кейси для індивідуальної роботи 2014 н.р. / TCHIBO GMBH IN HOT DRINKS

.pdf

COFFEE OPPORTUNITIES

Russia key growth market in Eastern Europe

Tchibo has a strong presence across Eastern Europe. Having started to expand into the region from the early 1990s, its geographic spread is far-reaching. With per capita consumption of coffee still below the Western European average in many of these markets, continued growth opportunities clearly exist, even though the more immediate outlook over the forecast period remains more moderate as the region is still recovering from the economic crisis.

Russia will be by far the most important growth market over the forecast period, set to account for nearly 80% of the US$2 billion increase in regional coffee sales predicted over 2011-2016. Tchibo, while smaller than rivals Nestlé and Kraft, still managed to claim a significant share of coffee sales in this market and as the third largest player it will be able to capitalise on the growth opportunity offered.

The outlook is less positive for Poland, where coffee is already highly mature, with per capita consumption significantly above Western Europe (570 cups per capita in 2011, compared to 450 cups per capita on average in Western Europe), although growth opportunities continue to exist also there, specifically in the emerging coffee pod category.

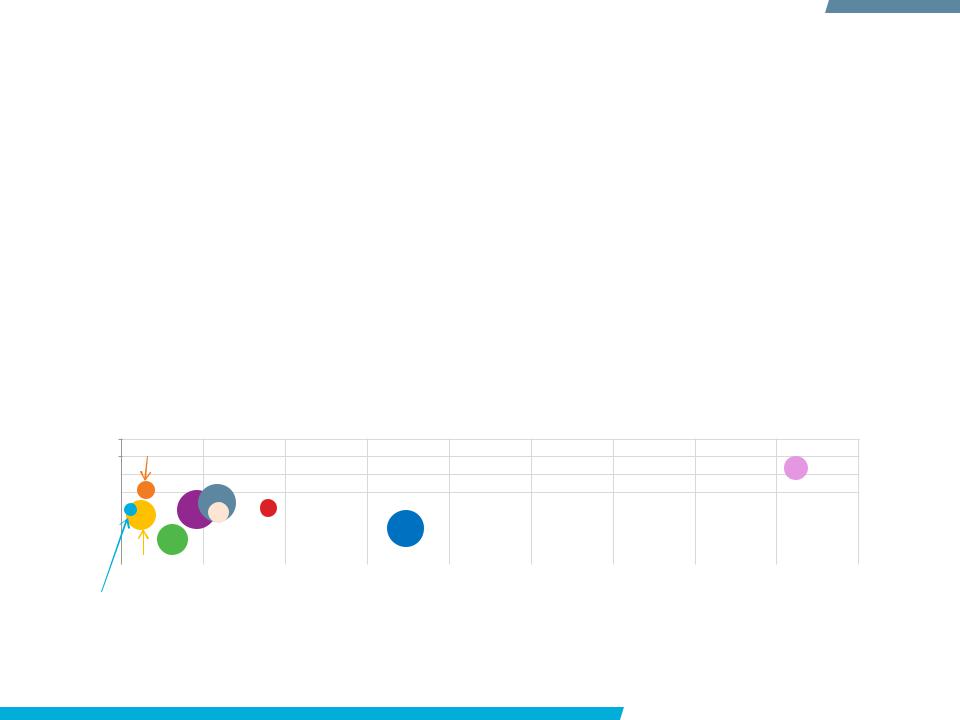

% CAGR 2011-2016

Tchibo GmbH in Eastern Europe: Coffee Presence and Growth Prospects by Market,

Off-Trade Value 2011-2016

10

8 Lithuania

6 |

|

|

Czech Republic |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Russia |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

4 |

|

|

|

|

|

Hungary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ukraine |

|

|

|

Poland |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

Romania |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

-2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Latvia |

Slovakia |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

-4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

0 |

500 |

1,000 |

1,500 |

2,000 |

2,500 |

3,000 |

3,500 |

4,000 |

4,500 |

|||||||||||||||||||||

|

||||||||||||||||||||||||||||||

Macedonia |

|

|

|

|

|

|

Market size 2011 (retail value RSP US$ mn) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Note: Bubble size shows company share of market in 2011, range displayed: 2.7-24.0%

© Euromonitor International |

HOT DRINKS: TCHIBO GMBH |

PASSPORT 21 |

COFFEE OPPORTUNITIES

Instant dominates in Russia but fresh coffee on the rise

In Russia, instant coffee dominates over fresh coffee, accounting for 80% of total coffee sales in 2011. Instant coffee is furthermore expected to continue to record positive growth, with sales set to increase by a further US$1 billion over 2011-2016. The main beneficiary of this growth will be category leaders Nestlé and Kraft (with a combined value share of 55% in 2011), but Tchibo will as the third-ranking player in the category also be able to claim a share of this growth.

Tchibo’s growth prospects in this market are also bright in the longer term. With the rapid rise of specialist coffee shops and the development of a more sophisticated coffee culture, there is a shift in demand from instant towards more premium fresh coffee; a trend that is already evident, with fresh coffee sales expected to grow at nearly twice the rate of instant coffee in Russia over the forecast period.

Tchibo’s area of strength is standard fresh ground coffee, and as such it will be able to capitalise on this shift in demand. Indeed, in this respect it is much better positioned than rival Nestlé which is not represented in the category. The company will however need to ensure that it competes effectively against local player Orimi and its Jockey brand, which benefits from its “quality at an affordable price” positioning that enabled the company to edge ahead of Tchibo to claim category leadership since 2010.

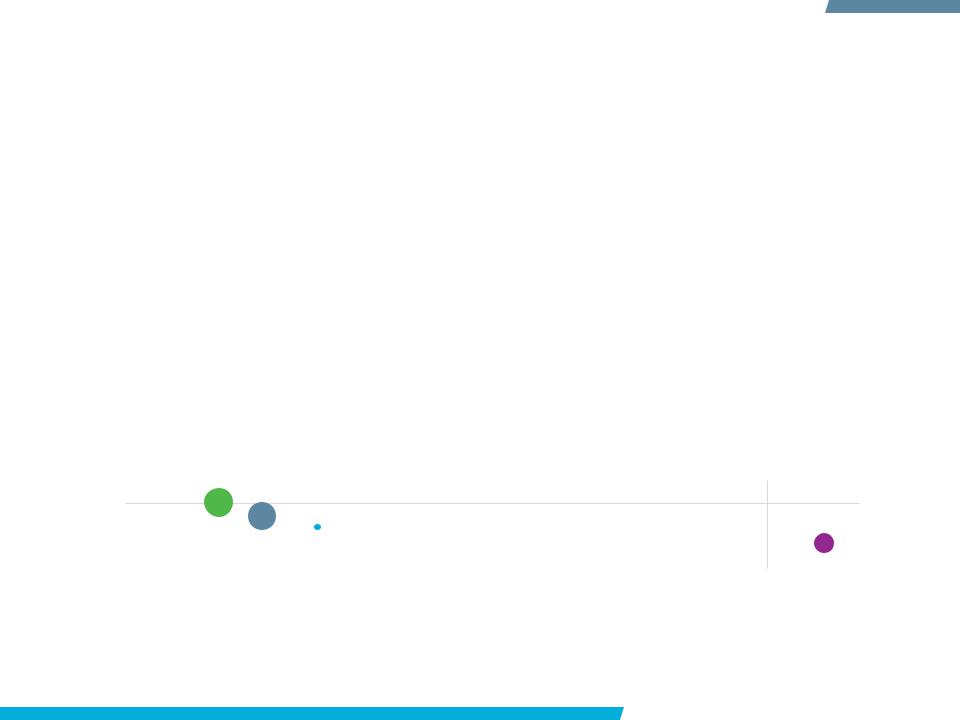

% CAGR 2011-2016

|

Tchibo GmbH in Russia: Coffee Presence and Growth Prospects by Category, Off- |

|

|

||||||||||||||||

20 |

|

|

|

|

|

|

Trade Value 2011-2016 |

|

|

|

|

|

|

|

|||||

Fresh Ground |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 |

Coffee Pods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fresh Coffee |

Beans |

|

|

|

|

|

|

Instant |

Coffee |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

Standard Fresh |

|

|

|

|

|

|

|

|

|

|

|

|

|||

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ground Coffee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-500 |

0 |

500 |

1,000 |

1,500 |

2,000 |

2,500 |

3,000 |

3,500 |

|||||||||||

Market size 2011 (retail value RSP US$ mn)

Note: Bubble size shows company share of category in 2011, range displayed: 1.1-20.4%

© Euromonitor International |

HOT DRINKS: TCHIBO GMBH |

PASSPORT 22 |

COFFEE OPPORTUNITIES

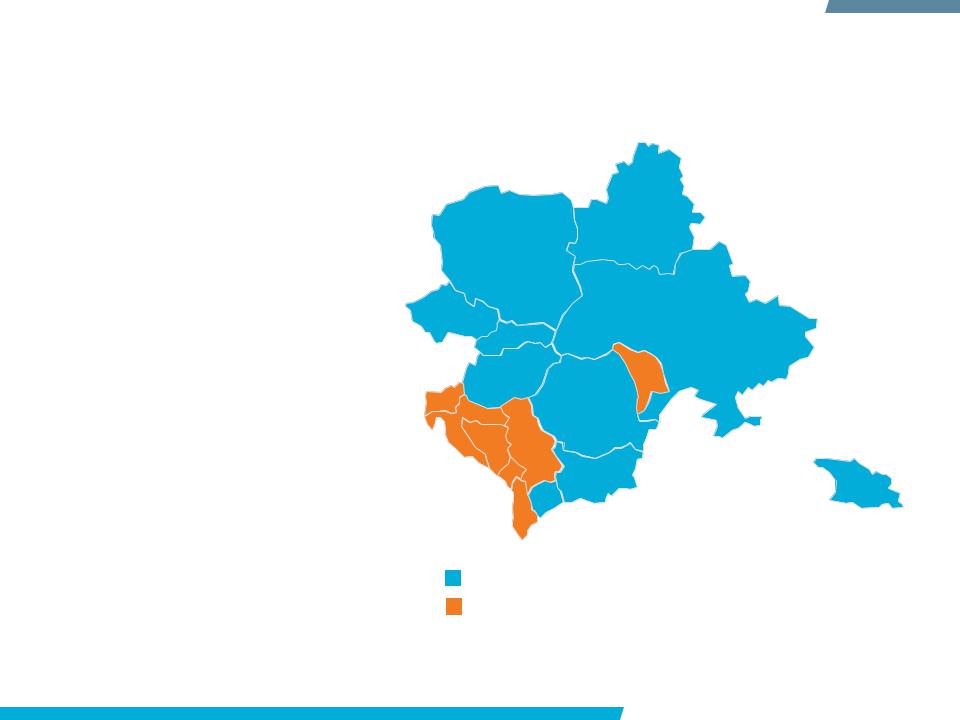

Balkan region offers further expansion opportunities

Further expansion opportunities in Eastern Europe would exist for Tchibo, despite the company’s already extensive geographic coverage.

Specifically, opportunities would remain for Tchibo to penetrate the Balkan region.

The company entered Macedonia in 2010 and in a country where local and regional companies continue to dominate, Tchibo has become the only Western player of significance in fresh coffee.

The Balkan states overall have a wellestablished café culture, and while traditional coffees continue to dominate among the older generation, younger consumers are increasingly attracted to foreign brands and keen to experiment with new flavours.

Tchibo can use the positive image German brands generally enjoy in these markets, where many consumers moreover have strong links with Germany.

Markets in which Tchibo has an established presence

Markets in which Tchibo has no/a negligible presence

© Euromonitor International |

HOT DRINKS: TCHIBO GMBH |

PASSPORT 23 |

STRATEGIC EVALUATION

COMPETITIVE POSITIONING

MARKET ASSESSMENT

COFFEE OPPORTUNITIES

BRAND STRATEGY

OPERATIONS

RECOMMENDATIONS

BRAND STRATEGY

Narrow brand portfolio dominated by Tchibo brand

Tchibo is overwhelmingly the company’s most significant brand by value sales, marketed across the company’s geographic markets. While fresh coffee is the brand’s main area of interest, Tchibo is also active in instant coffee in Eastern Europe, thus catering to the different preferences of consumers in the region.

Tchibo acquired the Eduscho brand in 1997 with the takeover of Bremen-based coffee roaster Eduscho. In terms of competitive position, Eduscho’s strength is in Austria, where it ranks as the leading coffee brand in terms of retail value. The popularity of the Eduscho brand in Austria is likely to prevent Tchibo taking the decision to phase out the brand in favour of a single Tchibo umbrella, even though Eduscho is only of secondary significance in its domestic market.

The company also has a few local brands, eg Jihlavanka, available exclusively in the Czech Republic, and Davidoff in Hungary.

Other brands marketed include Tchibo Cafissimo, the company’s coffee pod offer. Cafissimo forms a central part of Tchibo’s growth strategy, in particular in Germany where it is committed to gaining a greater share of the key coffee pod category. The brand has also been introduced across Tchibo’s international markets including Austria, Switzerland, Poland, the Czech Republic, Hungary, Slovakia and Turkey.

Tchibo embraces social media marketing

In terms of marketing, Tchibo has fully embraced the social media opportunity. The company has embraced networking sites such as Facebook, encouraging dialogue with its customers. Tchibo also introduced its own blog to its website, encouraging the exchange of opinion among customers and key opinion makers such as journalists. Furthermore, the company uses Twitter to provide product information.

As with other companies, Tchibo aims to create a “buzz” around new product launches and strengthen the “emotional bond” to its customers, thus reinforcing brand loyalty. Encouraging discussion also aids with new product development, helping the company to develop products that are tailored precisely to customers’ needs.

© Euromonitor International |

HOT DRINKS: TCHIBO GMBH |

PASSPORT 25 |

BRAND STRATEGY

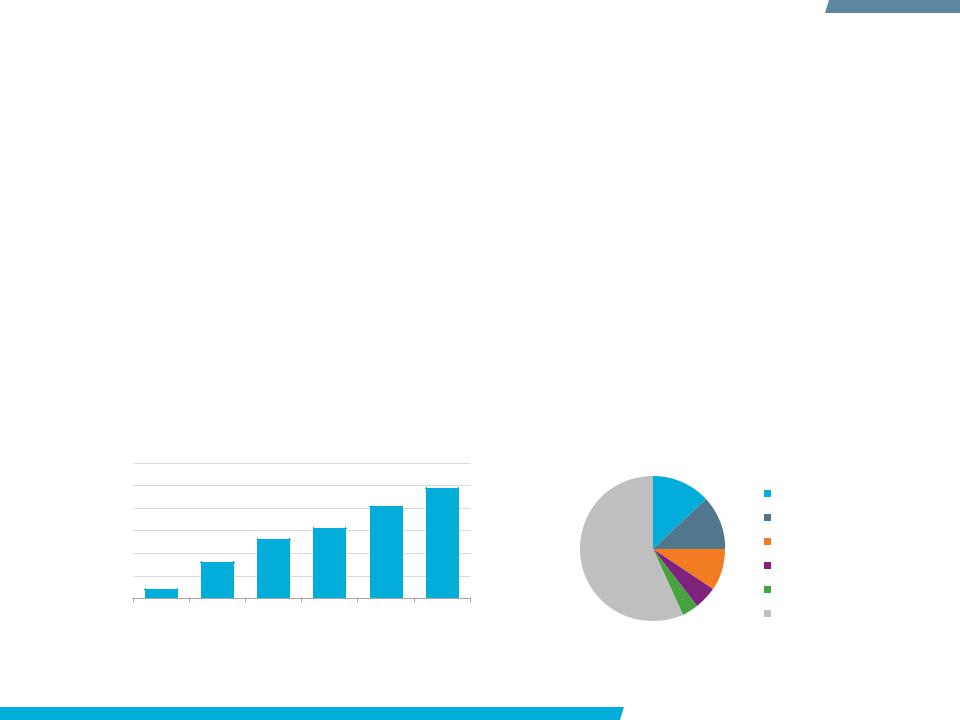

Tchibo: Eastern Europe drives growth

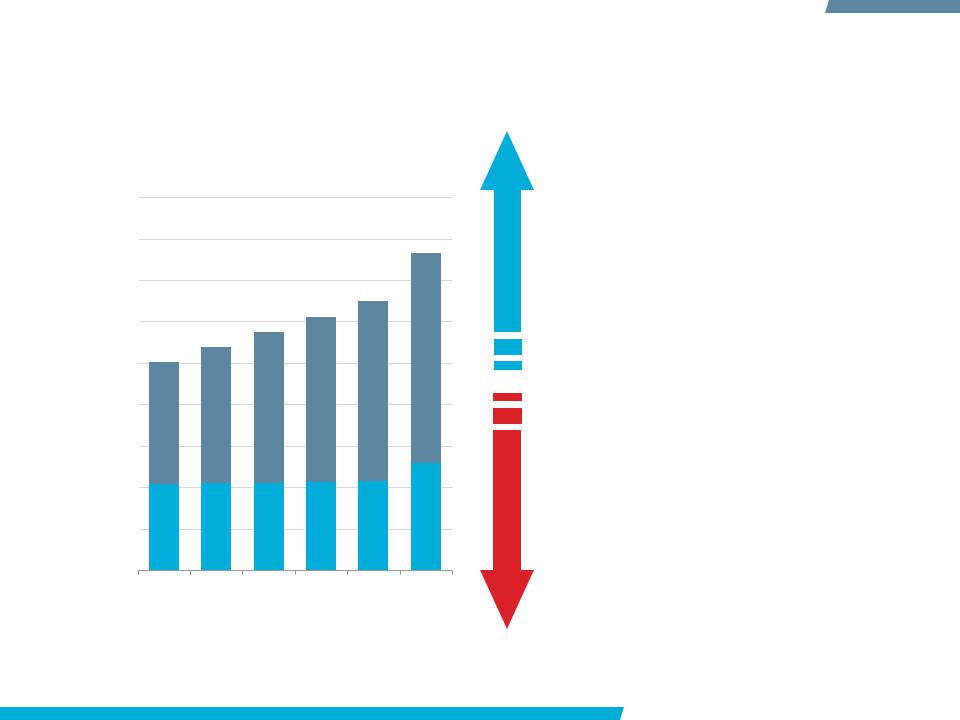

Retail value sales (US$ mn)

Tchibo Brand: Retail Value Sales Germany vs International 2006-2011

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

|||

|

|

|

Germany |

|

International |

|

||

|

|

|

|

|

||||

|

|

|

|

|

||||

W I N N E R S

L O S E R S

Eastern Europe drives sales

Tchibo’s positive performance over the 20062011 period is largely due to growth in its Eastern European markets. Russia and Poland in particular contributed significantly to its performance. Russian sales increased from US$152 million in 2006 to reach US$366 million in 2011. In Poland, sales grew from US$207 million in 2006 to reach US$294 million in 2011.

German sales grow but share falls

Tchibo also saw growth in its largest market, Germany, especially towards the end of the review period, largely as a result of price increases. In terms of its share of coffee, however, Tchibo declined overall from 12.2% in 2006 to 11.7% in 2011 as the brand came under increasing pressure from rival Melitta (which claimed the leadership position in standard fresh ground coffee for the first time in 2011) as well as private label.

© Euromonitor International |

HOT DRINKS: TCHIBO GMBH |

PASSPORT 26 |

BRAND STRATEGY

Cafissimo key to growth in Germany

Cafissimo, Tchibo’s brand in coffee pods, is a relatively recent addition to the company’s portfolio. The brand was introduced in 2005 in Germany, and has since been rolled out across many of the company’s international markets, although Germany remains by far its most important market in terms of sales.

Indeed, Cafissimo is the company’s best chance for ensuring continued growth in the mature domestic market where consumers have embraced the convenience of coffee pod systems. Germany is one of the world's most dynamic markets in terms of household penetration of coffee pods. Single-portion coffee is regarded as a quick and easy way to enjoy good quality coffee at home. The increase in sales of coffee pods is also affected by the high number of singles and small households.

Tchibo is determined to capitalise on the growth opportunity offered by its Cafissimo brand. While its share is still comparatively small, considering the fact that the category overall is still far from mature, Tchibo has the opportunity to claim a larger share of this important growth category. Recent innovations such as its 2011 introduction of Cafissimo DUO, claimed to be the smallest capsule machine in the world, are testament to the fact that Tchibo aims to differentiate Cafissimo with a unique product offering, which should enable the brand to effectively compete in the category.

|

|

Cafissimo: Retail Value Sales 2006-2011 |

Fresh Ground Coffee Pods in Germany: |

|||||

salesvalueRetail |

mn)(US$ |

60 |

|

|

|

|

|

Brand Value Shares 2011 |

50 |

|

|

|

|

|

Tassimo |

||

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

40 |

|

|

|

|

|

Senseo |

|

|

|

|

|

|

|

|

|

|

|

30 |

|

|

|

|

|

Nescafé Dolce Gusto |

|

|

|

|

|

|

|

|

|

|

|

20 |

|

|

|

|

|

|

|

|

10 |

|

|

|

|

|

Nespresso |

|

|

|

|

|

|

|

|

|

|

|

0 |

|

|

|

|

|

Cafissimo |

|

|

|

|

|

|

|

|

|

|

|

2006 |

2007 |

2008 |

2009 |

2010 |

2011 |

Others |

© Euromonitor International |

HOT DRINKS: TCHIBO GMBH |

PASSPORT 27 |

STRATEGIC EVALUATION

COMPETITIVE POSITIONING

MARKET ASSESSMENT

COFFEE OPPORTUNITIES

BRAND STRATEGY

OPERATIONS

RECOMMENDATIONS

OPERATIONS

Three-in-one store concept

Tchibo operates a unique “three-in-one” store concept that is a combination of coffee shop, retail store and coffee bar. The offer of freshly brewed coffee is mostly aimed at attracting customers into its stores, where customers are then able to browse the weekly-changing, competitively-priced non-food range. Indeed, it is the non-food range that is the company’s most profitable business segment.

The high-margin, non-food business had therefore also been a priority area for Tchibo in its stores, and the company went through a period when its coffee bar activities had been significantly scaled back. It is only relatively recently that the foodservice activities within its stores have been brought back to the fore, in an effort to entice customers back into its stores after a period of declining turnover within its non-food business.

While the “three-in-one” model overall proved successful in Germany, the uniqueness of the concept does not necessarily guarantee success in other markets. Germans are known to be “bargain hunters”, and searching for (quality) products that offer good value for money can be considered a national pastime. As such, German consumers are happy to shop for products such as lingerie in a coffee shop, so long as they perceive the products to offer genuinely good value.

On the other hand, the concept of offering such non-food items within the surroundings of a coffee shop/coffee bar may appear slightly more unusual in other cultures and markets where “bargain hunting” is not so deeply engrained in consumers’ psyches. As such, Tchibo needs to be flexible in its “three-in-one” approach when it comes to its international operations; indeed, the concept may have prevented Tchibo from becoming truly competitive in the UK, a market that it exited in 2009 and where the company faced very strong competition from specialist coffee shops on the one hand, and cut-price clothing retailers on the other hand.

© Euromonitor International |

HOT DRINKS: TCHIBO GMBH |

PASSPORT 29 |

OPERATIONS

Multi-channel distribution

Depots

Apart from its own outlets, Tchibo products are also distributed through “shop-in-shops” in a diverse range of retailers, from supermarkets to bakeries to drugstores.

While the first phase of its programme to revitalise sales in Germany was focused on its own shops, Tchibo has now turned its attention on its depots with the aim to give them a more modern feel. Having started at the beginning of 2012, Tchibo aims to have completed the remodelling of its depots in Germany, Austria and Switzerland within three years. The company’s own store remodels over the previous years serve as a blueprint for the depot modernisation programme.

Non-food specialist stores

In addition to its Tchibo stores and depots, in Germany the company also operates a small number of nonfood specialist stores under the name “Tchibo Prozente”. As of 2011, Tchibo had 30 such outlets and the company is on the lookout for sites to open further stores. Primarily, these outlets serve to sell any remaining stock from its other stores at a discounted price, however Tchibo has also introduced a permanent product range of clothing and homewares.

Online increasing in importance

The internet plays an increasingly important role both in terms of communicating product news to customers and in terms of social media marketing, but also as a distribution channel. According to Tchibo, its German online shop is one of the five most frequently visited online shops in the country, with online orders showing positive year-on-year increase.

Tchibo also has online shops in Austria, Switzerland, Poland, the Czech Republic, Turkey, Slovakia and Hungary. Online, the company offers a wider range of non-food products than in its stores, as well as additional services such as holiday deals, mobile phone services and “eco-friendly” gas and electricity deals.

© Euromonitor International |

HOT DRINKS: TCHIBO GMBH |

PASSPORT 30 |