.5 |

growth |

||

|

|

|

|

|

|

|

|

|

|||||||

6.0 |

|

|

|

|

|

|

|

|

|

|

1.0 |

||||

- |

|

|

|

|

|

|

|

|

|

|

y |

||||

4.5 |

|

|

|

|

|

|

|

|

|

|

-0.5 |

||||

sales |

|

|

|

|

|

|

|

|

|

|

y-on- |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Net |

3.0 |

|

|

|

|

|

|

|

|

|

|

-2.0 |

% |

||

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

1.5 |

|

|

|

|

|

|

|

|

|

|

-3.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

0.0 |

|

|

|

|

|

|

|

|

|

|

-5.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Metro |

Real |

Media |

Galeria |

||

Cash & |

|

Saturn |

Kaufhof |

||

Carry |

|

|

|

||

|

|

Net sales |

|

Annual % growth |

|

|

|

|

|||

|

|

|

|||

© Euromonitor International |

RETAILING: METRO AG |

PASSPORT 5 |

STRATEGIC EVALUATION

SWOT: Metro AG

STRENGTHS

Global reach with cash- and-carry; group scale

Metro’s wide global reach in 30 markets includes China, India, Russia and Turkey. It is largely based on cash- and-carry outlets, which give the group a large scale of operations and buying power.

OPPORTUNITIES

Media Markt/Saturn: Low prices for global chain

As the world’s second largest electronics and appliance specialist chain, with a global reach in key emerging markets, Media Markt/Saturn is an efficient player offering lower prices than most smaller retailers.

Further expansion in |

Developing multi-channel |

emerging markets |

synergies |

Metro has strong |

Metro’s acquisition of |

expansion prospects in |

Redcoon and Media |

in existing emerging |

Markt/Saturn’s venture |

markets such as China, |

into internet retailing |

Russia and Turkey, but |

could allow it to boost |

may also enter retailing |

synergies with store- |

in countries where it has |

based sales and give its |

cash-and-carry outlets. |

brands more clout. |

WEAKNESSES

Low growth prospects and margins in Germany

Growth prospects and margins are modest for retailers in the highly competitive German market, notably for department stores and hypermarkets. This ultimately limits global prospects.

THREATS

Internet retailing: Late entry in Western Europe

Metro’s delayed foray into internet retailing for the Media Markt/Saturn brand has left the group trailing rivals in a highgrowth channel for consumer electronics and media products, and it will need to step up investments.

Uncertainty surrounding |

Uncertain economic |

possible divestments |

prospects in Europe |

The possible disposal of The poor economic

department stores and hypermarkets would greatly reduce Metro’s scale of operations and its bargaining power. Uncertainty may lead to strategic paralysis.

outlook of the Eurozone leaves Metro vulnerable to a possible downturn in demand in its core Western European markets, notably for Media Markt/Saturn.

© Euromonitor International |

RETAILING: METRO AG |

PASSPORT 6 |

STRATEGIC EVALUATION

Key challenges: Multi-channel strategy dilemmas; sales slowdown

Department stores and hypermarkets: Disposal on hold, but should this remain on the cards?

Although tentative discussions regarding a disposal of Galeria Kaufhof department stores and Real hypermarkets are on hold, both divisions suffer from low profit, with low margins in Germany particularly affecting Real. However, hypermarkets remain a growth driver in emerging markets, notably in Russia. While Metro’s longer-term core activities may focus on Media Markt/Saturn and Metro/Makro cash-and-carry, this would reduce its global presence and its scale of operations.

Shape 2012 programme delivers strong profits but pressure remains in a difficult environment

With operating profit over the first nine months of 2011 up by 17% to almost €1.1 billion, Metro benefited from the successful implementation of the Shape 2012 programme to decentralise its organisation, cut costs and workforce and improve efficiency and productivity. However, Metro issued a profit warning for 2011 due to poor sales in the last quarter. Olaf Koch, Metro’s CEO since January

2012, will need to continue to cut costs to maintain profits, even if a review of the programme occurs.

Media Markt/Saturn: Slowdown in Europe and intense competition from internet retailers

Facing strong competition on price and choice from internet retailers for consumer electronics and media products in Western Europe, Media Markt/Saturn will rely increasingly on the success of its move into internet retailing, while sustaining expansion in emerging markets, notably China. A negative economic environment in Europe will add pressure for the division to make stores more distinctive in order to gain a competitive advantage.

Developing a multi-channel brand strategy and avoiding cannibalising store-based sales

With the acquisition of the Redcoon pure-play internet retailer in March 2011, Metro made a major move to expand into the channel. However, as it also relies on the Media Markt/Saturn brands for growth in internet retailing, Metro’s brand strategies online risk confusion. It is also struggling with conflicts of interests between boosting internet retailing and hindering store-based sales of Media Markt/Saturn.

© Euromonitor International |

RETAILING: METRO AG |

PASSPORT 7 |

STRATEGIC EVALUATION

COMPETITIVE POSITIONING

DOMESTIC STRATEGY

INTERNATIONAL STRATEGY

MULTI-CHANNEL STRATEGY

BRAND AND PRIVATE LABEL STRATEGIES OPERATIONS

OPPORTUNITIES AND RECOMMENDATIONS

COMPETITIVE POSITIONING

Electronic and appliance specialist and Eastern Europe boost sales

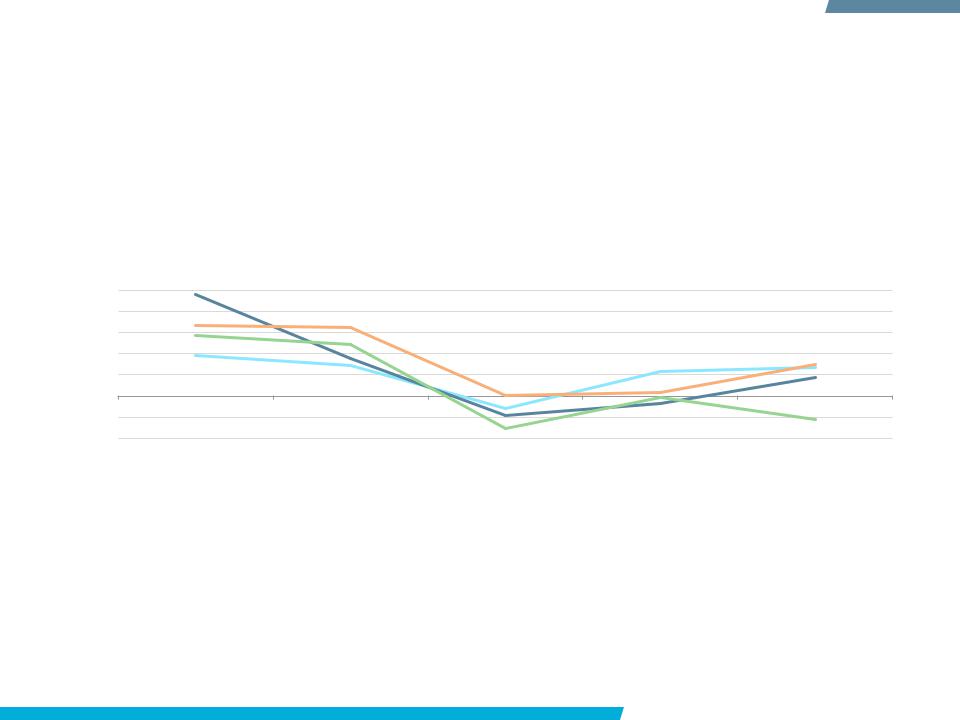

Metro’s sales growth over 2007-2011 was boosted by expansion in Eastern Europe. However, its sales in Germany stagnated, resulting in a steady erosion of its share in the country, especially in grocery retailing. Schwarz continued to see strong sales growth in Eastern Europe in both 2010 and 2011. Over the 20062011 period, Schwarz recorded steady growth in Western Europe, driven by expansion outside Germany. Carrefour’s global sales growth over 2006-2011 was lacklustre, with expansion in major emerging markets such as Argentina, Brazil and China partially offsetting stagnation in France and Italy.

Retailing: Leading Companies vs Global Market by Year-on-Year Growth 2007-2011

% year-on-year growth

25

20

15

10

5

0

-5

-10

A

C

B

2007 |

|

2008 |

2009 |

2010 |

2011 |

||||

|

|

Retailing |

|

Metro AG |

|

Carrefour SA |

|

Schwarz Beteiligungs GmbH |

|

|

|

|

|

|

|

||||

A: Metro’s sales grow rapidly due to a major expansion of the Media Markt/Saturn chain across Western Europe, but also as a result of a strong performance for hypermarkets in Germany and Eastern Europe.

B: Metro’s sales in US dollar terms are hit by the euro’s depreciation against the US dollar and the recession impacting global retailing, which offset Media Markt/Saturn’s rising sales in Western Europe.

C: Metro’s sales are resilient, but impacted by the slow growth of Media Markt/Saturn in Western Europe due to a economic uncertainty and a market exit in

France. Carrefour’s sales decline sharply due to the disposal of Dia.

© Euromonitor International |

RETAILING: METRO AG |

PASSPORT 9 |

COMPETITIVE POSITIONING

Competitive context: Metro a medium-sized player with larger rivals

Retailing: Top Companies by Value, 2008-2011 |

|

|

|

|||

|

|

|

|

|

|

|

Company (GBO name) |

4-year |

2008 |

2009 |

2010 |

2011 |

2011 % |

|

trend |

|

|

|

|

share |

Wal-Mart Stores Inc |

|

1 |

1 |

1 |

1 |

3.3 |

|

|

|

|

|

|

|

Carrefour SA |

|

2 |

2 |

2 |

2 |

0.9 |

|

|

|

|

|

|

|

Tesco Plc |

|

3 |

3 |

3 |

3 |

0.8 |

|

|

|

|

|

|

|

Seven & I Holdings Co Ltd |

|

4 |

4 |

4 |

4 |

0.8 |

|

|

|

|

|

|

|

Costco Wholesale Corp |

|

7 |

7 |

7 |

5 |

0.6 |

|

|

|

|

|

|

|

Schwarz Beteiligungs GmbH |

|

5 |

5 |

6 |

6 |

0.6 |

|

|

|

|

|

|

|

CVS Caremark Inc |

|

9 |

6 |

5 |

7 |

0.6 |

|

|

|

|

|

|

|

Walgreen Co |

|

12 |

8 |

8 |

8 |

0.6 |

|

|

|

|

|

|

|

Target Corp |

|

10 |

11 |

10 |

9 |

0.6 |

|

|

|

|

|

|

|

Kroger Co |

|

11 |

10 |

9 |

10 |

0.6 |

|

|

|

|

|

|

|

Aldi Group |

|

6 |

9 |

11 |

11 |

0.5 |

|

|

|

|

|

|

|

Auchan Group SA |

|

8 |

12 |

12 |

12 |

0.5 |

|

|

|

|

|

|

|

Metro AG |

|

16 |

18 |

18 |

18 |

0.4 |

|

|

|

|

|

|

|

Note: 2011 data are provisional |

|

|

|

|

|

|

Metro’s global ranking in retailing is relatively modest, as cash-and- carry accounts for around half of its revenues. It ranks behind most of its direct rivals including Auchan, Carrefour, Rewe and Schwarz. Auchan and Schwarz outperformed Metro’s sales growth in 2011, largely as a result of strong expansion in Asia Pacific and Eastern Europe respectively.

Schwarz competes directly against Metro’s Real hypermarket chain with its Kaufland banner. Both Aldi and Schwarz (Lidl) have seen their global rankings decline due to modest growth in Germany. By contrast, US-based retailers accentuated their dominance of the top 12 list, with five companies improving their rankings over 2008-2011, of which only Costco also operates outside the US.

© Euromonitor International |

RETAILING: METRO AG |

PASSPORT 10 |