кейси для індивідуальної роботи 2014 н.р. / LAVAZZA SPA, LUIGI IN HOT DRINKS

.pdf

GEOGRAPHIC AND CATEGORY OPPORTUNITIES

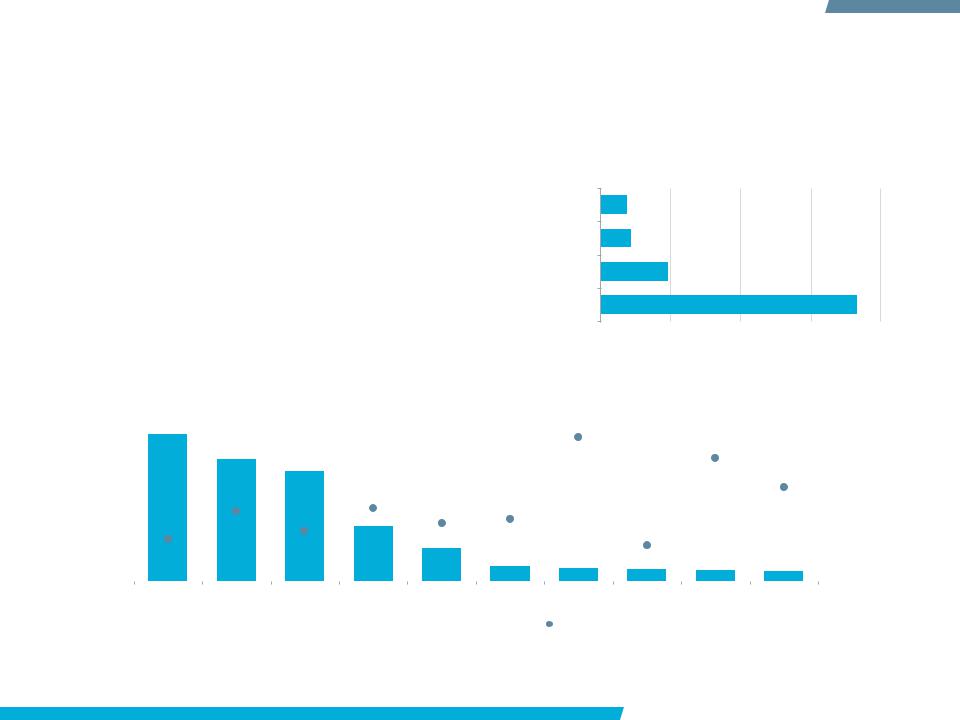

Can Lavazza gain a share of the US pod market?

While Lavazza’s stake in Green Mountain was a shrewd move, the company’s best prospects for growth lie in its alliance with Keurig as an attempt to enter the pod coffee market in the US in its own right.

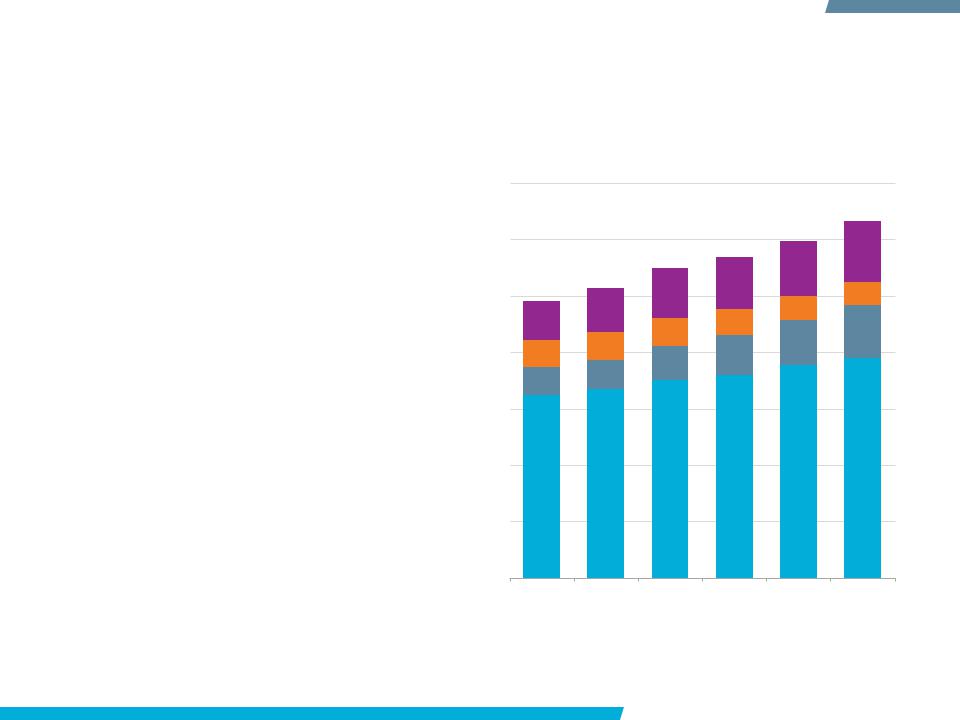

The US is expected to maintain its position as the biggest fresh coffee market over the forecast period, with sales expanding by US$500 million over the 2011-2016 period. Despite a difficult economic environment, few in the US seem to be willing to trade down to economy coffee. The only compromise many are willing to make is to brew their coffee at home and reduce on-trade consumption. Reflecting this, is the increased penetration of fresh coffee sold in coffee pods. Coffee pods’ value share of fresh coffee sales increased by eight percentage points to reach 9% in 2011.

Overall, fresh coffee in the US is set to post a 1.2% CAGR over 2011-2016 with pods at 12.3% CAGR, while instant will see a CAGR of 2.2%.Growth in off-trade sales reflects the consumer shift to purchasing coffee to brew at home in order to save money. The acceptance of singlecup brewing systems during this period will fuel the growth in off-trade sales of coffee during the economic recovery.

Value sales (US$ billion)

US: Hot Drinks Value Share

Breakdown by Company 2011

JM Smucker Co, The

JM Smucker Co, The

Starbucks Corp

Starbucks Corp

Kraft Foods Inc

Kraft Foods Inc

Green Mountain

Green Mountain

Coffee Roasters Inc

Unilever Group

Unilever Group

Others

Others

US: Coffee Growth by Category 2006/2011/2016

7

6

5

4

3

2

1

0

Fresh Ground |

Standard Fresh |

Instant Coffee |

||||||

Coffee Pods |

Ground Coffee |

|

|

|

||||

|

|

2006 |

|

|

2011 |

|

|

2016 |

|

|

|

||||||

|

|

|

||||||

© Euromonitor International |

HOT DRINKS: LAVAZZA SPA, LUIGI |

PASSPORT 21 |

GEOGRAPHIC AND CATEGORY OPPORTUNITIES

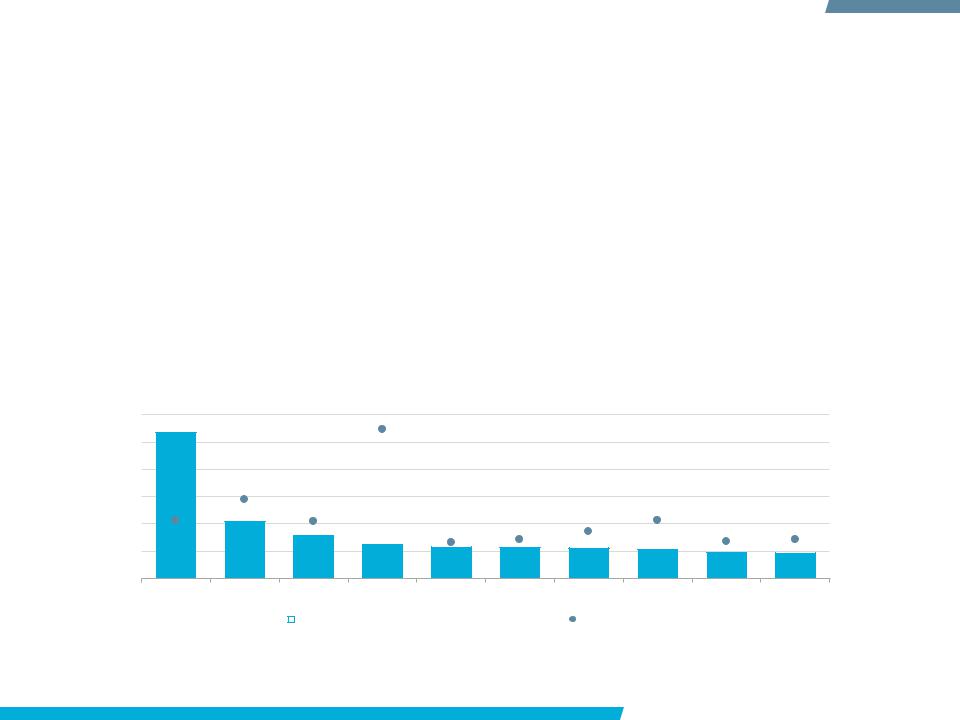

France: the next step for Lavazza’s pod coffee?

In absolute value growth terms, the market posing the greatest opportunity is France where some US$688 million of additional sales are expected in the fresh ground coffee pods market by 2016.

A problem Lavazza has to overcome however is that the company currently has no significant market share in fresh ground coffee pods in France, but only in standard fresh ground coffee in which it is the fourth biggest player. France is the ideal logical next step for Lavazza to push sales of its Lavazza A Modo Mio brand and the company should look to do this.

France: Standard Fresh Ground Coffee Value Sales by Company 2011

Lavazza

Segafredo Z

Sara Lee

Kraft

0 |

200 |

400 |

600 |

800 |

Value sales (US$ million)

Total value growth (US$ million)

|

|

|

|

Fresh Ground Coffee Pods Value Sales Growth 2011-2016 |

|

|

|

||||||

800 |

|

|

|

|

|

|

|

|

|

|

|

30% |

|

|

|

|

|

|

|

|

|

|

|

||||

700 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25% |

||||

|

|

|

|

|

|

|

|

|

|

|

|||

600 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

||||

500 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

400 |

|

|

|

|

|

|

|

|

|

|

|

15% |

|

|

|

|

|

|

|

|

|

|

|

||||

300 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

||||

|

|

|

|

|

|

|

|

|

|

|

|||

200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% |

||||

100 |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

France |

US |

Germany |

Italy |

Switzerland Canada |

Argentina Portugal |

Sweden |

Australia |

||||

|

|

|

|

|

|

|

Total Value Growth |

% Value CAGR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

Value CAGR

© Euromonitor International |

HOT DRINKS: LAVAZZA SPA, LUIGI |

PASSPORT 22 |

GEOGRAPHIC AND CATEGORY OPPORTUNITIES

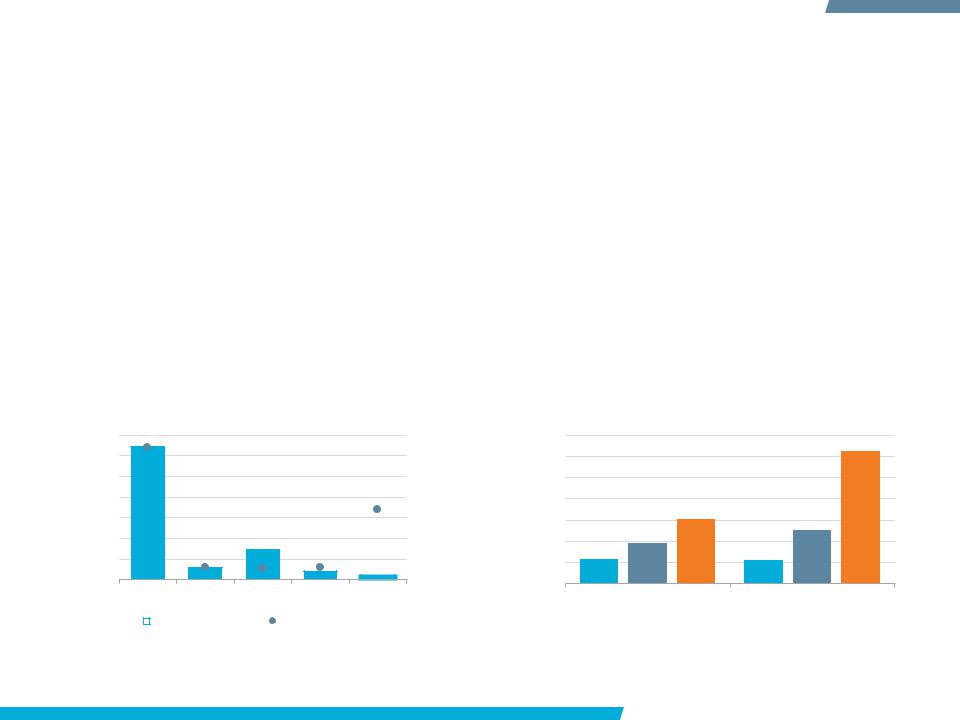

Lavazza should not rule out entering instant coffee category

Lavazza’s presence in instant coffee is very negligible. The instant coffee category, however, holds considerable promise. In many markets, such as Russia and China, it remains overwhelmingly the dominant format within coffee. However, these markets are typified by growing disposable incomes which suggests room for trading up to higher-quality coffees. The key benefit of instant is its ease of preparation and no requirement for a coffee machine.

Lavazza is clearly positioned as a premium player, but in some markets such as Russia, Thailand and

India this should not prevent it from launching a product similar to that of Kraft’s Kenko Millicano (which Kraft introduced into the UK in 2011). This is a premium-positioned instant coffee marketed as a better quality tasting coffee but with the convenience of instant. This approach, together with the gradual migration of consumers to fresh coffee as incomes increase, could serve Lavazza well in order to gain entry into dynamic new markets, which are currently missed opportunities for Lavazza. Lavazza’s most immediate opportunity is in India where it enjoys its strongest distribution network.

Absolute Value Growth (US$ million) 2011/2016

|

|

1,200 |

16% |

|

Absolute value growth |

(US$ million) 2011/2016 |

1,000 |

14% |

CAGR 2011-2016 |

|

||||

|

12% |

|||

800 |

10% |

|||

|

||||

600 |

8% |

|||

400 |

6% |

|||

|

||||

|

4% |

|||

200 |

|

|||

|

|

2% |

|

|

|

|

|

|

|

|

|

0 |

0% |

|

Russia |

China South Korea |

India |

Germany |

Mexico |

Thailand Philippines |

Brazil |

Australia |

||

|

|

|

Absolute Growth 2011/2016 US$ mn |

|

% CAGR 2011-2016 |

|

|

||

|

|

|

|

|

|

||||

|

|

|

|

|

|

||||

© Euromonitor International |

HOT DRINKS: LAVAZZA SPA, LUIGI |

PASSPORT 23 |

GEOGRAPHIC AND CATEGORY OPPORTUNITIES

Indian coffee shops should be the lever to gain Indian market share

Consumption of premium products is increasing within coffee in India. FMCG giants such as Hindustan Unilever, Nestlé India and Tata Global Beverages have started to launch premium products in response to growing demand. Rising disposable incomes and increasing consumer sophistication will continue to fuel demand for premium products over the coming years and Lavazza should use the equity gained from its strength in chained specialist coffee shops to promote sales of its own coffee brand. The company should consider both fresh coffee and possibly a premium-positioned instant coffee.

Demand for coffee is being driven by the surge in the number of cafés in India. The expansion of established coffee chains such as Java City, Café Coffee Day and Barista has resulted in an increase in both on-trade and off-trade sales. Traditionally, coffee drinking in India was mainly restricted to older consumers in South India. However, this situation is now starting to change, with cafés having become popular places to socialise among students and working professionals.

Lavazza Value Sales and Share of

Chained Specialist Coffee Shops 2011

sales (US$ million) |

70 |

|

|

|

25% |

|

sales (US$ million) |

700 |

60 |

|

|

|

20% |

|

600 |

||

|

|

|

|

Value share |

|

|||

50 |

|

|

|

|

500 |

|||

40 |

|

|

|

15% |

400 |

|||

|

|

|

|

|||||

30 |

|

|

|

10% |

300 |

|||

20 |

|

|

|

|

200 |

|||

Value |

|

|

|

|

|

Value |

||

|

|

|

|

5% |

|

|||

10 |

|

|

|

|

|

|||

|

|

|

|

|

100 |

|||

|

|

|

|

|

|

|||

0 |

|

|

|

0% |

|

|

||

|

|

|

|

|

|

0 |

||

|

India |

Taiwan |

Germany |

Italy |

Portugal |

|

|

|

|

|

|

|

India: Coffee Value Sales by Category 2006/2011/2016

Fresh Coffee |

Instant Coffee |

|

Value Sales 2011 |

% Value Share 2011 |

|

2006 |

|

2011 |

|

2016 |

|

|

|

|

|||||

|

|

|

|

© Euromonitor International |

HOT DRINKS: LAVAZZA SPA, LUIGI |

PASSPORT 24 |

GEOGRAPHIC AND CATEGORY OPPORTUNITIES

The Indian strategy

Hints of focus on at-home market in India

In 2011, Lavazza through its Fresh & Honest subsidiary launched a new coffee pod system - the Lavazza LB 850. Tata Croma is the exclusive retailer for the machine at present although it is also available for sale at select Barista locations.

The attempt to increase its penetration in the offtrade marks something of a change in direction for Fresh & Honest, which has primarily focused on the foodservice channel through its hospitality and corporate clients. The at-home segment, however, is likely to increase in importance for the company.

Coffee pod penetration is very low in the Indian market owing to high price points relative to the average Indian income. The LB 850 retails for around Rs13,500. In 2010, coffee pod sales were negligible in the market. Lavazza’s entry into this segment therefore gives it an early mover advantage. The contribution of sales, however, from coffee pods for Fresh & Honest is likely to be very small for some time to come.

Barista chain evolves its product offer

The Barista chain is divided into two formats, Barista Espresso and Barista Crème. Barista Crème is a new addition to the Barista chain and numbers only 15 outlets thus far across India. It is positioned as a coffee lounge, established to provide a more upmarket and relaxed place to socialise. To that end, the Crème format offers a fairly extensive food menu unlike the Espresso format, which focuses on coffee, soft drinks and desserts.

Lavazza has expanded Barista’s revenue from merchandise to include travel mugs, key chains, business card holders, a range of Barista ice cream for take home and chocolates. The offer of the new Lavazza LB 850 is yet another addition.

In 2011, Lavazza announced that in partnership with Visa it became the first Indian retailer to offer a cash withdrawal facility at point of sale enabling all Visa debit cardholders to withdraw cash from their accounts, as well as pay for their food and beverages at the till.

© Euromonitor International |

HOT DRINKS: LAVAZZA SPA, LUIGI |

PASSPORT 25 |

STRATEGIC EVALUATION

COMPETITIVE POSITIONING

MARKET ASSESSMENT

GEOGRAPHIC AND CATEGORY OPPORTUNITIES

BRAND STRATEGY

OPERATIONS

RECOMMENDATIONS

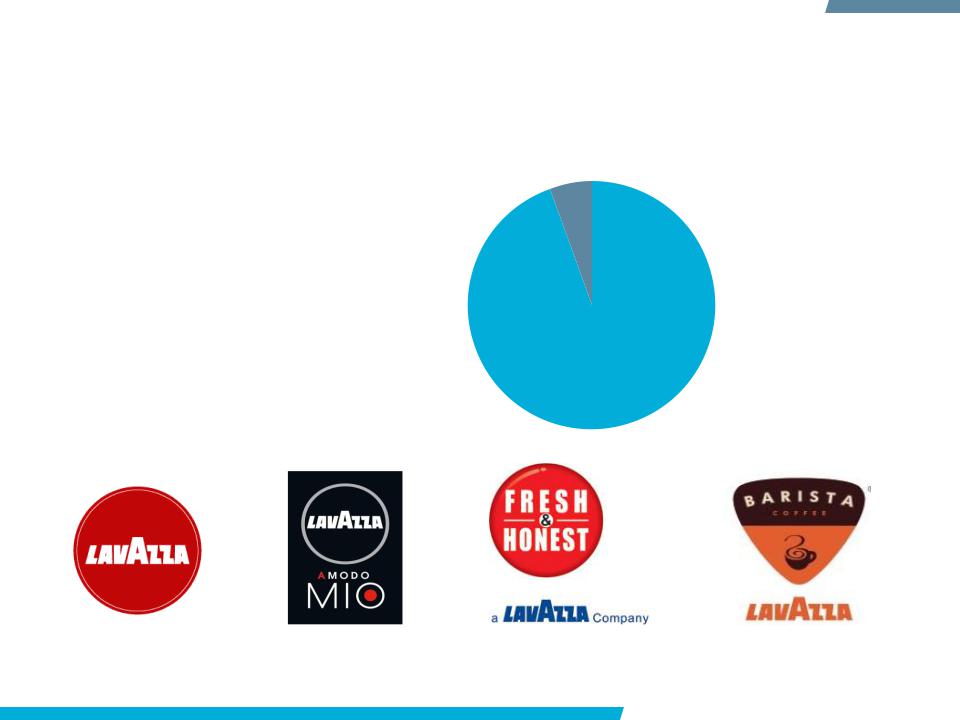

BRAND STRATEGY

The Lavazza brand leads but India sees new developments

Lavazza was the leader in the Italian fresh coffee category in 2011 and is synonymous with premium coffee across most of Western Europe. Lavazza A Modo Mio is the company’s best-selling coffee pod system. However, its sales are modest outside Italy.

Lavazza’s entry into the Indian market in 2007 has seen it increase its position in the office vending segment through the Fresh & Honest brand. Thus far the brand has not established a significant market share. The acquisition of the Barista specialist coffee shop chain in India has been followed by efforts to integrate the brand with that of Lavazza.

Lavazza Brand Value Sales Breakdown 2011

Lavazza

Lavazza

Lavazza A Modo Mio

Lavazza A Modo Mio

© Euromonitor International |

HOT DRINKS: LAVAZZA SPA, LUIGI |

PASSPORT 27 |

BRAND STRATEGY

Lavazza focuses on fresh coffee and Italy...

Lavazza offers most of its products under the Lavazza umbrella. Within its domestic Italian market, the company has established a massto premium brand profile, although of late it has been working to reinforce its standing in the upmarket segment, repositioning massmarket labels such as Lavazza Paulista.

In the company’s newer international markets, it has looked for markets with a growing café culture, eg India, Bulgaria and Argentina. Thus far it has not managed to leverage its increased presence in foodservice into the retail market for coffee. However, Lavazza sees these investments as opportunities to raise the profile for its brand such as by gradually substituting the Barista brand of coffee for Lavazza at the Indian coffee chain where the brand is available in fresh ground coffee and fresh coffee beans. However, its weak presence in instant coffee may mean that it could miss the growth opportunities in instant coffee in this market as well.

Value sales (US$ million)

Lavazza: Global Brand Sales by Country 2006-2011

1,400

1,200

1,000

800

600

400

200

0

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|||||

|

|

Other |

|

|

France |

|

Germany |

|

|

Italy |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

||||

© Euromonitor International |

HOT DRINKS: LAVAZZA SPA, LUIGI |

PASSPORT 28 |

BRAND STRATEGY

...but fares poorly with narrow geographic/product focus

Lavazza’s narrow geographic focus has meant that in terms of absolute value growth among the top 10 coffee brands it has done extremely well to achieve a 8% value CAGR and absolute growth of US$398 million.

Jacobs has benefited in large part from a strong presence in Eastern Europe, which helped it to achieve absolute value growth of US$839 million over the same period. Jacobs is available in both fresh and instant coffee. Lavazza meanwhile is almost exclusively a fresh coffee brand.

Moves made by Lavazza to boost its international presence remain in the early stages and have not focused on establishing a strong retail brand in emerging markets.

Nespresso, the rising star of the brands, has seen a 23% CAGR over 2006-2011, growing organically by aggressively marketing its proprietary coffee pod system. Lavazza has, outside Italy, been limited in this respect as well, but the potential for pod systems is huge and Lavazza must look to compete aggressively in this market.

Absolute Value Growth (US$ million) 2006/2011

Absolute value growth (US$ million) 2006/2011

6,000 |

|

|

|

|

|

|

|

|

25% |

|

|

|

|

|

|

|

|

||||

5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

20% |

||||

|

|

|

|

|

|

|

|

|||

4,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15% |

||||

|

|

|

|

|

|

|

|

|||

3,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10% |

||||

2,000 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5% |

||||

1,000 |

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

0% |

|

|

|

|

|

|

|

|

|

|||

|

|

Nescafé |

Jacobs |

Maxwell Nespresso Tchibo |

Folgers |

Lavazza |

Melitta Carte Noire Maxim |

|||

|

|

|

|

House |

|

|

|

|

|

|

|

|

|

|

|

Absolute Value Growth 2005/2010 |

|

% CAGR 2005-2010 |

|||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

% CAGR 2006-2011

© Euromonitor International |

HOT DRINKS: LAVAZZA SPA, LUIGI |

PASSPORT 29 |

STRATEGIC EVALUATION

COMPETITIVE POSITIONING

MARKET ASSESSMENT

GEOGRAPHIC AND CATEGORY OPPORTUNITIES

BRAND STRATEGY

OPERATIONS

RECOMMENDATIONS